Professional Documents

Culture Documents

VNFast Food 10

Uploaded by

Nguyen Minh DucOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VNFast Food 10

Uploaded by

Nguyen Minh DucCopyright:

Available Formats

Fast Food - Vietnam

Euromonitor International : Country Sector Briefing November 2010

Fast Food

Vietnam

List of Contents and Tables

Headlines ................................................................................................................................................................. 1 Trends ...................................................................................................................................................................... 1 Competitive Landscape .......................................................................................................................................... 2 Prospects .................................................................................................................................................................. 2 Category Data ......................................................................................................................................................... 3 Table 1 Fast Food by Subsector: Units/Outlets 2004-2009 ............................................................ 3 Table 2 Fast Food by Subsector: Number of Transactions 2004-2009 ........................................... 4 Table 3 Fast Food by Subsector: Foodservice Value 2004-2009.................................................... 5 Table 4 Fast Food by Subsector: % Units/Outlets Growth 2004-2009 ........................................... 6 Table 5 Fast Food by Subsector: % Transaction Growth 2004-2009 ............................................. 7 Table 6 Fast Food by Subsector: % Foodservice Value Growth 2004-2009 .................................. 8 Table 7 Sales of Bakery Products Fast Food by Type 2006-2009 .................................................. 8 Table 8 Global Brand Owner Shares of Chained Fast Food 2005-2009 ......................................... 9 Table 9 Brand Shares of Chained Fast Food 2006-2009 ................................................................ 9 Table 10 Forecast Sales in Fast Food by Subsector: Units/Outlets 2009-2014................................. 9 Table 11 Forecast Sales in Fast Food by Subsector: Number of Transactions 20092014 ..................................................................................................................................10 Table 12 Forecast Sales in Fast Food by Subsector: Foodservice Value 2009-2014 .......................11 Table 13 Forecast Sales in Fast Food by Subsector: % Units/Outlets Growth 20092014 ..................................................................................................................................12 Table 14 Forecast Sales in Fast Food by Subsector: % Transaction Growth 2009-2014.................13 Table 15 Forecast Sales in Fast Food by Subsector: % Foodservice Value Growth 2009-2014.........................................................................................................................13

Euromonitor International

Page

Fast Food

Vietnam

FAST FOOD IN VIETNAM

HEADLINES

Current value sales grow by 13% in 2009 to reach almost VND6.3 trillion The number of fast food outlets reaches 7,000 in 2009, a 6% increase over 2008 Through good business strategies, chained fast foods popularity continues to increase despite the economic crisis Chained burger fast food records the fastest current value sales growth of 29% in 2009 In 2009 KFC Vietnam Co Ltd leads a fragmented category with an 11% share of value sales Over the forecast period, fast food sales are expected to grow by an 8% constant value CAGR

TRENDS

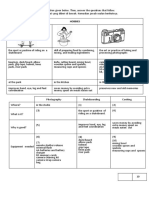

In 2009 the fast food category witnessed a big change in the pricing strategies of most companies. The adding of economy menu in most fast food outlets, together with massive promotion and discount campaigns, made fast food a more affordable meal choice for consumers. Apart from adjusting prices to increase market penetration, fast food players paid more attention to local taste preferences and catered their menus accordingly. Western-style fast food formats like burger or chicken either localised their food offer or added popular local dishes like Vietnamese stewed pork. Most fast food companies are basing their operations on the chained business model which allows more effective resource allocation, standardised management and led to the development of good strategies. Thus, despite the economic crisis, fast food was less affected than other categories and an outstanding growth performance was produced in 2009. Partially due to the negative impact of the economy downturn, fast food sales grew at a slower rate in current value terms compared to 2008. This growth pattern was also due to the wider introduction of economy menus, which resulted in slower growth in terms of sales per transaction and sales per outlet in current value terms in 2009. Nevertheless, fast foods value sales growth performance remained among the best in the consumer foodservice industry and the category registered exceptional development in terms of outlet numbers and value sales during a period of high economic difficulty. Chained burger fast food recorded the fastest current value sales growth of 29% in 2009, marginally ahead of chained chicken fast food. In 2009, chained burger fast food brands in Vietnam such as Lotteria and Jollibee employed good strategies, such as introducing local dishes to their menus, which attracted consumers and boosted sales. Chained chicken fast food is dominated by KFC. This is the preferred fast food format among Vietnamese customers, largely because chicken is used in many popular dishes in the country. In terms of the number of outlets, chained chicken fast food posted the fastest growth of 34% in 2009. Due to the higher popularity and greater acceptance of chicken fast food options among customers, it is easier for players in this category to expand their coverage quickly. Outlet expansion has been proved to be an effective strategy. Leading players, including KFC, spread out into newly developed cities and more remote areas, outside of the big cities where competition is already intense. Independent fast food overwhelmingly dominates the outlet landscape in Vietnam. This is due to the large presence of independent Asian fast food units, which evolved from street stalls/kiosks. Their format can be considered a hybrid of street stalls/kiosks and full-service restaurants. Nonetheless, the popularity of chained fast food players is increasing fast, reflected in much higher growth rates in terms of transactions, value sales and outlet numbers. Through professional management, good strategies and international reputations, chained fast food players are making their brands well-known to local people. This provides a strong competitive advantage over independent fast food players, which tend to operate on limited budgets and are unable to afford the costs of brand building.

Euromonitor International

Page

Fast Food

Vietnam

The value sales split between eat-in and take-away in fast food in Vietnam is quite unique due to the habits of local customers. In most countries, fast food is known for convenience and speed of service with the purpose to provide customers with a quick but nutritional meal. Thus, take-aways sales share is normally high. However, Vietnamese consumers still consider any kind of foodservice outlet, including fast food, as a place to sit in, eat and enjoy. This is particularly the case for chained fast food players such as KFC or Lotteria which offer pleasant decor and a comfortable and friendly ambience. Thus, customers choose to visit these outlets not only to eat but also to spend time socialising with friends and families. Therefore, eatin sales accounted for a high 91% share of value sales in 2009.

COMPETITIVE LANDSCAPE

In 2009, KFC remained the leading fast food player in terms of the number of outlets (1% share) and value sales (11% share). Among the first chained fast food players to enter Vietnam, KFC has developed its business strongly, building a strong brand name in the country out of its international reputation. Between 2006 and 2009, KFC has been active in developing a modern fast food category in Vietnam and its number of outlets doubled then tripled. KFC continued to dominate chained chicken fast food with no real competitors in this category. Still a young brand in the category, Jollibee has significantly fewer outlets and a much lower value sales base compared to big competitors. Vietnamese consumers have adapted strongly to modern and Westernstyle fast food in recent years, creating good opportunities for international fast food players to grow. This development contributed to Jollibees outstanding performance in 2009. The company registered the fastest value sales growth of 46% in 2009. Apart from keeping its original burger and chicken items, Jollibee successfully added familiar dishes such as chicken curry to the menu, which resulted in continuous sales growth and increasing numbers of customers. While local independent fast food players mostly operate through small family-owned units with minimal equipment and furniture, international chains have mostly chosen joint ventures as the safest way to expand their business in the Vietnam. With a previously undeveloped legal platform for franchising as well as strict policies issued by the government, it made sense for international companies to collaborate with a local partner. Leading brands such as KFC, Lotteria and Jollibee all chose this strategy. The only well-known player which chose to develop its business via the franchising model is the local chained Asian fast food company, Nam An Group, the owner of the Pho 24 brand. Its franchised business helped to grow Pho 24s outlet numbers as quick as would have been the case via a joint venture, yielding significant success for this local company. The food and drink offerings in the fast food category are becoming more sophisticated as companies pay more attention to the tastes and demands of local consumers. The most notable trend may be the increasing presence of economy or value menus, which offer assorted food items for a significantly lower price than the original set meal offer. This strategy is aimed at reaching out to a wider consumer group and it makes modern fast food options, which are sometimes considered too expensive, more affordable to most consumers. In addition, local dishes are being introduced to menus in an attempt to attract more customers. For example, Jollibee offered two new dishes, stewed pork with eggs and chicken curry, both served with rice. Regarding beverages and side dishes, players are also looking to offer new and interesting items such as cola carbonates with floating ice cream by Jollibee or KFCs egg tart, which has been a surprisingly big success. Domestic players continue to dominate in terms of outlet numbers. Generally, local players have good market knowledge and they understand local customers tastes and habits. They also offer familiar traditional meals which are easily accepted by all Vietnamese consumers. However, international fast food companies are developing in a more dynamic way and showing more promising growth rates. Local consumers are adapting to Western-style fast food and enjoying higher personal income, enabling them to afford the luxury of fast food. Moreover, foreign players have huge resources to carry out massive marketing and PR activities, which help to create or boost brand reputations and attract more customers, thereby accelerating their pace of expansion and market coverage.

PROSPECTS

Euromonitor International

Page

Fast Food

Vietnam

Because of the continuous change in local consumers eating and drinking habits, influenced by Western and modern cuisines, as well as much improved personal incomes and company development, the fast food category in Vietnam is expected to continue to flourish over the forecast period. A more welcome policy and legal regulations for franchising will provide players with more freedom and options to expand their businesses. This will create big opportunities for chained fast food players, both international and local, to grow more strongly and build-up their positions in the category and industry as a whole. Over the forecast period, fast food sales are expected to grow strongly, by an 8% constant value CAGR, as industry conditions are favourable. However, companies are likely to run risks and experience difficulties, especially when turning away from the traditional joint venture method of penetration to franchising to expand their businesses. One potential threat to growth is that once consumers have adapted to modern fast food items and modern ways of serving, they will quickly become bored by standardised dishes which may lack variety. Fast food players, therefore, should try to constantly develop and introduce new items and seasonal dishes to satisfy the quick changing demands of consumers. Chained chicken fast food sales are expected to increase by a 21% constant value CAGR, to record the highest growth over the forecast period. This is the preferred modern fast food type in Vietnam, while the burger and other Western-style fast food offerings remain strange tastes to local consumers. Thus, it will take time for people to become familiar with such items. KFC, the leading brand in chicken fast food and fast food overall, is anticipated to exploit various competitive advantages such as brand awareness and strong market coverage to maintain its position. As the competition between fast food players intensifies, companies are likely to employ various strategies to strengthen their positions. Maintaining growth in terms of outlet numbers is expected to be a key strategy because wider coverage offers greater opportunities to penetrate new areas and consumer bases and boost sales. While more units could result in lower average sales per outlet, most chained fast food players will continue to employ outlet expansion as one of their foremost development strategies. Besides, marketing and PR activities are expected to play a more active role in the short term. At the end of the review period, only KFC used television advertisements. However, more players are expected to develop attractive advertisements through various public media channels to improve their brand awareness and reputation and lure new customers.

CATEGORY DATA

Table 1 outlets 2004 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food 33 4,682 3,612 6 3,606 140 140 20 12 8 22 15 7 2005 56 5,061 3,941 17 3,924 175 175 28 19 9 30 20 10 2006 96 5,488 4,245 42 4,203 200 200 41 26 15 40 28 12 2007 150 5,893 4,531 62 4,469 220 220 65 44 21 65 44 21 2008 203 6,264 4,794 75 4,719 239 239 91 64 27 100 64 36 2009 253 6,572 5,017 88 4,929 249 249 110 79 31 131 86 45 Fast Food by Subsector: Units/Outlets 2004-2009

Euromonitor International

Page

Fast Food

Vietnam

Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

921 921 4,715

943 943 5,117

1,058 1,058 5,584

1,162 1,162 6,043

1,243 1,243 6,467

1,318 1,318 6,825

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 2 '000 transactions

Fast Food by Subsector: Number of Transactions 2004-2009

2004 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken 3,375.4 194,219.5 124,803.0 415.2 124,387.8 2,898.0 2,898.0 894.0 726.0 168.0 2,564.9 2,234.2 330.7

2005 5,618.3 213,087.2 140,751.0 1,243.6 139,507.4 3,742.0 3,742.0 1,374.9 1,179.9 195.0 3,687.6 3,194.8 492.8

2006 9,596.9 231,865.7 152,268.0 3,382.6 148,885.4 4,677.5 4,677.5 1,895.8 1,652.1 243.8 5,173.2 4,562.2 611.0

2007 15,145.2 248,868.2 162,121.5 4,972.4 157,149.1 5,613.0 5,613.0 3,150.8 2,841.3 309.6 8,248.0 7,331.5 916.5

2008 21,237.9 267,641.3 172,614.5 6,036.5 166,578.0 6,623.3 6,623.3 4,575.7 4,204.2 371.5 12,463.7 10,997.3 1,466.4

2009 26,936.7 283,970.6 182,030.0 7,123.1 174,906.9 7,351.9 7,351.9 5,702.2 5,297.3 404.9 16,276.1 14,516.4 1,759.7

Euromonitor International

Page

Fast Food

Vietnam

Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

66,435.0 66,435.0 197,594.9

69,150.0 69,150.0 218,705.4

77,448.0 77,448.0 241,462.5

84,880.0 84,880.0 264,013.3

92,602.0 92,602.0 288,879.2

99,547.2 99,547.2 310,907.3

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 3 VND billion

Fast Food by Subsector: Foodservice Value 2004-2009

2004 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food 152.3 2,733.2 1,419.9 16.8 1,403.2 56.3 56.3 41.0 33.0 8.1 109.6 102.6

2005 258.8 3,079.2 1,647.0 52.6 1,594.5 80.3 80.3 64.2 54.4 9.8 163.5 151.8

2006 444.7 3,479.3 1,852.2 146.2 1,706.0 108.3 108.3 89.8 76.9 12.9 241.8 221.6

2007 737.8 3,957.6 2,127.3 238.3 1,889.0 137.6 137.6 151.1 133.9 17.3 399.0 365.7

2008 1,080.7 4,481.0 2,388.5 301.2 2,087.3 172.0 172.0 227.5 205.4 22.1 628.4 574.1

2009 1,361.8 4,935.8 2,645.6 359.9 2,285.6 197.8 197.8 289.4 264.1 25.3 805.1 737.8

Euromonitor International

Page

Fast Food

Vietnam

- Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

7.1 -

11.7 -

20.2 -

33.3 -

54.3 -

67.3 -

1,258.6 1,258.6 2,885.5

1,383.0 1,383.0 3,338.0

1,631.9 1,631.9 3,924.1

1,880.4 1,880.4 4,695.4

2,145.2 2,145.2 5,561.7

2,359.8 2,359.8 6,297.6

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 4

Fast Food by Subsector: % Units/Outlets Growth 2004-2009

% Units/Outlets growth 2008/09 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food 24.6 4.9 4.7 17.3 4.5 4.2 4.2 20.9 23.4 14.8 31.0 34.4 25.0 2004-09 CAGR 50.3 7.0 6.8 71.1 6.5 12.2 12.2 40.6 45.8 31.1 42.9 41.8 45.1 2004/09 TOTAL 666.7 40.4 38.9 1,366.7 36.7 77.9 77.9 450.0 558.3 287.5 495.5 473.3 542.9 -

Euromonitor International

Page

Fast Food

Vietnam

Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

6.0 6.0 5.5

7.4 7.4 7.7

43.1 43.1 44.8

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 5

Fast Food by Subsector: % Transaction Growth 2004-2009

% transaction growth 2008/09 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food 26.8 6.1 5.5 18.0 5.0 11.0 11.0 24.6 26.0 9.0 30.6 32.0 20.0 7.5 7.5 2004-09 CAGR 51.5 7.9 7.8 76.6 7.1 20.5 20.5 44.9 48.8 19.2 44.7 45.4 39.7 8.4 8.4 2004/09 TOTAL 698.0 46.2 45.9 1,615.5 40.6 153.7 153.7 537.8 629.7 141.0 534.6 549.7 432.1 49.8 49.8 -

Euromonitor International

Page

Fast Food

Vietnam

Fast Casual Dining Fast Food

Source:

7.6

9.5

57.3

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 6 % value growth

Fast Food by Subsector: % Foodservice Value Growth 2004-2009

2008/09 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

2004-09 CAGR 55.0 12.5 13.3 84.7 10.3 28.6 28.6 47.8 51.6 25.7 49.0 48.4 56.9 13.4 13.4 16.9

2004/09 TOTAL 794.1 80.6 86.3 2,048.5 62.9 251.4 251.4 605.2 700.8 214.2 634.3 619.3 852.2 87.5 87.5 118.3

26.0 10.2 10.8 19.5 9.5 15.0 15.0 27.2 28.6 14.5 28.1 28.5 24.0 10.0 10.0 13.2

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Table 7 % value

Sales of Bakery Products Fast Food by Type 2006-2009

2006 Sandwich Specialists Sweet Bakery Goods Specialists Other Including Mixed Bakery Fast Food Total

Source:

2007 60.0 25.0 15.0 100.0

2008 59.4 25.9 14.6 100.0

2009 59.0 26.0 15.0 100.0

65.0 20.0 15.0 100.0

Official statistics, trade associations, trade press, company research, store checks, trade interviews, Euromonitor International estimates

Euromonitor International

Page

Fast Food

Vietnam

Table 8 % value Company

Global Brand Owner Shares of Chained Fast Food 2005-2009

2005 52.5 20.3 18.1 2.9 6.1 100.0

2006 46.1 31.1 14.3 3.0 5.5 100.0

2007 47.2 29.3 15.5 2.7 5.3 100.0

2008 51.5 24.4 16.1 2.9 5.2 100.0

2009 50.2 22.8 16.1 3.3 7.6 100.0

Yum! Brands Inc Nam An Group Lotte Group Jollibee Foods Corp Tricon Global Restaurants Inc Others Total

Source:

Trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 9 % value Brand KFC Pho 24 Lotteria Jollibee Others Total

Source:

Brand Shares of Chained Fast Food 2006-2009

Global Brand Owner KFC Vietnam Co Ltd Nam An Group Vietnam Lotteria Co Ltd Jollibee Vietnam Co Ltd

2006 46.1 31.1 14.3 3.0 5.5 100.0

2007 47.2 29.3 15.5 2.7 5.3 100.0

2008 51.5 24.4 16.1 2.9 5.2 100.0

2009 50.2 22.8 16.1 3.3 7.6 100.0

Trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 10 outlets

Forecast Sales in Fast Food by Subsector: Units/Outlets 2009-2014

2009 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent 253 6,572 5,017 88 4,929 249 249 110 79 31 131 86 45 -

2010 307 6,865 5,231 102 5,129 261 261 129 95 34 163 110 53 -

2011 365 7,139 5,437 118 5,319 275 275 149 112 37 195 135 60 -

2012 429 7,383 5,626 137 5,489 290 290 171 131 40 227 161 66 -

2013 499 7,596 5,798 159 5,639 306 306 194 152 42 259 188 71 -

2014 576 7,769 5,944 185 5,759 323 323 219 175 44 291 216 75 -

Euromonitor International

Page

Fast Food

Vietnam

Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

1,318 1,318 6,825

1,388 1,388 7,172

1,448 1,448 7,504

1,498 1,498 7,812

1,538 1,538 8,095

1,568 1,568 8,345

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 11 '000 transactions

Forecast Sales in Fast Food by Subsector: Number of Transactions 2009-2014

2009 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food 26,936.7 283,970.6 182,030.0 7,123.1 174,906.9 7,351.9 7,351.9 5,702.2 5,297.3 404.9 16,276.1 14,516.4 1,759.7 -

2010 32,963.1 299,242.3 191,040.5 8,262.7 182,777.8 8,013.6 8,013.6 6,836.9 6,409.7 427.2 20,296.7 18,290.6 2,006.0 -

2011 39,444.8 313,247.4 199,715.0 9,626.1 190,088.9 8,654.7 8,654.7 8,044.1 7,595.5 448.5 24,429.8 22,223.1 2,206.6 -

2012 46,455.0 325,714.2 208,004.5 11,262.5 196,742.0 9,260.5 9,260.5 9,393.5 8,924.7 468.7 28,628.9 26,267.7 2,361.1 -

2013 54,101.4 336,439.0 215,877.7 13,233.5 202,644.2 9,862.4 9,862.4 10,877.8 10,397.3 480.4 32,949.7 30,470.6 2,479.2 -

2014 62,513.2 343,611.9 222,312.6 15,615.5 206,697.1 10,454.2 10,454.2 12,498.9 12,008.9 490.0 37,467.1 34,888.8 2,578.3 -

Euromonitor International

Page

10

Fast Food

Vietnam

- Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

99,547.2 99,547.2 310,907.3

106,017.7 106,017.7 332,205.4

111,848.7 111,848.7 352,692.2

116,881.9 116,881.9 372,169.2

120,972.7 120,972.7 390,540.4

123,392.2 123,392.2 406,125.1

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 12 VND billion

Forecast Sales in Fast Food by Subsector: Foodservice Value 2009-2014

2009 Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience 1,361.8 4,935.8 2,645.6 359.9 2,285.6 197.8 197.8 289.4 264.1 25.3 805.1 737.8 67.3 -

2010 1,669.5 5,244.0 2,810.2 410.3 2,399.9 212.6 212.6 349.9 322.2 27.7 1,015.8 937.0 78.8 -

2011 2,007.3 5,505.8 2,965.7 469.8 2,495.9 227.5 227.5 415.0 385.0 30.0 1,241.1 1,152.5 88.6 -

2012 2,373.8 5,712.5 3,111.1 540.3 2,570.8 242.3 242.3 488.3 456.3 32.0 1,474.3 1,377.2 97.0 -

2013 2,778.4 5,868.7 3,259.1 624.0 2,635.1 256.8 256.8 569.5 536.1 33.3 1,722.1 1,618.2 103.8 -

2014 3,233.7 5,970.8 3,398.4 723.9 2,674.6 271.0 271.0 659.1 624.6 34.5 1,993.7 1,885.2 108.5 -

Euromonitor International

Page

11

Fast Food

Vietnam

Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

2,359.8 2,359.8 6,297.6

2,524.9 2,524.9 6,913.5

2,663.8 2,663.8 7,513.1

2,770.4 2,770.4 8,086.3

2,839.6 2,839.6 8,647.0

2,882.2 2,882.2 9,204.4

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 13

Forecast Sales in Fast Food by Subsector: % Units/Outlets Growth 2009-2014

% Units/Outlets growth 2009-14 CAGR Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food 17.9 3.4 3.4 16.0 3.2 5.3 5.3 14.8 17.2 7.3 17.3 20.2 10.8 3.5 3.5 2009/14 TOTAL 127.7 18.2 18.5 110.2 16.8 29.7 29.7 99.1 121.5 41.9 122.1 151.2 66.7 19.0 19.0

Euromonitor International

Page

12

Fast Food

Vietnam

Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

4.1

22.3

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 14

Forecast Sales in Fast Food by Subsector: % Transaction Growth 2009-2014

% transaction growth 2009-14 CAGR Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

2009/14 TOTAL 132.1 21.0 22.1 119.2 18.2 42.2 42.2 119.2 126.7 21.0 130.2 140.3 46.5 24.0 24.0 30.6

18.3 3.9 4.1 17.0 3.4 7.3 7.3 17.0 17.8 3.9 18.1 19.2 7.9 4.4 4.4 5.5

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 15

Forecast Sales in Fast Food by Subsector: % Foodservice Value Growth 2009-2014

Euromonitor International

Page

13

Fast Food

Vietnam

% value growth 2009-14 CAGR Chained Fast Food Independent Fast Food Asian Fast Food - Chained Asian Fast Food - Independent Asian Fast Food Bakery Products Fast Food - Chained Bakery Products Fast Food - Independent Bakery Products Fast Food Burger Fast Food - Chained Burger Fast Food - Independent Burger Fast Food Chicken Fast Food - Chained Chicken Fast Food - Independent Chicken Fast Food Convenience Stores Fast Food - Chained Convenience Stores Fast Food - Independent Convenience Stores Fast Food Fish Fast Food - Chained Fish Fast Food - Independent Fish Fast Food Ice Cream Fast Food - Chained Ice Cream Fast Food - Independent Ice Cream Fast Food Latin American Fast Food - Chained Latin American Fast Food - Independent Latin American Fast Food Middle Eastern Fast Food - Chained Middle Eastern Fast Food - Independent Middle Eastern Fast Food Pizza Fast Food - Chained Pizza Fast Food - Independent Pizza Fast Food Other Fast Food - Chained Other Fast Food - Independent Other Fast Food Fast Casual Dining Fast Food

Source:

2009/14 TOTAL 137.5 21.0 28.5 101.1 17.0 37.0 37.0 127.7 136.5 36.2 147.6 155.5 61.2 22.1 22.1 46.2

18.9 3.9 5.1 15.0 3.2 6.5 6.5 17.9 18.8 6.4 19.9 20.6 10.0 4.1 4.1 7.9

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Euromonitor International

Page

14

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Breeding Amazons Captivity: Treasure Island. NotDocument5 pagesBreeding Amazons Captivity: Treasure Island. NotOjeda BorisNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 08 02 Домашня Робота МедікомDocument3 pages08 02 Домашня Робота МедікомRuslanaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Ground Floor Plan Second Floor Plan: Maid'S QuartersDocument1 pageGround Floor Plan Second Floor Plan: Maid'S QuartersMark CornejoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- P2 Y5 Formative Test 1Document6 pagesP2 Y5 Formative Test 1Masyuri SebliNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Final Research PaperDocument12 pagesFinal Research PapermargiNo ratings yet

- Yield Performance of Mustard Using Varying Levels of Egg and Molasses Concoction PDFDocument12 pagesYield Performance of Mustard Using Varying Levels of Egg and Molasses Concoction PDFrusty100% (1)

- White Fang PRL2Document9 pagesWhite Fang PRL2Mercedes ManavellaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- RSD Life PostDocument17 pagesRSD Life PostSteveEvetsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grappa Handbook PDFDocument66 pagesGrappa Handbook PDFAnonymous ali1kFphNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Christmas Quiz Presentation in Red, Green, Yellow and Brown Retro StyleDocument26 pagesChristmas Quiz Presentation in Red, Green, Yellow and Brown Retro StylelarysataranenkoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Shopping ListDocument5 pagesShopping ListSachin Kumar BidichandaniNo ratings yet

- NAT Reviewer in Science 6Document7 pagesNAT Reviewer in Science 6HelenEnteroBacalla67% (6)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Angry CustomerDocument4 pagesThe Angry CustomerJawad IrfanNo ratings yet

- E7DWH-SS Instruction ManualDocument13 pagesE7DWH-SS Instruction ManualbluesealsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Easy Garam Masala Recipe AllrecipesDocument1 pageEasy Garam Masala Recipe AllrecipesOlga GarcíaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- UntitledDocument42 pagesUntitledaufcheNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Best Bet Dinner Menu July 2023Document2 pagesBest Bet Dinner Menu July 2023MatthewKangNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- How To Lose WeightDocument5 pagesHow To Lose Weightsunem blackNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- My Cook BookDocument66 pagesMy Cook BookAkshay KumariNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1000 English Collocations in 10 Minutes A DayDocument128 pages1000 English Collocations in 10 Minutes A DayKaksak VisagieNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- MaggiDocument5 pagesMaggiVishalNo ratings yet

- Past Simple Vs Continuous ExercisesDocument2 pagesPast Simple Vs Continuous ExercisesLazar CristinaNo ratings yet

- Pop IntroDocument8 pagesPop IntroSaurabh MundraNo ratings yet

- Nidhi-Tbi: National Initiative For Developing and Harnessing InnovationsDocument52 pagesNidhi-Tbi: National Initiative For Developing and Harnessing InnovationsshashiNo ratings yet

- Comparative Study of Rate of Fermentation of Fruit JuicesDocument30 pagesComparative Study of Rate of Fermentation of Fruit JuicesSubrat KumarNo ratings yet

- Ilmu Yang Bermanfaat - Rangkuman Materi Bahasa Inggris Kelas 9 Kurikulum 2013Document12 pagesIlmu Yang Bermanfaat - Rangkuman Materi Bahasa Inggris Kelas 9 Kurikulum 2013Rani Indah PratiwiNo ratings yet

- "Facts Are Not Science - As The Dictionary Is Not Literature." Martin H. FischerDocument16 pages"Facts Are Not Science - As The Dictionary Is Not Literature." Martin H. FischerVivek TripathyNo ratings yet

- Death & Co LA MenuDocument10 pagesDeath & Co LA MenuMatthewKang100% (1)

- Cookery VS CulinaryDocument4 pagesCookery VS CulinaryJuli Hyla RomanoNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- International WineDocument2 pagesInternational WinesafinditNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)