Professional Documents

Culture Documents

Sweet Spot Fading en

Uploaded by

windson_sgOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sweet Spot Fading en

Uploaded by

windson_sgCopyright:

Available Formats

Wednesday, 22 June 2011

Summary

As long as the S&P 500 stays above the 1,250 level, chart-technically a near-term rally to new highs remains possible. The market is oversold. That the Greek situation appears to become less tense could feed into the rally, yet it is unlikely to last long. In the medium term we expect stock prices to tumble (S&P 500 towards 1,100 and lower levels). The sweet spot of the past quarters a loose fiscal and monetary policy plus high economic growth in the emerging countries is dissipating. Central banks and governments are tightening their policies. As a result, the negative effects of the current balance sheet recession will come to the fore again. If so, it will be abundantly clear that stock prices have risen (far) above their real value.

Stock markets Sweet spot is fading

The pullback in stock prices since early May has now become strongly oversold. Investors are increasingly downbeat while several major stock indices are approaching important support levels. From a chart-technical perspective the drop could end at any moment. Subsequently, the markets could stage at least a substantial recovery (S&P 500 to 1,400). Such a recovery could go hand in hand with: A new financial aid package for Greece that does not trigger CDS payouts on Greek bonds (the latter would carry the risk of a negative chain reaction for financial institutions). Better economic data in the US and Europe as factors wear off that depressed growth earlier in 2011. For instance supply chain disruptions to imports from Japan, bad weather, and the (delayed) effect of the commodity price rally at the beginning of the year. The aforementioned technical indicators are no guarantee that prices will indeed rally sharply. So far volumes have been low on market rally days (a sign of weakness). In the past, sometimes steep drops occurred when the market was oversold. Should this happen again, a rally could still take place but probably not to (fractionally) new highs. A drop in the S&P 500 to well below 1,250 would suggest that the trend reversed from up to down in May.

Medium term outlook Whether this technical rally will start from the current level or even lower does not change our medium term outlook one bit. We think there is a high chance of additional drops. Research from Morgan Stanley and others shows that the current recovery is very weak compared to previous recessions and recovery periods in the past 50 years. Especially if we consider that: Normally, the recovery would be proportional to the gravity of the recession. As this has been the deepest recession since the Great Depression the recovery should have been exceptionally fierce as well. The recovery was boosted additionally by unprecedented fiscal and monetary impulses. Balance sheet recession Clearly the present recession is far from normal. It was not a reaction to monetary tightening measures curbing inflation, or a natural disaster. The root cause was high indebtedness. We are seeing a balance sheet recession; for it to end debts will need to be paid off. To what extent is unclear although earlier balance sheet recessions suggest that this could take years. During such a period of very low growth, fresh recessions could loom. In the recent past the fallout of the recession did not appear so bad but this was mainly because of the huge fiscal/monetary stimulus and the rise of the emerging markets (that did not have a debt problem and were benefiting from a very loose monetary policy in the West). In other words, stock prices ended up in a sweet spot on the back of the expansionary monetary policy and high growth in the developing industrial countries, where western multinationals are increasingly making a lot of profit. The process of debt reduction in the private sector is far from over. As long as property prices keep falling and household debts are above the long-term average, this deleveraging will continue. Most central banks are tightening their monetary policies and virtually all of the governments need to apply the fiscal brakes. In other words, the downward effects of deleveraging in the private sector will increasingly come to the fore. The predicament of the weak countries in Europe (that have been bailed out) shows that once public debt is excessive the state also starts to contribute to the balance sheet recession. Sweet spot melting away Currently stock prices are moving away from this sweet spot. As growth expectations continue to

2/4

decline on fiscal and monetary tightening we foresee falling profit expectations. It will increasingly become clear that stock prices have risen far above their actual value. Eventually the S&P 500 could drop to 1,100-1,000. Continuous tensions in the eurozone and fears of a banking crisis will likely depress stock prices as well. If a new aid package for Greece is agreed upon (which we expect) this will again be a liquidity solution to a solvency problem. In other words, the underlying problems in Greece will remain. The same issues (excessive indebtedness and lagging competitiveness) will play up repeatedly and it will merely be a matter of time before Greece needs to go cap in hand all over again. The same applies to Portugal. Following the current downturn, we foresee another rally on the stock markets once mounting deflation fears force central banks into flooring the gas pedal yet again.

Chart-technical Analysis

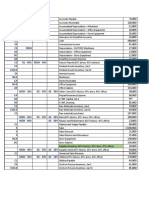

S&P 500: In recent days the S&P 500 index rallied in reaction to the drop (to 1,265) in recent weeks. This brief rally phase may well have ended (at 1,295). We anticipate additional drops. Support near 1,260 and 1,246 continues to be important.

DAX: The short-term pressure in the DAX has become neutral yet the short-term cycle is pointing towards potential consolidation. Support at 6,994 has been tested by now. That the rally exceeded 7,150/7,200 is a positive signal. It underpins a scenario that sees the DAX bottoming out. Conversely, a drop to below 6,990 would be negative for the DAX in the near future.

3/4

NIKKEI: The NIKKEI is still in a sideward pattern. However, signs are increasing that a minor rally may be in the offing. If the index drops below support at the 9,300 level, additional drops could occur in the near future. If so, support comes in around 9,200 and 9,000.

4/4

You might also like

- Olivers Insights - Share CorrectionDocument2 pagesOlivers Insights - Share CorrectionAnthony WrightNo ratings yet

- Lane Asset Management Stock Market Commentary December 2011Document8 pagesLane Asset Management Stock Market Commentary December 2011Edward C LaneNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- 2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonDocument2 pages2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonPranjayNo ratings yet

- Gold Yield Reports Investors IntelligenceDocument100 pagesGold Yield Reports Investors IntelligenceAmit NadekarNo ratings yet

- There's Nothing Good Here: Views From The Blue RidgeDocument8 pagesThere's Nothing Good Here: Views From The Blue RidgeZerohedgeNo ratings yet

- Lane Asset Management Stock Market Commentary April 2012Document7 pagesLane Asset Management Stock Market Commentary April 2012Edward C LaneNo ratings yet

- Fourth Q Uarter R Eport 2010Document16 pagesFourth Q Uarter R Eport 2010richardck61No ratings yet

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanNo ratings yet

- Lane Asset Management Stock Market Commentary March 2012Document6 pagesLane Asset Management Stock Market Commentary March 2012Edward C LaneNo ratings yet

- FX 20140417Document2 pagesFX 20140417eliforuNo ratings yet

- 11/14/14 Global-Macro Trading SimulationDocument17 pages11/14/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- 3Q2011 Markets Outlook USDocument12 pages3Q2011 Markets Outlook USsahil-madhani-3137No ratings yet

- Newsletter 11232011Document11 pagesNewsletter 11232011api-244253657No ratings yet

- Picton MahoneyDocument3 pagesPicton Mahoneyderailedcapitalism.comNo ratings yet

- Hussman Funds 2009-07-27Document2 pagesHussman Funds 2009-07-27rodmorley100% (2)

- Jak Na Dluhy V EU (Dokument V AJ)Document16 pagesJak Na Dluhy V EU (Dokument V AJ)Ivana LeváNo ratings yet

- Vital Signs: Tipping Point?!Document4 pagesVital Signs: Tipping Point?!trade100No ratings yet

- Volume 2.10 The Artificial Economic Recovery July 23 2010Document12 pagesVolume 2.10 The Artificial Economic Recovery July 23 2010Denis OuelletNo ratings yet

- Market Commentary 4/25/2012Document1 pageMarket Commentary 4/25/2012CJ MendesNo ratings yet

- Nordic Region Out Look 2013Document15 pagesNordic Region Out Look 2013Marcin LipiecNo ratings yet

- 2021.07 - Global Investment Views - ENDocument7 pages2021.07 - Global Investment Views - ENmheryantooNo ratings yet

- 11/11/14 Global-Macro Trading SimulationDocument20 pages11/11/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- The List Market Outlook en UsDocument12 pagesThe List Market Outlook en UsothergregNo ratings yet

- Outlook Fall 2014Document2 pagesOutlook Fall 2014Amin KhakianiNo ratings yet

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraNo ratings yet

- Anz Research: Global Economics & StrategyDocument14 pagesAnz Research: Global Economics & StrategyBelinda WinkelmanNo ratings yet

- Shadow Capitalism: Wednesday, November 24, 2010Document4 pagesShadow Capitalism: Wednesday, November 24, 2010Naufal SanaullahNo ratings yet

- A. Gary Shilling's: InsightDocument33 pagesA. Gary Shilling's: InsightmattpaulsNo ratings yet

- EdisonInsight February2013Document157 pagesEdisonInsight February2013KB7551No ratings yet

- Hussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011Document6 pagesHussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011KoalaCapitalSICAVNo ratings yet

- 2012 Nov 22 Olivers Insights Shares in Another Rough PatchDocument2 pages2012 Nov 22 Olivers Insights Shares in Another Rough PatchLuke Campbell-SmithNo ratings yet

- Economic and Market Outlook 2023 Down But Not OutDocument30 pagesEconomic and Market Outlook 2023 Down But Not OutKien NguyenNo ratings yet

- The US Stock Market Wants To Go Up Part II 03-31-20111 - by Economist Mike AstrachanDocument11 pagesThe US Stock Market Wants To Go Up Part II 03-31-20111 - by Economist Mike AstrachanShlomiNo ratings yet

- Deutsche Bank ResearchDocument3 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- What Is A RecessionDocument2 pagesWhat Is A Recessionbiks007No ratings yet

- JPM Market ReportDocument3 pagesJPM Market ReportDennis OhlssonNo ratings yet

- Global Investment Perspective: in This Issue HighlightsDocument19 pagesGlobal Investment Perspective: in This Issue HighlightsJohn SmithNo ratings yet

- Ip Newhighs Finalv2Document4 pagesIp Newhighs Finalv2Anonymous Feglbx5No ratings yet

- Weekly Market Commentary 06-13-2011Document2 pagesWeekly Market Commentary 06-13-2011Jeremy A. MillerNo ratings yet

- Bii 2016 Outlook Us VersionDocument20 pagesBii 2016 Outlook Us VersionEmil Biobelemoye Hirai-GarubaNo ratings yet

- Fidelity Perspective Dec2011Document3 pagesFidelity Perspective Dec2011lenovojiNo ratings yet

- Lane Asset Management Stock Market Commentary June 2012Document6 pagesLane Asset Management Stock Market Commentary June 2012Edward C LaneNo ratings yet

- Third Q Uarter R Eport 2010Document16 pagesThird Q Uarter R Eport 2010richardck50No ratings yet

- Is Greece The Next LehmansDocument2 pagesIs Greece The Next LehmansBilal RajaNo ratings yet

- 11/13/14 Global-Macro Trading SimulationDocument17 pages11/13/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Deteriorating Financial Conditions Threaten To Escalate The European Debt CrisisDocument2 pagesDeteriorating Financial Conditions Threaten To Escalate The European Debt CrisisKevin A. Lenox, CFANo ratings yet

- Eta Investment Report: A Year For The History BooksDocument31 pagesEta Investment Report: A Year For The History BooksTerence MollNo ratings yet

- UBS DEC Letter enDocument6 pagesUBS DEC Letter enDim moNo ratings yet

- Friedberg Mercantile Quarterly Report Q3 2011Document16 pagesFriedberg Mercantile Quarterly Report Q3 2011richardck61No ratings yet

- LTI Newsletter - Sep 2011Document19 pagesLTI Newsletter - Sep 2011LongTermInvestingNo ratings yet

- Monthly Outlook GoldDocument10 pagesMonthly Outlook GoldKapil KhandelwalNo ratings yet

- SPEX Issue 17Document10 pagesSPEX Issue 17SMU Political-Economics Exchange (SPEX)No ratings yet

- Edition 5 - Chartered 12th May 2010Document7 pagesEdition 5 - Chartered 12th May 2010Joel HewishNo ratings yet

- Economist Insights 20120416Document2 pagesEconomist Insights 20120416buyanalystlondonNo ratings yet

- Burch Wealth Management 05.09.11Document3 pagesBurch Wealth Management 05.09.11admin866No ratings yet

- Global Economics Weekly - Goldman Sachs 02.10.13Document13 pagesGlobal Economics Weekly - Goldman Sachs 02.10.13Martin Tsankov100% (1)

- The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyFrom EverandThe Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyRating: 5 out of 5 stars5/5 (1)

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Annual Equivalent MethodDocument6 pagesAnnual Equivalent Methodutcm77100% (1)

- Business Plan Template-ECI11Document21 pagesBusiness Plan Template-ECI11Mawada MawadaNo ratings yet

- v62 Form Honda CivicDocument2 pagesv62 Form Honda Civicdawudaaa9No ratings yet

- MeaningDocument2 pagesMeaningHappy BawaNo ratings yet

- Repo Vs Reverse RepoDocument9 pagesRepo Vs Reverse RepoRajesh GuptaNo ratings yet

- Analysis On Pre Merger and Post Merger Financial Performance of Selected Banks in IndiaDocument57 pagesAnalysis On Pre Merger and Post Merger Financial Performance of Selected Banks in IndiaSimran TalrejaNo ratings yet

- Export Pricing 4Document17 pagesExport Pricing 4Rohit JindalNo ratings yet

- Foreign Investment and Technological Transfer ActDocument19 pagesForeign Investment and Technological Transfer ActRASMITA BHANDARINo ratings yet

- Annual Report of IOCL 126Document1 pageAnnual Report of IOCL 126NikunjNo ratings yet

- Introduction To Accounting For Construction ContractsDocument4 pagesIntroduction To Accounting For Construction ContractsJohn TomNo ratings yet

- BBTX4203 Taxation II - Eaug20Document296 pagesBBTX4203 Taxation II - Eaug20MUHAMMAD ZAKI BIN BASERI STUDENTNo ratings yet

- Bank Alfalah Clearance DepartmentDocument7 pagesBank Alfalah Clearance Departmenthassan_shazaib100% (1)

- A Study On Financial Performance of Public Sector Banks in IndiaDocument38 pagesA Study On Financial Performance of Public Sector Banks in IndiaMehul ParmarNo ratings yet

- CA FInal DT SampleDocument8 pagesCA FInal DT SampleprasannaNo ratings yet

- Edelweiss Financial Services LTD INTRODocument2 pagesEdelweiss Financial Services LTD INTROVikas SinghNo ratings yet

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- 5 02-09-2022 Sale On Approval FTDocument4 pages5 02-09-2022 Sale On Approval FTShweta BhadauriaNo ratings yet

- Buehler Stoch Prop DividendsDocument21 pagesBuehler Stoch Prop DividendserererehgjdsassdfNo ratings yet

- Purchasing Power ParityDocument4 pagesPurchasing Power Parityakki0rockeyNo ratings yet

- Nama - Nama Perkiraan (Akun) Dan Istilah Dalam Bahasa InggrisDocument4 pagesNama - Nama Perkiraan (Akun) Dan Istilah Dalam Bahasa InggrisAlpha SimanjuntakNo ratings yet

- Seya-Industries-Result-Presentation - Q1FY201 Seya IndustriesDocument24 pagesSeya-Industries-Result-Presentation - Q1FY201 Seya Industriesabhishek kalbaliaNo ratings yet

- Life-Cycle Cost Analysis (LCCA) of Buildings: Jere RaunamaDocument14 pagesLife-Cycle Cost Analysis (LCCA) of Buildings: Jere RaunamatareqNo ratings yet

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- Investment BKG - SyllabusDocument3 pagesInvestment BKG - SyllabusAparajita SharmaNo ratings yet

- Aptitude StigenDocument3 pagesAptitude StigenMonisha VishwanathNo ratings yet

- A Level Accounting (9706) IAS Booklet v1 0Document58 pagesA Level Accounting (9706) IAS Booklet v1 0Mei Yi YeoNo ratings yet

- Step by Step Procedure For Creation of IDOCDocument34 pagesStep by Step Procedure For Creation of IDOCjolliestNo ratings yet

- The Lean Six Sigma Train Is Making Its Way Through Texas PDFDocument3 pagesThe Lean Six Sigma Train Is Making Its Way Through Texas PDFployneNo ratings yet

- Nisha Summer Project ReportDocument302 pagesNisha Summer Project ReportSaransh Singh67% (3)

- Factsheet For March 31st FinalDocument6 pagesFactsheet For March 31st FinalSandip PatilNo ratings yet