Professional Documents

Culture Documents

Combining Probability Forecasts (Michael P. Clementsa David I. Harvey - 2010)

Uploaded by

SemanticZenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Combining Probability Forecasts (Michael P. Clementsa David I. Harvey - 2010)

Uploaded by

SemanticZenCopyright:

Available Formats

International Journal of Forecasting 27 (2011) 208223

www.elsevier.com/locate/ijforecast

Combining probability forecasts

Michael P. Clements

a

, David I. Harvey

b,

a

Department of Economics, University of Warwick, United Kingdom

b

School of Economics, University of Nottingham, United Kingdom

Abstract

We consider different methods for combining probability forecasts. In empirical exercises, the data generating process of

the forecasts and the event being forecast is not known, and therefore the optimal form of combination will also be unknown.

We consider the properties of various combination schemes for a number of plausible data generating processes, and indicate

which types of combinations are likely to be useful. We also show that whether forecast encompassing is found to hold between

two rival sets of forecasts or not may depend on the type of combination adopted. The relative performances of the different

combination methods are illustrated, with an application to predicting recession probabilities using leading indicators.

c 2010 International Institute of Forecasters. Published by Elsevier B.V. All rights reserved.

Keywords: Probability forecasts; Forecast combinations; Recession probabilities

1. Introduction

In this paper we consider different ways of

combining probability forecasts of the same event. As

was noted by Diebold and Lopez (1996), forecasts of

economic and fnancial variables often take the form

of probabilities, and there are good reasons to believe

that probability forecasts will become increasingly

prominent.

1

For example, in a macroeconomic policy

setting, a forecast of the probability that the target

Corresponding address: School of Economics, University of

Nottingham, University Park, Nottingham NG7 2RD, United

Kingdom. Tel.: +44 0 115 9515481; fax: +44 0 115 9514159.

E-mail address: dave.harvey@nottingham.ac.uk (D.I. Harvey).

1

In other spheres, the combination of probability assessments

is commonplace, although the emphasis tends to be different from

rate of infation will be exceeded next year, or of the

probability that the economy will contract, may be

markedly more informative than simple point forecasts

of the expected rates of infation and output growth,

especially in the absence of any indication of the

degree of uncertainty to be attached to the point

forecasts.

An extensive body of literature in economics and

management science attests to the usefulness of fore-

cast combination for point forecasts, where by a point

ours. The literature on the combination of experts subjective

probability distributions (see, e.g., Clemen & Winkler, 1999; Genest

& Zidek, 1986) looks at ways of aggregating individual assessments

such that the aggregate possesses desirable properties, rather than

focusing on accuracy. See also Dawid (1986) and Winkler (1996)

on probability forecasting and evaluation from a meteorological

perspective, as well as for a discussion of earlier contributions.

0169-2070/$ - see front matter c 2010 International Institute of Forecasters. Published by Elsevier B.V. All rights reserved.

doi:10.1016/j.ijforecast.2009.12.016

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 209

forecast we mean a forecast, defned on R, of an out-

come that is also defned on R, in contrast to prob-

ability forecasts, which are defned on the interval

[0, 1] of a binary outcome variable. The recent liter-

ature on combining point forecasts covers a number of

areas, including the specifcation of the combination

weights, testing for forecast encompassing, the impact

of parameter estimation uncertainty, and the limiting

distributions of the tests when the forecasts are from

models which are nested.

2

With a few exceptions,

3

the

standard assumption in the literature has been that the

forecaster has a squared error loss function, and most

of the work on the combination of point forecasts has

been based on linear combinations of the individual

forecasts. The focus on linear combinations is read-

ily justifable when, in addition to squared-error loss,

we assume that the variable being forecast (y

t

) and the

forecasts (given by the vector f

t

) follow a joint Gaus-

sian distribution. Then, standard results indicate that

the conditional expectation E (y

t

| f

t

) is the optimal

predictor (the conditional expectation minimizes the

expected squared error loss), and the joint normality

of

y

t

f

ensures that the conditional expectation of

y

t

is a linear combination of the elements of f

t

(see,

for example, Timmermann, 2006, pp. 144145).

However, for probability forecasts, the limited

support of (y

t

, f

t

) suggests that the justifcation for

considering linear combinations of forecasts is more

problematic, and alternatives such as the logarithmic

opinion pool (LoOP) fgure prominently in the litera-

ture. We investigate different ways of combining prob-

ability forecasts, both in terms of the accuracy of the

combined forecasts, and in terms of the implications

for forecast encompassing. Because in practice the

data generating process of the forecasts and the event

being forecast will typically be unknown, we consider

the properties of various combination schemes for a

number of plausible data generating processes, in or-

der to see whether some tend to dominate the others.

2

See, for example, Bates and Granger (1969), Chong and

Hendry (1986), Clark and McCracken (2001), Deutsch, Granger,

and Ter asvirta (1994), Granger and Ramanathan (1984), Harvey,

Leybourne, and Newbold (1998), Hendry and Clements (2004),

Harvey and Newbold (2000), Newbold and Granger (1974), Stock

and Watson (1999) and West (1996, 2001), as well as the reviews

by Clemen (1989), Clements and Harvey (2009), Diebold and Lopez

(1996), Newbold and Harvey (2002) and Timmermann (2006).

3

Elliott and Timmermann (2004) is a notable exception.

We establish the large-sample properties of the com-

bination schemes, but, at least as importantly, we also

investigate their relative performances when the com-

bination weights are estimated, as is often done in

practice.

The plan of the rest of the paper is as follows.

In Section 2 we describe the forecast combinations

we consider, as well as the loss functions that are

typically used for evaluating probability forecasts.

Section 3 discusses two specifc data generation pro-

cesses and establishes the optimal form of combina-

tion in each case. Section 4 describes the estimation of

the combination weights for the two loss functions or

scoring rules, LPS and QPS, and contrasts the impli-

cations for forecast encompassing of using the optimal

form of combination for the given data generation pro-

cess with the situation when the form of combination

is non-optimal. In Section 5, using Monte Carlo, we

explore the relative accuracies of the different forecast

combinations for the two data generating processes of

Section 3, and focus in particular on the dependence

of the ranking on (i) the number of forecasts used to

estimate the combination weights, and (ii) the impor-

tance of the loss function: QPS versus LPS. Section 6

illustrates the different types of combinations of prob-

ability forecasts through an application based on com-

bining the forecast recession probabilities generated

using two leading indicators from the Conference

Boards Composite Leading Indicator. Section 7 offers

some concluding remarks.

2. Combinations and scoring rules for probability

forecasts

2.1. Forecast combinations

The frst combination method is the linear com-

bination of forecasts. In the literature on combining

experts subjective probability distributions, this is

commonly referred to as the linear opinion pool

(LiOP). In the econometrics literature, the most gen-

eral form of a linear combination of two point fore-

casts, f

1t

and f

2t

, is given by:

LiOP C

t

f

1t

, f

2t

;

= +

1

f

1t

+

2

f

2t

, (1)

where is used in a generic sense to denote the

combination parameters, and where no restrictions are

210 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

imposed on either or the weights {

1

,

2

}. The

weights are typically estimated by applying OLS to:

y

t

= +

1

f

1t

+

2

f

2t

+

t

,

as this corresponds to minimizing the sum of squared

forecast errors of the combined forecast. This is the

form of the regression for testing for forecast encom-

passing advocated by Fair and Shiller (1990), while re-

stricted versions have been considered by Chong and

Hendry (1986) and West (2001) (setting

1

= 1 when

testing that

2

= 0), and Harvey et al. (1998) and

West and McCracken (1998) (restricting

1

+

2

= 1).

Forecast encompassing holds when a combination of

two (or more) forecasts does not result in a statistically

signifcant reduction in the forecast loss relative to just

one of the forecasts: here,

2

= 0 implies that the f

1

forecast encompasses f

2

. Tests of forecast encompass-

ing assess ex post whether there is a linear combination

of forecasts that results in a statistically signifcant re-

duction in forecast loss (such as a reduction in mean

squared error) relative to using a particular forecast.

Note that, when applied to probability forecasts, nei-

ther the general form nor either of the restricted forms

ensure that C

t

[0, 1].

The second form of combination is the multiplica-

tive combination:

LoOP C

t

f

1t

, f

2t

;

= f

1

1t

f

2

2t

, (2)

which is known as the logarithmic opinion pool

(LoOP) when applied to experts subjective probabil-

ity distributions (see Genest & Zidek, 1986, and the

references therein). This is a simplifed version of the

following formula for combining discrete probability

distributions:

f

j

=

N

i =1

f

j

i

i

M

j =1

N

i =1

f

j

i

i

=

exp

i =1

i

log f

j

i

j =1

exp

i =1

i

log f

j

i

,

where f

j

i

is individual i s probability of class c

j

,

where there are M classes. The denominator is a

scaling factor. Typically,

N

i =1

i

= 1, and if the

weights are equal, i.e.

i

= N

1

, the LoOP deliv-

ers the geometric mean. Assuming a binary variable

(M = 2), and with N = 2, we obtain:

f =

f

1

1

f

2

2

f

1

1

f

2

2

+(1 f

1

)

1

(1 f

2

)

2

,

where we drop the j superscript on f and f

i

, which

are now the combined and individual probabilities of

the event occurring. The multiplicative combination

(Eq. (2)) follows directly by setting the denominator

equal to

1

. As was the case with Eq. (1), without

restrictions on ,

1

and

2

, there is no guarantee that

C

t

[0, 1].

The fnal form of combination is that of Kamstra

and Kennedy (1998) (henceforth KK). KK suggest

combining log odds ratios by logit regressions, with-

out claiming any optimality properties for the resulting

combination: we only claim that this methodology is

a means of combining individual probability forecasts

in a computationally attractive manner, while alleviat-

ing bias (p. 86). Specifcally, the KK combination of

f

1t

and f

2t

is:

KK C

t

f

1t

, f

2t

;

=

exp

+

1

ln

f

1t

1f

1t

+

2

ln

f

2t

1f

2t

1 +exp

+

1

ln

f

1t

1f

1t

+

2

ln

f

2t

1f

2t

=

exp ()

f

1t

1f

1t

f

2t

1f

2t

2

1 +exp ()

f

1t

1f

1t

f

2t

1f

2t

2

, (3)

where

1

and

2

are the maximum likelihood esti-

mates of the slope coeffcients from a logit regression

of y

t

on a constant, ln

f

1t

1f

1t

and ln

f

2t

1f

2t

. The KK

combination does ensure that C

t

[0, 1], whilst al-

lowing for an unrestricted intercept and not requiring

that

1

+

2

= 0. Consequently, relative to LoOP, the

KK combination restricts the resulting forecasts to the

unit interval whilst catering for forecasts which may

be individually biased.

2.2. Scoring rules

In contrast to the evaluation of point forecasts, the

actual probabilities are not observed, so that f , the

forecast probability that y = 1, is compared to the

realized value of y. The two main ways of scoring

probability forecasts are the quadratic and logarith-

mic scores. The Brier or quadratic probability score

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 211

(QPS: Brier, 1950) is simply the expected squared er-

ror E

( f y)

2

, corresponding to the usual notion

of squared-error loss. The logarithmic probability

score (LPS: see Brier, 1950; Good, 1952) is defned

as E

y log ( f ) (1 y) log (1 f )

.

4

For a se-

quence of probability forecasts and outcomes, { f

t

, y

t

},

t = 1, . . . , n, these scores are calculated as

QPS =

1

n

n

t =1

2 ( f

t

y

t

)

2

(4)

and

LPS =

1

n

n

t =1

[y

t

ln f

t

+(1 y

t

) ln (1 f

t

)] . (5)

It is conventional to calculate QPS as in Eq. (4), so that

QPS is twice the standard mean squared error measure

commonly calculated for point forecasts. These two

well-known measures for scoring probability forecasts

have been used in economic applications by Anderson

and Vahid (2001) and Diebold and Rudebusch (1989),

inter alia.

3. Data generating processes and optimal combi-

nations

The general form of DGP we consider is:

y

t

= 1 (g( f

1t

, f

2t

) > v

t

) , (6)

where v

t

U (0, 1) that is, v

t

is a uniform random

variable on (0, 1) and where g(.) is some function

of the individual probability forecasts f

1t

, f

2t

. This

implies that Pr (y

t

= 1) =

u

(g( f

1t

, f

2t

)), where

u

is the cdf (cumulative density function) of a uniform

(0, 1) random variable. By construction, the form of

the optimal combination is

C

f

1t

, f

2t

;

= Pr (y

t

= 1 | f

1t

, f

2t

)

= max[g( f

1t

, f

2t

), 0],

where the max function is employed since the form

of g( f

1t

, f

2t

) for one of our specifc DGPs (CJ-DGP,

below) does not ensure g( f

1t

, f

2t

) > 0, although for

both DGPs, g( f

1t

, f

2t

) < 1. Thus, when the DGP

for y

t

is specifed in terms of the forecasts f

1t

, f

2t

,

as here, the optimal or correct form of combination is

given by the DGP.

4

As written, LPS takes possible values on [0, +) and QPS

takes values on [0, 1].

The frst special case of Eq. (6) is the logit-based

DGP (henceforth L-DGP) considered by Clements

and Harvey (in press), which relates y

t

to the

forecast models explanatory variables via a logit-type

transformation, and where the forecasts are also logit

functions:

y

t

= 1

exp(

1

X

1t

+

2

X

2t

)

1 +exp(

1

X

1t

+

2

X

2t

)

> v

t

(7)

f

1t

=

exp(

11

X

1t

)

1 +exp(

11

X

1t

)

(8)

f

2t

=

exp(

12

X

2t

)

1 +exp(

12

X

2t

)

. (9)

This DGP refects the common practice of using logit

models to obtain probability forecasts.

5

It allows for

an investigation of forecast encompassing (when, say,

2

= 0), and of the effects of parameter estimation

uncertainty on predictive accuracy (i.e., the effects

of replacing the population

i j

by the estimator

i j

), although our focus will be on comparing the

accuracies of different combination methods, and

also on the effect of uncertainty on estimating the

combination weights. If we assume that {X

1t

, X

2t

} has

a normal distribution:

X

1t

X

2t

0

0

1

X

1

,X

2

X

1

,X

2

1

, (10)

then f

1t

and f

2t

are correlated, provided that

X

1

,X

2

= 0.

Assuming that X

1t

and X

2t

are scalars, the DGP

can be re-written for y

t

in terms of f

1t

and f

2t

by com-

bining Eq. (7) with rearrangements of Eqs. (8) and (9):

y

t

= 1

f

1t

1f

1t

11

f

2t

1f

2t

12

1 +

f

1t

1f

1t

11

f

2t

1f

2t

12

> v

t

,

so that the true Pr (y

t

= 1) in terms of the individual

forecasts is given by:

5

For example, logit models have been used to obtain forecasts

of the probabilities of recessions from information sets that include

leading indicators such as the yield curve; see, e.g., Estrella and

Mishkin (1998).

212 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

Pr (y

t

= 1 | f

1t

, f

2t

) =

f

1t

1f

1t

11

f

2t

1f

2t

12

1 +

f

1t

1f

1t

11

f

2t

1f

2t

12

,

(11)

which defnes the optimal form of combination:

C

f

1t

, f

2t

;

f

1t

1f

1t

11

f

2t

1f

2t

12

1 +

f

1t

1f

1t

11

f

2t

1f

2t

12

. (12)

In terms of Eq. (6), g( f

1t

, f

2t

) = C

f

1t

, f

2t

;

. It

is readily apparent that Eq. (12) is the form of com-

bination suggested by Kamstra and Kennedy (1998),

which we termed the KK combination in Section 2

(Eq. (12) is equivalent to Eq. (3) with = 0).

When the X

i t

are vectors of variables, we cannot

in general establish the optimality of the KK combi-

nation. For vector information sets, the log odds ratios

are given by:

ln

f

1t

1 f

1t

11

X

1t

, ln

f

2t

1 f

2t

12

X

2t

,

where

11

and

12

are the population values for the

two individual models. Then the logit regression of y

t

on the two log odds ratios results in:

Pr(y

t

= 1) =

exp(

1

11

X

1t

+

2

12

X

2t

)

1 +exp(

1

11

X

1t

+

2

12

X

2t

)

. (13)

This will only match the data generating process the

logit regression of y

t

on X

1t

and X

2t

given by Eq. (7)

if the following are satisfed:

11

=

1

,

2

12

=

2

. (14)

When these restrictions hold, KK is the optimal form

of combination.

The second special case of Eq. (6) is:

y

t

= 1

1t

u

(1)

2t

> v

t

+c

(15)

f

1t

= u

1t

f

2t

= u

2t

,

where the forecasts u

1t

and u

2t

are drawn from the

Cook and Johnson (1981) bivariate distribution:

f (u

1t

, u

2t

) =

+1

(u

1t

u

2t

)

+1

1t

+u

2t

1

(+2)

(16)

and c > 0. In terms of the general setup of Eq. (6),

g( f

1t

, f

2t

) = f

1t

f

(1)

2t

c, where c > 0 ensures

g( f

1t

, f

2t

) < 1. There are a number of reasons for

considering Eq. (15). It is simple enough to be analyti-

cally tractable for a number of cases of interest, whilst

generating forecasts with desirable characteristics, as

explained below. It is also, when c = 0, a data gener-

ation process for which LoOP is the optimal form of

combination.

This DGP has the property that the random vari-

ables u

1t

and u

2t

are correlated, but have marginal

distributions which are U (0, 1). The degree of corre-

lation between u

1t

and u

2t

, 0 1, is determined

by the parameter , with 0 as and 1

as 0. The equation for y

t

indicates that y

t

de-

pends on f

1t

and f

2t

, such that when the constant c is

zero, Pr (y

t

= 1) = u

1t

u

(1)

2t

, as v

t

is U (0, 1), and

is drawn independently of u

1t

and u

2t

for all t .

6

The

form of the DGP ensures that the forecasts have the

characteristics of probability forecasts (i.e., they are

defned on the unit interval), while also allowing for

contemporaneous correlation among the predictions (a

property frequently observed in practice). By setting

= 1, Pr (y

t

= 1) = u

1t

, and thus depends only on

f

1t

, so that f

2t

conveys no useful information, given

that we have f

1t

. When in addition c = 0, f

1t

is bi-

ased (as is f

2t

). Note that it is straightforward to sim-

ulate {y

t

, f

1t

, f

2t

} from Eqs. (15) and (16).

Since from Eq. (15):

Pr (y

t

= 1 | u

1t

, u

2t

) = Pr

1t

u

(1)

2t

> v

t

+c

= Pr

v

t

< u

1t

u

(1)

2t

c

= max(u

1t

u

(1)

2t

c, 0),

it follows immediately that the optimal type of combi-

nation, for c = 0, is given by:

C

t

( f

1t

, f

2t

; , c) = max( f

1t

f

(1)

2t

c, 0),

with f

1t

= u

1t

and f

2t

= u

2t

; or, simply, C

t

( f

1t

,

f

2t

; ) = f

1t

f

(1)

2t

when c = 0 as u

1t

u

(1)

2t

> 0.

6

Note that y

t

can also be written as y

t

= 1(u

1t

u

(1)

2t

> w

t

),

where w

t

U (c, 1 +c).

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 213

This matches the LoOP defned in Eq. (2), when = 1

in Eq. (2).

4. Loss functions and estimation

Suppose that we have the optimal form of combi-

nation for a given DGP. Consider selecting combina-

tion weights to minimize the LPS of the combined

forecast C

f

1t

, f

2t

;

. This is equivalent to

maximum likelihood (ML) estimation of , since the

likelihood function (for iid data on a Bernoulli random

variable with a probability C

t

() that Y

t

= 1) is given

by:

L =

y

t

=1

C

f

1t

, f

2t

;

y

t

y

t

=0

[1 C

t

( f

1t

, f

2t

; )]

1y

t

. (17)

Taking logs, we obtain:

ln L =

[y

t

ln C

t

( f

1t

, f

2t

; )

+(1 y

t

) ln(1 C

t

( f

1t

, f

2t

; ))],

which is proportional to (minus) LPS (see Eq. (5)).

Thus, ML using the likelihood function for an iid

Bernoulli random variable is equivalent to minimizing

LPS.

Alternatively, Pr (y

t

= 1 | f

1t

, f

2t

) = C

t

( f

1t

, f

2t

;

) can be thought of instead as the conditional

expectation:

E (y

t

| f

1t

, f

2t

) = C

f

1t

, f

2t

;

,

giving rise to the (generally nonlinear) regression

model:

y

t

= C

f

1t

, f

2t

;

+

t

, (18)

to be estimated by (nonlinear) least squares. The non-

linear least squares estimation of Eq. (18) is clearly

equivalent to estimating on the basis of minimizing

QPS.

Given that both Eqs. (17) and (18) are correctly

specifed, in the sense that they incorporate the opti-

mal form of combination, both maximum likelihood

estimation of Eq. (17) and nonlinear least squares es-

timation of Eq. (18) will provide consistent estimates

of under standard assumptions. By implication, the

parameters of the optimal combination will be esti-

mated consistently, regardless of whether we use QPS

or LPS. Tests of forecast encompassing based on both

QPS and LPS will therefore be valid, in the sense that

when f

2t

does not enter the optimal combination, both

QPS and LPS will indicate that f

1t

encompasses f

2t

in population.

As an example, consider the KK combination and

the L-DGP. The optimal form of combination is given

by Eq. (12), so that estimation of the combination

weights by QPS based on

C

f

1t

, f

2t

;

f

1t

1f

1t

f

2t

1f

2t

2

1 +

f

1t

1f

1t

f

2t

1f

2t

2

(19)

will result in:

1

p

11

,

2

p

12

.

When

2

= 0, so that y

t

depends only on X

1t

in the

DGP, testing for forecast encompassing (

2

= 0 in

Eq. (19)) will give the correct inference as

2

p

0.

The same inference would result from minimizing

Eq. (17) with C

t

given by Eq. (19).

Consider the second DGP, CJ-DGP. Minimizing

QPS corresponds to choosing {, c} such that:

arg min

{,c}

y

t

max(u

1t

u

(1)

2t

c, 0)

2

.

When = 1, such that f

1t

forecast encompasses f

2t

,

p

1.

When we dispense with the assumption that Eqs.

(17) and (18) are correctly specifed, as when C

t

(.)

is replaced by some other type of combination C

t

(.),

we cannot establish (in general) that the inference we

make concerning forecast encompassing will match

that made when the correct form of combination is

usedeven asymptotically.

Formally, for a loss function L = L (e

t

), let e

j,t

=

y

t

C

j t

(f

t

;

j

) denote the combined forecast error

associated with a form of combination given by C

j t

(.),

for j = 1, 2, . . . , J combination methods (in our case,

J = 3: LiOP, LoOP and KK). Conditional on the form

of combination, the optimal combination weights are

given by:

j

= arg min

j

E

e

j,t

, (20)

where the expectation is over the conditional distribu-

tion of e

t

, given past forecasts and outcomes. While

214 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

the optimal weight on f

2

may be zero in the optimal

form of combination, indicating forecast encompass-

ing of f

2

by f

1

, in general it cannot be proved that the

vector

j

, for combination method j , will also indi-

cate forecast encompassing.

Furthermore, although

E

e

j,t

j, (21)

where e

denotes the forecast error using the opti-

mal form of combination, we could have any accuracy

ranking among the different non-optimal combination

methods, i.e.:

E

e

1,t

e

2,t

. . . E

e

J,t

. (22)

Moreover, in practice, the population parameters {

1

, . . . ,

J

} will be replaced by estimates of the com-

bination weights. In that case, the inequality in Eq.

(21) may no longer hold, and the relationships between

the different forms of combination in Eq. (22) based

on population values may be overturned. The rankings

may also depend on the loss function, L(.). In what

follows, we report results for both loss functions (QPS

and LPS), as well as focusing on the form of the com-

bination, C

t

(.), and the impact of uncertainty about .

The next section describes the Monte Carlo investiga-

tion of the accuracy of optimal and non-optimal meth-

ods of forecast combination for both of our example

DGPs.

5. Monte Carlo simulations

Deriving analytical expressions for the value of

the loss for the different ways of combining forecasts

is mathematically intractable, except in a number

of special cases. Consequently, in this section we

report the results of some Monte Carlo simulations for

probability forecast combination using LiOP, LoOP

and KK, for both the L-DGP and the CJ-DGP. We

report the results frst for QPS (Section 5.1), then for

LPS (Section 5.2).

5.1. Simulation results for QPS

5.1.1. For the L-DGP

The simulations for the L-DGP are based on Eqs.

(7)(9), where the Xs are normal random variables

drawn from Eq. (10). We ignore parameter estima-

tion uncertainty in the forecast model parameters ,

in order to focus on uncertainty in the estimation of

the combination weights. Simulated population pa-

rameters , based on the average values across 10,000

replications of the logit model estimates on samples

of size 10,000, were used. We generated samples of

size n = {25, 50, 100, 200, } to estimate the com-

bination weights for a given replication (the case n =

indicates that optimal population weights, which

were simulated using a sample size of n = 10,000,

were used). We then used these estimated weights to

compute out-of-sample combined forecasts and the

corresponding QPS for that replication, using 10,000

out-of-sample observations in order to approximate

the population QPS associated with the given set

of combination weights.

7

The tables then report the

means and standard deviations of the simulated QPS

values across replications. Both here and throughout

the paper, simulations were performed in Gauss 9.0

using 10,000 Monte Carlo replications.

Table 1 reports the results for scalars X

1t

and X

2t

,

1

= 1 and

2

= 0 (so that encompassing holds in

the KK combination), and for correlation parameter

values

X

1

,X

2

= {0.2, 0.5, 0.8}. Focusing frstly on

the results for the population combination weights

(n = ), unreported results confrm that the KK

combination attaches zero weight to f

2

, and the same

is found to be true for LiOP and LoOP. All methods

result in the same limiting value of QPS, regardless of

the value of

X

1

,X

2

. Even though KK is the optimal

form of combination, when the combination weights

are estimated using small samples of forecasts, the

estimation uncertainty of this method is greater than

that of LiOP, and the latter method is shown to be the

most accurate in terms of QPS, with a lower mean and

standard deviation obtained for all correlation values.

The accuracy of the LoOP method lies between those

of KK and LiOP in small samples. Unreported results

for a non-encompassing case (

1

= 0.5 and

2

= 0.5)

7

We constrain 0 for the LoOP combination. We also

constrain infeasible values of the combined forecasts to their

boundary values (i.e., 0 or 1 for QPS, and 0.0001 or 0.9999 for

the results for LPS reported in Section 5.2). Replications where

all of the forecasts being combined are outside the feasible range

(for any of the combination schemes) are treated as anomalous

replications, and were resampled in order to obtain the simulation

results reported.

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 215

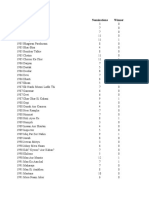

Table 1

Means and standard deviations of QPS across Monte Carlo replications: L-DGP,

1

= 1,

2

= 0.

n

X

1

,X

2

= 0.2

X

1

,X

2

= 0.5

X

1

,X

2

= 0.8

Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.459 0.041 0.460 0.041 0.460 0.041

LoOP 0.483 0.076 0.484 0.071 0.485 0.072

KK 0.491 0.080 0.492 0.081 0.492 0.082

50 LiOP 0.436 0.019 0.436 0.020 0.437 0.020

LoOP 0.443 0.030 0.443 0.031 0.444 0.030

KK 0.445 0.032 0.445 0.034 0.445 0.033

100 LiOP 0.425 0.010 0.425 0.010 0.425 0.010

LoOP 0.426 0.015 0.427 0.016 0.427 0.013

KK 0.427 0.012 0.427 0.013 0.427 0.013

200 LiOP 0.419 0.006 0.419 0.006 0.419 0.006

LoOP 0.420 0.009 0.420 0.010 0.420 0.007

KK 0.420 0.007 0.420 0.007 0.420 0.007

LiOP 0.413 0.413 0.413

LoOP 0.413 0.413 0.413

KK 0.413 0.413 0.413

again show that all three combinations give essentially

the same limiting value of QPS, but that LiOP is the

most accurate for small values of n.

In order to investigate the reason for the poor fnite-

sample performance of KK, which is the optimal

form of combination, Table 2 reports the bias-variance

decomposition of the mean QPS fgures reported in

Table 1. Given the defnition of QPS as twice the

expected squared error, the squared bias plus the

variance is equal to half the QPS values reported in

Table 1. From Table 2 it is apparent that the high

small-sample QPS values for KK are due primarily to

the variance. Although both the squared bias and the

variance increase as the sample size gets smaller, the

bias term is almost inconsequential compared to the

variance.

The results reported in Table 1 are for independent

data on {y

t

, f

1t

, f

2t

} across t , but in time series appli-

cations the data and forecasts are likely to be serially

dependent. We check that our results are qualitatively

unaffected by allowing for serial correlation by report-

ing in Table 3 the results for setups similar to those re-

ported in Table 1, but allowing for serial dependence.

Specifcally, the X

i t

(i = 1, 2) in Eqs. (8) and (9) are

replaced by W

i t

, where W

i t

= W

i,t 1

+X

i t

, i = 1, 2,

i.e., the explanatory variables are AR(1), with innova-

tions given by the X

i t

. The X

i t

are as defned in Eq.

(10). The results in Table 3 are for = 0.5, and are

qualitatively similar for values of such as = 0.8,

for example. It is apparent that autocorrelation has no

effect on either the rankings of the combination meth-

ods or our qualitative fndings, and thus, in order to

save space, in what follows we only report results for

serially independent data.

We also report results for when the two models

explanatory variables are vectors. To explore the rela-

tive performances of the three combination methods in

these cases, we consider the following generalization

of Eqs. (7)(9). Let X

1t

and X

2t

be (2 1) vectors:

X

1t

=

X

11t

X

12t

, X

2t

=

X

21t

X

22t

,

so that:

y

t

= 1

exp(

11

X

11t

+

12

X

12t

+

21

X

21t

+

22

X

22t

)

1 +exp(

11

X

11t

+

12

X

12t

+

21

X

21t

+

22

X

22t

)

> v

t

f

1t

=

exp(

11

X

11t

+

12

X

12t

)

1 +exp(

11

X

11t

+

12

X

12t

)

f

2t

=

exp(

21

X

21t

+

22

X

22t

)

1 +exp(

21

X

21t

+

22

X

22t

)

.

We assume that X

t

=

X

1t

X

2t

is jointly nor-

mally distributed, with zero means and unit variances,

and that all correlations are equal to zero except

for

X

11

,X

21

. A non-zero value of

X

11

,X

21

generates

216 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

Table 2

Bias-variance decomposition of simulated QPS values: L-DGP,

1

= 1,

2

= 0.

n

X

1

,X

2

= 0.2

X

1

,X

2

= 0.5

X

1

,X

2

= 0.8

Bias

2

Variance Bias

2

Variance Bias

2

Variance

25 LiOP 0.008 0.221 0.008 0.222 0.008 0.222

LoOP 0.012 0.230 0.011 0.231 0.011 0.232

KK 0.011 0.235 0.011 0.235 0.011 0.235

50 LiOP 0.004 0.214 0.004 0.214 0.004 0.214

LoOP 0.005 0.216 0.005 0.216 0.005 0.217

KK 0.005 0.218 0.005 0.217 0.005 0.218

100 LiOP 0.002 0.210 0.002 0.210 0.002 0.210

LoOP 0.002 0.211 0.002 0.211 0.002 0.211

KK 0.002 0.211 0.002 0.211 0.002 0.211

200 LiOP 0.001 0.208 0.001 0.208 0.001 0.208

LoOP 0.001 0.209 0.001 0.209 0.001 0.209

KK 0.001 0.209 0.001 0.209 0.001 0.209

correlated forecasts, and, in addition, each forecast has

an idiosyncratic component (X

12t

and X

22t

respec-

tively) which is independent of the other variables.

Table 4 reports results for the design parameters

{

11

= 2,

12

= 5,

21

= 4,

22

= 1}, which are

chosen such that the restrictions given by Eq. (14) for

KK to be the optimal form of combination are not

satisfed. Despite this, in the limiting case KK is still

the most accurate forecast combination, followed by

LoOP and lastly LiOP, with the differences in accuracy

being largein the order of 40% for

X

11

,X

21

=

0.2. For small values of n, LiOPs performance is

more competitive, with estimation uncertainty having

a considerably greater impact on the accuracy of

KK, and even more on that of LoOP. For n = 25,

for example, LiOP is better than KK for the larger

correlations between X

11

and X

21

, in terms both of

the mean QPS, and of the standard deviation being

substantially smaller.

5.1.2. For the CJ-DGP

We simulated data from Eqs. (15) and (16),

and computed the out-of-sample QPS mean and

standard deviation for each combination method,

where the combination parameters were estimated

using n = {25, 50, 100, 200, } observations (the

case n = again indicates the use of the optimal

population weights, simulated using n = 10, 000).

The simulations were conducted using the same

methodology as for the L-DGP, and the settings

employed were = {0.5, 1}, where = 1

corresponds to f

1

encompassing f

2

using the optimal

type of combination (LoOP when c = 0), as well as

Corr(u

1t

, u

2t

) = {0, 0.8} and c = {0, 0.5} to

allow for correlated and biased forecasts (when = 0

and c = 0 respectively). The results are recorded in

Tables 5 (for = 1) and 6 (for = 0.5).

Consider frst the case where the population

weights are used. When = 1, so that f

1

encompasses

f

2

using the optimal combination, unreported results

show that all three combinations attach zero weight to

f

2

when c = 0 and/or = 0, but not in the case where

the forecasts are both correlated and biased. Instead,

when both = 0 and c = 0, we fnd

2

values

for LiOP, LoOP and KK of 0.106, 0.015 and 0.082,

although the LoOP value of 0.015 is not signifcantly

different from zero across replications. This highlights

the result that when non-optimal combination methods

are employed, whether one forecast encompasses

another may depend on the form of the combination

adopted. For example, using LiOP we fnd that the

inclusion of f

2

attracts a non-zero weight in the

combination, whereas using LoOP the weight on f

2

is zero (i.e., f

1

forecast encompasses f

2

).

In terms of the most accurate combination, when

we abstract from estimation uncertainty (n = ),

LoOP is always at least as good as the other two

methods. This is true whether = 1 or = 0.5,

although the differences are small in magnitude. The

form of the DGP is such that the entries in the tables

for LiOP and LoOP can be calculated analytically for

some combinations of values of {c, }. For example,

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 217

Table 3

Means and standard deviations of QPS across Monte Carlo replications: L-DGP,

1

= 1,

2

= 0, autocorrelated explanatory variables.

n

X

1

,X

2

= 0.2

X

1

,X

2

= 0.5

X

1

,X

2

= 0.8

Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.444 0.048 0.445 0.050 0.445 0.049

LoOP 0.472 0.088 0.471 0.080 0.473 0.081

KK 0.478 0.086 0.478 0.087 0.478 0.085

50 LiOP 0.418 0.022 0.417 0.021 0.418 0.021

LoOP 0.426 0.035 0.425 0.033 0.426 0.033

KK 0.428 0.036 0.428 0.036 0.427 0.036

100 LiOP 0.405 0.010 0.405 0.010 0.405 0.010

LoOP 0.407 0.014 0.408 0.013 0.408 0.015

KK 0.408 0.013 0.408 0.013 0.408 0.013

200 LiOP 0.400 0.006 0.399 0.006 0.400 0.006

LoOP 0.401 0.014 0.400 0.009 0.400 0.009

KK 0.401 0.007 0.401 0.007 0.401 0.007

LiOP 0.394 0.394 0.394

LoOP 0.394 0.394 0.394

KK 0.394 0.394 0.394

Table 4

Means and standard deviations of QPS across Monte Carlo replications: L-DGP,

11

= 2,

12

= 5,

21

= 4,

22

= 1.

n

X

11

,X

21

= 0.2

X

11

,X

21

= 0.5

X

11

,X

21

= 0.8

Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.190 0.023 0.191 0.023 0.176 0.020

LoOP 0.245 0.076 0.244 0.072 0.230 0.067

KK 0.190 0.062 0.209 0.061 0.215 0.062

50 LiOP 0.179 0.012 0.181 0.011 0.166 0.010

LoOP 0.199 0.038 0.200 0.035 0.187 0.034

KK 0.152 0.035 0.171 0.034 0.176 0.033

100 LiOP 0.175 0.007 0.176 0.006 0.162 0.006

LoOP 0.181 0.023 0.183 0.023 0.170 0.019

KK 0.134 0.016 0.153 0.016 0.159 0.017

200 LiOP 0.173 0.005 0.174 0.004 0.160 0.004

LoOP 0.174 0.030 0.176 0.029 0.163 0.016

KK 0.126 0.008 0.145 0.008 0.150 0.008

LiOP 0.171 0.172 0.158

LoOP 0.166 0.168 0.157

KK 0.119 0.138 0.144

we can show that QPS

Li OP

> QPS

LoOP

for the

encompassing specifcation = 1, c = 0.5 and

= 0.

8

8

An appendix to this paper is available at www.forecasters.

org/ijf . This outlines the calculation of QPS for LiOP and LoOP

for the CJ-DGP.

When we allow for fnite-sample estimation uncer-

tainty, LiOP is the most accurate form of combination,

especially for the smaller sample sizes. For small val-

ues of n, both the LoOP and KK combinations are

similarly affected by estimation uncertainty, with the

standard deviation of QPS for LoOP being especially

large when c = 0.

218 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

Table 5

Means and standard deviations of QPS across Monte Carlo replications: CJ-DGP, = 1.

n c = 0, = 0 c = 0, = 0.8 c = 0.5, = 0 c = 0.5, = 0.8

Mean S.d. Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.367 0.033 0.369 0.035 0.194 0.021 0.196 0.023

LoOP 0.405 0.073 0.403 0.072 0.251 0.146 0.237 0.093

KK 0.406 0.074 0.406 0.072 0.245 0.063 0.242 0.059

50 LiOP 0.350 0.015 0.351 0.016 0.185 0.012 0.185 0.013

LoOP 0.363 0.033 0.362 0.030 0.212 0.112 0.203 0.048

KK 0.365 0.033 0.365 0.033 0.211 0.037 0.210 0.036

100 LiOP 0.341 0.008 0.342 0.008 0.180 0.007 0.180 0.007

LoOP 0.347 0.019 0.346 0.017 0.189 0.088 0.183 0.032

KK 0.347 0.014 0.347 0.014 0.191 0.017 0.191 0.018

200 LiOP 0.337 0.005 0.338 0.005 0.177 0.005 0.177 0.005

LoOP 0.339 0.008 0.339 0.007 0.177 0.060 0.174 0.008

KK 0.339 0.007 0.340 0.007 0.183 0.008 0.183 0.008

LiOP 0.333 0.333 0.174 0.174

LoOP 0.333 0.333 0.168 0.168

KK 0.333 0.333 0.176 0.176

Table 6

Means and standard deviations of QPS across Monte Carlo replications: CJ-DGP, = 0.5.

n c = 0, = 0 c = 0, = 0.8 c = 0.5, = 0 c = 0.5, = 0.8

Mean S.d. Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.443 0.040 0.390 0.036 0.124 0.016 0.188 0.023

LoOP 0.462 0.077 0.420 0.071 0.161 0.077 0.227 0.082

KK 0.476 0.077 0.425 0.073 0.171 0.061 0.231 0.060

50 LiOP 0.421 0.020 0.370 0.017 0.119 0.008 0.178 0.012

LoOP 0.418 0.031 0.380 0.033 0.137 0.039 0.196 0.056

KK 0.433 0.033 0.385 0.034 0.143 0.033 0.200 0.035

100 LiOP 0.409 0.010 0.360 0.009 0.116 0.005 0.173 0.007

LoOP 0.402 0.014 0.363 0.013 0.123 0.049 0.176 0.029

KK 0.414 0.013 0.366 0.014 0.127 0.017 0.181 0.016

200 LiOP 0.404 0.006 0.356 0.006 0.115 0.004 0.170 0.005

LoOP 0.395 0.006 0.356 0.007 0.114 0.032 0.167 0.010

KK 0.407 0.007 0.359 0.007 0.120 0.007 0.173 0.007

LiOP 0.399 0.351 0.113 0.167

LoOP 0.389 0.350 0.107 0.160

KK 0.400 0.352 0.115 0.167

5.2. Simulation results for LPS

5.2.1. For the L-DGP

The results for when LPS replaces QPS as the loss

function are reported in Table 7, where the setup is

exactly the same as that in Table 1, apart from the

loss function. Recall that KK is optimal. In contrast

to the results we obtained for QPS, KK is less affected

by estimation uncertainty than LoOP and LiOP, and

is markedly more accurate for the smallest set of

forecasts, n = 25. LoOP, and to a lesser extent LiOP,

are badly affected by estimation uncertainty in fnite

samples.

5.2.2. For the CJ-DGP

The LPS results for the CJ-DGP with = 1 (cor-

responding to Table 5 for QPS) are given in Table 8.

LoOP is optimal for c = 0, and from the limit results,

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 219

Table 7

Means and standard deviations of LPS across Monte Carlo replications: L-DGP,

1

= 1,

2

= 0.

n

X

1

,X

2

= 0.2

X

1

,X

2

= 0.5

X

1

,X

2

= 0.8

Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.749 0.323 0.740 0.280 0.736 0.289

LoOP 0.820 0.637 0.747 0.366 0.729 0.285

KK 0.669 0.097 0.667 0.088 0.664 0.083

50 LiOP 0.665 0.188 0.663 0.177 0.663 0.176

LoOP 0.671 0.264 0.661 0.185 0.657 0.168

KK 0.631 0.030 0.630 0.029 0.630 0.029

100 LiOP 0.633 0.176 0.631 0.155 0.628 0.120

LoOP 0.628 0.123 0.627 0.123 0.625 0.109

KK 0.615 0.014 0.614 0.014 0.614 0.014

200 LiOP 0.616 0.143 0.618 0.170 0.614 0.123

LoOP 0.613 0.113 0.613 0.099 0.610 0.042

KK 0.607 0.007 0.607 0.007 0.607 0.007

LiOP 0.599 0.599 0.599

LoOP 0.599 0.599 0.599

KK 0.599 0.599 0.599

Table 8

Means and standard deviations of LPS across Monte Carlo replications: CJ-DGP, = 1.

n c = 0, = 0 c = 0, = 0.8 c = 0.5, = 0 c = 0.5, = 0.8

Mean S.d. Mean S.d. Mean S.d. Mean S.d.

25 LiOP 0.685 0.370 0.679 0.371 0.879 0.826 0.822 0.893

LoOP 0.699 0.450 0.665 0.394 0.970 1.216 0.911 1.264

KK 0.586 0.130 0.577 0.102 0.709 0.433 0.652 0.397

50 LiOP 0.595 0.287 0.596 0.310 0.411 0.579 0.394 0.487

LoOP 0.591 0.258 0.572 0.209 0.422 0.677 0.465 0.929

KK 0.536 0.035 0.536 0.036 0.332 0.112 0.330 0.101

100 LiOP 0.561 0.314 0.553 0.277 0.321 0.398 0.328 0.452

LoOP 0.543 0.186 0.534 0.136 0.312 0.366 0.342 0.630

KK 0.517 0.015 0.517 0.016 0.299 0.020 0.299 0.022

200 LiOP 0.543 0.331 0.540 0.319 0.295 0.375 0.293 0.369

LoOP 0.523 0.166 0.515 0.083 0.278 0.238 0.293 0.414

KK 0.508 0.008 0.508 0.008 0.289 0.010 0.288 0.010

LiOP 0.500 0.500 0.251 0.250

LoOP 0.500 0.500 0.257 0.257

KK 0.500 0.500 0.280 0.279

LiOP is best when c = 0.5. However, when estimation

uncertainty is taken into account KK is clearly best, as

it was for the L-DGP.

5.3. Summary

In summary, our results indicate that for large sam-

ples of forecasts, corresponding to the known com-

bination weight case in the limit, LiOP is dominated

by KK for the L-DGP, and by LoOP for the CJ-DGP.

However, the impact of estimation uncertainty on the

rankings depends on whether the aim is to minimize

QPS or LPS. Under QPS, estimation uncertainty has a

dramatic effect on the accuracy of the KK and LoOP

combination forecasts when the sample of forecasts

is small, and in such small n cases, the LiOP com-

bination method may be expected to generate supe-

rior forecasts. However, for LPS loss KK might be

220 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

expected to be the preferred combination method

unless there are large samples of forecasts on which

the combination weights are to be estimated. The de-

terioration in the small-sample performance of LiOP

when accuracy is assessed by LPS rather than QPS

is attributable to the loss of precision from estimating

the weights using a numerical algorithm in the case of

LPS, rather than using OLS under QPS loss.

6. Empirical illustration

Our empirical illustration of the use of different

types of combinations of probability forecasts is based

on recession probability forecasting, where the reces-

sionary periods are those defned by the NBERs Busi-

ness Cycle Dating Committee.

9

Two logit forecasting

models are considered: one uses the spread or yield

curve, and the other uses average weekly hours.

10

The

usefulness of the spread for predicting US recessions

was established by Anderson and Vahid (2001), Es-

trella and Mishkin (1998), and Hamilton and Kim

(2000), and it is a component of the Conference

Boards Composite Leading Indicator (CLI). Average

weekly hours is also a component of the CLI.

11

Stock

and Watson (2003, Table 3, p. 77) found that hours was

on a par with the spread in terms of predicting output

growth at around the time of the 2001 recession.

After constructing the annual percentage change in

hours, we have monthly data from1965:01 to 2007:02.

We ran separate logit regressions of the recession in-

dicator variable on the spread, and of the recession

indicator on the annual change in hours. The estima-

tion sample began around 1965 for both models (the

precise starting point depends on the lag selected for

the leading indicator), and ended in either 1985:12

or 1995:12. For each estimation sample, the lag of

the indicator variable (either the spread or the hours

variable) is selected to maximize the model likelihood

9

See http://www.nber.org/cycles.html.

10

The spread data are the 10-year treasury constant maturity

rate (series identifer GS10) less the 3-month treasury bill at the

secondary market rate (series identifer TB3MS). The hours variable

is average weekly hours, total private industries (series identifer

AWHNONAG). The data were taken from the FRED website

http://research.stlouisfed.org/fred2.

11

See http://www.conference-board.org/economics/bci/serieslist

01.cfm. The Conference Board uses average weekly hours in

manufacturing.

value. From these estimated logit regressions, we use

the in-sample predicted recession probabilities over

this period to estimate the combination weights for

LiOP, LoOP and KK that minimize QPS. We then gen-

erate out-of-sample 1-step-ahead forecast recession

probabilities, without updating the logit model param-

eter estimates as the forecast origin is moved forward

in time (this is usually known as a fxed forecasting

scheme in the literature).

12

Using the weights esti-

mated for the in-sample predictions, the three forecast

combinations are constructed out-of-sample. The fore-

cast combinations are then evaluated out-of-sample by

QPS, and we report pairwise comparisons of equal

forecast accuracy using the modifed Diebold and

Mariano (1995) statistic of Harvey, Leybourne, and

Newbold (1997). The out-of-sample period begins in

1986:01 for the 1965 to 1985:12 estimation sample,

and in 1996:01 for the 1965 to 1995:12 estimation

sample, and runs until 2007:02 in both cases.

A possible criticism is that the out-of-sample

combination weights are calculated from in-sample

predictions rather than out-of-sample forecasts. This

could be remedied by introducing an additional data

split, so that between the current in-sample and out-

of-sample periods there is a period over which out-of-

sample forecasts are generated, which are then used to

estimate weights. However, it was felt that this would

complicate the illustration, with little gain in terms of

insight. The selected logit models are not the result

of elaborate model search/specifcation procedures

in each case we simply choose the best lag from a

maximum lag of twelve and thus there is little reason

to suppose that the in-sample fts will be very different

from their out-of-sample counterparts.

For both in-sample periods, a nine month lag was

selected for the spread, and a one month lag for hours.

Both leading indicators have a signifcant in-sample

predictive power for recessions for both in-sample

12

We also considered recursive and rolling schemes, whereby the

logit forecasting models parameters were updated as the forecast

origin was moved through the data, using either an expanding

window or fxed window of data. In both cases the combination

weights were estimated on the most recent 240 in-sample predicted

probabilities from the two models. In the case of the recursive

scheme the spread model was better than the combinations, while

for the rolling scheme the individual models and combinations were

all equally accurate, according to the Diebold-Mariano statistic.

Hence, there are no interesting differences between the various ways

of combining forecasts, so we do not report these results.

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 221

periods. We obtained pseudo-R

2

statistics of 0.288 and

0.290 for the spread, and 0.131 and 0.138 for hours,

using the measure of Estrella and Mishkin (1998).

Their pseudo-R

2

statistic is defned as:

R

2

= 1

ll

u

ll

r

2

n

ll

r

,

where ll

u

and ll

r

are the unrestricted maximised

value of the log likelihood, and the value imposing

the restriction that the slope coeffcients are zero,

respectively. In all cases we rejected the null that the

slope coeffcient (on either the spread or hours) could

be omitted.

Table 9 records the values obtained out-of-sample

for QPS using the individual indicator logit models,

as well as the LiOP, LoOP and KK combinations

of these forecasts. Of the two individual model

forecasts, the spread model is more accurate than

that using hours, matching the higher R

2

in-sample

for the spread, but combination improves upon the

best individual set of forecasts, with KK performing

markedly better than LiOP and LoOP in both forecast

periods. Table 10 indicates that the spread model

forecasts are statistically signifcantly more accurate

than those of the hours model, at the 1% level for

the forecast period 1986:01 to 2007:02, and at the

10% level for the shorter forecast period. Statistical

signifcance is assessed by the modifed Diebold-

Mariano statistic of the null of equal accuracy assessed

by QPS (see Diebold & Mariano, 1995; Harvey et al.,

1997).

13

The KK forecast combination is signifcantly

more accurate than either LiOP or LoOP at all levels

of signifcance for the second forecast period, and at

the 10% level for the frst forecast period. This result

is consistent with the simulation fndings, given that

the combination weights are estimated using samples

of size in excess of n = 200.

Since recessionary periods, as defned by the

NBER, are relatively rare events (there was only one

recession during our second forecast period), one way

of assessing the economic signifcance of our fndings

is to examine the forecast performance of the individ-

ual models and the best combination model (KK) at

13

Our setting satisfes the standard assumptions for the Diebold-

Mariano statistic to be valid: although the variable being forecast

is binary, the forecast error is continuous because the forecast

probability is continuous.

Table 9

QPS for out-of-sample recession probability forecasts.

Forecast

model/combination

1986:012007:02 1996:012007:02

Spread 0.087 0.073

Hours 0.108 0.093

LiOP 0.082 0.067

LoOP 0.084 0.071

KK 0.075 0.056

Notes: For the frst forecast period 1986:012007:02, the

combination weights are estimated from 240 in-sample predicted

probabilities, while for the second forecast period 1996:012007:02

there are around 360 data points.

these times. During the recession at the beginning of

the decade, the average probability of recession for the

model using hours was only 0.255, while that for the

spread was 0.410. The KK combination returned an

average forecast of 0.462.

7. Conclusions

Forecasts of economic and fnancial variables

which take the form of probabilities are becoming in-

creasingly common. As there is an extensive body of

literature in economic and management science sug-

gesting that forecast combination can improve on the

best individual forecast, we consider ways of com-

bining probability forecasts. For probability forecasts,

the justifcation for considering linear combinations is

weaker than in the case of standard point forecasts,

and we consider three combination schemes, one of

which is linear combination. When the loss function

is given by QPS, our simulation results indicate that

linear combination may work reasonably well when

the optimal combination weights are estimated from

a small sample of forecasts, but for moderate sample

sizes, combinations such as those proposed by Kam-

stra and Kennedy (1998) are likely to prove superior.

Moreover, when the loss function is given by LPS, our

results suggest that there is little to recommend linear

combination, particularly when we allow for estima-

tion uncertainty by having small or moderately sized

samples of forecasts on which to estimate the combi-

nation weights.

We present an empirical illustration based on com-

bining US recession probability forecasts from two

single leading indicator logit models. The Kamstra-

Kennedy combination is found to be more accurate

222 M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223

Table 10

Tests for equal QPS-forecast accuracy.

1986:012007:02 1996:012007:02

Test stat. p-value Test stat. p-value

Spread & Hours 2.89 0.002 1.43 0.077

Spread & LiOP 3.96 1.000 2.99 0.998

Spread & LoOP 4.73 1.000 1.97 0.975

Spread & KK 2.50 0.998 6.55 1.000

LiOP & KK 1.36 0.932 5.02 1.000

LoOP & KK 1.90 0.985 8.28 1.000

LiOP & LoOP 2.72 0.004 3.01 0.001

Notes: The test statistic is the modifed Diebold-Mariano statistic of the null hypothesis of equal accuracy, assessed by QPS. For x & y, a

p-value of less than 0.05 indicates rejection of the null hypothesis in favour of x being more accurate at the 5% level, and a p-value greater

than 0.95 indicates rejection of the null hypothesis in favour of y being more accurate at the 5% level.

than both the individual forecasts and the other types

of combinations we consider, including linear combi-

nation. Given that we have large samples of forecasts

on which to estimate the combination parameters for

the different ways of combining forecasts, the fnding

that the Kamstra-Kennedy combination fares best is

consistent with our simulation fndings.

For standard point forecasts, where the literature

focuses almost exclusively on linear combinations of

forecasts and squared error loss, the notion of forecast

encompassing is well-defned, and is a useful test of

predictive accuracy to be reported alongside related

tests, such as tests of whether two sets of forecasts

are equally accurate (e.g., Diebold & Mariano, 1995).

We have shown that for probability forecasts there

are a number of types of combination that might

be considered, and that forecast encompassing may

hold for one type of combination but not another.

Thus, while probability forecast encompassing tests

can still be conducted in a linear combination setting

(see Clements & Harvey, in press), when a broader

range of combination methods is allowed, the notion

of forecast encompassing appears to be less useful,

due to the dependence on the form of the combination.

For this reason we have focused mainly on the relative

accuracies of the different types of combination,

paying particular attention to the need to estimate

combination weights using what may, on occasion, be

relatively small samples of forecasts.

Acknowledgements

We are grateful to Graham Elliott and an anony-

mous referee for helpful comments.

References

Anderson, H. M., & Vahid, F. (2001). Predicting the probability

of a recession with nonlinear autoregressive leading indicator

models. Macroeconomic Dynamics, 5, 482505.

Bates, J. M., & Granger, C. W. J. (1969). The combination of fore-

casts. Operations Research Quarterly, 20, 451468. Reprinted

in T.C. Mills (ed.), Economic forecasting: The international

library of critical writings in economics. Cheltenham: Edward

Elgar, 1999.

Brier, G. W. (1950). Verifcation of forecasts expressed in terms of

probability. Monthly Weather Review, 78, 13.

Chong, Y. Y., & Hendry, D. F. (1986). Econometric evaluation of

linear macro-economic models. Review of Economic Studies,

53, 671690. Reprinted in C.W.J.Granger (ed.), Modelling

economic series. Oxford: Clarendon Press, 1990.

Clark, T. E., & McCracken, M. W. (2001). Tests of equal forecast

accuracy and encompassing for nested models. Journal of

Econometrics, 105, 85110.

Clemen, R. T. (1989). Combining forecasts: A review and anno-

tated bibliography. International Journal of Forecasting, 5,

559583. Reprinted in: T.C. Mills (ed.), Economic forecasting:

The international library of critical writings in economics.

Cheltenham: Edward Elgar, 1999.

Clemen, R. T., & Winkler, R. L. (1999). Combining probability

distributions from experts in risk analysis. Risk Analysis, 19,

187203.

Clements, M. P., & Harvey, D. I. (2009). Forecast combination and

encompassing. In T. C. Mills, & K. Patterson (Eds.), Palgrave

handbook of econometrics, volume 2: Applied econometrics

(pp. 169198). Basingstoke: Palgrave MacMillan.

Clements, M. P., & Harvey, D. I. (in press). Forecast encompassing

tests and probability forecasts. Journal of Applied Econometrics.

Cook, R. D., & Johnson, M. E. (1981). A family of distributions for

modelling non-elliptically symmetric multivariate data. Journal

of the Royal Statistical Society, Series B, 43, 210218.

Dawid, A. P. (1986). Probability forecasting. In S. Kotz, N. L.

Johnson, & C. B. Read (Eds.), Encyclopedia of Statistical

Sciences: vol. 7 (pp. 210218). John Wiley & Sons.

M.P. Clements, D.I. Harvey / International Journal of Forecasting 27 (2011) 208223 223

Deutsch, M., Granger, C. W. J., & Ter asvirta, T. (1994). The

combination of forecasts using changing weights. International

Journal of Forecasting, 10, 4757.

Diebold, F. X., & Lopez, J. A. (1996). Forecast evaluation and

combination. In G. S. Maddala, & C. R. Rao (Eds.), Handbook

of statistics: vol. 14 (pp. 241268). Amsterdam: North-Holland.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive

accuracy. Journal of Business and Economic Statistics, 13,

253263. Reprinted in T.C. Mills (ed.), Economic forecasting:

The international library of critical writings in economics.

Cheltenham: Edward Elgar, 1999.

Diebold, F. X., & Rudebusch, G. D. (1989). Scoring the leading

indicators. Journal of Business, 62, 369391.

Elliott, G., & Timmermann, A. (2004). Optimal forecast com-

binations under general loss functions and forecast error

distributions. Journal of Econometrics, 122, 4779.

Estrella, A., & Mishkin, F. S. (1998). Predicting US recessions:

Financial variables as leading indicators. Review of Economics

and Statistics, 80, 4561.

Fair, R. C., & Shiller, R. J. (1990). Comparing information in fore-

casts from econometric models. American Economic Review,

80, 3950.

Genest, C., & Zidek, J. V. (1986). Combining probability distri-

butions: A critique and an annotated bibliography. Statistical

Science, 1, 114148.

Good, I. (1952). Rational decisions. Journal of the Royal Statistical

Society, Series B, 14(1), 107114.

Granger, C. W. J., & Ramanathan, R. (1984). Improved methods of

combining forecasts. Journal of Forecasting, 3, 197204.

Hamilton, J. D., & Kim, D. H. 2000. A re-examination of the

predictability of economic activity using the yield spread.

NBER working papers, 7954.

Harvey, D. I., Leybourne, S., & Newbold, P. (1997). Testing

the equality of prediction mean squared errors. International

Journal of Forecasting, 13, 281291.

Harvey, D. I., Leybourne, S., & Newbold, P. (1998). Tests for

forecast encompassing. Journal of Business and Economic

Statistics, 16, 254259. Reprinted in T.C. Mills (ed.), Economic

forecasting: The international library of critical writings in

economics. Cheltenham: Edward Elgar, 1999.

Harvey, D. I., & Newbold, P. (2000). Tests for multiple forecast

encompassing. Journal of Applied Econometrics, 15, 471482.

Hendry, D. F., & Clements, M. P. (2004). Pooling of forecasts. The

Econometrics Journal, 7, 131.

Kamstra, M., & Kennedy, P. (1998). Combining qualitative fore-

casts using logit. International Journal of Forecasting, 14,

8393.

Newbold, P., & Granger, C. W. J. (1974). Experience with fore-

casting univariate time series and the combination of forecasts.

Journal of the Royal Statistical Society, Series A, 137, 131146.

Reprinted in T.C. Mills (ed.), Economic forecasting: The inter-

national library of critical writings in economics. Cheltenham:

Edward Elgar, 1999.

Newbold, P., & Harvey, D. I. (2002). Forecast combination and

encompassing. In M. P. Clements, & D. F. Hendry (Eds.), A

Companion to Economic Forecasting (pp. 268283). Oxford:

Blackwells.

Stock, J. H., & Watson, M. W. (1999). A comparison of linear and

nonlinear univariate models for forecasting macroeconomic

time series. In R. F. Engle, & H. White (Eds.), Cointegration,

causality and forecasting: A festschrift in honour of Clive

Granger (pp. 144). Oxford: Oxford University Press.

Stock, J. H., & Watson, M. W. (2003). How did leading indicator

forecasts perform during the 2001 recession? Federal Reserve

Bank of Richmond, Economic Quarterly, 89(3), 7190.

Timmermann, A. (2006). Forecast combinations. In G. Elliott, C.

Granger, & A. Timmermann (Eds.), Handbook of economic

forecasting, vol. 1. Handbooks in economics, 24 (pp. 135196).

North-Holland: Elsevier.

West, K. D. (1996). Asymptotic inference about predictive ability.

Econometrica, 64, 10671084.

West, K. D. (2001). Tests for forecast encompassing when forecasts

depend on estimated regression parameters. Journal of Business

and Economic Statistics, 19, 2933.

West, K. D., & McCracken, M. W. (1998). Regression-based

tests of predictive ability. International Economic Review, 39,

817840.

Winkler, R. L. (1996). Scoring rules and the evaluation of

probabilities (with discussion). Test, 5(1), 160.

You might also like

- Bayer. (2018) - Combining Value-At-Risk Forecasts Using Penalized Quantile RegressionsDocument22 pagesBayer. (2018) - Combining Value-At-Risk Forecasts Using Penalized Quantile RegressionsFida Fathiyah AddiniNo ratings yet

- GEOvolDocument27 pagesGEOvolDevashish SharmaNo ratings yet

- Christoffersen (1998)Document28 pagesChristoffersen (1998)Victor RoosNo ratings yet

- Testing Forecast Optimality Under Unknown Loss: July 2006Document35 pagesTesting Forecast Optimality Under Unknown Loss: July 2006Raphael AmoahNo ratings yet

- GMM and OLS Estimation and Inference For New Keynesian Phillips CurveDocument26 pagesGMM and OLS Estimation and Inference For New Keynesian Phillips CurveQuang Kien TaNo ratings yet

- Forecasting Volatilities of Corn Futures at Distant HorizonsDocument20 pagesForecasting Volatilities of Corn Futures at Distant HorizonsMisterTea EarlGreyNo ratings yet

- A New Approach For Evaluating Economic Forecasts: Tara M. SinclairDocument13 pagesA New Approach For Evaluating Economic Forecasts: Tara M. SinclairKim-Bich LongNo ratings yet

- (Quantitative Applications in The Social Sciences) Dr. Charles W. Ostrom - Time Series Analysis - Regression Techniques-Sage Publications, Inc (1990)Document29 pages(Quantitative Applications in The Social Sciences) Dr. Charles W. Ostrom - Time Series Analysis - Regression Techniques-Sage Publications, Inc (1990)Tornike ChivadzeNo ratings yet

- Back PDFDocument36 pagesBack PDFrzrt rt r tzrNo ratings yet

- On The Forecast Combination Puzzle: EconometricsDocument26 pagesOn The Forecast Combination Puzzle: EconometricsRafsan SiddiquiNo ratings yet

- Thomacos SeminarDocument30 pagesThomacos SeminarLuiz VelosoNo ratings yet

- How To Estimate Long-Run Relationships in EconomicsDocument13 pagesHow To Estimate Long-Run Relationships in EconomicsrunawayyyNo ratings yet

- Hand : Assessing Error Rate Estimators: The Leave-One-Out Method ReconsideredDocument12 pagesHand : Assessing Error Rate Estimators: The Leave-One-Out Method ReconsideredMohammad TaheriNo ratings yet

- The Relationship Between Risk and Expected Return in Europe: Ángel León (University of Alicante)Document33 pagesThe Relationship Between Risk and Expected Return in Europe: Ángel León (University of Alicante)Rym CharefNo ratings yet

- Object Risk Position Paper Mixture Models in Operational RiskDocument5 pagesObject Risk Position Paper Mixture Models in Operational RiskAlexandre MarinhoNo ratings yet

- Christoffersen &diebold - Cointegration and Long Horizon ForecastingDocument29 pagesChristoffersen &diebold - Cointegration and Long Horizon Forecastingkhrysttalexa3146No ratings yet

- 10.8 Loukia Meligkotsidoua Ekaterini Panopoiloi - A Quantile Regression Approach To Equity Premium PredictionDocument48 pages10.8 Loukia Meligkotsidoua Ekaterini Panopoiloi - A Quantile Regression Approach To Equity Premium PredictionPeterNo ratings yet

- FferDocument6 pagesFferlhzNo ratings yet

- Econometrics 06 00007 v2Document27 pagesEconometrics 06 00007 v2Adis SalkicNo ratings yet

- Versao Final 25 07 2017 InglesDocument14 pagesVersao Final 25 07 2017 InglesFrancisco SilvaNo ratings yet