Professional Documents

Culture Documents

KSFE

Uploaded by

jojuthimothyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KSFE

Uploaded by

jojuthimothyCopyright:

Available Formats

Gold Loan Scheme For what purposes can I avail of this advance facility?

This facility is for meeting any type of contingent requirements, thus harnessing the yellow metal, which is usually a non-sweating asset, for productive purposes. What is the duration of the advance? The advance is for a duration of six months. But it can be renewed, if necessary, upto an aggregate period of 24 months by remitting interest in every six months. What is the interest rate? The interest rate is 10% per annum (simple) to a loan upto and including Rs5000/-.Interest rate for loans above Rs 5000/- and upto & including Rs 25000/- is 12% per annum(simple).Interest rate for a loan of above Rs 25000/- is 13% per annum(simple).

What is the maximum amount of loan? Maximum amount of loan is Rs.3-lakhs. What is the special feature of this loan? The special feature for this loan is that the interest is charged for the actual number of days for which the gold is pledged, subject to the condition that minimum interest of Rs.25/- will be charged for an advance exceeding Rs.5000/-.

Interest Rates at a Glance Upto and including Rs.5000/- 10% per annum(simple) Above Rs.5000/- and upto & including Rs.25000/- 12%(simple) Above Rs.25000/- 13% per annum(simple) (Minimum Interest Rs.25/- for loans above Rs.5000/-) (Penal rate of 1%, if interest not remitted in every six months)

5.

What are the main attractions of Gold Loan Scheme of the KSFE ?

The Gold loan scheme of the KSFE is operated through the specialised Gold Loan counters with extended working hours upto 4.30p.m. in more than 250- branches. The loan applications are disposed within a very short time and since the Gold Loan counters are given immense discretionary powers in relation to the decision making about the suitability of the loan applicant for granting the advance is made in a jiffy. Further interest is charged for the actual number of days the gold is under pledge.

Scribd

Manappuram In its latest results the company has posted a net profit of Rs 119.72 crore,an increase of around 295 per cent.Increased profits were driven by a surge in companys gold loan book which went up to Rs 1,845.6 crore from Rs 397.5 crore, an increase of around 365 per cent

http://www.scribd.com/doc/32931353/Gold-Loan-Giant-Manappuram-Finance-Made-SuperProfit

GOLD LOAN GIANT MANAPPURAM FINANCE MAKES SUPER PROFIT THIRUVANANTHAPURAM: Gold loan major Manappuram General Finance and Leasing has reported a net profit of Rs 119.72 crore for the year ended March 31, 2010. Company officials said the figures are not comparable with that of the previous year, since the latest figure comprises those of the combined entities of Manappuram Finance Tamil Nadu and Manappuram General Finance and Leasing. In 2008-09, the net profit was Rs 30.30 crore.

Company chairman VP Nandakumar said income from services had increased from Rs 160.52 crore in 2008-09 to Rs 469.98 crore in 200910, and profit before tax was up at Rs 181.82 crore in 2009-10 as against Rs 46.28 crore the previous year. Nandakumar said the company was on a strong ground, considering that nearly 95% of its loan portfolio consisted of gold loans, and given the steady appreciation of gold as a commodity. During the year, Manappuram added 360 branches, taking its branch network to 1,005, and a footprint across 15 states. Officials said the company proposed to increase the branch strength to 1,400 by the yearend. In February, the company had placed equities worth Rs 245 crore with international institutions like Nomura and Capital World. This was the third time that the company had received FDI. Company managing director I Unnikrishnan said Manappuram planned to impart liquidity to the large reserves of privately held gold which was presently lying dormant. Procedure for gold loan http://www.scribd.com/doc/50439827/Procedure-for-Gold-loan 1. Against Mortgage of GOLD ornaments If you have gold jewellery to offer as collateral for personal loan, procedural hassles are minimal and banks don't check your credit score.The amount of documentation and the excessive verifications before your personal loan gets processed can be anightmare.Here is where your jewels can lend a hand, specifically gold.With the current interest rate fluctuations, opting for a jewel loan as against a personal loan is more lucrative. Not only areyour overall costs reduced, this will save a lot of your time."One of the major advantages is that the loan is processed almost immediately, within hours, even minutes at some banks,with minimal documentation," said Harsh Roongta, CEO, Apnapaisa.com.The Credit Information Bureau (India) Ltd scores which reflect an individual's credit history are beginning to play animportant role in acquiring personal loans. However, a jewel loan requires no such score.While the requisite documents for a jewel loan differ across lenders, most normally require no more than a proof of income or address.The clincher: the interest rates between a jewel loan and a personal loan can differ by as much as 5-8 per cent for the sameamount loaned.Some lenders charge a nominal fee for processing and others a small fee as closing charges. Co-operative banks requireyou to be a member, charges for which, again, can be as low as Rs 5.Jewel loans can be availed of at co-operative banks, public sector banks, private sector banks and other private lenders.

Some banks, however, offer it only in certain regions, the only disadvantage.While private lenders process the loan in less than a couple of hours, some co-operative and public sector banks may takeup to a day to issue the loan.In any case, the time is much less than the minimum three days of processing time for a personal loan. Loan to value, or the maximum ratio of a loan's size to the value of the asset, for a jewel loan is on par with that of a personal loan.The Reserve Bank of India has no strict policy on jewel loans.In late 2007, the RBI had issued a notification which permitted bullet repayment (a lump sum payment of the principal atmaturity) of gold loans.Subject to specific guidelines from the apex bank, each bank may fix its rate for gold, reflecting the market price at thatpoint of time.Care should be exercised if you have defaulted on a loan earlier, be it personal or any other. Your jewels might not bereturned at the end of the loan tenure if you approach the same branch.Approaching another branch or bank in this case would be one solution, as they would not have any record of your defaulthistory.A State Bank of India official, however, cautioned that some time in the near future, they would start looking at Cibilscores before approving a jewel loan.The loan tenure is not uniform across banks. With private lenders like HDFC Bank and some co-operative banks, thetenure is annual.Non-banking financial companies like Mannapuram Finance have a one-month tenure. But, an advantage with monthlyrenewals is that the loan value also increases every month with the appreciation of gold.At SBI, the individual must repay some amount of the principal along with the interest every month, as non-repayment for a continuous period of three months will render the loan a non-performing asset.Considering the advantage a jewel loan offers in terms of a rent-free locker, a little bit of juggling can even help you saverenting a locker for your jewels! (Obtain a fixed deposit on the loan, which should work out lesser than the rent chargedon lockers.)Of course, it makes more sense to opt for a jewel loan from a public sector bank or a co-op bank, as some private lendershave had a history of shutting down and not returning the gold

Procedure f or G old loan 1. F irst the temporary receipt is given to the customer this receipt contains only the number of items given by the customer . 2 . T

hen these ornaments are sent to the jeweler for verification . 3 . A fter verification the jeweler gives a receipt which contains the weight of the jewelry, price per 10 gms of gold, and the total value of the gold jewelry . 4 . O nce this verification receipt is received banks manager decides the amount that can be givento the customer for loan . 5 . A fter this loan is given to the customer

D etailed p rocedure f or g old loan : 1) T emporary receipt: T hree copies of this receipt are made . y

F irst copy is given to the customer . y S econd copy is placed inside the bag (in which jewelries are placed ) and is send to thejeweler . y T hird copy is kept with the bank for further reference . 2 ) H ow gold is taken to the jeweler: y A fter the jewelry along with the temporary receipt is placed inside the bag, the bagis sealed . y T his sealed bag is then sent to the jewelers shop . y F or security of this gold ornament one person from the bank and two securityguards goes to jewelers shop along with the bag containing gold ornaments . 3 ) O nce the verification is over jeweler puts the verification reports copy inside the bag alongwith temporary receipt and ornaments

. 4 ) A fter this the bag is again sealed by the jeweler and a tag is attached along with the bagwhich includes name of the customer, and the banks branch name . 5 ) T his bag is then again sent back to the bank . 6 ) A fter receiving of this valuation receipt all other formalities are done and the loan isdisbursed . 7 ) T his loan amount disbursed is not given completely to the customer a small amount isdeducted from it as charges for the following thing: y S tamp paper (for every Rs .1 lakhs, stamp paper charge is Rs .100) y Commission (Rs .10) y N ominal membership fees (it is Rs . 25 )

y V aluation fees (this is charged by the jeweler as his fees for valuing the gold ).

S ome im p ortant p oints to b e remem b ered : 1) G enerally valuation price is kept less then that of the current market price of thegold . Reason: If the customer doesnt repay the loan within the given period of time then auctionof this gold is done at the HEAD O FF IC E of the bank . A

nd the amount obtained willbe used for recovery of the loan and the extra amount is debited to account of theborrower . But in case during the auction the gold does not get sold then the jeweler will haveto purchase the gold at the value valued by him . 2 ) M anager permits loan of amount 7 0% of the valuation made by the jeweler . Reason: This is done so that after the loan period the amount to be paid by the customershould not go beyond the value of gold. 3) Auction is done generally in the month of September andMarch. Procedur e: y First notice is sent to the customer and10-15 days time is given to thecustomer to repay his/her loan. y If no response comes from customers side then an advertisement ispublished in the newspaper regarding the auction . Reasons why people go for gold loan: 1) They can get loan immediately within 5-6 hours 2) No need for any guarantor. 3) Easy procedure. 4) No documents needed . (only in case of mangalsutra NO C has to signed by wife). 5)Full loan can be paid at a time only 1 months interest is compulsory. 6) Security of gold as it is now the responsibility of the bank to safeguard the gold. 7)Last resource. 8) Reason for taking the loan need not to be mentioned

You might also like

- Rental Contract For Real PropertyDocument1 pageRental Contract For Real PropertySofie SofieNo ratings yet

- MCB Bank Account Types GuideDocument6 pagesMCB Bank Account Types GuideGhulam AbbasNo ratings yet

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- How Bank Creates MoneyDocument1 pageHow Bank Creates Moneyrazz_22No ratings yet

- Diamond AccountDocument2 pagesDiamond AccountJagadeesh YathirajulaNo ratings yet

- ) With Residence and Post-Office Address atDocument2 pages) With Residence and Post-Office Address atJaja GkNo ratings yet

- Understanding Natural Gas and LNG OptionsDocument248 pagesUnderstanding Natural Gas and LNG OptionsTivani MphiniNo ratings yet

- How Bank Makes MoneyDocument2 pagesHow Bank Makes MoneyudaykumarNo ratings yet

- Investment Bank Fraud DocumentedDocument10 pagesInvestment Bank Fraud DocumentedCon CernedNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

- California Employer'S Guide: (Internet) (Internet)Document126 pagesCalifornia Employer'S Guide: (Internet) (Internet)Julius HattenNo ratings yet

- Director Service Agreement Free SampleDocument3 pagesDirector Service Agreement Free Sampleapi-235666177No ratings yet

- Streamline loan verification with Lending Tree softwareDocument205 pagesStreamline loan verification with Lending Tree softwareSmiley Sravani100% (1)

- Where To Invest in Africa 2020Document365 pagesWhere To Invest in Africa 2020lindiNo ratings yet

- Quiz No. 3Document9 pagesQuiz No. 3Janwyne NgNo ratings yet

- Sacramento Auto Accident AttorneyDocument5 pagesSacramento Auto Accident AttorneyMona DeldarNo ratings yet

- CPA Review School's Professional Pre-Board ExamDocument16 pagesCPA Review School's Professional Pre-Board ExamMariane ValenzuelaNo ratings yet

- Core Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvDocument16 pagesCore Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvSandip NandyNo ratings yet

- E BankingDocument18 pagesE BankingHuelien_Nguyen_1121No ratings yet

- Gold Loan About Samarth FinanceDocument48 pagesGold Loan About Samarth FinanceshaileshNo ratings yet

- ACCA Study Material 2018-19Document2 pagesACCA Study Material 2018-19krebs38No ratings yet

- Corporate Liquidation CaseDocument1 pageCorporate Liquidation CaseASGarcia24No ratings yet

- Law On Sale - Contract of Sale - Q&ADocument6 pagesLaw On Sale - Contract of Sale - Q&AlchieSNo ratings yet

- Moorish National Republic Secures Commercial LienDocument5 pagesMoorish National Republic Secures Commercial LienKing ElNo ratings yet

- SEBI ManappuramNCD PDFDocument431 pagesSEBI ManappuramNCD PDFmsn_testNo ratings yet

- Concurrent AuditDocument7 pagesConcurrent AuditCA Harsh Satish UdeshiNo ratings yet

- Assignment - Credit PolicyDocument10 pagesAssignment - Credit PolicyNilesh VadherNo ratings yet

- Bankin and Fin Law Relationship Between Bank and Its CustomersDocument6 pagesBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestNo ratings yet

- General Banking of National Bank LimitedDocument52 pagesGeneral Banking of National Bank LimitedBishal IslamNo ratings yet

- Banking MaterialDocument87 pagesBanking Materialmuttu&moonNo ratings yet

- Indemnity EmployeeDocument3 pagesIndemnity Employeeasok45678No ratings yet

- Chapter-1: FinanceDocument86 pagesChapter-1: Financemanjunathb790% (1)

- Aetna Beneficiary FormDocument0 pagesAetna Beneficiary FormrecoverproNo ratings yet

- IFIC Bank's General Banking and Foreign Exchange ActivitiesDocument18 pagesIFIC Bank's General Banking and Foreign Exchange ActivitiessuviraiubNo ratings yet

- Affidavit For Trust and Reply NRC NCTEDocument3 pagesAffidavit For Trust and Reply NRC NCTEPiyush SharmaNo ratings yet

- BillDesk Payment GatewaydfDocument1 pageBillDesk Payment GatewaydfRajkumar MadanoliNo ratings yet

- Merchant BankDocument13 pagesMerchant Bankmdeepak1989No ratings yet

- BondsDocument26 pagesBondsAnup MauryaNo ratings yet

- Red Light Camera Refund Claim FormDocument4 pagesRed Light Camera Refund Claim FormLindsay TolerNo ratings yet

- Banker and CustomerDocument23 pagesBanker and CustomerAnkan Pattanayak100% (1)

- Report On Consumer Loan Services System of IDLCDocument51 pagesReport On Consumer Loan Services System of IDLCisraatNo ratings yet

- Rights of MortgagorDocument5 pagesRights of MortgagorShivangi SaxenaNo ratings yet

- Car LoanDocument105 pagesCar LoanRamesh RamNo ratings yet

- Functions of A Credit Rating AgencyDocument22 pagesFunctions of A Credit Rating Agencyharshubhoskar3500No ratings yet

- Toronto Parking Ticket Cancellation GuidelinesDocument18 pagesToronto Parking Ticket Cancellation GuidelinesTheGlobeandMailNo ratings yet

- Factors Affecting The Customer Satisfaction in E-BankingDocument14 pagesFactors Affecting The Customer Satisfaction in E-BankingViziniuc MadalinNo ratings yet

- ILFS Group Companies - NCLT and NCLAT OrdersDocument21 pagesILFS Group Companies - NCLT and NCLAT Ordersvismita diwanNo ratings yet

- 04/26/2013: Meeting of The Directors of The New York State Urban Development Corporation D/b/a Empire State Development (New York, NY) 9:30 A.M.Document188 pages04/26/2013: Meeting of The Directors of The New York State Urban Development Corporation D/b/a Empire State Development (New York, NY) 9:30 A.M.Empire State DevelopmentNo ratings yet

- The Law of Tort, Professional Liability and Consumer ProtectionDocument42 pagesThe Law of Tort, Professional Liability and Consumer ProtectionShirdah AgisteNo ratings yet

- Ocwen Trial QuestionsDocument3 pagesOcwen Trial QuestionsForeclosure FraudNo ratings yet

- Guidelines On CIBDocument4 pagesGuidelines On CIBShifatERahmanShifat100% (1)

- Chapter-4 Book pg-108: Sources of Bank FundsDocument22 pagesChapter-4 Book pg-108: Sources of Bank Fundsafnan huqNo ratings yet

- Negotiable Instrument ActDocument44 pagesNegotiable Instrument ActpothigaiselvansNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- RBI Response on Inoperative Bank Accounts and Unclaimed AmountsDocument29 pagesRBI Response on Inoperative Bank Accounts and Unclaimed AmountsigoysinghNo ratings yet

- Used Auto BankDocument6 pagesUsed Auto Bankfabio2006No ratings yet

- OBC CHARGEBACK FORMDocument1 pageOBC CHARGEBACK FORMTarun Kumar100% (6)

- Annual Clean Note CertificateDocument1 pageAnnual Clean Note CertificateHaniyaHanifNo ratings yet

- Jurisdiction of CourtsDocument5 pagesJurisdiction of CourtsAnonymous 17wvuDcENo ratings yet

- Power AttorneyDocument1 pagePower AttorneypropertyofrobertNo ratings yet

- Security Deposit Interest LetterDocument1 pageSecurity Deposit Interest LetterJustin MassaNo ratings yet

- Banker Customer RelationshipDocument7 pagesBanker Customer RelationshipJitendra VirahyasNo ratings yet

- Final Project For Print Out of Fullerton IndiaDocument51 pagesFinal Project For Print Out of Fullerton IndiaVinay Bairagi100% (1)

- PMJDY: Providing Financial Inclusion Through Bank AccountsDocument42 pagesPMJDY: Providing Financial Inclusion Through Bank AccountsshreeNo ratings yet

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- The Appropriations Law Answer Book: A Q&A Guide to Fiscal LawFrom EverandThe Appropriations Law Answer Book: A Q&A Guide to Fiscal LawNo ratings yet

- Avail Loan up to Rs 1 Crore Pledging GoldDocument8 pagesAvail Loan up to Rs 1 Crore Pledging GoldKaran DoshiNo ratings yet

- Attractive Features:: Mumbai: For Banks, Loan Against Gold Is A Glittering Business As Monetisation of The YellowDocument8 pagesAttractive Features:: Mumbai: For Banks, Loan Against Gold Is A Glittering Business As Monetisation of The YellowRipusudan TriwediNo ratings yet

- Memo Model Netting ActDocument12 pagesMemo Model Netting ActChristine LiuNo ratings yet

- Total and Cumulative Budgeted CostDocument15 pagesTotal and Cumulative Budgeted CostZahraJanelleNo ratings yet

- Cash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaDocument26 pagesCash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaJewelyn CioconNo ratings yet

- A Study On Risk Perception of Individual InvestorsDocument7 pagesA Study On Risk Perception of Individual InvestorsarcherselevatorsNo ratings yet

- Forex Trading by Money Market, BNGDocument69 pagesForex Trading by Money Market, BNGsachinmehta1978No ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Sriphala Carbons FinancialsDocument16 pagesSriphala Carbons Financials8442No ratings yet

- DCB NiYO Card Terms and ConditionsDocument16 pagesDCB NiYO Card Terms and ConditionsShivran RoyNo ratings yet

- Chapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoDocument101 pagesChapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoJay senthilNo ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- MBA Financial Management AssignmentDocument4 pagesMBA Financial Management AssignmentRITU NANDAL 144No ratings yet

- NBFC MCQ QuizDocument2 pagesNBFC MCQ QuizZara KhanNo ratings yet

- Arbaminch University College of Business and Economics Department of Accounting and FinancDocument8 pagesArbaminch University College of Business and Economics Department of Accounting and FinancbabuNo ratings yet

- ACCA104 - Notes ReceivableDocument7 pagesACCA104 - Notes ReceivableAnaluz Cristine B. CeaNo ratings yet

- Modern Greek Debt Tragedy Was Created by Goldman Sachs: Flying MachineDocument2 pagesModern Greek Debt Tragedy Was Created by Goldman Sachs: Flying MachineZerina BalićNo ratings yet

- Long Island Forum, Vol. XVII, Issue 7Document20 pagesLong Island Forum, Vol. XVII, Issue 7gregariousmonkNo ratings yet

- SPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsDocument8 pagesSPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsWaleed Barakat MariaNo ratings yet

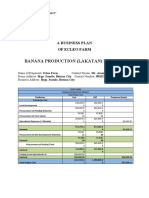

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Project Report On Market Survey On Brand EquityDocument44 pagesProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- 2016pk Panels8-17Document18 pages2016pk Panels8-17pkconferenceNo ratings yet