Professional Documents

Culture Documents

India Bulls Securities LTD

Uploaded by

Cool GauravOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Bulls Securities LTD

Uploaded by

Cool GauravCopyright:

Available Formats

Indiabulls Securities Ltd.

: Locations

S.No. Location Type 1 Registered Office Address F-60, Malhotra Building, 2nd Floor, Connaught Place New Delhi , Delhi - India PinCode :110001 Phone :011-41523700,,, Fax :011-41529071, 2 Corporate Office 8&9/F, Indiabulis Finance Centre, Tower 1, Eiphinstone Mills, Senapati Bapat Marg Mumbai , Maharashtra - India PinCode :400013 Phone :,,, Fax :, 3 Corporate Office "Indiabulls House", 448-451, Udyog Vihar, Phase V Gurgaon , Haryana - India PinCode :122001 Phone :,,,

Indiabulls Securities Ltd. : Capital Structure

From To Class of Shares Auth. Capital 19.00 100.00 100.00 100.00 Issued Capital 17.83 50.69 50.69 45.99 Paid-up Shares (No's) 17834099 253426989 253426989 229940648 Face Value (Rs) 10 2 2 2 (Rs. in Crore) Paid-up Capital 17.83 50.69 50.69 45.99

2006 2007 Equity Share 2007 2008 Equity Share 2008 2009 Equity Share 2009 2010 Equity Share

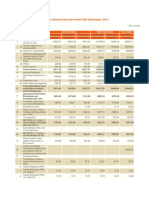

Indiabulls Securities Ltd. : Share Holding

Share Holding Pattern as on : FaceValue Share Holder 31/03/2011 2.00 31/12/2010 2.00 30/09/2010 2.00

No. Of Shares % Holding No. Of Shares % Holding No. Of Shares % Holding PROMOTER'S HOLDING

Foreign Promoters Indian Promoters Person Acting in Concert Sub Total

0 68713425 0 68713425

0.00 29.73 0.00 29.73

0 68713425 0 68713425

0.00 29.73 0.00 29.73

0 68713425 0 68713425

0.00 29.74 0.00 29.74

NON PROMOTER'S HOLDING Institutional Investors Mutual Funds and UTI Banks Fin. Inst. and Insurance FII's Sub Total 0 382320 24732792 25115112 0.00 0.17 10.70 10.87 0 326470 25026074 25352544 0.00 0.14 10.83 10.97 0 586360 23916329 24502689 0.00 0.25 10.35 10.60

Other Investors Private Corporate Bodies NRI's/OCB's/Foreign Others GDR/ADR Directors/Employees Government Others Sub Total General Public GRAND TOTAL 33163095 14556410 4688982 0 0 465950 52874437 84409537 231112511 14.35 6.30 2.03 0.00 0.00 0.20 22.88 36.52 100.00 38341965 14351932 4688982 0 0 394270 57777149 79269393 231112511 16.59 6.21 2.03 0.00 0.00 0.17 25.00 34.30 100.00 39719800 14252509 0 0 0 8055767 62028076 75840046 231084236 17.19 6.17 0.00 0.00 0.00 3.49 26.84 32.82 100.00

Indiabulls Securities Ltd. : Physical Performance

Year Months 1003 1003 1003 12 Product name Income From Brokerage & Commission Sales quantity 0 0 0 Sales unit of measurement Sales value(Rs. Crores) 236.01 60.12 40.76 Product Mix(%) 70.05 17.84 12.09

12 Interest 12 Other Services

Indiabulls Securities Ltd. : Annual Results (Standalone)

Standalone Consolidated March ' 11 12 Months March ' 10 12 Months March ' 09 12 Months March ' 08 12 Months (Rs. in Crore) March ' 07 12 Months

Sales Other Income Stock Adjustment Raw Material Power And Fuel Employee Expenses Excise Admin And Selling Expenses Research And Devlopment Expenses Expenses Capitalised Other Expenses Provisions Made Operating Profit Interest

325.45 12.13 0.00 0.00 0.00 130.45 0.00 66.94 0.00 0.00 27.83 0.00 100.23 39.22

337.60 7.15 0.00 0.00 0.00 133.57 0.00 49.13 0.00 0.00 27.81 0.00 127.09 19.08

391.88 11.40 0.00 0.00 0.00 111.61 0.00 236.58 0.00 0.00 30.90 0.00 12.80 19.45

617.35 11.32 0.00 0.00 0.00 105.41 0.00 0.00 0.00 0.00 114.58 0.00 397.35 15.69

422.83 23.78 0.00 0.00 0.00 105.98 0.00 0.00 0.00 0.00 112.24 0.00 204.61 14.14

Gross Profit Depreciation Taxation Net Profit / Loss Extra Ordinary Item Prior Year Adjustments

73.14 17.92 17.85 37.37 0.00 0.00

115.16 21.22 32.73 61.22 0.00 0.00

4.74 24.22 -6.60 -12.88 0.00 0.00

392.98 21.21 123.11 248.66 0.00 0.00

214.25 14.44 62.42 137.39 0.00 0.00

Equity Capital Equity Dividend Rate Agg.Of Non-Prom. Shares (in Lacs) Agg.Of Non PromotoHolding(%) OPM(%) GPM(%) NPM(%) EPS (in Rs.)

46.22 0.00 1,577.10 68.24 30.79 21.66 11.07 1.62

45.99 0.00 1,565.38 68.08 37.64 33.40 17.75 2.66

50.69 0.00 1,680.68 66.32 3.26 1.17 -3.19 -0.51

50.69 0.00 1,540.76 60.80 64.36 62.51 39.55 9.81

17.83 0.00 0.00 0.00 48.39 47.97 30.76 15.41

Indiabulls Securities Ltd. : Segmentwise - Yearly (Standalone)

Standalone Segment Revenue Segment Name Broking Others Total Segment Results Segment Name Other Unallocable expenditure net of Unallocable Income Broking Others Total Less-Interest Less : Unallocated Expenses/(income) Total Profit Before Tax Capital Employed March '10 106.42 0.71 107.13 13.24 -0.06 93.94 March '09 166.86 166.86 12.29 174.05 -19.48 March '08 -7.24 363.94 0.59 364.53 371.77 March '07 183.72 21.79 206.45 5.64 199.81 March '10 336.89 0.71 337.60 March '09 391.88 391.88 March '08 618.05 0.59 618.63 March '07 424.88 21.73 448.61 Consolidated

Segment Name Unallocated Capital Employed Broking Total

March '10 -183.85 403.78 219.93

March '09 -79.64 370.95 291.30

March '08 395.50 -31.48 -31.48

March '07 93.43 225.74 225.74

Indiabulls Securities Ltd. : Auditors

S.No Auditor's Name 1 Deloitte Haskins & Sells

Indiabulls Securities Ltd. : Accounting Policy (Year End: March 2010)

a) Basis of Consolidation: The Consolidated Financial Statements are prepared in accordance with Accounting Standard (AS) 21 Consolidated Financial Statements as notified under the Companies (Accounting Standards) Rules, 2006. Reference in these notes to Company, Holding Company, Companies or Croup shall mean to include Indiabulls Securities Limited or any of its subsidiaries, unless otherwise stated. b) Principles of consolidation: The Consolidated Financial Statements comprise of the Financial Statements of Indiabulls Securities Limited and its subsidiaries. The financial statements of the group companies are prepared according to uniform accounting policies, in accordance with accounting principles generally accepted in India. The effects of inter company transactions are eliminated on consolidation. c) Goodwill / Capital Reserve on consolidation: Goodwill / Capital Reserve represents the difference between the Companys share in the net worth of subsidiaries, and the cost of acquisition at each point of time of making the investment in the subsidiaries. For this purpose, the Companys share of net worth is determined on the basis of the latest financial statements prior to the acqui sition after making necessary adjustments for material events between the date of such financial statements and the date of respective acquisition. Capital Reserve on consolidation is adjusted against Goodwill on consolidation, if any. The Goodwill on consolidation is evaluated for impairment whenever events or changes in circumstances indicate that its carrying amount may have been impaired. e) Basis of Preparation of Financial Statements: The financial statements are prepared under the historical cost convention, on an accrual basis and in accordance with the Generally Accepted Accounting Principles in India and Accounting Standards as notified under the Companies (Accounting Standards) Rules, 2006. f) Use of Estimates: The preparation of financial statements in conformity with the Generally Accepted Accounting Principles requires estimates and assumptions to be made that affect the reported amount of assets and liabilities on the date of the financial statements and the reported amount oF revenues and expenses during the reporting period. Difference between the actual result and estimates are recognised in the period in which the results are known / materialised. g) Revenue Recognition: a Revenue from brokerage activities is accounted for on the trade date of transaction. b Revenue from interest charged to customers on margin funding is recognised on a daily/ monthly basis up to the last day of accounting period. - Depository income is accounted on accrual basis as and when the right to receive the income is established. m Revenue from interest from fixed deposits is recognised on accrual basis. Commission on mutual fund is recognised on accrual basis.

a Income from fee based advisory services is recognised on an accrual basis. - Dividend income on equity shares is recognised when the right to receive the dividend is unconditional at the balance sheet date. - Dividend Income on units of Mutual Fund is recognised when the right to receive the dividend is unconditional at the balance sheet date and any gains/losses are recognised on the date of redemption. h) Income from arbitrage and trading in securities and derivatives comprises profit/loss on sale of securities held as stock-in-trade and profit/loss on equity derivative instruments. Profit/loss on sale of securities is determined based on the weighted average cost of the securities sold. Profit/loss on equity derivative transactions is accounted for based on the Guidance Note on Accounting for Equity Index and Equity Stock Futures and Options issued by the Institute of Chartered Accountants of India which is more fully explained in i) and ii) below :Equity Index / Stock Futures: In accordance with Guidance Note on "Accounting for Equity Index and Equity Stock Futures and Options" issued by The Institute of Chartered Accountants of India (i) Initial Margin - Equity Index/ Stock Futures, representing the initial margin paid, and margin deposits representing additional margin paid over and above the initial margin, for entering into a contract for equity index/ stock futures which are released on final settlement / squaring-up of the underlying contract, are disclosed under Loans and Advances. (ii) Equity Index / Stock Futures are marked- to-market on a daily basis. Debit or credit balance disclosed under Loans and Advances or Current Liabilities, respectively, in the "Mark-to-Market Margin - Equity Index/ Stock Futures Account", represents the net amount paid or received on the basis of movement in the prices of in dex/ stock futures till the balance sheet date. (iii) As on the balance sheet date, profit/loss on open positions in Equity index/ stock futures is accounted for as follows: - Credit balance in the "Mark-to-Market Margin - Equity Index/Stock Futures Account", being the anticipated profit, is ignored and no credit for the same is taken in the profit and loss account. m Debit balance in the "Mark-to-Market Margin - Equity Index/Stock Futures Account", being the anticipated loss, is adjusted in the profit and loss account. (iv) On final settlement or squaring-up of contracts for equity index/stock futures, the profit or loss is calculated as the difference between the settlement/squaring-up price and the contract price. Accordingly, debit or credit balance pertaining to the settled/ squared-up contract in "Mark-to-Market Margin - Equity Index/Stock Futures Account" after adjustment of the provision for anticipated losses is recognised in the profit and loss account. When more than one contract in respect of the relevant series of equity index/stock futures contract to which the squared-up contract pertains is outstanding at the time of the squaring- up of the contract, the contract price of the contract so squared -up is determined using the weighted average cost method for calculating the profit/loss on squaring-up. i) Stock-in-trade: Stock-in-trade comprising of securities held for the purposes of trading is valued at lower of cost and market value. Profit or loss on sale of such securities is determined using weighted average cost method. j) Commercial Papers: The liability is recognised at face value of the commercial paper at the time of issue of commercial paper. The discount on issue of commercial paper is amortised over the tenure of the instrument. k) Fixed Assets:

(i) Tangible Assets: Tangible fixed assets are stated at cost, net of tax / duty credits availed, if any, less accumulated depreciation / impairment losses, if any. Cost includes original cost of acquisition, including incidental expenses related to such acquisition and installation. (ii) Intangible Assets: Intangible assets are stated at cost, net of tax / duty credits availed, if any, less accumulated amortisation / impairment losses, if any. Cost includes original cost of acquisition, including incidental expenses related to such acquisition and installation. l) Depreciation/Amortisation: Depreciation on tangible fixed assets is provided on straight-line method at the rates specified in Schedule XIV to the Companies Act, 1956. Depreciation on additions to fixed assets is provided on pro-rata basis from the date the asset is put to use. Depreciation on sale / deduction from fixed asset is provided for up to the date of sale / deduction / scrapping, as the case may be. Assets taken on finance lease are depreciated over the tenure of the lease. Assets costing Rs. 5,000 or less are fully depreciated in the year of purchase. Intangible assets consisting of Membership Rights of the Bombay Stock Exchange Limited are amortised on straight-line method basis over a period of five years from the date wh en the rights became available for use. Intangible assets consisting of software are amortised on a straight line basis over a period of four years from the date when the assets are available for use. m) Impairment of Assets: The Company assesses at each Balance Sheet date whether there is any indication that an asset may be impaired. If any such indication exists, the Company estimates the recoverable amount of the asset. Recoverable amount is higher of an assets net selling price and its value in use. If such recoverable amount of the asset or the recoverable amount of the cash generating unit to which the asset belongs is less than its carrying amount, the carrying amount is reduced to its recoverable amount. The reduction is treated as an impairment loss and is recognised in the Profit and Loss Account. If at the Balance Sheet date there is an indication that if a previously assessed impairment loss no longer exists, the recoverable amount is reassessed and the asset is reflected at the recoverable amount. n) Investments: Investments are classified as long term and current investments. Long term investments are carried at cost (ess provision, if any, for diminution other than temporary in their value. Current investments are valued at lower of cost and fair value. o) Employee Benefits: The Company has a defined contribution plan namely Provident Fund. Annual contribution to Employees Provident Fund Organisation is charged to profit and loss account. The Company has unfunded defined benefit plans namely long term compensated absences and gratuity for all the employees, the liability for which is determined on the basis of an actuarial valuation at the end of the year using the Projected Unit Credit Method. Actuarial gains and losses comprise experience adjustments and the effects of change in actuarial assumptions and are recognised in Profit and Loss account as income or expenses. p) Deferred Employee Stocfe Compensation Cost: The Company follows intrinsic value method as per Guidance Note on "Accounting for Employee Share-based Payments" issued by The Institute of Chartered Accountants of India for accounting Employee Stock Options granted. Deferred employee stock compensation cost for stock options are recognised and measured by the difference between the estimated value of the Companys shares at the stock options grant date and the exercise price to be paid by the option holders. The compensation expense is amortised over the vesting period of the options. The fair value of options for disclosure purpose is measured on the basis of a valuation performed in respect of stock options granted. q) Taxes on Income: Current tax is determined as the tax payable in respect of taxable income for the year and is computed in

accordance with relevant tax regulations. Deferred tax resulting from tim ing differences between book and tax profits is accounted for at the current rate of tax / substantively enacted tax rates at the Balance Sheet Date, as applicable, to the extent that the timing differences are expected to crystallise. Deferred Tax Assets are recognised where realisation is reasonably certain whereas in case of carried forward losses or unabsorbed depreciation, deferred tax assets are recognised only if there is a virtual certainty of realisation backed by convincing evidence. Deferred Tax Assets are reviewed for the appropriateness of their respective carrying values at each Balance Sheet date. r) Fringe Benefits Tax: Fringe Benefits Tax has been calculated in accordance with the provisions of the Income Tax Act, 1961 and the Guidance Note on Fringe Benefit Tax issued by the Institute of Chartered Accountants of India. Pursuant to the enactment of the Finance Act, 2009, Fringe Benefits Tax stands abolished w.e.f. April 01, 2009. s> Leases: In case of assets taken on operating lease, the lease rentals are charged to the profit and loss account and assets taken on finance lease have been capitalised, in accordance with Accounting Standard (AS) 19 - Leases as notified under the Companies (Accounting Standards) Rules, 2006. t) Preliminary Expenses: Preliminary expenses are adjusted against Securities Premium account (net of tax) to the extent available and the balance, if any, is charged off to the Profit and Loss account, as incurred. u) Share issue Expenses: Share issue expenses are adjusted against Securities Premium account to the extent of balance available and thereafter, the balance portion is charged off to the P rofit and Loss account, as incurred. v) Borrowing Costs: Borrowing costs that are attributable to the acquisition, construction or production of qualifying assets are capitalised as part of cost of the asset. All other borrowing costs are charged to reve nue. w) Provisions, Contingent Liabilities and Contingent Assets: Provisions are recognised only when there is a present obligation as a result of past events and when a reliable estimate of the amount of obligation can be made. Contingent liability is disclosed for (1) Possible obligations which will be confirmed only by future events not wholly within the control of the Company or (2) Present obligations arising from past events where it is not probable that an outflow of resources will be required to s ettle the obligation or a reliable estimate of the amount of the obligation cannot be made. Contingent Assets are not recognised in the financial statements since this may result in the recognition of income that may never be realised.

Friday, May 06, 2011

Indiabulls securities loses commission income because of increasing options market in FY11

Indiabulls Securities Limited announced its consolidated and standalone financial results for the year ended

March, 2011 on April 25, 2011. The standalone results posted a decrease in operating income by 3.60% to Rs 325.45 crore for the year ended March 2011 as against Rs 337.60 crore in the year 2009-10. The operating expenditure increased by 6.99% to Rs 225.22 crore compared to Rs 210.51 crore in the previous year. On consolidated basis, the operating income and total expenditure increased by 2.5% to Rs 361.03 crore and 16.81% to Rs 217.21 crore respectively. On a consolidated basis, the company reported a fall in net profit of 43.86% to Rs 37.88 crore for the year ended March 2011 as against Rs 67.47 crore in the last fiscal. On the same lines, the standalone profit decreased and stood at Rs 37.37 crore achieving a fall of 38.95% over the last fiscal figure of Rs 61.22 crore. Most of the brokerage firms have witnessed a fall in profits due to subdued retail participation. The share of lowyielding options segment has increased in the overall market volume, bringing down the profitability. The brokerage fee in the options segment is very low. On standalone basis, there was a decrease in employee cost by 2.33% to Rs 130.45 crore in FY11 from Rs 133.57 crore in the previous year. On consolidated basis, there was an increase in employee cost by a 6.47% to Rs 145.89 crore in FY11 from Rs 137.03 crore in the previous year. For the year under review, the standalone interest charges rose by 105.56% to Rs 39.22 crore whereas the tax expenses fell by 45.46% to Rs 17.85 crore. The consolidated interest charges increased by 108.64% to Rs 39.83 crore and tax expenses decreased by 45.6% to Rs 18.83 crore respectively.

Thursday, April 21, 2011

Industry Overview

The following information includes extracts from publicly available information, data and statistics derived from reports prepared by third party consultants, including the IMaCS Industry Report 2009 and the IMaCS Industry Report (2010 Update), private publications, and industry reports prepared by various trade associations, as well as other sources, which have not been prepared or independently verified by the Company, the Book Running Lead Managers, the Co-Book Running Lead Manager or any of their respective affiliates or advisors. Such information, data and statistics may be approximations or may use rounded numbers. Certain data has been reclassified for the purpose of presentation and much of the available information is based on best estimates and should therefore be regarded as indicative only and treated with appropriate caution. Overview of the Indian Economy India is the fifth largest economy in the world after the European Union, the United States, China and Japan with an estimated GDP of approximately US$3.5 6 trillion in 2009, on a purchasing power parity ("PPP") basis, (Source: CIA World Factbook). India is also one of the fastest growing economies in the world. According to the Central Statistical Organization, India's GDP grew at a rate of 7.4% in fiscal 2010. According to India Brand Equity Foundation, India is one of the largest bullion markets in the world. India is also the largest consumer of gold jewellery in the world (approximately 20% of global gold consumption), and the largest importer of gold in the world. Gold imports were approximately 739 tonnes in fiscal 2010. (Source: IBEF, http://www. ibef.org/industry/gemsjewellery. aspx) Overview of the Indian Consumer Credit Market The consumer credit market in India has undergone a significant transformation over the last decade and experienced rapid growth due to consumer credit becoming cheaper, more widely available and increasingly a

more acceptable avenue of funding for consumers. The consumer credit market has developed in India due to the following factors: - increased focus by banks and financial institutions on consumer credit resulting in a market shift towards regulated lenders from unregulated moneylenders/financiers; - increasing trend of Indian consumers to acquire assets such as cars, goods and houses on credit; - fast emerging middle class and growing number of households in our target segment; - improved terms of credit as interest rates in India fall in line with global interest rates; - legislative changes that offer greater protection to lenders against fraud and potential default increasing the incentive to lend; - growth in assignment and securitisation arrangements for consumer loans has enabled non deposit based entities to access wholesale funding and compete solely on their ability to originate, underwrite and service consumer loans. Credit availability, affordability and consumer confidence are the key drivers for consumer loan growth. A variety of financial intermediaries in the public and private sectors participate in India's consumer lending sector, including the following: - commercial banks; - long-term lending institutions; - NBFCs, including housing finance companies; - other specialized financial institutions and state-level financial institutions; and - lenders in the unorganized sector. Commercial Banks As of March 31, 2008, there were 166 scheduled commercial banks ("SCBs"), (including regional rural banks ("RRBs") in India (Source: RBI, Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks, December 2009). The number of banked centres served by SCBs was 34,731 of which 28,021 were single office centres and 64 centres had 100 or more bank offices (Source: RBI publication, Highlights as on April 19, 2010 http://www.rbi.org.in/scripts/PublicationsView.aspxRs.id=12260). Scheduled commercial banks are banks that are listed in a schedule to the Reserve Bank of India Act, 1934, and may be further categorised as public sector banks, private sector banks and foreign banks. Non-Banking Finance Companies A non-banking finance company ("NBFC") is a company registered under the Companies Act, 1956 and is engaged in the business of loans and advances, acquisition of shares/stock/bonds/debentures/securities issued by Government or local authority or other securities of like marketable nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, sale/purchase/construction of immovable property. A non-banking institution which is a company and which has its principal business of receiving deposits under any scheme or arrangement or any other manner, or lending in any manner is also a non-banking financial company (Residuary non-banking company). It is mandatory that every NBFC should be registered with RBI to commence or carry on any business of non-banking financial institution as defined in clause (a) of Section 45 I of the RBI Act, 1934. All NBFCs are not entitled to accept public deposits. Only those NBFCs holding a valid Certificate of Registration with authorisation to accept Public Deposits can accept/hold public deposits. NBFCs authorised to accept/hold public deposits besides having minimum stipulated net owned fund should also comply with the directions such as investing part of the funds in liquid assets, maintain reserves, rating etc. issued by the Bank (Source: RBI, FAQ_NBFC http://www.rbi.org.in/scripts/FAQView.aspxRs.Id=71 ). As of June, 2009 there were 12,740 NBFCs in India,

mostly in the private sector (Source: RBI Press Release dated October, 2009). Gold Finance Industry in India India is one of the largest markets for gold and as of fiscal 2010, accounts for approximately 10% of the total world gold stock with an annual demand of approximately 700 tonnes (Source: IMaCS Industry Report (2010 Update)). Several gold based financial products have been made available to retail consumers in the Indian market from time to time with a view to bring the gold holdings to the core financial market. Lending against gold has been one of the most popular instruments based on gold, and it works well with the Indian rural population, which typically views gold as an important savings instrument that is liquid and can be into converted into cash instantly to meet their urgent cash requirements. Moreover, traditionally gold owners in southern India are more open than elsewhere in the country to accept and exercise the option of pledging gold to borrow money (Source: IMaCS Industry Report 2009). The following chart illustrates gold demand trends in India Indian consumers have an affinity for gold that emanates from various social and cultural factors. Furthermore, the low level of financial inclusion and poor access to financial products and services make gold a safe and attractive investment proposition. In an effort to tap the market for gold related investment and services, companies in the financial sector have launched several products such as gold coins and bars, exchange traded gold funds and lending against gold. Gold Loans in India, have largely been concentrated insouthern India, which holds the largest proportion of India's gold portfolio, and is typically more open to borrowing against gold as compared to consumers in the northern and western regions of India (Source: IMaCS Industry Report 2009). Gold Loans have emerged as key gold based financial products, and in the year ended March 31, 2010, the organized Gold Loans market in India was estimated at between Rs. 350 billion andRs. 400 billion with a CAGR of approximately 40% during fiscal 2002 to fiscal 2010. Notwithstanding the above, the organized Gold Loans portfolio accounted for merely 1.2% of the value of total gold stock in India. The Gold Loans market is significantly under-penetrated and is expected to continue growing at the rate of 3540% in the future. (Source: IMaCS Industry Report (2010 Update). Gold Demand in India - Demand is relatively price in-elastic: Demand for gold has not been adversely impacted by rising prices. Despite increases in gold prices fromRs. 15,026 to Rs. 51,150 per ounce during the period from 2002 to 2009, the demand for gold has risen from 580 tonnes in 2002 to 620 tonnes in 2009 (Source: IMaCS Industry Report (2010 Update)). - South India constitutes the largest market for gold: Southern India has been the largest market accounting for approximately 40% of the gold demand, followed by the western region at approximately 25%, the northern region at 20-25%, and the eastern region at approximately 10-15% of India's annual gold demand. (Source: IMaCS Industry Report 2009). - Demand is further concentrated in rural pockets of India: Rural India is estimated to hold around 65% of total gold stock as this section of the population views gold as a secure and easily accessible savings vehicle along with its consumption purpose (Source: IMaCS Industry Report 2009). In addition to a growing organized Gold Loans market in India, there is a large long-operated, unorganised Gold Loans market which includes numerous pawnbrokers, money lenders and cooperative societies, operating primarily in rural areas of India, and providing loans against jewellery to families at interest rates in excess of 30%. These operators have a strong understanding of the local customer base and offer an advantage of immediate liquidity to customers in need, without requiring elaborate formalities and documentation. The southern region of India accounts for 85-90% of the Gold Loans market in India. Recently, large specialized NBFCs such as Muthoot Finance and Manappuram Finance have started expanding their businesses in northern and western India, and it is expected that there will be a gradual increase in the acceptability of Gold Loans product in these regions due to the concentrated marketing efforts of large NBFCs (Source: IMaCS Industry Report 2009). Drivers of Growth in Gold Loans Market in India

i. Regulatory incentives to lenders: The the prescribed risk weight on Gold Loans has been approximately 50% for commercial banks, further reducing the associated capital costs (Source: IMaCS Industry Report 2009). ii. Policy focus: The Government of India views Gold Loans as an effective means to meet the potential microfinance demand in India. In fiscal 2007, the Government of the state of Tamil Nadu set a jewellery loans target of Rs. 60 billion (75% of the total loan disbursement target) for co-operatives in Tamil Nadu (Source: IMaCS Industry Report 2009). iii. Increasing interest of the lenders in the segment: Considering the recent rise in default rates (expected to vary from 8-10% in fiscal 2009) in personal loans, banks have started focusing on the Gold Loans segment because it offers attractive returns (although lower than personal loans) with very low levels of defaults. Several private sector banks have started participating in the segment by getting into bilateral sale agreements with NBFCs that specialize in Gold Loan. A few private sector banks have also initiated efforts to tap into such segments (Source: IMaCS Industry Report 2009). iv. High levels of indebtedness: The National Sample Survey Organisation (NSSO) 2003 survey on situational assessment of farmers' indebtedness in the country has estimated that 60.4% of rural households in India were farmer households, out of which 48.6% were indebted. The incidence of indebtedness was highest in the state of Andhra Pradesh (82%) followed by Tamil Nadu (74.5%), Punjab (65.4%), Kerala (64.4%), Karnataka (61.6%) and Maharashtra (54.8 %) (Source: IMaCS Industry Report 2009). v. Changing customer attitudes and preferences: Indian customers have demonstrated a change in their traditionally debt-averse psychology, promoting the creation of assets through growth in financial liabilities which has been reflected in an annual growth of more than 30-35% in retail credit between fiscal 2002 and fiscal 2009. (Source: IMaCS Industry Report 2009). Economics of the gold finance industry in India NBFCs and banks operate with different underlying objectives in the Gold Loans segment which has been reflected in the margins and profitability for different category of lenders. NBFCs view Gold Loans as their primary business and have invested significantly in building their service offerings and typically command premium yields and attractive profitability. Historically banks viewed Gold Loans for agriculture as a safer means to meet their priority lending targets which typically offer low returns with high defaults. However, ecent changes in regulatory norms have precluded gold loans from being classified under the agriculture sector, thereby making such loans ineligible to meet banks' priority lending targets. Despite this banks usually are unable to offer the level of flexibility and rapid disbursals as compared to the specialised NBFCs. Competition The Gold Loans market has been dominated by SCBs focused on southern India, and NBFCs with market shares of approximately 58% and 32%, respectively in fiscal 2010, while the remaining market share has been held by small co-operative banks. In addition, there has been a rapid expansion in the market Gold Loans between fiscal 2002 and fiscal 2010 (Source: IMaCS Industry Report (2010 Update)). NBFCs offer flexibility, quick disbursal and an informal environment to their customers in return for a premium on the rates of interest offered. The loan-to-value ratio for 22 carat jewellery piece typically varies from 55-65% by banks while it varies from 70-80% by NBFCs, which may be further adjusted subject to the purity of gold. Further, the interest rates charged by the banks vary from 8-10% in case of loans for agricultural purposes and approximately 12-13% on loans for non-agricultural purposes while NBFCs charge interest rates between 22% and 26% (Source: IMaCS Industry Report 2009). However, recent changes in regulatory norms have precluded gold loans from being classified under the agriculture sector, thereby increasing the cost of funds of gold loan companies, including our Company. Role of NBFC's in the competitive landscape of the gold finance industry in India A typical Gold Loan customer expects high loan-to-value ratios, easy access, low levels of documentation and formalities, quick approval and disbursal of loans, lockers to ensure safety of their pledged gold and a team of expert valuers. Specialized NBFCs have created a niche in the Gold Loans capabilities by meeting these requirements of the typical Gold Loan customers, who require Gold Loans primarily to meet their urgent cash requirements(Source: IMaCS Industry Report 2009). NBFCs specializing in Gold Loans continue to perform strongly in the Gold Loans market and the overall

statistics demonstrate that the relative share of traditional gold finance NBFCs in the market has not changed significantly over the last three years. In fiscal 2010, the Gold Loans market was largely concentrated between two categories of lenders: south India based SCBs and NBFCs specializing in Gold Loans which held approximately 58% and 32%, respectively, of the total market. The rest of the Gold Loans portfolio was held by several small co-operative banks. (Source: IMaCS Industry Report 2009). Outlook of the Gold Loans Market in India Based on the assessment of the emerging dynamics and competitive landscape, the Gold Loans market is expected to grow at between 35% and 40% over the next three years. Moreover, as the market is currently under-penetrated, it is expected that the Gold Loans market will offer enough opportunities for portfolio expansion and retain attractive margins for all existing specialised NBFCs, banks and new entrants (Source: IMaCS Industry Report 2009). The branch expansion and marketing initiatives of various specialized NBFCs are anticipated to give a strong boost to the acceptability of Gold Loans and lead to further growth in the Gold Loans market. NBFCs in the Indian Gold Loans market In addition, it is anticipated that the large public sector banks in southern India will continue to be amongst the leading lenders, but considering the various regulatory and operational processes, it would be challenging for the banks to match the flexible service regime of the specialised NBFCs (Source: IMaCS Industry Report 2009). New NBFC entrants in the market are currently in a cautious preparatory mode to enter the Gold Loans market but it will take some time for these NBFCs to emerge as formidable competitors to specialized existing NBFCs. This is because it will take time for these new NBFCs to build the requisite focus, infrastructure (valuers, lockers, etc,) and branch network (Source: IMaCS Industry Report 2009). Specialized NBFCs are expected to continue to hold their share of the Gold Loans market with their ability to provide superior and niche servicing capabilities to their exiting and future customers. The following factors will be crucial in contributing to the continued growth of specialized NBFCs: - ability to maintain their strong hold in the southern India markets in terms of reach and customer services; - strengthening brand image in the target customer segments with a special emphasis on markets beyond the southern region in India; - developing related products such as education loans and offering fee based services such as money transfers or financial products distribution; and - capturing a strong market position in other regions of India, including in the northern and western regions (Source: IMaCS Industry Report 2009). Source :Muthoot Finance Ltd - 18/04/2011

At a Glance Industry Business Group CEO Face Value 2 Finance - General Indiabulls Group

You might also like

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- Cash Flow Statement PracticeDocument6 pagesCash Flow Statement PracticeVinod Gandhi100% (3)

- Project Financial Accounting For Managers Company: Godfrey Phillips India LimitedDocument8 pagesProject Financial Accounting For Managers Company: Godfrey Phillips India LimitedSOURAV ACHARJEENo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- (A) Fixed AssetsDocument14 pages(A) Fixed AssetsPriya GoyalNo ratings yet

- Investors Capital, Inc. and Subsidiaries Consolidated Statements of Financial Condition (Unaudited) (In Thousands, Except Share Data)Document9 pagesInvestors Capital, Inc. and Subsidiaries Consolidated Statements of Financial Condition (Unaudited) (In Thousands, Except Share Data)abdimmNo ratings yet

- PTC India (POWTRA) : Disappointment On Tolling and Other IncomeDocument8 pagesPTC India (POWTRA) : Disappointment On Tolling and Other Incomedrsivaprasad7No ratings yet

- Hero Motocorp: Previous YearsDocument11 pagesHero Motocorp: Previous YearssalimsidNo ratings yet

- Infosys Balance SheetDocument28 pagesInfosys Balance SheetMM_AKSINo ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisAmandeep SinghNo ratings yet

- QR Sept10Document1 pageQR Sept10Sagar PatilNo ratings yet

- PTCL Accounts 2009 (Parent)Document48 pagesPTCL Accounts 2009 (Parent)Najam U SaharNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Analysis of Earnings and Dividend LevelDocument6 pagesAnalysis of Earnings and Dividend Leveldeveshr25No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Accounting KFC Holdings Financial Ratio Analysis of Year 2009Document16 pagesAccounting KFC Holdings Financial Ratio Analysis of Year 2009Malathi Sundrasaigaran100% (6)

- Financial Results For June 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Bank Accounting PolicyDocument29 pagesBank Accounting Policykotha123No ratings yet

- Assignment: Topic: Financial Statement Analysis of National Bank of PakistanDocument28 pagesAssignment: Topic: Financial Statement Analysis of National Bank of PakistanSadaf AliNo ratings yet

- Absl Amc IpoDocument4 pagesAbsl Amc IpoRounak KhubchandaniNo ratings yet

- Session 1 Financial Accounting Infor Manju JaiswallDocument41 pagesSession 1 Financial Accounting Infor Manju JaiswallpremoshinNo ratings yet

- ACN 305 AssignmentDocument10 pagesACN 305 AssignmentTowhid KamalNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument52 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- Business Analytics End Term Project: Submitted by Submitted ToDocument15 pagesBusiness Analytics End Term Project: Submitted by Submitted ToVinayak ChaturvediNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Accounting of DmuDocument9 pagesAccounting of Dmugayathrinaik12No ratings yet

- Fixed Income CompositeDocument4 pagesFixed Income CompositeWaseem SajjadNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Coal India LimitedDocument14 pagesCoal India LimitedSarju MaviNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument52 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- HSBC Bank India's Annual ReportDocument40 pagesHSBC Bank India's Annual ReportRavi RajaniNo ratings yet

- Birla Sun Life Frontline Equity Fund: Investment ObjectiveDocument1 pageBirla Sun Life Frontline Equity Fund: Investment ObjectivehnarwalNo ratings yet

- Capitec Interim2004Document1 pageCapitec Interim2004naeemrencapNo ratings yet

- JETIR2002031Document5 pagesJETIR2002031adilsk1019No ratings yet

- Profit Margin, Net Margin, Net Profit MarginDocument5 pagesProfit Margin, Net Margin, Net Profit MarginsnehaNo ratings yet

- Consolidated Financial StatementsDocument40 pagesConsolidated Financial StatementsSandeep GunjanNo ratings yet

- Karnataka BankDocument76 pagesKarnataka BankRandhir Shah100% (1)

- Ias-33 EpsDocument59 pagesIas-33 Epssyed asim shahNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- BFSM AssignmentDocument29 pagesBFSM AssignmentdoraemonNo ratings yet

- StatementDocument12 pagesStatementsupertraderNo ratings yet

- Balance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Document22 pagesBalance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Santhiya ArivazhaganNo ratings yet

- Textile Industry ProjectDocument19 pagesTextile Industry ProjectMohammad Ajmal AnsariNo ratings yet

- 3 JBCMLDocument42 pages3 JBCMLArman Hossain WarsiNo ratings yet

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Document4 pagesUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathNo ratings yet

- Methodology Document of Nifty Cpse Index: January 2020Document13 pagesMethodology Document of Nifty Cpse Index: January 2020Sai Samapath KarumudiNo ratings yet

- Financial Planning & ForecastingDocument23 pagesFinancial Planning & ForecastingRanjan SingNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Zarfarie Binti Aron 195645 London Biscuits BHDDocument16 pagesZarfarie Binti Aron 195645 London Biscuits BHDzarfarie aronNo ratings yet

- Understanding Financial Statements of Life Insurance Corporation of IndiaDocument50 pagesUnderstanding Financial Statements of Life Insurance Corporation of IndiaSaurabh TayalNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet