Professional Documents

Culture Documents

Impact of Macroeconomics Variables On Stock Prices Emperical Evidance in Case of Kse Karachi Stock Exchange

Uploaded by

Narasimha PrasadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of Macroeconomics Variables On Stock Prices Emperical Evidance in Case of Kse Karachi Stock Exchange

Uploaded by

Narasimha PrasadCopyright:

Available Formats

European Journal of Scientific Research ISSN 1450-216X Vol.38 No.1 (2009), pp.96-103 EuroJournals Publishing, Inc. 2009 http://www.eurojournals.com/ejsr.

htm

Impact of Macroeconomics Variables on Stock Prices: Emperical Evidance in Case of KSE (Karachi Stock Exchange)

Suliaman D. Mohammad Associate professor, Federal Urdu University of Arts, Science and Technology E-mail: suliaman1959@gmail.com Adnan Hussain Visiting Lecturer, Federal Urdu University of Arts, Science and Technology E-mail: adnanaerc@gmail.com Adnan Ali Student of M.Phil, Applied Economics Research Centre, University of Karachi E-mail: adnanaliabbasi@hotmail.com Abstract The object this paper is to find the relationship between macroeconomic variables and prices of shares in Karachi stock exchange in Pakistan context. We considers the quarterly data of several economic variables such as foreign exchange rate, foreign exchange reserve, industrial production index, whole sale price index, gross fixed capital formation, and broad money M2 , these variables are obtain from 1986 to 2008 period . We try to make link these macroeconomics variables to stock prices. Compared to earlier work we have used multiple regression analysis and compare the results. The results shows that after the reforms in 1991 the influence of foreign exchange rate and reserve effects significantly to stock market whiles other variables like IIP and GFCF are not effects significantly to stock prices. so our result shows that internal factors of firms like increase production and capital formation not effects significantly while external factors like exchange rate and reserve are effects significantly the stock prices. So the after post reforms period is positively effects stock prices. The study will be very help full for national policy makers, researchers and corporate managers etc.

I. Introduction

The stock market is supposed to play an important role in the economy in the sense that it mobilizes domestic resources and channels them to productive investments. However, to perform this role it must have significant relationship with the economy. Capital markets are key elements of a modern, marketbased economic system as they serve as the channel for flow of long term financial resources from the savers of capital to the borrowers of capital. Efficient capital markets are hence essential for economic growth and prosperity. With growing globalization of economies, the international capital markets are also becoming increasingly integrated. While such integration is positive for global economic growth, the downside risk is the contagion effect of financial crisis, especially if its origin lies in the bigger markets. As for the effect of macroeconomic variables such as money supply and interest rate on stock prices, the efcient market hypothesis suggests that competition among the prot-maximizing investors

Impact of Macroeconomics Variables on Stock Prices: Emperical Evidance in Case of KSE (Karachi Stock Exchange)

97

in an efcient market will ensure that all the relevant information currently known about changes in macroeconomic variables are fully reected in current stock prices, so that investors will not be able to earn abnormal prot through prediction of the future stock market movements (Chong and Koh 2003). Therefore, since investment advisors would not be able to help investors earn above-average returns consistently, except through access to and employing insider information, a practice generally prohibited and punishable by law, there should be no stock broking industry, if one were to believe the conclusions of the EMH. Stock market is a critical cog in the wheel that smoothens the transfer of funds for economic growth. Broadly speaking, stock exchanges are expected to accelerate economic growth by increasing liquidity of financial assets and making global risk diversification easier for investors promoting wiser investment decisions. In principle, a well functioning stock market may help the economic growth and development process in an economy through growth of savings, efficient allocation of investment resources and alluring of foreign port folio investment. The stock market encourages saving by providing households having invest able funds, an additional financial instrument, which meets their risk preferences land liquidity needs better, it in fact provides individuals with relatively liquid means for risk sharing in investment projects. (agrawalla 2006).

II. History of KSE (Karachi Stock Market)

Since after independence in 1947 a multitude of problems have stood in Pakistan way of realizing its true economic potential. Include in the social and political problems are sectarian violence, increasing population, archaic bureaucratic procedures and political instability. Economic problems have include counter productive tax rated, debilitating customs duties that reduce foreign investment and the Pakistani government strategic approach that kept the economy as well as the stock market closed to foreigners. Although Pakistan continues to struggle with socio-political problems it has recently made tremendous strides in the economic front via reforms that were introduced in the early part of 1991. The most significant of the reforms was perhaps investment on very liberal terms and allowing for the first time after the independence of Pakistan history direct and indirect investment by foreign nationals and international investor in Pakistan equity market. These reforms have produced positive results. Karachi stock exchange is largest and most active stock market in Pakistan accounting for between 65% and 70 % of the value of the country total stock transaction as on October 1, 2004, 663 companies were listed with market capitalization $23.23 billion having listed capital of us $ 6.59 billion. Pakistan's industrial exports and foreign investment today are growing at the country's fastest rate ever. The country's foreign exchange reserves skyrocketed to $12327.9 million in 2003-04 from $2279.2 million in 1998-99. Similarly, several Pakistani stocks are now traded on international markets. Also, foreign brokerage houses are now being allowed through joint ventures with Pakistani investment bankers to participate in primary as well as secondary markets in Pakistan. Given the newfound interest in the Pakistani stock markets, an intriguing question is how these markets have performed over the years. To answer this question we examine the return generating process of the Karachi Stock Exchange (KSE). Karachi Stock Exchange is the biggest and most liquid exchange in Pakistan. It was declared the Best Performing Stock Market of the World for the year 2002. The KSE 100 Index touched at 5245.82 on October 01, 2004. KSE has been well into the 3rd year of being one of the Best Performing Markets of the world as declared by the international magazine Business Week. Similarly the US newspaper, USA Today, termed Karachi Stock Exchange as one of the best performing bourses in the world. Karachi Stock Exchange achieved a major milestone when KSE-100 Index crossed the psychological level of 15,000 for the first time in its history and peaked 15,737.32 on 20 April, 2008. Moreover, the increase of 7.4 per cent in 2008 made it the best performer among major emerging

98

Suliaman D. Mohammad, Adnan Hussain and Adnan Ali

markets but due to current global financial crisis it can be declined to 9,000 because foreign capital out flows increase very sharply. As of Sept25, 2009, 654 companies were listed with a market capitalization of Rs. 2.806 trillion (US$ 33.81 billion) having listed capital of Rs. 705.873 billion (US$ 10.615 billion). The KSE 100TM Index closed at 9359 on Sept 29, 2009. In section 3 we have analysis some previous work done in this regard as review literature in section 4 we define some variables which used in study and define data set. In section 5 we define econometrics methodology which we used in study in section 5 we concluded result form this study and finally in section 6 we concluded our study report

III. Literature review

There is lot work has been done so far in this regard. Now we have overview some of economist works in this section of the paper as review literatureThe hypothesis the change in macro economics variable have got strong impact on assets prices as subject extensive research Dr. Nishat (2004) analyze long term relationship between macroeconomic variables are stock price. He used CPI, IIP, money supply and foreign exchange rate as explanatory variable in this paper result indicates are causal relation between the stock price and economy. He used Karachi stock exchange 100 index price for 1974 to 2004. Analysis of his work found that industrial production index is largely positively significant while inflation is significantly negatively related he used granger causality test to determined effect the above said variables to stock price he found that interest rate is not cause scientifically to stock price. He used unit root technique to make data stationary. Shahid Ahmed (2003) has worked on SENSEX index price effects by real and financial sector performance in economy for the period 1997 to 2007. he used variables export and foreign exchange rate and foreign direct investment. He used methodology of granger causality test he finding are all variables are significantly effect stock price. He found the data is not stationary which sign that there is speculation in stock market he run AR which has high significance value Fazal Hussain and Tariq Masood (2001) they used variable investment, GDP and consumption and used granger casualty test to define the relation ship between these variables to stock price there finding on two lags above said variables highly significant effect on stock prices Robert D. gay (2008) he used MA method with OLS to find relation ship between stock prices and macro economics variables effects on four emerging economies India, Russia, Brazil and China. He used oil price, exchange rate, and moving average lags values as explanatory variables but result are insignificants which shows inefficiency in market final conclusion is that these economies are emerging so domestics factors more influence outside factors oil price and exchange rate Dr. Aftab(2000). He try to link between monetary and fiscal policy of Pakistan equities market and the result of his analysis is significant. He found that fiscal and monetary policy change market capitalization through equity (changes floated shares) and liquidity which can significantly causal relation shows with market capitalization/ stock price. In case of Pakistan data set is used 1993 to 1998 Liaquat Ali and Nadeem Ahmed(2008) they used data 1971 to 2006 and try to make relation ship of economic growth with stock market prices they found the dynamics relation ship between stock prices and economic growth. They employed DF-GLS test first time in case of Pakistan. M.Shahbaz (2006) he tries make relationship between stock prices and rate of inflation he used ARDL model which used dynamics analysis. His finding are stock hedges against inflation in long run but not in short run and discuss black economy which effect long run and short run prices of the stock he used variables CPI, as proxy of inflation and share of black economy the sample size he took 1971 to 2006. Safail Sharma (2007) he used rate of interest, exchange rate, industrial production index, money supply and inflation as explanatory variables he used AR and MA as also explanatory variable to remove effects of non stationary in the data. His finding are lags values are highly correlated with current prices suggest speculation in market. Exchange rate, industrial production index and money supply is significantly related he took data set 1986 to 2004.

Impact of Macroeconomics Variables on Stock Prices: Emperical Evidance in Case of KSE (Karachi Stock Exchange)

99

Song-zan-chiou-wei(2000) he used money supply oil price and exchange rate as explanatorily variables for Asian stock market he used VAR model applied to observed the differences of the structure of fluctuation after 1997 financial crises. His finding oil prices and inflation are highly effect the stock market of Asian economy Desislava Dimintrova (2005) he used exchange on stock prices by multivariate model he link exchange rate with economic policy (fiscal and monetary policy) with exchange rate and found relation with stock prices he defines interest parity condition effect on stock prices his results shows unambiguous effects on deprecation of stock prices on exchange rate deprecation

IV. Econometrics methodology and Data base

4.1. Data Base The assets valuation model and pricing of macroeconomics variables Stock prices and foreign exchange rate and reserve: stock prices relation ship regarding to foreign exchange is suggest to be decreasing/ increasing due to liberalization of stock market in any economy foreign direct investment will increase valuation of return and prices are as follows.

= + / r + = ps

Where = is total gain which equal to price of share = net dividend / profit = capital gain r = real interest rate = risk premium ps = price of shares As liberalized stock market it can cause reduced risk premium and increase competition in stock market which increase stock prices. Due to increase inflow of foreign exchange currency its supply increases it can cause to appreciate local currency so price of share increase due to improve foreign exchange reserve it cause exchange rate appreciate while other remain constant Stock prices and interest rate: increase in interest rate cause to increase opportunity cost of holding money which can substitution between stock and interest bearing securities and cause falling stock prices and another reason for falling stock prices is that when increase in interest rate it can cause increase in cost of production it can detorate companies profit and dividend which can reduced prices of shares it may also argued that the effect of discount rate would be negated if cash flows increase in same rate as inflation. How ever cash flow go not up with inflation other economy suggest pre existing contract would deny any immediate adjustment for firms revenue and cost Stock market and money supply: the direction of impact of monetary growth is negative because increase money supply increase in inflation so people maintained there real cash balance so they sells share and other assets which cause decline in share prices but on other hand increase monetary growth reduce interest rate which reduce cost of capital and increase earning of corporation. So we have found ambiguous effects. Industrial production index and stock prices: the direction IIP and stock prices are positive relation ship because increase IIP shows the increase in production of industrial sector which increase profit of industries and corporation. As dividend increase and share prices are increases so positive relation is found between IIP and share price Gross fixed capital formation and share price: gross fixed capital formation is defined as fixed assets accumulation. Assets accumulation increase by bond finance and equity finance if

100

Suliaman D. Mohammad, Adnan Hussain and Adnan Ali

cooperation wants to finance assets they floats share so supply of share increase and decline share prices or other ways increase assets finance by bond then firm/corporation credit worthiness decline which cause decline firm share prices so theory says increase Gross fixed capital formation decline share price in short run but in long run production increase cause increase share price so we can says ambiguous effects of share prices We have taken the data of sample period of above said variables from 1986 and 2007 to analysis the effects on share price. The logic behind taken the sample period between 1986 to 2007 is that in 1991 the reform of financial sector is start and it can cause liberalized stock market. 4.2. Econometrics methodology In our study we have taken time series data for econometrics analysis several preliminary statisitical steps must be taken the step included descriptive statistics, unit root, and auto regressive integrated moving average (ARIMA) model testing. The nature of time series data, it is necessary to test stationary of each individual variable. Stationary menas mean and variance between two time periods deapnd only on the distance or lag between the two time periods and not on the actual time at which co variance is computed to check the stationary ADF (augmented dickey fuler) test. It consists of regressing level and firest difference of the time series against constant The model used is as follows r = + rt j + at + rt 1 + we set the null hypothesis no stationary and alternative hypothesis is staionary and check all the variables stationary by ARIMA to make them stationary. We have finally the model SP = + 1 EXR + 2 IR + 3 IIP + 4 GFCF + 5 M 2 + 6 EXRR + In the above equation is constant and is coefficient of variables while is normally distributed error term

V. Result Analysis

The empirical result or evidence provided by the various studies mentioned in the section of review literature is shows that macroeconomics variables have strong effects on the stock market. In other words national stock market is said to be information ally inefficient with respect to most macroeconomics variables. If market is inefficient with respect to information then it has important implication both at micro and macro level. As evident in table no. 1

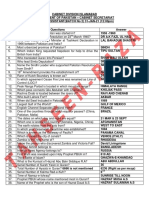

Table 1:

SP 127.6368 103.56 299.21 34.57 78.14981 0.972571 2.73852 14.12381 0.000857 88 EXCRES 3553.989 1322 14435 213 4217.17 1.163066 2.669788 20.23975 0.00004 88 EXR 39.89068 39.765 64.15 15.98 16.81541 0.019702 1.386929 9.546355 0.008453 88 GFCF 110574.6 89578.5 396551 17259 88349.3 1.241375 4.173968 27.65491 0.000001 88 IIP 105.5122 92.29 232 52.52 43.29091 1.104169 3.264533 18.13803 0.000115 88 IR 8.030114 7.89 15.42 1.05 3.050957 0.175299 2.924647 0.471524 0.789969 88 M2 400084.3 395424 1043700 69875.9 280527.7 0.411707 2.089966 5.522628 0.063209 88 WPI 81.3842 84.305 164.25 27.94 38.89997 0.274529 1.960819 5.064995 0.07946 88

mean median maximum minimum Std. Dev. Skewness Kurtosis Jarque-Bera probablity observation

As we saw in above table no.1 it can shows that all the variables are positively skewed which shows that they are asymmetrical. Kurtosis value of all variables also shows data is not normally distributed because values of kurtosis are deviated from 3. So the descriptive statistics shows that the values are not normally distributed about its mean and variance or other word we can says no

Impact of Macroeconomics Variables on Stock Prices: Emperical Evidance in Case of KSE (Karachi Stock Exchange)

101

randomness in data and therefore, being sensitive to speculation shows periodic change. This indicated that individual investor can earn considerably higher normal rate of profit from the Karachi stock market. So the results of above descriptive statistics raise the issue the inefficiency of market. The funds of market are not allocated to the productive sector of the economy. The result of unit roots test suggested that data/variables is not stationary at level except gross fixed capital formation other wise all variables are not stationary at level but they are stationary at first difference level. The value is 5% level significant of first difference level. We have used ADF (augmented dicky fuller) method used to find stationary of data as suggested in section 5 of this paper.

Table 2: Unit root test

At level -1.426297 3.311289 -1.335140 -1.647429 1.797305 -1.621632 -0.978078 -0.250161 At first difference -3.923520* -5.618675* -4.189409* -9.058792* -13.81579* -4.723153* -6.420688* -4.120358*

Variables Share price Gross fixed capital formation Foreign exchange reserve Interest rate Industrial index of production Whole sale price index (wpi) M2 (Broad Money) Foreign Exchange rate *significance level at 5%

Table 3:

Dependent Variable: SP

Coefficient 462.2149 0.983048* 0.983110* Std. Error 729.6082 0.035285 0.012342 t-Statistic 0.633511 27.85994 79.65724 Prob. 0.5281 0.0000 0.0000

Variable C AR(2) MA(1) Significance level at 5%

As evident from above table Karachi stock share prices are autoregressive of order 2 and highly significant and moving average is also very highly significance shows that prices are highly seasonal. Thus while studying the impact of macroeconomics variables lagged prices of Karachi stock exchange are also taken as independent variables.

Table 4: Dependent Variable: SP

Coefficient 50.93326 0.004599** -2.645900* -0.000134 0.151023** -1.242176* -3.59E-05* 2.411239* 0.820881* 0.989783* Std. Error 47.72902 0.002749 1.125605 9.09E-05 0.086775 0.595195 1.86E-05 0.813718 0.075523 0.001822 t-Statistic 1.067134 1.673216 -2.156000 -1.471965 1.740394 -2.087007 -1.931914 2.963239 10.86930 543.0924 Prob. 0.2893 0.0984 0.0356 0.1452 0.0858 0.0402 0.0571 0.0041 0.0000 0.0000

Variable C EXCRES EXR GFCF IIP IR M2 WPI AR(2) MA(1) *significance level at 5% **significance level at 10%

Further analysis also as reported in table no. 4 foreign exchange rate is highly significance at 4% level. It found that negative relation with KSE which shows that foreign institution investment has been significant factor in moving the stock market price as foreign investment increase reserve of foreign exchange also increases so exchange reserve is positively related with stock price at 10%

102

Suliaman D. Mohammad, Adnan Hussain and Adnan Ali

significance level. IIP are also significance at 9% level which suggested that as industrial production increase stock prices are increase. Interest rate is negatively related to stock prices as interest rate increase stock price fall down as we define section 4.1. Interest rate is significantly effect at 4% level. M2 is negatively related to stock prices and significant at 6% level.

VI. Conclusion

The finding of this research paper is that the hypothesis suggests that the changes in the macroeconomics variables cannot be used as a trading rule by investors to earn consistently abnormal profits in the stock market. Current as well as past information on the growth on the variables are fully reflected in assets prices so that investors are unable to formulate some profitable trading rule using the available information. The main objective of the present paper is to study the relationship between macroeconomics variables and Karachi stock market. We have used quarterly data of foreign exchange rate, foreign exchange reserve, gross fixed capital formation, M2, call money rate (interest rate proxy), Industrial production index and whole sales price index (proxy of inflation). The result shows that exchange rate and exchange reserve and highly affected the stock prices. We have saw that after liberalization in 1991 of stock market in Pakistan has largely increase stock prices in Pakistan. The empirical result also suggests that IR and M2 is also significant and effect negatively to stock prices. However, few variables like IIP and GFCF are neglect able effects to stock prices so result suggested that increase capital formation by firms and increase industrial production not affects stock prices.

References

[1] [2] [3] [4] [5] [6] [7] Shefali sharma and balwinder Singh (2007) share prices and macroeconomics variables in India, retrieved on Artja vijnana June 2007 Dr. Nishat (2004) Macro economics factors and Pakistan equity market retrieved by May 2004 Hasan fazal and Mehmood tariq (2001) the stock market and economy of Pakistan retrieved in PIDE (Pakistan institute of development economics) Stock Prices, Real Sector and the Causal Analysis: The Case of Pakistan (2004) retrieved by journal of management and social sciences Dr. Ayub mehar Stock market consequences of macroeconomic fundamentals (2001) retrieved in MRPA Dr. Shahbaz Akmal (2007) Stock return and inflation in case of Pakistan retrieved in Pakistan social and development review Robert D. Gay, Jr (2008) Effect Of Macroeconomic Variables On Stock Market Returns For Four Emerging Economies: Brazil, Russia, India, And China retrieved in international finance and economic journal Desislava dimitova (2005) The Relationship between Exchange Rates and Stock Prices: Studied in a Multivariate Model retrieved in issue in political economy Song zan chiou wei (1997) macroeconomics determinates of stock return and volatility retrieved in managerial economics journal Chen, N. F., Roll, R. & Ross, S. 1986. Economic forces and the stock market. Journalof Business 59(3): 83-403. Cooper, R. 1974. Efcient capital markets and the quantity theory of money. Journal of Finance 29(3): 887-908. Fama, E. F. 1981. Stock returns, real Activity, ination and money. The American Economic Review 71(4): 45-565. Jorgenson, D.W. 1967. The theory of investment behaviour. In R. Ferber, ed., Determinants of Investment Behaviour. New York: National Bureau of Economic Research

[8] [9] [10] [11] [12] [13] [14]

Impact of Macroeconomics Variables on Stock Prices: Emperical Evidance in Case of KSE (Karachi Stock Exchange) [15] [16] [17] [18] [19]

103

[20]

[21] [22] [23] [24] [25]

Shapiro, M.O. 1986.:Investment, output and the cost of capital. Brookings Papers on Economic Activity, 1: 11 l-52. Economic survey of Pakistan 2007-08 B., Chatrath, A., & Sanvicente, A. Z. (2002). Inflation, output, and stock prices: Evidence from Brazil. Journal of Applied Business Research, 18, 1, 61-76. Abdullah D. A. & Hayworth, S. C. (1983). Macroeconometrics of stock price fluctuations. Quarterly Journal of Business and Economics, 32, 1, 49-63. Diacogiannis, G. P., Tsiritakis, E. D., & Manolas, G. A. (2001). Macroeconomic factors and stock returns in a changing economic framework: The case of the Athens stock exchange. Managerial Finance, 27, 6, pg 23-41 Sharma, J.L. and R.E. Kennedy, 1977, A Comparative Analysis of Stock Price Behavior on the Bombay, London, and New York Stock Exchanges, Journal of Financial and Quantitative Analysis 17, 391-413. Lee, B.S, 1992, Causal Relationships Among Stock Returns, Interest Rates, Real Activity, and Inflation, Journal of Finance, 47, 1591-1603. Nishat. M., and M. Saghir, 1991, The stock Market and Pakistan Economy. Savings and Development 15:2. 131- 145 Dwyer, G.P. and M.S. Wallace, 1992, Cointegration and Market Efficiency, Journal of International Money & Finance, 14, 801-821. Annual reports of state bank of Pakistan (2007-08) National Accounts of Pakistan (product and Expenditure), Federal Bureau of Statistics, Statistics Division, 1988-89, 1998-1999 and 2008-09 Islamabad.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Cloze TestDocument54 pagesCloze TestSowmiyia100% (1)

- Magnus Marsden Living Islam Muslim Religious Experience-in-Pakistan s-North-West PDFDocument315 pagesMagnus Marsden Living Islam Muslim Religious Experience-in-Pakistan s-North-West PDFShah UbaidNo ratings yet

- Bank Al Habib BestDocument74 pagesBank Al Habib BestAbdul Ghafoor100% (1)

- "Political Awakening in British India": Q. Choose The Best AnswerDocument30 pages"Political Awakening in British India": Q. Choose The Best AnswerSumairaNo ratings yet

- Punjab Mein Urdu Hafiz Mehmood Khan ShiraniDocument329 pagesPunjab Mein Urdu Hafiz Mehmood Khan ShiraniIftikhar Ahmad100% (8)

- Most Repeated Questions of Current Affairs 2000 To 2024 UpdatedDocument72 pagesMost Repeated Questions of Current Affairs 2000 To 2024 UpdatedAamir KhanNo ratings yet

- Direct Action Day August 16Document8 pagesDirect Action Day August 16Fayyaz AliNo ratings yet

- Making Pakistan Bankable: SWOT AnalysisDocument21 pagesMaking Pakistan Bankable: SWOT AnalysisMuazzam BilalNo ratings yet

- 02-Cabinet Division Assistant IslamabadDocument2 pages02-Cabinet Division Assistant IslamabadAYESHA SHAZ100% (1)

- Class First YearDocument14 pagesClass First YeardodverdaaaNo ratings yet

- Class-9, Social Science, TERM-1 EXAMDocument6 pagesClass-9, Social Science, TERM-1 EXAMMayank RaiNo ratings yet

- AddresssDocument1 pageAddresssIfra38No ratings yet

- Educational Disparity in East and WestDocument46 pagesEducational Disparity in East and WestKRZ. Arpon Root HackerNo ratings yet

- Edu 365 Benchmark Brochure PDFDocument2 pagesEdu 365 Benchmark Brochure PDFapi-285011383No ratings yet

- INDIAN PARTITION AND ITS IMPACT ON INDIA - Mayurika DasDocument2 pagesINDIAN PARTITION AND ITS IMPACT ON INDIA - Mayurika DasVedant GoswamiNo ratings yet

- Madrasahs in Pakistan PDFDocument117 pagesMadrasahs in Pakistan PDFwww.alhassanain.org.english100% (1)

- 1OE28AUG23Document8 pages1OE28AUG23Ali ChemistNo ratings yet

- Constitution Crises of PakistanDocument2 pagesConstitution Crises of Pakistanmahrosh mamoon100% (2)

- Production & Operations Report on ShaPosh Textile PVT. LTDDocument7 pagesProduction & Operations Report on ShaPosh Textile PVT. LTDAsadvirkNo ratings yet

- Result SBOTS 16th BatchDocument3 pagesResult SBOTS 16th BatchHarlalNo ratings yet

- 5 Years Program Detailed Curriculum 2014 PDFDocument106 pages5 Years Program Detailed Curriculum 2014 PDFInder singhNo ratings yet

- Study of Ibrahim GroupDocument29 pagesStudy of Ibrahim GroupKamran Malik75% (4)

- Province Khyber Pakhtunkhwa: Pakistan Bait-Ul-MalDocument4 pagesProvince Khyber Pakhtunkhwa: Pakistan Bait-Ul-MalSan Lizas AirenNo ratings yet

- Class 12th Politcal Sciecne - (India Since Independence)Document557 pagesClass 12th Politcal Sciecne - (India Since Independence)himani prajapatiNo ratings yet

- ROLE OF PSYCHOLOGIST IN PAKISTANDocument10 pagesROLE OF PSYCHOLOGIST IN PAKISTANRohailNo ratings yet

- 5th Lecture Society & Social Str.Document19 pages5th Lecture Society & Social Str.Rida BatoolNo ratings yet

- 750 Prize Bond List 15 July 2019Document4 pages750 Prize Bond List 15 July 2019UzmaNo ratings yet

- 10 Previous Papers MCQS 2022 QambraniDocument15 pages10 Previous Papers MCQS 2022 QambraniATIF ULLAHNo ratings yet

- Paragraphs Notes 8Document12 pagesParagraphs Notes 8Zoobia GilaniNo ratings yet