Professional Documents

Culture Documents

Rodell Accounts 20032004

Uploaded by

unlockdemocracyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rodell Accounts 20032004

Uploaded by

unlockdemocracyCopyright:

Available Formats

Registered number: 383326

RODELL PROPERTIES LIMITED

DIRECTORS' REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2004

RODELL PROPERTIES LIMITED

COMPANY INFORMATION

DIRECTORS Rosemary Bechlar Stuart Hill Nina Temple (resigned 28th May 2004) Paul Robert Norman Simpson (appointed 28th May 2004)

SECRETARY

Peter Facey

COMPANY NUMBER

383326

REGISTERED OFFICE

6 Cynthia Street London N1 9JF

ACCOUNTANTS

Gotham Erskine Chartered Accountants Friendly House 52-58 Tabernacle Street London EC2A 4NJ

BANKERS

Co-operative Bank PLC 1, Islington High Street London N1 9TR

RODELL PROPERTIES LIMITED

CONTENTS

Page

Directors' report Accountants' report Profit and loss account Balance sheet Notes to the financial statements The following pages do not form part of the statutory accounts: Detailed profit and loss account and summaries

1 2 3 4 5-8

9 - 10

RODELL PROPERTIES LIMITED

DIRECTORS' REPORT For the year ended 31 March 2004

The directors present their report and the financial statements for the year ended 31 March 2004. STATEMENT OF DIRECTORS' RESPONSIBILITIES Company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the company and of the profit or loss of the company for that period. In preparing those financial statements, the directors are required to: select suitable accounting policies and then apply them consistently; make judgements and estimates that are reasonable and prudent; prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the company and to enable them to ensure that the financial statements comply with the Companies Act 1985. They are also responsible for safeguarding the assets of the company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities. PRINCIPAL ACTIVITIES The principal activities of the Company are that of property ownership, management and equipment leasing. DIRECTORS The directors who served during the year and their beneficial interests in the company's issued share capital were: Ordinary Shares shares of 1 each 31/3/04 1/4/03 Rosemary Bechlar Stuart Hill Nina Temple (resigned 28th May 2004) Paul Robert Norman Simpson (appointed 28th May 2004) 10 10 -

The report of the directors has been prepared in accordance with the special provisions of Part VII of the Companies Act 1985 relating to small companies. This report was approved by the board on 27 November 2004 and signed on its behalf.

Peter Facey Secretary

Page 1

RODELL PROPERTIES LIMITED

ACCOUNTANTS' REPORT TO THE DIRECTORS ON THE UNAUDITED FINANCIAL STATEMENTS OF RODELL PROPERTIES LIMITED

In accordance with the engagement letter dated 27th January 2003, and in order to assist you to fulfil your duties under the Companies Act 1985, we have compiled the financial statements of the Company which comprise the Profit and Loss Account, the Balance Sheet and the related notes from the accounting records and information and explanations you have given to us. This report is made to the Company's Board of Directors, as a body, in accordance with the terms of our engagement. Our work has been undertaken so that we might compile the financial statements that we have been engaged to compile, report to the Company's Board of Directors that we have done so, and state those matters that we have agreed to state to them in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's Board of Directors, as a body, for our work or for this report. We have carried out this engagement in accordance with technical guidance issued by the Institute of Chartered Accountants in England and Wales and have complied with the ethical guidance laid down by the Institute relating to members undertaking the compilation of financial statements. You have acknowledged on the balance sheet for the year ended 31 March 2004 your duty to ensure that the company has kept proper accounting records and to prepare financial statements that give a true and fair view under the Companies Act 1985. You consider that the company is exempt from the statutory requirement for an audit for the year. We have not been instructed to carry out an audit of the financial statements. For this reason, we have not verified the accuracy or completeness of the accounting records or information and explanations you have given to us and we do not, therefore, express any opinion on the financial statements.

Gotham Erskine Chartered Accountants Friendly House 52-58 Tabernacle Street London EC2A 4NJ

Page 2

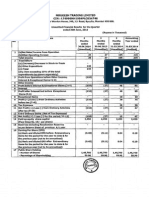

RODELL PROPERTIES LIMITED

PROFIT AND LOSS ACCOUNT For the year ended 31 March 2004

Note TURNOVER Administrative expenses OPERATING PROFIT Interest payable PROFIT ON ORDINARY ACTIVITIES BEFORE TAXATION TAX ON PROFIT ON ORDINARY ACTIVITIES PROFIT ON ORDINARY ACTIVITIES AFTER TAXATION DIVIDENDS RETAINED PROFIT FOR THE FINANCIAL YEAR 11 3 2 1,

2004 200,096 (77,133) 122,963 (7,639) 115,324 (23,365) 91,959 (73,896) 18,063

2003 208,393 (78,215) 130,178 (6,105) 124,073 (26,086) 97,987 (50,000) 47,987

The notes on pages 5 to 8 form part of these financial statements.

Page 3

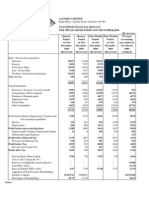

RODELL PROPERTIES LIMITED

BALANCE SHEET As at 31 March 2004

31 March 2004 Note FIXED ASSETS Tangible fixed assets Investments 4 5 1,801,725 356,847 2,158,572 CURRENT ASSETS Debtors Cash at bank and in hand 6 50,674 248,346 299,020 CREDITORS: amounts falling due within one year NET CURRENT ASSETS TOTAL ASSETS LESS CURRENT LIABILITIES CAPITAL AND RESERVES Called up share capital Revaluation reserve Other reserves Profit and loss account SHAREHOLDERS' FUNDS 11 11 8 60 633,518 1,961,638 (269,207) 2,326,009

31 March 2003 1,810,409 405,800 2,216,209

49,652 220,339 269,991

(131,583) 167,437 2,326,009

(179,300) 90,691 2,306,900

60 633,518 1,960,592 (287,270) 2,306,900

The directors consider that the company is entitled to exemption from the requirement to have an audit under the provisions of section 249A(1) of the Companies Act 1985 and members have not required the company to obtain an audit of its accounts for the year in question in accordance with section 249B(2) of the Act. The directors acknowledge their responsibilities for ensuring that the company keeps accounting records which comply with section 221 of the Companies Act 1985, and for preparing financial statements which give a true and fair view of the state of affairs of the company as at 31 March 2004 and of its profit for the year then ended in accordance with the requirements of section 226, and which otherwise comply with the requirements of the Act relating to the financial statements so far as applicable to the company. The financial statements have been prepared in accordance with the special provisions of Part VII of the Companies Act 1985 relating to small companies and in accordance with the Financial Reporting Standard for Smaller Entities (effective June 2002). The financial statements were approved by the board on 27 November 2004 and signed on its behalf. Stuart Hill Director The notes on pages 5 to 8 form part of these financial statements.

Page 4

RODELL PROPERTIES LIMITED

NOTES TO THE FINANCIAL STATEMENTS For the year ended 31 March 2004

1.

ACCOUNTING POLICIES 1.1 Basis of preparation of financial statements

The financial statements have been prepared under the historical cost convention as modified by the revaluation of and in accordance with the Financial Reporting Standard for Smaller Entities (effective June 2002). 1.2 Cash flow The financial statements do not include a cash flow statement because the company, as a small reporting entity, is exempt from the requirement to prepare such a statement under the Financial Reporting Standard for Smaller Entities (effective June 2002). 1.3 Turnover Turnover comprises rents receivable and investment income. 1.4 Tangible fixed assets and depreciation Tangible fixed assets are stated at cost less depreciation. Depreciation is provided at rates calculated to write off the cost of fixed assets, less their estimated residual value, over their expected useful lives on the following bases: Buildings improvement Fixtures and fittings 10% of cost 10% of cost

2.

OPERATING PROFIT The operating profit is stated after charging: 31/3/04 31 March 2004 Depreciation of tangible fixed assets Pension costs During the year, no director received any emoluments (2003 - nil). 8,684 1,666 31/3/03 31 March 2003 8,685 1,319

3.

TAXATION 31/3/04 31 March 2004 Analysis of tax charge in year UK corporation tax on profits of the year Under /(Over) provision for previous years Tax on profit on ordinary activities 23,365 23,365 25,031 1,055 26,086 31/3/03 31 March 2003

Page 5

RODELL PROPERTIES LIMITED

NOTES TO THE FINANCIAL STATEMENTS For the year ended 31 March 2004

4.

TANGIBLE FIXED ASSETS Land, Furniture, buildings fittings and and improvement equipment Cost or valuation At 1 April 2003 and 31 March 2004 Depreciation At 1 April 2003 Charge for the year At 31 March 2004 Net book value At 31 March 2004 At 31 March 2003 1,797,871 1,802,974 3,854 1,801,725 7,435 1,810,409 5,668 5,103 10,771 24,469 3,581 28,050 30,137 8,684 38,821 1,808,642 31,904 1,840,546 Total

At cost Surplus on valuation:

Cost or valuation of freehold properties at 31 March 2004 is as follows: At Cost 1,175,124 Surplus on valuation 633,518 1,808,642

A valuation of the freeholds was carried out by Baker Lambie, Chartered Surveyors of Myddleton Square, London EC1 in February, 2001. Their estimation of the value was 1,803,000 on an open market vacant possession basis.

Page 6

RODELL PROPERTIES LIMITED

NOTES TO THE FINANCIAL STATEMENTS For the year ended 31 March 2004

5.

FIXED ASSET INVESTMENTS Listed investments Cost At 1 April 2003 Redemption of treasury stock At 31 March 2004 405,800 (48,953) 356,847 405,800 (48,953) 356,847 Total

Listed investments The market value of the listed investments at 31 March 2004 was 350,014 (2003 - 444,596) . 6. DEBTORS 2004 Due within one year Trade debtors Other debtors Amount due from New Politics Network ACT recoverable 11,795 1,855 32,918 4,106 50,674 6,364 8,715 29,460 5,113 49,652 2003

7.

CREDITORS: Amounts falling due within one year 2004 Loans Payments received on account Trade creditors Corporation tax Social security and other taxes Other creditors 90,664 2,458 22,358 12,023 4,080 131,583 2003 135,664 2,806 1,357 29,514 5,454 4,505 179,300

The loan is unsecured and from New Politics Network. Interest is charged at 2% above base rate, and paid annually. The loan is repayable on demand.

Page 7

RODELL PROPERTIES LIMITED

NOTES TO THE FINANCIAL STATEMENTS For the year ended 31 March 2004

8.

SHARE CAPITAL 2004 Authorised 100 Ordinary Shares shares of 1 each Allotted, called up and fully paid 60 Ordinary Shares shares of 1 each 60 60 100 100 2003

9.

FREEHOLD REVALUATION RESERVE Surplus on revaluation of properties in February 2001 633,518

10.

INVESTMENT AND PROPERTY REALISATION RESERVE Surplus on sale of freehold properties 1981 to 1990 Net surplus on sale of securities 1983 to 2001 Deficit on maturity of securities 2001-02 Deficit on maturity of securities 2002-03 Surplus on maturity of securities 2003-04 At 31 March 2004 1,871,097 113,038 (2,838) (20,705) 1,047 1,961,638

11.

RESERVES Profit and loss account At 1 April 2003 Profit retained for the year At 31 March 2004 (287,270) 18,063 (269,207)

12.

PENSION COMMITMENTS There were annual commitments amounting to 1,666 (2003: 1,319) under defined pension contribution schemes. The arrears at the year end were 278 (2003: Nil).

13.

RELATED PARTY TRANSACTIONS - NEW POLITICS NETWORK New Politics Network, an unincorporated association, has beneficial ownership of 100% of the share capital. The company recharged employment and office costs totalling 40,555 (2003: 38,831) and paid 7,639 (2003: 6,015) as interest on a loan (note 7). At the year end, New Politics Network owed the company 32,917 (2003: 29,326) and was owed 90,664 (2003: 135,664) for the loan.

Page 8

RODELL PROPERTIES LIMITED

DETAILED TRADING AND PROFIT AND LOSS ACCOUNT For the year ended 31 March 2004 31/3/03 31 March 2003 208,393

Page TURNOVER Less: OVERHEADS Overheads and rental outgoings 10 10

31 March 2004 200,096

(77,133)

(78,215)

OPERATING PROFIT Interest payable

122,963 (7,639)

130,178 (6,105)

PROFIT FOR THE YEAR

115,324

124,073

For management information only.

Page 9

RODELL PROPERTIES LIMITED

SCHEDULE TO THE DETAILED ACCOUNTS For the year ended 31 March 2004

31 March 2004 TURNOVER Rental and recharge income Investment income - government stock Bank interest Other interest received 171,685 25,020 3,391 200,096

31/3/03 31 March 2003 171,891 33,343 3,150 9 208,393

31 March 2004 RENTAL OUTGOINGS Staff salaries Staff national insurance Staff pensions Printing and stationery Legal and professional Cleaning Leased telecom line Repairs and maintenance Depreciation - freehold properties Sub total 47,457 4,892 1,666 1,266 695 2,599 1,820 182 5,104 65,681

31/3/03 31 March 2003 43,973 4,099 1,319 164 1,160 1,272 406 4,330 5,104 61,827

ADMINISTRATIVE EXPENSES Accountancy Bank charges Penalties and surcharges Rates Water Light and heat Security and services Insurances Sundry Depreciation - equipment Sub total

2,000 553 375 2,797 85 40 1,436 85 500 3,581 11,452

2,400 416 1,396 2,899 81 133 3,290 1,805 387 3,581 16,388

Total

77,133

78,215

For management information only.

Page 10

You might also like

- Rodell Accounts Year Ending 31/03/07Document13 pagesRodell Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Rodell Accounts Year Ending 31/03/09Document14 pagesRodell Accounts Year Ending 31/03/09unlockdemocracyNo ratings yet

- New Politics Network LTD Accounts Year Ending 31/03/09Document8 pagesNew Politics Network LTD Accounts Year Ending 31/03/09unlockdemocracyNo ratings yet

- Unlock Democracy: Formerly Charter 88 (Company Limited by Guarantee No. 2440899)Document12 pagesUnlock Democracy: Formerly Charter 88 (Company Limited by Guarantee No. 2440899)unlockdemocracyNo ratings yet

- Charter 88 Accounts 2006-2007Document11 pagesCharter 88 Accounts 2006-2007unlockdemocracyNo ratings yet

- Chieftain Construction Holdings Sep 08Document31 pagesChieftain Construction Holdings Sep 08grumpyfeckerNo ratings yet

- CDB UK LTD 2007Document18 pagesCDB UK LTD 2007thestorydotieNo ratings yet

- British AirwaysDocument60 pagesBritish AirwaysLucymauriceNo ratings yet

- Charter 88 Accounts 2007-2008Document11 pagesCharter 88 Accounts 2007-2008unlockdemocracyNo ratings yet

- Chieftain Construction Sep 08Document23 pagesChieftain Construction Sep 08grumpyfeckerNo ratings yet

- AAB CN - Interim Report (2010 - Q1) - FinancialsDocument19 pagesAAB CN - Interim Report (2010 - Q1) - Financialselombardi1No ratings yet

- P1 - Corporate Reporting April 08Document25 pagesP1 - Corporate Reporting April 08IrfanNo ratings yet

- SP Setia Annual Report 2005Document13 pagesSP Setia Annual Report 2005Xavier YeohNo ratings yet

- Vantage Airport Group (UK) Directors' Report & Financial Statements (2011)Document15 pagesVantage Airport Group (UK) Directors' Report & Financial Statements (2011)ChristianErikssonNo ratings yet

- 13 April 2006 Newcastle United PLC Restatement of Financial Information Under Adopted International Financial Reporting StandardsDocument18 pages13 April 2006 Newcastle United PLC Restatement of Financial Information Under Adopted International Financial Reporting StandardsslashforeverNo ratings yet

- Financial Statement EuropeTrust 2005Document15 pagesFinancial Statement EuropeTrust 2005Peter ShettyNo ratings yet

- 2007 2008 Camposol Holding PLC and SubsidiariesDocument57 pages2007 2008 Camposol Holding PLC and SubsidiariesBeatriz YnecitaNo ratings yet

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Toa Key Players in AccounatncyDocument10 pagesToa Key Players in Accounatncyreina100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Directors' Report: Financial Results Year Ended 31.03.2005 Rs. Crore 110.05 26.11 2.08 24.03 2.04 26.07Document29 pagesDirectors' Report: Financial Results Year Ended 31.03.2005 Rs. Crore 110.05 26.11 2.08 24.03 2.04 26.07Neharika JethwaniNo ratings yet

- SKJNDocument32 pagesSKJNManojit GhatakNo ratings yet

- ITR3Q11Document67 pagesITR3Q11Klabin_RINo ratings yet

- IAS Conversion Document Mar12 LcciDocument22 pagesIAS Conversion Document Mar12 LcciStpmTutorialClassNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Limited: Sulabh EngineersDocument37 pagesLimited: Sulabh EngineersDhawan SandeepNo ratings yet

- Stream Q3 2011 FS 31oct11Document19 pagesStream Q3 2011 FS 31oct11doffnerNo ratings yet

- Annual Report To 31 March 2020 SignedDocument16 pagesAnnual Report To 31 March 2020 Signedapi-349531604No ratings yet

- 06-Infra & Property DevelopmentDocument9 pages06-Infra & Property Developmentmadhura_454No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Idea Cellular Services 2009-10Document16 pagesIdea Cellular Services 2009-10sanamohamedNo ratings yet

- Arun Excello Infrastructure Private LimitedDocument15 pagesArun Excello Infrastructure Private LimitedRamanujam RaghavanNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- New Politics Network Accounts Year Ending 31/03/07Document11 pagesNew Politics Network Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Maharashtra Metal Powders Limited: Standalone Balance Sheet For Period 01/04/2010 To 31/03/2011Document65 pagesMaharashtra Metal Powders Limited: Standalone Balance Sheet For Period 01/04/2010 To 31/03/2011ganeshkumar86No ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- New Microsoft Office Word DocumentDocument99 pagesNew Microsoft Office Word DocumentYasir KhanNo ratings yet

- Due Diligence ReportDocument16 pagesDue Diligence ReportHitesh Jain80% (5)

- Dr. Reddy's 2009Document3 pagesDr. Reddy's 2009Narasimhan SrinivasanNo ratings yet

- companiesRegActivities2010 2011Document42 pagescompaniesRegActivities2010 2011BrendaNo ratings yet

- 14 Reliance Retail Finance LimitedDocument28 pages14 Reliance Retail Finance LimitedRoshan FrndNo ratings yet

- CIEL Investment 2012Document65 pagesCIEL Investment 2012Caterina De LucaNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Quarterly Report 1Q11Document76 pagesQuarterly Report 1Q11Multiplan RINo ratings yet

- 3 Pre - PostDocument7 pages3 Pre - PostParul Bhardwaj VaidyaNo ratings yet

- Exide: EIL/SEC/2020Document18 pagesExide: EIL/SEC/2020Aneesh ViswanathanNo ratings yet

- Fac3761 106 2022 240129 234225Document21 pagesFac3761 106 2022 240129 234225lebiyacNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- In Healthcare Since 1907Document2 pagesIn Healthcare Since 1907mavis16No ratings yet

- Balance Sheet AbstractDocument28 pagesBalance Sheet AbstractAbhishek DhruwanshiNo ratings yet

- Consolidated Financial StatementsDocument40 pagesConsolidated Financial StatementsSandeep GunjanNo ratings yet

- Firescru 05.09.03 11.30am Item04Document20 pagesFirescru 05.09.03 11.30am Item04eunice_borjaNo ratings yet

- 1Q12 Financial StatementsDocument47 pages1Q12 Financial StatementsFibriaRINo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Independence Referendum Watch Report 2014Document16 pagesIndependence Referendum Watch Report 2014unlockdemocracyNo ratings yet

- Unlock Democracy Annual Report 2013-14Document19 pagesUnlock Democracy Annual Report 2013-14unlockdemocracyNo ratings yet

- Sex and Power 2014: Who Runs Britain?Document63 pagesSex and Power 2014: Who Runs Britain?unlockdemocracyNo ratings yet

- Real Recall - A Blueprint For Recall in The UKDocument32 pagesReal Recall - A Blueprint For Recall in The UKunlockdemocracyNo ratings yet

- Real Recall - A Blueprint For Recall in The UKDocument32 pagesReal Recall - A Blueprint For Recall in The UKunlockdemocracyNo ratings yet

- The Future of Devolution After The ReferendumDocument6 pagesThe Future of Devolution After The ReferendumunlockdemocracyNo ratings yet

- Ian Driver - 2016 UD Council Election AddressDocument1 pageIan Driver - 2016 UD Council Election AddressunlockdemocracyNo ratings yet

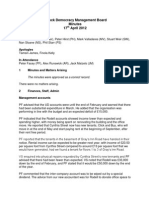

- Unlock Democracy Management Board Meeting, 25th March 2008 MinutesDocument4 pagesUnlock Democracy Management Board Meeting, 25th March 2008 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 1st June 2010 MinutesDocument3 pagesUnlock Democracy Management Board Meeting, 1st June 2010 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 12th October 2010 MinutesDocument3 pagesUnlock Democracy Management Board Meeting, 12th October 2010 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 8th December 2009 MinutesDocument4 pagesUnlock Democracy Management Board Meeting, 8th December 2009 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 10th August 2010 MinutesDocument6 pagesUnlock Democracy Management Board Meeting, 10th August 2010 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 9th February 2010 MinutesDocument3 pagesUnlock Democracy Management Board Meeting, 9th February 2010 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 11th April 2011 MinutesDocument5 pagesUnlock Democracy Management Board Meeting, 11th April 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Minutes 17 April 2012: PresentDocument5 pagesUnlock Democracy Management Board Minutes 17 April 2012: PresentunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 8th February 2011 MinutesDocument3 pagesUnlock Democracy Management Board Meeting, 8th February 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board 9th August 2011 MinutesDocument5 pagesUnlock Democracy Management Board 9th August 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board, 11th October 2011 MinutesDocument5 pagesUnlock Democracy Management Board, 11th October 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board, 11th December 2012 MinutesDocument4 pagesUnlock Democracy Management Board, 11th December 2012 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 14th June 2011 MinutesDocument4 pagesUnlock Democracy Management Board Meeting, 14th June 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 13th December 2011 MinutesDocument5 pagesUnlock Democracy Management Board Meeting, 13th December 2011 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 24th July 2012 MinutesDocument5 pagesUnlock Democracy Management Board Meeting, 24th July 2012 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 7th February 2012 MinutesDocument5 pagesUnlock Democracy Management Board Meeting, 7th February 2012 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Management Board Meeting, 11th September 2012 MinutesDocument5 pagesUnlock Democracy Management Board Meeting, 11th September 2012 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Council Meeting, 11th July 2009 MinutesDocument6 pagesUnlock Democracy Council Meeting, 11th July 2009 MinutesunlockdemocracyNo ratings yet

- Council Minutes 6th March 2010Document4 pagesCouncil Minutes 6th March 2010unlockdemocracyNo ratings yet

- Unlock Democracy Council Meeting, 21st February 2009 MinutesDocument5 pagesUnlock Democracy Council Meeting, 21st February 2009 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Council Meeting, 26th April 2008 MinutesDocument3 pagesUnlock Democracy Council Meeting, 26th April 2008 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Council Meeting, 12th September 2009 MinutesDocument8 pagesUnlock Democracy Council Meeting, 12th September 2009 MinutesunlockdemocracyNo ratings yet

- Unlock Democracy Council Meeting, 12th June 2010 MinutesDocument5 pagesUnlock Democracy Council Meeting, 12th June 2010 MinutesunlockdemocracyNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Japan Exchange Group: A Cinnober Customer CaseDocument4 pagesJapan Exchange Group: A Cinnober Customer CaseI SNo ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Sana Khan100% (1)

- Canfin Annual Report FY 2022-23Document320 pagesCanfin Annual Report FY 2022-23OneappNo ratings yet

- CH 09 Valuing Early-Stage VenturesDocument20 pagesCH 09 Valuing Early-Stage VenturesshakeelsajjadNo ratings yet

- Financial Structure Analysis of Indian Companies: A Review of LiteratureDocument9 pagesFinancial Structure Analysis of Indian Companies: A Review of LiteratureVįňäý Ğøwđã VįñîNo ratings yet

- Oracle Cost Management User's GuideDocument94 pagesOracle Cost Management User's Guidesherif ramadanNo ratings yet

- Ema Garp Fund - q2 2011 ReportDocument9 pagesEma Garp Fund - q2 2011 ReportllepardNo ratings yet

- Depreciated Replacement CostDocument7 pagesDepreciated Replacement CostOdetteDormanNo ratings yet

- Analiza Cash FlowDocument3 pagesAnaliza Cash FlowTania BabcinetchiNo ratings yet

- GFL Research Thesis 8-18-2020Document107 pagesGFL Research Thesis 8-18-2020Andy HuffNo ratings yet

- Lesson 2 - Financial Stement AnalysisDocument39 pagesLesson 2 - Financial Stement AnalysisTomoyo AdachiNo ratings yet

- Registration of Securities: Securities and Exchange CommissionDocument6 pagesRegistration of Securities: Securities and Exchange CommissionmmeeeowwNo ratings yet

- Impact of Inflation On The Financial StatementsDocument22 pagesImpact of Inflation On The Financial StatementsabbyplexxNo ratings yet

- FinmgtDocument92 pagesFinmgtMary Elisha PinedaNo ratings yet

- CBT With Sensitivity (Class) PDFDocument10 pagesCBT With Sensitivity (Class) PDFMahmudur RahmanNo ratings yet

- Liquidation 1Document28 pagesLiquidation 1Noemi T. LiberatoNo ratings yet

- Far 1 Notes Chapter 4Document66 pagesFar 1 Notes Chapter 4Nagaeshwary MuruganNo ratings yet

- 8.3 Coupon Bonds, Current Yield, and Yield To MaturityDocument8 pages8.3 Coupon Bonds, Current Yield, and Yield To MaturityDanish S MehtaNo ratings yet

- Chapter 7 - Cash Flow AnalysisDocument18 pagesChapter 7 - Cash Flow AnalysisulfaNo ratings yet

- FCFWACCReviewproblemspart 1 SolutionDocument2 pagesFCFWACCReviewproblemspart 1 SolutionKevser BozoğluNo ratings yet

- Ratio Analysis of HDFC ERGO: A Report OnDocument8 pagesRatio Analysis of HDFC ERGO: A Report OnchetanNo ratings yet

- MAS Assessment October 2020 PDFDocument15 pagesMAS Assessment October 2020 PDFARISNo ratings yet

- Cash Budget Questions (Revised)Document6 pagesCash Budget Questions (Revised)James WisleyNo ratings yet

- Practical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFDocument67 pagesPractical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFAdrianLynchpdci100% (7)

- Gec: CTCP Cơ Khí Gang Thép I. Business Overview: HydropowerDocument8 pagesGec: CTCP Cơ Khí Gang Thép I. Business Overview: HydropowerHuy Quang ĐỗNo ratings yet

- International Capilat BudgetingDocument43 pagesInternational Capilat BudgetingHimanshu GuptaNo ratings yet

- Coprorate Finance Question Paper (3 Hours 1000 Words)Document2 pagesCoprorate Finance Question Paper (3 Hours 1000 Words)Vasu PothunuruNo ratings yet

- JSW Steel: (Jswste)Document8 pagesJSW Steel: (Jswste)XYZNo ratings yet

- NPV Vs IRRDocument10 pagesNPV Vs IRRSaeed Ahmed KiyaniNo ratings yet