Professional Documents

Culture Documents

Cash Flow

Uploaded by

Shepherd Chikomborero NyajekaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow

Uploaded by

Shepherd Chikomborero NyajekaCopyright:

Available Formats

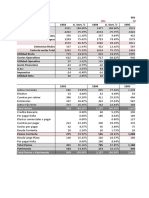

CONSOLIDATED STATEMENT OF CASH FLOWS (INDIRECT METHOD) FOR THE YEAR ENDED 31 DECEMBER 2008 (in thousands of currency

units)

OPERATING ACTIVITIES [Profit/loss] before tax Adjustments for: Finance costs Interest income Dividends from equity investments Share of [profit/loss] of associates/jointly controlled entities Depreciation of property, plant and equipment Impairment loss [recognised/reversed] in respect of property, plant and equipment Amortisation of other intangible assets Discount on acquisition Share-based payment expense [Gain/loss] on fair value changes of investment properties [Gain/loss] on disposal of property, plant and equipment [Development costs expensed] [Other non-cash items (please specify)]

Operating cash flows before movements in working capital [Increase/decrease] in inventories [Increase/decrease] in trade and other receivables [Increase/decrease] in provisions [Increase/decrease] in [investments held for trading/trading securities] [Increase/decrease] in trade and other payables [Other working capital items (please specify)]

Cash [generated from/used in operations] Income taxes paid Interest paid

NET CASH [FROM/USED IN] OPERATING ACTIVITIES

INVESTING ACTIVITIES Interest received Dividends received from associates Dividends received from equity investments Proceeds on disposal of available-for-sale investments Disposal of a subsidiary Proceeds on disposal of property, plant and equipment Purchases of property, plant and equipment Acquisition of investment in an associate Purchases of available-for-sale investments Purchases of patents and trademarks

Acquisition of a subsidiary Development costs paid [Increase/decrease] in pledged bank deposits

NET CASH [FROM/USED IN] INVESTING ACTIVITIES

FINANCING ACTIVITIES Dividends paid Repayments of borrowings Repayments of obligations under finance leases Proceeds on issue of convertible loan notes New bank loans raised Proceeds from issue of shares Expenses on issue of shares Payment on repurchase of shares [[Increase/decrease] in bank overdrafts]

NET CASH [FROM/USED IN] FINANCING ACTIVITIES

NET [INCREASE/DECREASE] IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT 1 JANUARY Effect of foreign exchange rate changes

CASH AND CASH EQUIVALENTS AT 31 DECEMBER, represented by Bank balances and cash Bank overdrafts

Note: The above illustrates the indirect method of reporting cash flows from operating activities.

CONSOLIDATED STATEMENT OF CASH FLOWS (DIRECT METHOD) FOR THE YEAR ENDED 31 DECEMBER 2008 (in thousands of currency units)

OPERATING ACTIVITIES

Cash receipts from customers Cash paid to suppliers and employees [Other cash receipts/paid (please specify)]

Cash [generated from/used in operations] Income taxes paid Interest paid

NET CASH [FROM/USED IN] OPERATING ACTIVITIES

INVESTING ACTIVITIES Interest received Dividends received from associates Dividends received from equity investments Proceeds on disposal of available-for-sale investments Disposal of a subsidiary Proceeds on disposal of property, plant and equipment Purchases of property, plant and equipment Acquisition of investment in an associate Purchases of available-for-sale investments Purchases of patents and trademarks Acquisition of a subsidiary Development costs paid [Increase/decrease] in pledged bank deposits

NET CASH [FROM/USED IN] INVESTING ACTIVITIES

FINANCING ACTIVITIES Dividends paid Repayments of borrowings Repayments of obligations under finance leases Proceeds on issue of convertible loan notes New bank loans raised Proceeds from issue of shares Expenses on issue of shares Payment on repurchase of shares [[Increase/decrease] in bank overdrafts]

NET CASH [FROM/USED IN] FINANCING ACTIVITIES

NET [INCREASE/DECREASE] IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT 1 JANUARY Effect of foreign exchange rate changes

CASH AND CASH EQUIVALENTS AT 31 DECEMBER, represented by Bank balances and cash X X Bank overdrafts (X) (X)

Note: The above illustrates the direct method of reporting cash flows from operating activities.

20X8

20X7

[X]

[X]

X (X) (X) [X] X [X] X (X) X [X] [X] [X] [X]

X (X) (X) [X] X [X] X (X) X [X] [X] [X] [X]

[X] [X] [X] [X] [X] [X] [X]

[X] [X] [X] [X] [X] [X] [X]

[X] (X) (X)

[X] (X) (X)

[X]

[X]

X X X X X X (X) (X) (X) (X)

X X X X X (X) (X) (X) (X)

(X) (X) [X]

(X) (X) [X]

[X]

[X]

(X) (X) (X) X X X (X) (X) [X]

(X) (X) (X) X X X (X) (X) [X]

[X]

[X]

[X] X X

[X] X X

X (X)

X (X)

perating activities.

20X8

20X7

X (X) [X]

X (X) [X]

[X] (X) (X)

[X] (X) (X)

[X]

[X]

X X X X X X (X) (X) (X) (X) (X) (X) [X]

X X X X X (X) (X) (X) (X) (X) (X) [X]

[X]

[X]

(X) (X) (X) X X X (X) (X) [X]

(X) (X) (X) X X X (X) (X) [X]

[X]

[X]

[X] X X

[X] X X

X (X)

X (X)

rating activities.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Berlin School Final Exam - Financial Accounting and MerchandisingDocument17 pagesBerlin School Final Exam - Financial Accounting and MerchandisingNarjes DehkordiNo ratings yet

- Cash Count CertDocument4 pagesCash Count CertShepherd Chikomborero NyajekaNo ratings yet

- OutworkDocument1 pageOutworkShepherd Chikomborero NyajekaNo ratings yet

- Cash CountDocument1 pageCash CountShepherd Chikomborero NyajekaNo ratings yet

- OutworkDocument1 pageOutworkShepherd Chikomborero NyajekaNo ratings yet

- OutworkDocument1 pageOutworkShepherd Chikomborero NyajekaNo ratings yet

- Report TemplateDocument1 pageReport TemplateShepherd Chikomborero NyajekaNo ratings yet

- Report WritingDocument4 pagesReport WritingShepherd Chikomborero NyajekaNo ratings yet

- Report TemplateDocument1 pageReport TemplateShepherd Chikomborero NyajekaNo ratings yet

- Tyres TestDocument2 pagesTyres TestShepherd Chikomborero NyajekaNo ratings yet

- By NatureDocument4 pagesBy NatureShepherd Chikomborero NyajekaNo ratings yet

- By NatureDocument4 pagesBy NatureShepherd Chikomborero NyajekaNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- BFMS Course OverviewDocument4 pagesBFMS Course OverviewPriyaNo ratings yet

- TCCB Revision - ProblemsDocument4 pagesTCCB Revision - ProblemsDiễm Quỳnh 1292 Vũ ĐặngNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- Investment Decision MakingDocument16 pagesInvestment Decision MakingDhruvNo ratings yet

- CPA Exam Questions on FASB Conceptual FrameworkDocument26 pagesCPA Exam Questions on FASB Conceptual FrameworkTerry GuNo ratings yet

- GFR 12 - A Form of Utilisation Certificate For Autonomous Bodies of The Grantee OrgnisationDocument3 pagesGFR 12 - A Form of Utilisation Certificate For Autonomous Bodies of The Grantee OrgnisationRavi GuptaNo ratings yet

- Chapter 6 Accounting For Foreign Currency TransactionDocument21 pagesChapter 6 Accounting For Foreign Currency TransactionMisganaw DebasNo ratings yet

- Measuring Market Inefficiencies and the Case for Current Value AccountingDocument13 pagesMeasuring Market Inefficiencies and the Case for Current Value AccountingXinwei GuoNo ratings yet

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008No ratings yet

- DMGT104 Financial Accounting PDFDocument317 pagesDMGT104 Financial Accounting PDFNani100% (1)

- The Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going ForwardDocument10 pagesThe Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going Forwardgreenam 14No ratings yet

- Week 03 - Bank ReconciliationDocument6 pagesWeek 03 - Bank ReconciliationPj ManezNo ratings yet

- Estimating the Cost of Short-Term Credit OptionsDocument6 pagesEstimating the Cost of Short-Term Credit OptionsKristine AlcantaraNo ratings yet

- Consolidated CSOFP of Jasin Bhd GroupDocument4 pagesConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahNo ratings yet

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsDocument185 pages(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheNo ratings yet

- OBLICON - Chapter 1 ProblemDocument1 pageOBLICON - Chapter 1 ProblemArahNo ratings yet

- Bangladesh's Leading Mobile Banking ServicesDocument12 pagesBangladesh's Leading Mobile Banking ServicesTaymur Hasan MunnaNo ratings yet

- Syllabus Mls Part 1 2Document18 pagesSyllabus Mls Part 1 2Fanatic AZNo ratings yet

- Ark Israel Innovative Technology Etf Izrl HoldingsDocument2 pagesArk Israel Innovative Technology Etf Izrl HoldingsmikiNo ratings yet

- PRMS FAQsDocument3 pagesPRMS FAQsfriendbceNo ratings yet

- Chapter 1 History and Development of Banking System in MalaysiaDocument18 pagesChapter 1 History and Development of Banking System in MalaysiaMadihah JamianNo ratings yet

- 1234449Document19 pages1234449Jade MarkNo ratings yet

- Project Finance in Developing Countries ExplainedDocument8 pagesProject Finance in Developing Countries Explained'Daniel So-fly OramaliNo ratings yet

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Document30 pagesEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- Vdocuments - MX - Blackbook Project On Mutual Funds PDFDocument88 pagesVdocuments - MX - Blackbook Project On Mutual Funds PDFAbu Sufiyan ShaikhNo ratings yet

- Cmfas M 9: OduleDocument23 pagesCmfas M 9: Odulezihan.pohNo ratings yet

- Online BankingDocument38 pagesOnline BankingROSHNI AZAMNo ratings yet

- MSU-CBA Receivables Financing Pre-Review ProgramDocument2 pagesMSU-CBA Receivables Financing Pre-Review ProgramAyesha RGNo ratings yet