Professional Documents

Culture Documents

Trade Station Calculated Indices

Uploaded by

viccarterOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Station Calculated Indices

Uploaded by

viccarterCopyright:

Available Formats

TradeStation Calculated Indices

Categories of TradeStation Calculated Indices Index Futures / Cash Index Premium Indices Description

The Index Futures / Cash Index Premium index provides you with the difference between the front month of the corresponding futures contract and the cash index. If the index is greater than 0, then the futures are currently trading at a premium to the cash index. If the index is less than 0, then the futures are currently trading at a discount to the cash index. If the index is exactly 0, then the futures are trading at the same value as the cash index. The Advancing Issues index provides you with the total number of stocks in a certain exchange or broad market index whose last trade is greater than its previous close. This index can be used to identify the current market breadth by helping to determine the strength or weakness of an uptrend. This index is often used in conjunction with the declining issues indices to add perspective to the advancing issues index. The Declining Issues index provides you with the total number of stocks in a certain exchange or broad market index whose last trade is less than its previous close. This index can be used to identify the current market breadth by helping to determine the strength or weakness of a downtrend. This index is often used in conjunction with the advancing issues indices to add perspective to the advancing issues index. The Unchanged Issues index provides you with the total number of stocks in a certain exchange or broad market index whose last trade is equal to its previous close. This index can be used to help distinguish trending markets from flat or oscillating markets. This index is often compared to the advancing issues indices and declining issues indices to add further perspective to the breadth analysis. The Advancing Declining Issues Difference index provides you with the total number of advancing issues that exceeds the total number of declining issues in a certain exchange or broad market index. If the index is greater than 0, then there are currently more advancing issues than declining issues in that exchange or market index. If the index is less than 0, then there are currently more declining issues than advancing issues in that exchange or market index. If the index is exactly 0, then there are currently an equal number of advancing issues and declining issues for that exchange or market index. This index can be used to help to identify the strength and/or direction of the current trend. The Volume of Advancing Issues index provides you with the total share volume of the stocks in a specific exchange or broad market index that make up the corresponding "Advancing Issues" index. This index can be used to determine the strength of an uptrend and is often used with the Volume Declining Issues indices in order to determine market breadth. The Volume of Declining Issues index provides you with the total share volume of the stocks in a specific exchange or broad market index that make up the corresponding "Declining Issues" index. This index can be used to determine the strength of a down trend and is often used with the Volume of Advancing Issues index in order to determine market breadth. The Total Volume index provides you with the total share volume of all of the stocks in a specific exchange or broad market index. This index can be used with the Volume of Advancing Issues index and Volume of Declining Issues index in order to determine the percent of total volume that represents advancing issues or the percent of total volume that represents declining issues. In addition, the Total Volume indices include the volume of unchanged issues.

Advancing Issues Indices

Declining Issues Indices

Unchanged Issues Indices

Advancing Declining Issues Difference Indices

Volume of Advancing Issues Indices

Volume of Declining Issues Indices

Total Volume indices

Page 1

TradeStation Calculated Indices

Categories of TradeStation Calculated Indices Up Down Volume Difference Indices Description

The Up Down Volume Difference index provides you with the difference between the volume of advancing issues and the volume of declining issues for a specific exchange or broad market index. If the index is greater than 0, then the volume of advancing issues is currently greater than the volume of declining issues. If the index is less than 0, then the volume of declining issues is currently greater than the volume of advancing issues. This index may be used to determine the strength of the current trend in the market. The Tick index provides you with the number of stocks in a specific exchange or broad market index whose last trade occurred on an uptick minus the number of stocks in a specific exchange or broad market index whose last trade occurred on a downtick. When the index is greater than 0, there are currently more stocks whose last trade occurred on an uptick than stocks whose last trade occurred on a downtick. When the index is less than 0, there are currently more stocks whose last trade occurred on a downtick than stocks whose last trade occurred on an uptick. This can help to determine short-term market sentiment. The Traders Index, a/k/a the TRIN, the Short Term Trade index, or the Arms Index, is a breadth indicator developed by Richard Arms. It is an oscillator that is commonly used to identify overbought and oversold conditions. The index is a ratio of ratios, i.e. its calculated by taking the ratio of advancing issues to declining issues, taking the ratio of the volume of advancing issues to the volume of declining issues, and then dividing the first of these ratios by the second. TradeStation provides a number of variations of the Arms index, based on NYSE, AMEX, NASDAQ, ARCX, Dow 30, NASDAQ 100, S&P 500, Russell 2000, and all US stocks. TradeStation also provides additional unique variations of the Arms index that make use of market value instead of market volume in other words, the cash value of shares traded as opposed to the raw number of shares traded. These value-based variations all begin with $VALTRIN.

Tick Indices

Traders (Arms) Indices

Page 2

TradeStation Calculated Indices

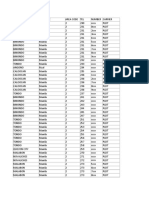

Index Futures / Cash Index Premiums Symbol Description $ESINX $NDIQX $SPINX $NQIQX $DJDJI $YMDJI $TFTFY Breadth Indices NYSE Breadth Indices $ADV $DECL $UNCH $ADD $UVOL $UVOLC NYSE Advancing Issues NYSE Declining Issues NYSE Unchanged Issues NYSE Adv-Decl Issues Diff Volume NYSE Advancing Issues Volume NYSE Adv Composite The number of NYSE issues whose last > its previous close. The number of NYSE issues whose last < its previous close. The number of NYSE issues whose last = its previous close. $ADV - $DECL Summation of the volumes of all stocks that make up the $ADV list. Only NYSE trades are factored into this index. NYSE NYSE NYSE NYSE NYSE E-mini S&P 500 Premium Index Nasdaq 100 Premium Index S&P 500 Premium Index E-Mini Nasdaq 100 Premium Dow Jones Premium Mini-Dow Premium Index Mini Russell 2000 @ES - $INX @ND.P - $IQX @SP.P - $INX @NQ - $IQX @DJ.P - $DJI @YM - $DJI @TF - $TFY

Formula

Exchange / Entitlement Required E-mini CME and S&P Index Full CME and S&P Index Full CME and S&P Index E-mini CME and S&P Index CBOT CBOT ICE US

Summation of the volumes of all stocks that make up the NYSE $ADV list. Trades from NYSE as well as regional exchanges are factored into this index. Summation of the volumes of all stocks that make up the $DECL list. Only NYSE trades are factored into this index. NYSE

$DVOL

Volume NYSE Declining Issues

$DVOLC

Volume NYSE Decl Composite

Summation of the volumes of all stocks that make up the NYSE $DECL list. Trades from NYSE as well as regional exchanges are factored into this index. Total Volume for all NYSE Stocks. Only NYSE trades are factored into this index. NYSE

$TVOL $TVOLC

Volume All NYSE Issues Volume NYSE Issues Composite

Total Volume for all NYSE Stocks. Trades from NYSE as well NYSE as regional exchanges are factored into this index. $UVOL - $DVOL $UVOLC - $DVOLC The number of NYSE stocks whose last trade was on an uptick minus the number of NYSE stocks whose last trade was on a downtick. Only trades executed on NYSE are factored into this index. The number of NYSE stocks whose last trade was on an uptick minus the number of NYSE stocks whose last trade was on a downtick. Trades from NYSE as well as regional exchanges are factored into this index. (($ADV / $DECL) / ($UVOL / $DVOL) + 1) NYSE NYSE NYSE

$VOLD $VOLDC $TICK

NYSE Up-Down Vol Diff NYSE Up-Down Vol Diff Comp NYSE Tick

$TICKC

NYSE Tick Composite

NYSE

$TRIN

NYSE Traders Index (Arms)

NYSE

Page 3

TradeStation Calculated Indices

Symbol $TRINC Description NYSE Traders Index (Arms) Composite AMEX Advancing Issues AMEX Declining Issues AMEX Unchanged Issues AMEX Adv-Decl Issues Diff Volume AMEX Advancing Issues Formula (($ADV / $DECL) / ($UVOLC / $DVOLC + 1)) AMEX Breadth Indices $ADVA $DECLA $UNCHA $ADAD $UVOLA The number of AMEX issues whose last > its previous close. AMEX The number of AMEX issues whose last < its previous close. AMEX The number of AMEX issues whose last = its previous close. AMEX $ADVA - $DECLA Summation of the volumes of all stocks that make up the $ADVA list. Only AMEX trades are factored into this index. Summation of the volumes of all stocks that make up the $ADVA list. Trades from AMEX as well as regional exchanges are factored into this index. Summation of the volumes of all stocks that make up the $DECLA list. Only AMEX trades are factored into this index. Summation of the volumes of all stocks that make up the $DECLA list. Trades from AMEX as well as regional exchanges are factored into this index. Total Volume for all AMEX Stocks. Only AMEX trades are factored into this index. Total Volume for all AMEX Stocks. Trades from AMEX as well as regional exchanges are factored into this index. $UVOLA - $DVOLA $UVOLAC - $DVOLAC The number of AMEX stocks whose last trade was on an uptick minus the number of AMEX stocks whose last trade was on a downtick. Only trades executed on AMEX are factored into this index. The number of AMEX stocks whose last trade was on an uptick minus the number of AMEX stocks whose last trade was on a downtick. Trades from AMEX as well as regional exchanges are factored into this index. (($ADVA / $DECLA) / ($UVOLA / $DVOLA) + 1) (($ADVA / $DECLA) / ($UVOLAC / $DVOLAC + 1)) NASDAQ Breadth Indices $ADVQ $DECLQ NASDAQ Advancing Issues NASDAQ Declining Issues The number of NASDAQ issues whose last > its previous close. The number of NASDAQ issues whose last < its previous close. NASDAQ NASDAQ AMEX AMEX Exchange / Entitlement Required NYSE

$UVOLAC

Volume AMEX Adv Composite

AMEX

$DVOLA

Volume AMEX Declining Issues

NYSE

$DVOLAC

Volume AMEX Decl Composite

AMEX

$TVOLA $TVOLAC

Volume All AMEX Issues Volume AMEX Issues Composite

AMEX AMEX

$VOLAD $VOLADC $TIKA

AMEX Up-Down Vol Diff AMEX Up-Down Vol Diff Comp AMEX Tick

AMEX AMEX AMEX

$TIKAC

AMEX Tick Comp

AMEX

$TRINA $TRINAC

AMEX Traders Index (Arms) AMEX Traders Index (Arms) Composite

AMEX AMEX

Page 4

TradeStation Calculated Indices

Symbol $UNCHQ $ADQD $UVOLQ Description NASDAQ Unchanged Issues NASDAQ Adv-Decl Diff Formula The number of NASDAQ issues whose last = its previous close. $ADVQ - $DECLQ Exchange / Entitlement Required NASDAQ NASDAQ NASDAQ

Volume NASDAQ Advancing Issues Summation of the volumes of all stocks that make up the $ADVQ list. Trades from NASDAQ as well as regional exchanges are factored into this index. Volume NASDAQ Declining Issues Summation of the volumes of all stocks that make up the $DECLQ list. Trades from NASDAQ as well as regional exchanges are factored into this index. Volume All NASDAQ Issues

$DVOLQ

NASDAQ

$TVOLQ

Total Volume for all NASDAQ Stocks. Trades from NASDAQ NASDAQ as well as regional exchanges are factored into this index. $UVOLQ - $DVOLQ NASDAQ

$VOLQD $TIKQ

NASDAQ Up-Down Vol Diff NASDAQ Tick

The number of NASDAQ stocks whose last trade was on an NASDAQ uptick minus the number of NASDAQ stocks whose last trade was on a downtick. Trades from NASDAQ as well as regional exchanges are factored into this index. (($ADVQ / $DECLQ) / ($UVOLQ / $DVOLQ) + 1) Dow 30 Breadth Indices NASDAQ

$TRINQ $ADVI $DECLI $UNCHI $ADID $UVOLI

NASDAQ Traders Index (Arms) Dow 30 Advancing Issues Dow 30 Declining Issues Dow 30 Unchanged Issues Dow 30 Advancing Issues Declining Issues Difference Dow 30 Up Volume

The number of Dow 30 issues whose last > its previous close. NASDAQ and NYSE The number of Dow 30 issues whose last < its previous close NASDAQ and NYSE The number of Dow 30 issues whose last = its previous close NASDAQ and NYSE $ADVI - $DECLI Summation of the volumes of all stocks that make up the $ADVI list. Only trades taking place on each stocks listed exchange are factored into this index. NASDAQ and NYSE NASDAQ and NYSE

$UVOLIC

Dow 30 Up Volume (Composite)

Summation of the volumes of all stocks that make up the NASDAQ and NYSE $ADVI list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. Summation of the volumes of all stocks that make up the $DECLI list. Only trades taking place on each stocks listed exchange are factored into this index. NASDAQ and NYSE

$DVOLI

Dow 30 Down Volume

$DVOLIC

Dow 30 Down Volume (Composite) Summation of the volumes of all stocks that make up the NASDAQ and NYSE $DECLI list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. Dow 30 Total Volume Total Volume for all Dow 30 Stocks. Only trades taking place NASDAQ and NYSE on each stocks listed exchange are factored into this index.

$TVOLI

$TVOLIC

Dow 30 Total Volume (Composite) Total Volume for all Dow 30 Stocks. Trades from each stocks NASDAQ and NYSE listed exchange as well as regional exchanges are factored into this index.

Page 5

TradeStation Calculated Indices

Symbol $VOLID $VOLIDC $TIKI Description Dow 30 Up Volume Down Volume $UVOLI - $DVOLI Difference Dow 30 Up Volume Down Volume $UVOLIC - $DVOLIC Difference (Composite) Dow 30 Tick Index The number of Dow 30 stocks whose last trade was on an uptick minus the number of Dow 30 stocks whose last trade was on a downtick. Only trades executed on each stocks listed exchange are factored into this index. Formula Exchange / Entitlement Required NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE

$TIKIC

Dow 30 Tick Index (Composite)

The number of Dow 30 stocks whose last trade was on an NASDAQ and NYSE uptick minus the number of Dow 30 stocks whose last trade was on a downtick. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. (($ADVI / $DECLI) / ($UVOLI / $DVOLI) + 1) (($ADVI / $DECLI) / ($UVOLIC / $DVOLIC + 1)) ARCX Breadth Indices NASDAQ and NYSE NASDAQ and NYSE

$TRINI $TRINIC

Dow 30 Traders Index (Arms) Dow 30 Traders Index (Arms) Composite ARCX Advancing Issues ARCX Declining Issues ARCX Unchanged Issues ARCX Advancing Issues Declining Issues Difference ARCX Up Volume

$ADVR $DECLR $UNCHR $ADRD $UVOLR

The number of ARCX issues whose last > its previous close. The number of ARCX issues whose last < its previous close. The number of ARCX issues whose last = its previous close. $ADVR - $DECLR Summation of the volumes of all stocks that make up the $ADVR list. Only ARCX trades are factored into this index. Summation of the volumes of all stocks that make up the $ADVR list. Trades from ARCX as well as regional exchanges are factored into this index. Summation of the volumes of all stocks that make up the $DECLR list. Only ARCX trades are factored into this index. Summation of the volumes of all stocks that make up the $DECLR list. Trades from ARCX as well as regional exchanges are factored into this index. Total Volume for all ARCX Stocks. Only ARCX trades are factored into this index.

ARCX ARCX ARCX ARCX ARCX

$UVOLRC

ARCX Up Volume (Composite)

ARCX

$DVOLR

ARCX Down Volume

ARCX

$DVOLRC

ARCX Down Volume (Composite)

ARCX

$TVOLR $TVOLRC

ARCX Total Volume ARCX Total Volume (Composite)

ARCX

Total Volume for all ARCX Stocks. Trades from ARCX as well ARCX as regional exchanges are factored into this index. ARCX ARCX

$VOLRD $VOLRDC

ARCX Up Volume Down Volume $UVOLR - $DVOLR Difference ARCX Up Volume Down Volume $UVOLRC - $DVOLRC Difference (Composite)

Page 6

TradeStation Calculated Indices

Symbol $TIKR Description ARCX Tick Index Formula The number of ARCX stocks whose last trade was on an uptick minus the number of ARCX stocks whose last trade was on a downtick. Only trades executed on ARCX are factored into this index. The number of ARCX stocks whose last trade was on an uptick minus the number of ARCX stocks whose last trade was on a downtick. Trades from ARCX as well as regional exchanges are factored into this index. (($ADVR / $DECLR) / ($UVOLR / $DVOLR) + 1) (($ADVR / $DECLR) / ($UVOLRC / $DVOLRC + 1)) NASDAQ 100 Breadth Indices $ADVND $DECLND $UNCHND $ADNDD $UVOLND $DVOLND $TVOLND $VOLNDD $TIKND Nasdaq 100 Advancing Issues Nasdaq 100 Declining Issues Nasdaq 100 Unchanged Issues NASDAQ100 Adv-Decl Issues Diff Nasdaq 100 Up Volume Nasdaq 100 Down Volume Nasdaq 100 Total Volume NASDAQ100 Up-Down Vol Diff Nasdaq 100 Tick The number of NASDAQ 100 issues whose last > its previous NASDAQ close. The number of NASDAQ 100 issues whose last < its previous NASDAQ close. The number of NASDAQ 100 issues whose last = its previous NASDAQ close. $ADVND - $DECLND Summation of the volumes of all stocks that make up the $ADVND list. Summation of the volumes of all stocks that make up the $DECLND list. Total Volume for all NASDAQ 100 Stocks. $UVOLND - $DVOLND NASDAQ NASDAQ NASDAQ NASDAQ NASDAQ Exchange / Entitlement Required ARCX

$TIKRC

ARCX Tick Index (Composite)

ARCX

$TRINR $TRINRC

ARCX Traders Index (Arms) ARCX Traders Index (Arms) Composite

ARCX ARCX

The number of NASDAQ 100 stocks whose last trade was on NASDAQ an uptick minus the number of NASDAQ 100 stocks whose last trade was on a downtick. Trades from NASDAQ as well as regional exchanges are factored into this index. (($ADVND / $DECLND) / ($UVOLND / $DVOLND) + 1) S&P 500 Breadth Indices NASDAQ

$TRINND

Nasdaq 100 Traders Index (Arms)

$ADVSP $DECLSP $UNCHSP $ADSPD

S&P 500 Advancing Issues S&P 500 Declining Issues S&P 500 Unchanged Issues S&P 500 Adv-Decl Issues Diff

The number of S&P 500 issues whose last > its previous close. The number of S&P 500 issues whose last < its previous close. The number of S&P 500 issues whose last = its previous close. $ADVSP - $DECLSP

AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

Page 7

TradeStation Calculated Indices

Symbol $UVOLSP Description S&P 500 Up Volume Formula Exchange / Entitlement Required

Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $ADVSP list. If the S&P 500 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the S&P 500 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $ADVSP list. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLSP list. If the S&P 500 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the S&P 500 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLSP list. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. Total Volume for all S&P 500 Stocks. If the S&P 500 stock is AMEX and NASDAQ and NYSE an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the S&P 500 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Total Volume for all S&P 500 Stocks. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. $UVOLSP - $DVOLSP $UVOLSPC - $DVOLSPC AMEX and NASDAQ and NYSE

$UVOLSPC

S&P 500 Up Volume Comp

$DVOLSP

S&P 500 Down Volume

$DVOLSPC

S&P 500 Down Volume Comp

$TVOLSP

S&P 500 Total Volume

$TVOLSPC

S&P 500 Total Volume Comp

$VOLSPD $VOLSPDC $TIKSP

S&P 500 Up-Down Vol Diff S&P 500 Up-Down Vol Diff Comp S&P 500 Tick

AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

The number of S&P 500 stocks whose last trade was on an AMEX and NASDAQ and NYSE uptick minus the number of S&P 500 stocks whose last trade was on a downtick. If the S&P 500 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the S&P 500 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. The number of S&P 500 stocks whose last trade was on an AMEX and NASDAQ and NYSE uptick minus the number of S&P 500 stocks whose last trade was on a downtick. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index.

$TIKSPC

S&P 500 Tick Composite

Page 8

TradeStation Calculated Indices

Symbol $TRINSP $TRINSPC Description S&P 500 Traders Index (Arms) S&P 500 Traders Index (Arms) Composite Russell 2000 Advancing Issues Russell 2000 Declining Issues Russell 2000 Unchanged Issues Russell 2000 Adv-Decl Diff Issues Russell 2000 Up Volume Formula (($ADVSP / $DECLSP) / ($UVOLSP / $DVOLSP) + 1) (($ADVSP / $DECLSP) / ($UVOLSPC / $DVOLSPC) + 1) Russell 2000 Breadth Indices $ADVRL $DECLRL $UNCHRL $ADRLD $UVOLRL The number of Russell 2000 issues whose last > its previous AMEX and NASDAQ and NYSE close. The number of Russell 2000 issues whose last < its previous AMEX and NASDAQ and NYSE close. The number of Russell 2000 issues whose last = its previous AMEX and NASDAQ and NYSE close. $ADVRL - $DECLRL AMEX and NASDAQ and NYSE Exchange / Entitlement Required AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $ADVR list. If the Russell 2000 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the Russell 2000 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $ADVR list. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLR list. If the Russell 2000 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the Russell 2000 stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index.

$UVOLRLC

Russell 2000 Up Volume Comp

$DVOLRL

Russell 2000 Down Volume

$DVOLRLC

Russell 2000 Down Volume Comp Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLR list. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. Russell 2000 Total Vol Total Volume for all Russell 2000 Stocks. If the Russell 2000 AMEX and NASDAQ and NYSE stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the Russell 2000 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Total Volume for all Russell 2000 Stocks. Trades from NYSE, AMEX and NASDAQ and NYSE AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. $UVOLRL - $DVOLRL $UVOLRLC - $DVOLRLC AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$TVOLRL

$TVOLRLC

Russell 2000 Total Vol Comp

$VOLRLD $VOLRLDC

Russell 2000 Up-Down V Diff Russell 2000 Up-Down V Diff Cp

Page 9

TradeStation Calculated Indices

Symbol $TIKRL Description Russell 2000 Tick Formula Exchange / Entitlement Required

The number of Russell 2000 stocks whose last trade was on AMEX and NASDAQ and NYSE an uptick minus the number of Russell 2000 stocks whose last trade was on a downtick. If the Russell 2000 stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the Russell 2000 stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. The number of Russell 2000 stocks whose last trade was on AMEX and NASDAQ and NYSE an uptick minus the number of Russell 2000 stocks whose last trade was on a downtick. Trades from NYSE, AMEX, and NASDAQ, as well as trades on all regional exchanges, are factored into this index. AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$TIKRLC

Russell 2000 Tick Composite

$TRINRL $TRINRLC

Russell 2000 Traders Index (Arms) (($ADVR / $DECLR) / ($UVOLR / $DVOLR) + 1) Russell 2000 Traders Index (Arms) (($ADVR / $DECLR) / ($UVOLRC / $DVOLRC) + 1) Composite Breadth Indices Utilizing AMEX, ARCX, NASDAQ, and NYSE Combined All US Advancing Issues All US Declining Issues All US Unchanged Issues All US Adv-Decl Issues Diff All US Up Volume The number of AMEX, ARCX, NASDAQ, and NYSE issues whose last > its previous close. The number of AMEX, ARCX, NASDAQ, and NYSE issues whose last < its previous close. The number of AMEX, ARCX, NASDAQ, and NYSE issues whose last = its previous close. $ADVUS - $DECLUS

$ADVUS $DECLUS $UNCHUS $ADUSD $UVOLUS

AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $ADVUS list. If the stock is an AMEX, ARCX, or NYSE stock, only trades on the listed exchange are factored into this index. If the stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the $ADVUS list. Trades from AMEX, ARCX, and NASDAQ, and NYSE as well as trades on all regional exchanges, are factored into this index. AMEX and NASDAQ and NYSE

$UVOLUSC

All US Up Volume Comp

$DVOLUS

All US Down Volume

Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLUS list. If the stock is an AMEX, ARCX, or NYSE stock, only trades on the listed exchange are factored into this index. If the stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the $DECLUS list. Trades from AMEX, ARCX, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. AMEX and NASDAQ and NYSE

$DVOLUSC

All US Down Volume Comp

Page 10

TradeStation Calculated Indices

Symbol $TVOLUS Description All US Total Volume Formula Total Volume for all AMEX, ARCX, NASDAQ, and NYSE issues. If the stock is an AMEX, ARCX, or NYSE stock, only trades on the listed exchange are factored into this index. If the stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index. Exchange / Entitlement Required AMEX and NASDAQ and NYSE

$TVOLUSC

All US Total Volume Comp

Total Volume for all AMEX, ARCX, NASDAQ, and NYSE AMEX and NASDAQ and NYSE issues. Trades from AMEX, ARCX, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. $UVOLUS - $DVOLUS $UVOLUSC - $DVOLUSC AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$VOLUSD $VOLUSDC $TIKUS

All US Up-Down Vol Diff All US Up-Down Vol Diff Comp All US Tick

The number of AMEX, ARCX, NASDAQ, and NYSE issues AMEX and NASDAQ and NYSE whose last trade was on an uptick minus the number of AMEX, ARCX, NASDAQ, and NYSE issues whose last trade was on a downtick. If the stock is an AMEX, ARCX, or NYSE stock, only trades on the listed exchange are factored into this index. If the stock is a NASDAQ stock, all trades, regardless of whether the trade is executed on NASDAQ or on a regional exchange, are factored into this index.

$TIKUSC

All US Tick Comp

The number of AMEX, ARCX, NASDAQ, and NYSE issues whose last trade was on an uptick minus the number of AMEX, ARCX, NASDAQ, and NYSE issues whose last trade was on a downtick. Trades from AMEX, ARCX, NASDAQ, and NYSE as well as trades on all regional exchanges, are factored into this index. (($ADVUS / $DECLUS) / ($UVOLUS / $DVOLUS) + 1) (($ADVUS / $DECLUS) / ($UVOLUSC / $DVOLUSC) + 1)

AMEX and NASDAQ and NYSE

$TRINUS $TRINUSC

All US Traders Index (Arms) All US Traders Index (Arms) Composite All AMEX, NASDAQ, and NYSE Advancing Issues All AMEX, NASDAQ, and NYSE Declining Issues All AMEX, NASDAQ, and NYSE Unchanged Issues All AMEX, NASDAQ, and NYSE Advancing Issues Declining Issues Difference

AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

Breadth Indices Utilizing all US Stocks excluding ARCA-listed stocks (AMEX, NASDAQ, and NYSE) $ADVUSL $DECLUSL $UNCHUSL $ADUSLD The number of AMEX, NASDAQ, and NYSE issues whose last > its previous close. The number of AMEX, NASDAQ, and NYSE issues whose last < its previous close. The number of AMEX, NASDAQ, and NYSE issues whose last = its previous close. $ADVUSL - $DECLUSL AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

Page 11

TradeStation Calculated Indices

Symbol $UVOLUSL Description Formula Exchange / Entitlement Required

All AMEX, NASDAQ, and NYSE Up Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE Volume $ADVUSL list. If the US stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index. All AMEX, NASDAQ, and NYSE Up Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE Volume (Composite) $ADVUSL list. Trades from AMEX, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. All AMEX, NASDAQ, and NYSE Down Volume Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLUSL list. If the US stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the volumes of all stocks that make up the AMEX and NASDAQ and NYSE $DECLUSL list. Trades from AMEX, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. Total Volume for AMEX, NASDAQ, and NYSE stocks. If the AMEX and NASDAQ and NYSE US stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index. Total Volume for all AMEX, NASDAQ, and NYSE Stocks. Trades from AMEX, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. AMEX and NASDAQ and NYSE

$UVOLUSLC

$DVOLUSL

$DVOLUSLC

All AMEX, NASDAQ, and NYSE Down Volume (Composite)

$TVOLUSL

All AMEX, NASDAQ, and NYSE Total Volume

$TVOLUSLC

All AMEX, NASDAQ, and NYSE Total Volume (Composite)

$VOLUSLD

All AMEX, NASDAQ, and NYSE Up $UVOLUSL - $DVOLUSL Volume Down Volume Difference All AMEX, NASDAQ, and NYSE Up $UVOLUSLC - $DVOLUSLC Volume Down Volume Difference (Composite) All AMEX, NASDAQ, and NYSE Tick Index

AMEX and NASDAQ and NYSE

$VOLUSLDC

AMEX and NASDAQ and NYSE

$TIKUSL

The number of AMEX, NASDAQ, and NYSE stocks whose AMEX and NASDAQ and NYSE last trade was on an uptick minus the number of US stocks whose last trade was on a downtick. If the US stock is an AMEX or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index.

Page 12

TradeStation Calculated Indices

Symbol $TIKUSLC Description All AMEX, NASDAQ, and NYSE Tick Index (Composite) Formula Exchange / Entitlement Required

The number of AMEX, NASDAQ, and NYSE stocks whose AMEX and NASDAQ and NYSE last trade was on an uptick minus the number of US stocks whose last trade was on a downtick. Trades from AMEX, ARCA, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. (($ADVUSL / $DECLUSL) / ($UVOLUSL / $DVOLUSL) + 1) (($ADVUSL / $DECLUSL) / ($UVOLUSLC / $DVOLUSLC) + 1) AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$TRINUSL $TRINUSLC

All AMEX, NASDAQ, and NYSE Traders Index (Arms) All AMEX, NASDAQ, and NYSE Traders Index (Arms) Composite

Value-Based Breadth Indices NYSE Value-Based Breadth Indices $UVAL NYSE Up Value Summation of the net change multiplied by the volume of each stock that makes up the $ADV list. Only NYSE trades are factored into this index. Summation of the net change multiplied by the volume of each stock that makes up the $ADV list. Trades from NYSE as well as regional exchanges are factored into this index. NYSE

$UVALC

NYSE Up Value (Composite)

NYSE

$DVAL

NYSE Down Value

The summation of the net change multiplied by the volume of NYSE each stock that makes up the $DECL list. Only NYSE trades are factored into this index. The summation of the net change multiplied by the volume of NYSE each stock that makes up the $DECL list. Trades from NYSE as well as regional exchanges are factored into this index. $UVAL - $DVAL $UVALC - $DVALC (($ADV / $DECL) / ($UVAL / $DVAL) + 1) (($ADV / $DECL) / ($UVALC / $DVALC + 1)) AMEX Value-Based Breadth Indices NYSE NYSE NYSE NYSE

$DVALC

NYSE Down Value (Composite)

$VALD $VALDC $VALTRIN $VALTRINC

NYSE Up Value Down Value Difference NYSE Up Value Down Value Difference (Composite) NYSE Value-based Traders Index (Arms) NYSE Value-based Traders Index (Arms) Composite AMEX Up Value

$UVALA

Summation of the net change multiplied by the volume of AMEX each stock that makes up the $ADVA list. Only AMEX trades are factored into this index. Summation of the net change multiplied by the volume of AMEX each stock that makes up the $ADVA list. Trades from AMEX as well as regional exchanges are factored into this index. The summation of the net change multiplied by the volume of AMEX each stock that makes up the $DECLA list. Only AMEX trades are factored into this index.

$UVALAC

AMEX Up Value (Composite)

$DVALA

AMEX Down Value

Page 13

TradeStation Calculated Indices

Symbol $DVALAC Description AMEX Down Value (Composite) Formula Exchange / Entitlement Required

The summation of the net change multiplied by the volume of AMEX each stock that makes up the $DECLA list. Trades from AMEX as well as regional exchanges are factored into this index. $UVALA - $DVALA $UVALAC - $DVALAC (($ADVA / $DECLA) / ($UVALA / $DVALA) + 1) (($ADVA / $DECLA) / ($UVALAC / $DVALAC + 1)) NASDAQ Value-Based Breadth Indices AMEX AMEX AMEX AMEX

$VALAD $VALADC $VALTRINA $VALTRINAC

AMEX Up Value Down Value Difference AMEX Up Value Down Value Difference (Composite) AMEX Value-based Traders Index (Arms) AMEX Value-based Traders Index (Arms) Composite NASDAQ Up Value

$UVALQ

Summation of the net change multiplied by the volume of each stock that makes up the $ADVQ list. All trades for NASDAQ listed stocks are included, regardless of the exchange on which the trade occurred.

NASDAQ

$DVALQ

NASDAQ Down Value

The summation of the net change multiplied by the volume of NASDAQ each stock that makes up the $DECLQ list. All trades for NASDAQ listed stocks are included, regardless of the exchange on which the trade occurred. $UVALQ - $DVALQ (($ADVQ / $DECLQ) / ($UVALQ / $DVALQ) + 1) Dow 30 Value-Based Breadth Indices NASDAQ NASDAQ

$VALQD $VALTRINQ

NASDAQ Up Value Down Value Difference NASDAQ Value-based Traders Index (Arms) Dow 30 Up Value

$UVALI

Summation of the net change multiplied by the volume of each stock that makes up the $ADVI list. Only trades taking place on each stocks listed exchange are factored into this index. Summation of the net change multiplied by the volume of each stock that makes up the $ADVI list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index.

NASDAQ and NYSE

$UVALIC

Dow 30 Up Value (Composite)

NASDAQ and NYSE

$DVALI

Dow 30 Down Value

The summation of the net change multiplied by the volume of NASDAQ and NYSE each stock that makes up the $DECLI list. Only trades taking place on each stocks listed exchange are factored into this index. The summation of the net change multiplied by the volume of NASDAQ and NYSE each stock that makes up the $DECLI list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. $UVALI - $DVALI $UVALIC - $DVALIC NASDAQ and NYSE NASDAQ and NYSE

$DVALIC

Dow 30 Down Value (Composite)

$VALID $VALIDC

Dow 30 Up Value Down Value Difference Dow 30 Up Value Down Value Difference (Composite)

Page 14

TradeStation Calculated Indices

Symbol $VALTRINI $VALTRINIC Description Formula Exchange / Entitlement Required NASDAQ and NYSE NASDAQ and NYSE

Dow 30 Value-based Traders Index (($ADVI / $DECLI) / ($UVALI / $DVALI) + 1) (Arms) Dow 30 Value-based Traders Index (($ADVI / $DECLI) / ($UVALIC / $DVALIC + 1)) (Arms) Composite ARCA Value-Based Breadth Indices ARCA Up Value

$UVALR

Summation of the net change multiplied by the volume of ARCA each stock that makes up the $ADVR list. Only ARCA trades are factored into this index. Summation of the net change multiplied by the volume of ARCA each stock that makes up the $ADVR list. Trades from ARCA as well as regional exchanges are factored into this index. The summation of the net change multiplied by the volume of ARCA each stock that makes up the $DECLR list. Only ARCA trades are factored into this index. The summation of the net change multiplied by the volume of ARCA each stock that makes up the $DECLR list. Trades from ARCA as well as regional exchanges are factored into this index. $UVALR - $DVALR $UVALRC - $DVALRC (($ADVR / $DECLR) / ($UVALR / $DVALR) + 1) (($ADVR / $DECLR) / ($UVALRC / $DVALRC + 1)) NASDAQ 100 Value-Based Breadth Indices ARCA ARCA ARCA ARCA

$UVALRC

ARCA Up Value (Composite)

$DVALR

ARCA Down Value

$DVALRC

ARCA Down Value (Composite)

$VALRD $VALRDC $VALTRINR $VALTRINRC

ARCA Up Value Down Value Difference ARCA Up Value Down Value Difference (Composite) ARCA Value-based Traders Index (Arms) ARCA Value-based Traders Index (Arms) Composite NASDAQ 100 Up Value

$UVALND

Summation of the net change multiplied by the volume of NASDAQ each stock that makes up the $ADVND list. Trades from NASDAQ as well as regional exchanges are factored into this index. The summation of the net change multiplied by the volume of NASDAQ each stock that makes up the $DECLND list. Trades from NASDAQ as well as regional exchanges are factored into this index. $UVALND - $DVALND NASDAQ NASDAQ

$DVALND

NASDAQ 100 Down Value

$VALNDD $VALTRINND

NASDAQ 100 Up Value Down Value Difference

NASDAQ 100 Value-based Traders (($ADVND / $DECLND) / ($UVALND / $DVALND) + 1) Index (Arms) S&P 500 Value-Based Breadth Indices S&P 500 Up Value

$UVALSP

Summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $ADVSP list. Only trades taking place on each stocks listed exchange are factored into this index.

Page 15

TradeStation Calculated Indices

Symbol $UVALSPC Description S&P 500 Up Value (Composite) Formula Exchange / Entitlement Required

Summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $ADVSP list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLSP list. Only trades taking place on each stocks listed exchange are factored into this index.

$DVALSP

S&P 500 Down Value

$DVALSPC

S&P 500 Down Value (Composite) The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLSP list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. S&P 500 Up Value Down Value Difference S&P 500 Up Value Down Value Difference (Composite) S&P 500 Value-based Traders Index (Arms) S&P 500 Value-based Traders Index (Arms) Composite Russell 2000 Up Value $UVALSP - $DVALSP $UVALSPC - $DVALSPC (($ADVSP / $DECLSP) / ($UVALSP / $DVALSP) + 1) (($ADVSP / $DECLSP) / ($UVALSPC / $DVALSPC + 1)) Russell 2000 Value-Based Breadth Indices AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$VALSPD $VALSPDC $VALTRINSP $VALTRINSPC

$UVALRL

Summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $ADVRL list. Only trades taking place on each stocks listed exchange are factored into this index.

$UVALRLC

Russell 2000 Up Value (Composite) Summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $ADVRL list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. Russell 2000 Down Value The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLRL list. Only trades taking place on each stocks listed exchange are factored into this index. The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLRL list. Trades from each stocks listed exchange as well as regional exchanges are factored into this index. $UVALRL - $DVALRL $UVALRLC - $DVALRLC AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$DVALRL

$DVALRLC

Russell 2000 Down Value (Composite)

$VALRLD $VALRLDC $VALTRINRL $VALTRINRLC

Russell 2000 Up Value Down Value Difference Russell 2000 Up Value Down Value Difference (Composite)

Russell 2000 Value-based Traders (($ADVRL / $DECLRL) / ($UVALRL / $DVALRL) + 1) Index (Arms) Russell 2000 Value-based Traders (($ADVRL / $DECLRL) / ($UVALRLC / $DVALRLC + 1)) Index (Arms) Composite

Page 16

TradeStation Calculated Indices

Symbol Description Formula Exchange / Entitlement Required

Value-Based Breadth Indices Utilizing all US Stocks (including ARCA) $UVALUS All US (incl. ARCA) Up Value Summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $ADVUS list. If the US stock is an AMEX, ARCA, or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index. Summation of the net change multiplied by the volume of each stock that makes up the $ADVUSR list. Trades from AMEX, ARCA, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. AMEX and NASDAQ and NYSE

$UVALUSC

All US (incl. ARCA) Up Value (Composite)

$DVALUS

All US (incl. ARCA) Down Value

The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLUSR list. If the US stock is an AMEX, ARCA, or NYSE stock, only trades on the listed exchange are factored into this index. If the US stock is a NASDAQ stock, all trades, regardless of whether the trade executed on NASDAQ or on a regional exchange, are factored into this index. The summation of the net change multiplied by the volume of AMEX and NASDAQ and NYSE each stock that makes up the $DECLUSR list. Trades from AMEX, ARCA, NASDAQ, and NYSE, as well as trades on all regional exchanges, are factored into this index. $UVOLUS - $DVOLUS $UVOLUSC - $DVOLUSC AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

$DVALUSC

All US (incl. ARCA) Down Value (Composite)

$VALUSD $VALUSDC

All US (incl. ARCA) Up Value Down Volume Difference All US (incl. ARCA) Up Value Down Volume Difference (Composite) All US (incl. ARCA) Value-based Traders Index (Arms) All US (incl. ARCA) Value-based Traders Index (Arms) Composite

$VALTRINUS $VALTRINUSC

(($ADVUS / $DECLUS) / ($UVOLUS / $DVOLUS) + 1)

AMEX and NASDAQ and NYSE

(($ADVUS / $DECLUS) / ($UVOLUSRC / $DVOLUSRC) + 1) AMEX and NASDAQ and NYSE

Moving Average Indices NYSE Moving Average Indices $10DMAAN $20DMAAN $50DMAAN $200DMAAN NYSE Issues Above 10 Day Moving The number of NYSE stocks for which todays Close > the 10 NYSE Average day moving average of the close. NYSE Issues Above 20 Day Moving The number of NYSE stocks for which todays Close > the 20 NYSE Average day moving average of the close. NYSE Issues Above 50 Day Moving The number of NYSE stocks for which todays Close > the 50 NYSE Average day moving average of the close. NYSE Issues Above 200 Day Moving Average The number of NYSE stocks for which todays Close > the 200 day moving average of the close. NYSE

Page 17

TradeStation Calculated Indices

Symbol $10DMABN $20DMABN $50DMABN $200DMABN $%10DMAAN $%20DMAAN $%50DMAAN $%200DMAAN $%10DMABN $%20DMABN $%50DMABN $%200DMABN Description Formula Exchange / Entitlement Required

NYSE Issues Below 10 Day Moving The number of NYSE stocks for which todays Close < the 10 NYSE Average day moving average of the close. NYSE Issues Below 20 Day Moving The number of NYSE stocks for which todays Close < the 20 NYSE Average day moving average of the close. NYSE Issues Below 50 Day Moving The number of NYSE stocks for which todays Close < the 50 NYSE Average day moving average of the close. NYSE Issues Below 200 Day Moving Average % of NYSE Issues Above 10 Day Moving Average % of NYSE Issues Above 20 Day Moving Average % of NYSE Issues Above 50 Day Moving Average The number of NYSE stocks for which todays Close < the 200 day moving average of the close. NYSE

The percentage of NYSE stocks for which todays Close > the NYSE 10 day moving average of the close. The percentage of NYSE stocks for which todays Close > the NYSE 20 day moving average of the close. The percentage of NYSE stocks for which todays Close > the NYSE 50 day moving average of the close.

% of NYSE Issues Above 200 Day The percentage of NYSE stocks for which todays Close > the NYSE Moving Average 200 day moving average of the close. % of NYSE Issues Below 10 Day Moving Average % of NYSE Issues Below 20 Day Moving Average % of NYSE Issues Below 50 Day Moving Average % of NYSE Issues Below 200 Day Moving Average AMEX Issues Above 10 Day Moving Average AMEX Issues Above 20 Day Moving Average AMEX Issues Above 50 Day Moving Average AMEX Issues Above 200 Day Moving Average The percentage of NYSE stocks for which todays Close < the NYSE 10 day moving average of the close. The percentage of NYSE stocks for which todays Close < the NYSE 20 day moving average of the close. The percentage of NYSE stocks for which todays Close < the NYSE 50 day moving average of the close. The percentage of NYSE stocks for which todays Close < the NYSE 200 day moving average of the close. AMEX Moving Average Indices The number of AMEX stocks for which todays Close > the 10 AMEX day moving average of the close. The number of AMEX stocks for which todays Close > the 20 AMEX day moving average of the close. The number of AMEX stocks for which todays Close > the 50 AMEX day moving average of the close. The number of AMEX stocks for which todays Close > the 200 day moving average of the close. AMEX

$10DMAAA $20DMAAA $50DMAAA $200DMAAA $10DMABA $20DMABA $50DMABA $200DMABA $%10DMAAA $%20DMAAA

AMEX Issues Below 10 Day Moving The number of AMEX stocks for which todays Close < the 10 AMEX Average day moving average of the close. AMEX Issues Below 20 Day Moving The number of AMEX stocks for which todays Close < the 20 AMEX Average day moving average of the close. AMEX Issues Below 50 Day Moving The number of AMEX stocks for which todays Close < the 50 AMEX Average day moving average of the close. AMEX Issues Below 200 Day Moving Average % of AMEX Issues Above 10 Day Moving Average % of AMEX Issues Above 20 Day Moving Average The number of AMEX stocks for which todays Close < the 200 day moving average of the close. AMEX

The percentage of AMEX stocks for which todays Close > the AMEX 10 day moving average of the close. The percentage of AMEX stocks for which todays Close > the AMEX 20 day moving average of the close.

Page 18

TradeStation Calculated Indices

Symbol $%50DMAAA $%200DMAAA $%10DMABA $%20DMABA $%50DMABA $%200DMABA Description % of AMEX Issues Above 50 Day Moving Average Formula Exchange / Entitlement Required

The percentage of AMEX stocks for which todays Close > the AMEX 50 day moving average of the close.

% of AMEX Issues Above 200 Day The percentage of AMEX stocks for which todays Close > the AMEX Moving Average 200 day moving average of the close. % of AMEX Issues Below 10 Day Moving Average % of AMEX Issues Below 20 Day Moving Average % of AMEX Issues Below 50 Day Moving Average The percentage of AMEX stocks for which todays Close < the AMEX 10 day moving average of the close. The percentage of AMEX stocks for which todays Close < the AMEX 20 day moving average of the close. The percentage of AMEX stocks for which todays Close < the AMEX 50 day moving average of the close.

% of AMEX Issues Below 200 Day The percentage of AMEX stocks for which todays Close < the AMEX Moving Average 200 day moving average of the close. NASDAQ Moving Average Indices NASDAQ Issues Above 10 Day Moving Average NASDAQ Issues Above 20 Day Moving Average NASDAQ Issues Above 50 Day Moving Average NASDAQ Issues Above 200 Day Moving Average NASDAQ Issues Below 10 Day Moving Average NASDAQ Issues Below 20 Day Moving Average NASDAQ Issues Below 50 Day Moving Average NASDAQ Issues Below 200 Day Moving Average % of NASDAQ Issues Above 10 Day Moving Average % of NASDAQ Issues Above 20 Day Moving Average % of NASDAQ Issues Above 50 Day Moving Average % of NASDAQ Issues Above 200 Day Moving Average % of NASDAQ Issues Below 10 Day Moving Average % of NASDAQ Issues Below 20 Day Moving Average % of NASDAQ Issues Below 50 Day Moving Average % of NASDAQ Issues Below 200 Day Moving Average The number of NASDAQ stocks for which todays Close > the NASDAQ 10 day moving average of the close. The number of NASDAQ stocks for which todays Close > the NASDAQ 20 day moving average of the close. The number of NASDAQ stocks for which todays Close > the NASDAQ 50 day moving average of the close. The number of NASDAQ stocks for which todays Close > the NASDAQ 200 day moving average of the close. The number of NASDAQ stocks for which todays Close < the NASDAQ 10 day moving average of the close. The number of NASDAQ stocks for which todays Close < the NASDAQ 20 day moving average of the close. The number of NASDAQ stocks for which todays Close < the NASDAQ 50 day moving average of the close. The number of NASDAQ stocks for which todays Close < the NASDAQ 200 day moving average of the close. The percentage of NASDAQ stocks for which todays Close > NASDAQ the 10 day moving average of the close. The percentage of NASDAQ stocks for which todays Close > NASDAQ the 20 day moving average of the close. The percentage of NASDAQ stocks for which todays Close > NASDAQ the 50 day moving average of the close. The percentage of NASDAQ stocks for which todays Close > NASDAQ the 200 day moving average of the close. The percentage of NASDAQ stocks for which todays Close < NASDAQ the 10 day moving average of the close. The percentage of NASDAQ stocks for which todays Close < NASDAQ the 20 day moving average of the close. The percentage of NASDAQ stocks for which todays Close < NASDAQ the 50 day moving average of the close. The percentage of NASDAQ stocks for which todays Close < NASDAQ the 200 day moving average of the close. Dow 30 Moving Average Indices

$10DMAAQ $20DMAAQ $50DMAAQ $200DMAAQ $10DMABQ $20DMABQ $50DMABQ $200DMABQ $%10DMAAQ $%20DMAAQ $%50DMAAQ $%200DMAAQ $%10DMABQ $%20DMABQ $%50DMABQ $%200DMABQ

Page 19

TradeStation Calculated Indices

Symbol $10DMAAI $20DMAAI $50DMAAI $200DMAAI $10DMABI $20DMABI $50DMABI $200DMABI $%10DMAAI $%20DMAAI $%50DMAAI $%200DMAAI $%10DMABI $%20DMABI $%50DMABI $%200DMABI Description Dow 30 Issues Above 10 Day Moving Average Dow 30 Issues Above 20 Day Moving Average Dow 30 Issues Above 50 Day Moving Average Dow 30 Issues Above 200 Day Moving Average Dow 30 Issues Below 10 Day Moving Average Dow 30 Issues Below 20 Day Moving Average Dow 30 Issues Below 50 Day Moving Average Dow 30 Issues Below 200 Day Moving Average Formula The number of Dow 30 stocks for which todays Close > the 10 day moving average of the close. The number of Dow 30 stocks for which todays Close > the 20 day moving average of the close. The number of Dow 30 stocks for which todays Close > the 50 day moving average of the close. The number of Dow 30 stocks for which todays Close > the 200 day moving average of the close. The number of Dow 30 stocks for which todays Close < the 10 day moving average of the close. The number of Dow 30 stocks for which todays Close < the 20 day moving average of the close. The number of Dow 30 stocks for which todays Close < the 50 day moving average of the close. The number of Dow 30 stocks for which todays Close < the 200 day moving average of the close. Exchange / Entitlement Required NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE NASDAQ and NYSE

% of Dow 30 Issues Above 10 Day The percentage of Dow 30 stocks for which todays Close > Moving Average the 10 day moving average of the close. % of Dow 30 Issues Above 20 Day The percentage of Dow 30 stocks for which todays Close > Moving Average the 20 day moving average of the close. % of Dow 30 Issues Above 50 Day The percentage of Dow 30 stocks for which todays Close > Moving Average the 50 day moving average of the close. % of Dow 30 Issues Above 200 Day The percentage of Dow 30 stocks for which todays Close > Moving Average the 200 day moving average of the close. % of Dow 30 Issues Below 10 Day The percentage of Dow 30 stocks for which todays Close < Moving Average the 10 day moving average of the close. % of Dow 30 Issues Below 20 Day The percentage of Dow 30 stocks for which todays Close < Moving Average the 20 day moving average of the close. % of Dow 30 Issues Below 50 Day The percentage of Dow 30 stocks for which todays Close < Moving Average the 50 day moving average of the close. % of Dow 30 Issues Below 200 Day The percentage of Dow 30 stocks for which todays Close < Moving Average the 200 day moving average of the close. ARCA Moving Average Indices

$10DMAAR $20DMAAR $50DMAAR $200DMAAR $10DMABR $20DMABR

ARCA Issues Above 10 Day Moving The number of ARCA stocks for which todays Close > the 10 ARCA Average day moving average of the close. ARCA Issues Above 20 Day Moving The number of ARCA stocks for which todays Close > the 20 ARCA Average day moving average of the close. ARCA Issues Above 50 Day Moving The number of ARCA stocks for which todays Close > the 50 ARCA Average day moving average of the close. ARCA Issues Above 200 Day Moving Average The number of ARCA stocks for which todays Close > the 200 day moving average of the close. ARCA

ARCA Issues Below 10 Day Moving The number of ARCA stocks for which todays Close < the 10 ARCA Average day moving average of the close. ARCA Issues Below 20 Day Moving The number of ARCA stocks for which todays Close < the 20 ARCA Average day moving average of the close.

Page 20

TradeStation Calculated Indices

Symbol $50DMABR $200DMABR $%10DMAAR $%20DMAAR $%50DMAAR $%200DMAAR $%10DMABR $%20DMABR $%50DMABR $%200DMABR Description Formula Exchange / Entitlement Required

ARCA Issues Below 50 Day Moving The number of ARCA stocks for which todays Close < the 50 ARCA Average day moving average of the close. ARCA Issues Below 200 Day Moving Average % of ARCA Issues Above 10 Day Moving Average % of ARCA Issues Above 20 Day Moving Average % of ARCA Issues Above 50 Day Moving Average The number of ARCA stocks for which todays Close < the 200 day moving average of the close. ARCA

The percentage of ARCA stocks for which todays Close > the ARCA 10 day moving average of the close. The percentage of ARCA stocks for which todays Close > the ARCA 20 day moving average of the close. The percentage of ARCA stocks for which todays Close > the ARCA 50 day moving average of the close.

% of ARCA Issues Above 200 Day The percentage of ARCA stocks for which todays Close > the ARCA Moving Average 200 day moving average of the close. % of ARCA Issues Below 10 Day Moving Average % of ARCA Issues Below 20 Day Moving Average % of ARCA Issues Below 50 Day Moving Average % of ARCA Issues Below 200 Day Moving Average The percentage of ARCA stocks for which todays Close < the ARCA 10 day moving average of the close. The percentage of ARCA stocks for which todays Close < the ARCA 20 day moving average of the close. The percentage of ARCA stocks for which todays Close < the ARCA 50 day moving average of the close. The percentage of ARCA stocks for which todays Close < the ARCA 200 day moving average of the close. NASDAQ 100 Moving Average Indices

$10DMAAND $20DMAAND $50DMAAND $200DMAAND $10DMABND $20DMABND $50DMABND $200DMABND $%10DMAAND $%20DMAAND $%50DMAAND $%200DMAAND

NASDAQ 100 Issues Above 10 Day The number of NASDAQ 100 stocks for which todays Close > NASDAQ Moving Average the 10 day moving average of the close. NASDAQ 100 Issues Above 20 Day The number of NASDAQ 100 stocks for which todays Close > NASDAQ Moving Average the 20 day moving average of the close. NASDAQ 100 Issues Above 50 Day The number of NASDAQ 100 stocks for which todays Close > NASDAQ Moving Average the 50 day moving average of the close. NASDAQ 100 Issues Above 200 Day Moving Average The number of NASDAQ 100 stocks for which todays Close > NASDAQ the 200 day moving average of the close.

NASDAQ 100 Issues Below 10 Day The number of NASDAQ 100 stocks for which todays Close < NASDAQ Moving Average the 10 day moving average of the close. NASDAQ 100 Issues Below 20 Day The number of NASDAQ 100 stocks for which todays Close < NASDAQ Moving Average the 20 day moving average of the close. NASDAQ 100 Issues Below 50 Day The number of NASDAQ 100 stocks for which todays Close < NASDAQ Moving Average the 50 day moving average of the close. NASDAQ 100 Issues Below 200 Day Moving Average % of NASDAQ 100 Issues Above 10 Day Moving Average % of NASDAQ 100 Issues Above 20 Day Moving Average % of NASDAQ 100 Issues Above 50 Day Moving Average % of NASDAQ 100 Issues Above 200 Day Moving Average The number of NASDAQ 100 stocks for which todays Close < NASDAQ the 200 day moving average of the close. The percentage of NASDAQ 100 stocks for which todays Close > the 10 day moving average of the close. The percentage of NASDAQ 100 stocks for which todays Close > the 20 day moving average of the close. The percentage of NASDAQ 100 stocks for which todays Close > the 50 day moving average of the close. The percentage of NASDAQ 100 stocks for which todays Close > the 200 day moving average of the close. NASDAQ NASDAQ NASDAQ NASDAQ

Page 21

TradeStation Calculated Indices

Symbol $%10DMABND $%20DMABND $%50DMABND $%200DMABND Description Formula Exchange / Entitlement Required NASDAQ NASDAQ NASDAQ NASDAQ

% of NASDAQ 100 Issues Below 10 The percentage of NASDAQ 100 stocks for which todays Day Moving Average Close < the 10 day moving average of the close. % of NASDAQ 100 Issues Below 20 The percentage of NASDAQ 100 stocks for which todays Day Moving Average Close < the 20 day moving average of the close. % of NASDAQ 100 Issues Below 50 The percentage of NASDAQ 100 stocks for which todays Day Moving Average Close < the 50 day moving average of the close. % of NASDAQ 100 Issues Below 200 Day Moving Average S&P 500 Issues Above 10 Day Moving Average S&P 500 Issues Above 20 Day Moving Average S&P 500 Issues Above 50 Day Moving Average S&P 500 Issues Above 200 Day Moving Average S&P 500 Issues Below 10 Day Moving Average S&P 500 Issues Below 20 Day Moving Average S&P 500 Issues Below 50 Day Moving Average S&P 500 Issues Below 200 Day Moving Average The percentage of NASDAQ 100 stocks for which todays Close < the 200 day moving average of the close. S&P 500 Moving Average Indices

$10DMAASP $20DMAASP $50DMAASP $200DMAASP $10DMABSP $20DMABSP $50DMABSP $200DMABSP $%10DMAASP $%20DMAASP $%50DMAASP $%200DMAASP $%10DMABSP $%20DMABSP $%50DMABSP $%200DMABSP

The number of S&P 500 stocks for which todays Close > the AMEX and NASDAQ and NYSE 10 day moving average of the close. The number of S&P 500 stocks for which todays Close > the AMEX and NASDAQ and NYSE 20 day moving average of the close. The number of S&P 500 stocks for which todays Close > the AMEX and NASDAQ and NYSE 50 day moving average of the close. The number of S&P 500 stocks for which todays Close > the AMEX and NASDAQ and NYSE 200 day moving average of the close. The number of S&P 500 stocks for which todays Close < the AMEX and NASDAQ and NYSE 10 day moving average of the close. The number of S&P 500 stocks for which todays Close < the AMEX and NASDAQ and NYSE 20 day moving average of the close. The number of S&P 500 stocks for which todays Close < the AMEX and NASDAQ and NYSE 50 day moving average of the close. The number of S&P 500 stocks for which todays Close < the AMEX and NASDAQ and NYSE 200 day moving average of the close.

% of S&P 500 Issues Above 10 Day The percentage of S&P 500 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 10 day moving average of the close. % of S&P 500 Issues Above 20 Day The percentage of S&P 500 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 20 day moving average of the close. % of S&P 500 Issues Above 50 Day The percentage of S&P 500 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 50 day moving average of the close. % of S&P 500 Issues Above 200 Day Moving Average The percentage of S&P 500 stocks for which todays Close > AMEX and NASDAQ and NYSE the 200 day moving average of the close.

% of S&P 500 Issues Below 10 Day The percentage of S&P 500 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 10 day moving average of the close. % of S&P 500 Issues Below 20 Day The percentage of S&P 500 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 20 day moving average of the close. % of S&P 500 Issues Below 50 Day The percentage of S&P 500 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 50 day moving average of the close. % of S&P 500 Issues Below 200 Day Moving Average The percentage of S&P 500 stocks for which todays Close < AMEX and NASDAQ and NYSE the 200 day moving average of the close. Russell 2000 Moving Average Indices

$10DMAARL $20DMAARL

Russell 2000 Issues Above 10 Day The number of Russell 2000 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 10 day moving average of the close. Russell 2000 Issues Above 20 Day The number of Russell 2000 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 20 day moving average of the close.

Page 22

TradeStation Calculated Indices

Symbol $50DMAARL $200DMAARL $10DMABRL $20DMABRL $50DMABRL $200DMABRL $%10DMAARL $%20DMAARL $%50DMAARL $%200DMAARL $%10DMABRL $%20DMABRL $%50DMABRL $%200DMABRL Description Formula Exchange / Entitlement Required

Russell 2000 Issues Above 50 Day The number of Russell 2000 stocks for which todays Close > AMEX and NASDAQ and NYSE Moving Average the 50 day moving average of the close. Russell 2000 Issues Above 200 Day Moving Average The number of Russell 2000 stocks for which todays Close > AMEX and NASDAQ and NYSE the 200 day moving average of the close.

Russell 2000 Issues Below 10 Day The number of Russell 2000 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 10 day moving average of the close. Russell 2000 Issues Below 20 Day The number of Russell 2000 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 20 day moving average of the close. Russell 2000 Issues Below 50 Day The number of Russell 2000 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 50 day moving average of the close. Russell 2000 Issues Below 200 Day The number of Russell 2000 stocks for which todays Close < AMEX and NASDAQ and NYSE Moving Average the 200 day moving average of the close. % of Russell 2000 Issues Above 10 The percentage of Russell 2000 stocks for which todays Day Moving Average Close > the 10 day moving average of the close. % of Russell 2000 Issues Above 20 The percentage of Russell 2000 stocks for which todays Day Moving Average Close > the 20 day moving average of the close. % of Russell 2000 Issues Above 50 The percentage of Russell 2000 stocks for which todays Day Moving Average Close > the 50 day moving average of the close. % of Russell 2000 Issues Above 200 Day Moving Average The percentage of Russell 2000 stocks for which todays Close > the 200 day moving average of the close. AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE AMEX and NASDAQ and NYSE

% of Russell 2000 Issues Below 10 The percentage of Russell 2000 stocks for which todays Day Moving Average Close < the 10 day moving average of the close. % of Russell 2000 Issues Below 20 The percentage of Russell 2000 stocks for which todays Day Moving Average Close < the 20 day moving average of the close. % of Russell 2000 Issues Below 50 The percentage of Russell 2000 stocks for which todays Day Moving Average Close < the 50 day moving average of the close. % of Russell 2000 Issues Below 200 Day Moving Average The percentage of Russell 2000 stocks for which todays Close < the 200 day moving average of the close. Moving Average Indices using all US Stocks

$10DMAAUS $20DMAAUS $50DMAAUS $200DMAAUS $10DMABUS $20DMABUS $50DMABUS $200DMABUS

All US Issues Above 10 Day Moving The number of All US stocks for which todays Close > the 10 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Above 20 Day Moving The number of All US stocks for which todays Close > the 20 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Above 50 Day Moving The number of All US stocks for which todays Close > the 50 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Above 200 Day Moving Average The number of All US stocks for which today Close > the 200 AMEX and NASDAQ and NYSE day moving average of the close.

All US Issues Below 10 Day Moving The number of All US stocks for which todays Close < the 10 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Below 20 Day Moving The number of All US stocks for which todays Close < the 20 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Below 50 Day Moving The number of All US stocks for which todays Close < the 50 AMEX and NASDAQ and NYSE Average day moving average of the close. All US Issues Below 200 Day Moving Average The number of All US stocks for which todays Close < the 200 day moving average of the close. AMEX and NASDAQ and NYSE

Page 23

TradeStation Calculated Indices

Symbol $%10DMAAUS $%20DMAAUS $%50DMAAUS $%200DMAAUS $%10DMABUS $%20DMABUS $%50DMABUS $%200DMABUS Description % of All US Issues Above 10 Day Moving Average % of All US Issues Above 20 Day Moving Average % of All US Issues Above 50 Day Moving Average Formula Exchange / Entitlement Required

The percentage of All US stocks for which todays Close > the AMEX and NASDAQ and NYSE 10 day moving average of the close. The percentage of All US stocks for which todays Close > the AMEX and NASDAQ and NYSE 20 day moving average of the close. The percentage of All US stocks for which todays Close > the AMEX and NASDAQ and NYSE 50 day moving average of the close.

% of All US Issues Above 200 Day The percentage of All US stocks for which todays Close > the AMEX and NASDAQ and NYSE Moving Average 200 day moving average of the close. % of All US Issues Below 10 Day Moving Average % of All US Issues Below 20 Day Moving Average % of All US Issues Below 50 Day Moving Average % of All US Issues Below 200 Day Moving Average NYSE Issues Crossing Above 10 Day Moving Average NYSE Issues Crossing Above 20 Day Moving Average NYSE Issues Crossing Above 50 Day Moving Average NYSE Issues Crossing Above 200 Day Moving Average NYSE Issues Crossing Below 10 Day Moving Average The percentage of All US stocks for which todays Close < the AMEX and NASDAQ and NYSE 10 day moving average of the close. The percentage of All US stocks for which todays Close < the AMEX and NASDAQ and NYSE 20 day moving average of the close. The percentage of All US stocks for which todays Close < the AMEX and NASDAQ and NYSE 50 day moving average of the close. The percentage of All US stocks for which todays Close < the AMEX and NASDAQ and NYSE 200 day moving average of the close. NYSE Moving Average Crossover Indices The number of NYSE stocks for which todays High crossed above the 10 day moving average of the close. The number of NYSE stocks for which todays High crossed above the 20 day moving average of the close. The number of NYSE stocks for which todays High crossed above the 50 day moving average of the close. The number of NYSE stocks for which todays High crossed above the 200 day moving average of the close. The number of NYSE stocks for which todays Low crossed below the 10 day moving average of the close. NYSE NYSE NYSE NYSE

$10DMACAN $20DMACAN $50DMACAN $200DMACAN

$10DMACBN $20DMACBN $50DMACBN $200DMACBN $%10DMACAN $%20DMACAN $%50DMACAN $%200DMACAN

NYSE NYSE NYSE NYSE NYSE NYSE NYSE NYSE

% of NYSE Issues Crossing Below The number of NYSE stocks for which todays Low crossed 20 Day Moving Average below the 20 day moving average of the close. % of NYSE Issues Crossing Below The number of NYSE stocks for which todays Low crossed 50 Day Moving Average below the 50 day moving average of the close. % of NYSE Issues Crossing Below The number of NYSE stocks for which todays Low crossed 200 Day Moving Average below the 200 day moving average of the close. % of NYSE Issues Crossing Above The percentage of NYSE stocks for which todays High 10 Day Moving Average crossed above the 10 day moving average of the close. % of NYSE Issues Crossing Above The percentage of NYSE stocks for which todays High 20 Day Moving Average crossed above the 20 day moving average of the close. % of NYSE Issues Crossing Above The percentage of NYSE stocks for which todays High 50 Day Moving Average crossed above the 50 day moving average of the close. % of NYSE Issues Crossing Above The percentage of NYSE stocks for which todays High 200 Day Moving Average crossed above the 200 day moving average of the close. % of NYSE Issues Crossing Below The percentage of NYSE stocks for which todays Low 10 Day Moving Average crossed below the 10 day moving average of the close.

$%10DMACBN

NYSE

Page 24

TradeStation Calculated Indices

Symbol $%20DMACBN $%50DMACBN $%200DMACBN Description Formula Exchange / Entitlement Required NYSE NYSE NYSE

% of NYSE Issues Crossing Below The percentage of NYSE stocks for which todays Low 20 Day Moving Average crossed below the 20 day moving average of the close. % of NYSE Issues Crossing Below The percentage of NYSE stocks for which todays Low 50 Day Moving Average crossed below the 50 day moving average of the close. % of NYSE Issues Crossing Below The percentage of NYSE stocks for which todays Low 200 Day Moving Average crossed below the 200 day moving average of the close. AMEX Moving Average Crossover Indices AMEX Issues Crossing Above 10 Day Moving Average AMEX Issues Crossing Above 20 Day Moving Average AMEX Issues Crossing Above 50 Day Moving Average The number of AMEX stocks for which todays High crossed above the 10 day moving average of the close. The number of AMEX stocks for which todays High crossed above the 20 day moving average of the close. The number of AMEX stocks for which todays High crossed above the 50 day moving average of the close.

$10DMACAA $20DMACAA $50DMACAA $200DMACAA

AMEX AMEX AMEX AMEX

AMEX Issues Crossing Above 200 The number of AMEX stocks for which todays High crossed Day Moving Average above the 200 day moving average of the close. AMEX Issues Crossing Below 10 Day Moving Average AMEX Issues Crossing Below 20 Day Moving Average AMEX Issues Crossing Below 50 Day Moving Average The number of AMEX stocks for which todays Low crossed below the 10 day moving average of the close. The number of AMEX stocks for which todays Low crossed below the 20 day moving average of the close. The number of AMEX stocks for which todays Low crossed below the 50 day moving average of the close.

$10DMACBA $20DMACBA $50DMACBA $200DMACBA $%10DMACAA $%20DMACAA $%50DMACAA $%200DMACAA

AMEX AMEX AMEX AMEX AMEX AMEX AMEX AMEX

% of AMEX Issues Crossing Below The number of AMEX stocks for which todays Low crossed 200 Day Moving Average below the 200 day moving average of the close. % of AMEX Issues Crossing Above The percentage of AMEX stocks for which todays High 10 Day Moving Average crossed above the 10 day moving average of the close. % of AMEX Issues Crossing Above The percentage of AMEX stocks for which todays High 20 Day Moving Average crossed above the 20 day moving average of the close. % of AMEX Issues Crossing Above The percentage of AMEX stocks for which todays High 50 Day Moving Average crossed above the 50 day moving average of the close. % of AMEX Issues Crossing Above The percentage of AMEX stocks for which todays High 200 Day Moving Average crossed above the 200 day moving average of the close. % of AMEX Issues Crossing Below The percentage of AMEX stocks for which todays Low 10 Day Moving Average crossed below the 10 day moving average of the close. % of AMEX Issues Crossing Below The percentage of AMEX stocks for which todays Low 20 Day Moving Average crossed below the 20 day moving average of the close. % of AMEX Issues Crossing Below The percentage of AMEX stocks for which todays Low 50 Day Moving Average crossed below the 50 day moving average of the close. % of AMEX Issues Crossing Below The percentage of AMEX stocks for which todays Low 200 Day Moving Average crossed below the 200 day moving average of the close. NASDAQ Moving Average Crossover Indices NASDAQ Issues Crossing Above 10 Day Moving Average NASDAQ Issues Crossing Above 20 Day Moving Average The number of NASDAQ stocks for which todays High crossed above the 10 day moving average of the close. The number of NASDAQ stocks for which todays High crossed above the 20 day moving average of the close.

$%10DMACBA $%20DMACBA $%50DMACBA $%200DMACBA

AMEX AMEX AMEX AMEX

$10DMACAQ $20DMACAQ

NASDAQ NASDAQ

Page 25

TradeStation Calculated Indices

Symbol $50DMACAQ $200DMACAQ Description NASDAQ Issues Crossing Above 50 Day Moving Average NASDAQ Issues Crossing Above 200 Day Moving Average Formula The number of NASDAQ stocks for which todays High crossed above the 50 day moving average of the close. The number of NASDAQ stocks for which todays High crossed above the 200 day moving average of the close. Exchange / Entitlement Required NASDAQ NASDAQ

$10DMACBQ $20DMACBQ $50DMACBQ $200DMACBQ $%10DMACAQ