Professional Documents

Culture Documents

New Home Sales July 2011

Uploaded by

Jessica Kister-LombardoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Home Sales July 2011

Uploaded by

Jessica Kister-LombardoCopyright:

Available Formats

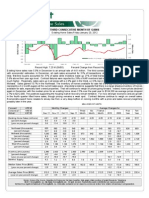

SALES SLIP, RECORD LOW INVENTORY

New Home Sales Tuesday July 26, 2011

20 10 400 Monthly % Change 0 -10 -20 -30 -40 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11

Monthly % Change Sales (Thousands of Units)

450

Thousands of Units

350

300

250

Record High: 1389k (07/05)

Percent Change from Record High: -77.5%

New home sales fell 1.0% in June to an annualized pace of 312k, compared to market expectations for a small increase of a rate of 320k. Meanwhile the prior month was revised slightly lower. Despite this months decline, new home sales are 1.6% above their year ago level in June 2010 but remain off a stunning 77.5% below their peak level of July 2005. At just over a 300k annual rate over the past year, new home sales remain exceptionally weak. Regionally, sales were mixed with a large 15.8% decline in the Northeast and a 12.5% decline in the West, with gains of 9.5% and 3.4% in the Midwest and South respectively. The inventory of new homes available for sale fell 1.8% in June to a record low level of 164k which represents a 6.3 month-supply at the current sale pace. Such low inventory levels will support pricing and the potential for new residential construction when demand strengthens. Home prices were up from one year ago; median sales prices gained 7.2% from June 2010 to $235,200 as average prices picked up 4.8%% to $269,000. New home sales remain quite slow and continue to face competition from the large number of distressed properties on the market. Demand remains constrained by slow job growth, tight credit and higher energy costs. It will be a rebound in the broader economy that would restore demand drivers and get homebuilding and new home sales back on track . THOUSANDS OF UNITS

Forecast: Consensus*: Actual: 310k 320k 312k Monthly Jun-11 312 -1.0 16 -15.8 46 9.5 181 3.4 69 -12.7 164 6.3 235.2 7.2 269.0 4.8 May-11 315 -0.6 19 -24.0 42 2.4 175 2.3 79 -1.3 167 6.4 222.4 -3.5 264.3 -6.0 Apr-11 317 3.9 25 0.0 41 5.1 171 0.0 80 14.3 173 6.5 223.9 7.5 267.3 -1.2 Mar-11 305 8.5 25 31.6 39 25.8 171 0.6 70 14.8 178 7.0 220.5 -1.9 260.8 -0.8 Three Month 315 Six Month 307 Twelve Month 301 Average for 2010 321 -14.1 31 -2.7 45 -17.7 173 -14.5 74 -15.3 190 8.0 221.2 3.1 271.5 1.2 2009 374 -22.4 31 -11.1 54 -21.8 202 -23.8 87 -22.9 234 9.0 214.5 -6.9 268.2 -7.2 Five Year 599 Ten Year 845

New Home Sales (percent change) Northeast (percent change) Midwest (percent change) South (percent change) West (percent change) Inventory Months of Supply Median Sales Price ($000) (year-on-year % change) Average Sales Price ($000) (year-on-year % change)

20 43 176 76

23 40 172 72

25 40 167 69

45 89 321 143

60 140 421 224

168 6.4 227.2 3.5 266.9 -1.0

175 6.9 227.0 2.9 266.7 -2.4

188 7.5 224.5 2.9 268.3 -1.7

362 8.5 230.6

376 6.3 215.4

288.2

268.2

Source: Bureau of the Census, Department of Commerce Via Haver Analytics. Data, graph & table courtesy of Insight Economics *Bloomberg 2011 HousingMatrix, Inc.| http://www.HousingMatrix.com | All rights reserved. Reproduction and/or redistribution are expressly prohibited. Hot Sheet is a registered trademark of HousingMatrix, Inc. Information contained herein is based on sources believed to be reliable, but accuracy is not guaranteed.

You might also like

- Effective Leadership Skills in The 21ST CenturyDocument67 pagesEffective Leadership Skills in The 21ST CenturySam ONi100% (1)

- 17.06 Planned Task ObservationsDocument1 page17.06 Planned Task Observationsgrant100% (1)

- Agile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFDocument90 pagesAgile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFMatian Dal100% (2)

- Rural Houses of The North of Ireland - Alan GaileyDocument6 pagesRural Houses of The North of Ireland - Alan Gaileyaljr_2801No ratings yet

- Affidavit of Discrepancy in GenderDocument2 pagesAffidavit of Discrepancy in GenderrogerNo ratings yet

- QUAMA000Document41 pagesQUAMA000Abd ZouhierNo ratings yet

- Accord Textiles LimitedDocument41 pagesAccord Textiles LimitedSyed Ilyas Raza Shah100% (1)

- Common Law MarriageDocument3 pagesCommon Law MarriageTerique Alexander100% (1)

- Newhome 8-23-11Document1 pageNewhome 8-23-11Jessica Kister-LombardoNo ratings yet

- New Home Sales June 2011Document1 pageNew Home Sales June 2011Jessica Kister-LombardoNo ratings yet

- New Home Sales November December) 2011Document1 pageNew Home Sales November December) 2011Jessica Kister-LombardoNo ratings yet

- July 2011 Existing Home SalesDocument1 pageJuly 2011 Existing Home SalesJessica Kister-LombardoNo ratings yet

- Existing Home Sales October 2011Document1 pageExisting Home Sales October 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales August 2011Document1 pageExisting Home Sales August 2011Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- July 2011: July Sales and Average Price Up Compared To 2010Document25 pagesJuly 2011: July Sales and Average Price Up Compared To 2010Steve LadurantayeNo ratings yet

- Nest Report Charlottesville: May 2011Document2 pagesNest Report Charlottesville: May 2011Jonathan KauffmannNo ratings yet

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoNo ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban DevelopmenttaejokimNo ratings yet

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoNo ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban Developmentp_balathandayuthamNo ratings yet

- OahuMonthlyIndicators Sept 2011Document13 pagesOahuMonthlyIndicators Sept 2011Mathew NgoNo ratings yet

- Joint Release U.S. Department of Housing and Urban DevelopmentDocument4 pagesJoint Release U.S. Department of Housing and Urban Developmentapi-25887578No ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Fraser Valley Nov 08Document13 pagesFraser Valley Nov 08HudsonHomeTeamNo ratings yet

- Q2 2012 Charlottesville Nest ReportDocument9 pagesQ2 2012 Charlottesville Nest ReportJim DuncanNo ratings yet

- Carmel Highlands Real Estate Sales Market Report For July 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report For July 2015Nicole TruszkowskiNo ratings yet

- Fraser Valley Oct 08Document13 pagesFraser Valley Oct 08HudsonHomeTeamNo ratings yet

- Greenwich Sales Report July 2011Document2 pagesGreenwich Sales Report July 2011HigginsGroupRENo ratings yet

- Market Stats For Weston, CTDocument4 pagesMarket Stats For Weston, CTMargaret BlockNo ratings yet

- Market Quest Glastobury Sep 2011Document4 pagesMarket Quest Glastobury Sep 2011Suzanne DelanyNo ratings yet

- Austin Realty Stats April 2012Document12 pagesAustin Realty Stats April 2012Romeo ManzanillaNo ratings yet

- July Real Estate Market Statistics For KatonahDocument4 pagesJuly Real Estate Market Statistics For KatonahMarc CampolongoNo ratings yet

- Economics Group: Weekly Economic & Financial CommentaryDocument9 pagesEconomics Group: Weekly Economic & Financial CommentaryRio PrestonniNo ratings yet

- Carmel Highlands Real Estate Sales Market Report For June 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report For June 2015Nicole TruszkowskiNo ratings yet

- Key S.C. Indicators: S.C. Leading Index Falls Sharply in JulyDocument4 pagesKey S.C. Indicators: S.C. Leading Index Falls Sharply in Julydan_hamilton_3No ratings yet

- Metropolitan Denver Real Estate Statistics As of November 30, 2011Document10 pagesMetropolitan Denver Real Estate Statistics As of November 30, 2011Michael KozlowskiNo ratings yet

- Metropolitan Denver Real Estate Statistics AS OF JULY 31, 2011Document10 pagesMetropolitan Denver Real Estate Statistics AS OF JULY 31, 2011Michael KozlowskiNo ratings yet

- Real Estate: Sales Las Vegas Market April 2014Document6 pagesReal Estate: Sales Las Vegas Market April 2014Gideon JoffeNo ratings yet

- Monterey Real Estate Sales Market Report For July 2015Document4 pagesMonterey Real Estate Sales Market Report For July 2015Nicole TruszkowskiNo ratings yet

- Monterey Real Estate Sales Market Report For June 2015Document4 pagesMonterey Real Estate Sales Market Report For June 2015Nicole TruszkowskiNo ratings yet

- Zip Code: 10533: Property SalesDocument4 pagesZip Code: 10533: Property Salesaj_dobbsNo ratings yet

- TRNDGX PressRelease Aug2011Document2 pagesTRNDGX PressRelease Aug2011deedrileyNo ratings yet

- June Saskatchewan Provincial Housing StatisticsDocument11 pagesJune Saskatchewan Provincial Housing StatisticsMortgage ResourcesNo ratings yet

- Fraser Valley Real Estate Statistics For January 2012Document11 pagesFraser Valley Real Estate Statistics For January 2012HudsonHomeTeamNo ratings yet

- Market Summary For August 2012Document3 pagesMarket Summary For August 2012api-96684081No ratings yet

- Weston - MARDocument4 pagesWeston - MARKathleenOConnellNo ratings yet

- Market Stats For Bethel December 2011Document4 pagesMarket Stats For Bethel December 2011Donna KuehnNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For February 2015Document4 pagesMonterey Homes Market Action Report Real Estate Sales For February 2015Nicole TruszkowskiNo ratings yet

- Monterey Real Estate Sales Market Action Report August 2015Document4 pagesMonterey Real Estate Sales Market Action Report August 2015Nicole TruszkowskiNo ratings yet

- Monthly Statistics Report August 2011Document1 pageMonthly Statistics Report August 2011Jim LeeNo ratings yet

- Housing Starts June 2011Document1 pageHousing Starts June 2011Jessica Kister-LombardoNo ratings yet

- March 2012 South LoopDocument1 pageMarch 2012 South LoopHillary Dunn DeckNo ratings yet

- Charlottesville Real Estate Market Update: November 2012Document2 pagesCharlottesville Real Estate Market Update: November 2012Jonathan KauffmannNo ratings yet

- Growth Weakens in China: Morning ReportDocument3 pagesGrowth Weakens in China: Morning Reportnaudaslietas_lvNo ratings yet

- Monterey Real Estate Sales Market Report For June 2016Document4 pagesMonterey Real Estate Sales Market Report For June 2016Nicole TruszkowskiNo ratings yet

- REBGV Stats Package, August 2013Document9 pagesREBGV Stats Package, August 2013Victor SongNo ratings yet

- Fed Snapshot Sep 2011Document47 pagesFed Snapshot Sep 2011workitrichmondNo ratings yet

- Housing Market Report Aug 2013 SalesDocument6 pagesHousing Market Report Aug 2013 SalesGideon JoffeNo ratings yet

- LSL Acad Scotland HPI News Release May 12Document10 pagesLSL Acad Scotland HPI News Release May 12Stephen EmersonNo ratings yet

- Carmel Highlands Real Estate Sales Market Report For October 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report For October 2015Nicole TruszkowskiNo ratings yet

- Construction Spending June 1stDocument1 pageConstruction Spending June 1stJessica Kister-LombardoNo ratings yet

- June 2012 Real Estate Market ReportDocument12 pagesJune 2012 Real Estate Market ReportRomeo ManzanillaNo ratings yet

- City: Westport: Property SalesDocument4 pagesCity: Westport: Property SalesMargaret BlockNo ratings yet

- August 2011 REBGV Statistics PackageDocument7 pagesAugust 2011 REBGV Statistics PackageMike StewartNo ratings yet

- Household Furniture World Summary: Market Values & Financials by CountryFrom EverandHousehold Furniture World Summary: Market Values & Financials by CountryNo ratings yet

- Wood Kitchen Cabinet & Counter Tops World Summary: Market Values & Financials by CountryFrom EverandWood Kitchen Cabinet & Counter Tops World Summary: Market Values & Financials by CountryNo ratings yet

- Economic Focus January 30, 2012Document1 pageEconomic Focus January 30, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- New Home Sales January 2012Document1 pageNew Home Sales January 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- Housing Starts December 2011Document1 pageHousing Starts December 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- Construction Spending 1-3-12Document2 pagesConstruction Spending 1-3-12Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoNo ratings yet

- Construction Spending December 2011Document1 pageConstruction Spending December 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-5-11Document1 pageEconomic Focus 12-5-11Jessica Kister-LombardoNo ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Winter Wonderland 2011 - AttendeeDocument1 pageWinter Wonderland 2011 - AttendeeJessica Kister-LombardoNo ratings yet

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-10-11Document1 pageEconomic Focus 10-10-11Jessica Kister-LombardoNo ratings yet

- November Construction SpendingDocument1 pageNovember Construction SpendingJessica Kister-LombardoNo ratings yet

- Economic Focus October 24, 2011Document1 pageEconomic Focus October 24, 2011Jessica Kister-LombardoNo ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Construction Spending Oct. 2011Document1 pageConstruction Spending Oct. 2011Jessica Kister-LombardoNo ratings yet

- New Home Sales September 2011Document1 pageNew Home Sales September 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Astm d4921Document2 pagesAstm d4921CeciliagorraNo ratings yet

- The Powers To Lead Joseph S. Nye Jr.Document18 pagesThe Powers To Lead Joseph S. Nye Jr.George ForcoșNo ratings yet

- Soal Pas SMKDocument3 pagesSoal Pas SMKsofiNo ratings yet

- (123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangDocument133 pages(123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangLâm Nguyễn hảiNo ratings yet

- MBC and SAP Safe Management Measures, Caa 2020-05-28Document9 pagesMBC and SAP Safe Management Measures, Caa 2020-05-28Axel KruseNo ratings yet

- Rbi Balance SheetDocument26 pagesRbi Balance SheetjameyroderNo ratings yet

- CHAPTER 7 MemoDocument4 pagesCHAPTER 7 MemomunaNo ratings yet

- International Portfolio TheoryDocument27 pagesInternational Portfolio TheoryDaleesha SanyaNo ratings yet

- Hanna Fenichel Pitkin - Fortune Is A Woman - Gender and Politics in The Thought of Nicollo Machiavelli - With A New Afterword (1999)Document388 pagesHanna Fenichel Pitkin - Fortune Is A Woman - Gender and Politics in The Thought of Nicollo Machiavelli - With A New Afterword (1999)Medbh HughesNo ratings yet

- Project On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesDocument9 pagesProject On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesSoumya Shefali ChandrakarNo ratings yet

- Joseph Stalin: Revisionist BiographyDocument21 pagesJoseph Stalin: Revisionist BiographyStefanoCzarnyNo ratings yet

- (はつもうで - hatsumōde)Document8 pages(はつもうで - hatsumōde)Ella NihongoNo ratings yet

- Research For ShopeeDocument3 pagesResearch For ShopeeDrakeNo ratings yet

- Paper 3 IBIMA Brand Loyalty Page 2727-2738Document82 pagesPaper 3 IBIMA Brand Loyalty Page 2727-2738Sri Rahayu Hijrah HatiNo ratings yet

- Marketing MetricsDocument29 pagesMarketing Metricscameron.king1202No ratings yet

- Specific Gravity of FluidDocument17 pagesSpecific Gravity of FluidPriyanathan ThayalanNo ratings yet

- Airtel A OligopolyDocument43 pagesAirtel A OligopolyMRINAL KAUL100% (1)

- University Student Council: University of The Philippines Los BañosDocument10 pagesUniversity Student Council: University of The Philippines Los BañosSherwin CambaNo ratings yet

- International Business Opportunities and Challenges Vol 2 1St Edition Carpenter Test Bank Full Chapter PDFDocument40 pagesInternational Business Opportunities and Challenges Vol 2 1St Edition Carpenter Test Bank Full Chapter PDFKathrynBurkexziq100% (7)

- Electronic Ticket Receipt: ItineraryDocument2 pagesElectronic Ticket Receipt: ItineraryChristiawan AnggaNo ratings yet

- Classical Dances of India Everything You Need To Know AboutDocument18 pagesClassical Dances of India Everything You Need To Know AboutmohammadjakeerpashaNo ratings yet

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDocument15 pagesAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)