Professional Documents

Culture Documents

P1 - Financial Accounting August 06

Uploaded by

IrfanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P1 - Financial Accounting August 06

Uploaded by

IrfanCopyright:

Available Formats

PROFESSIONAL 1 EXAMINATION - AUGUST 2006

Answer questions 1 to 3. and question 4 or 5. Note: Students have optional use of the Extended Trial Balance, which if used, must be included in the answer booklet. PRO-FORMA INCOME STATEMENT BY NATURE, INCOME STATEMENT BY FUNCTION AND BALANCE SHEET ARE PROVIDED

FINANCIAL ACCOUNTING

NOTES

TIME ALLOWED: INSTRUCTIONS:

3.5 hours, plus 10 minutes to read the paper.

During the reading time you may write notes on the examination paper but you may not commence writing in your answer book. Marks for each question are shown. The pass mark required is 50% in total over the whole paper. Start your answer to each question on a new page.

You are reminded that candidates are expected to pay particular attention to their communication skills and care must be taken regarding the format and literacy of the solutions. The marking system will take into account the content of the candidates' answers and the extent to which answers are supported with relevant legislation, case law or examples where appropriate.

The Institute of Certified Public Accountants in Ireland, 9 Ely Place, Dublin 2.

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

FINANCIAL ACCOUNTING

PROFESSIONAL 1 EXAMINATION AUGUST 2006 Time allowed 3.5 hours, plus 10 minutes to read the paper. Answer Questions 1 to 3 and Question 4 or 5.

1.

You are provided with the following information in relation to Hospital plc and its subsidiary undertaking Surgical limited. Hospital plc Consolidated Income Statement for the year ended 31st December 2005 Note Revenue Cost of sales Gross profit Administrative expenses Earnings before finance costs, taxation, depreciation and amortisation Depreciation and amortisation Operating loss Finance costs Loss for the year before taxation Taxation Loss for the year after taxation All above amounts relate to continuing activities 2 1 2,782 (10,022) (7,240) (2,789) (10,029) (139) (10,168) 1,334 (4,347) (3,013) (485) (3,498) (66) (3,564) 2005 000 21,981 (2,685) 19,296 (16,514) 2004 000 13,307 (1,551) 11,756 (10,422)

Statement of changes in equity

2005 000

2004 000 (3,564) (30) (3,594)

Loss for the financial year Exchange gain/(loss)

(10,168) 1 (10,167)

Page 1

Hospital plc Consolidated Balance Sheet at 31st December 2005 Note 000 Assets Tangible non-current assets Intangible assets 3 4 56,592 9,445 66,037 Current assets Inventories Trade receivables Cash and cash equivalents 271 3,423 1,127 4,821 70,858 Equity and Liabilities Called up share capital Share premium account Capital redemption reserve Accumulated losses 6,562 74,180 1 (28,654) 52,089 Non-current Liabilities Bank loan Provision for liabilities and charges 9,000 9,000 Current Liabilities Total Liabilities Total Equity and Liabilities 5 9,769 18,769 70,858 63 43 106 17,096 17,202 42,529 3,030 40,783 1 (18,487) 25,327 247 3,061 1,091 4,399 42,529 28,898 9,232 38,130 2005 000 000 2004 000

Page 2

The following additional information is available: (1) Operating Loss: 2005 000 This is arrived at after charging: Depreciation of owned tangible non-current assets Depreciation of tangible non-current assets held under finance leases and hire purchase contracts Amortisation of development cost Operating lease rentals other Auditors remuneration Profit on disposal of tangible non-current fixed assets Exceptional operation credit Exchange gains on day to day operating transactions 8,197 1,825 215 22 (3) (43) (473) 3,726 4 617 307 22 (207) 2004 000

The exceptional operation credit in 2005 relates to a reorganisation provision no longer required. (2) (3) The taxation charge for the year arises in respect of overseas corporation tax. Tangible Non-Current Assets: Cost: At 1st January 2005 Additions Disposals Foreign exchange difference At 31st December 2005 000 39,603 35,838 (145) 210 75,506

Accumulated Depreciation: At 1st January 2005 Provided for the year Disposals Foreign exchange difference At 31st December 2005 Net book value: At 31st December 2005 At 31st December 2004 56,592 28,898 10,705 8,197 (125) 137 18,914

Page 3

(4)

Intangible Fixed Assets: Cost: At 1st January 2005 Additional development costs Foreign exchange difference At 31st December 2005 Amortisation: At 1st January 2005 Provided for the year Foreign exchange difference At 31st January 2005 Net book value: At 31st December 2005 At 31st December 2004 9,445 9,232 1,071 1,825 128 3,024 000 10,303 1,670 496 12,469

Intangible fixed assets comprise development costs.

(5)

Current Liabilities: 000 2005 Bank loans Bank overdraft Unsecured loan notes Corporation tax PAYE/PRSI Trade creditors Other creditors Accruals and deferred income Finance costs 562 72 313 662 6,895 1,171 94 9,769 000 2004 7,613 906 1,249 209 245 5,213 421 1,135 105 17,096

Page 4

(6)

Acquisition of subsidiary undertaking: Hospital plc acquired 100 per cent of the equity share capital of Surgical Limited on 1st October 2005. Net assets acquired: 000 Tangible non-current fixed assets Inventories Trade receivables Corporation tax recoverable Trade payables Satisfied by: Shares issued 2,057 2,000 20 122 15 (100) 2,057

Requirement: (a) Prepare the consolidated cash flow statement of Hospital plc for the year ended 31st December 2005 in accordance with IAS 7, Cash Flow Statements. N.B. You are not required to provide notes to the consolidated cash flow statement. (24 marks)

(b)

Critically comment on the liquidity position of Hospital plc as at 31 December 2005.

(6 marks)

[Total 30 marks]

Page 5

2.

You are the Financial Accountant of Sungap Group Plc "Sungap", a group of companies engaged in manufacturing and retailing. The group prepares its financial statements to 31st December each year. Sungap has investments in two companies, Orange Ltd "Orange" and Peel Ltd. "Peel". The summarised Income Statements of these three companies for the year ended 31st December 2005 are as follows:Sungap 000 78,000 (37,500) 40,500 (23,000) 17,500 2,000 (2,000) 17,500 (4,750) 12,750 20,000 (2,750) 30,000 Orange 000 66,000 (32,000) 34,000 (18,000) 16,000 -(1,000) 15,000 (3,500) 11,500 15,500 -27,000 Peel 000 16,000 (7,000) 9,000 (5,000) 4,000 -(500) 3,500 (875) 2,625 14,375 (2,000) 15,000

Revenue Cost of Sales Gross Profit Other operating expenses Operating profit Investment Revenues Finance Costs Profit before taxation Income tax expense Profit after income tax expense Retained Profit at start of year Dividends Paid Retained profit at end of year

The following additional information is available:(1) On 1st January 2000 Sungap purchased 80% of the ordinary share capital of Orange for 7,250,000. The fair value of the net assets of Orange was the same as their book value on that date. The balance sheet of Orange on 1st January 2000 showed: 000 1,000 4,000 5,000

1 Ordinary share capital Profit and loss account

(2)

On 1st January 2005 Sungap purchased 100% of the ordinary share capital of Peel for 13,500,000. The balance sheet of Peel on that date showed: 000 6,000 10,000 16,000 1,625 14,375 16,000

Tangible non-current assets Inventories

1 Ordinary share capital Profit and loss account

The fair value of the net assets of Peel was the same as their book value on the acquisition date. Tangible non-current assets are depreciated over six years. During 2005 50% of the inventory was sold outside the Group on normal trading terms, with the remaining stock to be sold in 2006. (3) On 30th September 2005 Sungap disposed of the whole of its investment in Orange for 30,000,000. The Income Statement in respect of Orange Ltd. is for the period to 30th September 2005. The taxation payable in connection with the disposal is 1,000,000. The effect of the disposal has not yet been incorporated into the profit and loss account of Sungap.

Page 6

The activities of Orange are similar to Sungap and the directors of Sungap believe that the performance of the Group will not be materially affected following the disposal of Orange. (4) During the year ended 31st December 2005 Peel sold raw materials to Sungap at original cost, plus a mark up of 25%. At 31st December 2005 half of the raw materials sold to Sungap at a cost of 120,000 remained in Sungaps inventory. Sungap charges Peel a management fee of 55,000 per annum. The charge is included in the revenue of Sungap and in Other Operating Expenses of Peel. Transactions of each of the companies accrue evenly throughout the year.

(5)

(6)

REQUIREMENT: (a) Calculate the goodwill arising on the purchase of the shares in both Orange and Peel at the respective acquisition dates. (6 marks) Prepare the consolidated income statement of Sungap Group plc for the year ended 31st December 2005 in accordance with international accounting standards, incorporating any adjustments you consider necessary. N.B. You are not required to prepare notes to the consolidated income statement. (24 marks) [Total 30 Marks]

(b)

Page 7

3.

The following multiple choice question contains eight sections, each of which is followed by a choice of answers. Only one of each set of answers is strictly correct. REQUIREMENT: Give your answer to each section in the answer sheet provided. [Total: 20 marks] 1. The following are extracts from the balance sheet of Profco Limited at 31st December 2005: 8% Loan Notes Loans due in more than one year 7% Redeemable Preference Shares Revaluation Reserve Accumulated Profits Ordinary Share Capital 000 30 15 10 25 65 60

The gearing ratio for Profco is (to one decimal place) (a) (b) (c) (d) 2. 21.9% 26.8% 34.1% 44.0%

The following relates to the accounts of Taxco Limited for the year ended 30th November 2005: Net profit for the year ended 30th November 2005 Under-provision in respect of the year ended 30th November 2004 Depreciation charge for the year ended 30th November 2005 Tax Capital allowances for the year ended 30th November 2005 The effective tax rate on the profits for 2005 is 12.5% 000 160 10 30 35

Taxco Limiteds taxation charge in the income statement for the year ended 30 November 2005 will be: (a) (b) (c) (d) 3. 20,000 21,250 19,375 29,375

On the 1st April 2005, Traxco Limited commenced the construction of a new production facility. The following costs were incurred in the period from 1st May to 31st December 2005, the Companys year end date. 000 Site purchase 2,500,000 Site preparation 75,000 Construction costs 4,250,000 Allocated Administrative overheads 125,000 On 1st April 2005, Traxco Limited borrowed 9m to finance the project. The annual rate of interest applicable to the borrowing was 7%. Traxcos policy is to capitalise finance costs. What amount (to one decimal place) should be included in tangible non-current assets in respect of the new production facility at 31st December 2005? (a) (b) (c) (d) 6.8 6.9 7.4 7.3 million million million million

Page 8

4.

The following information relates to Multip plc for the year ended 31 December 2005: Profit before tax Taxation Transfer to reserves Dividends: Preference interim paid Ordinary interim paid Preference final proposed Ordinary final proposed Retained 2,500,000 (250,000) 2,250,000 (110,000) (105,000) (150,000) (105,000) (210,000) 1,570,000 1

The issued shares of Multip plc for the whole of the year was 3,500,000 6% preference shares of each and 3,600,000 ordinary shares of 1 each. The earnings per share of Multip plc are: (a) (b) (c) (d) 5. 0.352 0.625 0.567 0.436

Celtic Limited has two subsidiaries, West Limited in which it has an 80% interest and East Limited in which it has a 75% interest. During 2005 East Limited purchased goods from West Limited for 2,200,000. The goods had been manufactured by West at a cost of 1,500,000. East Limited spent an additional 380,000 on converting the goods to finished products. At the balance sheet date, East Limited had sold 60% of these goods for 3,500,000. In preparing the consolidated financial statements of Celtic Limited the remaining inventory should be stated at: (a) (b) (c) (d) 752,000 1,400,000 1,500,000 150,000

6.

Green Plc owned 60% of the ordinary share capital of Orange Plc. On 31st December 2005, Green Plcs year end; it sold 20% of its interest in Orange Plc to another company for 30 million. At the date of disposal Green Plcs consolidated carrying values of Orange Plcs net assets, including relevant goodwill, were 70 million. The consolidated profit or loss on disposal is: (a) (b) (c) (d) 40 16 18 12 million million million million loss profit profit loss

7.

Sarto Limited rents a photocopier from Macho Limited for 500 per month under a lease agreement which began on 1st May 2005 and will expire on 30th April 2008. A deposit of 1,000 was paid at the start of the lease period and will be refunded at the end of the lease period. Macho Limited carries out maintenance and repairs as part of the agreement. A new photocopier purchased outright on 1st May 2005 would have cost 11,000. The photocopier has an estimated useful life of 5 years and Sarto Limited does not have an option to purchase the photocopier. What will the charge be to the income statement of Sarto Limited in respect of the photocopier lease for the year ended 31st December 2005? (a) (b) (c) (d) 4,900 160 4,000 2,000

Page 9

8.

East Co. Limited purchased goods for re-sale from an American supplier and the goods were invoiced in US$. This purchase (and if unsold) any subsequent inventory valuation should be expressed in Euros, using the following conversion method: (a) (b) (c) (d) Rate Rate Rate Rate of of of of exchange exchange exchange exchange at at at at the the the the date of sale of the last of the goods. balance sheet date. date of purchase invoice. date of payment.

4.

The objective of IAS 38 Intangible Assets is to prescribe the accounting treatment for intangible assets and identify how to recognise an intangible asset if, and only if, certain criteria are met. It also specifies how to measure the carrying amount of intangible assets and requires certain disclosures. REQUIREMENTS: (a) State the definition of an intangible asset (2 marks) (b) Outline the criteria to be met to allow capitalisation of expenditure as an intangible asset. (6 marks) (c) (d) Discuss the treatment allowed for internally generated goodwill. Describe i) ii) The general disclosure requirements of IAS 38, and (8 marks) (2 marks)

The disclosure requirements of IAS 38 if intangible assets are accounted for at revalued amounts. (2 marks) [Total 20 marks]

Page 10

5.

(a)

IAS 40 Investment Property defines investment property as property held to earn rentals or for capital appreciation or both, rather than for use in production, administration or sale in the ordinary course of business. IAS 40 permits entities to choose between either: Fair value reporting Or Cost

REQUIREMENT: Set out in detail the measurement process required when applying the fair value model to investment properties. (12 marks) (b) The non-current assets of Mantra Systems Limited, which commenced trading on 1 March 2005 includes two investment properties which are let on an arms length basis. Mantra Systems Limited adopted the fair value model in accounting for its investment properties. On 31st December 2005 they were subject to professional valuation for the first time. The valuation details are as follows. Property Southend Westport Cost 000 210 390 Fair Value 000 345 280 Increase (Decrease) 000 135 (110)

REQUIREMENT: Explain and set out the journal entries necessary to record the movements between cost and fair value in respect of each of the properties for the period ended 31st December 2005. (8 Marks) [Total: 20 Marks]

END OF PAPER

Page 11

SUGGESTED SOLUTIONS

FINANCIAL ACCOUNTING

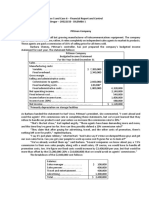

PROFESSIONAL 1 EXAMINATION AUGUST 2006 Examiners note re solutions: The solutions presented here are intended to be comprehensive and act as a learning aid for candidates. The examiner would not anticipate that an exam candidate would have sufficient time to complete answers at the level of detail given in these solutions. Also, these narrative answers are intended to cover a range of answers and hence candidates would not generally be expected to list all the points given. SOLUTION 1 (a) Hospital Group Plc Consolidated Cash Flow Statement For The Year Ended 31 December 2005 000 Cash flows from operating activities: Net loss before taxation Adjustments: Depreciation and amortisation (8,197+1,825) Profit on disposal of tangible non-current fixed assets Exceptional operation credit Finance costs Operating income before working capital adjustments Increase in inventories (271-20-247) Increase in accounts receivable (3,423-122-3,061) Increase in accounts payable (6,895 +662+1,171-5,213 -245-421-1,135-100) Cash generated from operations Finance costs paid (105+2,789-94) Income tax paid (209-15+139-313) Net cash from operating activities Cash flow from investing activities: Purchase of non-current tangible fixed assets (35,838-2,000) Additions to capitalised development costs Proceeds from sale of non-current tangible fixed assets (145-125+3) Net cash used in investing activities Cash flows from financing activities: Proceeds from issue of shares (6,562-3,030-2,057) Proceeds from Share premium (74,180-40,783) Bank loan (9,000-63-7,613) Unsecured loan notes (72-1,249) Net cash inflow from financing activities Foreign exchange adjustment (496-128+210-137-1) Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year (1,091-906) Cash and cash equivalents at end of year (1,127-562) (10,029) 10,022 (3) (43) 2,789 2,736 (4) (240) 1,614 4,106 (2,800) (20) 1,286 Marks Allocated

1

/2

(2x 1/2) 1 1 /2 1 /2 1 /2 (3 x1/2) 11/2 (3 x1/2) 11/2 (8x1/2) 4 (3x1/2) 11/2 (4x1/2) 2

(33,838) (1,670) 23 (35,485)

(2x1/2) 1

1

/2

(3x1/2) 11/2

1,475 33,397 1,324 (1,177) 35,019 (440) 380 185 565

(3x1/2) 11/2 (2x1/2) 1 (3x1/2) 11/2 (2x1/2) 1

/2

(2x1/2) 1 (2x1/2) 1 (Total 24 Marks)

Page 12

(b)

General Position: Overall, Hospital Plc achieved a net increase in cash and cash equivalents of 31 December 2005. 380,000 for the year ended 1 Mark The net cash inflow from operating activities arises mostly from increased credit from suppliers. The significant investment in non-current tangible fixed assets was financed from the issue of shares at a very significant premium. It is very unlikely that this will be achieved again in view of the heavy losses incurred. In addition the ability to pay any dividend is remote. 2 Marks The finance costs are a major strain on the groups resources. It is essential that trading losses are eliminated in the very short term. 1 Mark Short Term Liquidity: The current ratio at 31 December 2005 was approx. 0.5:1 ( 4,821/ 9,769) and the acid test ratio was 0.46:1. These ratios indicate a serious cash flow position. 1 Mark Recommendations: Hospital Plc should assess whether any non-core assets are available that can be disposed of to create liquidity. The gross profit margins are consistent but the administration expenses which increased by 50% from 2004 to 2005 needs to be investigated and appropriate measures to reduce the costs are essential. There may be once-off exceptional costs included. 1 Mark (Other relevant comments will be considered for marking purposes.) (Total: 6 Marks) [Overall Total: 30 Marks]

Page 13

SOLUTION 2 (a) Goodwill: Orange Limited: 1 January 2000 investment at cost Net assets acquired 80% x 5,000,000 Goodwill Goodwill: Peel Limited: 1 January 2005 investment at cost Net assets acquired 100% x 16,000,000 Negative Goodwill 13,500,000 16,000,000 2,500,000 1 Mark 1 Mark 1 Mark (Total: 6 Marks) (b) Sungap Group Plc Consolidate Income Statement For The Year Ended 31 December 2005 Revenue Cost of sales Gross profit Other operating expenses Operating profit Investment Revenue Finance costs Profit on disposal of subsidiary Profit before taxation Income tax expense Profit for the year after income tax expense Attributable to: Equity holders of the parent company Minority interest ( 11,500,000x20%) 000 159,825,000 (76,392,000) 83,433,000 (45,945,000) 37,488,000 (3,500,000) 7,600,000 41,588,000 10,125,000 31,463,000 29,163,000 2,300,000 51/2 Marks 51/2 Marks 31/2 Marks 7,250,000 4,000,000 3,250,000 1 Mark 1 Mark 1 Mark Marks Allocated

11/2 Mark 11/2 Mark 2 Marks 31/2 Marks

1 1

/2 Mark /2 Mark

(Total: 24 Marks) [Overall Total : 30 Marks]

Page 14

Working 1

Sungap Revenue Cost of sales Gross profit Other operating expenses Operating profit Investment revenue Finance costs Profit on disposal of subsidiary Profit before taxation Income tax expense Profit for the year after income tax expense 78,000,000 (37,500,000) 40,500,000 (23,000,000) 17,500,000 2,000,000 (2,000,000) 17,500,000 (4,750,000)

Peel 16,000,000 (7,000,000) 9,000,000 (5,000,000) 4,000,000 (500,000) 3,500,000 (875,000)

Orange 66,000,000

Adjustment

Final

(55,000)(W5) (120,000)(W4) (32,000,000) 120,000 (12,000) 34,000,000 (67,000) (18,000,000) 16,000,000 (55,000)

159,825,000 (76,392,000) 83,433,000 (45,945,000) 37,488,000 (3,500,000) 7,600,000 41,588,000 (10,125,000)

(2,000,000) (1,000,000) 15,000,000 (3,500,000 7,600,000 (1,000,000)

12,750,000

2,625,000

11,500,000

4,588,000

31,463,000

Working 2 Net assets at date of disposal of Orange Limited:

Share capital as at date of acquisition Profit and loss account at date of disposal Net assets at date of disposal 80% share Sale price Profit on sale

1,000,000 27,000,000 28,000,000 22,400,000 30,000,000 7,600,000

Working 3 Inventories - Intercompany Inventory Profit Sold 12,000 x half still unsold = 60,000 x 1/5 (profit mark-up on cost 25%) Workings 4 Intercompany Revenue Intercompany Revenue (sale) and cost of sales of Workings 5 Management Charge Intercompany management charge of

12,000

12,000 eliminated.

55,000 - eliminate revenue and expense.

Page 15

SOLUTION 3 1. 2. B D = 3. D 160,000+ 30,000 - 35,000 155,000 X12.5% = 19,375 +

10,000 =

29,375.

2,500,000 + 75,000 + 4,250,000 +( 9,000,000X7% X 9/12 = 472,500) = 7,297,500. 2,250,0000 - ( 105,000 + 1.5M + .38M = 105,000) = 2,040,000 / 3.6m shares = 0.567.

4. 5. 6. 7. 8.

C A B C C

1.88M X 40% = 30M =

752,000.

70M X 20% =

14M -

16M

500 X 8 = 4,000

(8 x 2 /2 = 20 Marks )

Page 16

SOLUTION 4 (a) (b) Intangible asset: an intangible asset is an identifiable non-monetary asset without physical substance. 2 Marks Examples of intangible assets include computer software, patents, copyrights, motion picture films, customer lists, mortgage servicing rights, fishing licences, import quotas, franchises, customer or supplier relationships, customer loyalty, market share and marketing rights. To be capitalized they must meet the definition of an intangible asset i.e. identifiability, control over a resource and the existence of future economic benefits. If an asset fails to meet this definition, than expenditure should be expensed unless part of a business combination, when it should be treated as part of goodwill. Identifiability Goodwill, in a business combination, represents a payment in anticipation of future economic benefits from assets that are not capable of being individually identified and separately recognized. An intangible asset meets the identifiability criterion in the definition of an intangible asset when it: Is separable i.e. capable of being separated or divided from the entity and sold, transferred, licensed, rented or exchanged, either individually or together with a related contract, asset or liability; or Arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations. 2 Marks Control An entity controls an intangible asset if it has the power to obtain future economic benefits and restrict the access of others to those benefits. Capacity to control is usually via legal rights, but that is not a necessary condition. 2 Marks Future economic benefits These can include revenue from the sale of products or services, cost savings or other benefits resulting from the use of the asset e.g. use of intellectual property may reduce future production costs rather than increase future revenues. 2 Marks Internally generated goodwill Internally generated goodwill shall not be recognized as an asset. It is not an identifiable resource (i.e. it is not separable nor does it arise from contractual or other legal rights) controlled by the entity that can be measured reliably at cost. Differences between the market value of an entity and the carrying amount of its identifiable net assets may capture a range of factors that affect the value of the entity. Such differences cannot be considered to represent the cost of intangible assets controlled by the entity. 2 Marks

(c)

Page 17

(d)(i) Disclosure General The following should be disclosed for each class of intangible assets split between internally generated and other intangible assets: 1. Whether the useful lives are indefinite or finite and, if the latter, their useful lives or amortization rates used 1 Mark The amortization methods adopted 1 Mark The gross carrying amount and accumulated amortization at start and end of the period 1 Mark The line item of the income statement in which the amortisation charge is included 1 Mark 5. A reconciliation of the carrying amount at start and end of the period showing: Additions, split between internal, acquired and via business combinations Retirements and disposals Revaluations Impairment losses Impairment losses reversed Amortization during the period Net exchange differences Other changes in carrying amount 1 Any 6 x /2 Marks = 3 Marks

2. 3. 4.

A class of intangible assets may include: 1. Brand names 2. Mastheads and publishing rights 3. Computer software 4. Licences and franchises 5. Copyrights, patents and other industrial property rights 6. Recipes, formulae, models, designs and prototypes 7. Intangible assets under development 1 Mark Further disaggregation may be required if it involves providing more relevant information. The financial statements shall also disclose: 1. 2. 3. 4. 5. If an intangible asset has an indefinite useful life, the carrying amount and the reasons supporting the assessment of that life; the significant factors should be described A description, the carrying amount and remaining amortisation period of any individual intangible asset that is material to the entity as a whole For acquired intangibles via grant, the initial fair value, their carrying amount, and whether carried under the benchmark or allowed alternative treatment for subsequent measurement The existence and carrying amounts of intangibles whose title is restricted or pledged for security The amount of contractual commitments for the acquisition of intangibles. (Total 8 Marks)

Page 18

(ii)

Intangible assets carried under the allowed alternative treatment The following shall be disclosed: 1. By class of intangible assets: The effective date of the revaluation The carrying amount and The carrying amount had the benchmark treatment been adopted (historic cost) 1 Mark 2. The amount of the revaluation surplus at start and end of period indicating any changes and any restrictions on distribution

/2 Mark

3.

The methods and significant assumptions applied in estimating the asset fair values.

/2 Mark

Research and development expenditure The aggregate amount of research and development expenditure expensed during the period should be disclosed. Other information An entity is encouraged to disclose the following: 1. A description of any fully amortised intangible asset that is still in use 2. A brief description of significant intangible assets controlled by the entity but not recognized as assets as they failed to meet the recognition criteria in IAS 38 or were generated prior to IAS 38 being made effective. (Total : 2 Marks) [Overall Total: 20 Marks]

Page 19

SOLUTION 5 (a) Measurement process required when applying the fair value model to investment properties. Accounting policy Either the fair value model or the cost model should be chosen and the same model applied to all investment properties. If fair value is chosen, an entity is encouraged (but not required) to determine fair value on the basis of a valuation by an independently qualified valuer. It is highly unlikely that a change from one model to another could result in a more appropriate policy under IAS 8. 1 Mark Fair value model After initial recognition, if fair value is adopted, entities must measure all investment properties at that value with any gains/losses being included in net profit/loss for the period in which it arises. Fair value is usually its market value but excluding any special terms. Any selling costs must not be deducted in arriving at fair value. 4 Marks When a property interest held by a lessee under an operating lease is classified as an investment property, the fair value model should be applied. The fair value should reflect the actual market state at the balance sheet date, not of the past or the future. It also assumes simultaneous exchange and completion of the contract between knowledgeable and willing parties. 1 Mark Fair value should reflect any rental income from current leases, and be based on reasonable and supportable assumptions about the markets view on rental income from future leases in the light of current market conditions. Both parties are assumed to be able to buy and sell at the best price possible, and not eager or forced to buy or sell. 1 Mark The best evidence of fair value is normally provided by current prices on an active market for similar property in the same location and condition. In the absence of this, an entity should consider information from a variety of sources, including: Current prices on an active market for properties of different nature, condition or location, adjusted to reflect those differences; Recent prices on less active markets, with adjustments to reflect any changes in economic conditions since the date of the transactions that occurred at those prices; and Discounted cash flow projections based on reliable estimates of future cash flows supported by external evidence and adopting discount rates reflection current market assessments of the uncertainty in the amount and timing of the cash flows. 2 Marks

In some cases, a different conclusion as to the fair value of an investment property may be suggested using the above. The reasons for those differences must be considered in order to arrive at the most reliable estimate of fair value. Where the variability in the range of fair values is so great and probabilities are so difficult to assess then the fair value may not be determined reliably on a continuing basis. Fair value is not the same as value in use. It does not reflect any: Additional value derived from the creation of a portfolio of properties in different locations; Synergies between investment property and other assets; Legal rights or restrictions that are specific to the current owner; and Tax benefits or tax burdens specific to the current owner. 1 Mark

Page 20

Care must also be taken not to double count assets or liabilities that are recognised separately for example: Equipment such as elevators or air conditioning; Furniture in a furnished lease; Prepaid or accrued rental income; and the fair value of investment property held under a lease reflects expected cash flows thus there is the need to add back any recognised lease liability to arrive at the fair value of the investment property Fair value should also not reflect future capital expenditure that will enhance or improve the property. Moreover, any expected excess expenditure over receipts should be accounted for under IAS 37. 1 Mark In exceptional cases, where there is clear evidence that the entity will not be able to determine the fair value of an investment property reliable on a continuing basis, an entity should measure the property according to the benchmark treatment in IAS 16 with an assumed residual value of zero. The entity must continue to apply IAS 16 until the property is disposed. However all other investment properties should be measured at fair value. If an entity has measured investment properties at fair value, it must continue to do so until disposal or unless the property becomes owner occupied, even if comparable market transactions become less frequent or market prices less readily available. 1 Mark Cost model if an entity adopts the cost model, it should measure all of its investment properties in accordance with IAS 16 i.e. at cost less accumulated depreciation and impairment losses. (Total: 12 Marks) (b) Journal entries and explanations in respect of investment properties valuations. Explanation: Under the fair value model, entities must measure all investments at fair value with any gains/losses being included in the net profit/loss for the period in which it arises. 2 Marks (i) Southend Property: Income statement Investment property Southend CR. DR. 135,000 135,000 3 Marks

(ii)

Westport Property: Income statement Investment property Southend DR. CR. 110,000 110,000 3 Marks (Total : 8 Marks) [Overall Total : 20 Marks]

Page 21

You might also like

- Process CostingDocument48 pagesProcess CostingIrfanNo ratings yet

- Financial Reporting IIDocument478 pagesFinancial Reporting IIIrfan100% (3)

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Who Assissainated BENAZIR BHUTTODocument213 pagesWho Assissainated BENAZIR BHUTTOIrfanNo ratings yet

- Leases IAS 17Document56 pagesLeases IAS 17Irfan100% (4)

- Events After The Reporting Period (IAS-10)Document6 pagesEvents After The Reporting Period (IAS-10)IrfanNo ratings yet

- SYLLABUS Spring 2015Document83 pagesSYLLABUS Spring 2015IrfanNo ratings yet

- F6 - TAXATION (PAKISTAN) ACCA - 2012 - Jun - QDocument12 pagesF6 - TAXATION (PAKISTAN) ACCA - 2012 - Jun - QIrfanNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2014Document6 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2014IrfanNo ratings yet

- (Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Document96 pages(Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Muhammad Usman Khan81% (21)

- (Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Document91 pages(Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Muhammad Usman Khan100% (3)

- Karway Khrbozay BY JAVED CHAUDHRYDocument1 pageKarway Khrbozay BY JAVED CHAUDHRYIrfanNo ratings yet

- Borrowing CostsDocument19 pagesBorrowing CostsIrfan100% (20)

- True Stories of WomanDocument12 pagesTrue Stories of WomanIrfanNo ratings yet

- Right of Parents, Wife and TeachersDocument176 pagesRight of Parents, Wife and TeachersIrfanNo ratings yet

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDocument9 pagesF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNo ratings yet

- Leases IAS 17Document56 pagesLeases IAS 17Irfan100% (4)

- Decentralization (Organization Behaviour)Document15 pagesDecentralization (Organization Behaviour)Irfan100% (1)

- Topic Wise Taxation Icap Past Papers (Pak) of C.ADocument30 pagesTopic Wise Taxation Icap Past Papers (Pak) of C.AIrfan33% (3)

- Ifrs 16 (Property, Plant and Equpement)Document82 pagesIfrs 16 (Property, Plant and Equpement)Irfan100% (7)

- Financial Reporting of IcampDocument20 pagesFinancial Reporting of IcampIrfanNo ratings yet

- Ifrs 36 (Impairement of Assets)Document33 pagesIfrs 36 (Impairement of Assets)Irfan100% (4)

- Solution of First Term Exam of Taxation (Module C) of C.ADocument4 pagesSolution of First Term Exam of Taxation (Module C) of C.AIrfanNo ratings yet

- P2-Coporate Reporting-Acca - Jun 2011Document8 pagesP2-Coporate Reporting-Acca - Jun 2011IrfanNo ratings yet

- First Term Exam of Taxtion (Pak) For Module C of C.ADocument3 pagesFirst Term Exam of Taxtion (Pak) For Module C of C.AIrfanNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- First Term Exam of Taxation For Moudul C of C.ADocument3 pagesFirst Term Exam of Taxation For Moudul C of C.AIrfanNo ratings yet

- Financial Reporting (S-501) : Stage-5 / Professional IIIDocument4 pagesFinancial Reporting (S-501) : Stage-5 / Professional IIIIrfanNo ratings yet

- F6-TAXATION - ACCA (PK) 2011 JunDocument11 pagesF6-TAXATION - ACCA (PK) 2011 JunIrfanNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualDocument22 pagesFinancial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualRayane M Raba'a0% (1)

- Accounting MCQsDocument29 pagesAccounting MCQsmastermind_asia9389No ratings yet

- Advanced Accounting 1Document11 pagesAdvanced Accounting 1SheenaGaliciaNew75% (8)

- Project Report for Term Loan of Rs. 45.40 LacsDocument16 pagesProject Report for Term Loan of Rs. 45.40 LacsneerajthakurNo ratings yet

- Accounting for Inventory CostsDocument16 pagesAccounting for Inventory CostsLemma Deme ResearcherNo ratings yet

- Davey Brothers in Class WorkingDocument13 pagesDavey Brothers in Class WorkingPiyush KumarNo ratings yet

- Financial Management C11 P11Document4 pagesFinancial Management C11 P11lynusannNo ratings yet

- 16 Format of Financial Follow Up Report SbiDocument4 pages16 Format of Financial Follow Up Report SbiSandeep PahwaNo ratings yet

- Survey of Accounting 5th Edition Edmonds Solutions ManualDocument25 pagesSurvey of Accounting 5th Edition Edmonds Solutions ManualAlexisScottcmr100% (40)

- Chapter 3 Deferred TaxDocument47 pagesChapter 3 Deferred TaxHammad Ahmad100% (1)

- Dhanuka Agritech - 6071240150422127514Document7 pagesDhanuka Agritech - 6071240150422127514Rohit DhimanNo ratings yet

- Chapter 3 - Accounting PrinciplesDocument23 pagesChapter 3 - Accounting PrinciplesVivek GargNo ratings yet

- 00388FS2021Document96 pages00388FS2021MUSE OMHNo ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

- Measuring of Assets RuswandyDocument5 pagesMeasuring of Assets RuswandyDillart SpaceNo ratings yet

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- Jurnal Ud. WirastriDocument13 pagesJurnal Ud. WirastriRinaNo ratings yet

- SEM 3A & 4A - Accounting AnalysisDocument36 pagesSEM 3A & 4A - Accounting AnalysisSteffen HoNo ratings yet

- Analyze financial statements with ratios and analysesDocument40 pagesAnalyze financial statements with ratios and analysesPhương Anh VũNo ratings yet

- Project Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Document20 pagesProject Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Arun OusephNo ratings yet

- Amalgamation of Companies and External Reconstruction QuestionsDocument12 pagesAmalgamation of Companies and External Reconstruction Questionskashish mehtaNo ratings yet

- CMA Part 2 Slides PDFDocument80 pagesCMA Part 2 Slides PDFmohamedNo ratings yet

- 0452 w06 Ms 2Document8 pages0452 w06 Ms 2Osama SalamaNo ratings yet

- Accounting 104 assignment solutionsDocument2 pagesAccounting 104 assignment solutionsClesclay FernandezNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- Changes in Accounting Policy XXX XXX Prior Period Errors XXX XXX Other Adjustments XXX XXXDocument1 pageChanges in Accounting Policy XXX XXX Prior Period Errors XXX XXX Other Adjustments XXX XXXMark Ronnier VedañaNo ratings yet

- Ebook PDF Corporate Finance 4th Edition by Jonathan Berk PDFDocument41 pagesEbook PDF Corporate Finance 4th Edition by Jonathan Berk PDFjennifer.browne345100% (34)

- Chapter 8 Implementing - Strategies - Marketing - FinanceDocument45 pagesChapter 8 Implementing - Strategies - Marketing - FinanceayuNo ratings yet

- Individual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150Document7 pagesIndividual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150iancroott100% (1)