Professional Documents

Culture Documents

Bank Alfalah LTD: Agriculture Products/ Schemes Offered by The Bank

Uploaded by

muhammada86Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Alfalah LTD: Agriculture Products/ Schemes Offered by The Bank

Uploaded by

muhammada86Copyright:

Available Formats

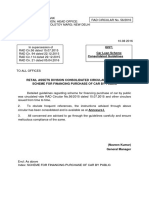

BANK ALFALAH LTD

Agriculture Products/ Schemes Offered by the Bank

Sr. No Name of Product/ scheme Purpose Salient Feature Terms & Conditions Tenure of Loan Markup Maximum Documents required Loan limit

Alfalah Paidawari Zarie Sahulat

Financing needs of agricultural producers, marketers, processor, exporters

>>The applicant shall be a genuine farmer, that is, individual/entities engaged in producing, The facility shall be short-term demand finance and processing, storage and marketing of farming classified as production loan. The principal and mark up products and those engaged in cattle, poultry and in short-term finance are repayable in lump sum within fish farming etc two months of the harvest of the crop for which the >>The applicants name shall appear in the finance is allowed. Generally, the finance provided Revenue records under farm credit extends for six to eight months >>The applicant shall not be a defaulter of the depending upon duration of each crop. However, in banking system case of sugarcane crop the term finance may be for one >>The applicant shall be able to produce proper 3-5 Years year for spring (February-March) plantation, the securities/sureties/pass book >> harvesting of which starts in October and continues upto The applicant (individual and /or business entity) February next. The duration of autumn sugarcane shall be a Pakistani/registered in Pakistan (planted in September-October) is 18 months. The >> The minimum and maximum age of the recovery of principal and mark up is usually required in individual borrower shall be 18 years and 65 lump sum, but repayment in installment is also years respectively. However, maximum age shall permissible depending upon cash flow pattern of the not exceed 70 years at the time of full adjustment project. of the liability. Applicants of age higher than the prescribed limit not exceeding age of 80 years shall provide two guarantees of creditworthy perso

>> CNIC Copy >> Photograph >> Pass Book As per >> Khasra Gardawri requirement >> Documentation of the regarding leased in 14-15% business and land (if any) cash flow >> Two Personal requirements Guarantees >> Other as per desire

The credit extended under the revolving scheme provides facility to the beneficiaries for any number of withdrawals and repayments (multiple operations) within the limit for a period of three years with once a year clean up from date of first withdrawal, with the consent Working capital needs of Alfalah Musalsal Zarie of the borrower. This scheme provides the much agricultural producers, marketers, Same as above Sahulat needed flexibility to the farmer in choosing the processor, exporters appropriate time to avail the loan or to repay the loan and reduce the mark-up burden besides being in a position to draw at any time under this scheme, for meeting his urgent credit requirements without any fresh documents at the time of withdrawals or renewals.

3 Years

14-15%

Same as above

Same as above

Alfalah Tractor and Transport Zarie Sahulat

Purchase of tractors, trolleys, pickups, motorcycles, trucks, refrigerator van, mini truck, transport machinery, country boat or other such items

This facility shall be a medium term demand finance facility spreading over 3 to 5 years repayable in monthly, quarterly or half yearly installments as per the Same as above borrowers liquidity position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements.

3-5 Years

14-15%

Same as above

Same as above

Alfalah Machinery & Equipment Zarie Sahulat

To finance machinery and equipment, such as combine harvester, thresher, picker,digger, trolley, planter, sowing drill, cultivator, plough, power tiller, harrow, cane crusher, tobacco curing equipment, bio gas unit, sulphuric acid generator, effective microbes technology (EMT) etc.

The facility shall be a medium term demand finance facility repayable in installments spreading over 3 to 5 years repayable in monthly, quarterly or half yearly installments as per the borrowers liquidity position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements. Repayment period less than 3 years is also possible depending upon cash flow position of the borrower or his option for early repayment. Mark up is to be recovered along with installments according to amortization schedule.

Same as above

3-5 Years

14-15%

Same as above

Same as above

Alfalah Aabpaash Zarie Sahulat

To meet irrigation water needs of the farmers for purchase and installation and electric charges of tube wells, turbines, lift pumps, electrical installation including cost of power lines and transformer, sprinkler, trickles and drip irrigation system etc.

This facility could be a short term facility for working capital requirements for operation, maintenance, electricity charges as well as medium term demand finance facility spreading over 3 to 5 years repayable in Same as above monthly, quarterly or half yearly installments as per the borrowers cash flow position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements.

3-5 Years

14-15%

Same as above

Same as above

>>The applicant shall be a genuine farmer, that is, individual/entities engaged in producing, processing, storage and marketing of farming products and those engaged in cattle, poultry and fish farming etc >>The applicants name shall appear in the Land development and Revenue records improvement, land leveling laser This facility shall be a medium term demand finance >>The applicant shall not be a defaulter of the leveling, clearance of jungle, farm facility spreading over 3 to 5 years repayable in monthly, banking system field layout, terracing, contouring, Alfalah Islah-e-Araazi quarterly or half yearly installments as per the >>The applicant shall be able to produce proper soil reclamation, embankment, 3-5 Years Zarie Sahulat securities/sureties/pass book >> land formation, bund construction borrowers cash flow position. Mark up is to be of mini dam, check karez, water recovered along with principal according to amortization The applicant (individual and /or business entity) plan as per approved repayment arrangements. shall be a Pakistani/registered in Pakistan reservoir, water catchments for rain fed areas, water course >> The minimum and maximum age of the individual borrower shall be 18 years and 65 years respectively. However, maximum age shall not exceed 70 years at the time of full adjustment of the liability. Applicants of age higher than the prescribed limit not exceeding age of 80 years shall provide two guarantees of creditworthy perso

As per requirement of the Same as above 14-15% business and cash flow requirements

Running finance facility as well as demand finance facility may be provided under this scheme. Running Working capital and fixed Finance facility is to be cleaned up once in a year and investment needs for broiler and markup is to be recovered on a quarterly basis or as per layer production, breeder flock, Alfalah Poultry Zarie approved arrangement.The medium term demand GP flock, hatchery, product Same as above Sahulat finance facility spreading over 3 to 5 years is repayable processing, packing, in monthly, quarterly or half yearly installments as per transportation, storage, compound the borrowers cash flow position. Mark up is to be feed making etc. recovered along with principal according to amortization plan as per approved repayment arrangements.

3-5 Years

14-15%

Same as above

Alfalah Dairy & Livestock Zarie Sahulat

Working capital and fixed investment financing of dairy and milk animals, feed lot and fattening station structure and equipment, livestock farm structure and equipment, fattening of animal, milk chilling plant, milk plant, cold storage, construction of sheds for animal, opening of private veterinary clinics (veterinary equipment), opening of veterinary store, milk plant and other eligible items

Running finance facility as well as demand finance facility may be provided under this scheme. Running Finance facility is to be cleaned up once in a year and markup is to be recovered on a quarterly basis or as per approved arrangement. The medium term demand Same as above finance facility spreading over 1 to 5 years is repayable in monthly, quarterly or half yearly installments as per the borrowers cash flow position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements

3-5 Years

14-15%

Same as above

Same as above

Inland:Fish seed and feed, manure charges, running charges of tube well pumps, construction excavation, expansion and rehabilitation of pond, installation of tube wells, water channels, Alfalah Fisheries Zarie fencing, boats, net twine, rope, Sahulat fish yards, cold storage etc Marine: Fuel, ration, and ice for marine fisheries, engine and spare parts, new boat and trawler, boat equipment etc.

Running finance facility as well as demand finance facility may be provided under this scheme. Running Finance facility is to be cleaned up once in a year and markup is to be recovered on a quarterly basis or as per approved arrangement. The medium term demand Same as above finance facility spreading over 1 to 5 years is repayable in monthly, quarterly or half yearly installments as per the borrowers cash flow position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements

3-5 Years

14-15%

Same as above

Same as above

10

Running finance facility as well as demand finance facility may be provided under this scheme. Running Finance facility is to be cleaned up once in a year and Construction of cold storage, markup is to be recovered on a quarterly basis or as per godown, bins, silos, structure for Alfalah Silos/Storage approved arrangement The medium term demand storage of wheat, steel/metal Same as above Zarie Sahulat capsules, hire charges for storage finance facility spreading over 5 to 7 years is repayable in monthly, quarterly or half yearly installments as per of raw agricultural product etc. the borrowers cash flow position. Mark up is to be recovered along with principal according to amortization plan as per approved repayment arrangements

3-5 Years

14-15%

Same as above

Same as above

11

Alfalah Marketing Zarie Sahulat

>>The applicant shall be a genuine farmer, that is, individual/entities engaged in producing, processing, storage and marketing of farming products and those engaged in cattle, poultry and fish farming etc Running finance facility as well as pre shipment or post >>The applicants name shall appear in the shipment facility may be provided under this scheme. Revenue records Running Finance facility is to be cleaned up once in a >>The applicant shall not be a defaulter of the year and markup is to be recovered on a quarterly basis To facilitate the marketing, banking system or as per approved arrangement. Pre shipment or packing, processing of the >>The applicant shall be able to produce proper produce and also for export of 3-5 Years post shipment financing from Banks own sources may securities/sureties/pass book >> cotton, cotton yarn, mutton, beef, be provided without any refinance from State Bank of The applicant (individual and /or business entity) fruits, vegetables etc Pakistan. The facility shall be subject to all other terms shall be a Pakistani/registered in Pakistan and conditions as observed by the Bank under this >> The minimum and maximum age of the category of financing in other items of export/import individual borrower shall be 18 years and 65 facility. years respectively. However, maximum age shall not exceed 70 years at the time of full adjustment of the liability. Applicants of age higher than the prescribed limit not exceeding age of 80 years shall provide two guarantees of creditworthy perso

As per requirement of the Same as above 14-15% business and cash flow requirements

12

For setting up seeds processing units, installation of fruit and vegetables machinery, milk chilling Alfalah Agri Industrial units, milk plants, polishing, Zarie Sahulat grading, packaging of fruits and vegetables, cotton ginning factories under BMR, compound feed mills etc.

Running finance facility as well as demand finance facility may be provided under this scheme. Running Finance facility is to be cleaned up once in a year and markup is to be recovered on a quarterly basis or as per approved arrangement. Demand finance Same as above facility shall be for 3-5 years repayable on monthly, quarterly, half yearly installments (principal plus markup) according to amortization plan as per cash flow or choice of the borrower after availing the grace period where approved. The facility is mainly for finance for crop production, seasonal inputs in case of sugarcane, cotton and rice, and for cultivation and marketing of tobacco crop. This facility is allowed to growers under arrangement with agri processors/procurement agencies/companies with whom they are registered to supply their produce or have a regular contract or agreement to this effect.

3-5 Years

14-15%

Same as above

Same as above

13

Alfalah Bills / Guarantees Zarie Sahulat

Financing against agri produce procurement receipt, purchase of bills, deferred payment leaf vouchers issued by tobacco companies, continuing guarantees etc.

Same as above

3-5 Years

14-15%

Same as above

Same as above

14

Alfalah Lease Zarie Sahulat

For leasing tractors, tube wells, quarterly or half yearly installments as per the farm machinery, plants, equipment borrowers cash flow position. Rent is to be recovered etc

The facility is a medium term demand finance facility spreading over 3 to 5 years repayable in monthly,

Same as above

3-5 Years

14-15%

Same as above

Same as above

along with principal according to amortization plan as per approved repayment arrangements.

You might also like

- CFP Introduction To Financial Planning Study Notes SampleDocument42 pagesCFP Introduction To Financial Planning Study Notes SampleMeenakshi67% (3)

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- Chapter 6 Notes To Financial StatementsDocument109 pagesChapter 6 Notes To Financial StatementsLede Ann Calipus Yap100% (2)

- SEEP FRAME Tool 2.07Document46 pagesSEEP FRAME Tool 2.07PiyushNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Mathematics of Finance - Rupinder Sekhon and Roberta BloomDocument45 pagesMathematics of Finance - Rupinder Sekhon and Roberta BloomYeong Zi YingNo ratings yet

- Amortization and Sinking FundsDocument46 pagesAmortization and Sinking FundssaneconNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- Bank LoansDocument54 pagesBank LoansMark Alvin LandichoNo ratings yet

- Financial Inclusion & Inclusive Growth of Rural Population.Document28 pagesFinancial Inclusion & Inclusive Growth of Rural Population.gokulNo ratings yet

- Agri LoanDocument3 pagesAgri LoanJunaid TararNo ratings yet

- CROP Loan: B. Post-Harvest ExpensesDocument9 pagesCROP Loan: B. Post-Harvest ExpensesRuchi ChaudharyNo ratings yet

- KCC (PNB Kisan Credit Card Scheme) 261218Document2 pagesKCC (PNB Kisan Credit Card Scheme) 261218Ramanpreet SinghNo ratings yet

- HOSUDEV Task-For-Module-4Document6 pagesHOSUDEV Task-For-Module-4MARY JOYCE ENDIQUENo ratings yet

- Rural Loan PolicyDocument3 pagesRural Loan PolicyVivek AnandNo ratings yet

- GPF For Participants Sept 22Document37 pagesGPF For Participants Sept 22ravin thapaNo ratings yet

- Land Bank of The PhilippinesDocument2 pagesLand Bank of The PhilippinesLiza SebastianNo ratings yet

- KCC CompleteDocument94 pagesKCC CompleteRonit HrishikeshNo ratings yet

- 1 CKCC MC 2015-01Document12 pages1 CKCC MC 2015-01suyashNo ratings yet

- Faysal Home FinanceDocument7 pagesFaysal Home FinanceArsalan Wasiq TarrerNo ratings yet

- Pagibig Loan Fill in Form2Document2 pagesPagibig Loan Fill in Form2froilan1010100% (1)

- Form HBL4Document3 pagesForm HBL4klerinetNo ratings yet

- AgLend Lesson6Document11 pagesAgLend Lesson6asdfgh12344321No ratings yet

- Pmfme Loan PolicyDocument7 pagesPmfme Loan PolicyHarika VenuNo ratings yet

- Pedrrmem: Bcc:Br:103/433Document41 pagesPedrrmem: Bcc:Br:103/433RAJANo ratings yet

- .In Rdocs Notification PDFs CRB5100512KCDocument12 pages.In Rdocs Notification PDFs CRB5100512KCDeep Prakash YadavNo ratings yet

- Public Provident Fund (PPF)Document3 pagesPublic Provident Fund (PPF)rupesh_kanabar1604100% (2)

- Crb5100512an PDFDocument11 pagesCrb5100512an PDFanand sahuNo ratings yet

- Renewal or Enhancement of DBGB Kisan Credit Card 13-22Document5 pagesRenewal or Enhancement of DBGB Kisan Credit Card 13-22Amit GuptaNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- Salary and Medal New Form2Document3 pagesSalary and Medal New Form2diamajolu gaygons100% (1)

- Shadabi Plan: Salient FeaturesDocument12 pagesShadabi Plan: Salient FeaturesAsad MahmoodNo ratings yet

- Kisan Credit Card (KCC) and Crop Loaning SystemDocument17 pagesKisan Credit Card (KCC) and Crop Loaning SystemRajivNo ratings yet

- Agriculture OEDocument51 pagesAgriculture OEKerey OPNo ratings yet

- Farm Ownership Loan Readiness ChecklistDocument5 pagesFarm Ownership Loan Readiness ChecklistJoshNo ratings yet

- Submitted To Submitted To DR - Liaqat Ali Amardeep Singh 18421078Document38 pagesSubmitted To Submitted To DR - Liaqat Ali Amardeep Singh 18421078Surbhi AroraNo ratings yet

- Loan and Credit FacilityDocument10 pagesLoan and Credit FacilityÅmmüÞärįĦãrNo ratings yet

- LIC Loan ApplicationDocument9 pagesLIC Loan ApplicationnelajaNo ratings yet

- Post Office Small Savings Ready ReckonerDocument1 pagePost Office Small Savings Ready Reckonerabhinav0115No ratings yet

- SLF001 MultiPurposeLoanApplicationForm (MPLAF) V01Document2 pagesSLF001 MultiPurposeLoanApplicationForm (MPLAF) V01mitzi_0350% (2)

- Rti 10 Adv SchemeDocument35 pagesRti 10 Adv SchemeNasir AhmedNo ratings yet

- FssaiDocument4 pagesFssaiO4 Xll 'E' Aman AshishNo ratings yet

- 2016 PROGRAMS - 1st QuarterDocument11 pages2016 PROGRAMS - 1st QuarterJWNo ratings yet

- Syndicate Kisan Credit Card (S.K.C.C) : Head Office: Manipal - 576 104, India Priority Sector Credit DepartmentDocument3 pagesSyndicate Kisan Credit Card (S.K.C.C) : Head Office: Manipal - 576 104, India Priority Sector Credit DepartmentSagarNo ratings yet

- Updates On Revised Kisan Credit Card (KCC) SchemeDocument10 pagesUpdates On Revised Kisan Credit Card (KCC) SchemeSelvaraj VillyNo ratings yet

- Sbi ProjectDocument7 pagesSbi ProjectSumeet KambleNo ratings yet

- FLAg Checklist of Requirement2Document1 pageFLAg Checklist of Requirement2elton jay amilaNo ratings yet

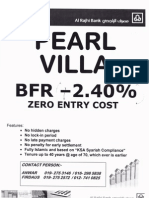

- Al Rajhi BankDocument4 pagesAl Rajhi BankSimon LeeNo ratings yet

- Clean OverdraftDocument8 pagesClean OverdraftfatincheguNo ratings yet

- FLS010 HDMF MPL Application Form Aug 09 - 092809Document2 pagesFLS010 HDMF MPL Application Form Aug 09 - 092809Amz Sau Bon100% (1)

- G.O.MS - No. 218Document5 pagesG.O.MS - No. 218younusbasha143No ratings yet

- Notes of Consumer FinanceDocument8 pagesNotes of Consumer Financemuneebmateen01No ratings yet

- PSL3 - Agriculture Schemes - Part 2Document16 pagesPSL3 - Agriculture Schemes - Part 2svmkishoreNo ratings yet

- TNAU Agritech Portal - Crop InsuranceDocument5 pagesTNAU Agritech Portal - Crop InsurancegunasridharanNo ratings yet

- Revised Scheme For Issue of Kisan Credit Card (KCC)Document15 pagesRevised Scheme For Issue of Kisan Credit Card (KCC)manindersingh949No ratings yet

- Srinath 123Document69 pagesSrinath 123hullur_srinath62633No ratings yet

- What Is The Differences Between GPF EPFDocument7 pagesWhat Is The Differences Between GPF EPFsanthoshkumark20026997No ratings yet

- AP G.o.ms - No. 218Document5 pagesAP G.o.ms - No. 218younusbasha143No ratings yet

- AFFP Naga RoadshowDocument19 pagesAFFP Naga RoadshowMabelGaviolaVallenaNo ratings yet

- Kisan All-Purpose Term LoanDocument2 pagesKisan All-Purpose Term LoanvanhussianNo ratings yet

- Intermediate Accounting 2 Week 2 Lecture AY 2020-2021 Chapter 2:notes PayableDocument5 pagesIntermediate Accounting 2 Week 2 Lecture AY 2020-2021 Chapter 2:notes PayabledeeznutsNo ratings yet

- Account Management and Loss Allowance Guidance Checklist Pub CH A CCL Acct MGMT Loss Allowance ChecklistDocument5 pagesAccount Management and Loss Allowance Guidance Checklist Pub CH A CCL Acct MGMT Loss Allowance ChecklistHelpin HandNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- Quiz 3Document15 pagesQuiz 3help215No ratings yet

- FI AA 04 PresentationDocument106 pagesFI AA 04 PresentationZlatilNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Intangible Assets IAS 38Document32 pagesIntangible Assets IAS 38waqas724No ratings yet

- Periodic Payments: AmortizationDocument4 pagesPeriodic Payments: AmortizationRutvi Shah RathiNo ratings yet

- Fixed AssetsDocument10 pagesFixed AssetsMikka JoyNo ratings yet

- 2100 Solutions - CH2Document60 pages2100 Solutions - CH2Trong DinhNo ratings yet

- Share Based Payments Share Option & Sars Resa 1 PB Aud: ProblemDocument12 pagesShare Based Payments Share Option & Sars Resa 1 PB Aud: Problemsino akoNo ratings yet

- 14 - Asset Acquisitions Case 2 - Equipment PurchaseDocument3 pages14 - Asset Acquisitions Case 2 - Equipment PurchaseQuan Qa0% (1)

- Accounting Standard 26Document16 pagesAccounting Standard 26Melissa ArnoldNo ratings yet

- Chapter 7 Intangible Assets Exercises T3AY2021Document4 pagesChapter 7 Intangible Assets Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Table-Initial MeasurementDocument2 pagesTable-Initial MeasurementEla Gloria MolarNo ratings yet

- CA Final Audit Sample MCQs by ICAIDocument53 pagesCA Final Audit Sample MCQs by ICAIAditya HalderNo ratings yet

- Ver - 2.0 Amortization Calculator-MPMG FinancingDocument6 pagesVer - 2.0 Amortization Calculator-MPMG FinancingMuhammad Rajeel Gil KhanNo ratings yet

- Audit of IntangiblesDocument7 pagesAudit of IntangiblesAireese33% (3)

- ITAL PINAS Audited Financial Statement 2015 ItalpinasDocument93 pagesITAL PINAS Audited Financial Statement 2015 ItalpinasDaves VestNo ratings yet

- Pentagon Password and ReportDocument86 pagesPentagon Password and ReportmichaelNo ratings yet

- QUIZ Week 1Document2 pagesQUIZ Week 1hopefuldonorNo ratings yet

- IFRS 16 Handbook Lease Accounting - 1Document23 pagesIFRS 16 Handbook Lease Accounting - 1Salam NaddafNo ratings yet

- Kabboudi: Problem NotesDocument7 pagesKabboudi: Problem NotesamanittaNo ratings yet