Professional Documents

Culture Documents

ACI Financial Analysis

Uploaded by

Mollah Md NaimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACI Financial Analysis

Uploaded by

Mollah Md NaimCopyright:

Available Formats

Parvez M Chowdhury

(880) 174 167 4023; parvez@bracepl.com

ACI Limited

January 2010

Company Summary 52-week Price Range (BDT) Current Price 12-month Target Price Dividend Yield Total Return Number of Shares MM Market Cap BDT MM BDT MM Revenue Ops Income Net Income Margins Gross Margin Operating Margin Net Margin Growth Revenue Growth Operating Income Growth Net Income Growth Per Share EPS Dividend Book Value/Share Cashflow BDT MM Operating Capex Dividend Valuation P/E P/B ROE Miscellaneous BDT MM Total Debt Cash Debt/Equity

600

Rating: SECTOR PERFORM Target Price: BDT 675

370 - 548.8 509.7 675 2% 17% 19.4 9,890.2 2008A 2009E 2010E 10,341.4 11,050.6 13,632.4 947.5 1,001.0 1,239.2 932.9 784.7 465.4 2008A 30% 9% 9% 2008A 80% 55% 156% 2008A 48.08 10.00 144.92 2009E 29% 9% 7% 2009E 7% 6% -16% 2009E 40.44 10.00 175.36 2010E 29% 9% 3% 2010E 23% 24% -41% 2010E 23.98 10.00 189.34 2010E 1,114.9 -679.5 -194.0 2010E 21.3x 2.7x 13% 2010E 5,729.5 144.3 156%

1200000

ACI Limited is one of the largest and most recognized pharmaceuticals manufacturing companies in Bangladesh. Maintaining the legacy of its predecessor company British ICI, ACI has good manufacturing practices and technical leadership in its flagship pharmaceuticals business. However, the company has expanded its business beyond pharmaceuticals encompassing agro-chemical, animal health, agromachinery, consumer brands and retail chains. Since the company has been expanding its business horizon rather aggressively for the last few years, ACI has found itself in a cash crunch, which ultimately led the company to resort to a fair bit of leverage. Despite cash constraint, ACI is one of the more consistent dividend paying companies in the local market. We initiate our coverage of ACI Limited with a Sector Perform rating and a 12-month target price of BDT 675. Our recommendation considers the superior revenue generating ability of pharma business and the growth potential of ACIs agro-chemical business whose merits are somewhat counteracted by the expansion into consumer brands and retail chain business. Our price target is based on a P/E ratio of 18x expected 2011 EPS of BDT 39.44 and 3.0x expected 2011 book value of BDT 222.03. We believe that despite its upside potential, significant risk remains because of ACIs over-leverage and over-extension. Our target price is predicated upon ACI being able to improve its cash position by issuance of zero-coupon bonds, improvement of the retail business or outright divestment, and making sizable profit on its consumer item (salt, flour) businesses. Table 1: Performance Snapshot

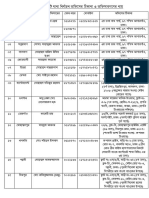

2006 Sales YoY Growth Operating Income Operating Margin Net Income YoY Growth Net Margin Dividend/Share Total Debt Total Assets Debt/Asset Debt/Equity BDT MM BDT MM BDT MM BDT MM BDT MM BDT 4,237.9 27% 452.6 33% 139.7 3% 3% 6.00 1,776.0 3,716.3 61% 146% 2007 5,756.8 36% 609.7 35% 364.2 161% 6% 8.50 3,024.0 5,911.9 64% 168% 2008 10,341.4 80% 947.5 55% 932.9 156% 9% 10.00 4,944.8 9,409.3 66% 176% 2009E 11,050.6 7% 1,001.0 6% 784.7 -16% 7% 10.00 5,259.9 10,392.9 63% 155% 2010E 13,632.4 23% 1,239.2 24% 465.4 -41% 3% 10.00 5,729.5 11,435.8 63% 156% 2011E 16,139.4 18% 1,639.1 32% 774.8 66% 5% 10.00 5,029.5 11,533.0 56% 117%

2008A 2009E -1,514.2 578.4 -1,212.1 -1,500.0 -161.7 -194.0 2008A 10.6x 3.5x 33% 2008A 4,944.8 233.8 176% 2009E 12.6x 2.9x 23% 2009E 5,259.9 -566.8 155%

12-month Price Performance

500

1000000

400

800000

300

600000

200

400000

100

200000

Source: Company Annual Reports

Volume Close

ACI Limited (DSE, CSE: ACI)

Business Advanced Chemical Industries Limited (ACI) is a leading and fast growing pharmaceutical industry in Bangladesh which was incorporated when ICI Plc of UK had sold their pharmaceutical business in 1992. At that time the name of the Company was changed to ACI Limited. ACI inherited the rich ICI culture of product quality, customer service and social responsibility and continues to nurture. ACI is the first company in Bangladesh to obtain certification of ISO 9001 Quality Management System in 1995. ACI is also the first Company in Bangladesh to get certification of ISO 14001 Environmental Management System in 2000. In what was primarily a Pharmaceutical business in 1992 with a turnover of Tk.80 million with stagnant growth, the new management brought about fundamental changes in policies and has in the year 2005 grown to over Tk. 3413.05 million in turnover through diversified business interest including personal care products, food products, animal health, agrochemicals and seeds in addition to gaining a strong position in Pharmaceuticals. ACI represents principals like AstraZeneca, UCB, Searle and Fujisawa in Pharmaceuticals business; Colgate-Palmolive, Heinz & Dabur in Consumer Products sector; Syngenta in Agrochemicals; Ranbaxy, Dabur, Wockhardt, Sanofi and Invesa in Animal Health sector. Industry One of the fastest growing sectors with an annual average growth rate of 14-16%, Bangladeshs pharmaceutical industry contributes to almost 1.3% of GDP. The market size was around BDT 39.0 billion in 2007. Local companies and MNCs together meet 95% of the countrys drug demand but the local manufacturers dominate the industry; they enjoy approximately 87% of market share, while multinationals hold a 13% share. Another notable feature of this sector is the concentration of sales among a very small number of top companies. The top 15 players or 6% of the manufacturers control around 73% of the market share. Given the country's lack of spending power, the pharmaceutical market remains tiny in comparison with the population size. Pharmaceutical spending is amongst the lowest in the world in per capita terms. Healthcare expenditures consist of only 3.4% of GDP. However, the increased awareness of healthcare and the governments increased expenditure in this sector is causing the demand to increase in this sector. Growth and margins ACI has been enjoying formidable growth in sales with a 4-year CAGR of 33%. Operating profit growth also remains respectable. Net profit growth, however, is not so impressive. ACI witnessed a large jump in net profit growth in the last Table 2 and 3: Growth and Margin couple of years (161% in 2007 and 156% in 2008). These abnormal growths were a direct 2006 2007 2008 2009 2010 2011 Sales growth 27% 36% 80% 7% 23% 18% result of profit from sale of shares and Operating profit growth 33% 35% 55% 6% 24% 32% investments. Since these extra-ordinary items Net profit growth 3% 161% 156% -16% -41% 66% are unlikely to be recurring in the future, we estimate the net profit growth will become 2006 2007 2008 2009 2010 2011 negative for 2009 and 2010 which already look Gross Margin 35% 35% 30% 29% 29% 29% to be a testing period for the company. The Operating Margin 11% 11% 9% 9% 9% 10% profit growth rates took a hit as the company Net Margin 3% 6% 9% 7% 3% 5% expanded aggressively to consumer brands and retail business. However, we expect the profit Source: Company Annual Reports and BRAC EPL Estimates

ACI Limited (DSE, CSE: ACI)

growth to return to positive from 2011 when these segments start to produce profit themselves. ACIs margins have been consistent and we expect them to remain similar for a while. Outlook for 2009 From its recently published 3Q09 report, 2009 does not seem to be a very good year for ACI. Although consolidated revenue increased by 15% from BDT 7,378.9mn in 3Q08 to 8,466.4mn in 3Q09, gross profit increased by only 9% from BDT 2,261.7mn to 2,468.5mn. Net profit increased from BDT 256.0mn in 3Q08 to 437.4mn in 3Q09. However, if extraordinary income of BDT 512.8mn from sale of share is removed, profit before taxes becomes close to zero for the first three quarters of 2009. It appears that ACI is achieving its sales growth mostly from high volume low margin retail business lines. The company is rapidly growing its food, salt, flour and logistics business by committing management resources and large amount of capital. Although these are only the beginning years for these businesses with initial high capital outlays and operating expenses, the low gross margins do not foretell of very high profits in the future. Higher leverage and worsening cash situation ACI continued increasing its leverage through 2008 and the first nine months of 2009. Current total debt is over BDT 4.5 billion, which is about 50% higher than that in end-2007. Current debt to equity ratio is about 150%. Increase in debt, especially short-term debt occurred mainly because of higher working capital requirements. Since year-end 2007, ACIs non-cash working capital increased by 80% by the end of 2008 and by 140% by the end of 3Q09. Most of this increase in working capital has been financed by short-term debt. Since the end of 2007, bank overdraft and short-term bank loan increased by 70%. ACI plans to increase the number of retail stores from 12 at the beginning of this year to 125 by 2010. This would require further increase in working capital. Higher short-term debt has significantly increased ACIs financing costs. ACI paid BDT 220.5mn in financing cost for all of 2007. Financing costs during the nine months in 2009 is close to BDT 450.0mn. It appears as if ACI is borrowing short-term debt only to meet its interest expense. Currently ACI is in a negative cash position of BDT 3.5 billion (excluding long-term debt), compared to -4.0 billion in end 2008. A welcome respite in cash crunch came from the divestment of ACI Formulations shares. Since ACI separately listed ACI Formulations in 2008, it has sold 35% of the total shares for a total of BDT 1,350 million. It may prove desirable if not necessary for ACI to divest from some other businesses, especially unrelated retail businesses that need to be decoupled from the pharma and chemicals businesses. A still attractive company, but needs clear direction ACIs Pharma business is still growing at a steady pace and is very profitable. Compared to an industry average of about 45%, ACI pharma achieved a gross margin of over 50% last year and 56% YTD 2009. It is investing heavily in novelty drugs such as anti-cancer, respiratory drugs and metered dose inhalers. In a market with strong pharmaceuticals manufacturers and almost no local producer of raw materials, ACI has a heads up through its investment in novel drug delivery systems (NDDS). In the separate but related business of agrichemicals, ACI has correctly identified the need for producing and marketing high value-adding agro-supplies such as pesticides and nutrients. With a growing population, limited land and increasing demand for high-value food, demand for agroinput will continue to grow. The gross margins from this business segment is similar to pharmaceuticals. ACIs justification for expanding into the retail consumer market is not too convincing. Although it is a fact that huge inefficiency remains in this market, ACI is not the best placed company to take

ACI Limited (DSE, CSE: ACI)

advantage of this inefficiency. Already there are a number of contenders for the high-end and organized grocery market. It is a far-fetched plan that ACI would source the supplies for its chainstores from the farmers that use its agro-nutrients. There is a likelihood that ACI would be able to get this business off the ground and break-even in the next couple of years, but it would not be as profitable as that of the core pharma and chemicals business. We believe that despite the challenges, ACI is a potentially good investment. In Bangladesh, there are not many professional management teams that investors can bet on. ACI has the legacy of a multinational management culture, a sound product line in pharma and chemicals, and a vision about improvement in demographics and in commercial farming. We believe with the offering of the zero-coupon bonds, ACI has taken the right step towards improving its business fundamentals. Before any new investment in ACI, it needs to be seen how well they execute the retail consumer item business. Improving cash position - ACI 20% Convertible Zero Coupon Bonds ACI has finalized the pricing of its convertible zero-coupon bonds. A total of 1.3 million of bonds would be offered (60% private placement, 40% public offer) at a face value of BDT 1,000 each, for a face value of BDT 1.34 billion and an issue value of BDT 1.0 billion. The bonds will mature in five years with an implied interest rate of 10.5%. Five bonds in a lot will have five different maturity dates at the end of each year and one bond from a lot will mature at the end of each year. At maturity of each respective bond, repayment will be made with 80% in cash and 20% in ordinary common shares. The conversion price at each maturity date would be 110% of the book value at the date of the last audited financial statement. The zero-coupon bond goes a long way to finance fixed capital needs, repay some of the shortterm debt and plug working capital needs. The implied interest rate (10.5%) is fairly low compared to what ACI has been paying (in excess of 14%). All these come at a price which is dilution of shares. However, Total dilution over a period of five years is less than 5%. This is a good deal for ACI. With such cash constraints, ACI is better advised to stop cash dividend and retain cash instead. That does not seem likely because of a large family holding and for the likely effect on stock prices. Outlook for various business segments Pharmaceuticals: Pharmaceuticals still constitutes the largest (24% of revenue) and most profitable business segment for ACI Limited. ACI achieved over 30% growth in the pharma segment in the last four years and lifted itself to 6th in ranking by revenue among pharma manufacturers in the country, compared to 9th position in 2007. During this time of growth, ACI maintained and improved its profitability. Compared to an average of 45% for the listed pharmaceutical companies, ACI managed over 48% gross margin in the last four years. ACI has a wide range of pharma products that includes legacy ACI brands as well as products from global manufacturers such as xx and xx. The company has a wide range of products in antibiotics, gastro-intestinal and cardiovascular classes as well as vitamin and mineral supplements and respiratory products. ACI has launched 43 new products and has been adding new respiratory and anesthetic products. The company plans to derive further growth from novelty products such as metered dose inhalers (MDI). The new MDI product line was launched in late 2009. The company also produces novel drug delivery systems (NDDS) which it uses for its own consumption as well as sells to other manufacturers. Although export sales increased over 70%, this is still a small source of sales and does not significantly impact total revenue. We expect the pharma division to continue its growth and profitability. Because of its expansion programs and introduction of new lines and products, we

ACI Limited (DSE, CSE: ACI)

estimate the pharma segment to grow at a rate of 25% over the near-term. We also expect this segment to maintain a high gross margin. Consumer brands: ACIs consumer brand segment (18% of revenue) has performed as a high volume profitable business in the past. This was mainly because of its commanding market share and excellent name recognition in some of its household hygiene and cleaning products. ACIs aerosol insect spray has remained a ubiquitous household product for the last 30 years without any competition. The Savlon brand is universally recognized as a potent antiseptic liquid. Savlon liquid and antiseptic crme do not face any material competition in the antiseptic product market. Both aerosol spray and Savlon command over 70% of the market share in their respective markets. ACI has complemented such brand names with other personal hygiene and household cleaning product. The consumer brand segment has achieved over 25% sales growth over the last four years, albeit with a thin gross margin of about 23%. We expect these levels to continue in growth and margin for the consumer brands. Agribusiness and Animal health: Animal health is a part of ACIs agribusiness division, part of which has been divested with the listing of ACI Formulations. This segment constitutes about 20% of the total revenue. While the seeds, fertilizer and cropex are high-volume low-margin businesses, certain parts of the business such as animal health generate a healthy gross margin (about 40%). This segment gives the company an exposure to the ever-expanding and rapidly commercializing agriculture sector in Bangladesh, especially in dairy, poultry and aquaculture industries. As a low-income country, Bangladesh still has a low per capita protein intake. Traditionally, protein needs of the country have largely been met by homestead-based livestock farming and natural sources such as riverfish, as well as vegetable protein. However, with a growing middle class, demand for animal protein is growing rapidly. ACI produces feed for dairy, poultry and aqua farming as well as manufactures vaccines. The growth potential for this business is huge as commercial farmers get used to standard feed and vaccines. However, the industry itself is on weak grounds as farmers cope with a number of adverse business conditions such as the outbreak of the avian-flu. The seed and fertilizer businesses are also affected by the governments agro-input distribution policies, which change based on macroeconomic conditions and election cycles. Consequently, we expect ACIs agribusiness to continue to grow at an uneven pace. ACI Food, ACI Salt and ACI Pure Flour: These are ACIs high volume low margin businesses that were launched in the last two years. They constitute about 20% of the revenue but less than 10% of the gross profit. Through these three segments, ACI serves the retail food market in spices, other food-ingredients, salt and flour. The retail food market in the country is highly fragmented where many different processors, especially no-name small companies operate. As there is no clear volume or quality leadership in this market, it is possible that one or more brands will eventually dominate this market. However, that is a long-time quest for somebody else and it is not clear why a specialist pharmaceuticals and chemical products company that is completely inexperienced in retail food products decided to pursue this market. While ACI boasts of high growth and brand name recognition, these businesses did little to the bottom line except padding up revenue and making an aggregate loss of about BDT 100Mn in 2008.

ACI Limited (DSE, CSE: ACI)

ACI Logistics: ACI logistics is another of the companys new and highly ambitious but unrelated businesses. ACI logistics is in the business of owning and operating neighborhood retail stores. It would be competing with two other successful local retail chains in the urban areas, namely Agora and Nandon, each with about 30 stores. These chains are targeted at affluent urban centers and are limited to the two major cities in the country. Although the concept is new in the country, these two and other smaller chains have gained a foothold as suppliers of standard, higher quality grocery and other food products at a clean environment and fixed price. However, the target market of high middle class consumers is small with a limited growth. ACI states that it has a separate clientele in mind for its chain Swapno, namely the middle class who aspires for the same services but are not willing to pay high prices. Consequently, Swapno has targeted less affluent neighborhoods with low-rent smaller stores. ACI management correctly points out that in the grocery market, there exists a huge supply chain inefficiency. There is a large gap between the price received by the grower and the price paid by the end-buyer. Also, significant improvements can be made by standardizing the farming, contracting, procurement and transportation practices. While that part is true, ACIs plans to capture the retail grocery market is surprisingly unrealistic. It initially planned to open up to 125 stores by 2010 from a base of 12 in 2008. It lined up a syndicated loan of BDT 125.0mn to finance the fixed cost for the stores. However, the challenges of such rapid growth such as logistics, working capital financing and management of individual stores caught up and the company has trimmed its growth to a total of 60 stores in the first year. Initially, the toughest challenge appears to be financing the initial fixed cost of opening the stores as well as meeting the huge working capital requirement of stoking the stores. ACI Motors and other segments: ACI motors is in the business of sales and distribution of agro-machinery and light commercial vehicles, mostly Indian brands. This is another way for ACI to take an exposure in the commercial farming industry. With a very low capital intensity in the agricultural sector in Bangladesh and a demand to quickly increase productivity, this business is expected to grow in the future. However, until recently this segment has proved to be another high-volume low-margin business for ACI. Until the associated spare parts, service and other high value-added products are added, this business would continue to remain low-margin.

ACI Limited (DSE, CSE: ACI)

Valuation We made several assumptions to determine a fair value for ACI

ACI completes the convertible zero-coupon bond transaction by early 2010 Gross margin for the pharma and agro-chemicals segment remain high and then levels off to the industry average in the longer terms Gross margin for the consumer and retail segments stabilize at the 20% level Selling, general and operating costs accelerates because of expansion of the consumer and retail items during the initial years; expense growth rate slows down in the later years when the retail businesses mature ACI pays off its short term debts first and maintains a D/E ratio of about 30%.

Table 4, 5 and 6: Valuation

Discounted FCF Operating Cash Capital Expendture Change in Debt Net Terminal Value Terminal Value Terminal Debt Net free cash flow Discount Rate Terminal Growth Rate 15.0% 9.00% -606,540,327 905,091,401 64,048,280 NPV NPV/Share -60,150,210 11,050,450,933 569.49 65,183,313 2008 2009 2010 2011 2012 2013 2014 2015

578,368,698 1,114,949,068 1,231,726,511 1,410,844,831 1,690,114,889 1,788,059,630 1,967,010,983 -1,500,000,000 315,090,975 -606,540,327 -679,457,053 469,599,385 905,091,401 -467,678,231 64,048,280 -400,178,280 -60,150,210 -424,931,576 -451,216,003 -200,000,000 -479,126,271 -200,000,000 21,037,902,697 23,396,572,260 2,358,669,563 1,136,843,627 22,325,787,409 -700,000,000 -1,070,816,761 -1,200,000,000

65,183,313 1,136,843,627 1,287,884,712

Source: BRAC EPL Estimates Other Pharmaceuticals Square Pharmaceuticals Beximco Pharmaceuticals Renata Reckitt Benckiser GlaxoSmithKline Average ACI Source: BRAC EPL Estimates Price 2008 EPS 2938.25 125.25 164.71 3.61 9970.25 303.37 1252.31 35.05 640.21 11.87 428.81 18.16 P/E 23.46 45.63 32.86 35.73 53.94 38.32 23.62 BVPS 659.32 69.14 438.37 92.46 75.72 144.92 P/B 4.46 2.38 22.74 13.54 8.45 10.32 2.96 ACI valuation 2011 estimates Multiple Target price EPS 39.41 18.0 709.40 BVPS 222.03 3.0 666.08

We believe 2009 and 2010 will continue to be transition years for ACI and would not reflect its real earnings potential. Based on 2011 earnings and book value, and a 18x P/E and 3.0x P/B, we derive a target price of BDT 675 in 2011. With an average 2.0% dividend yield, this price target would provide a 17% total return in 12 months.

ACI Limited (DSE, CSE: ACI)

Table 7: Income Statement

2006 Revenue Cost of sales Gross profit Admisnistrative expenses Distribution expenses Selling expenses Operating profit Other income Result From opeating activities Profit from sale of shares Share of Profit equity accounted investees EBIT Financing cost Provision for contribution to WPPF Profit before tax Income tax expenses: Current tax expense Deferred tax income Profit after tax Earning per share (adjusted for current number) Source: Company Annual Reports and BRAC EPL Estimates 165.6 14.9 139.7 7.20 177.6 15.7 364.2 18.77 194.6 32.8 932.9 48.08 103.1 0.0 784.7 40.44 176.5 0.0 465.4 23.98 293.9 0.0 774.8 39.41 4,237.9 2,770.6 1,467.2 119.0 193.3 702.2 452.6 56.1 508.7 0.0 37.0 471.7 163.7 308.0 17.7 290.4 2007 5,756.8 3,749.1 2,007.7 171.1 252.4 974.5 609.7 83.2 692.9 86.2 3.8 775.3 220.5 554.7 28.6 526.1 2008 10,341.4 7,289.4 3,052.0 321.8 277.1 1,505.7 947.5 68.1 1,015.6 639.3 0.9 1,654.0 523.8 1,130.2 35.5 1,094.6 2009E 11,050.6 7,839.5 3,211.2 331.5 331.5 1,547.1 1,001.0 63.5 1,064.5 512.8 0.0 1,577.3 642.8 934.5 46.7 887.8 2010E 13,632.4 9,734.9 3,897.5 409.0 409.0 1,840.4 1,239.2 67.7 1,306.9 0.0 0.0 1,306.9 631.2 675.7 33.8 641.9 2011E 16,139.4 11,433.8 4,705.6 484.2 484.2 2,098.1 1,639.1 70.6 1,709.7 0.0 0.0 1,709.7 584.7 1,125.0 56.3 1,068.8

Table 8: Cash Flow Statement

2006 Operating Activity Net Income Add back non cash expense Change in working capital Cash Flow from operations Investing Activity Capital Expenditure Cash Flow from Investing Financing Acitivity Change in Debt Newly issued shares Dividend Paid Cash flow from Financing Net cash Beginning Balance Cash Balance Operating cash flow per share Source: Company Annual Reports and BRAC EPL Estimates 154.6 107.2 983.7 1,090.9 3.94 1,008.1 -112.9 1,090.9 978.0 -21.23 965.0 -744.2 978.0 233.8 -78.04 315.1 0.0 -194.0 121.1 -800.6 233.8 -566.8 29.81 469.6 0.0 -194.0 275.6 711.1 -566.8 144.3 57.46 -700.0 53.4 -194.0 -840.6 -76.6 144.3 67.7 63.48 -123.8 -709.0 -194.9 -1,500.0 -1,500.0 -679.5 -679.5 -467.7 -467.7 76.4 -412.0 -1,514.2 784.7 274.3 -480.6 578.4 465.4 339.7 309.8 1,114.9 774.8 374.1 82.7 1,231.7 2007 2008 2009E 2010E 2011E

ACI Limited (DSE, CSE: ACI)

Table 9: Balance Sheet

2006 Inventory Debtors Advances Inter-company receivable Cash and bank balances Total current assets 1,239.2 524.4 300.8 28.9 47.5 2,140.8 2007 1,583.0 1,051.6 482.9 27.6 82.6 3,227.7 2008 3,144.3 1,958.5 576.6 13.0 233.8 5,926.1 2009E 2,850.7 2,310.5 1,076.6 13.0 -566.8 5,684.0 2010E 3,245.0 2,408.4 576.6 13.0 144.3 6,387.2 2011E 3,277.4 2,456.2 576.6 13.0 67.7 6,390.9

PPE Net Capital work-in-progress Intangible assets Investment Total non-current assets

1,393.4 39.4 104.7 38.1 1,575.5

1,949.9 567.5 104.7 62.0 2,684.1

2,975.5 265.0 108.3 134.5 3,483.2

4,201.2 265.0 108.3 134.5 4,708.9

4,540.9 265.0 108.3 134.5 5,048.6

4,634.4 265.0 108.3 134.5 5,142.1

Total assets

3,716.3

5,911.9

9,409.3

10,392.9

11,435.8

11,533.0

Bank overdraft Short term bank loan Long term bank loan- Current portion Creditors Other current liabilities Total current liabilities

166.1 1,178.7 46.2 505.4 237.4 2,133.8

314.2 1,915.0 154.8 759.4 338.5 3,481.9

1,209.6 2,870.8 232.9 1,313.4 344.8 5,971.6

1,200.0 3,200.0 232.9 1,391.3 340.3 6,364.5

1,000.0 2,870.8 232.9 1,693.2 339.1 6,136.1

500.0 2,870.8 232.9 1,856.2 339.1 5,799.1

Zero coupon bond Long term bank loan Other liabilities Long term liabilities 44.5 325.6 370.1 281.2 348.6 629.8 313.3 312.4 625.7 313.3 312.4 625.7

1,000.0 313.3 312.4 1,625.7

800.0 313.3 312.4 1,425.7

Total liabilities

2,503.9

4,111.7

6,597.3

6,990.3

7,761.8

7,224.8

Share capital Share premium Reserves Retained earnings Total equity

161.7 250.0 309.5 411.9 1,133.1

161.7 250.0 602.0 693.7 1,707.4

161.7 250.0 598.9 1,493.3 2,504.0

194.0 250.0 598.9 2,051.6 3,094.6

194.0 250.0 598.9 2,322.9 3,365.9

247.5 250.0 598.9 2,903.7 4,000.2

Minority interest

79.3

92.8

308.0

308.0

308.0

308.0

Total equity and liabilities

3,716.3

5,911.9

9,409.3

10,392.9

11,435.8

11,533.0

Book value per share Source: Company Annual Reports and BRAC EPL Estimates

62.48

92.77

144.92

175.36

189.34

222.03

ACI Limited (DSE, CSE: ACI)

Table 10: Indicators

2006 Growth: Sales growth Operating profit growth Net profit growth 27% 33% 3% 36% 35% 161% 80% 55% 156% 7% 6% -16% 23% 24% -41% 18% 32% 66% 2007 2008 2009 2010 2011

Segment contribution to revenue: Pharma and chemicals Consumer and retail 34% 66% 37% 63% 28% 72% 34% 66% 36% 64% 37% 63%

Margins: Gross margin Operating margin EBITDA Margin Net margin 35% 11% 14% 3% 35% 11% 16% 6% 30% 9% 18% 9% 29% 9% 17% 7% 29% 9% 12% 3% 29% 10% 13% 5%

Ratios: Depreciation/assets Inventory turnover Sales/assets Working capital (MM BDT) Working capital ratio Return on equity Return on assets 0% 224% 114% 7.0 100% 12% 4% 0% 237% 97% -254.2 93% 20% 6% 6% 232% 110% -45.4 99% 33% 10% 6% 275% 106% -680.5 89% 23% 8% 6% 300% 119% 251.1 104% 13% 4% 6% 349% 140% 591.8 110% 18% 7%

Leverage: Debt/equity Debt/assets 146% 61% 168% 64% 176% 66% 155% 63% 156% 63% 117% 56%

Per share: EPS CFPS BVPS 7.20 3.94 62.48 18.77 -21.23 92.77 48.08 -78.04 144.92 40.44 29.81 175.36 23.98 57.46 189.34 39.41 63.48 222.03

Multiples: P/E P/B Source: Company Annual Reports and BRAC EPL Estimates 59.0x 8.2x 22.6x 5.5x 8.8x 3.5x 12.6x 2.9x 21.3x 2.7x 12.9x 2.3x

ACI Limited (DSE, CSE: ACI) IMPORTANT DISCLOSURES

Analyst Certification: Each research analyst and research associate who authored this document and whose name appears herein certifies that the recommendations and opinions expressed in the research report accurately reflect their personal views about any and all of the securities or issuers discussed therein that are within the coverage universe. Disclaimer: Estimates and projections herein are our own and are based on assumptions that we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any security. As it acts for public companies from time to time, BRAC-EPL may have a relationship with the above mentioned company(s). This report is intended for distribution in only those jurisdictions in which BRAC-EPL is registered and any distribution outside those jurisdictions is strictly prohibited. Compensation of Analysts: The compensation of research analysts is intended to reflect the value of the services they provide to the clients of BRAC-EPL. As with most other employees, the compensation of research analysts is impacted by the overall profitability of the firm, which may include revenues from corporate finance activities of the firm's Corporate Finance department. However, Research analysts' compensation is not directly related to specific corporate finance transaction. General Risk Factors: BRAC-EPL will conduct a comprehensive risk assessment for each company under coverage at the time of initiating research coverage and also revisit this assessment when subsequent update reports are published or material company events occur. Following are some general risks that can impact future operational and financial performance: (1) Industry fundamentals with respect to customer demand or product / service pricing could change expected revenues and earnings; (2) Issues relating to major competitors or market shares or new product expectations could change investor attitudes; (3) Unforeseen developments with respect to the management, financial condition or accounting policies alter the prospective valuation; or (4) Interest rates, currency or major segments of the economy could alter investor confidence and investment prospects.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Water Test ReportDocument1 pageWater Test ReportMollah Md NaimNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- TAMAS2017 BuyerGuide1016 최종Document12 pagesTAMAS2017 BuyerGuide1016 최종Mollah Md NaimNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Excel Beta ExampleDocument7 pagesExcel Beta Examplezeeshan3No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 20 Ltrs Drum Label (Chlorpyriphos)Document1 page20 Ltrs Drum Label (Chlorpyriphos)Mollah Md NaimNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Report CID, Westmoreland Energy, Inc. (WEI)Document27 pagesReport CID, Westmoreland Energy, Inc. (WEI)Mollah Md NaimNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Working Capital Management of Pharmaceutical Companies of Bangladesh Evidence From Dhaka Stock Exchange LimitedDocument47 pagesWorking Capital Management of Pharmaceutical Companies of Bangladesh Evidence From Dhaka Stock Exchange LimitedMollah Md NaimNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- List of Registered Pesticides of Saint LuciaDocument37 pagesList of Registered Pesticides of Saint LuciaMollah Md NaimNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ThinkagroDocument5 pagesThinkagroMollah Md NaimNo ratings yet

- Assignment 1 PAQDocument2 pagesAssignment 1 PAQMollah Md NaimNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Sauslys Food PVT LTD Online Dhaka GuideDocument6 pagesSauslys Food PVT LTD Online Dhaka GuideMollah Md NaimNo ratings yet

- Anik Enterprise LedgerDocument2 pagesAnik Enterprise LedgerMollah Md NaimNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Working Capital Management of Pharmaceutical Companies of Bangladesh Evidence From Dhaka Stock Exchange LimitedDocument47 pagesWorking Capital Management of Pharmaceutical Companies of Bangladesh Evidence From Dhaka Stock Exchange LimitedMollah Md NaimNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 2019 China Pesticide Suppliers GuideDocument47 pages2019 China Pesticide Suppliers GuideMollah Md Naim100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 5 - How - To - Apply For Environment Clearance CertificateDocument2 pages5 - How - To - Apply For Environment Clearance CertificateMollah Md NaimNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Form - 1: Application For RemedyDocument1 pageForm - 1: Application For RemedySarkarArdhenduRiponNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Bike Repair Application SampleDocument1 pageBike Repair Application SampleMollah Md NaimNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Form - 1: Application For RemedyDocument1 pageForm - 1: Application For RemedySarkarArdhenduRiponNo ratings yet

- Biodata For Marriage - Muslim FormatDocument1 pageBiodata For Marriage - Muslim FormatMollah Md NaimNo ratings yet

- 15 Thana Election Office Dhaka PDFDocument1 page15 Thana Election Office Dhaka PDFMollah Md NaimNo ratings yet

- B-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Document1 pageB-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Mollah Md NaimNo ratings yet

- B-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Document1 pageB-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Mollah Md NaimNo ratings yet

- B-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Document1 pageB-08-71 Vai Vai Traders-1054 1 0 1 Ragbindapur Bazar, Nobabgonj, Dinajpur, Md. Anwar Hossain 1 1 BGRLAL05176Mollah Md NaimNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Income Tax For Pension and Retirement Benefit - Research PaperDocument24 pagesIncome Tax For Pension and Retirement Benefit - Research PaperSomeoneNo ratings yet

- Sussex ISC ProspectusDocument29 pagesSussex ISC ProspectusMollah Md NaimNo ratings yet

- Notice 35th Batch Subject SelectionDocument1 pageNotice 35th Batch Subject SelectionMollah Md NaimNo ratings yet

- BL Offer With AAMRA SmartphonesDocument7 pagesBL Offer With AAMRA SmartphonesMollah Md NaimNo ratings yet

- Bangladesh Customs TariffDocument3 pagesBangladesh Customs TariffMollah Md NaimNo ratings yet

- Fin444.3 Assignment2 Id082011030Document6 pagesFin444.3 Assignment2 Id082011030Mollah Md NaimNo ratings yet

- Report of Pesticide Hotspots in BangladeshDocument18 pagesReport of Pesticide Hotspots in BangladeshMollah Md NaimNo ratings yet

- ch02 BusinesscombiDocument41 pagesch02 BusinesscombiNadine SantiagoNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Cambridge IGCSE™: Accounting 0452/23 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2020ATTIQ UR REHMANNo ratings yet

- External Audits of Microfinance Institutions: A HandbookDocument62 pagesExternal Audits of Microfinance Institutions: A HandbookGere TassewNo ratings yet

- 2020 FA L4 To L10 StudentsDocument40 pages2020 FA L4 To L10 Students徐恺民No ratings yet

- ABFRL Ambit Oct16 PDFDocument33 pagesABFRL Ambit Oct16 PDFDoshi VaibhavNo ratings yet

- Cheat Sheet BATDocument4 pagesCheat Sheet BATUmar PatelNo ratings yet

- Amity Global Business School Amity Global Business School: Valuation ConceptsDocument36 pagesAmity Global Business School Amity Global Business School: Valuation ConceptssachinremaNo ratings yet

- ACC Limited AnalysisDocument10 pagesACC Limited Analysisjawahar_8888No ratings yet

- Financial Statements AnswersDocument6 pagesFinancial Statements AnswersKrizzia Fatima PiodosNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisVirgil Kit Augustin AbanillaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Balance Sheet Analysis of Manufacturing CompanyDocument3 pagesBalance Sheet Analysis of Manufacturing CompanyPrateek JainNo ratings yet

- DABUR INDIA LTD Intrinsic Value - Fundamental AnalysisDocument3 pagesDABUR INDIA LTD Intrinsic Value - Fundamental AnalysisPrakash JoshiNo ratings yet

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianNo ratings yet

- Valuation of Assets and Liabilities in an AcquisitionDocument2 pagesValuation of Assets and Liabilities in an AcquisitionMelanie SamsonaNo ratings yet

- Case 51 Palamon Capital Partners Team System SPADocument10 pagesCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- Absorption Variable SeatworkDocument2 pagesAbsorption Variable SeatworkMaxy BariactoNo ratings yet

- Financial Transaction WorksheetDocument3 pagesFinancial Transaction Worksheetjen 01No ratings yet

- CHAPTER 10 - Changes in Accounting EstimateDocument8 pagesCHAPTER 10 - Changes in Accounting EstimateChristian GatchalianNo ratings yet

- Midterm Reviewer Cost AccountingDocument14 pagesMidterm Reviewer Cost AccountingPrecious AnneNo ratings yet

- Aa2 - Chapter 6 Suggested Answers: Exercises Exercise 6-1Document17 pagesAa2 - Chapter 6 Suggested Answers: Exercises Exercise 6-1Izzy BNo ratings yet

- Chapter 2 - Advanced AccDocument15 pagesChapter 2 - Advanced AccAsad KhadarNo ratings yet

- Query Results - 1Document13 pagesQuery Results - 1arnoldvkNo ratings yet

- Management Accounting Concepts and Techniques PDFDocument310 pagesManagement Accounting Concepts and Techniques PDFvishnupriya100% (1)

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument9 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicKarlayaanNo ratings yet

- Adv Acc Sol Manual 2008Document190 pagesAdv Acc Sol Manual 2008Khey Soniga RollanNo ratings yet

- Cfas ReviewerDocument10 pagesCfas ReviewerMarian grace DivinoNo ratings yet

- 101-Accounting For Buisness DecisionsDocument268 pages101-Accounting For Buisness DecisionsAkshay GadeNo ratings yet

- Tewodros AlemuDocument113 pagesTewodros AlemuDagnachew TsegayeNo ratings yet

- AMG Inc-For Student Spreadsheet-TemplateDocument28 pagesAMG Inc-For Student Spreadsheet-Templateiqbal irfaniNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)