Professional Documents

Culture Documents

Reenply Ndustries: On A Firm Footing

Uploaded by

rahulrupvyasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reenply Ndustries: On A Firm Footing

Uploaded by

rahulrupvyasCopyright:

Available Formats

PCG Research | Urban Infrastructure

Result Update

Greenply Industries

GREENPLY INDUSTRIES

On a firm footing

INR 315

BUY

January 23, 2008

Greenply Industries (GIL) Q3FY08 results were in line with our expectations. Net sales were up by 40% Y-o-Y at INR 1.5 bn, and EBITDA and net profit were up by 47% and 50% Y-oY at INR 211 mn and INR 98 mn, respectively. We are revising our FY09 estimates to incorporate revenues from the bathroom cubicle business as well as expansion of the laminates unit in Himachal Pradesh. Revenues and net profit for FY09E have been revised upwards by ~5% and 2%, respectively. Further upside to our estimates for FY09 would be better-than-anticipated growth in realisations and volumes as well as improvement in working capital cycle, which we have not included. We thus remain positive on GILs prospects, given the strong demand for interior infrastructure products. We maintain our BUY recommendation. Key highlights Net sales up by 40% Y-o-Y at INR 1.5 bn. Volume and realisation growth aided rise in net sales. Realisations for laminates and decorative veneer divisions were up 10% and 11% Y-o-Y respectively. Expanded capacities from Uttaranchal unit drove plywood volumes up by 51% Y-o-Y. The plywood division contributed 55% of revenues at INR 898 mn, compared to 49% in the same quarter previous year.

Reuters : : GRPL.BO MTLM IN Prakash Kapadia +91-22-4097 9843 prakash.kapadia@edelcap.com Grishma Shah +91-22-4097 9842 grishma.shah@edelcap.com

Laminates and allied products contributed 45% of revenues at INR 729 mn, compared to 51% during the same quarter previous year. Strong growth in EBITDA and net profit; margins subdued EBITDA grew at 47% Y-o-Y at INR 211 mn whereas net profit grew at 50% Y-o-Y at INR 98 mn. Despite a strong growth in EBITDA and profit, margins where under pressure on the back of higher than anticipated marketing and staff costs. GIL is increasing its marketing team to widen its distribution network across India for its entire product basket benefits of which we believe would be visible in FY09E.

Bloomberg

Market Data 52-week range (INR) Share in issue (mn) M cap (INR bn/USD mn) Avg. Daily Vol. BSE (000) : : : : 419 / 101 17.0 5.4 / 135.8 31.8

Share Holding Pattern (%) Promoters MFs, FIs & Banks FIIs Others : : : : 54.9 8.2 10.4 2.5

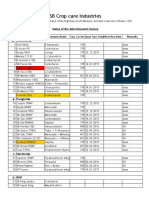

Financials Year to March Revenues (INR mn) EBITDA (INR mn) Net profit (INR mn) EPS (INR) P/E

* consolidated

Q3FY08 1,525 211 98 5.8

Q3FY07 1,089 144 66 4.0

%change Q2FY08 %change 40.1 1,484 2.8 46.7 216 (2.6) 49.7 112 (12.0) 45.0 6.7 (13.9)

FY07* 4,406 463 226 13.7 22.9

FY08E* 5,467 776 408 24.0 13.1

Edelweiss Research is also available on Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Greenply Industries

Capex plans: Laminates unit to be on stream by Q2FY10E; MDF yet to be finalized GIL has announced plans to venture into MDF manufacturing as well as increase its laminates capacity. The MDF plant will come up at its existing unit at Uttaranchal, whereas the laminates facility will be set up in Himachal Pradesh. We have not assumed MDF expansion in our estimates as we are awaiting further clarity. The Himachal unit will have a capacity of ~ 2.03 mn sheets. Expansion will be done at a cost of INR 700 mn and will be funded through a mix of debt and internal accruals with majority of capex to be completed in FY09E. We expect the laminates unit to be on stream by Q2FY10E. The company plans to use laminates from this unit for its bathroom cubicle business as well as sell them in the market. Upgrading FY09 estimates: Incorporating new business as well as expansion plans We are upgrading our FY09 revenue and profit estimates by ~5% and 2%, respectively, to incorporate revenues and profits from the bathroom cubicle business as well as expansion at the Himachal unit. We expect GIL to install ~3,500 units in FY09E fetching revenues of ~ INR 99 mn. For FY09E, GIL will be importing most of the material from Malaysia, Taiwan, and China, and do the assembling in India, whereas post Q2FY10E GIL intends to replace imports with laminates from the Himachal unit. The targeted customers will be malls, airports, lounges, corporates, among others. Outlook and valuations: Going strong; maintain BUY We expect GILs revenue and profit to grow at CAGR of 14% and 31%, respectively, during FY07-09E. We have not incorporated the proposed capacity expansion plans for MDF in our estimates as we are waiting clarity on funding, cost, and size of the project. Our numbers will be revised once details of the capex plans are available. At CMP of INR 315, the stock is trading at 13.1x FY08E EPS of INR 24.0 and 10.6x FY09E EPS of INR 29.8. We maintain our BUY recommendation.

Greenply Industries

Financials snapshot Year to March Net revenues Raw materials Staff costs Purchase of finished goods Admin. & selling expenses Other expenditure Total expenditure EBITDA Interest Depreciation Other income Profit before tax Tax Profit after tax Net profit Equity capital No. of shares (mn) EPS (INR) P/E (x) as % of net revenues Raw material Staff costs Purchase of finished goods Admin. & selling expenses Other expenditure EBITDA Net profit Tax rate

*Consolidated

(INR mn) Q3FY08 1,525 740 108 60 215 192 1,315 211 46 36 3 132 33 98 98 85 17.0 5.8 Q3FY07 %change 1,089 609 72 1 124 137 945 144 39 24 0 81 15 66 66 82 16.5 4.0 Q2FY08 %change 1,484 775 90 20 190 193 1,267 216 49 33 23 156 45 112 112 83 16.6 6.7 FY07* 4,406 2,358 298 120 956 212 3,943 463 118 87 8 266 40 226 226 82 16.4 13.7 22.9 FY08E* 5,467 3,171 355 0 902 262 4,690 776 153 128 48 543 136 408 408 85 17.0 24.0 13.1 FY09E* 6,548 3,716 409 98 1,048 314 5,586 963 182 155 23 648 143 506 506 85 17.0 29.8 10.6

40.1 21.5 49.1 4,216.4 72.6 39.4 39.1 46.7 16.8 51.5 1,836.1 62.9 120.2 49.7 49.7 3.2 3.2 45.0

2.8 (4.4) 20.2 200.5 13.2 (1.0) 3.7 (2.6) (7.6) 7.3 (87.9) (15.6) (24.8) (12.0) (12.0) 2.3 2.3 (13.9)

48.5 7.1 4.0 14.1 12.6 13.8 6.5 25.4

56.0 6.6 0.1 11.4 12.6 13.2 6.0 18.8

52.2 6.0 1.4 12.8 13.0 14.6 7.5 28.5

53.5 6.8 2.7 21.7 4.8 10.5 5.1 15.2

58.0 6.5 16.5 4.8 14.2 7.5 25.0

56.8 6.3 1.5 16.0 4.8 14.7 7.7 22.0

Greenply Industries

Company Description

GIL, incorporated in 1984, is now Indias largest interior infrastructure company. GIL is a market leader in organized plywood and laminates in India with a market share of ~25% and ~15%, respectively. The company has units located at West Bengal, Nagaland, Rajasthan, and Uttaranchal for manufacturing plywood, decorative veneers, laminates, and particle boards. Recently it has also acquired two Gujarat based plywood units. GIL has a presence with 24 marketing offices, a 217 member marketing team, 1,700 authorized distributors and dealers, and 5,400 sub-dealers in India and an export presence in 18 countries across the globe.

Investment Theme

One of the largest organized players in the interior infrastructure space, GIL has, over the past two years, grown at 52% CAGR in terms of profit. The improvement in margins has been aided by the companys shifting from low-margins products like sawn timber to value-added products like decorative veneers. GIL has increased its plywood capacity by 25%, that of laminates by 35%, and pre-lam particleboard capacity by 160% over FY05-07. With the renovation cycle for furniture reducing from 12-15 years to three-four years and a booming housing market we believe the demand side indicators are fairly strong to support 20-25% Y-o-Y industry growth for the next three years, which augurs well for GIL.

Key Risks

Any slowdown in the economy. Fluctuations in raw material pricestimber, phenol, and paper. A change in government policies pertaining to timber procurement/production.

Greenply Industries

Financial Statements

Income statement Year to March Net sales Total revenues Raw material cost Purchase of finished/trad. goods Employee cost Manufacturing expenses Selling, admin. & other expenses Total operating expenses EBITDA Depreciation EBIT Interest expense Other income Profit before tax Provision for tax Profit after tax Net Profit Earnings per share Shares outstanding Dividend (INR/share) Common size metrics as % on revenues Year to March Operating expenses Depreciation EBITDA margins Net profit margins Growth metrics (%) Year to March Revenues EBITDA PBT Net profit EPS FY05 NA NA NA NA NA FY06 61.9 72.4 114.6 166.5 0.5 FY07 57.6 56.8 61.1 60.5 31.1 FY08E 24.1 67.8 104.0 80.4 74.6 FY09E 19.8 24.0 19.3 24.1 24.1 FY05 90.1 2.4 9.9 3.1 FY06 89.4 2.3 10.6 5.0 FY07 89.5 2.0 10.5 5.1 FY08E 85.8 2.3 14.2 7.5 FY09E 85.3 2.4 14.7 7.7 FY05 1,726 1,726 1,100 39 66 70 280 1,555 171 42 130 61 9 77 24 53 53 10.4 5.1 2.5 FY06 2,795 2,795 1,613 8 147 135 598 2,500 295 63 232 76 10 165 25 141 141 10.5 13.4 2.0 FY07 4,406 4,406 2,358 120 298 212 956 3,943 463 87 376 118 8 266 40 226 226 13.7 16.4 2.5 FY08E 5,467 5,467 3,171 0 355 262 902 4,690 776 128 648 153 48 543 136 408 408 24.0 17.0 2.5 (INR mn) FY09E 6,548 6,548 3,716 98 409 314 1,048 5,586 963 155 808 182 23 648 143 506 506 29.8 17.0 2.5

Cash flow statement Year to March Cash flow from operations Cash for working capital Net operating cash flow- A Net purchase of fixed assets Net purchase of investments Net cash flow from investing- B Proceeds from equity Proceeds from preference shares Proc./Repayments from borrowings Dividend payments Net cash flow from financing- C Net cash flow (A+B+C)

5

(INR mn) FY06 204 (118) 86 (712) (712) 164 536 (32) 667 42 FY07 313 (122) 190 (512) (1) (513) 219 (31) 252 (31) 408 85 100 (49) 107 (60) FY08E 535 (202) 333 (500) (500) 56 FY09E 661 (210) 450 (750) (750) 300 (49) 251 (49) FY09E 830 (140) 690 (250) (250) (350) (49) (399) 42

Greenply Industries

Balance sheet As on 31st March Equity capital Pref capital Reserves & surplus Shareholders funds Secured loans Unsecured loans Deferred tax liability Source of funds Gross block Depreciation Net block Capital work in progress Net fixed assets Investments Goodwill Cash, bank bal & deposits Inventory Sundry debtors Loans & advances Total current assets Sundry creditors Others Provisions Proposed dividend Others Total current liabilities Net current assets Application of funds Book value (BV) per share (INR) 20 473 414 90 998 184 25 14 6 8 223 774 1,197 78 62 845 508 173 1,587 580 34 39 21 18 653 934 1,947 49 FY05 51 31 312 395 662 113 27 1,197 711 299 412 9 421 1 FY06 67 31 562 660 1,038 200 49 1,947 1,100 420 680 332 1,012 1 1,005 1,087 1,268 212 58 2,625 1,815 462 1,353 129 1,482 1 1 147 1,143 738 260 2,288 1,024 66 57 29 28 1,146 1,141 2,625 66 FY07 82 1,417 1,502 1,368 212 58 3,140 2,444 590 1,854 1,854 1 1 87 1,418 916 260 2,680 1,270 66 61 49 12 1,397 1,284 3,140 88 FY08E 85

(INR mn) FY09E 85 1,874 1,959 1,668 212 58 3,897 3,194 745 2,449 2,449 1 1 38 1,699 1,097 260 3,094 1,521 66 61 49 12 1,648 1,446 3,897 115

Ratios Year to March ROE (%) ROCE (%) Inventory days Debtor days Fixed assets t/o Debt /Equity Valuation parameters Year to March EPS (INR) FY05 10.4 18.6 38.4 5.1 4.4 44.1 FY06 10.5 FY07 13.7 FY08E 24.0 FY09E 29.8 FY05 13.4 10.8 100 88 4.2 2.0 FY06 21.3 11.9 110 66 4.1 1.9 FY07 20.8 14.3 95 61 3.3 1.4 FY08E 27.1 20.7 95 61 2.9 1.1 FY09E 25.8 20.7 95 61 2.7 1.0

Y-o-Y growth (%)

CEPS (INR) P/E (x) Price/BV (x) EV/Sales (x) EV/EBITDA (x)

0.5

15.2 38.2 8.1 2.9 27.0

31.1

19.0 29.1 6.1 1.8 17.6

74.6

31.5 13.1 3.6 1.5 10.7

24.1

38.9 10.6 2.7 1.3 9.0

Greenply Industries

Edelweiss Securities Limited, 8th Floor, Chander Mukhi, Nariman Point, Mumbai 400 021, Board: (91-22) 4097 9797, Email: research@edelcap.com

Naresh Kothari Mohan Natarajan 2286 4246 4097 9758 Co-Head, Private Client Services Co-Head, Private Client Services

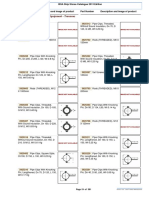

Distribution of Ratings / Market Cap

Edelweiss Research Coverage Universe Buy

Rating Distribution* 108

Rating Interpretation

Rating Expected to

appreciate more than 20% over a 12-month period appreciate up to 20% over a 12-month period depreciate up to 10% over a 12-month period depreciate more than 10% over a 12-month period

Accumulate

44

Reduce

16

Sell

3

Total

188

Buy Accumulate

* 12 stocks under review / 5 rating withheld

> 50bn

Market Cap (INR) 103

Between 10bn and 50 bn

66

< 10bn

19

Reduce Sell

This document has been prepared by Edelweiss Securities Limited (Edelweiss). Edelweiss and its holding company and associate companies are a full service, integrated investment banking, portfolio management and brokerage group. Our research analysts and sales persons provide important input into our investment banking activities. This document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable, but we do not represent that it is accurate or complete and it should not be relied on as such. Edelweiss or any of its affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors. We and our affiliates, officers, directors, and employees may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as advisor or lender/borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Edelweiss and affiliates to any registration or licensing requirements within such jurisdiction. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe, any such restrictions. The information given in this document is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. This information is subject to change without any prior notice. Edelweiss reserves the right to make modifications and alterations to this statement as may be required from time to time. However, Edelweiss is under no obligation to update or keep the information current. Nevertheless, Edelweiss is committed to providing independent and transparent recommendation to its client and would be happy to provide any information in response to specific client queries. Neither Edelweiss nor any of its affiliates, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Past performance is not necessarily a guide to future performance. The disclosures of interest statements incorporated in this document are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. Edelweiss Securities Limited generally prohibits its analysts, persons reporting to analysts and their family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Analyst holding in the stock: no.

Copyright 2007 Edelweiss Research (Edelweiss Securities Ltd). All rights reserved

Edelweiss Research is also available on Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset. Edelweiss Research is also available on Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

You might also like

- MMM SyllabusDocument34 pagesMMM SyllabusPunit ChoradiyaNo ratings yet

- Customer Ret. ChallengesDocument9 pagesCustomer Ret. ChallengesrahulrupvyasNo ratings yet

- An Economic Analysis ofDocument36 pagesAn Economic Analysis ofrahulrupvyasNo ratings yet

- The Industrial Disputes ActDocument71 pagesThe Industrial Disputes ActsharmarohitmsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Phenomenology of The SelfDocument5 pagesPhenomenology of The SelfGuilherme CastelucciNo ratings yet

- Annex A - Scope of WorkDocument4 pagesAnnex A - Scope of Workمهيب سعيد الشميريNo ratings yet

- IGCSE 0408 Unseen Poem QuestionsDocument5 pagesIGCSE 0408 Unseen Poem QuestionsMenon HariNo ratings yet

- Products ListDocument11 pagesProducts ListPorag AhmedNo ratings yet

- ProjectDocument22 pagesProjectSayan MondalNo ratings yet

- Group 4&5 Activity Syntax AnalyzerDocument6 pagesGroup 4&5 Activity Syntax AnalyzerJuan PransiskoNo ratings yet

- Listening Tests 81112Document13 pagesListening Tests 81112luprof tpNo ratings yet

- Case Study Managerial EconomicsDocument4 pagesCase Study Managerial EconomicsZaza Afiza100% (1)

- (QII-L2) Decorate and Present Pastry ProductsDocument30 pages(QII-L2) Decorate and Present Pastry ProductsLD 07100% (1)

- Different Principles Tools and Techniques in Creating A BusinessDocument5 pagesDifferent Principles Tools and Techniques in Creating A BusinessLuna LedezmaNo ratings yet

- Project On Mahindra BoleroDocument35 pagesProject On Mahindra BoleroViPul75% (8)

- NATO Obsolescence Management PDFDocument5 pagesNATO Obsolescence Management PDFluisNo ratings yet

- 2012 Conference NewsfgfghsfghsfghDocument3 pages2012 Conference NewsfgfghsfghsfghabdNo ratings yet

- FM Testbank-Ch18Document9 pagesFM Testbank-Ch18David LarryNo ratings yet

- Aashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraDocument291 pagesAashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraMohammed NasserNo ratings yet

- Dash8 200 300 Electrical PDFDocument35 pagesDash8 200 300 Electrical PDFCarina Ramo LakaNo ratings yet

- LET-English-Structure of English-ExamDocument57 pagesLET-English-Structure of English-ExamMarian Paz E Callo80% (5)

- Ocr A Level History Russia CourseworkDocument7 pagesOcr A Level History Russia Courseworkbcrqhr1n100% (1)

- LMSTC Questionnaire EFFECTIVENESS IN THE IMPLEMENTATION OF LUCENA MANPOWER SKILLS TRAINING CENTER BASIS FOR PROGRAM ENHANCEMENTDocument3 pagesLMSTC Questionnaire EFFECTIVENESS IN THE IMPLEMENTATION OF LUCENA MANPOWER SKILLS TRAINING CENTER BASIS FOR PROGRAM ENHANCEMENTCriselda Cabangon DavidNo ratings yet

- Region: South Central State: Andhra PradeshDocument118 pagesRegion: South Central State: Andhra PradeshpaulinNo ratings yet

- Visual Inspection ReportDocument45 pagesVisual Inspection ReportKhoirul AnamNo ratings yet

- Purification of Dilactide by Melt CrystallizationDocument4 pagesPurification of Dilactide by Melt CrystallizationRaj SolankiNo ratings yet

- Geopolymer Book Chapter1 PDFDocument37 pagesGeopolymer Book Chapter1 PDFDick ManNo ratings yet

- Programming MillDocument81 pagesProgramming MillEddy ZalieNo ratings yet

- USTH Algorithm RecursionDocument73 pagesUSTH Algorithm Recursionnhng2421No ratings yet

- Black Hole Safety Brochure Trifold FinalDocument2 pagesBlack Hole Safety Brochure Trifold Finalvixy1830No ratings yet

- Net Pert: Cable QualifierDocument4 pagesNet Pert: Cable QualifierAndrés Felipe Fandiño MNo ratings yet

- ISSA2013Ed CabinStores v100 Часть10Document2 pagesISSA2013Ed CabinStores v100 Часть10AlexanderNo ratings yet

- CP3 - June2019 2Document5 pagesCP3 - June2019 2Sifei ZhangNo ratings yet

- Catalogo Escavadeira EC27CDocument433 pagesCatalogo Escavadeira EC27CNilton Junior Kern50% (2)