Professional Documents

Culture Documents

Profile Senior Accountant Final

Uploaded by

Achu F AchamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profile Senior Accountant Final

Uploaded by

Achu F AchamCopyright:

Available Formats

Competency Framework Senior Accountant Profile

Contemporary CGAs working as Senior Accountants are integral to their organizations functional and operational teams. In addition to the traditional financial role, Senior Accountants are expected to add value by contributing to complex projects including systems enhancements, business/financial process improvements, or by developing key analytical tools to measure the success of an organizations strategic activities. CGA-Canadas 2003 Comprehensive Practice Analysis Survey (CPAS)* provided certain results that related directly to Senior Accountants, including: 1. Within the technical areas, Senior Accountants spend almost 40% of their workday involved with Financial Accounting and Reporting, compared to 10% in Management Accounting, and 5% each in Finance and Financial Planning, Information Technology, General Business, Taxation, and Assurance. ** 2. Senior Accountants are highly educated, enjoy a high rate of full-time employment, have extensive experience, and work in various areas including industry, commerce, public practice, and government. 3. Over 80% of the Senior Accountant respondents have a post-secondary degree. This group also indicated that if they were to pursue additional credentials, they would be most interested in obtaining a Masters of Business Administration (MBA) (36%), Certified Financial Planner (CFP) (21%), or Certified Financial Analyst (CFA) (19%) designation.

Note: For more information about the CPAS, refer to the Professional Competence article in the Mar-Apr 2004 issue of the CGA Magazine. ** Note: These figures are median values and consequently do not sum to 100%. *

Outlook for Senior Accountants

In the CPAS, respondents were asked to identify changes and trends in the accounting profession. The survey identified some important changes including more focus on international trade and globalization, harmonization of U.S. and Canadian standards, an expanded role for CGAs as business advisors, and communication of complex financial information to internal and external stakeholders. The CPAS findings indicated that Senior Accountants spend approximately 66% of their workday on traditional accounting and 34% on high-growth specialities. These results are corroborated by various AICPA research conducted during 2003-2004, as well as Robert Half Internationals Next Generation Accountant report. These high-growth specialty areas include Information Technology, E-commerce, forensic accounting, international accounting/taxation, and environmental accounting. In summary, to meet the changing needs of the marketplace, Senior Accountants need to strengthen and expand their competency skills, not only in the traditional technical areas, but also in non-technical areas such as leadership, general management, and professionalism.

Senior Accountant Profile

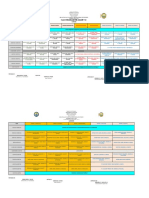

The following chart shows the competency skills and the levels of experience that a typical Senior Accountant would have acquired after seven years in their career.

Senior Accountant Profile

GM GM GM GM GM PF PF PF PF LS LS LS TK TK TK TK TK TK TK TK

Financial Accounting Management Accounting Taxation Assurance Personal Finance Corporate Finance Information Technology Business Law Org'l and Strategic Leadership Team Building and Development Training and Coaching Integrative Approach Ethics and Trust Personal Skills Practice Management Communicating Negotiating Project Management Problem Solving Client Focus

1 1 1 1 1 1 1 1 1

2 2

2 2 2

2 2 2

0

Main Index Key TK - Technical Knowledge LS - Leadership PF - Professionalism GM - General Management

Skill Levels

The CGA Competency Framework Model

All sample profiles provided under the Competency Assessment Tool (C.A.T.) are based on the CGA Competency Framework Model. This model has four main categories:

Technical Knowledge (TK) Leadership (LS) Professionalism (PF) General Management (GM)

Each category is further detailed into sub-categories. For example, Technical Knowledge includes:

Financial Accounting Management Accounting Taxation Assurance Personal Finance Corporate Finance Information Technology Business Law

Each sub-category is split into four Skill Levels, with Level 0 being a very cursory knowledge of the subject matter and Level 4 being the most advanced knowledge. For the purposes of the C.A.T., the Skill Levels and Expectations are broadly based and are for reference purposes within the context of the C.A.T. only. The Work Experience column assumes practical work experience within a particular competency area. Skill Levels Level 0 Introductory Expectations

Work Experience 0 <1 year

has awareness of the subject area but may not have either technical skills or practical experience in the subject area given the individuals limited knowledge of the subject area, may not have the basic technical skills or experience to perform at a staff level within an organization possesses or demonstrates ability at a threshold level in his/her role in the organization CGAs bring at least this level of competence with them to entry-level positions demonstrates competence in the Level 1 Basic competency areas performs with experience and effectiveness CGAs assume operational or management responsibility demonstrates effectiveness in the Level 2 Intermediate competency areas CGAs usually acquire these advanced competencies through professional development and hands-on experience in a business or organization expectations of senior professionals and executives, who must consult and weigh competing interests, take informed risks, and be accountable for decisions and the ensuing repercussions demonstrates mastery in the Level 3 Advanced competency areas

Level 1 Basic

1 and <4 years

Level 2 Intermediate

4 and <7 years

Level 3 Advanced

7 years

You might also like

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Practical Experience LogbookDocument6 pagesPractical Experience Logbookng soo keeNo ratings yet

- M.Salman ACCA (+923332327714)Document2 pagesM.Salman ACCA (+923332327714)Muhammad SalmanNo ratings yet

- Per User Guide and Logbook2Document76 pagesPer User Guide and Logbook2Anthony LawNo ratings yet

- Audit and Assurance Syllabus 2015Document12 pagesAudit and Assurance Syllabus 2015Maddie GreenNo ratings yet

- Regulatory Framework of AuditingDocument18 pagesRegulatory Framework of AuditingSohaib BilalNo ratings yet

- Practitioner's Guide To Audit of Small EntitiesDocument315 pagesPractitioner's Guide To Audit of Small Entitiesswat2kk5No ratings yet

- Events After The Reporting Period (IAS 10)Document16 pagesEvents After The Reporting Period (IAS 10)AbdulhafizNo ratings yet

- Overtime Audit Report-EDocument0 pagesOvertime Audit Report-EGarto Emmanuel SalimNo ratings yet

- Auditor Performance EvaluationDocument6 pagesAuditor Performance EvaluationLugis AndriantoNo ratings yet

- Case StudyDocument5 pagesCase StudyAshwin KumarNo ratings yet

- Auditing and Accounting DifferencesDocument65 pagesAuditing and Accounting DifferencesTushar GaurNo ratings yet

- A Report On Audit Planning of ACI LIMITEDDocument33 pagesA Report On Audit Planning of ACI LIMITEDAtiaTahiraNo ratings yet

- CIA P1 SII Independence and ObjectivityDocument47 pagesCIA P1 SII Independence and ObjectivityJayAr Dela Rosa100% (1)

- BRAC Internal Audit CharterDocument14 pagesBRAC Internal Audit CharterImran Alam ChowdhuryNo ratings yet

- Presentation On Risk Based Auditing For NGOsDocument26 pagesPresentation On Risk Based Auditing For NGOsimranmughalmaniNo ratings yet

- Draft Attached Formats: 1. Resignation Letter by AuditorDocument6 pagesDraft Attached Formats: 1. Resignation Letter by AuditorAlamba Charitable TrustNo ratings yet

- Log BookDocument53 pagesLog BookJeetkamal KaurNo ratings yet

- Functions of Marketing DepartmentDocument10 pagesFunctions of Marketing Departmentdani9203No ratings yet

- Auditor-General Pakistan Permanent FileDocument14 pagesAuditor-General Pakistan Permanent Filegmk_t84No ratings yet

- Audit Reports TypeDocument3 pagesAudit Reports Typesarah031No ratings yet

- Tender Waiver Form 2015Document6 pagesTender Waiver Form 2015ahtin618No ratings yet

- UBG163 Assessment Question Feb 2021Document9 pagesUBG163 Assessment Question Feb 2021bup hrlcNo ratings yet

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindeNo ratings yet

- PwC Vietnam IT Auditor JobDocument2 pagesPwC Vietnam IT Auditor JobHoàng MinhNo ratings yet

- ATR Answers - 5Document43 pagesATR Answers - 5Christine Jane AbangNo ratings yet

- Labour Laws Compliance Checklist-GratuityDocument5 pagesLabour Laws Compliance Checklist-Gratuityairline_maniNo ratings yet

- ManSci SyllabusDocument8 pagesManSci SyllabusKarlo Marco CletoNo ratings yet

- The Balanced Scorecard: A Tool To Implement StrategyDocument39 pagesThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoNo ratings yet

- QuestionsDocument28 pagesQuestionssohail merchant100% (1)

- Principle of Auditing AssignmentDocument6 pagesPrinciple of Auditing AssignmentranjinikpNo ratings yet

- Empleyado Brochure PDFDocument3 pagesEmpleyado Brochure PDFRose ManaloNo ratings yet

- IC Internal Audit Checklist 8624Document3 pagesIC Internal Audit Checklist 8624Tarun KumarNo ratings yet

- BDP Department Periodic Audit Report .2Document30 pagesBDP Department Periodic Audit Report .2Arefayne WodajoNo ratings yet

- Certifr Questions BankDocument86 pagesCertifr Questions BankysalamonyNo ratings yet

- Introduction to Auditing - Meaning, Importance and DifferencesDocument56 pagesIntroduction to Auditing - Meaning, Importance and Differencesanon_696931352No ratings yet

- Evolving Finance at MerckDocument4 pagesEvolving Finance at MerckRatish MayankNo ratings yet

- PWC Application Form 2011Document3 pagesPWC Application Form 2011Ngoc NhuNo ratings yet

- IAS 16, Property, Plant and Equipment OverviewDocument3 pagesIAS 16, Property, Plant and Equipment OverviewSpencerNo ratings yet

- Risk Matrix Assessment Bank Risk Matrix AssessmentDocument3 pagesRisk Matrix Assessment Bank Risk Matrix Assessmentabdullahsaleem91No ratings yet

- ManagementAccounting (TermPaper)Document11 pagesManagementAccounting (TermPaper)Eshfaque Alam Dastagir100% (1)

- Project REPOPT ON CADocument52 pagesProject REPOPT ON CABhawna PamnaniNo ratings yet

- Professional: $245 Academic: $135 Student: $39 Two-Year Student: $78Document5 pagesProfessional: $245 Academic: $135 Student: $39 Two-Year Student: $78anwarNo ratings yet

- TOPIC 3d - Audit PlanningDocument29 pagesTOPIC 3d - Audit PlanningLANGITBIRUNo ratings yet

- Auditors LiabilityDocument36 pagesAuditors LiabilityVaibhav BanjanNo ratings yet

- Bookkeeping Basics for Small BusinessesDocument26 pagesBookkeeping Basics for Small Businessesjack lukeNo ratings yet

- CA Final Audit - EXTRA 30 Integrated Case LawsDocument69 pagesCA Final Audit - EXTRA 30 Integrated Case LawsSri PavanNo ratings yet

- ACA CMA MaCpping RevisedDocument3 pagesACA CMA MaCpping RevisedDebashis1982No ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- At 04 Auditing PlanningDocument8 pagesAt 04 Auditing PlanningJelyn RuazolNo ratings yet

- Mu1 CgaDocument17 pagesMu1 Cgaromie2bNo ratings yet

- ISQC1 What's New-01.02.18 PDFDocument13 pagesISQC1 What's New-01.02.18 PDFTumi Makatane MasekanaNo ratings yet

- HRMIS FormDocument1 pageHRMIS FormShaloom TVNo ratings yet

- The Audit Process - Final ReviewDocument5 pagesThe Audit Process - Final ReviewFazlan Muallif ResnuliusNo ratings yet

- The Chief Audit Executive-Understanding The Role and Professional Obligations of A CAE PDFDocument18 pagesThe Chief Audit Executive-Understanding The Role and Professional Obligations of A CAE PDFRexBodotaNo ratings yet

- AUDIT CHALLENGESDocument34 pagesAUDIT CHALLENGES張祐榮 ウヨンNo ratings yet

- BSA Policies and ProceduresDocument2 pagesBSA Policies and Proceduresjay1ar1guyenaNo ratings yet

- Flow Chart - Trial Balance - WikiAccountingDocument6 pagesFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNo ratings yet

- Oil & Gas Supply Chain - Key FindingsDocument18 pagesOil & Gas Supply Chain - Key FindingsAchu F AchamNo ratings yet

- Data Collection Techniques GuideDocument11 pagesData Collection Techniques GuideAchu F AchamNo ratings yet

- 04 Intro To Quantitative MethodsDocument323 pages04 Intro To Quantitative MethodsAchu F Acham100% (3)

- 04 Intro To Quantitative MethodsDocument323 pages04 Intro To Quantitative MethodsAchu F Acham100% (3)

- Human Flourishing and the Role of ScienceDocument3 pagesHuman Flourishing and the Role of ScienceThom Steve Ty100% (1)

- Legal Research and Law ReformDocument27 pagesLegal Research and Law ReformAdv Rakhi Vyas100% (2)

- Adobe Scan Jun 03, 2023Document12 pagesAdobe Scan Jun 03, 2023BeastBiasNo ratings yet

- Module 4 - Myself in Other's ShoesDocument39 pagesModule 4 - Myself in Other's Shoesrez hablo80% (5)

- Generative AI Tools - Attempt ReviewDocument4 pagesGenerative AI Tools - Attempt Reviewvinay MurakambattuNo ratings yet

- A51810195 Fahmitha Shawkath PDocument1 pageA51810195 Fahmitha Shawkath PsandeepNo ratings yet

- Control of Sales ForceDocument28 pagesControl of Sales ForceswanandrajputNo ratings yet

- Southwestern University: Application FormDocument1 pageSouthwestern University: Application FormThiody Hope LimosneroNo ratings yet

- CRV Open Source - v3.0. Remote ViewingDocument104 pagesCRV Open Source - v3.0. Remote ViewingVito Ciccia Romito100% (2)

- BLE Computer 2080Document2 pagesBLE Computer 2080siddharthshishusadan2No ratings yet

- Arawomo Anuoluwapo ProjectDocument51 pagesArawomo Anuoluwapo ProjectAdebisi Adewale BlessingNo ratings yet

- 10 - PMDC Postgraduate Medical and Dental Education Standards and Regulation 2018Document109 pages10 - PMDC Postgraduate Medical and Dental Education Standards and Regulation 2018Shazin Javed0% (1)

- Class Program For Grade 7-10: Grade 7 (Hope) Grade 7 (Love)Document2 pagesClass Program For Grade 7-10: Grade 7 (Hope) Grade 7 (Love)Mary Neol HijaponNo ratings yet

- Artificial Intelligence: "PR TeemuenrDocument472 pagesArtificial Intelligence: "PR TeemuenrutkarshNo ratings yet

- Parents Magazine Fall 2012Document36 pagesParents Magazine Fall 2012cindy.callahanNo ratings yet

- Scheduling and Load BalancingDocument11 pagesScheduling and Load BalancingSubburam SivakumarNo ratings yet

- ListDocument5 pagesListmyjoyonline.comNo ratings yet

- Speaker Dynamics in Zimbabwean Debate - Speaker Dynamics in Zimbabwe Tertiary Institutions Debate Mlungele M. Nsikani & Zimazile N. BangoDocument3 pagesSpeaker Dynamics in Zimbabwean Debate - Speaker Dynamics in Zimbabwe Tertiary Institutions Debate Mlungele M. Nsikani & Zimazile N. BangoThabo DubeNo ratings yet

- Writing and Speaking Topics - Summit 1Document8 pagesWriting and Speaking Topics - Summit 1Châu Trương mỹ100% (2)

- How Societies RememberDocument27 pagesHow Societies RememberCatarina Pinto100% (1)

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesNolie De Lara CastilloNo ratings yet

- Dream Program: Intensive 3 Day 1Document3 pagesDream Program: Intensive 3 Day 1G DraNo ratings yet

- Relationship Among Theory, Research and PracticeDocument16 pagesRelationship Among Theory, Research and PracticeLourdes Mercado0% (1)

- App2 - Entreprenuership: Input 13 The 4M's of OperationDocument4 pagesApp2 - Entreprenuership: Input 13 The 4M's of OperationRhina MayNo ratings yet

- Redress EssayDocument3 pagesRedress Essayapi-296712028No ratings yet

- СР по молоді, життю, організаціямDocument2 pagesСР по молоді, життю, організаціямIraaaaNo ratings yet

- MWM Project M 3Document3 pagesMWM Project M 3Tanvi KhuranaNo ratings yet

- Bedanking ThesisDocument6 pagesBedanking Thesisafkodkedr100% (2)

- BMEC - Case AnalysisDocument1 pageBMEC - Case AnalysisJoanah TayamenNo ratings yet

- Memory Strategies and Education Protect Mental DeclineDocument7 pagesMemory Strategies and Education Protect Mental DeclineHarsh Sheth60% (5)