Professional Documents

Culture Documents

Accounts

Uploaded by

Priyank AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts

Uploaded by

Priyank AgarwalCopyright:

Available Formats

Assignment-1 Ratio Analysis on BAJAJ Motors Prof:Seema dogra

Introduction

The Hero Honda story began with a simple vision the vision of a mobile and an empowered India, powered by Hero Honda. This vision was driven by Hero Hondas commitment to customer, quality and excellence, and while doing so, maintains the highest standards of ethics and societal responsibilities. Twenty five years and 25 million two wheelers later, Hero Honda is closer to fulfilling this dream. This vision is the driving force behind everything that we do at Hero Honda. We understood that the fastest way to turn that dream into a reality is by remaining focused on that vision. There were many unknowns but we kept faith, and today, Hero Honda has been the largest two wheeler company in the world for eight consecutive years. Our growth has kept compounding. The company crossed the ten million unit milestone over a 19-year span. In the new millennium, Hero Honda has scaled this to 15 million units in just five

years! In fact, during the year in review, Hero Honda sold more two wheelers than the second, third and fourth placed Two-wheeler Company put together. With Hero Honda, the domestic two wheeler market was able to show positive growth during the year in review. Without Hero Honda, the domestic market would have actually shrunk. Over the course of two and a half decades, and three successive joint venture agreements later, both partners have fine-tuned and perfected their roles as joint venture partners. What the two partners did was something quite basic. They simply stuck to their respective strengths. As one of the world's technology leaders in the automotive sector, Honda has been able to consistently provide technical know-how, design specifications and R&D innovations. This has led to the development of world class, value - for- money motorcycles and scooters for the Indian market. On its part, the Hero Group has taken on the singular and onerous responsibility of creating world-class manufacturing facilities with robust processes, building the supply chain, setting up an extensive distribution networks and providing insights into the mind of the Indian customer. Since both partners continue to focus on their respective strengths, they have been able to complement each other. In the process, Hero Honda is recognized today as one of the most successful joint ventures in the world. It is therefore no surprise that there are more Hero Honda bikes on this country's roads than the total population of some European countries put together!

HERO HONDA'S MISSION

Hero Hondas mission is to strive for synergy between technology, systems and human resources, to produce products and services that meet the quality, performance and price aspirations of its customers. At the same time maintain the highest standards of ethics and social responsibilities. This mission is what drives Hero Honda to new heights in excellence and helps the organization forge a unique and mutually beneficial relationship with all its stake holders.

HERO HONDA'S MANDATE

Hero Honda is a world leader because of its excellent manpower, proven management, extensive dealer network, efficient supply chain and worldclass products with cutting edge technology from Honda Motor Company, Japan. The teamwork and commitment are manifested in the highest level of customer satisfaction, and this goes a long way towards reinforcing its leadership status.

BOARD OF DIRECTORS

No Name of the Directors . 1 Mr. Brijmohan Lall Munjal 2 3 4 5 6 7 8 Mr. Pawan Munjal Mr. Toshiaki Nakagawa Mr. Sumihisa Fukuda Mr. Om Prakash Munjal Mr. Sunil Kant Munjal Mr. Masahiro Takedagawa Mr. Satoshi Matsuzawa (Alternate Director to Mr. Takashi Nagai) Mr. Pradeep Dinodia

Designation Chairman & Whole-time Director Managing Director & CEO Joint Managing Director Technical Director Non-executive Director Non-executive Director Non-executive Director Non-executive Director

10 Gen.(Retd.) V. P. Malik 11 Mr. Analjit Singh 12 Dr. Pritam Singh 13 Ms. Shobhana Bhartia 14. Mr. Meleveetil Damodaran Mr. Ravi Nath

Non-executive Director Non-executive Director Non-executive Director Non-executive Director Non-executive Director Non-executive Director Non-executive Director

& Independent & Independent & Independent & Independent & Independent & Independent & Independent

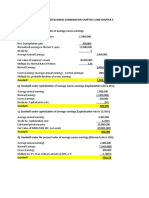

Balance sheet of Hero Honda ( Rs. in crores)

Mar '07 12 mths Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities 34.80 34.80 0.00 0.00 2,330.15 0.00 2,364.95 0.00 157.20 157.20 2,522.23 Mar '07 12 mths 1,800.63 635.10 1,165.53 189.92 1,973.87 275.58 335.25 35.26 646.09 268.04 Mar '08 12 mths 34.80 34.80 0.00 0.00 2,784.22 0.00 2,819.02 0.00 127.01 127.01 2,946.03 Mar '08 12 mths 1,938.78 782.52 1,156.26 408.49 2,566.82 317.10 297.44 130.58 745.12 196.37 Mar '09 12 mths 34.80 34.80 0.00 0.00 3,379.29 0.00 3,414.09 0.00 88.69 88.69 3,502.78 Mar '09 12 mths 2,516.27 942.56 1,573.71 120.54 3,368.75 326.83 149.94 217.49 694.26 325.80

Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances

Fixed Deposits Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities Book Value (Rs)

0.52 914.65 0.00 1,171.50 437.24 1,608.74 -694.09 0.00 2,635.23 165.59 123.70

0.51 942.00 0.00 1,455.57 499.76 1,955.33 -1,013.33 0.00 3,118.24 56.37 149.55

2.08 1,022.14 0.00 1,678.93 526.97 2,205.90 -1,183.76 0.00 3,879.24 100.54 190.33

Profit & Loss account of Hero Honda Motors( Rs. in crores) Mar '07 Mar '08 Mar '09 12 mths 12 mths 12 mths Income Sales Turnover 11,553.47 12,048.30 13,553.23 Excise Duty 1,647.52 1,703.29 1,227.85 Net Sales 9,905.95 10,345.01 12,325.38 Other Income 197.68 216.30 222.14 Stock Adjustments 3.20 -14.14 22.09 Total Income 10,106.83 10,547.17 12,569.61 Expenditure Raw Materials 7,255.66 7,465.36 8,842.14 Power & Fuel Cost 52.45 56.55 73.70 Employee Cost 353.81 383.45 448.65 Other Manufacturing Expenses 280.17 304.11 354.08 Selling and Admin Expenses 558.99 563.27 669.34 Miscellaneous Expenses 206.11 190.36 206.54 Preoperative Exp Capitalised 0.00 0.00 0.00 Total Expenses 8,707.19 8,963.10 10,594.45 Mar '07 Operating Profit PBDIT Interest PBDT 12 mths 1,201.96 1,399.64 13.76 1,385.88 Mar '08 12 mths 1,367.77 1,584.07 13.47 1,570.60 Mar '09 12 mths 1,753.02 1,975.16 13.04 1,962.12

Depreciation Other Written Off Profit Before Tax Extra-ordinary items PBT (Post Extra-ord Items) Tax Reported Net Profit Total Value Addition Preference Dividend Equity Dividend Corporate Dividend Tax Per share data (annualised) Shares in issue (lakhs) Earning Per Share (Rs) Equity Dividend (%) Book Value (Rs)

139.78 0.00 1,246.10 0.00 1,246.10 388.21 857.89 1,451.53 0.00 339.47 57.69 1,996.88 42.96 850.00 123.70

160.32 0.00 1,410.28 0.00 1,410.28 442.40 967.88 1,497.74 0.00 379.41 64.48 1,996.88 48.47 950.00 149.55

180.66 0.00 1,781.46 0.00 1,781.46 499.70 1,281.76 1,752.31 0.00 399.38 67.87 1,996.88 64.19 1,000.00 190.33

Key Financial Ratios of Hero Honda Motors( Rs. in crores) Mar '07 Mar '08 Mar '09 Investment Valuation Ratios Face Value 2.00 2.00 2.00 Dividend Per Share 17.00 19.00 20.00 Operating Profit Per Share 60.19 68.50 87.79 (Rs) Net Operating Profit Per Share 496.07 518.06 617.23 (Rs) Free Reserves Per Share (Rs) 121.70 147.55 188.33 Bonus in Equity Capital 59.98 59.98 59.98 Profitability Ratios Operating Profit Margin(%) 12.13 13.22 14.22 Profit Before Interest And Tax 10.63 11.57 12.64 Margin(%) Gross Profit Margin(%) 12.85 11.67 12.75 Cash Profit Margin(%) 9.98 9.59 10.84 Adjusted Cash Margin(%) 8.84 9.59 10.84 Net Profit Margin(%) 8.58 9.27 10.30 Adjusted Net Profit Margin(%) 7.44 9.27 10.30

Return On Capital Employed(%) Return On Net Worth(%) Adjusted Return on Net Worth(%) Return on Assets Excluding Revaluations Return on Assets Including Revaluations Return on Long Term Funds(%) Liquidity And Solvency Ratios Current Ratio Quick Ratio Debt Equity Ratio Long Term Debt Equity Ratio Debt Coverage Ratios Interest Cover Total Debt to Owners Fund Financial Charges Coverage Ratio Financial Charges Coverage Ratio Post Tax Management Efficiency Ratios Inventory Turnover Ratio Debtors Turnover Ratio Investments Turnover Ratio Fixed Assets Turnover Ratio Total Assets Turnover Ratio Asset Turnover Ratio Average Raw Material Holding Average Finished Goods Held Number of Days In Working Capital Profit & Loss Account Ratios Material Cost Composition

43.48 34.73 30.11 20.21 20.21 43.48

41.57 32.41 28.14 19.08 19.08 41.57

43.33 33.72 30.73 --43.33

0.57 0.40 0.07 0.07 711.75 0.07 93.44 73.51

0.48 0.32 0.04 0.04 648.15 0.04 108.14 84.76

0.46 0.31 0.02 0.02 664.40 0.02 142.76 113.15

36.25 40.11 47.48 9.54 3.99 6.01 8.46 2.49 -25.22

42.82 32.70 42.82 5.89 3.52 5.89 10.69 1.87 -35.26

47.53 55.10 47.53 5.34 3.36 5.34 8.27 2.16 -34.58

73.24

72.16

71.73

Imported Composition of Raw Materials Consumed Selling Distribution Cost Composition Expenses as Composition of Total Sales Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit Dividend Payout Ratio Cash Profit Earning Retention Ratio Cash Earning Retention Ratio AdjustedCash Flow Times Earnings Per Share Book Value

1.10 5.11 2.66

0.67 4.86 2.35

0.79 4.72 2.01

46.29 39.80 46.62 55.06 0.19 Mar '07 42.96 123.70

45.86 39.34 47.19 55.65 0.13 Mar '08 48.47 149.55

36.45 31.95 60.01 65.36 0.06 Mar '09 64.19 190.33

You might also like

- Hero Is Growing, Grow With Hero.Document14 pagesHero Is Growing, Grow With Hero.danishrezaNo ratings yet

- Hero Honda - Profit & Loss A/c, Balance SheetDocument14 pagesHero Honda - Profit & Loss A/c, Balance Sheetdanishreza100% (3)

- Term 1 ProjectDocument9 pagesTerm 1 ProjectNiraj ThakurNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- A Mini Project Report On Fiancial ManagementDocument15 pagesA Mini Project Report On Fiancial ManagementAmit SharmaNo ratings yet

- Financial Reporting and Analysis ProjectDocument15 pagesFinancial Reporting and Analysis Projectsonar_neel100% (1)

- Hero Honda Motors LTD: VisionDocument9 pagesHero Honda Motors LTD: VisionHarsha KanhaiNo ratings yet

- Here 2013-14Document180 pagesHere 2013-14AnneJacinthNo ratings yet

- DLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverDocument15 pagesDLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverShashi ShekharNo ratings yet

- B. Economics ProjectDocument16 pagesB. Economics Projectusman faisalNo ratings yet

- Annual Report 2014-15Document102 pagesAnnual Report 2014-15deepa rahejaNo ratings yet

- Ar M&MDocument95 pagesAr M&MDaksh AnandNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata Motorssadafkhan21No ratings yet

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriNo ratings yet

- NFL Annual Report 2011-2012Document108 pagesNFL Annual Report 2011-2012prabhjotbhangalNo ratings yet

- Synopsis For The Project of BbaDocument7 pagesSynopsis For The Project of BbaDhruv GandhiNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Ratio Analysis Tata MotorsDocument14 pagesRatio Analysis Tata MotorsvinayputhurNo ratings yet

- Financial Statement Analysis Lenovo Final 1Document18 pagesFinancial Statement Analysis Lenovo Final 1api-32197850550% (2)

- Fervensiness Sutnga ME Research AssignmentDocument11 pagesFervensiness Sutnga ME Research AssignmentFerven SutngaNo ratings yet

- HERO MOTOCORP LTD PPT Dharm VeerDocument15 pagesHERO MOTOCORP LTD PPT Dharm Veerdharm veer100% (1)

- Fin Analysis - Tvs Motor CompanyDocument16 pagesFin Analysis - Tvs Motor Companygarconfrancais06No ratings yet

- Sarfraz FM ToyotaDocument25 pagesSarfraz FM Toyotamsamib4uNo ratings yet

- 3c Tata MotorsDocument13 pages3c Tata MotorsManjunath BaraddiNo ratings yet

- Itc LTD Financial Analysis: Group 4Document20 pagesItc LTD Financial Analysis: Group 4Kanav ChaudharyNo ratings yet

- Balance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Document22 pagesBalance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Santhiya ArivazhaganNo ratings yet

- Group 23 FAC102 Final ProjectDocument19 pagesGroup 23 FAC102 Final ProjectrajeshNo ratings yet

- Pedilite Industries Desk ReportDocument21 pagesPedilite Industries Desk ReportAniket YadavNo ratings yet

- Axis BankDocument31 pagesAxis BankPrathap AnNo ratings yet

- Bharti Airtel Annual Report 2012 PDFDocument240 pagesBharti Airtel Annual Report 2012 PDFnikhilcsitmNo ratings yet

- DeutscheBank EquityIPO v1.1Document9 pagesDeutscheBank EquityIPO v1.1Abinash BeheraNo ratings yet

- Fie M Industries LimitedDocument4 pagesFie M Industries LimitedDavuluri OmprakashNo ratings yet

- AR2008Document98 pagesAR2008Joko YanNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Introduction L&T FinalDocument31 pagesIntroduction L&T Finaltushar kumarNo ratings yet

- Bharti Airtel Annual Report Full 2010-2011Document164 pagesBharti Airtel Annual Report Full 2010-2011Sidharth ChopraNo ratings yet

- Company Profile: Hero Motocorp LimitedDocument25 pagesCompany Profile: Hero Motocorp LimitedjupinderNo ratings yet

- Nishat Mills Ratio AnalysisDocument6 pagesNishat Mills Ratio AnalysisBabar KhanNo ratings yet

- Live Project AccountsDocument20 pagesLive Project AccountsPranadeepa Majumder SarkarNo ratings yet

- Honda Atlas Cars AnalysisDocument14 pagesHonda Atlas Cars AnalysisPrince WamiqNo ratings yet

- Final Exam Financial ManagementDocument2 pagesFinal Exam Financial ManagementAnonymous 0PsfK9wKNo ratings yet

- Apollo Tyres ProjectDocument10 pagesApollo Tyres ProjectChetanNo ratings yet

- EDGR Audited Results For The 52 Weeks To 04 Jan 14Document1 pageEDGR Audited Results For The 52 Weeks To 04 Jan 14Business Daily ZimbabweNo ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- Final Project of FA & R - IIDocument13 pagesFinal Project of FA & R - IIAbdul RafayNo ratings yet

- Cost Accounting ProjectDocument14 pagesCost Accounting Projectdipesh bajajNo ratings yet

- Tata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Document46 pagesTata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Arpkin_loveNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- AFM Project - Group5 - TATA MotorsDocument16 pagesAFM Project - Group5 - TATA MotorsAnkit MukhopadhyayNo ratings yet

- MAC Project - Group 6Document26 pagesMAC Project - Group 6Vatsal SharmaNo ratings yet

- Hero Honda A SWOT AnalysisDocument3 pagesHero Honda A SWOT AnalysisKarthik VaratharajanNo ratings yet

- HYNDAI COMPANY ANALYSYS-11-1 (FinalDocument25 pagesHYNDAI COMPANY ANALYSYS-11-1 (FinalShraddha MoreNo ratings yet

- Balance Sheet of Titan IndustriesDocument24 pagesBalance Sheet of Titan IndustriesAkanksha NandaNo ratings yet

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Fauji CementDocument34 pagesFauji Cementshani2750% (2)

- The Big Shift in IT Leadership: How Great CIOs Leverage the Power of Technology for Strategic Business Growth in the Customer-Centric EconomyFrom EverandThe Big Shift in IT Leadership: How Great CIOs Leverage the Power of Technology for Strategic Business Growth in the Customer-Centric EconomyRating: 5 out of 5 stars5/5 (1)

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Monthly Operating Report: United States Bankruptcy CourtDocument23 pagesMonthly Operating Report: United States Bankruptcy CourtsperlingreichNo ratings yet

- Accounting MemeDocument2 pagesAccounting MemeIan Jay DescutidoNo ratings yet

- Blaine Kitchenware Inc.Document13 pagesBlaine Kitchenware Inc.vishitj100% (4)

- Homework Notes Unit 1 MBA 615Document10 pagesHomework Notes Unit 1 MBA 615Kevin NyasogoNo ratings yet

- 157 28235 EA419 2012 1 2 1 Chapter04Document40 pages157 28235 EA419 2012 1 2 1 Chapter04Agus WijayaNo ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Volume 3 Answers Volume 3 AnswersDocument105 pagesVolume 3 Answers Volume 3 AnswersBrice AldanaNo ratings yet

- Principles of Marketing (First Quarter)Document5 pagesPrinciples of Marketing (First Quarter)rosellerNo ratings yet

- Candlestick Exam (30marks)Document35 pagesCandlestick Exam (30marks)Justine JoseNo ratings yet

- Intermediate Financial Accounting I&II Course OutlineDocument6 pagesIntermediate Financial Accounting I&II Course OutlineTalila Sida100% (2)

- Hari AchuthanDocument5 pagesHari AchuthanNarenNo ratings yet

- Hedge Funds: Approaches To Diversification: Firevision, LLC & Professor Robert McdonaldDocument50 pagesHedge Funds: Approaches To Diversification: Firevision, LLC & Professor Robert McdonaldDenis CruzeNo ratings yet

- Difference Between GAAP and IFRSDocument8 pagesDifference Between GAAP and IFRSNoor Mymoon100% (1)

- Cash Flow and Financial PlanningDocument64 pagesCash Flow and Financial PlanningAmjad J AliNo ratings yet

- BondDocument23 pagesBondVishal AhujaNo ratings yet

- CH 14 - Translation SolutionDocument3 pagesCH 14 - Translation SolutionJosua PranataNo ratings yet

- Lewis Mutswatiwa...Document69 pagesLewis Mutswatiwa...LEWIS MUTSWATIWANo ratings yet

- Sbi PDFDocument4 pagesSbi PDFbhavanaNo ratings yet

- IT Sector ReviewDocument16 pagesIT Sector ReviewPratik RambhiaNo ratings yet

- Report of Internship Hedge PDFDocument56 pagesReport of Internship Hedge PDFGopi Krishnan.n100% (1)

- Stock Valuation: Dr. C. Bulent AybarDocument35 pagesStock Valuation: Dr. C. Bulent AybarkeithNo ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Financial Analysis of RelianceDocument51 pagesFinancial Analysis of Reliancekkccommerceproject100% (3)

- FM For CA Intermediate 6-11-20Document45 pagesFM For CA Intermediate 6-11-20Lakshay Singh BhandariNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- TB - Chapter02 Financial Statements, Cash Flows and Taxes PDFDocument67 pagesTB - Chapter02 Financial Statements, Cash Flows and Taxes PDFJennifer RasonabeNo ratings yet

- Options Trading Strategies: A Guide For Beginners: Elvin MirzayevDocument4 pagesOptions Trading Strategies: A Guide For Beginners: Elvin MirzayevJonhmark AniñonNo ratings yet

- Intl Legal Guide To Corp Recovery & InsolvencyDocument257 pagesIntl Legal Guide To Corp Recovery & InsolvencyVJ FernandezNo ratings yet

- Suppose You Created A Two Stock Portfolio by Investing 50 000 IDocument1 pageSuppose You Created A Two Stock Portfolio by Investing 50 000 IAmit PandeyNo ratings yet

- Case 15 Pacific Healthcare - B - Student - 6th EditionDocument1 pageCase 15 Pacific Healthcare - B - Student - 6th EditionAhmed MahmoudNo ratings yet