Professional Documents

Culture Documents

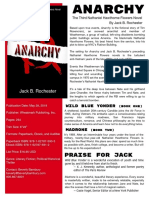

2011 Publishing Market Guide

Uploaded by

IUPRESS_permissCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 Publishing Market Guide

Uploaded by

IUPRESS_permissCopyright:

Available Formats

Publishing Industry Market Brief

Prepared by the

U.S. Commerce Department Global Publishing Team

Tis years ofcial sponsors:

Table of Contents

Australia 3

Austria 8

Belgium 12

Chile 17

China 28

Czech Republic 34

Denmark 40

France 44

Germany 53

Hong Kong 58

India 62

Italy 65

Mexico 69

Te Netherlands 78

Te Philippines 80

Qatar 86

Te Global Publishing Teamof

U.S. Commercial Service

U.S. Department of Commerce

Te U.S. Commercial Service (CS) Global Publishing Team is made up of domestic

and international trade specialists who provide targeted assistance to the U.S. pub-

lishing industry. Our team members are located throughout the United States and in

U.S. Embassies and Consulates worldwide. We are the publishing industrys primary

export resource and should be your frst point of contact if you are looking to sell

rights or titles internationally.

Why U.S. publishers should work with the CS Global Publishing Team:

n We ofer services to help you maximize your time at international book fairs,

including appointment-scheduling and pre-show promotion programs

n We can identify overseas qualifed partners and supply critical background

information

n We provide opportunities to showcase titles at international book fairs, allowing

you to explore new markets

n We coordinate country- and issue-specifc webinars with industry experts to

help you stay current on issues facing publishers

Let the CS Global Publishing Team connect you with your local team member today

so you can take advantage of these resources. For more information on CS Global

Publishing Team assistance, visit www.export.gov/industry/paper.

Te CS Global Publishing Team expresses our sincere gratitude to Publishers Weekly and

PubMatch for their support in sponsoring this market research guide. Publishers Weekly is

the international book industrys leading news magazine and website, covering every as-

pect of creating, producing, marketing and selling the written word in book, audio, video

and electronic formats. PubMatch is the frst comprehensive international rights network

for the publishing community and connects publishers, authors and agents worldwide.

Visit www.publishersweekly.com and www.pubmatch.com to learn more.

We would also like to thank Lightning Source for printing this guide. Lightning

Source, an Ingram Content Group company, is the leader in providing a comprehen-

sive suite of inventory-free on-demand print and distribution services for books to

the publishing industry. For more information visit www.lightningsource.com.

Best regards,

Dawn Bruno

Global Publishing Team Leader

U.S. Commercial Service

New York City, New York

212-809-2647

Dawn.Bruno@trade.gov

www.export.gov

Capital: Canberra

Population: 21.7 million

GDP*: $889.6 billion

Currency: Australian Dollar

Language: English

*(purchasing power parity)

Summary

Australia is the third largest English-speaking book market afer the United States and

the United Kingdom. Tree quarters of the Australian adult population report reading

for pleasure every day or on most days of the week. Book demand exceeds US$1 billion.

Australians continue to purchase books, with the efects of the current world economic

crisis minimally afecting this sector. Most books are purchased as gifs or for recreation.

Imports supply over 40 percent of the market, with 28 percent originating from the United

States. Te sale of reference books and non-fction works continues to increase.

Market Demand

Nearly 30 percent of all books read in Australia are bought new. 50 percent of Australian

readers read either fction or non-fction, with one quarter preferring fction and the other

non-fction. Te highest demand for books in the Australian market lies in educational

books, including professional and reference books, followed by general non-fction books.

Ten percent of readers choose to purchase a book by an Australian author; how-

ever 88 percent of readers say the authors nationality does not afect their choice.

Price is an important factor, with 46 percent of Australian readers say that price

contributes to the books they choose.

Income, gender and education also determine book demand. Demand for books

generally increases with income. However, low income earners in Australia purchase

books in similar numbers to those in the middle income bracket. Females tend to read

more than males, on average reading 8.9 hours per week compared to males 7.3 hours.

Individuals with tertiary education qualifcations also have a greater propensity to read.

Te book buying cycle in Australia is similar around the world. Prior to the De-

cember holiday season, book purchases increase dramatically. Nearly 40 percent

of book buyers acquire books for relaxation over the holiday, and 10 percent of

books buyers give them as gifs.

AUSTRAlIA

Russia 92

Singapore 96

Spain 98

Sweden 101

Taiwan 106

Turkey 109

United Kingdom 113

Table of Contents

Publishing Industry Market Brief 3

Market Data

Market Size for Books (All fgures in US $ thousand)

2008 2009 2010 (estimated)

Total Market Size 915,580 1,025,450 1,086,977

Total Local Production 617,447 687,497 728,746

Total Exports 99,239 110,597 117,232

Total Imports 397,372 448,550 475,463

Imports from the US 110,902 129,517 137,288

Exchange rates:

2008 0.8774

2009 0.7812

2010 0.7812

Demand for books grew to US$1.025 billion in 2009, with an anticipated growth

of 6 percent through 2010. Imports valued at US$448 million supplied 43 percent

of domestic demand in 2009. Te major sources of imported books are United

States (28%), United Kingdom (28%), China (15%) and Hong Kong (11%).

Supply from local and U.K. publishers maintain a strong competitive environ-

ment. Imports from the U.K. accounted for US$129 million, or 28 percent of the

total import market in 2009. Te U.S. holds a similar market share of 28 percent.

Imports from China accounted for US$67 million, or 15 percent of the import

market share. Imports from Hong Kong total US$52 million in 2009, or 11 per-

cent of the total import market. Book imports from South East Asia are a refec-

tion in book printing ofshore by U.K. and U.S. publishers.

Best Prospects

As trends project, demand for reference books will increase. Trends also specif-

cally forecast growth for computer, business and self-help books, as Australians

are increasingly referring to books for assistance with information technology

and the use of the Internet.

Key Suppliers

Te Australian Bureau of Statistics indicates that over 230 book publishers in

Australia supply over 128 million books annually. Te majority of the larger pub-

lishers in Australia are subsidiaries of U.S. or U.K. companies, with smaller local

publishers serving specialized markets.

U.S. subsidiaries in Australia include Random House, McGraw-Hill, Pearson,

and Scholastic. Imprints by Random House include Arrow, Bantam, Century,

Chatto and Windus, Corgi, Doubleday, Ebury, Hutchinson, Jonathan Cape,

Knopf, Vintage, and William Heinemann. U.S. publishers McGraw-Hill, Pearson,

and Scholastic supply the Australian education market.

U.K. subsidiaries include Hodder Headline and Pan Macmillan. Hodder Headline

publishes a diverse range of books, including a strong childrens component. Many

of its titles are from Australian authors. Pan Macmillan produces an array of titles

under imprints including Macmillan, Pan, Picador, Macquarie Dictionary Publish-

ers, Pancake, St. Martins Press, Tor, Forge, Grifn, and Sidgwick & Jackson.

Australian publishers continue to maintain a market share of more than 50 per-

cent. Te majority of local publishers sales (77%) are to retailers and other book

distributors, while the remaining 23 percent of sales are directly to the consumer.

Tere are 1,800 booksellers in Australia. Other book chains include Dymocks, Col-

lins Booksellers and the ABC Bookshop. Tese chains have 142, 59 and 12 Aus-

tralian stores respectively. An additional 1,200 independent booksellers supply the

market. 34 percent of Australians purchase from these independent booksellers,

with 65 percent of Australians purchasing their books from book chains.

Prospective Buyers

End-users of books include:

1. Te general public;

2. Students and academics;

3. Professionals; and

4. Libraries, the majority of which are public libraries or school libraries.

Te selection of a book by the general public is usually related to leisure activity,

whereas academic books are associated with research. Higher education in Austra-

lia is ofered at two levels, universities and vocational education institutions. Tere

are over 700,000 students in higher education institutions. In addition, over 100

Technical and Further Education (TAFE) Centers ofer vocational training.

Professionals between 26-60 years old purchase books to improve their knowl-

edge base. Tis is due to increased workforce competition and the importance of

skill acquisition. Individuals in this demographic have typically completed col-

lege or entered the workforce directly. Tese individuals have a higher disposable

income than younger demographics and will pay a higher price for quality books.

Tere are over 1,000 libraries throughout Australia. 11.9 million people, or 57

percent of the population, are members of or borrow from public libraries. Data

Publishing Industry Market Brief 5 4 Publishing Industry Market Brief

from the Australia Council for the Arts indicates a trend toward borrowing, rath-

er than purchasing books. Over 35 percent of books are borrowed, with most

borrowing from public libraries.

Market Entry

Distribution is primarily undertaken by publishers. Books are distributed on a

sale-or-return basis to booksellers. Unsold books are returned to the publisher.

However, some books are sold on a frm sale basis. A number of publishers

also act as distributors for smaller publishing houses. Independent wholesaling

is non-existent at a national level.

Local chain stores cater to the mass market. As a consequence, the smaller pub-

lishers materials are generally handled by the independent book stores, which

serve niche end-users needs.

Australia has a range of fnancial services from local and international banks.

Financing practices are comparable to those in the U.S. Terms of payment are

negotiable, with import fnancing afected through open accounts; commercial

bills of exchange (sight and time drafs); letters of credit; and cash in advance.

Usually payment terms of 30-60 days are considered the norm amongst the book

industry, with letter of credit and sight drafs the most common methods.

Market Issues & Obstacles

In 2009 the Productivity Commission, an agency of the Australian Federal Gov-

ernment, investigated the deletion of the 30 day copyright rule. Te Australian

Government rejected change to this law on November 11, 2009. Te legislation

maintains restrictions on the parallel importation of books.

Australian 30 day copyright legislation allows the importation of a new title, as

long as the title is unavailable in Australia, within 30 days of its publication. If

a book is not available in Australia within 30 days of its publication overseas, a

bookseller is permitted to parallel import.

Te reasons behind the decision are twofold. Te Australian Government con-

siders any regulation change unlikely to have a material efect on book availability

in the Australian market. It also suggests that technology innovation such as e-

books will automatically develop book reform in this market.

Duty on books is zero, under the Australian Free Trade Agreement (FTA), which

was enacted on January 1, 2005. However, book imports are subject to a Goods

and Services Tax (GST) of 10 percent. While the producer/supplier pays the GST

to the Australian Taxation Ofce, the consumers pay the GST cost as well. Te

importer pays the GST to the Australian Customs Service.

Te one exception to this is educational books. Such books are exempt from the

GST, as long as the books appear on the syllabus of a school or university course.

Te FTA also has strengthened intellectual property rights with copyright ex-

tending to 70 years rather than 50 years.

Entry into this market depends on tailoring the products to meet Australian

spelling standards. Spelling in Australia is based on English from the United

Kingdom. Early childhood educators in Australia are, however, increasingly pro-

moting spelling standards for young children with the Macquarie Dictionarys

recommended standards.

Trade Events

Australian Booksellers Association Annual Conference & Trade Exhibition 2011

Date: July 21-25, 2011

Location: Melbourne

Website: www.aba.org.au

Resources & Contacts

Australian Booksellers Association

Unit 9, 828 High Street

Kew East VIC 3102

Phone: 61-3-9859-7322

Fax: 61-3-9859-7344

Email: mail@aba.org.au

Website: http://www.aba.org.au

Australian Publishers Association

60/89 Jones Street

Ultimo NSW 2007

Phone: 61-2-9281-9788

Fax: 61-2-9281-1073

Email: ofce@publishers.asn.au

Website: http://www.publishers.asn.au

Commercial Service Contact Information

Location: Melbourne, Australia

Contact: Annette Ahern

Email: annette.ahern@mail.doc.gov

Phone: +613 3 9526 5928

Fax: +61 3 9510 4660

Website: buyusa.gov/Australia.

Publishing Industry Market Brief 7 6 Publishing Industry Market Brief

AUSTRIA

Capital: Vienna

Population: 8.3 million

GDP*: $373.2 billion

Currency: Euro

Language: German

*(purchasing power parity)

Summary

Austria has 1,474 publishing companies, 280

periodical publishers and 100 newspaper

publishers in an industry structure composed

primarily of small and mid-sized companies.

Tere are 4,100 authors in Austria, 400 of

them working full-time. With its 3.6 million

private households, the book market gener-

ates annual sales of $2.2 billion.

Household Spending on Published Materials in 2009 (in USD)

Product Group Spending per Household Total Sales (in millions)

Books 171.68 618.04

Educational material & textbooks 136.58 491.70

Newspapers and magazines 374.62 1,348.63

Paper and stationery 57.24 206.08

Total 603.54 2,172.75

(Source: Branchen-Monitor Buch, Association of the Austrian Book Trade)

Book Sales

Year Sales USD (in millions) Percentage Change

2004 999.91 -

2005 990.86 -0.9%

2006 995.38 +0.5%

2007 1,040.66 +4.5%

2008 1,015.68 -2.4%

2009 1,038.02 +2.2%

2010 1,056.70 +1.8%

(Source: Branchen-Monitor Buch, Association of the Austrian Book Trade)

Of the 8,195 individual new releases in Austria in 2009, 780 or just fewer than

10% were foreign or multi-lingual. Te foreign publications were released in 37

languages, of which English had the largest share with 67%, French ranking sec-

ond with 8% and Swedish and Spanish with around 3%.

Market Trends

In publishing, the trend towards the digitalization of content is ongoing. More

and more books are being posted on the Internet, yet the costs are still very high

since the process of digitalization involves expensive manual or mechanical han-

dling. (Source: Association of the Austrian Book Trade)

Book sales are still dominated by individual bookstores. However, the trend is

moving towards increased consolidation. In 2005 31% of book sales were made

through a chain compared to 38% in 2009. Approximately 15% of book sales were

made via the Internet. (Source: Association of the Austrian Book Trade)

Publishing Industry Market Brief 9 8 Publishing Industry Market Brief

Te following table indicates the allocation of new releases in literary felds:

(Source: National Library of Austria)

Because of its proximity and shared language, Germany is Austrias premier trad-

ing partner in books, with 80% of new book releases in Austria imported from

Germany and 80% of Austrian book exports going to Germany.

Market Entry

American publishing houses can approach Austrian booksellers by contacting

an intermediary delivery company (please contact the U.S. Commercial in Aus-

tria for a detailed contact list), or by contacting a bookseller directly. In Austria,

books are subject to a price-fxing restraint, which commits publishing houses

and book importers to adhere to a pre-arranged end price. Te intent of this law

is to ensure a broad variety of literature and enables small bookstores to produce

sufcient income to stay in operation. Legislators fear that without this system a

handful of fnancially strong companies would push small booksellers into ruin

and dominate the marketplace and that eventually only books that are expected

to achieve high volume sales will be available. However, the Austrian price-fxing

law does not apply to books in the English language. American publishing houses

can calculate their prices independently and negotiate directly with the book-

seller over discount rates and gross proft margins. In Austria the average proft

margin for booksellers is between 30% and 40%. (Source: Association of the Aus-

trian Book Trade)

Trade Events

lITERA 2011

International Book Fair

Linz, Austria

April 28- May 1, 2011

http://www.linzkongress.at/litera/englisch/index_litera_en.html

FRANKFURTER BUCHMESSE 2011

International Book Fair

Frankfurt, Germany

October 12- 16, 2011

http://www.buchmesse.de/en/ff

Most major Austrian publishers regularly attend the Frankfurt Book Fair, either

as exhibitor or visitor.

BUCH WIEN 11

International Book Fair

Vienna, Austria

November 10- 13, 2011

http://www.buchwien.at

Resources and Key Contacts

Association of the Austrian Book Trade

www.buecher.at

Association of the Book and Media Industry

www.buchwirtschaf.at

Commercial Service Contact Information

Name: Manfred Weinschenk

Position: Senior Commercial Specialist

Email: manfred.weinschenk@trade.gov

Phone: + 43-1-313-39-2285

Address: Boltzmanngasse 16, 1090 Vienna, Austria

Publishing Industry Market Brief 11 10 Publishing Industry Market Brief

BElGIUM

Capital: Brussels

Population: 10.4 million

GDP*: $383.4 billion

Currency: Euro (EUR)

Language: Dutch (ofcial) 60%

French (ofcial) 39%

German (ofcial) 1%

*(purchasing power parity)

Introduction

Located at the heart of Europe, Belgium is a highly industrialized and cultured

country, featuring a mature and growing publishing industry. Tis developing

trend is due to the fact that the three Belgian communities publish numerous

titles in their own language. As a result, in multiple distribution places you can

fnd Belgian publications in Dutch, French, and German as well as other foreign

languages.

Each of these three regions is in charge of education and culture, making the

industry attractive and well organized. To promote reading, numerous activi-

ties are ofered to the inhabitants. Belgium has an abundance of reading clubs,

Chques Lecture, reading competitions, district libraries, book fairs, and other

entertaining events designed for all ages. Te focus is on educating children, who

are encouraged to participate in reading competitions, exhibitions, writing com-

petitions, etc. Authors are frequently invited to read their works in school.

Te ADEB (Association des Editeurs Belges/Belgian Editors Association-French)

and the VUV (Vlaamse Uitgevers Vereniging/Flemish Publishers Association-

Dutch) organize several professional events related to the editing industry, such

as training sessions, prizes, and fairs in Belgium and abroad. In addition, there

are many other Belgian associations that bring their support and experience to

the world of reading.

Belgian Publishing Sector

Members of the ADEB have generated 95% of book sales in the French-speaking

region of Belgium, amounting to 252.2 million. VUV members represent 90%

of book sales in the Dutch-speaking region of Belgium.

Number Number Titles produced/ Titles in print per

of enterprises of employees million people million population

1,119 9,786 680 16,505

Belgium has the second highest number of per capita sales of books in Europe

(147), right behind Denmark (154). Te Belgian regions are continuously mak-

ing eforts to emphasize the value of education and to view books as a physical

manifestation of it. Moreover, the country is a net exporter of printed materials in

general, and a net importer of books.

In recent years, domestic production has decreased, with more books being im-

ported, especially from the European neighbors such as France and the Nether-

lands. (Source: Strengthening the Competitiveness of the EU Publishing Sector.

Commission of the European Communities: Commission Staf Working Paper. 7

Oct 2005)

Current Marketing Trends

When entering the Belgian market, foreign frms have the advantage that they are

competing against domestic companies who ofen struggle to fnd enough capital

to fnance new ventures. Te foreign corporations might, however, encounter dif-

fculties because a few larger outlets dominate the market.

Presently, the most successful businesses are large retailers. Unfortunately they

make business more challenging for smaller booksellers, wholesalers, less known

e-traders and others.

Even though e-commerce is a booming market, the well-established retailers

maintain the majority of the market, partially due to their user-friendly websites.

Belgian consumers are generally apprehensive about using e-commerce, as they

tend to be loyal to their book-retailer and their services.

Belgian companies made 2.8% of their sales through the Internet in 2007 (the Eu-

ropean average is 3%.) Te leaders in internet sales of books are Denmark (11%),

Ireland (9%), and Norway (6%).

Publishing Industry Market Brief 13 12 Publishing Industry Market Brief

Main Competitors

In Belgium, the strongest level of competition is amongst the illustrative media

companies, which produce comic books and childrens literature. Teir sales are

growing year afer year.

It might also be important for traders to be aware of the fact that the Belgian

schools have opted for the use of British publications at the elementary and inter-

mediate levels. Nevertheless, at the highest levels, teachers and students all have

the freedom to decide on the type of resources they want to rely on.

Current Demand

In recent years, comic books have been growing increasingly popular. While these

types of publications, from Japanese manga to graphic novels, have been gaining

popularity, scientifc texts, encyclopedias and dictionaries are losing ground due

to the emergence of online information portals.

Regulatory Environment

Te regulatory environment, with regards to cross-border sales of books in Bel-

gium, is quite encouraging. As mentioned previously, Belgium has the second

most open publishing industry in the EU.

Tere is no system of fxed prices for books. Belgium is one of the few Western

European countries that has chosen not to implement an RPM (retail price main

tenance), or government-mandated prices on books. Tis may make it easier for

foreign publishers to ofer their goods in Belgium at very competitive prices.

Although a 21% VAT (Value Added Tax) is levied on most products, books are

subject to only a 6% rate. Tis has been a signifcant advantage for the publishing

industry.

For individuals who are familiar with the challenges of cross-border book sales

in other European countries, Belgium should not be considered such a difcult

market. Besides being the second most open publishing market in Europe, it has

also discarded protectionist measures for domestic booksellers in favor of inter-

national trade of printed goods. Te main obstacle to trade remains the consum-

ers increasing reliance on large retailers.

Of course, other regulations remain enforced in the book industry, such as the

right of reprography. SABAM (Belgian Society of Authors, Composers, and Pub-

lishers) administers and manages copyright material in Belgium. For more infor-

mation, please visit: www.sabam.be

Trade Events

Foire du livre de BruxellesBrussels Book Fair

Every year in February or March, the popular Brussels Book Fair is the meeting

point of authors, lecturers, and publishers. Te 40th fair (2010) featured 2,000

authors, publishers, and designers. Authors expressed their opinions and gave

autographs to their admirers. Speakers were also invited to voice their opinion.

Te audience was eclectic and came from all parts of Belgium. For more informa-

tion, please visit: www.fb.be

Publishing Industry Market Brief 15 14 Publishing Industry Market Brief

Book Sales by genre and language

(Source: ADEB and VUV)

Resources and Key Contacts

ADEB

Association des Editeurs Belges (French language)

Web: www.adeb.be

VUV

Vlaamse Uitgevers Vereniging (Dutch language)

Web: www.boek.be

Sterling Books

English bookshop in Brussels

Web: http://www.sterlingbooks.be

FNAC-Brussels

Bookshop

Web: www.fnac.be

Filigranes

Bookshop

Web: www.fligranes.be

Commercial Service Contact Information

Name: Brigitte de Stexhe

Position: Commercial Specialist

E-mail: Brigitte.de.stexhe@trade.gov

Phone: +32 2 811 47 54

Address: Bvd du Rgent 27

1000 Brussels

Belgium

CHIlE

Capital: Santiago

Population: 16.9 million

GDP*: $260 billion

Currency: Peso

Language: Spanish

*(purchasing power parity)

Summary

In Chile there are approximately 3,144 printing companies, 60 percent of which are

located in the Santiago Metropolitan Region. Te Chilean Book Chamber (C-

mara Chilena del Libro) is a local not-for-proft business federation that represents

publishing companies, book distributors and book stores. It has over 100 members.

According to the Chilean Book Chamber, US$ 140 million of books are sold annually.

Te majority of these sales are to the Chilean government for educational purposes.

For example, the current Administration created the Maletn Literario (Literature

Briefcase), a project which sponsors the donation of 26 diferent book titles to low-

income families in order to promote reading. Approximately 267,000 families beneft

from this project. Tis Literature Briefcase constituted an additional US$ 10 million

of government expenditure on books, aside from the annual government budget for

public school books. Seventy-fve percent of the books in Chile are imported.

Publishers now ofer diferent types of media products. In addition to books,

publishers now produce a range of interactive CDs, as well as incorporating the

Internet into their sales and distribution strategy through methods such as on-

line books. Additionally, the largest distributors have their own bookstore(s).

Most publishers use two modes of production: of-set and digital. Of-set pro-

duction yields superior quality. However, its variable unit cost makes it unattract-

ive in many cases. For editions of 10,000 copies or more, the unit cost is less than

that of digital production, while for editions of fewer than 10,000 copies, digital

production (the unit cost of which does not vary according to volume) is cheaper.

For this reason, the majority of small editions are produced digitally.

Te largest segment in the Chilean book industry is education. Its biggest cus-

tomer is the governments Ministry of Education (Ministerio de Educacin, or

MINEDUC). Te government purchases at least 8,000,000 to 12,000,000 books

a year for the public elementary education system. This represents an average

Publishing Industry Market Brief 17 16 Publishing Industry Market Brief

of four to six books for each of the 2,000,000 students. Consequently, publish-

ers separate their business into two divisions: educational products and all other

products. In selecting texts, MINEDUC considers the bid price and the quality of

the content. Tese factors are evaluated and then the book is rated on a scale of one

to seven (with seven being the best). Almost all school books are published in Chile.

Te second-largest segment is best-selling fction; almost all books in this sector are

imported. All other segments account for approximately 10 percent of the market.

Te publishing industry in Chile uses the International Standard Book Number

(ISBN) system. In Chile, as well as in most of Latin America, every book that is

printed receives this registration number which is generally associated with a bar

code. It is used to identify the title, edition, binding, author, publisher, city, and

country of origin. Tis system makes it easier for a library or private individual

anywhere in the world to acquire a book published in Chile.

Market Demand

According to the Chilean Book Chamber in 2007 3,723 titles were printed. In

2008 3,908 titles were printed and in 2009 the total reached 4,462 titles, represent-

ing an increase of 14.18% compared to 2008. Ninety percent of publishers publish

less than 100 titles per year, with 25 percent of the titles having less than 500 cop-

ies printed and most of the remainder with no more than 1,500 copies.

Te book printing industry is concentrated in the Santiago Metropolitan Region;

89 percent of all books in Chile are printed in this Region. Ninety-two percent of

all printed books are paperback, the majority of which are of a basic quality, while

3.6 percent are hardcover and 2.3 percent are considered luxurious (with a very

ornate cover and/or leather binding).

According to a global study of intellectual property issues commissioned by the

European Union, out of 63 countries, Chile was fourth in piracy and intellectual

property rights violations in such industries as music, books, movies, sofware,

clothing design, etc. According to CONAPI (Te Chilean Anti-Piracy Commis-

sion), book piracy (photocopies) results in annual losses of US$ 25 million for

the local publishing industry. Even though Chile has an anti-piracy law, and the

Chilean Book Chamber and CONAPI have focused their eforts on fghting pi-

racy, the problem is still prevalent.

Te black market constitutes 25 percent of the total book industry. Piracy is both

a product of and a reason for the high prices of books in Chile, driven also by

the low number of copies per edition, transport expenses, bookstore monopolies,

VAT tax (19 percent) and the expense of the paper. In Chile, the publishing in-

dustry looses annually US$27 M due to books piracy.

Books are distributed by the publishers to the bookstores on consignment, and

the prices in the large chains can vary on a daily basis. Bookstores cannot charge

more than the publishers suggested retail price nor less than the bookstores wholesale

cost, which is fxed at 60 percent of the suggested retail price. Te Internet booksellers

that have appeared in recent years, such as Amazon.com and small local variants, pose no

signifcant threat to traditional bookstores and their own Internet outlets. Chilean book

consumers are traditional in their shopping, and for the most part prefer to shop in a store

more than on a computer. In addition, they are very sensitive to shipping times and costs.

In the world of Spanish-language books, specialized bookstores in several areas still have a

clear advantage when it comes to carrying and having in stock non-general interest books.

Market Data

In 2001, publishers specialized in publishing national authors founded the Chilean Pub-

lishers Association (Asociacin de Editores de Chile), in order to have a representative

body. In 2005, these independent publishers were prohibited from belonging to the

Chilean Book Chamber. Tere are issues between the independent publishers and

the Chilean Book Chamber, which is dominated by Spanish multinational companies

such as Grupo Planeta, Santillana and Random House Mondadori, among others.

Local production of printing and graphic arts equipment in Chile represents less

than 10 percent of the market and is primarily comprised of cutting machines,

gluing machines, sealing envelope machines and a few fexography printing ma-

chines manufactured by Infexco and Cafsa.

Import Statistics

Books Imports per Year

US$ Million

2010 57

2009 53

2008 69

2007 56

Books Imports 2010 US$

Books 351,102

Others * 1,816,728

Encyclopedias 1,953,401

Others ** 1,418,204

School books 9,001,434

Technical-professional books 894,992

Academic Books, Scientifc & Technical 8,628,580

Childrens Books 4,619,940

Others *** 22,616,248

Technical Manuals 2,270,887

Others **** 3,287,226

TOTAL 56,858,742

Source: Chilean customs statistics

Notes: *) Posters, catalog, advertising poster, technical documentation, brochure, pocket manuals, printed mat-

ter, sheets, books, licenses, manuals, cooking books, among others. **) Books, dictionaries, licenses and manuals.

***) Literature books, educational books, religious books, medical books, bind books, cooking books and touristic

guides etc. ****) Technical documentation and books, magazines, annual reports, cooking books, manuals, licenses,

religious books, medical books, touristic guides, telephone books, brochures, fascicules, catalogs, bible and posters.

Publishing Industry Market Brief 19 18 Publishing Industry Market Brief

Magazine and

Newspaper Imports

Year US$ CIF

2010 5,753,658

2009 5,826,862

2008 7,156,315

Source: Chilean customs statistics

Note: Newspapers represent less

than one percent of these imports.

Best Prospects

n New ways of producing and commercializing books such as:

l Printing per demand, i.e. express book machines (EBMs): a type of digital

printing machine that allows the consumer to print the book that he/she wants

to buy in a store

l Sales through virtual media

l Digital format publishing

n All paper is imported, with the exception of newspaper

n Main raw materials and parts imported by the sector

- Inks

- Paper, plastic, tissues and metals

- Gravure cylinders

- Picture flms

- Chemicals for printing plate processing

- Printing plates

n Environmental friendly or recycling equipment and materials

Key Suppliers

In 2010, the companies presented with the Best Suppliers 2010 by the Printing

and Graphic Association, ASIMPRES, award were: AGFA Chile, for supplies and

services and GMS Productos Grfcos Ltda. for equipment and machinery.

U.S. authors who have their work translated into Spanish will probably already have

an international distribution agreement with a publisher; therefore they can use the

information contained in this report to ensure that the Chilean market is captured.

Key Country Suppliers of Books to Chile

Source: Chilean customs statistics 2010

Key Country Suppliers of Magazines and Newspapers

Spai

n

32

%

US

A

14

%

Argentin

a 1

3

%

Per

u

3

%

Mexic

o

7

%

Chin

a

5

%

U

K

6

%

Colombi

a

3

%

Panam

a

2

%

Hong

Kong

2

%

Singapor

e 2

%

Urugua

y

2

%

Other

s

9

%

Publishing Industry Market Brief 21 20 Publishing Industry Market Brief

Source: Chilean customs statistics 2010

Spain

Uraguay Panama

US

Colombia

U

China

Mexico

Argentina

Singapore

Main Distributors/Suppliers of Printing and Graphic Equipment

Phototypesetting Machinery

n Agfa Gevaert

n HAGRAF Maquinarias Grfcas

n Imagex

n GMS Productos Grfcos

n Davis Graphics

n Ditra

Papers

n Avery Dennison Chile

n CMPC Papeles

n Dibco

n Distribuidora de Papeles

Industriales

n Foilsur

n GMS Productos Grfcos

n Papelera Dimar

Inks

n Dibco

n Flint Ink Chile

n GMS Productos Grfcos

n Sunchemical Chile

n BASF Chile

local Manufacturers (10 percent of the total market)

n Infexco (Ingenieria de Flexografa y Conversion S.A.): specializes in manu-

facturing rotary fexographic printing equipment with central impression cylin-

ders, incorporating both European and U.S. technologies for narrow-, medium-

and wide-web presses alike. Te company also distributes laminating, microdot

positioning, and servo motor technology for on-the-run registration; hot-melt

application equipment and peripherical equipment.

n Cafsa: distributes and manufactures graphic machines, supplies, and equip-

ment. Tey also represent Drent Goebel (U.S.A.), Kluge (Canada), TMZ (Spain),

Moligraf (Argentina), Sohn (U.S.A.), Servotroquel (Spain), PlanaPlastic (Spain),

and Plastic Recycling Technology PTR (Italy).

Most of the countrys predominant publishers are local branches of international

conglomerates. Te largest is Grupo Santillana, followed by Editorial Planeta and

Editorial Sudamericana. National publishers, although not as large as the mul-

tinationals, are still capable of competing in several niche markets.

n Intergrfca Print & Pack

(Ferrostaal Chile)

n GMS Productos Grfcos

n HAGRAF Maquinarias Grfcas

n Suministros Grfcos

n Xerox Chile

Other Printing supplies

n Dibco

Movies

n Agfa Gevaert

n GMS Productos Grfcos

Other Services

n Avery Dennison Chile

n Avis RotoDie

n Dibco

n Vigamil (Sobres)

n Santillana publishing houses include: Alfaguara, Aguilar, Richmond Publish-

ing, Altea, and Taurus. Te group has an estimated 90 percent share of the el-

ementary school texts market. National publishers Dolmen and Universitaria

account for most of the remaining 10 percent.

n Editorial Planeta Chile forms part of Spains Grupo Planeta, the worlds larg-

est Spanish-language publisher. Although established as a distributor in 1968, it

wasnt until 1986 that it started publishing Chilean literature. Editorial Planeta

includes: Seix-Barral, Ediciones Destino, Martnez Roca, Espasa Calpe, Ariel,

Temas de Hoy, Ediciones del Bronce, Crtica, Emec, and Planeta Argentina.

n Editorial Sudamericana Chilena is the local branch of Argentinas Editorial

Sudamericana, which in 2002 was acquired by the Random House division of

worldwide media group Bertelsmann. As a result of the joint venture between

Random House and the leading Italian book and magazine publisher Mondadori,

Sudamericanas list of representations has expanded from an already considerable

base - which included: Plaza y Jans, Lumen,

Debate, Galaxia Gutenberg, and Beascoa. Te group now also includes: Monda-

dori, Grijalbo, Electa, and Montena.

Te countrys principal publishing association is the Cmara Chilena del Libro

(Te Chilean Book Chamber, www.camaradellibro.cl), a local not-for-proft busi-

ness federation, which represents over 100 publishing companies, book distribu-

tors and book stores in Chile. Tis organization is responsible for the major book

fairs throughout the country: Iquique, Via del Mar, Talca, Concepcin, Temuco,

and the International Book Fair of Santiago. Te Chamber is also part of the

UNESCO program, CERLALC (Regional Center for Book Development in Latin

America and the Caribbean), headquartered in Bogot, Colombia. United States

companies are recommended to contact the Chamber directly.

CERLALC maintains the largest registry of books published in Argentina, Brazil,

Colombia, Chile, and Mexico. In recent years its presence has been extended to

Peru, Venezuela, and Uruguay. With the addition of Spain, the database now

contains about 1,200,000 titles, every one of which physically exists somewhere

in Latin America and is possible to obtain. It is treated as a living catalogue of

books that are currently part of the sales stock of the publishers involved in non-

rare books or collectors editions. CERLALC is currently working to make the

registry, plus the approximately 6,000 new publications appearing every month,

avail able on the Internet and on CD-ROM.

Publishing Industry Market Brief 23 22 Publishing Industry Market Brief

Prospective Buyers

Chilean consumers of books sold in bookstores, as opposed to books purchased

by educational institutions, can generally be divided into one of two market seg-

ments: those looking for rare and other hard-to-fnd books or mass consumers

looking for a low price. Te former normally belong to the upper-middle class

and have a university education.

Te most widely sold authors in Chile are Latin American for the most part: Gabriel

Garca Mrquez, Mario Vargas Llosa, Paulo Coelho, Jorge Luis Borges, and Chiles

most emblematic authors, Pablo Neruda, Gabriela Mistral, and Vicente Huidobro.

Te most widely sold non-Latin American authors are usually international best-

sellers translated from English, such as Stephen King and Mario Puzo.

Te national marketing of Chilean authors is concentrated on book fairs and

complemented by occasional advertising in printed media. Te opinions of local

literary critics play a fundamental role in determining the success of books by

authors who havent yet established their names, so much so that frst editions of

such books are normally limited to 500 copies. Sales volume for a Chilean author

is considered to be good if it breaks 10,000 copies a year.

Main Importers of Books 2010

Importer Total %

BOOKS AND BITS S.A. 7.67

EDITORIAL OCEANO DE CHILE S.A. 4.77

EDITORIAL CONTRAPUNTO LTDA. 3.51

SANTILLANA DEL PACIFIC S.A. DE 4.11

EMPRESA EL MERCURIO S.A.P. 2.94

LIBERALIA EDICIONES LTDA. 2.91

SANTILLANA DEL PACIFICO S.A. 2.85

EDITORIAL PLANETA CHILENA S.A. 2.60

PUBLICACIONES TECNICAS MEDITERRANEO 2.38

EMPRESA EDITORA ZIG ZAG S.A. 2.26

DISTRIBUIDORA DE LIBROS KUATRO 2.25

GALILEO LIBROS LTDA. 2.22

RANDOM HOUSE MONDADORI S.A. 2.19

LEXUS EDITORES DE CHILE 2.16

OTHERS 55.18

Source: Legal Publishing

Main importers of Magazines and Newspapers 2010

Importer Total %

DISTRIBUIDORA ALFA S.A. 54.69

PROMOTORA DE BELLEZA S.A. 7.66

EDITORIAL TELEVISA CHILE S.A. 5.00

CAFE BRITT CHILE LTDA 3.03

XYZ EDITORA S.A. 3.01

INFORMATIVO AGRICOLA LTDA. 2.29

EDITORIAL PUNTOLEX S.A. 1.94

IGLESIA ADVENTISTA DEL 7 DIA 1.90

ASOC. DE MEJORAMIENTO MUTUO 1.55

SANOFI-AVENTIS DE CHILE S.A. 1.44

LA BIBLIOTECA S.A. 1.17

OTHERS 16.32

Source: Legal Publishing

Main Printing Companies in Chile, in Order of Importance

n Morgan S.A. (Chile, El Mercurio group)

n RR Donnelley Chile Ltda. (U.S.A.)

n World Color Chile (50% Chile, former Quebecor World)

n Consorcio Periodstico de Chile (La Tercera, Copesa)

n Empresa Periodstica La Nacin (Chile)

n Molina Flores, AMF (Chile)

n Marinetti (Chile)

Market Entry

Establishing a local subsidiary or branch ofce in Chile is the appropriate strat-

egy for a U.S. company that believes that sales volumes will be large, and / or

local service support or localized inventory are keys to success. Any corporation

legally constituted abroad may form, under its own name, an authorized branch

(agency) or subsidiary in Chile.

Another strategy would be to appoint an agent or representative with good access

to relevant buyers and solid technical expertise.

It should be noted that in Chile the standard Value Added Tax (VAT) of 19 percent

is applied to books, making them among the most expensive in Latin America. In

contrast, other Latin American countries have no VAT on books or concession-

ary rates of 50-60 percent below VAT.

Publishing Industry Market Brief 25 24 Publishing Industry Market Brief

Market Issues & Obstacles

Before the U.S. Chile Free Trade Agreement (FTA), U.S. printing and graphic

equipment was subject to import tarifs of six percent in the Chilean market with-

out preferential access. Afer the agreement, printing and graphic equipment

gained preferential access as tarifs fell to zero immediately. Tis puts U.S. prod-

ucts on more even footing with other competing countries.

Te U.S.-Chile FTA has led to strong growth in the printing and graphic equip-

ment market in Chile.

Te U.S.Chile FTA

n Eliminates tarifs on almost 90 percent of U.S. products imported into Chile

and more than 95 percent of Chilean exports to U.S. Tarifs on all products will

be eliminated within 12 years since its beginning in 2004.

n Elimination of Chiles six percent general tarif has made U.S. products signif-

cantly more competitive, as they had been losing ground to other countries with

which Chile already had preferential trade agreements.

Chile has bilateral trade agreements with the U.S. and approximately 55 other

countries and is an OCDE member since 2010.

Ocean freight can take between one and two months to arrive in Chile, so when

importing, Chilean companies prefer the much faster air freight service, even if

it is more expensive, especially when importing state-of-the-art technology (size

and weight permitting).

Te Chilean book industry faces copyright violations, primarily the photocopy-

ing of medical texts and reference books, mostly at university level. Most of these

copies are translations of U.S. titles, produced by U.S. subsidiaries in Mexico and

Chile. Most of the illegal copying takes place at copy shops located near universi-

ties and at university-run photocopy facilities on campuses. Commercial piracy

primarily afects Spanish-language literature. Some of the most pirated authors in

Chile include Isabel Allende, Marcela Serrano, Paulo Coelho, and Pablo Neruda.

Trade Events

Santiago Book Fairs

Feria del libro Parque Forestal

Cmara Chilena del Libro

Web: www.camaradellibro.cl

Feria Internacional del libro Infantil y Juvenil

May-June 2011

Municipalidad de Providencia / Cmara Chilena del Libro

Web: www.camaradellibro.cl/infantil

Feria del libro de uoa

August-September 2011

Municipalidad de uoa / Cmara Chilena del Libro

Web: www.camaradellibro.cl/nunoa

Feria Internacional del libro de Santiago

October - November 2011

Cmara Chilena del Libro

Web: www.flsa.cl

Book Fairs in Regions

Feria del libro de Via del Mar

Via del Mar

Cmara Chilena del Libro

Web: www.camaradellibro.cl/vina

Resources & Key Contacts

Chilean Book Chamber: http://www.camaradellibro.cl/

Latin-American Graphic Industry Confederation:

http://www.conlatingraf.org/index2.htm

Chilean Association of Independent Book Publishers:

http://www.editoresdechile.cl/sobre.aspx

Printing and Graphics Association: http://www.asimpres.cl

Commercial Service Contact Information

Location: Santiago, Chile

Contact: Caludia Melkonian

Email: claudia.melkonian@trade.gov

Phone: (+56 2) 330-3312

Fax: (+56 2) 330-3172

Website: www.buyusa.gov/chile.

Publishing Industry Market Brief 27 26 Publishing Industry Market Brief

Capital: Beijing

Population: 1.3 billion

GDP*: $9.872 trillion

Currency: Yuan

Language: Mandarin, Cantonese

*(purchasing power parity)

Summary

Despite a restrictive environment and rampant pirating, Chinas publishing mar-

ket presents some opportunities for foreign companies. In the last ten years, the

number of imported book titles more than doubled, while the availability of jour-

nals and magazines distributed in the market increased by nearly tenfold accord-

ing to Chinese government data. Chinas General Administration of Press and

Publication (GAPP) reports total sales of books in China reached 123.6 billion

RMB in 2006. Government data shows total revenue in the book market climb-

ing at a rate around three to four percent per year, others estimate revenue growth

as fast as ten percent. Some argue these numbers are spurred by some reforms

and added participation by the private sector, including foreign frms. Rising

incomes in a country thirsty for reading materials also contributes.

Unfortunately, entering the market is not clear-cut. Despite their WTO commit-

ments, China has yet to make full trading and distribution rights available for

foreign publishing companies. Foreign frms can not, of their own accord, import

or distribute imported books in China. Te right to import books, distribute

imported books and publish books is reserved for a collection of Chinese state

owned companies. Foreign frms wanting to export books to China or publish

books on the mainland must do so through the aforementioned companies.

Inability to adequately protect copyrights haunts the market. Pirated copies of best

sellers, educational/reference material etc. are sold around the country. It is a prob-

lem for both Chinese and foreign copyright holders. A wealth of information on

Chinas regime to protect intellectual property is available at www.stopfakes.gov.

CHINA

Market Demand

A 2005 survey by the China Research Institute of Publishing Science suggests that

49 percent of Chinese read books at least once a month. Te same survey in 1999

reported a fgure of 60 percent. Te Institutes research shows an increase in the

number of people preferring to read online. Despite that, the data suggest that the

book publishing market is growing. Rising incomes and increasing levels of educa-

tion, including English language profciency, support the demand for content.

China can be divided into three large markets Guangzhou/Pearl River Delta,

Shanghai/Yangtze River Delta and Beijing/Tianjin. Te large coastal cities have

the highest disposable incomes and are the largest book markets. Tat said,

growth in Chinas second and third tiers cities is strong. China has over 100

cities with a population of a million or more. In China, you can fnd over 2,700

libraries, 2300 colleges with 25 million students and 77,000 high schools with 85

million students, according to the China Education Yearbook.

According to government surveys, the major factors prompting consumers to buy

books tend to be recommendations by friends, the issuance of new titles and the

popularity of the author. In 2006, people between the ages of 19 to 24 purchased

the most books by total revenue, taking up 46 percent of the market. Coming

in second, those between the ages of 25 to 35 comprised 26 percent of the book

market. In 2006, GAPP reported that almost 70 percent of readers in China were

college graduates. Of consumers who purchased books, around 40 percent spent

about $4.00 to $12.00 per month and 1/3 spent more than $12.00.

28 Publishing Industry Market Brief Publishing Industry Market Brief 29

Market Data

Te Structure of Book Publishing Expressed by Professional Category

of Publishing Houses in 2006

Professional House

Ratio of Ratio of

Number of Ratio of Total Total

Professional Publishing Percentage Total Titles Printed Marked

Category Houses (%) (%) Volume (%) Price (%)

Classical

Books 19 3.45 1.37 0.80 1.49

Education 32 5.82 14.86 27.60 18.74

Science/ 126 22.91 30.75 17.00 23.79

Tech

Fine Arts 34 6.18 3.69 4.23 3.73

Ethnic 15 2.73 1.85 1.30 1.21

Childrens

Books 31 5.64 5.69 8.91 5.22

Social

Sciences 225 40.91 34.42 31.79 37.87

Literature/

Arts 41 7.45 3.90 4.17 4.31

General 22 4.00 3.00 3.94 3.25

Travel &

Tourism 5 0.91 0.48 0.25 0.40

Source: China National Publications Import and Export Corporation

A total of 233,971 titles, including reprints, were printed in 2006. A very large

proportion of the market is still made up of school and college textbooks with

51,925 titles printed in 2006. Te market for primary and secondary textbooks,

however, is highly regulated by the government and difcult to enter for foreign

publishers. However, U.S. frms have had some success with the tertiary and

post-graduate textbook market.

GAPP data shows the United States leads other countries with close to 3,000 license

agreements sold to China in 2006. Te other opportunity for western publishers is

primarily found in the licensing of rights for local English-language reprints or trans-

lations, and for joint-investment projects. According to GAPP, as of 2006, sales of

translated books accounted for 18 percent of total revenues of the retail market. Of

that 18 percent, the U.S. holds the highest market share of translated books at 38%.

China purchased 10,950 foreign licensed book titles in 2006, a 16.7 percent in-

crease from 2005. Tis fgure represented 8.4 percent of all new titles published

in China in 2006. Each year, about 8 to 10 percent of the market of new book titles

in China draws its origins from foreign sources. Te United States tends to lead

all other foreign countries in licensing agreements with China.

Number of Foreign Copyright Total number of new titles

licensed Books in China published in China

2003 12,516 110,812

2004 10,040 121,597

2005 9,382 128,578

2006 10,950 130,264

Source: GAPP, OpenBook

Best Prospects

Compared with 2005, publishing houses printed more books focused on social

sciences, tourism, general books and science/technology in 2006. Publishing

houses appear to be focusing slightly less on education, childrens books, litera-

ture/arts, fne arts and classical books, which are realizing a drop in printing vol-

ume in recent years.

GAPP states that, for a long period, educational publishing, textbook and teaching

materials made up a signifcant part of the publishing industry, as much as 60 percent.

Even today, a large portion of the market is comprised of textbooks. But with the text-

book bidding system, a system that makes the cost of purchasing teaching materials

cheaper for elementary/middle schools, and the decline of student population since

2004, total publishing and distribution revenue of teaching materials is shrinking.

Beyond the classroom, there is a growing demand for instructional material focused

on business and management. Subjects covering energy resources and environment

are growing in popularity. According to China National Publications Import and Ex-

port Corporation (CNPIEC), one of the largest state-owned distributors of imported

books, demand for academic books on subjects such as STM (science, technology,

and medicine), fnance, and economics remains strong. Moreover, as English levels

improve, there is an increasing demand for imported books in these areas.

1. Literature Sector

2. Childrens & Juvenile Sector

3. Economic Management Sector

4. English Language Learning Sector

30 Publishing Industry Market Brief Publishing Industry Market Brief 31

Key Suppliers

GAPP reports that there are 573 publishing houses in China, all state-owned. It is

not uncommon for government organs or industrial focused state-owned compa-

nies to have their own publishing houses. Te largest publishing house in China,

in terms of revenue, is Higher Education Press. Peoples Education Press, Jiangsu

Education Press, Foreign Language Teaching and Research Press and Zhejiang

Education Press round out the top fve. Higher Education Press ranked frst in

2006 with 994 million RMB in sales. Of the top 50 publishing houses, most do a

few hundred million RMB to a hundred million RMB in sales per year.

Market Entry

Te common practice for foreign companies to enter the Chinese market is by

means of licensing or co-publishing arrangements with Chinese partners. Li-

censing arrangements allow Chinese publishing companies to purchase rights

to translate, publish, or distribute particular versions of the book in China. Co-

publishing projects, on the other hand, vary in form signifcantly but generally

allow Chinese and foreign companies to contract in partnership to produce a

preprinted or translated version of a book. Te Book Division of the local Copy-

right Bureau must approve Chinese editions that are produced under a standard

royalty-based copyright licensing arrangement.

Market Issues & Obstacles

To publish a book, foreign companies must work through one of Chinas state

owned publishing houses. In fact, each year, only Chinas state owned publishing

houses are allocated a limited supply of book codes (ISBNs) by the GAPP. It is

possible, however, for foreign frms to partner with a private Chinese company

who then works through a state owned publishing house to obtain a book code

and publish a book. China has a signifcant number of private publishing re-

lated frms doing such business.

In addition, the law forbids foreign frms from having editorial control. However,

foreign frms can participate in the process as consultants, providing advice on

advertising and distribution.

China started opening its retail sector to foreign participation in 2002. As of

2005, foreign frms were allowed to have wholly owned bookstores nationwide.

However, China still does not grant foreign companies trading rights for the im-

portation of books, newspapers, periodicals, electronic publications and audio

and video products. Piracy is only exacerbated by Chinas continued adherence

to these import restrictions, which slow the exportation process and lead to the

entry of pirated materials into the market before legitimate ones.

China allows foreign companies to invest in approved Chinese state owned com-

panies who are involved in the advertising, printing or publication of books.

Tere are a number of restrictions. For example, a foreign frm cannot have a

majority interest, and the entity formed cannot distribute imported books. Al-

though, distribution of books published in China is permitted.

Te publishing industry is overseen by the government agencies below.

n Department of Publicity of the CPC (DOP): DOP is responsible for overseeing

information dissemination in China, as well as for supervising and guiding the

other regulatory bodies with regard to the publishing industry.

n General Administration of Press and Publication (GAPP): GAPP is respon-

sible for the overall administration of the publishing industry in line with the

policy set by the CPC. On an administrative level, the GAPP allocates book codes

and periodical series numbers, which are Chinese equivalent of ISBN numbers

and ISSN numbers respectively. GAPP holds censorship responsibilities, main-

taining a list of prohibited content.

n Ministry of Commerce (MOFCOM): MOFCOM oversees the establishment

of corporate vehicles by foreign investors in China. Any enterprise established

with foreign capital in publishing-related sectors must be approved by both the

GAPP and MOFCOM.

Trade Events

15th Beijing International Book Fair

Date: August 31-September 4, 2011

Venue: Tianjin International Exhibition Center

Website: http://www.bibf.net/bibf/index.jsp

Resources & Key Contacts

General Administration of Press and Publication (GAPP)

http://www.gapp.gov.cn

China Publishing Group

http://www.cnpubg.com

Beijing OpenBook Market Consulting Center

http://www.openbook.com.cn

Commercial Service Contact Information

Location: Beijing, China

Contact: Jing Qiu; Frank Joseph

Email: Jing.Qiu@mail.doc.gov

Frank.Joseph@mail.doc.gov

Phone: 8610-8529-6655

Fax: 8610-8529-6558

Website: www.buyusa.gov/china.

32 Publishing Industry Market Brief Publishing Industry Market Brief 33

CzECH REPUBlIC

Capital: Prague

Population: 10.2 million

GDP*: $262.8 billion

Currency: Czech Koruna

Language: Czech

*(purchasing power parity)

Summary

A nation of avid readers, the Czech Republic ranks among the worlds top ten countries

in terms of the number of published titles per 10,000 inhabitants. Like many countries,

the Czech Republic is facing a decline in the number of readers due to the availability of

other media and activities. However, book reading remains a key part of the countrys

cultural life. Te total book market turnover is estimated at CZK4.5 billion ($200 mil-

lion). Estimates for the non-periodicals market are not available; however, it is a vibrant

sub-sector and there is an ever-growing number and variety of newspaper and maga-

zines available in the market.

Market Demand

In comparison to the U.S. market, book publishing in the Czech Republic is on a chal-

lenging scale. With only 10 million inhabitants and a language used only within its bor-

ders, the Czech publishing market is a small one. However, Czech publishers can rely on

a population of avid readers that frequently buy books to create home libraries.

Te number of books published in the Czech market has been rising steadily dur-

ing the last ten years. Te all time high number of published books was reached

in 2008. Despite a slight drop of 5% in 2009 caused by the stagnation of the Czech

economy, the Czech Republic is still among countries with the highest number of

books published annually per capita.

Number of Books Published in the Czech Republic

2007 18, 029

2008 18, 520

2009 17, 598

Source: National Library of the Czech Republic

Te selection of books and publications is rich and varied, both in quantity and

genre. Fiction accounted for 25% of total book production in 2009. In compari-

son with 2008, 3% less of fction books were published, children books remained

stable, and the number of school and university textbooks dropped by 30%. Te

latter is likely caused by the growing availability of information on the Internet.

Comparison of Publication in Selected Genres

2007 2008 2009

Fiction 3, 927 4, 162 4, 475

Children books 1, 187 1, 385 1, 367

School & Univeristy Textbooks 1, 971 2, 132 1, 489

Source: Association of Czech Booksellers and Publishers

Rapid growth in the number of periodicals, including newspapers and journals,

occurred in the 1990s afer the fall of communism. Te number of periodical pub-

lishers increased to 1,6001,700. Te Union of Publishers of Periodicals annually

publishes Media Project, a report on newspaper and magazine readership and sales.

Te report shows that Czech periodical readership remains high with 88.6% of the

population aged 12-79 years (7.9 million people) reading at least one periodical reg-

ularly. Daily press readability remains stable, with the tabloid Blesk being the most

popular daily (with 1.43 million readers a day), followed by Mlada Fronta Dnes

(874,000 readers) and Pravo (417,000 readers). In other categories, the top three

publications are as follows: womens magazines: Blesk pro zeny (649,000 readers),

Chvilka pro tebe (640,000 readers), and Svet zeny (471,000 readers); women life-

style magazines: Glanc (249,000 readers), Cosmopolitan (191,000 readers), and Elle

(175,000 readers); men lifestyle magazines: Maxim (159,000), For Men (114,000),

and Playboy (100,000); society magazines: Rytmus zivota (820,000 readers), Nedelni

Blesk (732,000 readers), and Pestry svet (433,000 readers); business and economic

magazines: Ekonom (102,000 readers), Euro (92,000 readers), and Eurozpravodaj

(89,000 readers); housing magazines: Chatar & chalupar (90,000 readers), Rodinny

dum (68,000 readers), and Dum a zahrada (67,000 readers); and teen magazines:

Bravo (193,000 readers), ABC (155,000 readers), and Bravo Girl! (154,000 readers).

Market Data

Te structure of Czech book production has remained largely unchanged over

the past several years. In 2009, books in the Czech language were again predomi-

nant in the countrys book production. For Czech publication of foreign language

books, English has clearly dominated the market followed by German and French.

Translations usually amount to about one third of total Czech book production,

ranking it among the worlds top consumers of translated texts, along with the

Baltic countries and Hungary. Te number of languages of translated books has

Publishing Industry Market Brief 35 34 Publishing Industry Market Brief

in recent years hovered around 45. Te three most ofen translated languages has re-

mained unchanged since 1990. English has defended its dominant position, as almost half

of all published translations originate from English language texts. Despite a long-term

decline, translations from German have again become the second most numerous, with

French ending third at some distance. Two other languages reaching over 100 translations

include Slovak and Spanish. 2009 saw an increase of the number of translations, which

accounted for 33% of the total number of books published. Of all the books published in

2009, 15,134 were in Czech language, 752 in English, 209 in Slovak, and 89 in German.

Numbers of Published Book Translations in the Czech Republic

2007 2008 2009

From English 2, 665 2, 969 3, 005

From German 1, 115 1, 168 1, 157

From French 285 270 293

From Spanish 116 95 114

From Slovak 57 76 225

From Polish 53 81 73

From Russian 66 66 78

Source: Association of Czech Booksellers and Publishers

One interesting aspect of the industry concerns the relationship between Czech

publishers and public libraries. Czech law requires that publishers ofer one copy

of each publication to libraries specifed by the Ministry of Culture to ensure that

selected libraries have access to current production. Tis so-called compulsory

ofer does, in some cases, cause problems between libraries and publishers.

On the other hand, the Association of Czech Booksellers and Publishers started

cooperating with the Svet knihy company to launch a campaign supporting books

and reading aimed especially at children, entitled Growing with the Book. It

draws inspiration from similar models applied in the U.S. and the EU. Te proj-

ect enjoys growing interest and participation. Tere is also a growing number of

book festivals and book awards, as well as an emergence of new authors.

Te operation of the ISBN and ISMN systems in the Czech Republic is based on gener-

ally accepted international rules and regulations. Participation in the system is volun-

tary, and national agencies typically contact publishers directly. Important materials are

available on the National Library websites (See the end of this report for addresses).

Best Prospects

Best prospects for U.S. publishers in the Czech market are primarily in B2B sales

of rights for bestselling novels, while specifc niche markets exist for other cat-

egories such as documentaries, arts and life style, travel and tourism, scientifc,

technical, medical, management, social and human sciences and childrens books.

Major Czech publishing frms usually attend international book fairs, such as the

Frankfurt Book Fair in Germany. Tere are also opportunities at the Czech Inter-

national Book Fair, which takes place annually in Prague.

Key Suppliers

Te publishing of books in the Czech Republic is divided between more publish-

ing entities than in countries that have enjoyed an uninterrupted and continu-

ous development towards specialization and concentration of book producers.

In 2009 there were 4,583 publishers registered in the Czech Republic. However, it

is estimated that approximately half of these publishers are not active. A decisive

share of Czech book production is attributed to only several dozen publishers.

In 2009, only eighteen publishers published more than 200 books per year. Seven

of these publishers are university or government establishments. University and

state institution presses are, as in other countries, usually characterised by a large

number of highly specialized titles at relatively low print runs.

Number of Registered Publishers in the Czech Republic

2005 3,775

2006 3,908

2007 4,073

2008 4,344

2009 4,583

Source: Grand Biblio magazine

Te book stores face competitive pressure from market chains and bookshop

chains, similar to the situation abroad. In some regions book stores have disap-

peared, ofen due to competitive stores operated by publishing houses and new

literary cafs that have come into existence.

Prospective Buyers

Like many countries, the Czech Republic is facing a decline in the number of

readers due to the availability of other media. However, book reading remains

a key part of the countrys cultural life. Despite all the challenges, statistics show

that in terms of the number of book titles published, the Czech Republic ranks

among the top countries in the world. In terms of published titles per 10,000 in-

habitants, the country even makes it to the top ten.

Publishing Industry Market Brief 37 36 Publishing Industry Market Brief

Market Entry

A recommended strategy for a U.S. company interested in penetrating the Czech

publishing market would be to fnd a local partner/representative or to open an

ofce in the country. Without a local representative who can support everyday

contact with customers and government representatives, it is very difcult to suc-

ceed in this market. A U.S. company can stimulate further sales by working with

Czech partners on efective marketing campaigns, as well as by utilizing trade

shows, in-country promotions, and advertising. Te U.S. Commercial Service of-

fers a number of ways to help U.S. companies fnd business partners in the Czech mar-

ket. Tese include setting up meetings with Czech companies interested in partnership,

government ofcials and associations representatives (Gold Key Service), due diligence

on prospective partners (International Company Profle) and events to introduce new

product lines to potential customers (Single Company Promotion). More information

and contacts can be found at http://www.buyusa.gov/czechrepublic/en/

Market Issues & Obstacles

Te Czech Republic is a highly developed, open market with liberal policies and in-

tense competition. While imports from the EU are exempt, products from non-EU

countries are subject to import duties. Customs duty rates are updated annually and

are harmonized within EU countries. In addition, all goods, imported or produced

domestically, are subject to a value-added-tax (VAT). Te value added tax rate for

non-periodic publications (books, brochures) is ten percent.

Te Czech Republic is a member of various international copyright agreements.

In accordance with European Union legislation, a protection period of 70 years

from the authors death applies in the country. One of the principles of Czech

copyright is the reciprocity principle, whereby foreign authors enjoy at least the

same level of protection as Czech authors, provided reciprocity is ensured.

Te key factors infuencing book prices are the cost of the material (paper, print-

ing services) and authors fees. Authors fees bear the greatest infuence on the

fnal price of any book, especially with foreign authors whose publications are

translated into the Czech language. Book prices are considered contract prices

and recommended sale prices are printed only on limited number of publications.

Czech is the ofcial language in the Czech Republic. More than half of Czech com-

pany representatives are able to communicate in English or in German as well.

Trade Events

International Book Fair and literary Festival, Prague

May, 2012, www.svetknihy.cz

Resources & Key Contacts

Almanach Labyrint, www.almanachlabyrint.cz

Association of Czech Booksellers and Publishers, www.sckn.cz

American Chamber of Commerce, www.amcham.cz

General Directorate of Customs, www.cs.mfcr.cz

Ministry of Culture, www.mkcr.cz

National Library, www.nkp.cz

Union of Publishers of Periodicals, www.uvdt.cz

Commercial Service Contact Information

Location: Prague, Czech Republic

Contact: Jana.Ruckerova

Email: Jana.Ruckerova@trade.gov

Phone: +420 257 022 310

Website: www.buyusa.gov/czechrepublic.

Publishing Industry Market Brief 39 38 Publishing Industry Market Brief

DENMARK

Capital: Copenhagen

Population: 5.5 million

GDP*: $311.9 billion

Currency: Krone

Language: Danish

*(purchasing power parity)

Summary

Te Danish publishing market has been decreasing during the last couple of years.

Nevertheless, e-book sales and general purchases of reading material over the In-

ternet have increased. Te majority of books sold in Denmark are in the Danish

language and are distributed and sold through major Danish publishing and book-

selling operations. A U.S. publisher looking to enter the Danish market can partner

with a local publishing house to translate and distribute books or may partner with

an European distributor to sell books in English. From January 2011, the Danish

market has become liberalized.

Market Overview

Te Danish publishing market consists of 1,160 publishing companies, 41 news-

paper companies, and 1,269 printing houses, altogether comprising a total annual

turnover of more than USD 6.1 billion. Afer years of increasing book sales, the

market has recently experienced a slight decline. Since 2008 the book sales have

decreased by four percent annually. More than half of the Danish publishers and

media companies were operating with losses in 2010.

Te e-book market has increased in Denmark due to an increased sale of techni-

cal devices such as e-book readers, smartphones, tablets, and small computers. It

has been estimated that the Danish market for e-books has the potential to reach

20 percent of all titles sold by 2016.Te price level for e-books is still fairly high

and they are sold both by physical and online stores. Audio book sales have slowly

increased during the last fve years and audio books are estimated to make up 6-8

% of the Danish book sale in general over the next couple of years.

Market Demand