Professional Documents

Culture Documents

Exchange System Paying in Out-1

Uploaded by

bulkablOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exchange System Paying in Out-1

Uploaded by

bulkablCopyright:

Available Formats

"RS Official Gazette", Nos 9/2007, 118/2007 and 18/2009

Pursuant to Article 34, paragraph 6 of the Law on Foreign Exchange Operations ("RS Official Gazette", No 62/2006), the Governor of the National Bank of Serbia hereby issues DECISION N PAYMENT, COLLECTION OF PAYMENTS, PAYING IN AND PAYING OUT IN FOREIGN CASH 1. This Decision shall prescribe the cases in which payment, collection of payments, paying in and paying out may be effected in foreign cash. 2. Under the terms hereof, payment, collection of payments, paying in and paying out in foreign cash may be effected in types of foreign exchange prescribed by the decision on types of foreign exchange and foreign cash that can be purchased and sold in the foreign exchange market. By way of exception to paragraph 1 of this Section, paying in and paying out within the meaning of Section 7 hereof may also be effected in those types of currencies that can be traded in cash transactions as prescribed by the decision referred to in that paragraph. 3. In the execution of activities they were incorporated to perform, resident - legal entity, entrepreneur and branch of a legal entity may effect collection of payment in foreign cash when: - rendering services to resident and non-resident natural persons in international commodity and passenger transport; - selling goods to resident and non-resident natural persons in duty free shops; - supplying foreign aircraft and ships with fuel, lubricating oil and other consumables in airports and sea ports in the Republic of Serbia; - collecting pay toll for foreign-registration vehicles. 4. Diplomatic-consular representative offices of the Republic of Serbia may, pursuant to the law on republic administrative fees, collect their fees in foreign cash, which is to be deposited on their foreign currency accounts abroad in line with regulation on keeping foreign exchange on bank accounts abroad. 5. A resident shall pay in foreign cash generated within the meaning of Section 3 hereof in such resident's foreign currency account within three days at the latest from the date of its collection, and shall submit documents to the bank to prove that the amount to be paid in was acquired through sale of goods, and/or rendering of services (invoice, bill, etc.). By way of exception to paragraph 1 hereof: - resident referred to in Section 3 hereof may keep in its foreign currency cash vault a maximum of 5% of the amount of the day's last

transaction effected in foreign cash for the purpose of having sufficient small change in a particular currency to begin that day's trading; - a bank may pay out foreign cash to the resident referred to in Section 3 hereof against a decision of the resident's competent body for the purpose specified in indent 1 of this paragraph in the amount needed to begin that day's trading in a particular currency. 6. A resident who exhibits goods in an international fair and collects payments in foreign cash, shall pay in such cash in its foreign currency account with a bank in the Republic of Serbia within three business days at the latest from the date such international fair closes. At the same time, such resident shall submit to the bank a document on the customs clearance of goods that were sold in the fair, in line with the law on customs duty, as well as a document on the collection of payment for such goods in foreign cash. 6. Resident from Section 3 hereof who collected payments under exports of goods and services in foreign cash and such collection was not made through a bank due to force majeure, i.e. war, natural disaster, political events, acts of authority and other circumstances beyond its control (hereinafter: force majeure), shall pay in such foreign cash to its foreign currency account with a bank. On making payment referred to in paragraph 1 hereof, resident from that paragraph shall submit: - proof of force majeure by reason of which the collection of payments could not be made through a bank; - documentation showing that the amount of foreign cash to be paid in has been acquired through the exports of goods and/or services (single customs document for goods, and/or contract and invoice for services); - certificate of receipt of foreign cash from non-resident, specifying the number under which the foreign trade contract was filed in the export control book. 6b. Resident from Article 2, indent 1, provision 6 of the Law on Foreign Exchange Operations, who within its operations received and/or generated foreign cash that could not be paid in to the account with the National Bank of Serbia, and/or bank due to force majeure, shall pay in such cash to that account. On making payment referred to in paragraph 1 hereof, resident from that paragraph shall submit: - documentation on the grounds of acquisition of foreign cash, signed by the resident's responsible person;

- proof of force majeure by reason of which the payment of foreign cash to the account of the National Bank of Serbia, and/or bank could not be made. 7. A bank and a resident - legal entity and entrepreneur licensed by the National Bank of Serbia to perform exchange operations shall pay in and pay out foreign cash through a special foreign currency current account with a bank in line with the regulation on the terms of opening and the manner of maintaining foreign currency accounts of residents. 8. A resident and a bank shall pay in and pay out foreign cash related to business trips abroad up to the amount specified by the regulation on the requirements for effecting personal and physical transfers of means of payment to and from abroad, and in line with the regulation on terms and conditions of performing external payment transactions. 9. For the purposes hereof, business days shall be every day, except Sundays and public holidays that have been proclaimed non-business days. 10. This Decision shall enter into force one day after its publication in the "RS Official Gazette". D. No 8 24 January 2007 Belgrade Governor National Bank of Serbia Radovan Jelasic, sign.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ethiopia's foreign exchange regulationsDocument8 pagesEthiopia's foreign exchange regulationssamuel debebeNo ratings yet

- TutorialDocument3 pagesTutorialSaido Saibok0% (2)

- Forex For Beginners To Forex TradingDocument42 pagesForex For Beginners To Forex TradingMake Money BossNo ratings yet

- Audit of Forex TransactionsDocument4 pagesAudit of Forex Transactionsnamcheang100% (2)

- Mishkin PPT ch03Document15 pagesMishkin PPT ch03Mukesh KumarNo ratings yet

- Chapter 3 Foreign Exchange and Its SignificanceDocument16 pagesChapter 3 Foreign Exchange and Its SignificanceRach BNo ratings yet

- Cover - Chapter I - Chapter V - BibliographyDocument30 pagesCover - Chapter I - Chapter V - BibliographyBlank KingsNo ratings yet

- Ibo 6Document23 pagesIbo 6Charan SinghNo ratings yet

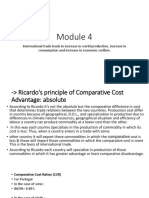

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTANo ratings yet

- The Determination of Exchange RatesDocument33 pagesThe Determination of Exchange RatesBorn HyperNo ratings yet

- Financial Planning For Individual InvestorDocument83 pagesFinancial Planning For Individual Investorrathodsantosh101100% (2)

- Forex Basics: Navigation Forex Basics Featured Forex Brokers Forex Ebooks AutotradingDocument10 pagesForex Basics: Navigation Forex Basics Featured Forex Brokers Forex Ebooks AutotradingAnkur JainNo ratings yet

- Chapter 1 The Rise of GlobalizationDocument11 pagesChapter 1 The Rise of GlobalizationCJ IbaleNo ratings yet

- Trade Like A Boss FINALDocument74 pagesTrade Like A Boss FINALGoran KristanNo ratings yet

- Foreign Exchange Quiz AnswersDocument12 pagesForeign Exchange Quiz AnswersPadyala SriramNo ratings yet

- A Price Action Traders Guide To Supply and DemandDocument17 pagesA Price Action Traders Guide To Supply and Demandmohamed100% (2)

- Jim Rickards' IMPACT SystemDocument101 pagesJim Rickards' IMPACT SystemTushar KukretiNo ratings yet

- A STEP-BY-STEP GUIDE TO PRICE ACTION TRADINGDocument20 pagesA STEP-BY-STEP GUIDE TO PRICE ACTION TRADINGBig Bomber100% (11)

- What Are The Agency Services Rendered by Bank?: Funds Transfer ServiceDocument2 pagesWhat Are The Agency Services Rendered by Bank?: Funds Transfer ServiceAnkitha TheresNo ratings yet

- Annual Report RBI 2018 PDFDocument268 pagesAnnual Report RBI 2018 PDFSahitya SoniNo ratings yet

- The Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystsDocument82 pagesThe Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystskessbrokerNo ratings yet

- Module 4Document39 pagesModule 4yashNo ratings yet

- Review of Literature For Foreign Exchange or ForexDocument2 pagesReview of Literature For Foreign Exchange or Forexrajesh bathulaNo ratings yet

- Treasury, Forex and IBDocument53 pagesTreasury, Forex and IBMuktak GoyalNo ratings yet

- Coins of SikkimDocument3 pagesCoins of Sikkimalamgirian100% (1)

- ICICI Bank Summer Training ReportDocument70 pagesICICI Bank Summer Training ReportvipinkathpalNo ratings yet

- Fin Mar Prelim ReviewerDocument4 pagesFin Mar Prelim ReviewerGhillian Mae GuiangNo ratings yet

- Softex FormDocument13 pagesSoftex Formapi-3733759100% (1)

- Financial Services QBDocument89 pagesFinancial Services QBVimal RajNo ratings yet

- Imrp4 - Investec Bank Mauritius Limited - Preference Share Dividend Announcement - Imrp4!07!08 - 2023Document3 pagesImrp4 - Investec Bank Mauritius Limited - Preference Share Dividend Announcement - Imrp4!07!08 - 2023Khahliso Kay SeekoNo ratings yet