Professional Documents

Culture Documents

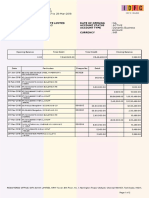

MPT Statistics

Uploaded by

sportsgirlmta23Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MPT Statistics

Uploaded by

sportsgirlmta23Copyright:

Available Formats

Sales Excellence 1. Feature what it is characteristics a. So that.. b. Meaning.. c. -Providing.. d. -Allowing 2. Advantage explains what something does a.

a. -What this means to you.. b. -The benefit to you is 3. Benefit - Personalization Im concerned with risk of FA xx in this environment Definitely (NAME), I understand your concern and appreciate you sharing that with me today. This is actually something Ive heard from a few other advisors as well where Ive been able to help them with their concerns and I wish to help you with yours today. So (NAME), just so I can better help you with this issue and make the best use of your time Im going to talk you to you about 2 features in regards to the fund. Ill explain the feature in more detail, mention some of the advantages as well as the benefit that this brings to you in order to relieve some of your concerns. How does that sound? Great!

Floating Rate High Income Feature: Standard deviation has ranked in the bottom decile among Morningstar Bank Loan peers for the 3 and 5 year periods and since inception. Advantage: What this means to you is you are purchasing a fund with one of the lowest risk statistics in the category. You are essentially receiving one of our most attractive income funds that focuses on a total return strategy but has lower volatility and lower risk than among many of its competitors. Benefit: This feature will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: The sharpe ratio has consistently ranked in the top quartile over the 3, and 5 year period and since inception as well. The sharpe ratio essentially measures risk adjusted performance. Advantage: What this means to you knowing that the ratio has ranked among the top is that the returns have been getting better and better. The benefit to this is that you are essentially receiving income without being exposed to too much risk. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds standard deviation that has ranked in the bottom decile among its peers and its high sharpe ratio contributing to its strong risk adjusted returns. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today? Emerging Markets Income

Feature: Information ratio which measures consistent manager outperformance of its benchmark. The ratio has ranked in the top 15% of peers over 3, and 5 year periods and in 51st percentile over 10 years. Advantage: What this means to you is that your clients will be rewarded for each incremental unit of risk taken, but because the manager has proven his consistency in outperformance, you know there wont be any excess or unnecessary risk when it comes to this fund. Benefit: This will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: The sharpe ratio has consistently ranked in the top third among Morningstar Emerging Markets Bond peers over the 3, and 5 year period. The sharpe ratio essentially measures risk adjusted performance. Advantage: What this means to you knowing that the ratio has ranked among the top third is that the returns have been getting better and better. The benefit to this is that you are essentially receiving income without being exposed to too much risk. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds information ratio that has ranked in the top 15% of its peers and its high sharpe ratio contributing to its strong risk adjusted returns. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today? Mid Cap II Feature: Standard deviation has been below the benchmark and category average for the 3 and 5 year periods and since inception. Advantage: What this means to you is that you are receiving a fund with lower risk statistics than its benchmark and are exposing yourself to less volatility and risk while at the same time having higher risk adjusted returns. Benefit: This statistic should help in easing that concern in regards to the risk in the fund. It will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: Fund has consistently delivered higher alpha than the category average. It has ranked in the top quartile among peers over 5 year period and since inception. Advantage: This feature gives you that reassurance in the funds performance. It has lower volatility than its benchmark and among the highest alphas, higher than the category average. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds standard deviation that has been below the benchmark and category average and its high alpha ranked in the top quartile among peers. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today?

Municipal Income Feature: Standard deviation has been fairly similar to that of the Barclays Muni Index and significantly below that of the Morningstar Muni National Long Average over the 3, 5 and 10 year periods. Advantage: What this means to you is that it makes it an easier story to bring to clients since its risk and volatility are much less than some others. Just to put it in perspective, when compared to Eaton Vance National Municipal Income, on its 36 month rolling annualized standard deviation, Eaton Vance averages about 11% more in its standard deviation. What this means is that they will have a greater variance of returns from what the fund usually averages. Benefit: This statistic should help in easing that concern in regards to the risk in the fund. It will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: The funds sharpe ratio has consistently ranked in the top third among Morningstar National Long Peers. Advantage: What this means to you knowing that the ratio has ranked among the top third is that the returns have been getting better and better. The benefit to this is that you are essentially receiving income without being exposed to too much risk. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds standard deviation that has been similar to the bench but significantly below the Muni long average and the funds sharpe ratio that has ranked in the top third among peers. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today? Strategic Income Feature: The sharpe ratio has consistently ranked in the top third among Morningstar Multi-sector bond peers. The sharpe ratio essentially measures risk adjusted performance. Advantage: What this means to you knowing that the ratio has ranked among the top third is that the returns have been getting better and better. The benefit to this is that you are essentially receiving income without being exposed to unnecessary risk. Benefit: This statistic should help in easing that concern in regards to the risk in the fund. It will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: Information ratio which measures consistent manager outperformance of its benchmark. The ratio has ranked in the top quartile among peers over 3, 5, and 10 year period. Advantage: What this means to you is that your clients will be rewarded for each incremental unit of risk taken, but because the manager has proven his consistency in outperformance, you know there wont be any excess or unnecessary risk when it comes to this fund. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds sharpe ratio that has ranked in the top third among peers and the funds information ratio that has also ranked in the top quartile among its peers as well. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today?

New Insights Feature: Standard deviation has been lower than the benchmark and category average for the 3, and 5 year periods. Advantage: What this means to you is that you are receiving a fund with lower risk statistics than its benchmark and are exposing yourself to less volatility and risk while at the same time having higher risk adjusted returns. Benefit: This statistic should help in easing that concern in regards to the risk in the fund. It will give you peace of mind and let you sleep easier at night knowing that Fidelity has you and your clients best interests in mind. Feature: Fund has consistently delivered higher alpha and is ranked in the top third percentile of its large growth peers since inception. Advantage: This feature gives you that reassurance in the funds performance. It has lower volatility than its benchmark and among the highest alphas, two statistics that really complement each other. Benefit: This feature will also help in easing some of those concerns you may have when it comes to risk in the fund. It will also make your job a lot easier because these risk measures Ive provided you with today, you will be able to confidently bring them to your clients and prove the true safety and security this fund has to offer. So again, the two features Ive mentioned here today are the funds standard deviation that has been lower than the benchmark and its category average and its high alpha ranked in the top third percentile among its peers. Both great risk measures to look at when evaluating a fund risk profile. So (NAME), have I helped you in relieving some of your concerns today?

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- B E Billimoria Company Limited PDFDocument1 pageB E Billimoria Company Limited PDFmanishaNo ratings yet

- BAS Vs BSSDocument2 pagesBAS Vs BSSGunjan ShahNo ratings yet

- Stock Market ProjectDocument16 pagesStock Market Projectapi-278469995No ratings yet

- Learn large numbers and place value system in Indian currencyDocument17 pagesLearn large numbers and place value system in Indian currencyVijayalakshmi ISAMNo ratings yet

- KRE Report - V2 PDFDocument17 pagesKRE Report - V2 PDFabuzar royeshNo ratings yet

- City of Toronto Law0569 Schedule A Vol1 Ch1 800Document328 pagesCity of Toronto Law0569 Schedule A Vol1 Ch1 800RafiyaNo ratings yet

- Macroeconomics course readings and assessment agreedDocument3 pagesMacroeconomics course readings and assessment agreeddheeraj sehgalNo ratings yet

- Anthony Downs An Economic Theory of Democracy Harper and Row 1957Document321 pagesAnthony Downs An Economic Theory of Democracy Harper and Row 1957muhammad afitNo ratings yet

- Vikram Solar BrochureDocument14 pagesVikram Solar BrochureRuwan WijemanneNo ratings yet

- Steel CH 1Document34 pagesSteel CH 1daniel workuNo ratings yet

- Ekurhulen North District Technology Grade 8 PaperDocument10 pagesEkurhulen North District Technology Grade 8 Papersiyabonga mpofu100% (2)

- ISO-10664Document10 pagesISO-10664Daniel Quijada LucarioNo ratings yet

- Wroking Capital Management of Britannia IndustriesDocument15 pagesWroking Capital Management of Britannia IndustriesSujata MansukhaniNo ratings yet

- Organization and Management: Module 4: Quarter 1, Week 3 & 4Document18 pagesOrganization and Management: Module 4: Quarter 1, Week 3 & 4juvelyn luegoNo ratings yet

- TCS Placement Paper On 12th Feb 2010Document13 pagesTCS Placement Paper On 12th Feb 2010Jannathul Firdous MohamedNo ratings yet

- IDFC Bank StatementDocument2 pagesIDFC Bank StatementSURANA197367% (3)

- Futurology in PerspectiveDocument10 pagesFuturology in Perspectivefx5588No ratings yet

- Applied Value Investing (Renjen, Oro-Hahn) FA2015Document4 pagesApplied Value Investing (Renjen, Oro-Hahn) FA2015darwin12No ratings yet

- Schedul 25 Nov 23Document1 pageSchedul 25 Nov 23CloudyNo ratings yet

- Policy Details: Page 1 of 5Document5 pagesPolicy Details: Page 1 of 5shaiju samNo ratings yet

- Tour Guiding: Week 2 By: Jenina Chayne ContrerasDocument25 pagesTour Guiding: Week 2 By: Jenina Chayne ContrerasCaroline AmbrayNo ratings yet

- RMesh Brochure - March 2021Document2 pagesRMesh Brochure - March 2021WilfredoJrReyNo ratings yet

- Lower Taxes: Supporting Households, Driving Investment and Creating JobsDocument19 pagesLower Taxes: Supporting Households, Driving Investment and Creating JobsLeeNo ratings yet

- Lesson 2: Science and Technology in Different PeriodsDocument2 pagesLesson 2: Science and Technology in Different Periodssushicrate xxNo ratings yet

- Piwer Point PresentationDocument25 pagesPiwer Point PresentationAhmed SultanNo ratings yet

- Economics P1 Nov 2022 MG EngDocument21 pagesEconomics P1 Nov 2022 MG Engnontokozoangel562No ratings yet

- Ha Joon Chang Industrial Policy 2020Document28 pagesHa Joon Chang Industrial Policy 2020Liber Iván León OrtegaNo ratings yet

- Ipl 2024 ScheduleDocument3 pagesIpl 2024 SchedulefostacfssairecruiterNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDani Yustiardi MunarsoNo ratings yet

- Visit Report: Page 1 of 26Document26 pagesVisit Report: Page 1 of 26OğuzcanYazarNo ratings yet