Professional Documents

Culture Documents

Accountancy Eng

Uploaded by

Prasad C MOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy Eng

Uploaded by

Prasad C MCopyright:

Available Formats

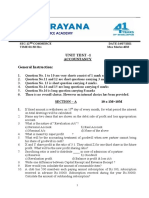

Total No.

of Questions : 24

Code No. March, 2010

30

ACCOUNTANCY

Time : 3 Hours 15 Minutes ( English Version ) SECTION A Answer any eight questions, each carrying two marks. 1. 2. 3. 4. 5. 6. What is the object of preparing the statement of affairs ? What is fluctuating capital system ? What is revaluation account ? Give the journal entry for sale of assets on dissolution of partnership firm. What is oversubscription of shares ? Under what heading do the following items appear in the Companys Balance Sheet ? a) b) 7. 8. 9. Loose tools Unclaimed dividend. 8 2 = 16 Max. Marks : 100

What is original cost method of depreciation ? What are Legacies ? What is computerised accounting ?

10. Mention two types of accounting packages. SECTION B Answer any three questions, each carrying six marks. 3 6 = 18

11. Suresh, a partner in a firm has withdrawn the following amounts during the year ended 31. 12. 2008 for his personal use. Rs. 9,000 on 01. 04. 2008 Rs. 6,000 on 30. 06. 2008 Rs. 5,000 on 01. 09. 2008 Rs. 7,000 on 30. 11. 2008 Calculate the interest on drawings at 8% per annum under product method.

12. Anil, Bharath and Chandra are partners sharing profits and losses in the ratio of 5 : 4 : 3. Anil retires. Bharath gets

1 1 th and Chandra gets th of 4 6

Anils share. Calculate the new profit and loss sharing ratio of Bharath and Chandra.

13. Pavan, Rakesh and Sohan are partners sharing profits and losses in the ratio of 3 : 2 : 1. Their capital balances on 01 . 01. 2008 stood at Rs. 45,000, Rs. 30,000 and Rs. 20,000 respectively. Rakesh died on 30. 09. 2008. Partnership deed provides the following : a) b) c) d) Interest on capital at 10% per annum. Salary to Rakesh Rs. 800 per month. His share of goodwill. His share of profit upto the date of death on the basis of previous years profit. i) ii) Goodwill of the firm Rs. 27,000 Profits for the year 2007 Rs. 15,000

Prepare Rakeshs Capital Account. 14. Varun Company Limited forfeited 500 shares of Rs. 100 each for nonpayment of the final call money Rs. 25 per share. Later these shares were reissued at Rs. 90 per share. Give necessary Journal Entries. 15. Mention any six advantages of computerised accounting.

SECTION C Answer any four from the following questions, each carrying fourteen marks : 4 14 = 56

16. Arun kept his books of account under single entry system. He gave the following information : Particulars Cash Cash at Bank Stock Debtors Creditors Bills payable Investments Furniture Buildings 01. 01. 2008 Rs. 8,500 14,000 25,000 16,000 10,400 3,100 15,000 60,000 31. 12. 2008 Rs. 9,600 16,400 31,000 20,000 7,500 6,500 15,000 60,000

During the year, he withdrew Rs. 9,000 for personal use. On 01. 05. 2008, he has introduced Rs. 15,000 as additional capital. Adjustments : a) b) c) d) e) f) Depreciate furniture by 20% Appreciate buildings by 15% Allow interest on capital at 6% per annum Create reserve for doubtful debts at 5% on debtors Outstanding salary Rs. 4,500 Rent receivable Rs 1,100

Prepare : i) ii) iii) Statement of affairs Statement of profit or loss Revised statement of affairs.

17. Ratan and Suraj are partners sharing profits and losses in the ratio of 3 : 2. Their Balance sheet as on 31. 12. 2008 was as follows : Balance Sheet as on 31. 12. 2008 Liabilities Creditors Bills Payable General Reserve Capitals : Ratan Suraj Rs. 60,000 Rs. 30,000 90,000 Rs. 13,500 7,500 15,000 Cash Stock Debtors Bills Receivable Furniture Machinery Buildings Profit and Loss A/c. 1,26,000 They admit Vinod to partnership for the following terms : a) b) c) Assets Rs. 6,500 21,000 18,000 5,500 10,000 24,000 40,000 1,000 1,26,000

1 th share on 01. 01. 2009 based on 6

! He should bring in Rs. 20,000 as capital

Buildings to be revalued at Rs. 50,000 Furniture and Machinery to be depreciated at 10% and 5% respectively

d) e)

Reserve for doubtful debts to be provided at 10% on Debtors Goodwill account to be raised and maintained to the extent of Rs. 25,000.

Prepare : i) ii) iii) Revaluation Account Capital Accounts of Partners Balance Sheet as on 01. 01. 2009.

18. Mohan, Nagaraju and Prakash are partners sharing profits and losses in the ratio of 4 : 3 : 2 . Their Balance sheet as on 31. 12. 2008 was as follows : Balance Sheet as on 31. 12. 2008 Liabilities Creditors Bills Payable Prakashs Loan A/c. Reserve Fund Capitals : Mohan Nagaraju Prakash Rs. 30,000 Rs. 20,000 Rs. 10,000 60,000 1,30,000 1,30,000 Rs. 25,000 17,000 10,000 18,000 Cash Debtors Stock Investments Furniture Goodwill Buildings Assets Rs. 9,000 27,000 15,000 5,000 14,000 20,000 40,000

On the above date the firm was dissolved. The assets realised as follows : a) Debtors realised 10% less than the book value and investments realised 20% more than the book value. Buildings realised Rs. 60,000, stock realised Rs. 12,000 and furniture sold for Rs. 15,000. b) c) d) Goodwill taken by Mohan at Rs. 15,000 Creditors and Bills payable settled at discount of 5% Realisation expenses Rs. 2,000.

Prepare : i) ii) iii) Realisation Account Capital Accounts of Partners Cash Account.

19. On 01. 01. 2005 a firm purchased a lease costing Rs. 50,000 for a term of 4 years. It is proposed to depreciate the lease by Annuity method charging 5% interest. With reference to Annuity tables to write off Re. 1 at 5% over a period of 4 years the amount to be charged is 0282012. Show Lease account and Interest account for all four years.

20. Following are the Balance sheet and Receipts and Payments A/c. of Diamond Sports Club, Davanagere. Balance Sheet as on 31. 12. 07 Liabilities Outstanding Salary Pre-received Subscriptions Capital Fund Rs. 3,500 2,000 92,000 Cash Sports Materials Furniture Land and Building 97,500 Receipts and Payments A/c for the year ended 31. 12. 08. Receipts To Balance b/d Subscriptions Entrance Fees Sale of old neswpapers Sports Fees Rs. 10,500 42,000 5,000 1,500 7,200 Payments By Salary Sports Materials ( 01. 07. 2008 ) Investments Postage Electricity Charges Up-keep of Grounds Balance c/d 66,200 Adjustments : a) b) c) d) Outstanding subscription for 2008 Rs. 1,000 Outstanding salary as on 31. 12. 2008 Rs. 4,500 Half of the Entrance fees to be capitalised Depreciate sports materials at 20% per annum and furniture at 5%. 14,000 10,000 1,200 2,300 4,500 11,200 66,200 Rs. 23,000 Assets Rs. 10,500 25,000 12,000 50,000 97,500

Prepare : i) ii) Income and Expenditure Account Balance Sheet.

21. Following is the Trial Balance of Vishwas Trading Company Ltd. as on 31. 12. 2008 : Trial Balance as on 31. 12. 2008 Particulars Called up Share Capital Calls in Arrear Stock ( 01. 01. 2008 ) Purchases and Sales Returns Freight Wages Salaries Directors Fees Postage Printing Charges General Expenses Interest on Investments Interim Dividend Investments Goodwill Buildings Machinery Furniture Bills receivable and Bills payable Debtors and Creditors Debentures Reserve Fund Profit and Loss Appropriation A/c. Cash at Bank Debit Rs. 3,000 14,000 55,000 5,000 3,400 11,600 13,000 3,200 1,300 2,500 4,500 5,000 15,000 40,000 85,000 30,000 16,000 12,000 24,000 17,000 3,60,500 Credit Rs. 1,00,000 1,40,000 3,000 3,300 17,000 15,200 50,000 20,000 12,000 3,60,500

Adjustments : a) Closing stock valued at Rs. 15,000 b) Outstanding salary Rs. 2,000 c) Depreciate machinery at 10% and Furniture at 5% d) Make a provision for tax Rs. 12,000 e) Transfer Rs. 15,000 to Reserve fund f) Proposed dividend Rs. 7,500. Prepare Final Accounts.

SECTION D ( Practical Oriented Questions ) Answer any two of the following questions. Each question carries five marks : 2 5 = 10

22. Prepare an Executors Loan Account showing the repayment in two annual equal instalments along with interest with imaginary figures. 23. Prepare a Machinery Account for two years with imaginary figures under diminishing method of depreciation. 24. Classify the following items into Capital and Revenue : a) b) c) d) e) Sale of furniture Annual whitewashing and painting expenses to buildings Sale of old newspapers Donations for construction of buildings Annual maintenance grant received from government.

You might also like

- Accountancy March 2008 EngDocument8 pagesAccountancy March 2008 EngPrasad C M100% (2)

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- 3hr Paper 4feb 2010Document3 pages3hr Paper 4feb 2010Bhawna BhardwajNo ratings yet

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Document5 pagesCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNo ratings yet

- MKGM Accounts Question Papers ModelDocument101 pagesMKGM Accounts Question Papers ModelSantvana ChaturvediNo ratings yet

- Financial Accounting Scanner Section IIDocument17 pagesFinancial Accounting Scanner Section IImknatoo1963No ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77No ratings yet

- Accounting concepts and principles in financial statementsDocument6 pagesAccounting concepts and principles in financial statementskartikbhaiNo ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- c2 Partnership ProblemsDocument6 pagesc2 Partnership ProblemsSiva SankariNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- APEEJAY SCHOOL SAKET CLASS XII ACCOUNTANCY EXAMDocument12 pagesAPEEJAY SCHOOL SAKET CLASS XII ACCOUNTANCY EXAMTanya JainNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavNo ratings yet

- 18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec BDocument5 pages18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec Bakki3004No ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- The Figures in The Margin On The Right Side Indicate Full MarksDocument16 pagesThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Sample Paper Accountancy Class XIIDocument6 pagesSample Paper Accountancy Class XIIAcHu TanNo ratings yet

- ACCOUNTANCY EXAM PAPERDocument58 pagesACCOUNTANCY EXAM PAPER9chand3No ratings yet

- Advance Financial Accounting Past Paper 2016 B Com Part 2Document5 pagesAdvance Financial Accounting Past Paper 2016 B Com Part 2dilbaz karimNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocument3 pagesGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916No ratings yet

- II Pu Acc 23 Dis Pre QprsDocument92 pagesII Pu Acc 23 Dis Pre QprskrupithkNo ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- 29Document3 pages29sharathk916No ratings yet

- Where Success Follows Brilliance: Accounting and Bookkeeping QuestionsDocument6 pagesWhere Success Follows Brilliance: Accounting and Bookkeeping QuestionsAtul Kumar100% (1)

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- C.A. Final Financial Reporting Consolidated BSDocument7 pagesC.A. Final Financial Reporting Consolidated BSDivyesh TrivediNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document50 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Pre-Board Examination AccountancyDocument13 pagesPre-Board Examination AccountancyKunal KapoorNo ratings yet

- Sy Bcom Oct2011Document83 pagesSy Bcom Oct2011Anonymous l0j1IwcPDNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Model Question Set 1Document2 pagesModel Question Set 1Destiny Tuition CentreNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet