Professional Documents

Culture Documents

GTB Report

Uploaded by

Olawale Oluwatoyin BolajiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GTB Report

Uploaded by

Olawale Oluwatoyin BolajiCopyright:

Available Formats

Page 1 of 2

FACTBOOK 2010

GUARANTY TRUST BANK PLC

1. Head Office:

Plural House,

Plot 1669, Oyin Jolayemi Street,

P. O. Box 75455, Victoria Island, Lagos.

Tel: 234-01-2622650 - 69, 3201096-1100. Fax: 234-01-2715227;

Telex: 23380 GT BANK NG

Website:http://www.gtbplc.com;

E-mail: corpaff@gtbplc.com

Swift Add: Gtb Ingla Xxx

8. Company Secretary:

Mrs. Olutola Omotola

9. Auditors:

KPMG Professional Services

(Chartered Accountants)

22, Gerrard Road,

P. O. Box 51204, Ikoyi, Lagos.

Tel: 234-01-271-8955. Fax: 234-01-462-0704

10. Company Registrars:

GTB Registrars Limited

7, Anthony Village Road, Anthony Village, Lagos.

2. Nature of Business:

Universal Banking

3. Date of Incorporation:

20th July, 1990 (RC. 152321)

1991 - Commenced Operations

11. Subsidiaries/Offshore Subsidiaries:

GTB (Gambia) Limited

GTB (Sierra Leone) Limited

Guaranty Trust Assurance Plc.

GTB (Ghana) Limited

GTB Finance B.V.(Netherlands)

GTB Registrars Limited

Kakawa Discount House Limited

GT Homes Limited

GTB Asset Management Limited

GTB Liberia Limited

4. Date Listed on The Exchange:

9th September, 1996

5. NSE Classification:

Banking

6. ISIN Number:

NGGUARANTY06

7. Board of Directors:

Owelle Gilbert P. Chikelu (Chairman up till May 26, 2010)

Mr. Oluwole S. Oduyemi (Chairman w.e.f. May 26, 2010)

Mr. Olutayo Aderinokun, (MD/CEO)

Mr. Olusegun J. K. Agbaje

Mr. Victor G. Osibodu (Up till April 2010)

Alhaji Mohammed K. Jada (Up till April 2010)

Mr. Adetokunbo B. Adesanya (Up till April 2010)

Egbert U. Imomoh

Mr. Andrew A. Alli

Mr. Akindele Akintoye

Mr. Babajide Ogundare

Mrs. Catherine N. Echeozo

Mrs. G. T. Osuntoki

Mr. Akin George-Taylor

Mr. Kadiri Adebayo Adeola

(With effect from April 2010)

Mr. Olabode Mubasheer Agusto (With effect from April 2010)

Mr. Ibrahim Hassan (With effect from April 2010)

Mrs. Stella Okoli (With effect from April 2010)

12. End of Accounting Year

31st December

13. Number of Employees

3,711

Mr.

14. Capital St ructure

i. Authorised:

N15,000,000,000.00

ii. Paid-Up N9,326,875,000.00

15. Analysis of Shareholding

Stanbic Nominees Nig. Ltd- GDR (Underlying shares)13.21%

Stanbic NomineesNig. Limited - trading

7.94%

Other Nigerian Citizens & Associations

78.85%

FIVE-YEAR FINANCIAL SUMMARY

ASSETS

Dec. 2009

Nm

Feb. 2008

Nm

Feb. 2007

Nm

Cash and balances with CBN

Treasury bills

Due from other banks

Loans and advances to customers

Other facilities

Advances under finance lease

Insurance receivables

Investment securities

Deferred tax assets

Equipment on lease

Trading properties

Other assets

Property and equipment

Goodwill on consolidation

35,890

36,936

225,330

563,488

6

810

136,194

411

5,071

15,523

46,491

354

----------1,066,504

======

64,350

62,216

219,822

416,319

24

563

91,511

37

15,086

49,273

39,630

354

----------959,184

======

38,970

65,764

79,910

288,152

18

472

117,768

21

12,063

94,765

33,970

166

----------732,038

======

7,462

119,077

51,454

4,042

6,840

119,077

34,093

3,335

Total Assets

Liabilities:

Share capital

Share premium

Reserves

Non-controlling interest

9,327

119,077

58,700

5,142

Feb. 2006

Nm

Feb. 2005

Nm

32,621

31,127

126,437

102,164

101,472

42,912

115,746

84,201

4,444

4,461

304

156

42,257

14,360

29

1

42,154

16,360

20,880

12,100

141

69

------------------486,485

307,911

=====

=====

4,000

21,392

21,932

2,662

3,000

21,392

16,158

208

file://C:\Users\WALE\Desktop\FactBook 2010 (D)\Section 2_files\Banking_files\Guarant...

7/12/2011

Page 2 of 2

Customer deposits

Due to other banks

Claims payable

Finance lease obligations

Liability on investment contracts

Liabilities on insurance contracts

Current income tax payable

Other liabilities

Deferred tax liabilities

Dividend payable*

Retirement benefit obligations

Debt securities in issue

Other facilities

Other borrowings

Guarantees and other

commitments on behalf of customers

INCOME STATEMENT

Gross Earnings

Net operating income

Operating expenses

Allowance for loan loss and other risk assets

Profit before tax

Taxation

Extra-ordinary income

Profit after taxation and extra-ordinary income

Non-controlling interest

Profit attributable to shareholders

Earnings per share (Unadjusted)

Declared Dividend per share**

683,081

14,982

351

2,211

1,115

1,126

3,484

85,492

4,347

253

65,486

12,333

----------1,066,504

======

470,606

27,965

186

2,125

586

795

9,637

198,401

3,475

475

48,838

14,058

----------959,184

======

362,936

325

70

2,350

337

625

6,125

135,770

2,809

1,205

56,143

---------732,038

======

294,501

45

31

199

323

3,486

73,292

1,086

985

4,489

58,063

---------486,485

=====

215,774

356

12

61

54

2,207

33,214

1,087

645

4,506

9,238

---------307,911

=====

332,820

======

400,369

======

325,600

======

116,282

82,377

=====

=====

196,408

======

121,660

(56,170)

(37,527)

----------27,963

(4,276)

----------23,687

(11)

----------23,676

======

127k

100k

218,287

155,725

======

======

80,963

62,080

(41,055)

(30,777)

(4,579)

(3,934)

-------------------35,329

27,368

(7,014)

(6,199)

-------------------28,316

21,169

(707)

(369)

-------------------27,609

20,800

======

======

185k

167k

70k

75k

91,163

67,440

=====

=====

35,779

25,572

(19,325)

(13,300)

(737)

(1,784)

------------------15,716

10,489

(2,523)

(2,182)

283,487

------------------13,194

8,590

(201)

(44)

------------------12,993

8,546

=====

=====

162k

142k

103k

70k

Basic Earnings Per Share (Kobo)

185

200

162

180

160

167

142

127

140

Earnings

120

100

80

60

40

20

0

Feb.2005 Feb.2006 Feb.2007 Feb.2008 Dec.2009

Year

*Restated to account for the retrospective adoption of SAS 23

**Declared dividend represents the interim dividend declared and paid during the year plus the final dividend proposed for the

precding year but declared during the current year.

Important Note:

While every effort is made to ensure accuracy, no responsibility is accepted for any error, which may occur in this book.

Home | The Stock Exchange| Quoted Companies | Issuing Houses | The Registrars

Nigerian Stock Exchange

All Rights Reserved

file://C:\Users\WALE\Desktop\FactBook 2010 (D)\Section 2_files\Banking_files\Guarant...

7/12/2011

You might also like

- Shelf Drilling Invoice - 100%Document2 pagesShelf Drilling Invoice - 100%kunlekokoNo ratings yet

- PT Yulie Sekurindo Tbk. Securities SummaryDocument2 pagesPT Yulie Sekurindo Tbk. Securities SummaryIshidaUryuuNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Invoice No To AriseDocument2 pagesInvoice No To AriseKhemet LtdNo ratings yet

- Petronet 2022 Q2Document12 pagesPetronet 2022 Q2thirurajaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Invoice No 2 To AriseDocument2 pagesInvoice No 2 To AriseKhemet LtdNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Chilaw Finance Limited Intro..Document115 pagesChilaw Finance Limited Intro..Ebony West100% (1)

- Maple Leaf Cement (PVT) LTD Profit & Loss Account AnalysisDocument10 pagesMaple Leaf Cement (PVT) LTD Profit & Loss Account AnalysisAhsan AzamNo ratings yet

- BPI CSOC - September 30, 2011 and December 31, 2010Document1 pageBPI CSOC - September 30, 2011 and December 31, 2010abby_caballesNo ratings yet

- Bdo FS PDFDocument21 pagesBdo FS PDFJo AntisodaNo ratings yet

- Shareholder's Funds: Blance Sheet As of 31st December, 1999 Birla 3M LimitedDocument27 pagesShareholder's Funds: Blance Sheet As of 31st December, 1999 Birla 3M LimitedSandeep ChowdhuryNo ratings yet

- 2010 Financial Report C I LeasingDocument24 pages2010 Financial Report C I LeasingVikky MehtaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Objetivo N°1: What Kind of Work You Would Conduct in The District?Document5 pagesObjetivo N°1: What Kind of Work You Would Conduct in The District?Angel FernanzedNo ratings yet

- Sterling Bank PLC - 2008 Annual ReportDocument100 pagesSterling Bank PLC - 2008 Annual ReportSterling Bank PLC100% (3)

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Hyundai Motor Company and Its SubsidiariesDocument84 pagesHyundai Motor Company and Its SubsidiariesCris TinaNo ratings yet

- Ravi 786Document23 pagesRavi 786Tatiana HarrisNo ratings yet

- NG Dangfl 2010 Ar 00Document40 pagesNG Dangfl 2010 Ar 00Oyeleye TofunmiNo ratings yet

- Nexia SABTBusinessin SAGuideDocument68 pagesNexia SABTBusinessin SAGuidesacey20.hbNo ratings yet

- Xingang WangDocument1 pageXingang Wangmuskan.j.talrejaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document2 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PT Agung Podomoro Land TBK.: Summary of Financial StatementDocument2 pagesPT Agung Podomoro Land TBK.: Summary of Financial StatementTriSetyoBudionoNo ratings yet

- Financial Management of Dutch Bangla Bank LimitedDocument44 pagesFinancial Management of Dutch Bangla Bank LimitedRajesh PaulNo ratings yet

- Dev EreDocument1 pageDev Ereumuttk5374No ratings yet

- Dangote Flour Mills Financials 2012Document1 pageDangote Flour Mills Financials 2012Simileoluwa Cullen AdebajoNo ratings yet

- PTSP - Icmd 2009 (B01)Document4 pagesPTSP - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Source: Annual Accounts of BanksDocument6 pagesSource: Annual Accounts of BanksARVIND YADAVNo ratings yet

- 2021 Actual Accounts.Document18 pages2021 Actual Accounts.Elijah Amanoghene OSIANORNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- NBK Annual Report Highlights Strong PerformanceDocument157 pagesNBK Annual Report Highlights Strong PerformancesumitNo ratings yet

- 03-LBP2015 Executive Summary PDFDocument7 pages03-LBP2015 Executive Summary PDFFrens PanlarocheNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Prestige 6Document1 pagePrestige 6Kay OdeNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Statements of Khulna Power Company Limited for 2009-2013Document19 pagesFinancial Statements of Khulna Power Company Limited for 2009-2013MD Rakibul Hassan RiponNo ratings yet

- SEI TermsheetDocument4 pagesSEI Termsheetmelvin.lim013No ratings yet

- 2012 Annual ReportDocument94 pages2012 Annual ReportMuzammil RehmanNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- DCN 180620142147 5460177Document3 pagesDCN 180620142147 5460177Sarath S SundarNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Identification & Summary: D&B ReportDocument8 pagesIdentification & Summary: D&B ReportChandra ShekarNo ratings yet

- 10-Casiguran Aurora 2010 Part1-Notes To FSDocument9 pages10-Casiguran Aurora 2010 Part1-Notes To FSKasiguruhan AuroraNo ratings yet

- 981 1370516495Document262 pages981 1370516495Rajendran KajananthanNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- Const. ContractsDocument9 pagesConst. ContractsKenneth Bryan Tegerero TegioNo ratings yet

- SAP Interest Calculation Configuration PDFDocument8 pagesSAP Interest Calculation Configuration PDFRajeev MenonNo ratings yet

- Word Report of Bank Al HabibDocument22 pagesWord Report of Bank Al HabibAdeel SajjadNo ratings yet

- R.A. No. 9267 - The Securitization Act of 2004Document11 pagesR.A. No. 9267 - The Securitization Act of 2004Jansennia MarieNo ratings yet

- Special ContractDocument17 pagesSpecial ContractAbhinavNo ratings yet

- July 25, 2022Document77 pagesJuly 25, 2022Debasish DashNo ratings yet

- Time ValueDocument28 pagesTime ValueANKIT GUPTANo ratings yet

- Bajaj Allianz CashRich Insurance Plan - Ver2Document24 pagesBajaj Allianz CashRich Insurance Plan - Ver2hdfcblgoaNo ratings yet

- CPF in Singapore - A Cap Market Boost or DragDocument26 pagesCPF in Singapore - A Cap Market Boost or DragNing LuoNo ratings yet

- Horley Methodist 2013 M3 (A)Document6 pagesHorley Methodist 2013 M3 (A)STPMmaths100% (1)

- A Study On Customer Satisfaction of Insurance CompaniesDocument6 pagesA Study On Customer Satisfaction of Insurance CompaniesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 3) Tupaz IV vs. Court of AppealsDocument17 pages3) Tupaz IV vs. Court of AppealsresjudicataNo ratings yet

- Understanding Cash Flow Statement - QuestionDocument4 pagesUnderstanding Cash Flow Statement - Questionprianto tanNo ratings yet

- Chapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Document5 pagesChapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Kiana FernandezNo ratings yet

- Trans-Pacific Industrial v. CADocument1 pageTrans-Pacific Industrial v. CAKimNo ratings yet

- Chapter 2 Lesson 1Document12 pagesChapter 2 Lesson 1April BumanglagNo ratings yet

- UCPB Interest Rates Ruled Illegal in Beluso CaseDocument3 pagesUCPB Interest Rates Ruled Illegal in Beluso CaseKaren Ryl Lozada BritoNo ratings yet

- DD Rules V 4 19 Rulebook Nov 2011 FinalDocument68 pagesDD Rules V 4 19 Rulebook Nov 2011 Finalimesimaging100% (1)

- Appendix I Performance Bank GuaranteeDocument2 pagesAppendix I Performance Bank GuaranteenasirphedNo ratings yet

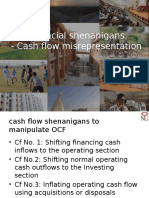

- Financial Shenanigans CashflowsDocument19 pagesFinancial Shenanigans CashflowsAdarsh ChhajedNo ratings yet

- David Astle The Beginning and The EndDocument22 pagesDavid Astle The Beginning and The EndIgnacio De Torres100% (1)

- Mendiola Vs CA DigestDocument2 pagesMendiola Vs CA DigestAbby ParwaniNo ratings yet

- Credit Transactions: San Beda College of LawDocument27 pagesCredit Transactions: San Beda College of LawJumen Gamaru TamayoNo ratings yet

- 2019 BUSINESS LAW EXAMINABLE SUPPLEMENTDocument21 pages2019 BUSINESS LAW EXAMINABLE SUPPLEMENTQwerty19oNo ratings yet

- Hong Kong International AirportDocument15 pagesHong Kong International AirportHimanshu SainiNo ratings yet

- What Is MoneyDocument9 pagesWhat Is Moneymariya0% (1)

- Dairy Farm (25 Animal)Document38 pagesDairy Farm (25 Animal)Ali HasnainNo ratings yet

- Volvo Working Capital ManagementDocument108 pagesVolvo Working Capital ManagementRaj MurthyNo ratings yet

- Commercial BankingDocument74 pagesCommercial BankingShishir N VNo ratings yet