Professional Documents

Culture Documents

Property Tax - Rent Rebate in Pennsylvania

Uploaded by

Jesse WhiteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Tax - Rent Rebate in Pennsylvania

Uploaded by

Jesse WhiteCopyright:

Available Formats

You can file a claim for a deceased individual. His or her name should be entered as the Estate of.

In addition to the other information on the application, a copy of Letters of Administration or the short certificate must be attached. The deceased individual must have been alive for the entire year. You must be able to verify that you paid property taxes or rent. Proof can include receipted tax bills for owners and rent certificates or rent receipts for renters. If you are claiming a rebate because you are disabled, you need to submit proof that you are receiving disability benefits from a federal agency or program. If you are not covered by any disability program, you must submit a complete medical report from your family physician. The Property Tax/Rent Rebate Program is just one of many senior citizen programs authorized and created by the Pennsylvania General Assembly. More information on these and other state-related programs is available in my office.

If you have any other questions about Pennsylvanias Property Tax/ Rent Rebate Program, call my office or the Department of Revenue at 1-888-222-9190. The department also maintains a special TDD number for the hearing impaired, which can be reached by calling 1-800-447-3020.

property tax/ rent rebate program

State Representative

Compliments of

Jesse White

Capitol offiCe: 102B East Wing P.O. Box 202046 Harrisburg, PA 17120-2046 Phone: (717) 783-6437 Fax: (717) 780-4781 DiStRiCt offiCeS: Cecil: 3855 Millers Run Road P.O. Box 285 Cecil, PA 15321 Phone: (724) 746-3677 Fax: (724) 746-3799 Burgettstown: 1425 Burgettstown Plaza #5 Burgettstown, PA 15021 Phone: (724) 947-4422 Fax: (724) 947-5386 Canton Township: 2403 Jefferson Ave. Suite C Washington, PA 15301 Phone: (724) 222-4192 Fax: (724) 222-4194 WeBSite: www.pahouse.com/white

We got ours!

lpo rev 0210

Need help cuttiNg through the red tape?

What is the property tax/rent rebate program and who benefits?

Pennsylvanias Property Tax/Rent Rebate Program benefits people who are 65 or older, widows and widowers 50 or older, and disabled people 18 or older. People who meet the age and income requirements may receive a refund on their property tax or rent paid during the previous year. The program was expanded in 2007 to ease the burden of property taxes on senior citizens and others who can least afford these taxes.

What do i have to do to receive a property tax or rent rebate?

If you qualify for a property tax or rent rebate, you need to fill out a Property Tax/Rent Rebate application form as soon as possible. The application form is available at my office, as well as several other locations, including state Revenue Department offices, area agencies on aging and senior centers. My staff can help you fill out the application and answer any questions you might have. The deadline for filing for a property tax or rent rebate is June 30, unless the deadline is extended. Checks are sent out after July 1 of the given year and if you apply after June 30 it usually takes 10 weeks to receive your rebate. If you have a question about the status of your claim after you file it, you can call 1-888PATAXES (1-888-728-2937). You should allow at least eight to 10 weeks from the date you mail your claim before you call to inquire about it.

homeoWNer s

If you have a household income of $35,000 or less, you may qualify for a refund of up to $650 based on the amount of property tax you paid last year. You also may receive an additional property tax refund up to 50 percent of your base rebate if you earn less than $30,000 and your property taxes are more than 15 percent of your income. Exception for Scranton, Pittsburgh and Philadelphia: Homeowners living in these school districts are eligible for a special supplement equal to up to 50 percent of their base rebate a total rebate up to $975. However, the applicants household income must be below $30,000.

reNter s

If you have a household income of $15,000 or less, you may qualify for a refund of up to $500 based on the amount of rent you paid last year. Low-income renters earning $8,000 or less are eligible for a $650 rebate.

NOTE: Claimants may deduct half of any Social Security including Medicare premiums or Railroad Retirement Tier 1 benefits from other income when determining eligibility. This means that a renter or homeowner could have a higher household income and still qualify for the rebate program. The Property Tax/Rent Rebate Program is funded by the Pennsylvania Lottery. A portion of this program also is funded by gaming revenue. This program is expected to help more than 600,000 older Pennsylvanians annually.

What else do i need to know?

You can receive a property tax or rent rebate only on the primary residence you occupied during the period for which you are claiming a rebate. If you own a residence, you must have paid your property taxes prior to filing for a rebate. Renters need to make certain their landlords paid property taxes on the rental property.

i got mine!

You might also like

- Propertytax ReliefDocument2 pagesPropertytax ReliefJohny HoNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Washington Assurance Wireless Free Cell PhoneDocument2 pagesWashington Assurance Wireless Free Cell PhoneCindaRose100% (1)

- Wells Fargo Loss Mitigation Package (2011)Document13 pagesWells Fargo Loss Mitigation Package (2011)Chris QualmannNo ratings yet

- General Exemption InformationDocument4 pagesGeneral Exemption InformationO'Connor AssociateNo ratings yet

- How Did The Income Tax Start?: Irs - GovDocument6 pagesHow Did The Income Tax Start?: Irs - GovApurva BhargavaNo ratings yet

- Maw D ApplicationDocument10 pagesMaw D ApplicationRichard GuthNo ratings yet

- RTPMST05081618Da FFL WE (1) Att Wireless LinkupDocument5 pagesRTPMST05081618Da FFL WE (1) Att Wireless LinkupTanya ParsonsNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Marguerite C. Quinn: Quinn To Host Home Improvement Consumer Protection Act Seminar Home ImprovementDocument4 pagesMarguerite C. Quinn: Quinn To Host Home Improvement Consumer Protection Act Seminar Home ImprovementPAHouseGOPNo ratings yet

- A Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights ReservedDocument5 pagesA Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights Reservedapi-251198534No ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- 2015 Understanding RPTaxes - 12!29!2014Document2 pages2015 Understanding RPTaxes - 12!29!2014SewSkinnyNo ratings yet

- Tax Time InfoDocument4 pagesTax Time InfoNews 12 New JerseyNo ratings yet

- US Internal Revenue Service: p1546Document24 pagesUS Internal Revenue Service: p1546IRSNo ratings yet

- Instructions Booklet No Forms IncludedDocument44 pagesInstructions Booklet No Forms IncludedkonnetikutNo ratings yet

- HC1 April 2016 PDFDocument20 pagesHC1 April 2016 PDFWill RogersNo ratings yet

- Help With Your Rent and Council Tax: ProofsDocument28 pagesHelp With Your Rent and Council Tax: Proofsjason_preciousNo ratings yet

- Rights and Responsibilities of Supplemental Nutrition Assistance Program (Snap) Households Your RightsDocument21 pagesRights and Responsibilities of Supplemental Nutrition Assistance Program (Snap) Households Your RightsAsh FoxxNo ratings yet

- HC1 December 2019Document20 pagesHC1 December 2019TomNo ratings yet

- ScriedriebrochureDocument32 pagesScriedriebrochureapi-317156030No ratings yet

- Senior Citizen Services in PennsylvaniaDocument2 pagesSenior Citizen Services in PennsylvaniaJesse WhiteNo ratings yet

- Saskatchewan Assistance Program Handbook: InformationDocument23 pagesSaskatchewan Assistance Program Handbook: InformationAmillia SparkNo ratings yet

- Questions & Answers On Tax Deferral: 33-06.pdf 33-06 - Fill PDFDocument2 pagesQuestions & Answers On Tax Deferral: 33-06.pdf 33-06 - Fill PDFO'Connor AssociateNo ratings yet

- What About?: Questions Ordained Ministers Ask About TaxesDocument4 pagesWhat About?: Questions Ordained Ministers Ask About TaxesRa ElNo ratings yet

- Teamster UPS Hardship FormDocument19 pagesTeamster UPS Hardship Formmnharris1550% (2)

- Your 2019 Social Security Cost of Living IncreaseDocument4 pagesYour 2019 Social Security Cost of Living IncreasetugwareNo ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Your 2024 Social Security Cost of Living IncreaseDocument4 pagesYour 2024 Social Security Cost of Living IncreasenazoyaqNo ratings yet

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNo ratings yet

- Litigator2016 Special FINALDocument4 pagesLitigator2016 Special FINALMountain States Legal FoundationNo ratings yet

- DHS-PUB-1010 - 243538 - 7 Important Things About Programs & ServicesDocument38 pagesDHS-PUB-1010 - 243538 - 7 Important Things About Programs & ServicesAryas VajraNo ratings yet

- Vet State Benefits - VI 2018Document6 pagesVet State Benefits - VI 2018DonnieNo ratings yet

- An Assignment of Tax Planning On "Tax System in United States of America"Document23 pagesAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniNo ratings yet

- E Selfhelp RedundancyDocument12 pagesE Selfhelp RedundancykabulibazariNo ratings yet

- HC 1Document20 pagesHC 1multiekNo ratings yet

- Taxes and Benefits: Information For Our Lesbian, Gay, Bisexual and Transgender CustomersDocument20 pagesTaxes and Benefits: Information For Our Lesbian, Gay, Bisexual and Transgender CustomersAshtagonNo ratings yet

- Taxation Assignment #2Document2 pagesTaxation Assignment #2Keirulf Jay AlmarioNo ratings yet

- A Guide To Australian Government Payments 2014Document44 pagesA Guide To Australian Government Payments 2014Wing ChuNo ratings yet

- 1-ON Trillium Aug-2019Document6 pages1-ON Trillium Aug-2019moizitouNo ratings yet

- Energy Assistance Programs Application 2011-2012: EligibilityDocument4 pagesEnergy Assistance Programs Application 2011-2012: EligibilityKeithen SaundersNo ratings yet

- SAWS2PLUS - Medical ApplicationDocument27 pagesSAWS2PLUS - Medical Applicationbaydude239874100% (1)

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloNo ratings yet

- Christiana Summer 2011 NewsletterDocument2 pagesChristiana Summer 2011 NewsletterPAHouseGOPNo ratings yet

- Disability Tax CreditDocument72 pagesDisability Tax CreditJose GonzalezNo ratings yet

- Use This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceDocument22 pagesUse This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceafacewithoutanameNo ratings yet

- Hardship ExemptionDocument6 pagesHardship ExemptionAlice Louise KassensNo ratings yet

- Application For Calfresh Benefits: How Do I Apply?Document16 pagesApplication For Calfresh Benefits: How Do I Apply?SiberNo ratings yet

- Https Doc-08-6k-Docsviewer - GoogleusercontentDocument8 pagesHttps Doc-08-6k-Docsviewer - GoogleusercontentGastromanNo ratings yet

- Tax File Number DeclarationDocument7 pagesTax File Number DeclarationJessie YuNo ratings yet

- OTR 50 Percent Senior Citizen Tax Benefit Letter 2014 09 11Document1 pageOTR 50 Percent Senior Citizen Tax Benefit Letter 2014 09 11Scott RobertsNo ratings yet

- Nationstar 122016Document6 pagesNationstar 122016kathy bechtleNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- July NewsletterDocument4 pagesJuly NewsletterIncome Solutions Wealth ManagementNo ratings yet

- Hillsborough Co Spay Neuter VoucherDocument2 pagesHillsborough Co Spay Neuter Voucherapi-312135148No ratings yet

- NoticeDocument2 pagesNoticeOmar CastroNo ratings yet

- Application For CalFresh, Cash Aid, and - or Medi-Cal - Health Care ProgramsDocument29 pagesApplication For CalFresh, Cash Aid, and - or Medi-Cal - Health Care ProgramsDanNo ratings yet

- MarkWest v. Cecil Township Zoning Hearing Board ORDERqDocument22 pagesMarkWest v. Cecil Township Zoning Hearing Board ORDERqJesse WhiteNo ratings yet

- Right-To-Know Request Form CasciolaDocument3 pagesRight-To-Know Request Form CasciolaJesse WhiteNo ratings yet

- An Open Letter From Jesse WhiteDocument4 pagesAn Open Letter From Jesse WhiteJesse WhiteNo ratings yet

- Right-To-Know Request Form CowdenDocument3 pagesRight-To-Know Request Form CowdenJesse WhiteNo ratings yet

- Counterclaim PDFDocument18 pagesCounterclaim PDFJesse WhiteNo ratings yet

- Robinson Township Et Al vs. Commonwealth of PADocument88 pagesRobinson Township Et Al vs. Commonwealth of PAJesse WhiteNo ratings yet

- Hearing Transcript: Jennifer Andreis Moninger v. Cecil Township Et Al.Document281 pagesHearing Transcript: Jennifer Andreis Moninger v. Cecil Township Et Al.Jesse WhiteNo ratings yet

- White Hearing Committee ReportDocument4 pagesWhite Hearing Committee ReportJesse WhiteNo ratings yet

- Complaint W AttachmentsDocument27 pagesComplaint W AttachmentsJesse WhiteNo ratings yet

- Polling PlacesDocument2 pagesPolling PlacesJesse WhiteNo ratings yet

- Pre Election LetterDocument2 pagesPre Election LetterJesse WhiteNo ratings yet

- Jesse White, Eileen White and Nicole White v. Sharlene WatazychynDocument64 pagesJesse White, Eileen White and Nicole White v. Sharlene WatazychynJesse WhiteNo ratings yet

- White Hearing Committee ReportDocument4 pagesWhite Hearing Committee ReportJesse WhiteNo ratings yet

- Polling PlacesDocument2 pagesPolling PlacesJesse WhiteNo ratings yet

- JW Handout 3Document2 pagesJW Handout 3Jesse WhiteNo ratings yet

- Polling PlacesDocument2 pagesPolling PlacesJesse WhiteNo ratings yet

- Writ of SummonsDocument3 pagesWrit of SummonsJesse WhiteNo ratings yet

- Jesse White For Magisterial District JudgeDocument2 pagesJesse White For Magisterial District JudgeJesse WhiteNo ratings yet

- Jesse White Appellate BriefDocument26 pagesJesse White Appellate BriefJesse WhiteNo ratings yet

- Traci McDonald-Kemp Campaign Finance ReportDocument29 pagesTraci McDonald-Kemp Campaign Finance ReportJesse WhiteNo ratings yet

- T Cf12pageW BACKDocument1 pageT Cf12pageW BACKJesse WhiteNo ratings yet

- Complaints For Defamation and Commercial DisparagementDocument54 pagesComplaints For Defamation and Commercial DisparagementJesse White50% (2)

- T Cf12pageW FRONTDocument1 pageT Cf12pageW FRONTJesse WhiteNo ratings yet

- In Re Nomination Petition of Jesse WhiteDocument22 pagesIn Re Nomination Petition of Jesse WhiteJesse WhiteNo ratings yet

- Letter To PA DEP Secretary Abruzzo Regarding Wastewater Contamination Issues at Worstell Wastewater ImpoundmentDocument13 pagesLetter To PA DEP Secretary Abruzzo Regarding Wastewater Contamination Issues at Worstell Wastewater ImpoundmentJesse WhiteNo ratings yet

- Worstell Impoundment DEP DocumentsDocument1,187 pagesWorstell Impoundment DEP DocumentsJesse WhiteNo ratings yet

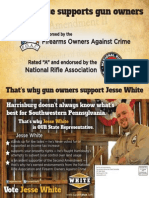

- Jesse White: Champion of Our 2nd Amendment RightsDocument2 pagesJesse White: Champion of Our 2nd Amendment RightsJesse WhiteNo ratings yet

- Setting The Record Straight: Rep. Jesse White Responds To Negative Attacks With Positive PlanDocument1 pageSetting The Record Straight: Rep. Jesse White Responds To Negative Attacks With Positive PlanJesse WhiteNo ratings yet

- Worstell Impoundment Water LogsDocument158 pagesWorstell Impoundment Water LogsJesse WhiteNo ratings yet

- Pennsylvania Auditor General Report On FrackingDocument158 pagesPennsylvania Auditor General Report On FrackingglenncoinNo ratings yet

- Contribution of Science and Technology To National DevelopmentDocument2 pagesContribution of Science and Technology To National DevelopmentAllan James DaumarNo ratings yet

- Cisa 2Document6 pagesCisa 2Ahmad MaaytahNo ratings yet

- 1.0 Design Andheri Khola Bridge, 1x25m 8.4m 3 GirderDocument18 pages1.0 Design Andheri Khola Bridge, 1x25m 8.4m 3 GirderManoj ChaudharyNo ratings yet

- Ujar10 10434839Document11 pagesUjar10 10434839Fitryane LihawaNo ratings yet

- Best of Thekkady (Periyar) Recommended by Indian Travellers: Created Date: 27 December 2015Document8 pagesBest of Thekkady (Periyar) Recommended by Indian Travellers: Created Date: 27 December 2015sk_kannan26No ratings yet

- Safety Manual For DumperDocument9 pagesSafety Manual For DumperHimanshu Bhushan100% (1)

- 2013 CATALOG - WebDocument20 pages2013 CATALOG - WebDevin ZhangNo ratings yet

- Allison at 500, at 1500 Series Parts Catalog: 2 1 See Section 10Document7 pagesAllison at 500, at 1500 Series Parts Catalog: 2 1 See Section 10amin chaabenNo ratings yet

- Topic: Matrix Addition and SubtractionDocument6 pagesTopic: Matrix Addition and SubtractionAnonyNo ratings yet

- Optical Current TransformerDocument22 pagesOptical Current TransformerchallaramcharanreddyNo ratings yet

- Class 10 - Organizational Structure and CultureDocument11 pagesClass 10 - Organizational Structure and CultureTrịnh ThanhNo ratings yet

- Indian - Origin Girls Bag Google Science Honour - Yahoo! India EducationDocument3 pagesIndian - Origin Girls Bag Google Science Honour - Yahoo! India EducationRiyaz RafiqueNo ratings yet

- A) Discuss The Managing Director's Pricing Strategy in The Circumstances Described Above. (5 Marks)Document17 pagesA) Discuss The Managing Director's Pricing Strategy in The Circumstances Described Above. (5 Marks)Hannah KayyNo ratings yet

- HboDocument126 pagesHboKunal ChaudhryNo ratings yet

- Thesun 2009-07-09 Page05 Ex-Pka Director Sues Nine For rm11mDocument1 pageThesun 2009-07-09 Page05 Ex-Pka Director Sues Nine For rm11mImpulsive collectorNo ratings yet

- However, A Review of The Factual Antecedents of The Case Shows That Respondents' Action For Reconveyance Was Not Even Subject To PrescriptionDocument7 pagesHowever, A Review of The Factual Antecedents of The Case Shows That Respondents' Action For Reconveyance Was Not Even Subject To Prescriptionkemsue1224No ratings yet

- Code of Ethics Multiple Choice QuestionsDocument4 pagesCode of Ethics Multiple Choice QuestionsGideon P. Casas88% (24)

- Macaw Recovery Network - Výroční Zpráva 2022Document20 pagesMacaw Recovery Network - Výroční Zpráva 2022Jan.PotucekNo ratings yet

- Hypochlorous AcidDocument25 pagesHypochlorous AcidDirector Research100% (2)

- RFP For Corporate Engagement Platform PDFDocument28 pagesRFP For Corporate Engagement Platform PDFAnupriya Roy ChoudharyNo ratings yet

- Solar Smart Irrigation SystemDocument22 pagesSolar Smart Irrigation SystemSubhranshu Mohapatra100% (1)

- PDF 20699Document102 pagesPDF 20699Jose Mello0% (1)

- Relevé: Partie 6: Vidéo "Le Blues en Jazz"Document1 pageRelevé: Partie 6: Vidéo "Le Blues en Jazz"santiagoNo ratings yet

- Type SAP Usage / Definition Example Procurement RotablesDocument4 pagesType SAP Usage / Definition Example Procurement Rotablessabya1411No ratings yet

- SEMIKRON DataSheet SK 30 GD 066 ET 24914960Document5 pagesSEMIKRON DataSheet SK 30 GD 066 ET 24914960prajwalNo ratings yet

- Introduction To SCILABDocument14 pagesIntroduction To SCILABMertwysef DevrajNo ratings yet

- Learning Dynamics and Vibrations by MSC AdamsDocument80 pagesLearning Dynamics and Vibrations by MSC AdamsFrancuzzo DaniliNo ratings yet

- Abstract 2 TonesDocument8 pagesAbstract 2 TonesFilip FilipovicNo ratings yet

- Euroleague Basketball: Change Pays Off ForDocument36 pagesEuroleague Basketball: Change Pays Off ForNikos TagalnikNo ratings yet

- Conscious Parallelism and Price Fixing Defining The BoundaryDocument29 pagesConscious Parallelism and Price Fixing Defining The BoundaryFelipe Augusto Diaz SuazaNo ratings yet