Professional Documents

Culture Documents

EsqRezoning

Uploaded by

Carolanne ReynoldsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EsqRezoning

Uploaded by

Carolanne ReynoldsCopyright:

Available Formats

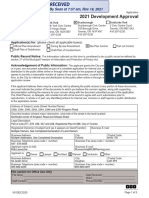

2545 Queens Avenue / West Vancouver, BC V7V 2Y9 / George @ Pajari.

ca

District of West Vancouver 750 - 17th Street West Vancouver, BC 2011 May 24 (Revised) Attention: Mr. Bob Sokol, Director of Planning, Lands, and Permits Dear Mr. Sokol: re Community Amenity Contribution for the Proposed Rezoning of 2031, 2047, and 2063 Esquimalt Avenue

As I made clear at the Public Hearing May 16th, I fnd the suggestion that upzoning residential land by 300% in the number of units and by 74% in the overall density, increases the value of the land by only 5%, barely credible. Although the problems with the land-residual appraisal method used to come up with this result are well known in the literature (as I alluded to in my brief presentation at the Public Hearing1), I would like to show that even using the land-residual method and the numbers presented in the staff report2, a more accurate estimate of the Uplift is something closer to $1.7 million3. The incorrect low estimate of Uplift of $155K by the consultant is a result of a number of mistakes in applying the pro forma model to the determination of Uplift in this particular case. 1. Incorrectly Including Costs Associated with Rezoning Delays Rezoning is a time-consuming and risky process that the proponent, an experienced developer, is very familiar with. The developer could have commenced construction on his land last year (under the existing zoning) but made the informed and deliberate attention to gamble on obtaining an upzoning. It is not clear why his additional carrying costs incurred as a result of this risky decision ought to be borne by the municipality (in the form of a signifcantly reduced amenity contribution). It is not the policy of the District to compensate developers for their additional costs incurred from delays in the rezoning process if the rezoning application fails. so why is staff recommending (in essence) that the District compensate this developer for those costs if his application succeeds? To put it another way, if Uplift is the increase in the fair market value of the land from the day before it is rezoned to the day after, what does it matter to the calculation of fair market values how long the developer has owned the land prior to the rezoning? That the developer has been sitting on the property for seven months is of no concern to potential purchasers of the rezoned property and therefore will have no effect on the value of the rezoned property. If a developer decides to delay his project in an attempt to obtain an upzoning, that decision is his alone and so all costs associated with that decision ought to be his to bear. Therefore the Uplift calculation (i.e. the community amenity contribution) should not be reduced by the carrying

1 District of West Vancouver, Public Hearing 2011-05-16 2 Council Report: Community Amenity Contribution for the Proposed Rezoning of 2031, 2047, and 2063 Esquimalt Avenue (Development Application No. 08-041); dated May 10, 2011; File 1010-20-08-041 3 This is a very rough estimate, after correcting for the two major errors detailed in this letter, but before the reduction to account for the carrying costs associated with the corrected community amenity contribution amount.

Letter to Mr. Bob Sokol, DWV

Page 2 of 2

2011-05-24

costs associated with those delays. This correction increases the Uplift calculation by approx. $230,000. 2. Failure to Adj ust Sale Prices for Appreciation Recall that the basis of the land-residual appraisal method is that land value is the difference between the value of the development and the costs of the development (including proft). The pro forma calculated by the consultant4 estimates that the development, if sold on September 1st, would fetch $9.3 million, and would cost $5.4 million to build. This would result in an imputed land value of $4 million (i.e. an Uplift of $788,000). But this would only be the case if one could sell the development the same day as the land was purchased, which of course is not possible. So the consultant has added $633,000 in costs to cover the interest charges that will accrue over the 33 months from property purchase to the sale of the last unit. The problem is that while the consultant has increased the costs to account for the time period from purchase to sale, he has not similarly adjusted the revenue fgures. He assumes that if the units would sell for $9.4 million on September 1st, 2010, they will still only sell for $9.4 million 33 months later. Obviously this is wrong as a comparison with the consultant's April 13th report5 proves. In that report he estimates the development would sell for $9.6 million if sold on April 13th. So the consultant estimates that the development's sale price would increase by 3.5% over the seven months from September to April (5.7% annually6) but does not include that appreciation in his pro forma. To adjust the costs for the time-value of money without similarly adjusting the revenue fgures is not balanced nor fair to the community. If we correct the pro forma to adjust both the costs and revenue for the passage of time, and use the consultant's own estimate of the increase in revenue over time (extended out 33 months), we fnd that the revenue fgure ought to be closer to $10.8 million (and not $9.3 million). There are a number of other much less signifcant errors in the pro forma (calculating interest charges on the imputed Uplift including community amenity costs from day one, even though the community amenity costs are not incurred until much later in the project and that a fraction (25%) of Uplift is never an incurred cost; including the imputed Uplift value in the proft calculations) but these are much smaller than the errors detailed above. In summary, even if we accept the land-residual approach and the assumptions used in the pro forma, the May 9th consultant's report overstates the costs in the pro forma by $233,000 and understates the revenue by something on the order of $1.5 million. Therefore a more accurate estimate of the Uplift (for the purposes of community amenity calculations) will be closer to $1.7 million than the $155,000 suggested. Yours truly,

(signed)

George Pajari

4 Ibid. Appendix 'D'. 5 Ibid. Appendix 'C'. 6 For comparison, the Canadian Real Estate Association (CREA) forecasts that BC home prices will increase 9.2% in 2011.

You might also like

- 'Fiscally Irresponsible': Ortega Memo On RTADocument11 pages'Fiscally Irresponsible': Ortega Memo On RTATucsonSentinelNo ratings yet

- Lakeport City Council - Workshop PacketDocument115 pagesLakeport City Council - Workshop PacketLakeCoNewsNo ratings yet

- Aug. 23 2021 Grand Forks Beacon Staff ReportDocument7 pagesAug. 23 2021 Grand Forks Beacon Staff ReportJoe BowenNo ratings yet

- Second + PCH Comment Letter Draft EIRDocument29 pagesSecond + PCH Comment Letter Draft EIREgrets Not RegretsNo ratings yet

- PDP Fact Sheet - Dev Econ ViabDocument6 pagesPDP Fact Sheet - Dev Econ ViabEmma SteelNo ratings yet

- Merits of Site ValueDocument48 pagesMerits of Site ValueLev LafayetteNo ratings yet

- Restricted Appraisal ReportDocument84 pagesRestricted Appraisal ReportDicky BhaktiNo ratings yet

- Land Development Case Study in The City of Brandon ManitobaDocument37 pagesLand Development Case Study in The City of Brandon ManitobaTianyuLiuNo ratings yet

- 23 184LOE DraftDocument6 pages23 184LOE DraftIsaac KeastNo ratings yet

- Ternercenter2.Berkeley - Edu ProformaDocument11 pagesTernercenter2.Berkeley - Edu ProformaAugusto CésarNo ratings yet

- 1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageDocument109 pages1) Aug 30 Cover Letter To Mayor Rob Ford and Members of Council - PackageIsaiah WaltersNo ratings yet

- CMS Attachments PDFDocument197 pagesCMS Attachments PDFRecordTrac - City of OaklandNo ratings yet

- Fiscal Impact AssessmentDocument41 pagesFiscal Impact AssessmentPranalNo ratings yet

- Zoning, Taxes, and Affordable Housing: Lessons From Bloomberg's Final TermDocument16 pagesZoning, Taxes, and Affordable Housing: Lessons From Bloomberg's Final TermManhattan InstituteNo ratings yet

- Grant Application Flood Damage Prevention: Construction ProjectDocument9 pagesGrant Application Flood Damage Prevention: Construction ProjectTuan Mejar Syed SyeshNo ratings yet

- Street Rehab Brief Jan13Document21 pagesStreet Rehab Brief Jan13Caleb AmickNo ratings yet

- Analyzing Impact of Town Planning Scheme Intervention On Land Values IJERTV12IS020055Document9 pagesAnalyzing Impact of Town Planning Scheme Intervention On Land Values IJERTV12IS0200552022par5360No ratings yet

- Finance & Administration Committee July 6, 2011 City Hall Audit Report RecommendationDocument247 pagesFinance & Administration Committee July 6, 2011 City Hall Audit Report Recommendationapi-85309621No ratings yet

- FY14 Overview MemoDocument3 pagesFY14 Overview MemokeithmontpvtNo ratings yet

- Residual Land Valuation MethodDocument7 pagesResidual Land Valuation Methodrajeshjadhav89100% (1)

- Comments On The Penn Station General Project PlanDocument4 pagesComments On The Penn Station General Project PlanState Senator Liz KruegerNo ratings yet

- RFP P-4-12-23 Original Invitation & AddendumsDocument77 pagesRFP P-4-12-23 Original Invitation & AddendumsMatthew Daniel NyeNo ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet

- D.C. Government Sues Don PeeblesDocument13 pagesD.C. Government Sues Don PeeblesMike Madden100% (2)

- RFP Addendum P-08-129ADocument60 pagesRFP Addendum P-08-129ATimothy GibbonsNo ratings yet

- Quntity SurveyingDocument6 pagesQuntity SurveyingMalith De SilvaNo ratings yet

- A.16 Conditional Construction Completion Certificate (CCCC)Document1 pageA.16 Conditional Construction Completion Certificate (CCCC)Sami AjNo ratings yet

- Liberty & Elm Development - C VersionDocument5 pagesLiberty & Elm Development - C VersionWVXU NewsNo ratings yet

- Development Agreement: Former Macy's HQDocument10 pagesDevelopment Agreement: Former Macy's HQWVXU NewsNo ratings yet

- CommunicationsDocument25 pagesCommunications66tdpykb4yNo ratings yet

- PLN - Application Form - Development Approval ApplicationDocument9 pagesPLN - Application Form - Development Approval ApplicationyagnicpcNo ratings yet

- Office of The State ComptrollerDocument4 pagesOffice of The State ComptrollerflippinamsterdamNo ratings yet

- Standard Form Contract AECOM - Bills ProjectDocument50 pagesStandard Form Contract AECOM - Bills ProjectWGRZ-TVNo ratings yet

- March 14, 2014Document1 pageMarch 14, 2014api-63385278No ratings yet

- New Due Date For Proposals Is 3:00 PM, EST, Tuesday, July 21, 2009. New Deadline For Vendor Questions (Set 2) 3PM EST, July 7, 2009Document19 pagesNew Due Date For Proposals Is 3:00 PM, EST, Tuesday, July 21, 2009. New Deadline For Vendor Questions (Set 2) 3PM EST, July 7, 2009Asish KumarNo ratings yet

- AB Transcript 1 Use Urban PlanningDocument9 pagesAB Transcript 1 Use Urban PlanningrameshinfraNo ratings yet

- Nichol Road Housing DevelopmentDocument81 pagesNichol Road Housing DevelopmentRevelstoke MountaineerNo ratings yet

- Exercises Front Door With TIF, Tax Credits and GrantsDocument2 pagesExercises Front Door With TIF, Tax Credits and Grantsludovica margherita radiceNo ratings yet

- District Energy Contract Award RecommendationDocument4 pagesDistrict Energy Contract Award RecommendationkeithmontpvtNo ratings yet

- Letter of Agreement: - AND Town of Falmouth Community Preservation CommitteeDocument11 pagesLetter of Agreement: - AND Town of Falmouth Community Preservation CommitteeAkash KannojiaNo ratings yet

- YCM - ReviewComments - Stage I Only - R 04 PDFDocument24 pagesYCM - ReviewComments - Stage I Only - R 04 PDFahmedkamilNo ratings yet

- SBL MOCK 1 Cbe PlatformDocument9 pagesSBL MOCK 1 Cbe PlatformSaahil ShahNo ratings yet

- Council Report On ORA Purchase of City Property 5-10-2011 PDFDocument20 pagesCouncil Report On ORA Purchase of City Property 5-10-2011 PDFRecordTrac - City of OaklandNo ratings yet

- 11-10-20 Memo From Susan Wright - Revenue ReportDocument3 pages11-10-20 Memo From Susan Wright - Revenue ReportOwenFDNo ratings yet

- 1st Time Lighting Installation LocalDocument2 pages1st Time Lighting Installation LocalgussiemillerNo ratings yet

- ProcudureDocument5 pagesProcudureChristine KanyangoNo ratings yet

- Anand Rathi Jan 11Document44 pagesAnand Rathi Jan 11rvs2020No ratings yet

- The Real Estate Development ProcessDocument7 pagesThe Real Estate Development Processahmed100% (1)

- Project Plan For The Creation of Tax Incremental District No. 6Document31 pagesProject Plan For The Creation of Tax Incremental District No. 6JNo ratings yet

- Wainfleet Development Charge ReportDocument129 pagesWainfleet Development Charge ReportDave JohnsonNo ratings yet

- Dohoney Streetcar Budget February 2012Document5 pagesDohoney Streetcar Budget February 2012COASTNo ratings yet

- Consulting Services Agreement TemplateDocument22 pagesConsulting Services Agreement TemplateLevko DovganNo ratings yet

- Mayor of Oakland Letter To Susan Muranishi Re Howard Terminal With AttachmentsDocument11 pagesMayor of Oakland Letter To Susan Muranishi Re Howard Terminal With AttachmentsZennie AbrahamNo ratings yet

- Guide To Making A Planning ApplicationDocument6 pagesGuide To Making A Planning ApplicationconaldixNo ratings yet

- 2009 Proposed Amendments To The Covington Comprehensive Plan Final PublicDocument4 pages2009 Proposed Amendments To The Covington Comprehensive Plan Final PublicMichael MaddoxNo ratings yet

- Façade Grant ApplicationDocument4 pagesFaçade Grant ApplicationEffNowNo ratings yet

- CESMM3 - Dubai Metro RailDocument20 pagesCESMM3 - Dubai Metro RailShanmuganantha KathiraveluNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- ITAC Annual Summary of DWV Budget 2005-2010Document6 pagesITAC Annual Summary of DWV Budget 2005-2010Carolanne ReynoldsNo ratings yet

- Response To North Shore News Article On West Vancouver LibraryDocument4 pagesResponse To North Shore News Article On West Vancouver LibraryCarolanne ReynoldsNo ratings yet

- Analysis of Telephone Service Expenditures by The District of West VancouverDocument1 pageAnalysis of Telephone Service Expenditures by The District of West VancouverCarolanne ReynoldsNo ratings yet

- W-Van Council, Dec.13,2010Document2 pagesW-Van Council, Dec.13,2010Carolanne ReynoldsNo ratings yet

- International Marketing Channels: Mcgraw-Hill/IrwinDocument35 pagesInternational Marketing Channels: Mcgraw-Hill/IrwinIzatti AyuniNo ratings yet

- Backflush Accounting FM May06 p43-44Document2 pagesBackflush Accounting FM May06 p43-44khengmaiNo ratings yet

- Format For BQDocument2 pagesFormat For BQAfroj ShaikhNo ratings yet

- Chapter 2 - Management EnvironmentDocument47 pagesChapter 2 - Management EnvironmentLe Thuy TrangNo ratings yet

- Trango Tech Digitalization Construction Report (Final)Document27 pagesTrango Tech Digitalization Construction Report (Final)Bilal KhanNo ratings yet

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- Zuellig V Sibal PDFDocument25 pagesZuellig V Sibal PDFCarlo AfNo ratings yet

- Bs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)Document9 pagesBs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)JANISCHAJEAN RECTONo ratings yet

- Work ImmersionDocument10 pagesWork ImmersionKathy Sarmiento100% (1)

- A2 Form Sample - Gokul KRISHNANDocument3 pagesA2 Form Sample - Gokul KRISHNANAlbi GokulNo ratings yet

- Apple Inc StrategyDocument4 pagesApple Inc Strategyvaibhav_gupta20110% (1)

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberNo ratings yet

- Time Value of Money: Present and Future ValueDocument29 pagesTime Value of Money: Present and Future ValuekateNo ratings yet

- To DoDocument3 pagesTo DoSolomon AttaNo ratings yet

- 5.1PUNNF Brochure 2Document10 pages5.1PUNNF Brochure 2Darlington EzeNo ratings yet

- Business Intelligence AutomotiveDocument32 pagesBusiness Intelligence AutomotiveElsaNo ratings yet

- Franchise BrochureDocument3 pagesFranchise BrochurePari SavlaNo ratings yet

- Quality Management and Practises in Automobile SectorDocument57 pagesQuality Management and Practises in Automobile Sectorshivi73100% (16)

- Mock Test (Only Writing Session) : Deadline: 6th December 2021 ( 5pm )Document3 pagesMock Test (Only Writing Session) : Deadline: 6th December 2021 ( 5pm )Thu HàNo ratings yet

- EU Compendium of Spatial PlanningDocument176 pagesEU Compendium of Spatial PlanningVincent NadinNo ratings yet

- Corporate Governance AssignmentDocument12 pagesCorporate Governance AssignmentMayank Rajpoot0% (1)

- Innovation All ChapterDocument94 pagesInnovation All Chapterbereket amareNo ratings yet

- Controller Investor Relations RoleDocument4 pagesController Investor Relations RoleNoel MiñanoNo ratings yet

- Ra 6657 As Amended 31 Jan 11, 1317 HrsDocument59 pagesRa 6657 As Amended 31 Jan 11, 1317 HrsCharm Divina LascotaNo ratings yet

- Madworx Rate ProposalDocument3 pagesMadworx Rate ProposalNoriega LaneeNo ratings yet

- Computer Science AICTEDocument2 pagesComputer Science AICTEchirag suresh chiruNo ratings yet

- Chapter 7: Internal Controls I: True/FalseDocument10 pagesChapter 7: Internal Controls I: True/FalseThảo NhiNo ratings yet

- COBECON - Math ProblemsDocument16 pagesCOBECON - Math ProblemsdocumentsNo ratings yet

- NABARD Automated Milk Collection Project PDFDocument13 pagesNABARD Automated Milk Collection Project PDFGrowel Agrovet Private Limited.100% (2)

- NCP 31Document14 pagesNCP 31Arunashish MazumdarNo ratings yet