Professional Documents

Culture Documents

Retail Industry in India

Uploaded by

salonigoel11Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail Industry in India

Uploaded by

salonigoel11Copyright:

Available Formats

Macro-Economics Case Study

Inflation In India

Section S4, Group 11 FT12422 FT12430 FT12455 FT12468 FT12471 Deepthi D HariharanG Saloni Goel Subin Peter Joseph Uday Pratap Singh

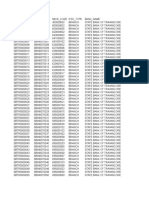

Is inflation in India structural or monetary? The recent inflation rise was largely cyclical and that the structural inflation trend should remain stable in the range of 5-5.5%. India's inflation has been lower compared with other emerging markets. Inflation WPI and CPI-Industrial Workers (CPI-IW) have averaged 5.3% and 6.8%, respectively, over the last 15 years compared with 11.2% average (CPI) for emerging markets. Double-digit inflation is not the norm. Indeed, over the last 10 years on an annual average basis, WPI inflation crossed 10% not once while CPIIW crossed 10% only one time. during 2003-07, India's GDP growth averaged 8.9% and WPI inflation averaged 5.5%. In other words, India has been able to transition to higher growth without the significant acceleration in inflation but for the recent cyclical spikes in inflation as discussed above India's investment to GDP gradually rose from 25.2% in F2003 to 37.7% in F2008 and savings to GDP to rose from 26.3% in F2003 to 36.4% in F2008. Infrastructure spending also increased from a trough of 4.3% of GDP in F2003 to 6.4% of GDP in F2008. Capital deepening, a rise in trade to GDP, increased capital inflows, an improvement in technology and corporate management efficiency helped improve productivity growth. Total factor productivity growth accelerated to 3.8% during 2003-07 from an average 2.4% in the 1990s. However, in the long term, capacities are flexible and can be increased in response to rising demand pressure without stoking inflationary expectations. The structural inflation trend in India should be lower, not higher, due to the possibility of improved supply side conditions. What about structural rise in food demand and inflation? Disentangling the cyclical component from the structural component is not easy. Food inflation

has averaged 12.2% year-on year since summer 2008 due to two years of backto-back poor farm output. Prior to that, during 2006 and 2007 when GDP growth averaged 9.7% and domestic food demand growth was strong, average food inflation was in the 6-7% range. This was higher than the preceding five-year (2001-05) period, when average food inflation was 3.4% and GDP growth was 6.6%. In other words, in the event of GDP growth remaining strong at 8.5-9%, considering the structural supply hurdles, food inflation is likely to remain high in the 6-7% range.Moreover, investments in the economy tend to be higher than savings The key risk, from a cyclical and structural perspective, will be the government's policies. If the government and the central bank attempt to boost growth through the support of loose fiscal and monetary policies instead of structural reforms, which help boosts savings and investments, inflation will be higher than expectations. What is the nature and what are the causes of this inflation? Nature of Inflation: India is as a country where inflation is relatively more volatile through the business cycle than in other countries. It doesnt help that Indian agricultural output is very volatile, partly because of poor infrastructure, bad supply chains, poor storage facilities, and the like. This means that changes in weather conditions or other factors affecting output can lead to really large price fluctuations. The wholesale price inflation always lags behind the consumer price inflation, with its greater focus on food and fuel prices. The relative weights attached to food and fuels in the consumer price index basket is amongst the highest for India. This too contributes to the abnormally high recorded rates of inflation for India.

Causes for Inflation Food price situationGlobal and local. Domestic food price inflation has witnesss high volatility due to both structural and transitory factors .The food article prices came down in Feb but protein rich food price remained high due to structural demand supply imbalances. on food manufactured products inflation, an indicator of demand side pressure , rose shapely from 4.8% in Jan to 6.1% in Feb. There is strong enough evidence in favor of more structural-demographic factors for India's food inflation. The rising percapita incomes are naturally accompanied by shifting consumption patterns. People increase their consumption of high-protein meats and pulses, oils, vegetables and fruits.

It may therefore be no coincidence that the prices increases have been steepest in these categories. At a compounded annual growth rate (CAGR), the price of a basket of vegetables has increased 21.26% in the last five years, compared to the WPI for all commodities rising by around 5%. In simple terms, the increased supply (and the acreage, prod\uction and productivity of vegetables have risen) has not been able to keep pace with the increase in demand. In fact, as the graphic below indicates, the relative weights attached to food and fuels in the consumer price index basket are amongst the highest for India. This too contributes to the abnormally high recorded rates of inflation for India.

RBI Policies RBI planned that Liquidity from the market can be drained by decreasing money supply and to do so it is increasing CRR, repo rate, reverse repo rate and taking other measure like that. But interest is that whether hike to crr and other factors will curb inflation and what are the other factors, which are influencing inflation.Repo and reserve Repo rates hikes by 25 bps to 6.75% and 5.75%.CRR has remained untouched at 6.00%.SLR at 24%.

The inflation rate in India was last reported at 9.41 percent in April of 2011. From 1969 until 2010, the average inflation rate in India was 7.99 percent reaching an historical high of 34.68 percent in September of 1974 and a record low of -11.31 percent in May of 1976. Commodity prices. Prices of some commodities rose sharply in the recent period even as the global recovery was fragile. They continue to impact inflation, domestically and globally. We have the shares of oil companies in the portfolio of our country. We also have companies in the areas of iron ore, copper, platinum, nickel and coal. The per-capita income of a general Indian is on rise. Hence, the demand for the

commodity will remain strong going ahead. The energy consumption is going up in the Asian countries as well as the other developing countries. Can organized retailing in India reduce the inflation? The Indian retail industry is one of the fastest growing industries in India. It has both organized and unorganized sectors. Though initially, the retail industry in India was mostly unorganized with more than 90 % of share but due to the change of tastes and preferences of the consumers, with increase in the purchasing power and large number of working young population, the industry is getting more organized. The Indian organized retail industry is valued at about $300 billion and In India the vast middle class and its almost untapped retail industry are the key attractive forces for global retail giants wanting to enter into newer markets, which in turn will help the India Retail Industry to grow faster. Indian retail is expected to grow 25 per cent annually. Modern retail in India could be w `orth US$ 175-200 billion by 2016. According to the current statistics of India, 95% of the total business in retail is shared by kiraana stores. The various self-service stores selling food and personal care products are pantaloon retail stores, RPG Retail stores, Tata Retail, KRaheja Corp. Group etc. With the assumption of organized retail sector to have large penetration in the Indian market in future stands true, it can reduce the effect of inflation by better government policy exercises price capping at the higher end over the organized retail sector. Also by extending a considerable lower price to the consumer and an optimum price to the producer with help of retailers providing an extensive delivery with efficient supply chain.

References:

http://articles.economictimes.indiatimes.com/2010-1122/news/27574850_1_india-s-gdp-wpi-inflation-gdp-growth/3 http://ibnlive.in.com/news/food-prices-a-structural-inflation-driver-rbi/1337677.html

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Project Report On Sales and Distribution Management VIP Luggages Submitted byDocument22 pagesA Project Report On Sales and Distribution Management VIP Luggages Submitted bydyumnaNo ratings yet

- UPSCDocument4 pagesUPSCArata Chandra Deep50% (2)

- Porters Five Forces AnalysisDocument83 pagesPorters Five Forces AnalysisNimesh Gunasekera67% (3)

- RedBrand Answers 1Document3 pagesRedBrand Answers 1Karthikeyan VelusamyNo ratings yet

- Iasdm1 FT12455Document4 pagesIasdm1 FT12455salonigoel11No ratings yet

- KarenDocument1 pageKarensalonigoel11No ratings yet

- Martin ThesisDocument86 pagesMartin Thesissalonigoel11No ratings yet

- BRD InvoicesDocument29 pagesBRD InvoicesJTOCCN ORAINo ratings yet

- JKReorganisation (withMCQs) NewDocument47 pagesJKReorganisation (withMCQs) NewRajeshNo ratings yet

- Telugu Pandit Training Colleges PDFDocument1 pageTelugu Pandit Training Colleges PDFNagaraj KumarNo ratings yet

- SBT Ifsc DetailsDocument125 pagesSBT Ifsc DetailsPanruti S Sathiyavendhan0% (1)

- EOUT (Synopsis)Document8 pagesEOUT (Synopsis)Zenith RoyNo ratings yet

- Economics ProjectDocument15 pagesEconomics ProjectAnanya ShuklaNo ratings yet

- Bhakti Movement in South IndiaDocument2 pagesBhakti Movement in South IndiaJibin Jose.GNo ratings yet

- Ginni International Limited-1Document17 pagesGinni International Limited-1Charanpreet SinghNo ratings yet

- JSIS 203 SyllabusDocument6 pagesJSIS 203 SyllabusTJ HookerNo ratings yet

- Sbi Associates PO ResultDocument4 pagesSbi Associates PO ResultbankportalibpsNo ratings yet

- PDFViwer AspxDocument8 pagesPDFViwer AspxPuneet SapoliaNo ratings yet

- Tamil Calender in TamilDocument7 pagesTamil Calender in TamilMohan RajNo ratings yet

- Class Notes 9 Bakhtiyar Khalji 1Document3 pagesClass Notes 9 Bakhtiyar Khalji 1Rokeya Alfi MahiNo ratings yet

- STD 12 Physics Part-2 Guj Medium 2019 PDFDocument232 pagesSTD 12 Physics Part-2 Guj Medium 2019 PDFDivyesh RanganiNo ratings yet

- CholanDocument2 pagesCholanThevalozheny RamaluNo ratings yet

- Characteristics of Indian Economy Pre-Colonial and ColonialDocument15 pagesCharacteristics of Indian Economy Pre-Colonial and Colonialcooooool1927100% (9)

- Standing Committee On Social Justice & EmpowermentDocument90 pagesStanding Committee On Social Justice & EmpowermentHussainNo ratings yet

- Mic Electronics Research ReportDocument17 pagesMic Electronics Research ReportSudipta BoseNo ratings yet

- Press ReleaseDocument3 pagesPress ReleaseVasu Ram JayanthNo ratings yet

- PSB Comparison - Q1 FY 22-23Document1 pagePSB Comparison - Q1 FY 22-23MehanNo ratings yet

- CT - List of Commercial Taxes OfficesDocument27 pagesCT - List of Commercial Taxes OfficesAshik A100% (1)

- War of Independence 1857Document2 pagesWar of Independence 1857Ahmad RazaNo ratings yet

- GK Today Current Affairs December 2015Document251 pagesGK Today Current Affairs December 2015Enforcement OfficerNo ratings yet

- FR CDS I 18 EnglDocument5 pagesFR CDS I 18 EnglVaibhavBadgujarNo ratings yet

- India Today - March 19, 2018 PDFDocument144 pagesIndia Today - March 19, 2018 PDFNetaji GandiNo ratings yet

- General Studies (Prelims) Paper - 1991Document42 pagesGeneral Studies (Prelims) Paper - 1991ShreeRamNo ratings yet

- List of Books Available at Embassy LibraryDocument108 pagesList of Books Available at Embassy LibrarySACHCHIDANAND PRASADNo ratings yet