Professional Documents

Culture Documents

Ratio Analysis

Uploaded by

ismailmbeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis

Uploaded by

ismailmbeCopyright:

Available Formats

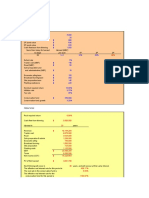

Balance Sheet

as at December 31, 2010

Pakistan Tobacco Company

Lakson Tobacco Company

2010

2009

2008

2010

2009

2008

Rs. '000

Rs. '000

Rs. '000

Rs. '000

Rs. '000

Rs. '000

Non Current Assets

Property, Plant and Equipment

5,823,688

5,952,108

5,599,758

3,847,679

3,845,739

3,322,278

Long term investment in subsidiary company

5,000

5,000

5,000

Long Term Loans

3,417

7,310

9,244

421

853

1,681

Long Term Deposits and Prepayments

15,375

19,915

41,172

51,678

42,603

37,634

5,847,480

5,984,333

5,655,174

3,899,779

3,889,196

3,361,594

6,002,823

5,765,367

4,059,063

7,706,696

5,880,236

5,327,107

199,207

218,375

190,646

359,922

319,477

245,836

1,597

1,684

2,666

164,240

65,847

36,181

48,267

48,598

65,917

10,405

50,050

130,204

118,329

72,483

105,728

161,579

109,162

113,834

556

1,408

3,959

Other receivables

93,546

88,147

246,675

90,018

80,697

23,571

Income tax paid in advance

15,206

398,964

87,122

150,780

Current Assets

Stock-in-trade

Stores and spares

Trade debts

Loans and advances

Short term prepayments

Profit accrued

Cash and bank balances

51,945

47,874

69,172

15,104

109,559

46,718

6,530,920

6,242,528

4,739,867

8,907,484

6,703,558

6,078,190

###

###

###

###

###

###

SHARE CAPITAL AND RESERVES

Authorised capital

3,000,000

3,000,000

3,000,000

1,000,000

1,000,000

1,000,000

Issued, subscribed and paid-up-capital

2,554,938

2,554,938

2,554,938

615,803

615,803

615,803

Reserves

1,047,149

1,705,296

1,053,393

5,972,124

5,243,473

4,671,938

576,894

960,653

706,220

3,602,087

4,260,234

3,608,331

7,164,821

6,819,929

5,993,961

Trade and other payables

5,339,725

5,037,469

4,324,704

1,187,234

1,210,484

1,263,291

Accrued interest/mark-up

46,789

27,659

10,354

61,564

35,176

22,465

Short term running finance

2,252,218

1,300,837

572,397

2,471,772

789,525

770,668

Current income tax liability

490,815

303,183

Sales tax and excise payable

1,449,872

1,346,640

996,495

7,638,732

6,856,780

5,210,638

5,170,442

3,381,825

3,052,919

1,137,581

1,109,847

1,576,072

472,000

391,000

392,904

Unappropriated profit

Current liabilites

Non current liabliites

Deferred taxation

###

-

###

-

###

-

###

-

###

-

###

-

Profit and Loss Account

For the year ended December 31, 2010

Pakistan Tobacco Company

2010

2009

Lakson Tobacco Company

2008

2010

(Rupees in thousand)

Gross turnover

60,195,535

Excise duty

2008

(Rupees in thousand)

33,890,900

30,475,781

24,937,931

###

###

###

(4,925,476)

(4,320,684)

(3,474,885)

(8,766,485)

(8,223,439)

(6,829,699)

###

###

###

21,666,525

18,872,495

Less: Sales Tax

Turnover-net of sales tax and excise duty20,952,629

Cost of sales

57,544,309

2009

###

49,053,928

###

###

13,302,502

13,400,669

11,297,221

(8,956,591)

(8,431,334)

(6,980,754)

Gross profit

6,204,912

8,224,459

7,276,759

4,345,911

4,969,335

4,316,467

Distribution and marketing expenses

(3,279,390)

(2,246,014)

(1,933,364)

(2,540,291)

(2,640,804)

(1,915,540)

Administrative expenses

(1,233,165)

(1,100,814)

(928,358)

(813,395)

(701,145)

(530,091)

(208,211)

(514,665)

(615,458)

Other operating expenses

Other operating income

Operating profit

Other expenses

Other income

Finance cost

Profit before taxation

46,610

226,499

60,551

(4,674,156)

(3,634,994)

(3,416,629)

1,530,756

4,589,465

3,860,130

4,589,465

36,933

102,826

59,600

1,567,689

4,692,291

3,919,730

(--- )

(--- )

(--- )

(--- )

(3,353,686)

(3,341,949)

(2,445,631)

1,627,386

1,870,836

992,225

3,860,130

(26,013)

920,291

(141,028)

1,486,358

1,714,600

93,663

103,111

76,358

1,589,469

1,790,958

(137,275)

(89,336)

4,648,489

3,893,717

876,679

(492,909)

(1,626,083)

(1,361,422)

(304,117)

(541,749)

Profit after taxation

925,100

3,022,406

2,532,295

572,562

958,384

3.62

11.83

9.30

15.56

9.91

(156,236)

1,013,954

Taxation

Earning per share

1,418,009

(43,802)

(--- )

(71,934)

1,530,756

(149,680)

(--- )

1,500,133

(45,639)

1,745,319

(639,919)

1,105,400

17.95

1-

LIQUIDITY RATIOS

The liquidity of a business firm is measured by its ability to satisfy its short term

obligaions as they come due.

A. NET WORKING CAPITAL

Net working capital is commonly used to measure a firm's overall liquidity. It is calculated

by subtracting current liabilities from current assets.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SMS Script Test BlastingDocument5 pagesSMS Script Test BlastingGabe Coyne100% (1)

- Hitungan Kuis 7 Bunyan - Lumber - CaseDocument15 pagesHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaNo ratings yet

- Structuring An International Joint Venture in The European UnionDocument9 pagesStructuring An International Joint Venture in The European UnionChengsen GuoNo ratings yet

- Info-Tech Pricing ProposalDocument4 pagesInfo-Tech Pricing ProposalPravs AnsNo ratings yet

- Inside the Black Box: Role of CEO Compensation Peer GroupsDocument14 pagesInside the Black Box: Role of CEO Compensation Peer GroupsneckitoNo ratings yet

- NRPL Pitch DeckDocument13 pagesNRPL Pitch Deckprashantrai2No ratings yet

- CLP AssignmentDocument7 pagesCLP Assignmentaditya swaroopNo ratings yet

- AEFARDocument13 pagesAEFAREka MonleonNo ratings yet

- Hiraya Marketing Agency: By: Jolina A. ReyesDocument26 pagesHiraya Marketing Agency: By: Jolina A. ReyesjolinaNo ratings yet

- Project 2 Accounting Chris FarquharDocument16 pagesProject 2 Accounting Chris Farquharapi-545829899No ratings yet

- A Study On Consumer Preference Towards Patanjali Products - With Special Reference To Erode City G. Gurusanthosini & G. GomathiDocument4 pagesA Study On Consumer Preference Towards Patanjali Products - With Special Reference To Erode City G. Gurusanthosini & G. GomathiAnirudh Singh ChawdaNo ratings yet

- Victoria Electricity Industry (Residual Provisions) Act 1993Document468 pagesVictoria Electricity Industry (Residual Provisions) Act 1993Harry_TeeterNo ratings yet

- Residential Tax Abatement Proposal Presentation (Jan. 2023)Document27 pagesResidential Tax Abatement Proposal Presentation (Jan. 2023)WVXU NewsNo ratings yet

- Quiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Document4 pagesQuiz Time Value of Money For Student MM 21 (Maria BR Sihaloho 207007016)Ferry PratamaNo ratings yet

- 175 GW Parliamentary Standing Committee March 2021Document118 pages175 GW Parliamentary Standing Committee March 2021Niraj KumarNo ratings yet

- Authority To Transfer Accountability For School Funds: Stand Alone Shs No.10 BayogDocument2 pagesAuthority To Transfer Accountability For School Funds: Stand Alone Shs No.10 BayogReyes C. ErvinNo ratings yet

- 2018 Book InequalityDocument391 pages2018 Book InequalityEgyptianNo ratings yet

- Dos SANTOS - THE STRUCTURE OF DEPENDENCEDocument6 pagesDos SANTOS - THE STRUCTURE OF DEPENDENCEmehranNo ratings yet

- ePGP - Sec A - Group-02 - Case Study Mid Term Assignment - Marketing ManagementDocument15 pagesePGP - Sec A - Group-02 - Case Study Mid Term Assignment - Marketing ManagementMadhav JhaNo ratings yet

- Probabilistic Models and Safety StockDocument22 pagesProbabilistic Models and Safety Stockİrem ErgenNo ratings yet

- Revisi PPT1-Production, Productivity, & Global Environment and Operations StrategyDocument56 pagesRevisi PPT1-Production, Productivity, & Global Environment and Operations StrategyIntan PramestiNo ratings yet

- The 2015 Hedge Fund Rising Stars - Oleg NodelmanDocument5 pagesThe 2015 Hedge Fund Rising Stars - Oleg NodelmanTrevor SoarNo ratings yet

- Fixed Variable and Marginal Costs PDFDocument14 pagesFixed Variable and Marginal Costs PDFHam ZaNo ratings yet

- Nortech Trinity Company Profile 2021-22 FinalDocument32 pagesNortech Trinity Company Profile 2021-22 FinalNORTECH TRINITYNo ratings yet

- COGS Worksheet (Pricing)Document2 pagesCOGS Worksheet (Pricing)Shahbaz AliNo ratings yet

- UK Economy Overview and ExercisesDocument13 pagesUK Economy Overview and ExercisesTomasNo ratings yet

- Tax Invoice BillDocument1 pageTax Invoice BillAbhay Pratap SinghNo ratings yet

- Statement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Document2 pagesStatement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Ranjeet RajputNo ratings yet

- Centenial Surgical Suture Rating Sensitivity FactorsDocument9 pagesCentenial Surgical Suture Rating Sensitivity FactorsRicha RohillaNo ratings yet