Professional Documents

Culture Documents

Form No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)

Uploaded by

jay_yashwanteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)

Uploaded by

jay_yashwanteCopyright:

Available Formats

Date:24-07-2011

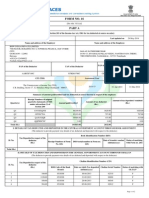

Form No. 26AS

(See Section 203AA and second proviso to Section 206C(5) and Rule 31AB)

Assessment Year:

2011-12

Annual Tax Statement under section 203AA

Permanent Account Number: AQVPB7517Q Name of Assessee : BAIDYA CHANCHAL Financial Year: 2010-11 Assessment Year: 2011-12

* If there are any changes in your name and/or address as mentioned above, submit Request for new PAN card or/and changes or correction in PAN data with any TIN-FC or online (www.tin-nsdl.com).

PART A PART C

- Details of Tax Deducted at Source - Details of Tax Paid (Other than TDS or TCS)

PART B REFUND

- Details of Tax Collected at Source - Details of Paid Refund

PART A - Details of Tax Deducted At Source

Sr.No. Name of the Deductor TAN of the Deductor Section Under which deduction made** (504) 192 192 192 192 192 192 192 192 192 Date of Payment/ Credit Amount Paid/ Credited Tax deducted (TDS+ Surcharge + Education Cess) (507) 1063.00 1087.00 1087.00 1087.00 1195.00 1195.00 1384.00 1459.00 4748.00 TDS deposited Status of Booking (P/F/U)@ (508) 1063.00 1087.00 1087.00 1087.00 1195.00 1195.00 1384.00 1459.00 4748.00 F F F F F F F F F

(All Amounts in INR)

Date of Booking

Remarks (in case of reversals)*

(501)

(502)

(503) MUMS63193E MUMS63193E MUMS63193E MUMS63193E MUMS63193E MUMS63193E MUMS63193E MUMS63193E MUMS63193E

(505) 31-07-2010 31-08-2010 30-09-2010 31-10-2010 30-11-2010 31-12-2010 31-01-2011 28-02-2011 31-03-2011

(506) 27947.40 28180.20 28180.20 28180.20 29227.80 29227.80 30076.80 30804.30 47013.00

STATE BANK OF INDIA 1 MUMBAI 2 3 4 5 6 7 8 STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI STATE BANK OF INDIA MUMBAI

10-11-2010 10-11-2010 10-11-2010 25-01-2011 25-01-2011 25-01-2011 23-06-2011 23-06-2011 23-06-2011

9 STATE BANK OF INDIA

Sr.No.

Name of the Deductor

TAN of the Deductor

(501) MUMBAI SubTotal Total

(502)

(503)

Section Under which deduction made** (504)

Date of Payment/ Credit

Amount Paid/ Credited

Tax deducted (TDS+ Surcharge + Education Cess) (507)

TDS deposited Status of Booking (P/F/U)@ (508) 14305.00 14305.00

Date of Booking

Remarks (in case of reversals)*

(505)

(506)

Back to Top

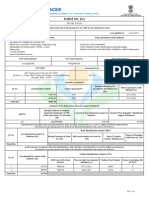

PART B - Details of Tax Collected At Source

Sr.No. Name of the Collector TAN of the Collector Section Under which collection made** (512) Date on which amount paid/debited (513) Amount paid/ debited Amount of Tax collected (TCS+ Surcharge + Education Cess) (515) TCS deposited Status of Booking (P/F/U)@ (516)

(All Amounts in INR)

Date of Booking

Remarks (in case of reversals)*

(509)

(510)

(511)

(514)

* * * No Transactions Present * * *

Back to Top

PART C - Details of Tax Paid (Other than TDS or TCS)

Date on Which Tax Deposited (527)

(All Amounts in INR)

Remarks (in case of reversals)*

Major Sr.No. Head Code# (517) (518)

Minor Head Code% (519)

Tax (520)

Surcharge (521)

Education Cess (522)

Interest (523)

Others (524)

Total Tax (525)

BSR Code (526)

Challan Serial No. (528)

* * * No Transactions Present * * *

Back to Top

Details of Paid Refund

(All Amounts in INR)

Sr.No.

Assessment year for which Refund is Paid

Mode of Payment

Amount of Refund

Date of Payment

Remark

* * * No Transactions Present * * *

to download Form 26AS.

To extract the zip file, please enter the date of birth in case of individual tax payers and the date of incorporation for non-individual tax payers as password in the format of DDMMYYYY (Date of Birth/ Date of Incorporation should be same as printed on PAN card). For example, if your date of birth / incorporation is November 23, 1985 then the password will be 23111985. For extraction of files use WinZip version 9.0 and above, WinRaR version 3.90 and above and 7-Zip version 4.65 and above.

Back to Top

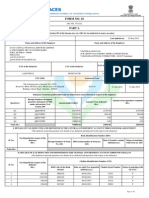

The data is updated till 22-07-2011

NOTE:

1. The figures in the brackets represent reversal (negative) entries.

2. In 'Part C' Details of Tax Paid (Other than TDS or TCS) payments related to Securities Transaction Tax and Banking Cash Transaction Tax are not displayed.

3. Tax Credits appearing in the Annual Tax Statement are on the basis of the details given by the deductor in the TDS/TCS statement filed by him. The same should be verified before claiming tax credit and only the amount which pertains to you should be claimed.

4. Date in DD-MM-YYYY format.

Legends

@ Status of Booking (P/F/U)

Provisional (P) Unmatched (U) Final (F) Only for TDS/TCS affected by Government deductors. Provisional tax credit is effected on the basis of TDS/TCS statements filed only. On verification of the payment details by the Pay & Accounts Officer (PAO), status will change to Final (F). Deductors have not deposited the taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when the payment details in the bank match with the details of deposit in the TDS/TCS statement. In case of non-Government deductors, payment details of TDS/TCS deposited in bank by the deductor have matched with the payment details mentioned in the TDS/TCS statement filed by the deductor. In case of Government deductors, details of TDS/TCS booked in Government account have been verified by the Pay & Accounts Officer (PAO).

You might also like

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- Form 26ASDocument1 pageForm 26ASMadhav SomaniNo ratings yet

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111No ratings yet

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111No ratings yet

- Babu Form 16Document4 pagesBabu Form 16sundar1111No ratings yet

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111No ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form 16 ADocument23 pagesForm 16 Amlkhantwal8404No ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111No ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Itr 62 Form 26 ASDocument3 pagesItr 62 Form 26 ASNiteshwar ShuklaNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- FIN GL BBP 005 Extended Withholding TaxDocument12 pagesFIN GL BBP 005 Extended Withholding TaxSurani shaiNo ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111No ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Form 16A-Corporation BankDocument2 pagesForm 16A-Corporation BankSoumali PalNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- Doc. Required - Pre Audit List - 2020-21Document6 pagesDoc. Required - Pre Audit List - 2020-21Meenaxi SoniNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- Role of PAODocument29 pagesRole of PAOAjay DhokeNo ratings yet

- GST Payments - GST Refund Online & OfflineDocument6 pagesGST Payments - GST Refund Online & Offlineajayprajapti828No ratings yet

- Mrs Kudithipudi Hima Bindu 25-1-1340, NETHAJI NAGAR,, 8TH STREET, Podalakur Road,, Andhrakesari Nagar, Nellore, Andhra Pradesh - 524004 9703512254Document2 pagesMrs Kudithipudi Hima Bindu 25-1-1340, NETHAJI NAGAR,, 8TH STREET, Podalakur Road,, Andhrakesari Nagar, Nellore, Andhra Pradesh - 524004 9703512254Raveendra Babu CherukuriNo ratings yet

- ViewDocument2 pagesViewVenkat JvsraoNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Leave Salary Calculator of W.b.govt EmployeesDocument13 pagesLeave Salary Calculator of W.b.govt EmployeesRavi BhairiNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- Document Checklist - Sole-ProprietorDocument4 pagesDocument Checklist - Sole-ProprietorKarthik DeshapremiNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- New Microsoft Office Word Document-2Document1 pageNew Microsoft Office Word Document-2seelam manoj sai kumarNo ratings yet

- Candidate Hall TicketDocument1 pageCandidate Hall Ticketaman pareekNo ratings yet

- Assessing Officer (AO Code) AO No. Area Code AO Type Range CodeDocument2 pagesAssessing Officer (AO Code) AO No. Area Code AO Type Range Codemeghana polNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- 12495/pratap Express Third Ac (3A)Document2 pages12495/pratap Express Third Ac (3A)miteshsinghal21No ratings yet

- Account Opening Form For Resident Indivi PDFDocument4 pagesAccount Opening Form For Resident Indivi PDFShamit BakshiNo ratings yet

- Transfer Application FormDocument1 pageTransfer Application FormChaitanya Chaitu CANo ratings yet

- Disclamer Iijs 2019 Visitor Online Portal UpdatedDocument2 pagesDisclamer Iijs 2019 Visitor Online Portal UpdatedPatitapaban DasNo ratings yet

- 881053278006296Document2 pages881053278006296Sameer MittalNo ratings yet

- FAQsDocument3 pagesFAQsRavi PonduriNo ratings yet

- MR - Asireddy Sandeep ReddyDocument8 pagesMR - Asireddy Sandeep ReddySrinivasaCharyNo ratings yet

- Document Checklist - Loan and Advances - Education Loan - Individual - Federal BankDocument1 pageDocument Checklist - Loan and Advances - Education Loan - Individual - Federal BankDarsh DoshiNo ratings yet

- CandidateHallTicket PDFDocument2 pagesCandidateHallTicket PDFRavi ManiNo ratings yet

- IRDA Claim FormDocument4 pagesIRDA Claim FormSatya SundarNo ratings yet

- Documents Checklist - Vidya Sagar ReddyDocument1 pageDocuments Checklist - Vidya Sagar Reddy18CVE1004 D. Suvamshi kumarNo ratings yet

- FormDocument5 pagesFormKavita SinghNo ratings yet

- Afcat PDFDocument2 pagesAfcat PDFSarode RamNo ratings yet

- TRACES Annual Tax StatementDocument1 pageTRACES Annual Tax StatementRaviteja SiramsettiNo ratings yet

- ReactivationForm DormantClient IGSLDocument2 pagesReactivationForm DormantClient IGSLxavierjosephNo ratings yet

- TCS Hall TicketDocument1 pageTCS Hall TicketPreethi0% (1)

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- Bharat Sanchar Nigam Limited (A Government of India Enterprise) (Cutomer Agreement Form For New Landline Telephone Connection)Document2 pagesBharat Sanchar Nigam Limited (A Government of India Enterprise) (Cutomer Agreement Form For New Landline Telephone Connection)praveen kumar SaggurthiNo ratings yet

- TendernoticeDocument11 pagesTendernoticeBiplab RoyNo ratings yet

- Mohit Sbi 5000, Admit CardDocument5 pagesMohit Sbi 5000, Admit CardFood ingredientNo ratings yet

- Tender Document: DR - Ysr Horticultural UniversityDocument29 pagesTender Document: DR - Ysr Horticultural UniversityMoran RajNo ratings yet

- List of Documents For TrustDocument4 pagesList of Documents For TrustSunil SoniNo ratings yet

- A078633865Document2 pagesA078633865Kiska Bhai kisi ki bhanchodNo ratings yet

- Start Up Start Company: Start Business in IndiaDocument13 pagesStart Up Start Company: Start Business in IndiaNishok NagamaniNo ratings yet

- Hotel Booking ConfirmationDocument3 pagesHotel Booking ConfirmationGNANAPRAKASH K0% (1)

- PACL Lodha Commette Final NOTICE of SALE With Property DetailsDocument4 pagesPACL Lodha Commette Final NOTICE of SALE With Property DetailsVivek Agrawal100% (2)