Professional Documents

Culture Documents

Nature and Pattern of FDI Flows in India Sectoral Analysis

Uploaded by

Ravindra DarriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nature and Pattern of FDI Flows in India Sectoral Analysis

Uploaded by

Ravindra DarriCopyright:

Available Formats

Project Report

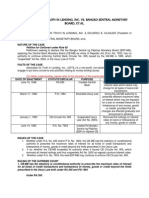

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Nature and Pattern of FDI flows in India: Sectoral Analysis

6th May, 2011

Group 5 Jitendra Narula [Roll Number 17] Rajesh Garg [Roll Number 30] Ravi Ganesh [Roll Number 33] Ravindra Singh Darri [Roll Number 34] Tejinder Singh [Roll Number 58]

Page |1

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Table of contents

Table of contents ............................................................................................................................... 2 Executive Summary ........................................................................................................................... 3 Introduction ....................................................................................................................................... 5 Components of FDI ............................................................................................................................ 6 Analysis of FDI inflows ....................................................................................................................... 7 Global trends in FDI inflows ........................................................................................................... 7 Indian trends in FDI inflows ........................................................................................................... 9 Source of FDI Inflows................................................................................................................ 10 Future potential of FDI inflows in India.................................................................................... 11 FDI route of entry to India ........................................................................................................ 13 FDI in India Greenfield versus Brownfield ............................................................................. 14 FDI in India Regional Dispersion ............................................................................................ 15 FDI in India Sectoral Dispersion............................................................................................. 16 How the sectoral dispersion has changed over the years? ..................................................... 18 Sectoral analysis ....................................................................................................................... 19 FDI and other macro-economic indicators .............................................................................. 25 Determinants of FDI ................................................................................................................. 26 Conclusions ...................................................................................................................................... 28 Suggestions and recommendations ................................................................................................ 29 References ....................................................................................................................................... 31

Page |2

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Executive Summary

Foreign direct investment (FDI) has played an important role in the process of globalisation during the past two decades. The rapid expansion in FDI by multinational enterprises since the mid-eighties may be attributed to significant changes in technologies, greater liberalisation of trade and investment regimes, and deregulation and privatisation of markets in many countries including developing countries like India. Capital formation is an important determinant of economic growth. While domestic investments add to the capital stock in an economy, FDI plays a complementary role in overall capital formation and in filling the gap between domestic savings and investment. At the macro-level, FDI is a non-debt-creating source of additional external finances. At the micro-level, FDI is expected to boost output, technology, skill levels, employment and linkages with other sectors and regions of the host economy. The aim of this report is to provide an insight to the trend and patterns of FDI emerging in India. The report also focuses on spatial and sectoral spread of FDI-enabled production facilities in India and their linkages with the growth and employment in India. The top FDI receiving sectors have strong backward and / or forward linkages with the economy. The sectors with strong backward and forward linkages include construction; fuels; chemicals; and metallurgical industries. Services sectors, telecommunications, and consultancy services have strong forward linkages. The sectors with strong backward linkages include electrical equipment; drugs and pharmaceuticals; food processing; and textiles. Normally FDI-enabled manufacturing firms pay higher wage per rupee of net fixed capital compared to domestically invested firms. Within FDI firms, the value is relatively high in sectors including electricity distribution and control apparatus; general purpose machinery; footwear; medical appliances; and building of construction parts. Output-capital ratio is also higher in FDI firms than in domestic firms. Within FDI-enabled firms, the output capital ratio is relatively high in sectors such as petroleum products; mining of iron ore; medical appliances; electricity distribution and control apparatus; and transport equipment. The corresponding values in these sectors are much lower in the case of domestically invested firms. The overall net foreign exchange earning is negative for FDI-enabled as well as domestically invested firms mainly due to a deficit in the manufacture of petroleum products. Sectors with positive net foreign exchange earnings include chemicals; mining of iron ores; textiles; and software and publishing. The market capitalisation of the FDI-enabled service firms is less than two-fifth the combined market capitalisation of manufacturing and service firms. FDI-enabled manufacturing firms account for 12 per cent of total exports by FDI-enabled and domestically invested manufacturing firms taken together. About 13 per cent of total sales by FDI-enabled firms are exported. This implies that FDI has entered India

Page |3

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

mainly to seek domestic markets. Mining of iron ore; non-ferrous metals; special purpose machinery; textiles; and software and publishing have relatively high export-to-sales ratios. FDI in India amounted to a paltry $393 million in 1992-93. By 2007-08, it had climbed to $34.7 billion and by 2008-09, to $35 billion. However FDI into India during April 2010 -February 2011 period has registered a decline of 25.6% to touch $18.3 billion compared with a corresponding figure of $24.62 billion for FY 2009-10, which is cause of concern. Total FDI inflows are estimated at US$90 billion during April 2000 to March 2009. The services sector; computer hardware & software; telecommunications; real estate; construction; automobiles; power; metallurgical industries; petroleum and natural gas; and chemicals received the highest FDI. Mauritius is the main source followed by Singapore, the US, the UK, the Netherlands and Japan. One important concern in Indias industrial policy is the dispersal of industrial plants across the states of the country. There are two types of cluster forces, viz., spill-overs and natural advantage. Natural advantage refers to factors of production which provide enabling conditions for producing certain goods, e.g., tea, wine, photographic films, etc. Spillovers refer to physical as well as intellectual spillovers. It is observed that 10 out of the top 25 FDI employment sectors have relatively high clusters and 9 are relatively dispersed; six sectors are moderately clustered. Some of the highly clustered sectors with high employment in FDI-enabled production units include growing of crops; motor parts; general purpose machinery; medical appliances and transport equipment, among others. In the case of output, 6 out of the top 25 FDI sectors have relatively high cluster and 11 are relatively dispersed; eight sectors are moderately clustered. Some of the highly clustered sectors with high output in FDI-enabled production units include motor parts, general purpose machinery, transport equipment, and medical appliances, among others. Multiple factors are likely to play a simultaneous role in helping a firm decide on plant location. The decision would primarily be based on the nature of the plant under consideration. For example, it is more likely that an integrated iron and steel plant would be located close to regions producing primary inputs (iron ore and coal) and a cement plant close to limestone quarries. While we are writing this report, Indias largest FDI project POSCO with an investment of $12 billion in steel plant has been cleared is cause for cheers, not least because it renders fatuous claims that being green is incompatible with development. This is good news, but it took POSCO six years to get the environmental clearance. So lengthy was the process that the original deal expired. POSCO perserved, but it is not certain if others will.

Page |4

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Introduction

During last thirty years, there has been a tremendous growth in global Foreign Direct Investment (FDI). In 1980 the total inward stock of FDI equalled only 6.6% of world Gross Domestic Product (GDP), while in 2009 the share had increased to 30.7% (UNCTAD 2010). This dramatic development has taken place simultaneously with a substantial growth in international trade. The growth in international flows of goods and capital implies that geographically distant parts of the global economy are becoming increasingly interconnected as economic activity is extended across boundaries. FDI is an important factor in the globalisation process as it intensifies the interaction between states, regions and firms. Growing international flows of portfolio and direct investment, international trade, information and migration are all parts of this process. The large increase in the volume of FDI during the past two decades provides a strong incentive for research on this phenomenon. FDI is less volatile than other private flows and provides a stable source of financing to meet capital needs. FDI is an important and probably dominant channel of international transfer of technology. MNCs, the main drivers of FDI are powerful and effective vehicles for disseminating technology from developed to developing countries and are often the only source of new and innovative technology which is not available in the arms length market. The technology disseminated through FDI generally comes as a package including the capital, skills and managerial know-how needed to appropriate technology properly. Recent years have seen increased public concern that the benefits of FDI have yet to be demonstrated and that, where benefits exist, they may not be shared equitably in the society. The adjustment costs associated with FDI include higher short term unemployment due to corporate restructuring, increased market concentration and incomplete utilisation of FDI benefits due to incoherent institutional policies and regulatory conditions, unavailability of skilled labour and infrastructure. The debate on the likely costs and benefits has reached new heights. Under these circumstances it is important to inform the discussion by drawing lessons from the country experience and to assist the Government in identifying the conditions and policy requirements for maximising the benefits of FDI and minimising the risks and potential costs. In this report we are discussing different aspects of FDI at the macro-economic level using aggregated data for FDI. This report has been prepared in order to allow for the possibility of finding results that can provide knowledge about the nature, trend and pattern of inward FDI flow in India.

Page |5

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Components of FDI

The BPM5 and the benchmark recommend that FDI statistics can be compiled as a part of the BOP and international investment position statistics. Consequently countries are expected to collect and disseminate FDI data according to the standard components presented in the BPM5. The concept of FDI includes the capital funds that the direct investor provides to a direct investment enterprise as well as the capital funds received by the direct investment enterprises from the direct investor. It comprises not only the initial transaction establishing the relationship between the investor and the enterprise but also all subsequent transactions between them and among affiliated enterprises, both incorporated and unincorporated (IMF, 1993). The components of Direct Investment constitute direct investment income, direct investment transactions and direct investment position. FDI flows are the sum of three basic components; viz. equity capital, reinvested earnings and other capital associated with inter-company debt transactions: Equity Capital: It consists of the value of the MNCs investment in shares of an enterprise in a foreign country. It consists of non cash which can be in the form of tangible and intangible components such as technology fee, brand name etc. It comprises equity in branches, all shares in subsidiaries and associates and other capital contributions. Reinvested Earnings: It consists of the sum of the direct investors share (in proportion to the direct equity participation) of earnings not distributed as dividends by subsidiaries or associates and earnings of branches not remitted to the direct investor. Other Direct Investment Capital: They are also known as inter-company debt transactions. They cover the short and long term borrowing and lending of funds including debt securities and suppliers credit-between direct investors and subsidiaries, branches and associates (BPM5). In sum direct investment capital transactions include those operations that create or liquidate investments as well as those that serve to maintain, expand or reduce investments. The IMF definition thus includes as many as twelve different elements, namely: equity capital, reinvested earnings of foreign companies, inter-company debt transactions including short term and long term loans, overseas commercial borrowing (financial leasing, trade credits, grants, bonds), non cash acquisition of equity, investment made by foreign venture capital investors, earnings data of indirectly held FDI enterprises, control premium, non competition fee and so on.

Page |6

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Analysis of FDI inflows

Global trends in FDI inflows

FDI inflows plummeted in 2009 in all three major groupings developed, developing and transition economies. This global decline reflects the weak economic performance in many parts of the world, as well as the reduced financial capabilities of TNCs. Following their 2008 decline, FDI flows to developed countries further contracted by 44 per cent in 2009. Falling profits resulted in lower reinvested earnings and intra-company loans, weighing on FDI flows to developed countries. At the same time, a drop in leveraged buyout transactions continued to dampen cross-border M&As.

Shift in foreign investment inflows towards developing and transition economies is expected to accelerate. This shift was already apparent during 20072009 due to these economies growth and reform, as well as their increased openness to FDI and international production. As a result, developing and transition economies now account for nearly half of global FDI inflows (fig. I.3). While part of this relative increase may be temporary, most of it reflects a longer-term shift in TNC activity.

Page |7

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Global rankings of the largest FDI recipients confirm the emergence of developing and transition economies: three developing and transition economies ranked among the six largest foreign investment recipients in the world in 2009, and China was the second most popular destination (fig. I.4). While the United States maintained its position as the largest host country in 2009, a number of European countries saw their rankings slide.

Page |8

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Indian trends in FDI inflows

FDI inflows grew steadily through the first half of the 90s but stagnated between 1996-97 and 2003-04. The year-on-year fluctuations until 2003-04 make it difficult to identify a clear trend; however, inflows have been increasing continuously since 2004-05.During 2008-09, India registered FDI inflows of $33.6 bn and total cumulative inflows from August 1991 to March 2009 have been to the tune of $155 billion.

The growth rate of 154.7% in FY 2006-07 is remarkable. This was the period when disinvestment was on peak in India. It continued in FY 2007-08, however with a significant growth of 50 %. In FY 1998-98, 200203 & 2003-04, growth in FDI was negative which was largely due to political unrest. In FY 2008-09 and in 2009-10, the FDI has gone down largely because of Global recession and delays in environmental clearances to some big projects like POSCO steel.

Page |9

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Source of FDI Inflows

Indias 83% of cumulative FDI is contributed by nine countries while remaining 17 per cent by rest of the world. Indias perception abroad has been changing steadily over the years. This is reflected in the ever growing list of countries that are showing interest to invest in India. Mauritius emerged as the most dominant source of FDI contributing 44 % of the total investment in the country. Singapore was the second dominant source of FDI inflows with 9% of the total inflows. However, USA slipped to third position by contributing 7% of the total inflows.

Among the countries heading the list of FDI inflows into India is Mauritius. This could be attributed to the double taxation treaty that India has signed with Mauritius and also to the fact that most US investment into India is being routed through Mauritius. However, Singapore is the second largest investor in India followed by the US and other developed countries like the UK and the Netherlands, which are Indias major trading partners. Table 2.10 shows the share of the top investing countries in Indias FDI for the two sub-periods defined earlier. While the significance of Germany and Japan has declined in terms of their share in FDI inflows into India, Cyprus and the UAE have entered the list of top 10 investing countries during the recent cumulative period.

P a g e | 10

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

The India-Mauritius Double Taxation Avoidance Agreement (DTAA) was signed in 1982 and has played an important role in facilitating foreign investment in India via Mauritius. It has emerged as the largest source of foreign direct investment (FDI) in India, accounting for 50 per cent of inflows between August 1991 and 2008. A large number of foreign institutional investors (FIIs) who trade on the Indian stock markets operate from Mauritius.

According to the DTAA between India and Mauritius, capital gains arising from the sale of shares are taxable in the country of residence of the shareholder and not in the country of residence of the company whose shares have been sold. Therefore, a Company resident in Mauritius selling shares of an Indian company will not pay tax in India. Since there is no capital gains tax in Mauritius, the gain will escape tax altogether.

Future potential of FDI inflows in India

India still regarded as an underperformer Though FDI in India is showing buoyant trends, it is still ranked as an under performer, when the performance and potential is compared with other countries in the world. If we analyze the reason, we could see that:

Being a developing country with a low GDP per capita, many illiterate people and poor social and economic infrastructures, India could not attract FDI. India implemented, after its independence an inward looking strategy including planning, nationalization, an import substitution policy, where tax structure was complex and FDI was conditionally tolerated for internal needs and minority shares.

P a g e | 11

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

If some measures of de-licensing were taken in 1985-86, it was mainly in 1991 that India opened up to foreign investment, parallel with liberalisation of the economy. Private and foreign firms were permitted to invest in activities previously reserved for the public sector. FDI was allowed not only for the domestic market but also for exports, investment ceilings were raised; policy environment and procedures were simplified and streamlined. This was beneficial for the Indian economy. However, India began to emerge with inertia. That means we need wider and more meaningful reforms to induce FDI inflows.

However, reserves the potential to emerge as a top FDI destination Indias economic reforms way back in 1991 has generated strong interest in foreign investors and turning India into one of the favorite destinations for global FDI flows. FDI inflows in India have grown due to its human capital, size of market, rate of growth of the market and political stability. If India can further open up its economy, create flexible labour laws, create strategic infrastructure at SEZs and take strategic

P a g e | 12

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

policy initiatives of providing economic freedom, it may remain as a favourite destinations for global FDI flows.

FDI route of entry to India

The actual FDI inflows in India are welcomed under five broad heads: Foreign Investment Promotion Boards (FIPB) approval route for larger projects, Reserve Bank of Indias (RBI) automatic approval route acquisition of shares route (since 1996) RBIs non resident Indian (NRIs) scheme External commercial borrowings (ADR/GDR) route

The FIPB route represents larger projects which require bulk of inflows and account for governments discretionary approval. Although, the share of FIPB route is declining somewhat as compared to RBIs automatic route and acquisition of existing shares route. Automatic approval route via RBI shows an upward trend of FDI inflows since 1995. This route is meant for smaller sized investment projects. Acquisition of existing shares route and external commercial borrowing route gained prominence (in 1999 and 2003) and shows an upward increasing trend. However, FDI inflows through NRIs route show a sharp declining trend.

P a g e | 13

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

FDI in India Greenfield versus Brownfield

P a g e | 14

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Much of the FDI is realised either through the greenfield or the M&A route. According to the information provided in UNCTAD (2008), the number of greenfield investments is far ahead of the M&A deals realised during any year. This clearly indicates the preference for a new establishment as against choosing from the acquisition of an existing one or a merger. However, the greenfield investment itself may be used to set up a new unit altogether or to fund the expansion of an existing unit.

The figures for FDI through acquisitions of shares and the non-acquisition modes indicate the clear continuous dominance of fresh foreign investments over investments made to acquire existing shares.

FDI in India Regional Dispersion

The regional distribution of FDI inflows in the above table shows highly concentrated patterns. Six regional offices received around more than 70 percent of Indian FDI inflows. Mumbai, New Delhi and their surroundings include half of the FDI received by India since 2000. The areas of Bangalore and Chennai with almost 7 percent and 6 percent each respectively lag behind. Then there are places surrounding Hyderabad (4 percent) and Ahmedabad (4 percent).

Most software companies are in Mumbai and Bangalore where the Indian Industry originally developed, but they are also developing quickly in Delhi and its surroundings as well as in Andhra Pradesh and Tamil Nadu. As to the main poles of competitiveness, they are mainly concentrated in the South on the axis of Madras and Bangalore, and around Delhi and Mumbai.

P a g e | 15

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

FDI in India Sectoral Dispersion

Sector wise Analysis of FDI Inflow in India reveals that maximum FDI has taken place in the service sector including the telecommunication, information technology, travel and many others. The service sector is followed by the computer hardware and software in terms of FDI. High volumes of FDI take place in telecommunication, real estate, construction, power, automobiles, etc. The rapid development of the telecommunication sector was due to the FDI inflows in form of international players entering the market and transfer of advanced technologies. The telecom industry is one of the fastest growing industries in India. With a growth rate of 45%, Indian telecom industry has the highest growth rate in the world FDI inflows in real estate sector in India have developed the sector. The increased flow of foreign direct investment in the real estate sector in India has helped in the growth, development, and expansion of the sector.

P a g e | 16

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

FDI Inflows to Construction Activities has led to a phenomenal growth in the economic life of the country. India has become one of the most prime destinations in terms of construction activities as well as real estate investment. The FDI in Automobile Industry has experienced huge growth in the past few years. The increase in the demand for cars and other vehicles is powered by the increase in the levels of disposable income in India. The options have increased with quality products from foreign car manufacturers. The introduction of tailor made finance schemes, easy repayment schemes has also helped the growth of the automobile sector. The basic advantages provided by India in the automobile sector include, advanced technology, cost-effectiveness, and efficient manpower. Besides, India has a well-developed and competent Auto Ancillary Industry along with automobile testing and R&D centres. The automobile sector in India ranks third in manufacturing three wheelers and second in manufacturing of two wheelers. Opportunities of FDI in the Automobile Sector in India exist in establishing Engineering Centres, Two Wheeler Segment, Exports, Establishing Research and Development Centres, Heavy truck Segment, Passenger Car Segment. The increased FDI Inflows to Metallurgical Industries in India has helped to bring in the latest technology to the industries. Further the increased FDI Inflows to Metallurgical Industries in India has led to the development, expansion, and growth of the industries. All this has helped in improving the quality of the products of the metallurgical industries in India.

P a g e | 17

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

The increased FDI Inflows to Chemicals industry in India has helped in the growth and development of the sector. The increased flow of foreign direct investment in the chemicals industry in India has helped in the development, expansion, and growth of the industry. This in its turn has led to the improvement of the quality of the products from the industry.

How the sectoral dispersion has changed over the years?

The major sectors attracting FDI inflows in India have been Services and Electrical & electronics amounting US$ 30,421millions or 32 % of total FDI. Service sector tops the chart of FDI inflows in 2008 with India emerged as a top destination for FDI in services sector. Services exports are the major driving force in promoting exports.

Top 5 sectors in aggregate for FDI inflows constitute US$ 50,479 mn during August 1991 to Dec. 2008 which accounts for 53.2% of total FDI inflow. Out of this, nearly 40.8% of FDI inflows are in high priority areas like Services, Electrical Equipments, Telecommunication, etc.

P a g e | 18

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Sectoral analysis

Infrastructure Sector

The infrastructure sector constitutes Power, Non-conventional energy, Petroleum and natural gas, Telecommunication, Air Transport, Ports, Construction activities and real estate.

FDI up to 49% is allowed for investing companies in infrastructure/ services sector except telecom sector) through FIPB route. The infrastructure sector accounted for 28.62% of total FDI inflows from 2000 to 2008. Initially the inflows were low but there is a sharp rise in investment flow from 2005 onwards. Telecommunication received the highest percentage (8.05%) followed by construction activities (6.15%), real estate (5.78%), and power (3.16%). The major investment comes from Mauritius (56.30%) and Singapore (8.54%). In order to attract the investment, New Delhi (23.2%) and Mumbai (20.47%) enjoy the top two positions in India.

Infrastructure sector received 2528 numbers of foreign collaborations with an equity participation of US$ 111.0 bn; 41.15% of the total investment. Out of 2528 foreign collaborations 633 were technical and 2795 are financial collaborations during 1991-2008. The top Indian companies which received FDI inflows in Infrastructure sector during 2000 to 2008 are IDEA, Cellule Ltd, Bhaik Infotel P.Ltd, Dabhol Power Company Ltd, Aircel Ltd, Relogistics Infrastructure P.Ltd.

India has encouraged FDI in infrastructure sector from the very initiation of its economic reforms, but the demand for it is still not being fulfilled. In fact, investment is heavily concentrated in consumer durables sector rather than in long term investment projects such as power generation, maintaining roads, water management and on modernizing the basic infrastructure. The shortage of power is estimated at about 10% of the total electrical energy and approximately 20% of peak capacity requirement.

However, insufficient and poor conditions of Indias infrastructure are the major factors to the slowdown in growth which reduces the trust and enthusiasm for FDI from investors and economic growth of the country. Further, insufficient power supply, inadequate and unmaintained roads, an over- burdened railway system, severely congested urban areas, may continue to plague the Indian economy in the coming years.

P a g e | 19

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Services Sector

Services sector puts the economy on a proper glide path. It is among the main drivers of sustained economic growth and development by contributing 55% to GDP. There is a continuously increasing trend of FDI inflows in services sector with a steep rise in the inflows from 2005 onwards. Service sector received an investment of US$ 19.2 bn which is 19.34% of the total FDI inflows from 1991-2008 from FIPB/SIA, acquisition of existing shares and RBIs automatic routes only. However, this amount does not include FDI inflows received through acquisition route prior to Jan. 2000. Among the subsectors of services sectors, financial services attract 10.25% of total FDI inflows followed by banking services (2.22%), insurance (1.60%) and non- financial services (1.62%) respectively. Outsourcing, banking, financial, information technology oriented services make intensive use of human capital. FDI would be much more efficient and result oriented in these services vis- a-vis services which make intensive use of semiskilled and unskilled labour.

In India, FDI inflows in services sector are heavily concentrated around two major cities- Mumbai (33.77%) and Delhi (16.14%). Mauritius top the chart by investing 42.52% in services sector followed by UK (14.66%), Singapore (11.18%). The total number of approvals for services sector (financial nonfinancial) have been of the order of 1626 (5.78% of the total approvals) with an equity participation of US$ 8.7 bn, 10.28% of the total investment. Services sector ranks 3rd in the list of sectors in terms of cumulative FDI approved from August 1991 to Dec 2008. Out of 1626 numbers of foreign collaborations, 77 are technical and 1549 are financial in nature. Majority of collaborations in technology transfers are from USA (30) and UK (8).the leading Indian companies which received FDI inflows in services sector are: Cairn (I) Ltd, DSP Merrill Lynch Ltd, AAA Global Ventures Pvt. Ltd., Kappa Industries Ltd, Citi Financial Consumer Finance (I) Ltd, Blue Dart Express Ltd, Vyasa Bank Ltd, CRISIL Ltd, Associates India Holding Co. Pvt. Ltd, Housing Development Finance Corp. Ltd.

P a g e | 20

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Trading Sector

Trading sector received 1.67% of the total FDI inflows from 1991-2008. Trading (wholesale cash and carry) received highest percentage (84.25%) of total FDI inflow to this sector from 2000-2008 followed by trading (for exports) with 9.04%, e-commerce with (2.38%). Trading sector shows a trailing investment pattern upto 2005 but there is an exponential rise in inflows from 2006 onwards. Further, major investment inflows came from Mauritius (24.69%), Japan (14.81%), and Cayman Island (14.60%) respectively from 2000-2008. Investment in India is heavily concentrated in three cities viz. Mumbai (40.76%), Bangalore (15.97%), and New Delhi (12.05%). As far as technology transfers are concerned, total numbers of 20 technical and 1111 financial collaborations have been approved for Trading sector from 1991-2008. Maximum numbers of technology transfers are approved from USA (5), Japan (3) and Netherlands. The top five Indian companies which received FDI inflows are Multi Commodity Exchanges of India Ltd, Anchor Electricals, Multi Commodity Exchanges of India Ltd, Metro Cash and Carry India Pvt. Ltd, Essilor India Pvt. Ltd.

Consultancy Sector

Consultancy Sector received US$ 1.1 bn which is 1.14% of total inflows received from 2000-2008 through FIPB/SIA route, acquisition of existing shares and RBIs automatic route. Management services received an investment of US$ 737.6 million, marketing US$138.65 million and Design and Engineering services constitute an investment of US$ 110.43.

Major share of investment in consultancy services comes from Mauritius with 37.2%, USA (25.47%) and Netherlands 6.63% respectively. FDI inflows in consultancy sector registered a continuous increasing trend of FDI inflows from 2005 onwards. Further, in India Mumbai (38.76%) and New Delhi (13.01%) received major percentages of FDI inflow for consultancy sector from 2000-2008. Total numbers of technology transfers in consultancy services are 125, out of which 40 technical collaborations are approved with USA, 21 with UK, and 14 with Germany from 1991-2008.

Education Sector

FDI up to 100% is allowed in education sector under the automatic route. Education sector received US$ 308.28 million of FDI inflow from 2004-2008. Education sector shows a steep rise in FDI inflows from 2005 onwards. Heavy investment in education sector came from Mauritius with 87.95%, followed by Netherlands (3.76%), USA (2.93%) respectively.

P a g e | 21

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

In India, Bangalore received 80.14% of total FDI inflow followed by Delhi (6.45%), Mumbai (5.58%) respectively. As far as technology transfer and financial collaborations are concerned, total number of 2 technical and 112 financial collaborations are approved for education sector. Out of 2 technical collaborations, USA and Japan begged one each during 1991-2008. Further, India is endowed with a large pool of skilled people with secondary and tertiary level of education. India with this level of education attracts foreign firms in science, R & D, and high technology products and services. The endowment of science, engineering, and technology oriented people facilitate the spillovers of technology and know how. Moreover, the medium of instruction at these education levels is English the lingua franca of business. India with this added advantage benefits in attracting foreign firms in education sector.

Housing and Real Estate sector

Housing and Real Estate sector accounts US$ 4.7 bn of FDI inflows which is 5.78% of the total inflows received through FIPB/SIA route, acquisition of existing shares and RBIs automatic route during 2000 2008. There is an exponential rise in the amount of FDI inflows to this sector after 2005.

Heavy investment i.e. 61.96% came from Mauritius. In terms of most attractive locations in India New Delhi and Mumbai with 34.7% and 29.8% shares are on the first and second positions. The total numbers of foreign collaborations in Housing and Real Estate sector is 18 with an equity participation of US$1.0 bn during 1991-2008. Maximum numbers of foreign collaborations in Housing and Real Estate sector is with Mauritius (7), Singapore (2), and U.K (2). The top five Indian companies which received maximum FDI inflows in this sector are: Emaar MGF Land P. Ltd, Emaar MGF Land P. Ltd, Shivaji Marg Properities, Shyamaraju & Company (India) Pvt. Ltd, and India Bulls Infrastructure Development.

Construction activities sector

Construction activities Sector includes construction development projects viz. housing, commercial premises, resorts, educational institutions, recreational facilities, city and regional level infrastructure, township. The amount of FDI in construction activities during Jan 2000 to Dec. 2008 is US$ 4.9 bn which is 6.15% of the total inflows received through FIPB/SIA route, acquisition of existing shares and RBIs automatic route. The construction activities sector shows a steep rise in FDI inflows from 2005 onwards. Major investment in construction activities is received from Mauritius which is accounted nearly 58.61% of total FDI inflows during 2000-2008. In India Delhi, Mumbai, and Hyderabad receives maximum amount (viz. US$ 1245.61, 1000.5, and 943.22 bn) of investment. As far as technology transfers are concerned, total numbers of 9 technical and 223 numbers of financial collaborations have been approved for

P a g e | 22

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

construction activities, which accounts for 0.11% of the total collaborations approved during August 1991 to December 2008.

Maximum numbers of technical collaborations are approved with France (3) and USA (2). The top five Indian companies which received FDI inflows in this sector are: W.S Electric Ltd, Carmen Builders & Construction Pvt. Ltd, Caitlin Builders & Developers Pvt. Ltd, W.S. Electric Ltd, and PVP Ventures Pvt. Ltd.

Automobile Industry

Automobile Industry Sector comprises Passenger cars, auto ancillaries etc. FDI inflows in the automobile Industry sector, during Jan 2000 to Dec. 2008 is US$ 3.2 bn which is 4.09% of the total inflows received through FIPB/SIA route, acquisition of existing shares and RBI automatic route. The trends in automobile sector show that there is a continuous increase of investment in this sector after 2005 onwards (Chart3.20). Major investment came from Japan (27.59%), Italy (14.66%), USA (13.88%) followed by Mauritius(7.77%) and Netherlands (6.91%). in India Mumbai, New Delhi and Ahmedabad received major chunks of investment i.e. 36.98%, 26.63% and 9.47%). The total numbers of approvals for automobile industry have been of the order of 1611 with an equity participation of US$ 6.1 bn, which is 7.01% of the total investment.

Automobile industry sector ranks 5th in the list of sectors in terms of cumulative FDI approved from August 1991 to Dec 2008. Out of 1611 numbers of foreign collaborations approved 734 are technical and 877 are financial in nature.

Highest numbers of technical collaborations are with Japan in automobile Industry. Major Indian companies which received highest percentage of FDI inflows in automobile industry are Escorts Yamaha Motor Ltd, Yamaha Motors India Pvt. Ltd, Punjab Tractors Ltd., Yamaha Motor Escorts Ltd, Endurance Technologies P. Ltd, General Motors India td, and Fiat India Automobile P. Ltd.

Computer Software and Hardware Sector

Computer Software and Hardware sector received US$ 8.9 bn which constitute 11.43% of the total FDI inflows during the period Jan 2000 to Dec 2007. Computer Software and Hardware sector shows a continuous increasing trend of FDI inflows (Chart-3.21). Mauritius with an investment of US$ 4789 bn remained at the top among the investing countries in India in this Sector. Other major investing countries in this sector are USA (12.88%), Singapore (10.07%) etc. Among Indian locations Mumbai received 22.44% of investment followed by Bangalore (10.8%), and Chennai (9.90%).

P a g e | 23

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Computer Software and Hardware industry fetched 3636 numbers of foreign collaborations. Out of 3636, 125 are technical and 3511 are financial in nature with an equity participation of US$ 3.0bn. Major technological transfers come from USA (43.2%) and Japan (10.4%). The top Indian companies which received FDI inflows in this sector are: I Fliex Solutions Ltd, I Flex Solutions ltd, Tata Consultancy Services Ltd, Infrasoft Technologies Ltd, Mphasis BFL Ltd, I- Flex Solutions Ltd, Digital Global Soft Ltd, India Bulls Financials Services P. Ltd, IFLEX Solutions Ltd, Unitech Reality Projects Ltd.

Telecommunications Sector

Telecommunications Sector comprises Telecommunications, Radio Paging, Cellular Mobile/ Basic Telephone Services etc. India received cumulative FDI inflows of US$ 100.4 bn during 1991-2008. Out of this, Telecommunications Sector received an inflow of US$ 8.2 bn, which is 8.4% of the total FDI inflows during August 1991 to December 2008. There has been a steady flow of FDI in telecommunications from 1991 to 2005, but there is an exponential rise in FDI inflows after 2005 (Chart-3.22). Mauritius with 82.22% of investment remains on the top among the investing countries in this sector. Other investing countries in the telecom sector are Russia (5.41%) and USA (2%). New Delhi attracts highest percentage (32.58%) of FDI inflows during Jan 2000 to Dec 2008. The total numbers of approvals for telecommunications Industry have been of the order of 1099 with an equity participation of US$ 13.3 bn, 14.34% of the total investment. Telecommunication sector ranks 2nd in the list of sectors in terms of cumulative FDI approved from August 1991 to Dec 2008. Out of 1099 foreign collaborations, 139 are technical and 960 are financial in nature.

Highest numbers (32) of technical collaborations are approved with USA followed by Japan (19), U.K. (12), Canada (12) and Germany (12). The leading Indian companies which received FDI inflows in this sector are: Bhaik Infotel p. Ltd, Aircel Ltd, Bharti Tele Ventures Ltd, Bharti Telecom ltd, Flextronics Software Systems Ltd, Hathway Cable & Data Com. Pvt. Ltd, Unitech Developers & Projects Ltd, Hutchison Essar South Ltd. Etc.

Manufacturing Sector

The manufacturing sector plays a significant role in the Indian economy, contributing nearly 17 per cent to the GDP (in 2008-09). Encouraged by the increasing presence of multinationals, the scaling up of operations by domestic companies and an ever-expanding domestic market, the Indian manufacturing sector has been averaging 9 per cent growth in the past four years (2004-08), with a record 12.3 per cent in 2006-07. Industry and manufacturing were the major contributors to the economy, having a

P a g e | 24

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

consistently high GDP growth rate in the past two years, making India one of the fastest growing economies in the world. India has all the requisite skills in product, process and capital engineering, due to its long manufacturing history and higher education system. Indias cheap, skilled manpower is attracting a number of companies across diverse industries, making India a global manufacturing powerhouse. FDI inflows into manufacturing have been computed based on FDI records provided by DIPP.

FDI inflows in the manufacturing sector was as follows: electrical equipment (including s/w & elec.) occupied the highest share, i.e., 30.6 per cent during 2000-2007, followed by the transportation industry (9.9 per cent), fuels (power & oil refinery) (7.7 per cent), chemicals (other than fertilizers) (4.8 per cent) and drugs and pharmaceuticals (4.0). The remaining sectors have a share of less than 4 per cent in total FDI inflows in manufacturing. However, the share of manufacturing in total FDI inflows of India was 34.02 per cent in 2007.

FDI and other macro-economic indicators

FDI is considered to be the life blood and an important vehicle of for economic development as far as the developing nations are concerned. The important effect of FDI is its contribution to the growth of the economy. FDI has an important impact on countrys trade balance, increasing labour standards and skills, transfer of technology and innovative ideas, skills and the general business climate. FDI also provides opportunity for technological transfer and up gradation, access to global managerial skills and practices, optimal utilization of human capabilities and natural resources, making industry internationally competitive, opening up export markets, access to international quality goods and services and augmenting employment opportunities. The reliance on FDI is rising heavily due to its al round contributions to the growth of the economy. FDI to developing countries since 1990s is the leading source of external financing. The rise in FDI volume is accompanied by marked change in its composition.

High degree positive correlation has been found between FDI and economic development.

P a g e | 25

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

FDI as a percentage of GDP: The graph below suggests growing inflows of foreign direct investment in the 1990s. In 1970 and 1980, large parts of world except US had zero or small inflows of foreign investment. The Indias share of FDI inflows in GDP has been very small in absolute terms, remaining less than one (2000, 2003, and 2005). However the ratio improved dramatically (1.85) in 2006, which reflects the growth in the economy, improvement in the investment climate as well as the buoyancy in FDI flows.

Source: World Bank Website http://data.worldbank.org/indicator/BM.KLT.DINV.GD.ZS

Determinants of FDI

Market Size: The attractiveness of large markets is related to larger potential for local sales, because local sales are more profitable than export sales especially in larger countries where economies of scale can be eventually reaped. Economic stability of the country: This is measured in terms of Interest Rates: The level of External Indebtedness Debt Service Ratio Foreign Exchange Reserves Exchange Rate Regime Inflation Rate Deficit in the Balance Of Payments

P a g e | 26

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Availability of human capital: Cheap and productive labour reduces the cost of production and yields high profitability and thus has a positive effect on FDI. Availability of natural resources: If the resources are available locally the cost of production remains low, as the cost of transportation is saved. It is the sustained availability of the resources which matter in the investment decisions. Economic policies of the host country: Economic policies include the industrial policies, trade policies, tax structures, the intellectual property protection regime, bilateral investment treaties, regional integration frameworks, multilateral investment frameworks etc of a country. Infrastructural facilities: The development of roads, rails, electricity and communication system are important infrastructural facilities which are vital for the development of the industry Agglomeration effects: Agglomeration economies arise from the presence of other firms, other industries, as well as from the availability of skilled labour force. This gives rise to economies of scale and positive externalities, including knowledge spillovers, specialized labor and intermediate inputs.

P a g e | 27

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Conclusions

It may be concluded that FDI share of developed countries is shrinking and developing countries had made their presence felt by receiving a descent amount of FDI in the last two decades. Although India is not the most preferred destination of global FDI, but there has been a generous flow of FDI in India since 1991. The economic reform process started in 1991 helps in creating a conducive and healthy atmosphere for foreign investors and thus, resulting in substantial amount of FDI inflows in the country. India, with a share of nearly 75% emerged as a major recipient of global FDI inflows in South Asia region in 2007. India has considerably decreased its fiscal deficit from 4.5 percent in 2003-04 to 2.7 percent in 2007-08 and revenue deficit from 3.6 percent to 1.1 percent in 2007-08. Economic reform process since 1991 have paves way for increasing foreign exchange reserves to US$ 251985 millions as against US$ 9220 millions in 1991-92. The changing policy framework has affected the trends and patterns of FDI inflows received by the country. At the same time, the composition and type of FDI has changed considerably. Even though manufacturing industries have attracted rising FDI, the services sector accounted for a steeply rising share of FDI stocks in India since the mid-nineties. Thus, although the magnitude of FDI inflows has increased, in the absence of policy direction the bulk of them have gone into services and soft technology consumer goods industries bringing the share of manufacturing and technology intensive among them down. Trading sector shows a trailing pattern up to 2005 but there is an exponential rise in inflows from 2006 onwards. More FDI is being pumped into India's housing sector. Education sector attracts foreign investors in the last decade. Research and Development expenditure shows unexpected negative sign as of expected positive sign. This could be attributed to the fact that R&D sector is not receiving enough FDI as per its requirement. In terms of investing countries, it can be noted that there is a high degree of concentration with nearly 40 percent of the investment coming from Mauritius. This generous flow of FDI is largely because of India has maintained Double Tax Avoidance Agreements (DTAA) with nearly 70 countries of the world. Much of the FDI in India is realized through the Greenfield projects. The major FDI inflows in India are concluded through automatic route and acquisition of existing shares route than through FIPB, SIA route during 1991-2008. State- wise FDI inflows show that Maharashtra, New Delhi, Karnataka, Gujarat and Tamil Nadu received major investment from investors because of the infrastructural facilities and favourable business environment provided by these states.

P a g e | 28

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Even though the foreign direct investment (FDI) into the country continues to remain on a downward trajectory, this drop can be attributed to our Protectionist environmental policies which delayed some of the big FDI projects like POSCOs. But overall situation is improving. There are quite a few investments that have been received like the tie-up between the British-based oil company BP and Reliance Industries and the deal between Vodafone and Essar. A number of fresh investments were in the pipeline which will boost overall FDI into the country in FY12. These are indicators of continuing investor confidence in India and are likely to add to the FDI portfolio this year substantially. In a nutshell, despite troubles in the world economy, India continued to attract substantial amount of FDI inflows. India due to its flexible investment regimes and policies prove to be the horde for the foreign investors in finding the investment opportunities in the country and the India story remains very strong.

Suggestions and recommendations

FDI as a strategic component of investment is needed by India for its sustained economic growth and development. FDI is necessary for creation of jobs, expansion of existing manufacturing industries and development of the new one. Indeed, it is also needed in the healthcare, education, R&D, infrastructure, retailing and in longterm financial projects. We recommend the following suggestions to improve the inward flow of FDI in India-- Policy makers to focus more on attracting diverse types of FDI Quicker and greater government responsiveness will help transform a range of sectors and create employment. For example the POSCO project itself, its estimated, will create around 48,000 direct and indirect jobs. Firm time limits for green clearance would address concerns-voiced even by RBI- that delays undermine FDI inflow. It is suggested that the government should push for the speedy improvement of infrastructure sectors requirements which are important for diversification of business activities. Government should ensure the equitable distribution of FDI inflows among states.The central government must give more freedom to states, so that they can attract FDI inflows at their own level. The government should also provide additional incentives to foreign investors to invest in states where the level of FDI inflows is quite low.

P a g e | 29

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

Government must target at attracting specific types of FDI that are able to generate spillovers effects in the overall economy. This could be achieved by investing in human capital, R&D activities, environmental issues, dynamic products, productive capacity, infrastructure and sectors with high income elasticity of demand.

Government must pay attention to the emerging Asian continent as the new economic power house of business transaction and try to boost the trade within this region through bilateral, multilateral agreements and also concludes FTAs with the emerging economic Asian giants.

FDI should be guided so as to establish deeper linkages with the economy, which would stabilize the economy (e.g. improves the financial position, facilitates exports, stabilize the exchange rates, supplement domestic savings and foreign reserves, stimulates R&D activities and decrease interest rates and inflation etc.) and providing to investors a sound and reliable macroeconomic environment.

As the appreciation of Indian rupee in the international market is providing golden opportunity to the policy makers to attract more FDI in Greenfield projects as compared to Brownfield investment. So the government must invite Greenfield investments.

The policy makers should ensure optimum utilization of funds and timely implementation of projects. The government while pursuing prudent policies must also exercise strict control over inefficient bureaucracy, red - tapism, and the rampant corruption, so that investors confidence can be maintained for attracting more FDI inflows to India. Last but not least,the government ensures FDI quality with magnitude.

Indeed, India needs a business environment which is conducive to the needs of business. As foreign investors doesnt look for fiscal concessions or special incentives but they are more of a mind in having access to a consolidated document that specified official procedures, rules and regulations, clearance, and opportunities in India.

P a g e | 30

Project Report

MBA (IB) PT (2009-12) INDIAN ECONOMY AND TRADE POLICY

References

1. Government of India. Economic Survey 2010-11. New Delhi: Ministry of Finance. 2. National Council of Applied Economic Research, 2010. FDI in India and its growth linkages. New Delhi: M/s. Cirrus Graphics Pvt. Ltd; Naraina Industrial Area. 2009, August 3. Hooda, Sapna (2011). A Study of FDI and Indian Economy. Doctoral dissertation, Department of Humanities and Social Sciences, National Institute of Technology, Kurukshetra, India 4. Chatterjee, Sumna (2010). An Economic Analysis of FDI in India. Doctoral dissertation, Department of Economics, Faculty of Arts, The Maharaja Sayajirao University of Baroda, Vadodara, Gujrat, India 5. Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Govt. of India, 2011. Consolidated FDI policy. http://dipp.nic.in/Fdi_Circular/FDI_Circular_012011_31March2011.pdf (accessed April 22, 2011) 6. UNCTAD. World Investment Report 2010. www.unctad.org/wir or www.unctad.org/fdistatistics. (accessed April, 22, 2011) 7. Fact Sheet on FDI (from August 1991 to February 2011).

http://dipp.nic.in/fdi_statistics/india_FDI_February2011.pdf. (accessed April 22, 2011) 8. RBIs FDI INFLOWS DATA AS PER INTERNATIONAL BEST PRACTICES (as per RBIs monthly bulletin). http://siadipp.nic.in/publicat/newsannual/2009/chapter1.4.B.pdf. (accessed April 22, 2011) 9. State/RBI Region-wise Foreign Direct Investment (1991-2011).

http://www.indiastat.com/industries/18/foreigndirectinvestment/17578/staterbiregionwiseforei gndirectinvestment/449558/stats.aspx. (accessed April 22, 2011) 10. Foreign Direct Investment. http://www.tradechakra.com/direct-foreign-india-investment.html. (accessed April 29, 2011) 11. Singh, Shalini (2011). Popular Articles About Foreign Direct Investment. Indiatimes.com. http://articles.timesofindia.indiatimes.com/keyword/foreign-direct-investment (accessed April, 29, 2011)

P a g e | 31

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- World Tax ReformDocument333 pagesWorld Tax ReformncariwibowoNo ratings yet

- PFRS 16 Summary - With TaxDocument56 pagesPFRS 16 Summary - With Taxsherryl caoNo ratings yet

- Central BankingDocument22 pagesCentral BankingKhalid AzizNo ratings yet

- Secured Transactions Flow Chart (Collateral)Document10 pagesSecured Transactions Flow Chart (Collateral)Kathleen Alcantara94% (16)

- Financial Management for Entrepreneurs & Executives SeminarDocument3 pagesFinancial Management for Entrepreneurs & Executives SeminarMabsNo ratings yet

- Ackman's Letter To PWC Regarding HerbalifeDocument52 pagesAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- Part 7. Read The Text and Fill in The Blanks With The Correct Answer. Choose A, B or CDocument2 pagesPart 7. Read The Text and Fill in The Blanks With The Correct Answer. Choose A, B or CLaura BeNo ratings yet

- GR 194201Document7 pagesGR 194201RajkumariNo ratings yet

- Spouses Cuyco v. Spouses Cuyco, GR No. 168736 April 19, 2006Document1 pageSpouses Cuyco v. Spouses Cuyco, GR No. 168736 April 19, 2006franzadonNo ratings yet

- QuestionsDocument87 pagesQuestionsramu_n16100% (2)

- Introduction of Financial RulesDocument68 pagesIntroduction of Financial RulesTariq Waqar50% (2)

- Revised Nekepte 2Document18 pagesRevised Nekepte 2theodrosbaby100% (1)

- Peter ContiDocument289 pagesPeter ContiRaul BarnaNo ratings yet

- 10000002222Document112 pages10000002222Chapter 11 DocketsNo ratings yet

- International Introduction To Securities and Investment Ed6 PDFDocument204 pagesInternational Introduction To Securities and Investment Ed6 PDFdds50% (2)

- Civil ProcedureDocument6 pagesCivil ProcedureAya BeltranNo ratings yet

- Advocates of Til vs. BSPDocument3 pagesAdvocates of Til vs. BSPIrene RamiloNo ratings yet

- Bus-Org Cases-31 To 40Document7 pagesBus-Org Cases-31 To 40Dashy CatsNo ratings yet

- PA v0.25Document18 pagesPA v0.25Sai PawanNo ratings yet

- Obligation and Contracts-ECEDocument45 pagesObligation and Contracts-ECECrisJoshDizon50% (6)

- Lagos State Investor Handbook FinalsDocument35 pagesLagos State Investor Handbook Finalsdavid patrick50% (2)

- 10-09-22 SACCO Automation ReportDocument88 pages10-09-22 SACCO Automation ReportTomBiko100% (1)

- Surname: First Name: Campus France Registration Number: IN Age: Marital StatusDocument2 pagesSurname: First Name: Campus France Registration Number: IN Age: Marital StatusSahil ShahNo ratings yet

- Financial Accounting and Analysis Exam QuestionsDocument2 pagesFinancial Accounting and Analysis Exam QuestionsPraveena MallampalliNo ratings yet

- Rashmi PDF of ReportDocument67 pagesRashmi PDF of ReportrashmiNo ratings yet

- Business Math Week 9Document10 pagesBusiness Math Week 9황혜진No ratings yet

- Advanced Accounting MCGRAW-HILL - Chapter 13 - SOLMANDocument48 pagesAdvanced Accounting MCGRAW-HILL - Chapter 13 - SOLMANklariz_ventura100% (1)

- Cautionary note on sharing access to our websiteDocument21 pagesCautionary note on sharing access to our websiteHarman MultaniNo ratings yet

- Forest City Realty Trust 10K Annual Report Feb. 22, 2018Document182 pagesForest City Realty Trust 10K Annual Report Feb. 22, 2018Norman OderNo ratings yet

- GA Motion To Set Aside Wrongful Foreclosure SaleDocument30 pagesGA Motion To Set Aside Wrongful Foreclosure Salenilessorrell100% (2)