Professional Documents

Culture Documents

Derivative Report 21st July 2011

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Report 21st July 2011

Uploaded by

Angel BrokingCopyright:

Available Formats

Derivative Report

India Research

July 21, 2011 Comments

The Nifty futures open interest increased by 4.54% while

Nifty Vs OI

Minifty futures open interest increased by 7.04% as market closed at 5567.05 levels.

The Nifty July future closed at a premium of 2.50 points,

against a premium of 10.75 points in the last trading session, while the Aug futures closed at a premium of 22.55 points.

The Implied Volatility of at the money options decreased

from 17.20% to 16.50%.

The PCR-OI decreased from 1. 25 to 1.12 points. The total OI of the market is `143,629cr and the stock

futures OI is `35,506cr.

Few liquid stocks where CoC is positive are RUCHISOYA,

HOTELEELA, CROMPGREAV, SINTEX and INDIACEM.

OI Gainers

SCRIP ARVIND CROMPGREAV GITANJALI HOTELEELA IRB OI 944000 11155000 4211000 4592000 3710000 OI CHANGE (%) 263.08 99.37 50.61 35.06 31.47 PRICE 86.80 176.75 310.20 48.30 186.95 PRICE CHANGE (%) 2.30 -15.15 1.91 6.04 0.81

View

Net buying in the Index futures from FIIs was not

much in the last trading session, but build up in open interest is clearly suggesting that some are forming fresh long and some fresh short positions. They were net sellers of `90cr in the cash market segment.

Yesterday, significant buildup was observed in the

5600 to 5800 Call options and some unwinding was observed in most of the Put options mainly the 5500 and 5600 Puts.

IVRCLINFRA is moving in a narrow range of `68-69

OI Losers

SCRIP EXIDEIND CHENNPETRO ORBITCORP FEDERALBNK CESC OI 1750000 235000 4544000 582000 642000 OI CHANGE (%) -13.11 -12.96 -12.35 -9.77 -9.45 PRICE 170.35 225.10 44.05 459.70 331.55 PRICE CHANGE (%) -1.30 -0.71 -3.61 -0.48 0.52

in the past few trading sessions. Yesterday, it was showing some strength. We may see a positive move up to `74. Traders can trade with positive bias with a stop loss of `66.50.

LT is showing some weakness and CoC has turned to

negative. We may see correction in the counter up to `1770. Traders can trade with negative bias around 1815-1818 levels. Keep a stop loss of `1845.

Put-Call Ratio

SCRIP NIFTY INFY RELIANCE SBIN TCS PCR-OI 1.12 0.30 0.46 1.02 0.50 PCR-VOL 0.93 0.33 0.40 0.67 0.47

Historical Volatility

SCRIP

CROMPGREAV CUMMINSIND HAVELLS HOTELEELA LUPIN

HV

108.28 25.19 44.07 46.30 32.32

SEBI Registration No: INB 010996539

For Private Circulation Only

Derivative Report | India Research

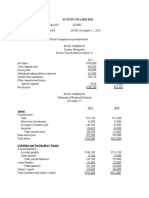

FII Statistics for 20-July-2011

Open Interest Detail Buy Sell Net Contracts INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS TOTAL Value (Rs. in cr.) 12827.63 43371.36 32700.62 1164.56 90064.16 Change (%) 7.27 0.54 0.98 -4.38 4.41

Turnover on 20-July-2011

No. of Contracts Turnover (Rs. in cr.) Change (%)

Instrument

1959.77 7276.17 1832.43 317.14

1903.34 7185.52 2225.14 329.16

56.43 90.65 (392.71) (12.02) (257.65)

460971 1558119 1168405 41126 3228621

Index Futures Stock Futures Index Options Stock Options Total

491137 572929 3565793 143992 4773851

12944.10 15988.87 100616.52 3943.36 133492.86

11.84 15.37 12.73 8.55 12.82

11385.51 11643.16

Nifty Spot = 5567.05

Lot Size = 50

Bull-Call Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5600 5700 5600 5800 5700 5800 Price 42.45 15.20 42.45 5.30 15.20 5.30 9.90 90.10 5709.90 37.15 162.85 5637.15 Risk 27.25 Reward 72.75 BEP 5627.25

Bear-Put Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5500 5400 5500 5300 5400 5300 Price 30.35 11.20 30.35 5.15 11.20 5.15 6.05 93.95 5393.95 25.20 174.80 5474.80 Risk 19.15 Reward 80.85 BEP 5480.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation

Nifty Put-Call Analysis

For Private Circulation Only

SEBI Registration No: INB 010996539

Derivative Report | India Research

Strategy Date 04-July-2011 11-July-2011 18-July-2011

Scrip NIFTY RELIANCE RELINFRA

Strategy Long Call Long Call Ladder Bull Call Spread

Status Continue Continue Continue

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section).

Derivative Research Team

For Private Circulation Only SEBI Registration No: INB 010996539 3

You might also like

- Derivatives Report 25th July 2011Document3 pagesDerivatives Report 25th July 2011Angel BrokingNo ratings yet

- Derivatives Report 17th February 2012Document3 pagesDerivatives Report 17th February 2012Angel BrokingNo ratings yet

- Derivatives Report 16th December 2011Document3 pagesDerivatives Report 16th December 2011Angel BrokingNo ratings yet

- Derivatives Report 25th November 2011Document3 pagesDerivatives Report 25th November 2011Angel BrokingNo ratings yet

- Derivatives Report 11th August 2011Document3 pagesDerivatives Report 11th August 2011Angel BrokingNo ratings yet

- Derivatives Report 13th September 2011Document3 pagesDerivatives Report 13th September 2011Angel BrokingNo ratings yet

- Derivatives Report 21 Sep 2012Document3 pagesDerivatives Report 21 Sep 2012Angel BrokingNo ratings yet

- Derivative Report 21st September 2011Document3 pagesDerivative Report 21st September 2011Angel BrokingNo ratings yet

- Derivatives Report 22nd July 2011Document3 pagesDerivatives Report 22nd July 2011Angel BrokingNo ratings yet

- Derivatives Report 28th July 2011Document3 pagesDerivatives Report 28th July 2011Angel BrokingNo ratings yet

- Derivatives Report 25 Jun 2012Document3 pagesDerivatives Report 25 Jun 2012Angel BrokingNo ratings yet

- Derivatives Report 31st January 2012Document3 pagesDerivatives Report 31st January 2012Angel BrokingNo ratings yet

- Derivatives Report 2nd November 2011Document3 pagesDerivatives Report 2nd November 2011Angel BrokingNo ratings yet

- Derivatives Report 12 Nov 2012Document3 pagesDerivatives Report 12 Nov 2012Angel BrokingNo ratings yet

- Derivatives Report, 11 April 2013Document3 pagesDerivatives Report, 11 April 2013Angel BrokingNo ratings yet

- Derivatives Report 06 Sep 2012Document3 pagesDerivatives Report 06 Sep 2012Angel BrokingNo ratings yet

- Derivatives Report 14th October 2011Document3 pagesDerivatives Report 14th October 2011Angel BrokingNo ratings yet

- Derivatives Report 16 Nov 2012Document3 pagesDerivatives Report 16 Nov 2012Angel BrokingNo ratings yet

- Derivatives Report 12th April 2012Document3 pagesDerivatives Report 12th April 2012Angel BrokingNo ratings yet

- Derivatives Report 10th April 2012Document3 pagesDerivatives Report 10th April 2012Angel BrokingNo ratings yet

- Derivatives Report 24th January 2012Document3 pagesDerivatives Report 24th January 2012Angel BrokingNo ratings yet

- Derivatives Report 23 Oct 2012Document3 pagesDerivatives Report 23 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 27 Jun 2012Document3 pagesDerivatives Report 27 Jun 2012Angel BrokingNo ratings yet

- Derivatives Report 14th November 2011Document3 pagesDerivatives Report 14th November 2011Angel BrokingNo ratings yet

- Derivatives Report 14 Aug 2012Document3 pagesDerivatives Report 14 Aug 2012Angel BrokingNo ratings yet

- Derivatives Report 11 Jul 2012Document3 pagesDerivatives Report 11 Jul 2012Angel BrokingNo ratings yet

- Derivatives Report 20th Dec 2012Document3 pagesDerivatives Report 20th Dec 2012Angel BrokingNo ratings yet

- Derivatives Report 10 Jul 2012Document3 pagesDerivatives Report 10 Jul 2012Angel BrokingNo ratings yet

- Derivatives Report, 22 April 2013Document3 pagesDerivatives Report, 22 April 2013Angel BrokingNo ratings yet

- Derivative Report 25th August 2011Document3 pagesDerivative Report 25th August 2011Angel BrokingNo ratings yet

- Derivatives Report 16 Oct 2012Document3 pagesDerivatives Report 16 Oct 2012Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 4th January 2012Document3 pagesDerivatives Report 4th January 2012Angel BrokingNo ratings yet

- Derivatives Report 07 Feb 2013Document3 pagesDerivatives Report 07 Feb 2013Angel BrokingNo ratings yet

- Derivatives Report 12 Oct 2012Document3 pagesDerivatives Report 12 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 27th April 2012Document3 pagesDerivatives Report 27th April 2012Angel BrokingNo ratings yet

- Derivatives Report 12th March 2012Document3 pagesDerivatives Report 12th March 2012Angel BrokingNo ratings yet

- Derivatives Report 2nd December 2011Document3 pagesDerivatives Report 2nd December 2011Angel BrokingNo ratings yet

- Derivatives Report 1st March 2012Document3 pagesDerivatives Report 1st March 2012Angel BrokingNo ratings yet

- Derivatives Report 24th October 2011Document3 pagesDerivatives Report 24th October 2011Angel BrokingNo ratings yet

- Derivatives Report 2nd May 2012Document3 pagesDerivatives Report 2nd May 2012Angel BrokingNo ratings yet

- Derivatives Report 26th July 2011Document3 pagesDerivatives Report 26th July 2011Angel BrokingNo ratings yet

- Derivatives Report 30th September 2011Document3 pagesDerivatives Report 30th September 2011Angel BrokingNo ratings yet

- Derivatives Report 30 Nov 2012Document3 pagesDerivatives Report 30 Nov 2012Angel BrokingNo ratings yet

- Derivatives Report, 23 April 2013Document3 pagesDerivatives Report, 23 April 2013Angel BrokingNo ratings yet

- Derivatives Report 14 Dec 2012Document3 pagesDerivatives Report 14 Dec 2012Angel BrokingNo ratings yet

- Derivatives Report 21st October 2011Document3 pagesDerivatives Report 21st October 2011Angel BrokingNo ratings yet

- Derivatives Report, 25 March 2013Document3 pagesDerivatives Report, 25 March 2013Angel BrokingNo ratings yet

- Derivatives Report 13 JUNE 2012Document3 pagesDerivatives Report 13 JUNE 2012Angel BrokingNo ratings yet

- Derivatives Report 26 Oct 2012Document3 pagesDerivatives Report 26 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 15 Oct 2012Document3 pagesDerivatives Report 15 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 7th February 2012Document3 pagesDerivatives Report 7th February 2012Angel BrokingNo ratings yet

- Derivatives Report 23rd February 2012Document3 pagesDerivatives Report 23rd February 2012Angel BrokingNo ratings yet

- Derivatives Report, 17 April 2013Document3 pagesDerivatives Report, 17 April 2013Angel BrokingNo ratings yet

- Derivatives Report 27 Aug 2012Document3 pagesDerivatives Report 27 Aug 2012Angel BrokingNo ratings yet

- Derivatives Report 12 Dec 2012Document3 pagesDerivatives Report 12 Dec 2012Angel BrokingNo ratings yet

- Derivatives Report 31 Oct 2012Document3 pagesDerivatives Report 31 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 20th April 2012Document3 pagesDerivatives Report 20th April 2012Angel BrokingNo ratings yet

- Derivatives Report 29 Aug 2012Document3 pagesDerivatives Report 29 Aug 2012Angel BrokingNo ratings yet

- Value Investing in Asia: The Definitive Guide to Investing in AsiaFrom EverandValue Investing in Asia: The Definitive Guide to Investing in AsiaNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Futures July-August 2014Document68 pagesFutures July-August 2014anudoraNo ratings yet

- Lesson #5 Quiz - CourseraDocument1 pageLesson #5 Quiz - CourseraMaricel VargasNo ratings yet

- How To Trade Options - Book Review - Lawrence G. McMillan, McMillan On OptionsDocument3 pagesHow To Trade Options - Book Review - Lawrence G. McMillan, McMillan On OptionsHome Options TradingNo ratings yet

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqNo ratings yet

- Finm 693 Asian Paints (2309)Document10 pagesFinm 693 Asian Paints (2309)Thakur Anmol RajputNo ratings yet

- Dessertation Final ReportDocument94 pagesDessertation Final ReportDeep ChoudharyNo ratings yet

- C.F. Zambeze Q - ADocument5 pagesC.F. Zambeze Q - AthesaqibonlineNo ratings yet

- Balance Sheet Horizontal Analysis TemplateDocument2 pagesBalance Sheet Horizontal Analysis TemplateArif RahmanNo ratings yet

- Climate Finance Syllabus (Spring 2023)Document5 pagesClimate Finance Syllabus (Spring 2023)Hamza HaiderNo ratings yet

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- 2015 Annual ReportDocument19 pages2015 Annual ReportiftikharNo ratings yet

- Format For Cash Flow Statement (Indirect Method)Document4 pagesFormat For Cash Flow Statement (Indirect Method)andreqwNo ratings yet

- Magic Formula Tesed by Paiboon On SETDocument13 pagesMagic Formula Tesed by Paiboon On SETmytheeNo ratings yet

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- (BNP Paribas) Quantitative Option StrategyDocument5 pages(BNP Paribas) Quantitative Option StrategygneymanNo ratings yet

- Lehman Brothers Documents Unearthed by FCICDocument322 pagesLehman Brothers Documents Unearthed by FCICDealBookNo ratings yet

- Quiz Lesson 5 Inflation ProtectionDocument5 pagesQuiz Lesson 5 Inflation ProtectionAKNo ratings yet

- Module III Intrest Rate and Currency SwapDocument21 pagesModule III Intrest Rate and Currency SwapJ BNo ratings yet

- Managing Personal Finances WiselyDocument39 pagesManaging Personal Finances WiselyYong Chun WahNo ratings yet

- Shubhra Johri Cases-25Document19 pagesShubhra Johri Cases-25Manohar ReddyNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- Entering India ReportDocument107 pagesEntering India Reportasthana.a961No ratings yet

- Business FinanceDocument5 pagesBusiness FinanceJojie Mae GabunilasNo ratings yet

- FM1 SolutionsDocument34 pagesFM1 SolutionsAnton PopovNo ratings yet

- Google 10k 2015Document3 pagesGoogle 10k 2015EliasNo ratings yet

- Bodie Investments 12e IM CH23Document3 pagesBodie Investments 12e IM CH23lexon_kbNo ratings yet

- Basel IV Crypto enDocument8 pagesBasel IV Crypto enMorgane FournelNo ratings yet

- Question No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsDocument7 pagesQuestion No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsrafianazNo ratings yet

- Castro Maryliam T 3Document4 pagesCastro Maryliam T 3Kyle KuroNo ratings yet

- AP 5904Q InvestmentsDocument4 pagesAP 5904Q Investmentskristine319No ratings yet