Professional Documents

Culture Documents

Mathematics of The Portfolio Frontier

Uploaded by

ryangibboOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mathematics of The Portfolio Frontier

Uploaded by

ryangibboCopyright:

Available Formats

The Quarterly Review of Economics and Finance

44 (2004) 337361

The mathematics of the portfolio frontier:

a geometry-based approach

Avi Bick

Faculty of Business Administration, Simon Fraser University, Burnaby, BC, Canada V5A 1S6

Received 24 April 2003; accepted 28 April 2003

Abstract

The mathematics of the portfolio frontier and the Capital Asset Pricing Model (CAPM) are derived

by using Analytical Geometry as the point of departure. The paper provides the Analytical Geometry

theorem which is the analog of the CAPM relationship between frontier portfolios.

2003 Board of Trustees of the University of Illinois. All rights reserved.

JEL classication: G11, G12

Keywords: Mean-variance; Portfolio frontier; Capital Asset Pricing Model

1. Introduction

Markowitzs (1952) and Tobins (1958) theory of portfolio selection is one of the most

important pillars of Financial Economics. Built on this theory is the celebrated Capital Asset

Pricing Model (CAPM), developed by Sharpe (1964), Lintner (1985), and Mossin (1966).

1

Roughly speaking, the model says that investors are compensated on the average for taking risk.

The CAPM equation relates the expected rate of return of a security to its risk, as measured

by its beta, which is the (normalized) covariance of two random variables: the return of the

given security and the return of the market portfolio.

This work is a self-contained expository paper on the basics of Portfolio Theory. At the

same time, this is also a research paper because it contributes at the foundational level by

Further details of the mathematics can be found at. http://www.bus.sfu.ca/homes/avi b/Bick papers.htm.

Tel.: +1-604-291-3748; fax: +1-604-291-4920.

E-mail address: bick@sfu.ca (A. Bick).

1062-9769/$ see front matter 2003 Board of Trustees of the University of Illinois. All rights reserved.

doi:10.1016/j.qref.2003.04.001

338 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

demonstrating that the celebrated CAPM equation is based on a result of Analytical Geometry.

Thus the Fundamental Theorem of Portfolio Theory (in our terminology), which entails the

CAPM equation, is just a translation of an Analytical Geometry theorem into the setting of

portfolio selection.

The geometric aspects of portfolio selection, developed in Merton (1972), Gonzales-Gaverra

(1973), Roll (1977) and in numerous other works, are well-known.

2

However, in this literature

the geometry is always interpreted as a representation of the portfolio selection problem. In

contrast, our exposition will be based on compartmentalization of the geometry and the

required matrix algebra. The paper is aimed at readers who appreciate an approach where the

underlying pure-mathematics structure is made transparent before any applications.

The paper is organized as follows: Section 2 presents Analytical Geometry results. Section 3

contains the matrix algebra tools that we need later. In Section 4 we discuss the mean-variance

portfolio selection problem, where the goal is to identify the portfolio frontier, namely those

portfolios with minimal variance among all portfolios with the same expected return. Properties

of the portfolio frontier are discussed in Section 5. This is just a repetition of the results from

Section 3 in the setting of Section 4. In Section 6, we combine these results with the Slope

Comparison Theorem from Section 2, and derive the Fundamental Theorem of Portfolio

Theory, which is (in relation to the historical development) the CAPM equation without as-

suming an equilibrium. Sections 79 discuss important special cases. Section 10 discusses the

connection between the previous results and market equilibrium. Section 11 is a short summary.

2. The geometric results

Consider the conic section in the -plane, given by

2

= k

2

[( )

2

+b

2

], (1)

where k > 0, b 0 and R are given parameters. If b > 0, the equation can be written in

standard form as

2

k

2

b

2

( )

2

b

2

= 1, (2)

and it represents a hyperbola. We also allow b = 0 in (1), in which case the equation

2

=

k

2

( )

2

represents two lines intersecting at (0, ). Later in the paper and denote standard

deviation of return and expected return, respectively, and therefore we restrict our attention to

the half-plane 0. Hence Eq. (1) denes a function : R [0, ). (We will use the same

notation for the -coordinate and the function () = (; k

2

, b

2

, ), but the meaning will be

clear from the context.) This function has a a minimum at = , and the minimal value is

( ) = kb. Thus () = 0 only if b = 0 and = , otherwise () > 0. It actually makes

more sense to represent the graph in the -plane, but in most of the nance literature on the

subject this is done in the -plane, and we will follow this custom here. This is not essential.

With the given parameters, dene C : R R R as follows:

C(, ) := C(, ; k

2

, b

2

, ) := k

2

[( )( ) +b

2

]. (3)

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 339

We note that C satises, for , ,

1

,

2

, R

C(, ) =

2

(), (4)

C(

1

+(1 )

2

, ) = C(

1

, ) +(1 )C(

2

, ), (5)

C(, ) = C(, ), [C(, )]

2

2

()

2

(), (6)

C(, ) = k

2

b

2

=

2

( ). (7)

The inequality in (6) is a matter of simple algebra, using (1) and (3). The rest is straightforward.

Property (5), which is satised in both variables, means, as a matter of terminology, that C is a

biafne map.

One can then dene : R R R as follows: (, ) = 0 if C(, ) = 0, otherwise

(, ) :=

C(, )

()()

. (8)

In light of (6), this is well-dened and 1 1. We add parenthetically, although it is not

used at the formal development at this stage, that later in the paper C(, ) will represent the

covariance between two frontier portfolios with expected returns and , respectively, and

will be the correlation coefcient.

Next, dene Z : R \ { } R via

C(, Z()) = 0. (9)

That is, for = ,

Z() := Z(; , b

2

) :=

b

2

. (10)

If b > 0 then clearly

Z(Z()) = . (11)

We note in this case that > if and only if Z() < , if and only if > Z(). We also

obtain, by simple algebra,

2

() = k

2

( )( Z()), (12)

2

(Z()) = k

2

(Z() )(Z() ), (13)

where (13) is obtained from (12) by replacing by Z(). In the case b = 0 we have that

Z() = for each = , and the two previous equations clearly remain correct.

Later in the paper C(, ) will be given in the form

C(, ) = (, 1)

, (14)

where is a given 2 2 symmetric nonnegative denite matrix with

11

> 0. Then

C(, ) =

11

+

12

( +) +

22

= k

2

[( )( ) +b

2

], (15)

340 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

where

:=

12

11

, k

2

:=

11

> 0, (16)

b

2

:=

11

22

2

12

2

11

=

det()

2

11

0. (17)

Substituting (16) and (17) in Eq. (10) gives, for = ,

Z() =

12

+

22

11

+

12

. (18)

The geometric meaning of Z is as follows: If b = 0, Z() = for each , and Z() is the

intersection of the lines (1) with the -axis. If b = 0, this is true for the tangent line:

Proposition 2.1. Fix k > 0 and R.

(a) Suppose b > 0 and let = . Then the straight line through (0, Z()) and ((), ) is

tangent to the hyperbola (1) at ((), ).

(b) Equivalently, suppose b > 0 and let r = . Then the straight line through (0, r) and

((Z(r)), Z(r)) is tangent to the hyperbola (1) at ((Z(r)), Z(r)). In this case the tangency

point is on the upper arc of the hyperbola, namely Z(r) > , if and only if r < .

Proof (outline). In part (a), apply elementary Calculus. Part (b) follows from the fact that if

r = Z() then = Z(r). The second statement in (b) is clear.

The main result of this section is this:

3

Theorm 2.2 (Slope Comparison Theorem). Fix k > 0, b 0 and R. Then

(a) For each R and = ,

Z() =

C(, )

2

()

( Z()). (19)

(b) Suppose b > 0. Then (19) is equivalent to the property that for each R and r = ,

r =

C(, Z(r))

2

(Z(r))

(Z(r) r), (20)

which can also be written as

r

()

= (, Z(r))

Z(r) r

(Z(r))

. (21)

To state it in geometric terms: Consider the tangent line to the hyperbola (1) through (0, r) for

any r = . Then the tangency point is ((Z(r)), Z(r)), and Eq. (21) says:

Slope of line connecting (0, r) to an arbitrary hyperbola point ((), )

= (, Z(r)) Slope of line through (0, r) tangent to the hyperbola

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 341

(0,r )

0

0

((),)

((Z (r ),Z (r ))

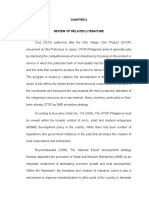

Fig. 1.

Proof. Write = + (1 )Z() where = ( Z())/( Z()). Expand C(, )

as in (5) and use (7) and (9). This will give (19). Applying this equation with r = Z() and

= Z(r) gives Eqs. (20) and (21). The verbal equation at the end is just a restatement of

(21), combined with the geometric interpretation in Proposition 2.1 (see Fig. 1).

The next proposition, which is a slight generalization of Proposition 2.1, is needed only in

Section 9 and may be skipped for now:

Proposition 2.3. Fix k > 0, b > 0 and R. Let r R and let

2

:= k

2

b

2

/[( r)

2

+b

2

].

(a) For each R,

2

( r)

2

k

2

[( )

2

+b

2

]. (22)

This is a relationship between a hyperbola and a reected line, which can also be expressed

as

2

(;

2

, 0, r)

2

(; k

2

, b

2

, ). (23)

(b) If r = , equality holds in (22) only at = Z(r; b

2

, ). This is where the reected line is

tangent to the hyperbola.

(c) If r = , i.e.

2

= k

2

, then strict inequality holds in (22) for each , and the two half-lines

which constitute the graph of

2

(;

2

, 0, r) are asymptotic to the hyperbola corresponding

to

2

(; k

2

, b

2

, ).

342 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

Proof (outline). To prove (22), move everything in this inequality to the right-hand side and nd

the minimum of a quadratic function. If r = , this minimum is at the point = Z(r; b

2

, )

where the quadratic function is equal to zero. If r = , the above quadratic function reduces

to a positive constant. The formula for the asymptotes of a hyperbola is well known. In our

notation this is

2

= k

2

( r)

2

. This concludes the proof.

We should also mention, although this is not needed as a part of the formal argument, that

2

was found from

(Z(r) r)

(Z(r))

2

=

( r)

2

+b

2

k

2

b

2

, (24)

where the functions and Z are evaluated with parameters (k

2

, b

2

, ). (Use Eqs. (10) and

(13) to substitute Z(r) and

2

(Z(r)), respectively.) In light of Proposition 2.1, the left-hand

side is the squared slope of the tangent line to the hyperbola (1) through (0, r), provided that

r = .

3. Some matrix algebra preparations

In this section we will summarize some results on matrix inversion by partitioning. Material

on this topic can be found in Faddeev and Faddeeva (1963), Section 24 or Zhang (1999) Section

2.2.

4,5

In these texts it is assumed that the upper-left block (V below) is invertible, but we also

need the case when this is not necessarily satised.

Proposotion 3.1. Let Q and A be (n + m) (n + m) symmetric matrices such that Q has a

zero mm bottom-right submatrix. That is, they can be partitioned in the form

Q =

V Y

Y

, A =

, (25)

where V, R

nn

and Y, R

nm

. (The bottom-right mm submatrix of A is denoted

for convenience. Prime denotes transposition.) Then

(a) A = Q

1

if and only if

I

n

0

0 I

m

= QA =

V+Y

VY

Y

, (26)

where I

j

is the j j identity matrix. In particular:

V = Y, (27)

V = . (28)

(b) Suppose V is invertible, and so is := Y

V

1

Y. Then Q is invertible and

Q

1

=

V

1

(I

n

YY

V

1

) V

1

Y

Y

V

1

, (29)

where =

1

.

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 343

Proof. The second equality in (26) is a result of block multiplication. Eq. (27) is the upper-right

block equality in (26). To obtain (28), left-multiply (27) by

and use the bottom-right equality

in (26).

Under the additional assumptions of part (b), Eq. (27) becomes = V

1

Y. The next

step in specifying Q

1

is to use the upper-left block equality in (26) and conclude that =

V

1

(I

n

YY

V

1

). Nowall that is left to do is to nd . The equality in the bottom-left block

of (26) translates to

0 = Y

= Y

V

1

Y

V

1

YY

V

1

= Y

V

1

Y

V

1

. (30)

This is satised if =

1

.

Corollary 3.2. Suppose Q, V and Y are matrices as in (25). If V is positive denite and Y is of

rank m, then := Y

V

1

Y is positive denite. Therefore the conditions (and hence the result)

of part (b) of Proposition 3.1 are satised. That is, Q

1

exists and is given by (29).

Proof. If V is positive denite, it also has a positive denite inverse V

1

. Now it is an easy

exercise to show that is also positive denite. (Or see Theorem 4.2.1 in Golub and Van Loan

(1996).) Hence is invertible, and the conclusion follows.

Two other results, for the case m = 2, are needed later:

Corollary 3.3. With notation as in Proposition 3.1, assume that A = Q

1

and that V is

nonnegative denite. Then is also nonnegative denite. If is 2 2, this entails that either

11

> 0 or

11

=

12

= 0.

Proof. The fact that is nonnegative denite is immediate from(28). The rest is true in general

for a 2 2 symmetric nonnegative denite matrix . Indeed, for each R,

0 (, 1)(, 1)

=

11

2

+2

12

+

22

, (31)

which clearly entails the desired conclusion.

Proposition 3.4. Suppose Q is an (n +2) (n +2) symmetric matrix of the form

Q =

V (E, 1)

(E, 1)

, (32)

where V R

nn

and E, 1 R

n

. Assume that Q is invertible. As a matter of notation, assume

that Q

1

= A is partitioned as in (25). Dene, for each R,

w() :=

R

n

, (33)

where is as in (25). Then

(a) w is an afne function. That is, if =

1

+(1 )

2

where

1

,

2

, R, then

w() = w(

1

) +(1 )w(

2

). (34)

344 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

(b) For , R

w()

E = , w()

1 = 1, (35)

Vw() = (E, 1)

= (

11

+

12

)E +(

12

+

22

)1, (36)

w()

Vw() = (, 1)

. (37)

(c) For R and x R

n

such that 1

x = 1,

x

Vw() = (x

E, 1)

= w(x

E)

Vw(), (38)

x

Vw(x

E) = w(x

E)

Vw(x

E). (39)

(d) If in addition, V is nonnegative denite, then

w(x

E)

Vw(x

E) x

Vx. (40)

Proof. Part (a) is straightforward. To prove part (b), we combine the denition (33) and the

bottom-right equality in (26) (with Y = (E, 1)), obtaining

w()

(E, 1) = (, 1)

(E, 1) = (, 1). (41)

Eq. (36) follows from (27) and (33). Eq. (37) follows from (35) and (36). Eq. (38) follows from

(36) and (37). Eq. (39) is a special case of (38) which we need. To prove part (d), open the

brackets in

(x w(x

E))

V(x w(x

E)) 0, (42)

and apply (39).

4. The minimum-variance frontier

We now turn to the problem of identifying the minimum-variance frontier. We are given

n 2 securities (investments), which are to be held over a given period, say between time

0 and time 1. A portfolio of these n securities is identied with a column vector w =

(w

1

, . . . , w

n

)

W

n

, where prime denotes transposition and W

n

:=

w R

n

;

i

w

i

= 1

.

The w

i

s represent the proportions of wealth invested in securities i = 1, . . . , n, and they are

allowed to be negative (representing a short position) or above 1. If w, x W

n

, R, then

clearly the afne combination w +(1 )x is also in W

n

. In words, a portfolio of portfolios

is a portfolio in the original securities.

The n securities are characterized by a column vector of expected returns (or mean returns)

over the period, E = (E

1

, . . . , E

n

)

R

n

and by an n n covariance matrix of the returns,

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 345

denoted V, which is symmetric and nonnegative denite. The expected return of a portfolio

w W

n

is w

E. The covariance between portfolios w, x W

n

is w

Vx, and the variance of

w is w

Vw. For our purpose, all this can be taken as a denition. We say that w and x are

uncorrelated (or orthogonal) if w

Vx = 0.

A more detailed background, which is mostly not needed in the sequel, is this: Ownership

of securities is represented by shares, which are traded at time 0 (without transaction costs,

in our setting). Let P

j,1

be the time-1 price of one share of security j {1, . . . , n}. We may

assume that securities do not pay dividends or other payouts, or alternatively, that P

j,1

already

includes dividends reinvested in security j. The rate of return (return, for short) of security

j is R

j

:= (P

j,1

P

j,0

)/P

j,0

, where P

j,0

is the time-0 price. Prices are specied in some units

of account, say dollars. Let R := (R

1

, . . . , R

n

)

. We regard time-0 prices as given, and we

model uncertainty at time 1 by assigning a joint probability distribution to (P

1,1

, . . . , P

n,1

).

(We allow the possibility that one of these securities is riskless, namely that its time-1 price is

deterministic.) Thus R becomes an R

n

-valued random variable, and by denition,

E := E[R] R

n

, V := E[(R E)(R E)

] R

nn

, (43)

where E denotes the expectation (mean) operator with the appropriate dimensionality. Thus

E

j

:= E[R

j

], j = 1,. . . ,n, is the expected return of security j. The (i, j) component of the

covariance matrix V is V

i,j

:= Cov(R

i

, R

j

) := E[(R

i

E

i

)(R

j

E

j

)], assuming that these are

nite numbers. In particular V

i,i

:= Var(R

i

) := Cov(R

i

, R

i

). For each portfolio w W

n

, its

return over the period is the random variable R

w

:= w

R which has mean E[R

w

] = w

E. The

covariance between the returns of portfolios w, x W

n

(the covariance between w and x, for

short) is

Cov(R

w

, R

x

) = E[(w

R w

E)(R

x E

x)] = w

Vx. (44)

The variance of portfolio w is Cov(R

w

, R

w

) = E[(w

Rw

E)

2

] = w

Vw, and this also proves

that the matrix V is nonnegative denite.

Our goal is to identify the minimum-variance portfolios. That is, for each R we wish to

nd the portfolio with minimal variance for that level of expected return. We may envision

a nancial advisor who has many clients, all of whom have the same beliefs and prefer higher

mean and lower variance of return. While the tradeoff between expected return and variance

may vary among these clients, the advisor wishes to present to all of them a reduced menu of

only those portfolios that make sense. This is the mean-variance frontier, or the portfolio

frontier, as this set, or its representation in the mean-standard deviation plane, is often called

in the literature. As we shall see below, only the upper portion of this set contains portfolios

which are candidates for optimal mean-variance selection.

Portfolio selection can be narrowed down further by solving for a single portfolio which is

optimal for a given individual. Mathematically, an individuals preferences can be represented

by a utility function of the form U(, ) which is maximized over a given set in R

2

. Typically

it assumed that U is suitably smooth and is decreasing in and increasing in . For example,

Best and Grauer (1990) take U(, ) = t

2

/2, where t is a risk tolerance parameter. The

minimum-variance frontier can then be found as a second step by varying the parameter t. See

also the Bodie, Kane, and Marcus (1999) textbook, which uses this utility function in some

346 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

simple cases (e.g., two stocks). However, in this paper we will not go into the individuals

optimization problem and the focus is solely on identifying the whole minimum-variance

frontier.

Mathematically, following Merton (1972),

6

we wish to solve, for any given R,

Problem(, E, V) : min

wR

n

1

2

w

Vw, (45)

s.t. w

E = , w

1 = 1, (46)

where 1 = (1, . . . , 1)

. To solve that, we use the Lagrangian

L =

1

2

w

Vw +

1

( w

E) +

2

(1 w

1). (47)

The standard procedure of differentiating Lwith respect to w

1

, . . . , w

n

,

1

and

2

and equating

these derivatives to zero gives n + 2 equations in n + 2 unknowns. In matrix notation, the

following system is obtained.

V E 1

E

0 0

1

0 0

, (48)

where on the right-hand side 0 R

n

. Denote the (n +2) (n +2) matrix on the left-hand side

by Q.

The assumptions that we need are as follows:

(A.1) The matrix V is symmetric and nonnegative denite.

(A.2) The matrix Q from (48) in invertible. As a matter of notation, assume that Q

1

= A is

partitioned as in (25).

(A.3)

11

from (25) is positive.

Condition (A.1) is our standing assumption. Conditions (A.2)(A.3) will be corollaries of

other conditions later in the paper, but at this point we regard them as assumptions. Note that

(A.2) implies that E is not a multiple of 1. If E is a multiple of 1, say E = 1, then all portfolios

have the same expected return , and Problem (, E, V) can be solved only for = . This

is the case of a one-point frontier. Also note that assumption (A.3) rules out the possibility

that (, 1)(, 1)

, interpreted below as variance, does not depend on . (See Corollary 3.3.)

This is the case of a vertical-line frontier. In this paper we will not elaborate on these two

cases.

Assuming (A.1)(A.3), we obtain

= Q

1

, (49)

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 347

where the secondequalityis a matter of notation. The minimum-variance portfoliowithexpected

return is:

w() = w(; E, V) =

. (50)

Proposition 3.4 lists properties of this function. In particular, the covariance between two

minimum-variance portfolios is

C(, ) := w()

Vw() = (, 1)

= k

2

[( )( ) +b

2

], (51)

where in the last equality we used the fact that C(, ) is of the form (14), hence it can be

represented as in (15)(17). We can then dene Z as in (10) or (18) relative to the above C. We

can also use (18) and (36) to write, provided that = :

Vw() = (

11

+

12

)(E Z()1). (52)

For the global-minimum portfolio w( ) we have, based on (36), (16) and (17):

Vw( ) =

11

12

2

12

11

1 = k

2

b

2

1. (53)

The variance of a frontier portfolio is

2

()= C(, ). If b = 0, namely det() = 0, then

(51) gives

2

( ) = C( , ) = 0. That is, the portfolio w( ) has zero variance, so that its mean

return is in fact a riskfree rate. In this case Eq. (10) says that, for each = , Z() = ,

and thus Z() is the riskfree rate.

The notation (E, V), k

2

(E, V) and b

2

(E, V) will be used later when we wish to emphasize

the dependence on (E, V) (via ), and likewise we will allow ourselves to switch notation

and write C(, ; E, V),

2

(; E, V) and Z(; E, V) (instead of C(, ; k

2

, b

2

, ) etc., as in

Section 2).

5. Properties of the minimum-variance frontier

We remain in the setting of Section 4. In this section we restate known results, mainly from

Szeg (1980) and Huang and Litzenberger (1998), henceforth H-L.

7

The difference is that our

treatment does not require the explicit solution for the weights vector w, and as a result we do

not need to distinguish between two cases, with or without the riskfree rate. We only assume

that (A.1)(A.3) are satised. In fact, the results were already presented as matrix algebra

propositions, and all that is left to do here is to give the Portfolio Theory interpretation.

The (E, V)-minimum-variance frontier or (E, V)-portfolio frontier is dened as

F

n

(E, V) := {w(; E, V); R} R

n

. (54)

We will also refer to the (E, V)-minimum-variance frontier in the -plane, which is the set

{((; E, V), ); R}. We will abbreviate the terminology or notation when no ambiguity

arises.

348 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

The point (( ), ) represents the global minimum portfolio. (Recall that , k

2

and b

2

are

as in (16) and (17).) We note that for a > 0,

2

( +a) =

2

( a) while +a > a. This

means that w( a) is dominated by w( +a) in the mean-variance sense. In the language of

portfolio theory, it is inefcient. The efcient portfolios are those in {w( + a; a 0)},

represented by the upper portion of the conic section (hyperbola or reected line).

Going back to the matrix algebra work in Section 3, we interpret Proposition 3.4 in the

portfolio selection context:

F

n

is closed under afne combinations. Furthermore, any two arbitrary different elements

span the whole set. This is because, for xed

1

,

2

R,

2

=

1

, any Rcan be written

as =

1

+(1 )

2

where = (

2

)/(

2

1

), and (34) holds.

Eq. (38) gives the covariance between an arbitrary portfolio and an arbitrary frontier portfolio.

It says that if a frontier portfolio w() is xed, then its covariance with any portfolio x is the

same as its covariance with the frontier portfolio with the same mean return as x. This is a

key observation which will enable us (below) to extend the Slope Comparison Theorem to

non-frontier portfolios.

Eq. (39) says that the covariance of any portfolio with the frontier portfolio which has the

same mean return is equal to the variance of the latter.

The inequality in (40) conrms that any frontier portfolio w() has minimal variance com-

pared to all portfolios x with mean return x

E = .

It also follows by right-multiplying (53) by x

that all portfolios x W

n

have the same

covariance with the global-minimum portfolio, and this covariance is necessarily equal to

the variance of the latter portfolio:

x

Vw( ) = k

2

b

2

= w( )

Vw( ). (55)

6. The Fundamental Theorem of Portfolio Theory

We remain in the setting of Section 4, assuming that (A.1)(A.3) hold. Recall that Z is as in

(10) or (18) relative to C from (51).

Proposition 6.1. For every frontier portfolio w() with = there exists a unique frontier

portfolio w() which is uncorrelated with it, namely such that w()

Vw() = 0. This is given

by = Z().

Proof. This is just a restatement of Section 2 results in the portfolio selection setting.

Note. This includes the case b = 0 (that is, det() = 0,

2

( )= 0), where Z() = .

The concept of beta plays a major role in Portfolio Theory and asset pricing models. In

our framework we dene, for x R

n

and y W

n

such that y

Vy > 0,

(x, y) =

x

Vy

y

Vy

. (56)

We obtain:

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 349

Theorm 6.2

8,9

(The Fundamental Theorem of Portfolio Theory).

(a) For any = and x W

n

,

x

E = Z() +(x, w())( Z()). (57)

Equivalently, if x W

n

and y, z F

n

such that y

E = and y

Vz = 0, then

x

E = z

E +(x, y)(y

E z

E). (58)

(b) This is true, in particular, if a riskless portfolio exists (the case b = 0, that is, det() = 0),

whereZ() = z

E = is the riskfree rate.

Proof. Eq. (57) is obtained from Eq. (19), applied to C from (51), with = x

E, and incor-

porating (38). In light of the previous proposition, the equivalence between (57) and (58) is

straightforward, via y = w(), z = w(Z()).

One interpretation (or a sketch of an alternative proof) of Eq. (57) is this: Consider the conic

section {( (), ); R} (a hyperbola or a reected line) corresponding to all the portfolios

generated by x W

n

and w() F

n

. It is inside the n-asset frontier {((), ); R} and it

is tangent to it at the point = . Since they have the same tangent line at this point, it does not

matter if Z() is computed with respect to {( (), ); R} or {((), ); R}. Eq. (57)

is then obtained by applying Eq. (19) (the slope comparison theorem) to {( (), ); R}

at the point = . This will be elaborated upon in Appendix A.

Another interpretation: Recall that we regarded E and V as given and we used them to com-

pute the portfolio frontier. Eq. (58) says that we can go backward and infer E from frontier

portfolios in the following sense: The expected return of each portfolio (equivalently, the ex-

pected return E

j

of each security j {1, . . . , n}) can be calculated from (i) its beta relative

to a reference frontier portfolio, and (ii) the expected returns of this frontier portfolio and its

uncorrelated twin. This is important later in Section 10 when we regard expected returns as

being determined by equilibrium.

7. Special case: n risky securities, V is positive denite

The previous section contains the main results of the paper. The only purpose of this section

is to show how an important special case ts in the previous setting. For better integration with

the next section, we switch notation and write instead of V. (In both special cases is a

positive denite matrix. In this section is equal to V from Section 4, whereas in the next

section is a submatrix of V.)

The assumptions used here are as follows:

(B.1) E is not a multiple of 1. That is, rank (E, 1) = 2.

(B.2) The matrix (denoted V in (45)) is symmetric and positive denite.

This entails that the matrix Q from Section 4 is invertible, as we shall see below, and thus

conditions (A.1)(A.3) from our previous analysis will be satised.

10

350 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

In what follows we will need the notation:

:= (E, 1)

1

(E, 1) =

1

E 1

1

E

1

1

E 1

1

1

, (59)

:= (E, ) := det() = (E

1

E)(1

1

1) (1

1

E)

2

, (60)

r R E

r

:= E r1. (61)

Lemma 7.1. For all r R,

(E, ) = (E

r

, ) := (E

1

E

r

)(1

1

1) (1

1

E

r

)

2

. (62)

Proof (outline). Apply straightforward algebra. Another way to see it: Use matrix Calculus to

show that (d/dr)(E

r

, ) = 0. This implies that (E

r

, ) = (E

0

, ).

After these preparations, let us now compute Q

1

explicitly. In light of Corollary 3.2, is

positive denite and its determinant is positive. This corollary also says that Q is invertible,

and

11

Q

1

=

1

(I

n

(E, 1)(E, 1)

1

)

1

(E, 1)

(E, 1)

, (63)

where

=

1

=

1

1

1 1

1

E

1

1

E E

1

E

. (64)

This means, in particular, that is positive denite. Later we will use the straightforward

relationships

11

+

12

=

1

1

1

E

,

12

+

22

=

1

E

1

E

. (65)

Now that we have , this species the minimum-variance frontier in the -plane as the

hyperbola (1) with the parameters (see (16) and (17))

(E, ) :=

1

1

E

1

1

1

, k

2

(E, ) :=

1

1

1

(E, )

, (66)

b

2

(E, ) :=

(E, )

(1

1

1)

2

. (67)

We also record a relation between these parameters which will be needed later in Section 9. (It

may be skipped for now.)

Lemma 7.2. For each r R,

( r)

2

+b

2

k

2

b

2

= E

1

E

r

. (68)

Proof (outline). from(66) satises r = 1

1

E

r

/1

1

1. Substitute this in the left-hand

side of (68), and also b

2

and k

2

as above, where = (E

r

, ) is now taken from (62).

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 351

We can now rewrite the expressions for C(, ), Z() and w() in this setting. Let us start

with Eq. (51), which gives the covariance between frontier portfolios. Substituting the geometric

parameters from (66) and (67), we can write the last equality in (51) as:

12

C(, ) =

1

1

1

1

E

1

1

1

1

E

1

1

1

+

1

1

1

1

=

1

(1

1

1)

1

{(1

1

E

)(1

1

E

) +}. (69)

The variance of a frontier portfolio is then

2

()= C(, ).

Next, we obtain, for = ,

13

Z(; E, ) =

(1

1

E) E

1

E

(1

1

1) 1

1

E

= +

E

1

E

1

E

, (70)

where the rst equality is a straightforward conversion of (18). The second equality requires

some algebraic manipulation. (Start from the right-hand side.) Another connection between

and Z() is as follows:

(1

1

E

)(1

1

E

Z()

) + = 0. (71)

This is obtained by combining (69) with C(, Z()) = 0.

Finally, we wish to write the expression for the minimum-variance portfolio with expected

return . Left-multiplying Eq. (36) (with V = ) by

1

and combining with (65) gives:

14

w() =

1

1

{(1

1

E

)E +(E

1

E

)1} (72)

Alternatively, if = , we can use (52) and (65) to express w() as

w() =

1

(1

1

E

)

1

E

Z()

=

1

1

1

E

Z()

1

E

Z()

, (73)

where in the second equality we applied (71).

One interpretation of (73) is as follows: For a given r = , substitute = Z(r) and r = Z()

in the equation, so that the formula is

r = w(Z(r)) =

1

1

1

E

r

1

E

r

. (74)

Recall that ((Z(r)), Z(r)) is the intersection point of the hyperbola and the tangent line through

(0, r). The formula identies w(Z(r)), the tangency portfolio relative to (0, r) and thus it

species the minimum-variance frontier as the set of tangency portfolios generated by varying

(0, r) on the -axis.

15

The global-minimum portfolio w( ) is obtained from (74) by taking

r , Z(r) , which gives w( ) =

1

1/(1

1

1) = k

2

b

2

1

1. It can be shown

that this in agreement with (53) and (72).

8. Special case: a riskfree rate exists

Another special case of interest is when one of the securities is riskless, while the other

securities have a positive denite covariance matrix. Here it is convenient to switch notation

352 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

and denote the number of securities by n+1, where n 1. We will write the (n+1)-dimensional

vector of expected returns as

E = (E

1

, . . . , E

n

, E

n+1

)

= (E

S

, R

F

)

, (75)

where E

S

includes only the expected returns of the rst n securities (stocks), and the return of

security n +1, which is riskless (to be formalized in assumption (C.2) below), is denoted R

F

.

Likewise, we will write a portfolio w W

n+1

as w = (w

S

, w

n+1

)

, where w

S

is the column

vector of investments in the stocks, and w

n+1

= 1 1

w

S

is the investment in the riskfree rate.

The assumptions used in this section are as follows:

(C.1) E is not a multiple of 1. (Here 1 R

n+1

.) Equivalently, E

S

= R

F

1. (Here and below,

1 R

n

.)

(C.2) The (n +1) (n +1) covariance matrix V from (45) has an n n upper-left submatrix

which is symmetric and positive denite. The (n + 1)-th row and (n + 1)-th column

of V are zero.

Again, as we shall see below, this entails that the matrixQfrom(48) (an(n+3)(n+3) matrix

in our case) is invertible and that

11

(from (25)) is positive, and thus conditions (A.1)(A.3)

from our previous analysis will be satised.

16

Note that we can express the covariance between

two portfolios x, w W

n+1

as x

Vw = x

S

w

S

.

We denote E := E

S

R

F

1. (In the notation of the previous section, this is E

R

F

relative to

E

S

.) In addition,

:= E

1

E > 0, K :=

1

1

E, (76)

J :=

1

(I

n

EK

) =

1

1

EE

1

, (77)

(E

S

, ) :=

1

1

E

S

1

1

1

, (78)

and we note that

1

K = 0 1

1

E = 0 R

F

= (E

S

, ). (79)

In this sections setting the matrix from (48) becomes

Q =

0 E +R

F

1 1

0

0 R

F

1

E

+R

F

1

R

F

0 0

1

1 0 0

. (80)

The inverse is

Q

1

=

J J1 K R

F

K

1

J 1

J1 1

K 1 +R

F

1

K

K

1

1

1

R

F

R

F

K

1 +R

F

K

1

1

R

F

1

(R

F

)

2

. (81)

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 353

The matrix Q

1

was computed by following the method of Section 3, where blocks are

identied recursively, except that here 4 4 partitions were used. We will not give the details,

but the assertion that the above matrix is the inverse can be veried by multiplying it by Q.

(The reader may need to use the facts that J is symmetric, JE = 0 and K

E = 1.) Admittedly,

inverting Q is not the most economical way of solving the problem, but the intention here is to

present the solution as a special case of (49).

17

Recall that is the bottom-right 2 2 submatrix of Q

1

, and thus (16) and (17), together

with (81), translate to

(E, V) = R

F

, b

2

(E, V) = 0, k

2

(E, V) =

1

=

1

E

1

E

. (82)

The (E, V)-minimum-variance frontier in the -plane is composed of the two half-lines orig-

inating from (0, R

F

) (associated with the portfolio (0, . . . , 0, 1)

), as specied in (1).

Proposition 8.1. For each R, the frontier portfolio which has expected return , namely

the portfolio (w

S

(), w

n+1

())

W

n+1

, is given by

18

w

S

() = ( R

F

)K, w

n+1

() = 1 ( R

F

)1

K. (83)

If = R

F

and x = (x

S

, x

n+1

)

W

n+1

is an arbitrary portfolio, then (restating the Funda-

mental Theorem of Portfolio Theory)

x

S

E = x

E R

F

=

x

S

w

S

()

w

S

()

w

S

()

( R

F

). (84)

Proof. The rst part follows from (50):

w() =

w

S

()

w

n+1

()

K R

F

K

1

K 1 +R

F

1

. (85)

The second part is just a restatement of Theorem 6.2 part (b).

In the Finance literature, Eq. (84) is typically written in the form

E[R

x

] R

F

=

Cov(R

x

, R

p

)

Var(R

p

)

(E[R

p

] R

F

), (86)

where the notation R

x

is as in Section 4, and p := w().

We already sawin the general case in Section 5 that any two different frontier portfolios from

the minimum-variance frontier span the frontier. This applies in this sections setting, with the

frontier F

n+1

(E, V). As it was pointed out by Feldman and Reisman (2003), a computationally

convenient choice is the riskfree rate and the portfolio (in our notation) y = (y

S

, 1 1

y

S

)

,

where y

S

=

1

E. They noted that this is always an efcient portfolio. This corresponds to the

portfolio specied in (83) with the choice = R

F

+. Note that the case 1

y

S

= 0 is not ruled

out. (More on this condition below.)

354 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

9. Comparing portfolio frontiers

We remain in the setting of the previous section, where security n+1 provides a riskless rate

of return R

F

. If n 2, it is interesting to relate the minimum-variance frontier F

n+1

(E, V) to

the set F

n

(E

S

, ) obtained by investing only in the stocks. This is the topic of this section. For

F

n

(E

S

, ) to be non-degenerate, we need to assume now that E

S

is not a multiple of 1. (This

assumption is stronger than (C.1).)

If R

F

= (E

S

, ) (or see (79) for equivalent conditions), we denote

T

:= Z(R

F

; E

S

, ) = R

F

+

E

1

E

1

1

E

= R

F

+

1

1

K

, (87)

where the second equality follows from (70). We call w(

T

; E, V) F

n+1

(E, V) Portfolio T.

The following result is just a translation of Proposition 2.3 from the geometry section:

Proposition 9.1. The parameters of the (E, V)-frontier and the (E

S

, )-frontier are related via

k

2

(E, V) =

1

E

1

E

=

k

2

(E

S

, )b

2

(E

S

, )

( (E

S

, ) R

F

)

2

+b

2

(E

S

, )

, (88)

and hence, for each R,

2

(; E, V)

2

(; E

S

, ). (89)

In addition,

19

(i) If R

F

= (E

S

, ), equality holds only at =

T

. That is, the (E, V)-frontier (a reected

line) is tangent to the(E

S

, )-frontier (a hyperbola) at ((

T

),

T

).

(ii) If R

F

= (E

S

, ), there is strict inequality in (89) for each , and the (E, V)-frontier

is asymptotic to the (E

S

, )-frontier. In this case k

2

:= k

2

(E, V) = k

2

(E

S

, ) and the

(E, V)-frontier is the reected line

2

= k

2

( R

F

)

2

.

Proof. Eq. (88) is a result of (68) and (82), applied to r = R

F

. The rest is just a translation of

Proposition 2.3 to this sections setting. Of course, Eq. (89) can also be explained by comparing

the feasible sets of portfolios of the two optimization problems.

The same result can be rephrased as a statement on portfolio weights:

Proposition 9.2.

(a) If R

F

= (E

S

, ) then w

n+1

() = 1 for all , hence the investments in the stocks in every

(E, V)-frontier portfolio satisfy w

S

1 = 0.

(b) If R

F

= (E

S

, ) then there is a unique solution to w

n+1

(; E, V) = 0, and this is

T

from (87). That is, portfolio T is a pure-stock (E, V)-frontier portfolio. The corresponding

stock investments are

w

S

(

T

; E, V) = (

T

R

F

)K = (1

1

E)

1

1

E. (90)

(c) Assuming that R

F

= (E

S

, ),

w

S

(

T

; E, V) = w(

T

; E

S

, ). (91)

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 355

In words: The n-vector w

T

:= w

S

(

T

; E, V) which describes the stock components of

portfolio T is equal to the solution of the n-security portfolio problem (

T

, E

S

, ). That

is, in the -plane, ((w

T

w

T

)

1/2

,

T

) belongs both to the (E, V)-frontier and to the

(E

S

, )-frontier.

Proof. Again, note the conditions equivalent to R

F

= (E

S

, ), specied in (79). Parts (a)

and (b) of the proposition follow from (83). In Part (c), to see (91), write

w(

T

; E

S

, ) =w(Z(R

F

; E

S

, ); E

S

, )

=

1

1

1

E

1

E = w

S

(

T

; E, V), (92)

where in the second equality we applied (74) (recalling that E = E

R

F

) and in the third equality

we used (90).

10. The connection to equilibrium

The above results were derived from the point of view of one individual who computes the

portfolio frontier. They do not require any assumptions on the beliefs or risk preferences of

other market participants. In addition, securities 1, . . . , n (in the notation of Section 4) may

potentially constitute a subset of all securities which are available. We simply need to interpret

W

n

as all portfolios of securities 1, . . . , n instead of all possible portfolios, and likewise

for F

n

. This was evident in the previous section where two different portfolio frontiers were

compared.

The distinction between Portfolio Theory and asset pricing theories, like the celebrated Cap-

ital Asset Pricing Model, is that the latter are concerned with aggregate demand by all investors

and infer equilibrium relationships (to be elaborated upon below) between expected returns

and risk characteristics. Such theories typically require assumptions on all market participants

or on a representative individual.

Let us start by assuming a general setting as in Section 4, with n securities which may or may

not include a riskfree security. Assume, in addition, that these are all the securities in the market.

For each security j, let M

j

:=

N

j

P

j,0

, where

N

j

is the number of outstanding shares and P

j,0

is the time-0 price. This is the aggregate value of security j in units of account (dollars). Let

M :=

j

M

j

and m

j

:= M

j

/

M. Then m := (m

1

, . . . , m

n

)

is called the market portfolio.

This was the supply side. Let us now look at the demand for securities. We assume that

there are I individuals, denoted i = 1, . . . , I, who invest for the same time horizon and have

the same beliefs. (That is, they believe in the same (E, V).) Note that in the portfolio problem

(, E, V), formulated in Section 4, the goal is to identify the minimum-variance frontier, but

this does not specify how each individual makes his specic choice. We will not elaborate on

this here. For further details on individual portfolio choice and its connection to mean-variance

portfolio selection, see Levy and Markowitz (1979), Ingersoll (1987), Meyer and Rasche (1992),

Constantinides and Malliaris (1995), Berk (1997) and references therein. For our purposes we

will simply regard it as an assumption that the optimal portfolio of each individual i is a frontier

portfolio w(

i

) which is strictly efcient, i.e.,

i

> (E, V).

356 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

Let W

i

> 0 be the time-0 value (wealth, measured in dollars) of individual is portfo-

lio, and let

W :=

i

W

i

. Individual i wishes to hold w

j

(

i

)W

i

dollars worth of security j,

and the sum over all individuals (the aggregate demand) is D

j

:=

I

i=1

w

j

(

i

)W

i

dollars.

Clearly

j

D

j

=

W. The aggregate demand portfolio d W

n

is dened by d

j

:= D

j

/

W.

Then

d =

I

i=1

W

i

w(

i

) = w

i=1

W

i

. (93)

(For the second equality, see Proposition 6.1). As a convex combination,

i

(W

i

/

W)

i

is also

larger than (E, V), and we conclude that d is also a strictly-efcient frontier portfolio.

We now turn to the concept of equilibrium. For our purposes, this market is at equilibrium if

M

j

= D

j

for each j. (For a more detailed denition of equilibrium, which is beyond what we

need here, see Appendix B.) This implies that

M =

W, and that m = d. Thus an equilibrium

assumption boils down to the fact that the market portfolio is equal to the aggregate demand

portfolio. The latter is a strictly-efcient frontier portfolio, and thus the Fundamental Theorem

of Portfolio Theory is valid when the market portfolio is used as the reference frontier port-

folio. Mathematically, this means that we can write the market portfolio as a frontier portfolio

of the form m = w(

m

), where

m

is its expected return, and then we can restate Theo-

rem 6.2 with =

m

. (At the same time, the theorem remains correct for any other frontier

portfolios !)

More specically, in the setting of Section 7, without a riskfree rate, Eq. (57) implies that,

in equilibrium,

x

E = Z(

m

) +

x

Vm

m

Vm

(

m

Z(

m

)). (94)

This is the main result of Blacks (1972) zero-beta model.

20

It says that for an arbitrary

portfolio x,

Expected return of portfolio x

= Expected return of the frontier portfolio z uncorrelated with the market portfolio m

+(x, m) Difference between expected returns of z and m

(See (56) for the denition of .)

In the setting of Section 8, let us introduce the additional assumption that the riskfree rate

(security n +1) has zero net supply. That is, M

n+1

= 0, which means that individuals lend and

borrow between themselves. Thus equilibrium in this setting boils down to the assertion that

the market portfolio is an efcient frontier portfolio which is a pure-stock portfolio. If n 2,

it means that the tangency portfolio T from Section 9 is equal to the market portfolio, and it

is efcient. The latter property is possible only if R

F

< (E

S

, ). Eq. (57) implies that, in

equilibrium,

x

E = R

F

+

x

Vm

m

Vm

(

m

R

F

). (95)

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 357

This is the main result of the Sharpe-Lintner-Mossin Capital Asset Pricing Model.

21

It says that

for an arbitrary portfolio x,

Expected return of x

= R

F

+(x, m) Difference between expected return of the

market portfolio and the riskfree rate.

11. Summary

We have developed a geometry-rst approach to derive the mathematics of the portfolio

frontier and the CAPM.

Notes

1. See also Sharpes (1991) summary.

2. See also Szeg (1980), Ingersoll (1987), Huang and Litzenberger (1998) and

Constantinides and Malliaris (1995).

3. The theorems title is suggested by the author.

4. Note a typographical error in the F&F text, middle of p. 162: a negative sign should

come before A

1

BN.

5. In the Portfolio Theory literature, Szeg (1980) uses this method, but with a different

matrix. See his Appendix E.

6. Textbook coverage is available in Szeg (1980), Ingersoll (1987), Huang and

Litzenberger (1998) and Cochrane (2001). See also Sections 1.1 and 1.2 in Steinbach

(2001). Our matrix representation below is similar (albeit not in the same order of

rows) to the one in Steinbachs paper. For alternative approaches, see Elton, Gruber,

and Padberg (1976), Best and Grauer (1990) and Ttnc (2001). Benninga and

Czaczkes (2000) provide spreadsheet calculation methods in addition to theory.

7. Our w, V (or ), E, 1,

1

,

2

, , Z(), E

1

E, 1

1

E, 1

1

1, , R

F

, E and

correspond to Szegs x, V, r, e,

1

,

2

, ,

0

, , , ,

2

, , d and d

V

1

d,

respectively, and to H-Ls w, V, e, 1, , , E[ r

p

], E[ r

zc(p)

], B, A, C, D, r

f

, e r

f

1 and

H, respectively.

8. The theorems title is suggested by the author and is not a universally-used name.

9. The result is parallel to Eqs. (3.16.2) and (3.19.1) in H-L and to Propositions 3 and 4

in the appendix to Chapter 9 in Benninga and Czaczkes (2000). A short proof for part

(b) also appears in Feldman and Reisman (2003).

10. See also Szeg (1980), Appendix C, on the connection between assumptions (B.1) and

(B.2) and invertibility of Q.

11. This is consistent with the solution in H-L, Section 3.9 and with Theorem 1.5 in

Steinbach (2001).

12. This is parallel to Eq. (4.4) in Szeg (1980) and Eq. (3.11.1) in H-L.

13. The rst equality corresponds to Eq. (4.24) in Szeg (1980) and Eq. (3.14.2) in H-L.

The second equality is parallel to Eq. (4.30) in Szegs book.

358 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

14. This is parallel to Szegs Eq. (2.9). To compare to H-Ls results, pp. 6465: w(0) is

their g and w(1) is their g +h.

15. This corresponds to Proposition 1 in the appendix to Chapter 9 in Benninga and

Czaczkes (2000).

16. See also Szeg (1980), Appendix F, on the connection between assumptions (C.1) and

(C.2) and invertibility of Q.

17. See Szeg (1980), H-Lor Steinbach (2001) for a direct approach of solving the Problem

(, E, V) in the presence of a riskfree rate. Our Q

1

is consistent with the solution in

Theorem 1.8 in Steinbachs paper.

18. Eq. (83) coincides, after some algebra, with Eqs. (6.10) and (6.11) in Szeg (1980).

19. This part is parallel to Theorem (6.54) in Szegs book (where his

corresponds to

our

T

) and to discussion in H-L, Section 3.18. For the graphs, see Szegs Figure 6.4

or H-L Figures. 3.18.13.18.3.

20. See also Ingersoll (1987) pp. 9295, H-L Section 4.11.

21. See also Ingersoll (1987) pp. 9295, H-L Section 4.13.

Appendix A

In this appendix we briey outline an alternative proof of Eq. (57) (the fundamental theorem

of portfolio theory), which provides additional insights regarding the connection to the slope

comparison theorem.

Fix x W

n

and w(

0

) F

n

for some

0

= . We will prove (57) for this x and for =

0

,

limiting ourselves to the case x

E =

0

. Dene a biafne map

C : R R R via

C(

0

,

0

) := w(

0

)

Vw(

0

) = C(

0

,

0

), (A.1)

C(x

E, x

E) := x

Vx,

C(x

E,

0

) := x

Vw(

0

), (A.2)

which is then extended as in (5) in both variables. Dene

2

() :=

C(, ) for any R.

This is the variance of the portfolio with mean which is spanned by x and w(

0

). That is, one

can verify that

x

E +(1 )

0

= {x +(1 )w(

0

)}

V{x +(1 )w(

0

)} =

2

().

Thus the portfolios spanned by afne combinations of x and w(

0

) generate the conic section

() (a hyperbola or a reected line) in the -plane, and the corresponding biafne map is

C(, ).

Applying Eq. (19) (the slope comparison theorem) to

C(, ), evaluated at = x

E and

=

0

, we obtain

x

E

Z(

0

) =

C(x

E,

0

)

C(

0

,

0

)

(

0

Z(

0

)). (A.3)

where

Z is dened as in Section 2 with respect to

C. In light of (A.1) and (A.2), this translates

to Eq. (57), provided that we show that

Z(

0

) = Z(

0

).

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 359

Indeed, because of the optimality of the n-security frontier, we must have () () for all

. Eq. (A.1) also says that (

0

) = (

0

). Thus at =

0

, the two curves () and () must

have the same tangent line. (This idea appears in the CAPM proof in Jensen (1972).) Recalling

the interpretation of Z as the intercept of a tangent line, we conclude that

Z(

0

) = Z(

0

).

It should be mentioned that this includes the cases that (i) and are hyperbolas, possibly

identical, (ii) and are reected lines, necessarily identical, and (iii) is a reected line and

in a hyperbola.

Appendix B

This appendix, which complements Section 10, will elaborate on the denition of equili-

brium in a mean-variance setting, following Nielsen (1988) with slight modications. Suppose

there are n securities which are traded at time 0 in a frictionless market by I individuals. Assume

that there are

N

j

0 outstanding shares of security j. Individual i is endowed with e

i,j

shares

of security j, and thus

i

e

i,j

=

N

j

for each j.

The uncertainty is modeled by assigning a joint probability distribution to (P

1,1

, . . . , P

n,1

),

the time-1 prices of the n securities. (This includes the possibility that one of the securities is

riskless.) This probability distribution, regarded below as xed, represents the common beliefs

of all individuals. For every possible vector of time-0 prices P

0

= (P

1,0

, . . . , P

n,0

) (announced

by a Walrasian auctioneer), an individual can compute the joint probability distribution of

the R

n

-valued random variable R = R(P

0

), where R

j

= P

j,1

/P

j,0

1 is the return of security

j. This distribution denes the mean-variance parameters as in (43), where now we can regard

the expected returns vector E = E(P

0

) and the covariance matrix V = V(P

0

) as functions

of P

0

.

We assume that individual is portfolio selection problem can be represented as

max

xW

n

U

i

((x

Vx)

1/2

, x

E; W

i

), (B.1)

where U

i

(, ; W

i

) is a suitably smooth function which is decreasing in and increasing in

, and may depend as a parameter on the individuals time-0 wealth W

i

. (This representation

can actually be obtained as a result from more primitive assumptions on risk preferences. See

Section 10 for references on this issue.) For a given P

0

, individual i computes his time-0 wealth

W

i

(P

0

) =

j

e

i,j

P

j,0

and solves for his optimal portfolio, using E = E(P

0

) and V = V(P

0

).

Suppose the solution is x

i

(P

0

) = (x

i,1

(P

0

), . . . , x

i,n

(P

0

))

W

n

, and let

i

(P

0

) = x

i

(P

0

)

E.

Such a solution is necessarily of the form

x

i

(P

0

) = w(

i

(P

0

); E(P

0

), V(P

0

)), (B.2)

where the right-hand side is the solution of Problem (

i

(P

0

); E(P

0

), V(P

0

)) as in Section 4. In

other words, this is the minimum variance portfolio among all portfolios with expected return

i

(P

0

). The portfolio can also be expressed in terms of the number of shares in each security.

For security j, this number (including the individuals initial endowment) is

N

i,j

(P

0

) =

x

i,j

(P

0

)W

i

(P

0

)

P

j,0

. (B.3)

360 A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361

We can envision each individual i responding to the declared price vector P

0

by submitting

his optimal holdings (N

i,1

(P

0

), . . . , N

i,n

(P

0

)) to the auctioneer. This procedure can be repeated

for every time-0 price vector P

0

. Then P

0

is an equilibrium price vector if the market clears,

that is, if for j = 1, . . . , n

I

i=1

N

ij

(P

0

) =

N

j

. (B.4)

In the notation of Section 10, this translates to D

j

= M

j

for each j. (Multiply the two sides of

(B.4) by P

j,0

and use (B.2) and (B.3).)

References

Benninga, S., & Czaczkes, B. (2000). Financial modeling (2nd ed.). Cambridge, MA: MIT Press.

Berk, J. B. (1997). Necessary conditions for the CAPM. Journal of Economic Theory, 73, 245257.

Best, M. J., & Grauer, R. R. (1990). The efcient set mathematics when mean-variance problems are subject to

general linear constraints. Journal of Economics and Business, 42, 105120.

Black, F. (1972). Capital market equilibrium with restricted borrowing. Journal of Business, 45, 444454.

Bodie, Z., Kane, A., & Marcus, A. J. (1999). Investments (4th ed.) Boston: Irwin/McGraw-Hill.

Cochrane, J. H. (2001). Asset pricing. Princeton, NJ: Princeton University Press.

Constantinides, G. M., & Malliaris, A. G. (1995). Portfolio theory. In R. A. Jarrow, V. Maksimovic, & W. T. Ziemba

(Eds.), Handbooks in operations research and management science: Finance (Vol. 9). Amsterdam, New York:

Elsevier.

Elton, E. J., Gruber, M. J., & Padberg, M. W. (1976). Simple criteria for optimal portfolio selection. Journal of

Finance, 31, 13411357.

Faddeev, D. K., & Faddeeva, V. N. (1963). Computational methods of linear algebra. San Francisco: WH Freeman.

Feldman, D., & Reisman, H. (2003). Simple construction of the efcient frontier. European Financial Management,

9, 251259.

Golub, G. H., & Van Loan, C. F. (1996). Matrix computations (3rd ed.). Baltimore: Johns Hopkins University Press.

Gonzales-Gaverra, N. (1973). Ination and capital asset market prices: Theory and tests. Unpublished PhD

dissertation, Stanford University.

Huang, C.-F., & Litzenberger, R. H. (1998). Foundations for nancial economics. New York: North-Holland.

Ingersoll, J. E. (1987). Theory of nancial decision making. Totowa, NJ: Rowman & Littleeld.

Jensen, M. C. (1972). Capital markets: Theory and evidence. Bell Journal of Economics, 3, 357398.

Levy, H., &Markowitz, H. M. (1979). Approximating expected utility by a function of mean and variance. American

Economic Review, 69, 308317.

Lintner, J. (1965). The valuation of risky assets and the selection of risky investments in stock portfolios and capital

budgets. Review of Economics and Statistics, 47, 346382.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7, 7791.

Merton, R. C. (1972). An analytic derivation of the efcient portfolio frontier. Journal of Financial and Quantitative

Analysis, 7, 18511872.

Meyer, J., & Rasche, R. H. (1992). Sufcient conditions for expected utility to imply mean-standard deviation

rankings: Empirical evidence concerning the location and scale condition. Economic Journal, 102, 91106.

Nielsen, L. T. (1998). Uniqueness of equilibrium in the classical Capital Asset Pricing Model. Journal of Financial

and Quantitative Analysis, 23, 329336.

Roll, R. (1977). A critique of the asset pricing theorys tests. Part I. On past and potential testability of the theory.

Journal of Financial Economics, 4, 129176.

Sharpe, W. (1964). Capital asset prices: A theory of capital market equilibrium under conditions of risk. Journal of

Finance, 19, 425442.

A. Bick / The Quarterly Review of Economics and Finance 44 (2004) 337361 361

Sharpe, W. F. (1991). Capital asset prices with and without negative holdings. Journal of Finance, 46, 489509.

Steinbach, M. C. (2001). Markowitz revisited: Mean-variance models in nancial portfolio analysis. Siam Review,

43, 3185.

Szeg, G. P. (1980). Portfolio theory: With application to bank asset management. New York: Academic Press.

Tobin, J. (1958). Liquidity preference as behavior towards risk. Review of Economic Studies, 25, 6586.

Ttnc, R. H. (2001). A note on calculating the optimal risky portfolio. Finance and Stochastics, 5, 413417.

Zhang, F. (1999). Matrix theory: Basic results and techniques. New York: Springer.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Isuzu 4be1 Engine Manual KolesooreDocument5 pagesIsuzu 4be1 Engine Manual KolesooreRaymart Dealca75% (8)

- Type DG Mod 320 Part No. 952 013: Figure Without ObligationDocument1 pageType DG Mod 320 Part No. 952 013: Figure Without Obligationsherub wangdiNo ratings yet

- Ti - e - Protegol 32-97 Jan 08Document3 pagesTi - e - Protegol 32-97 Jan 08A MahmoodNo ratings yet

- Project Human Resource Management Group PresentationDocument21 pagesProject Human Resource Management Group Presentationjuh1515100% (1)

- Test Your Skills For Computer Basics: November 2013Document24 pagesTest Your Skills For Computer Basics: November 2013Charie C. OrbocNo ratings yet

- CHR Report 2017 IP Nat InquiryDocument30 pagesCHR Report 2017 IP Nat InquiryLeo Archival ImperialNo ratings yet

- 21S18052 - Joshua Partogi Hutauruk - Review BUSNOV - Umbrella - WarsDocument5 pages21S18052 - Joshua Partogi Hutauruk - Review BUSNOV - Umbrella - WarsJoshua HutaurukNo ratings yet

- BTK - A318 - A319 - A320 - A321 - IPC - 01-Aug-2019 - FIG. 79-00-00-09 - TUBES SCAVENGE INSTL-CFM56 Zone(s) 400 (Aug 01 - 19)Document2 pagesBTK - A318 - A319 - A320 - A321 - IPC - 01-Aug-2019 - FIG. 79-00-00-09 - TUBES SCAVENGE INSTL-CFM56 Zone(s) 400 (Aug 01 - 19)Irfan05No ratings yet

- AWS Solution Architect SampleDocument3 pagesAWS Solution Architect SamplepandiecNo ratings yet

- Case Studies Public LibraryDocument4 pagesCase Studies Public LibraryHimalya Kaim83% (6)

- ForecastingDocument16 pagesForecastingSadain Bin MahboobNo ratings yet

- Kumara SwamiyamDocument21 pagesKumara SwamiyamVijey KumarNo ratings yet

- RRLDocument4 pagesRRLWen Jin ChoiNo ratings yet

- Gendex 9200 enDocument204 pagesGendex 9200 enArturo Jimenez Terrero80% (5)

- Ergonomics and Facilities Planning For The Hospitality IndustryDocument5 pagesErgonomics and Facilities Planning For The Hospitality IndustryJulie Fe de AlcaNo ratings yet

- El Condor1 Reporte ECP 070506Document2 pagesEl Condor1 Reporte ECP 070506pechan07No ratings yet

- PD Download Fs 1608075814173252Document1 pagePD Download Fs 1608075814173252straulleNo ratings yet

- BEVERAGE SERVICE INDUSTRY Lesson 1Document18 pagesBEVERAGE SERVICE INDUSTRY Lesson 1milyn maramagNo ratings yet

- Kesehatan Dan Keadilan Sosial inDocument20 pagesKesehatan Dan Keadilan Sosial inBobbyGunarsoNo ratings yet

- The Casbah 29 (1986) - 01 September 2015Document13 pagesThe Casbah 29 (1986) - 01 September 2015Ishaan BlundenNo ratings yet

- Assessment Task 1: Written Questions 1. Identify and Describe Five Common Components of A Business PlanDocument6 pagesAssessment Task 1: Written Questions 1. Identify and Describe Five Common Components of A Business PlanJoanne Navarro AlmeriaNo ratings yet

- Literature Review On Climate Change in NigeriaDocument9 pagesLiterature Review On Climate Change in Nigeriac5rn3sbr100% (1)

- Shortcrete PDFDocument4 pagesShortcrete PDFhelloNo ratings yet

- Reading #11Document2 pagesReading #11Yojana Vanessa Romero67% (3)

- Episode 1Document10 pagesEpisode 1ethel bacalso100% (1)

- 4-Sided Planer & Moulder Operation Manual: For Spares and Service ContactDocument48 pages4-Sided Planer & Moulder Operation Manual: For Spares and Service ContactAlfred TsuiNo ratings yet