Professional Documents

Culture Documents

KPI

Uploaded by

Bujji RaviOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KPI

Uploaded by

Bujji RaviCopyright:

Available Formats

KPI - Key Performance Indicators KPI tells the performance of a network on a daily/weekly/monthly basis, which helps to improve the

network, so that operator & customer both enjoys the service at its most. Key Performance Indicators for Telecom Industry are:Systems and Network Performance Analysis / Capacity Planning

Availability Grade of service Service life of equipment Bit error ratio (data, bits & elements transfer) Bit rate (data, bits and elements transfer) Downtime / Time out of service Call completion ratio Cost of support systems Cost of operational systems Average call length Analysis of ASR routes Network traffic, congestion Idle time on network Dropped calls

Quality / Usage (Airtime): Analysis of the volume of successful calls

Mean Opinion Score Service Duration of calls Billed amount on each call

Coverage

% of land covered with services % of population covered with services Average land unavailable to services Average population unavailable to services Access to customer service

Faults and complains (Trouble tickets analysis)

% of open and level of escalation priority required % closed Mean time to resolved Work in progress Customer service level statistics

Customer Analysis

Customer segmentation Analysis of subscriptions Top N customers Churn (No. of Subscriber who stopped using Services or left particular network)

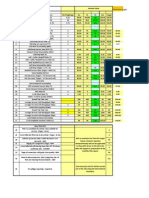

ASR (Answer Seizure Ratio) - Number of successfully answered calls divided by the total number of calls attempted (seizures) multiplied by 100. (Answer / Seizure) * 100 = Answer Seizure Ratio. Standard Value = 40% - 45%. MOU (Minutes of Usage) per Subscriber It calculates the Total Minutes used in a Network divided by the number of subscribers. CCR (Call Completion Ratio) - Total no of calls completed / Total no of calls attempted * 100%. Higher the ratio is better. Standard Value > 98%. LUSR (Location Update Success Rate) Its a ratio of no of times mobiles update its location successfully to the no of times mobiles request network for location update. LUSR = (Location Update Success / Location Update Request)*100. Standard Value >= 98%. PSR (Paging Success Rate) Its a ratio of no of times network successfully find the mobiles to the no of times network tries to locate the mobiles within its area. PSR = (No of Network Paging Response / No of Network Paging Attempts)*100. Standard Value >= 92%. 100 KPIs for Mobile Telecom Operators 45 Votes Telecommunication service industry around the world is facing significant challenges from competition, technological revamps at very short frequencies and never-ending customer demands. In full-grown markets, the preferred path to growth is that of acquisition of competitors or alliance with newer partners. On the other hand, promising markets with explosive demand provide vast opportunities for the players. Today, telecommunication industry is no longer technology centric, but it revolves more around customer relationship. Customer satisfaction and marketing intelligence with innovative promotional schemes and advanced technology are the drivers of business. Also, cutthroat competition and mammoth investments in the telecom industry churn away profit margins and make intelligent decision making critical. And how do CXOs make decisions? Through KPI monitoring, control and analysis. As in the rest of the industries, a performance indicator or key performance indicator (KPI) is a measure of performance. Such measures are commonly used to help an organization define and evaluate how successful it is, typically in terms of making progress towards its long-term organizational goals. KPIs can be specified by answering the question, What is really important to different stakeholders?. KPIs may be monitored using Business Intelligence techniques to assess the present state of the business and to assist in prescribing a course of action. The act of monitoring KPIs in real-time is known as business activity monitoring (BAM). KPIs are frequently used to value difficult to measure activities such as the benefits of leadership development, engagement, service, and satisfaction.

My friend Pareek has just sent me a set of 100 KPIs for telecom operators. He includes some illustrative figures in the brackets that show indicative values for an Asian Operator we will not disclose. Hope it helps. Best regards, CVA.

100 KPIs for Telecom Operators (Mobile Network Operators) Subscribers (Subs) 1. 2. 3. 4. Usage 1. Minutes of Usage (MOU) 1. MOU Segmentation: Prepaid (400) , Postpaid (1000), Aggregate (420) 2. MOU Segmentation: Incoming (220), Outgoing (200), Aggregate (420) 2. Number of Outgoing SMS Per Sub Per Month (30) 3. Minutes Carried Per Month (MON) (50 billion) 4. % Airtime Capacity Utilization 5. Minutes Per Site 6. Number of Calls 7. Number of Calls per Subscriber 8. Average Call Duration 9. Roaming Minutes 10. International Roaming Minutes 11. International Roaming Minutes Segmentation: Incoming (64%), Outgoing (36%) Revenue 1. ARPU ( Average Revenue Per User) 1. ARPU Segmentation: Voice ($4), Data ($8), Aggregate ($4) 2. ARPU Segmentation: Prepaid ($3), Postpaid ($11), Blended ( $4) 2. ARPM (Average Revenue Per Minute) 1. ARPM Segmentation: Prepaid ($0.15), Postpaid ($0.022), Blended ($0.02 ) 3. Average Revenue Per Call 4. Average Revenue Per Cell Site 5. Average Revenue Per Employee 6. Revenue Breakup (%) 1. Access: Connection, Subscription (15%) 2. Wireless Voice (55%) 3. Data (5%) 4. Internet (5%) 5. Interconnect (10%) 6. Roaming (10%), International Roaming Revenue (1%) 7. International Roaming Revenue Segmentation: Postpaid (99%) Total Subs Subs Segmentation: Prepaid (95%), Post Paid (5%) Churn per month (3%) Subscriber per Employee (13,000)

Coverage and Spread 1. 2. 3. 4. 5. 6. 7. Towns Covered Population Covered Area Covered Globalization: Number of Countries Operating Entity % Traffic Within Own Mobile (55%) Top 50% Users Revenue % Top 50% Sites Revenue %

Market Share 1. Subs Share 2. Revenue Market Share 3. Minutes Market Share Incremental Performance 1. 2. 3. 4. 5. Share of Net Adds Subs Share of Incremental Revenue Quarterly Sites Added MRPU ( Marginal Revenue Per User) Growth 1. Subs Growth 2. Revenue Growth 3. Services Revenue Growth 4. Services Revenue Acceleration 5. ARPU Growth 6. ARPM Growth 6. Subs Added / Retail Point of Presence (POP) Operational Efficiency 1. Average Margin Per User (AMPU) 1. AMPU Segmentation: Prepaid (More),Postpaid (Less), Blended() 2. Employee Cost / Town Covered ($2500) 3. Number of BTS Sites 4. Number of MSC Sites 5. Number of Employees 6. MSC/ Subs 7. MSC/ BTS 8. BTS/ Subs (1000) 9. BTS/ Km2 10. Capex 1. Capex (% Revenue) (25%) 2. Capex per Sub ($140) 3. Capex per Minute ($0.07) 4. Capex per Site ($100K ) 11. Opex 1. Opex per Sub ( $3) 2. Opex per Minute ($0.02) 3. Opex per site ($3000) 12. Gross Capex ( Gross Fixed Assets + Incremental Capex) 13. Opex as % Revenue (60%)

14. Spectrum Charges as % Revenue (2%) 15. License Fee as % Revenue (6%) 16. InterConnect Cost as % Revenue (16%) 17. Business Operations Cost 1. Service Opex (Customer Care & Billing, Service Creation & Administration) as % Revenue (15%) 18. Network Operating Cost as % Revenue (16%) 1. Rental as % Network Opex (15%) 2. Power & Fuel as % Network Opex (25%) 3. Repair & Maintenance as %Network Opex (20%) 4. Transmission as % Network Opex (15%) 5. Core Network as % Network Opex (10%) 6. Hardware and Software as % Network Opex (10%) 19. Labor Cost (% Revenue) (5%) 20. OSS/ BSS Ratio Marketing 1. Subscriber Acquisition Cost (SAC ) : Dealer Commission, Terminal Subsidy, Sales, Marketing, Distribution 1. SAC as % Revenue (10%) 2. SAC / net Addition (12$) 3. SAC / Minute (0.001$) 2. Sales Outlet 1. Company Owned Sales Outlet 2. Number of Retail Outlets or Point of Presence (POP) Quality 1. Service Performance 1. RTT Delay (Ms) (800) 2. Application Through Put ( kbps) (25 Kbps) 3. Call Setup Time 2. Network Congestion 1. Point of Interconnection (POI) Congestion (<0.5%) 3. Connection Establishment (Accessibility) 1. Call Setup Success Rate (CSSR) (>95%) 2. Standalone Dedicated Control Channel (SDCCH) Congestion (<1%) 3. TDH Congestion (<2%) 4. Connection Maintenance (Retainability) 1. Call Drop Rate (CDR) (< 2%) 2. Worst Affected Cells for Call Drop Rate (<5%) 3. Connection with Good voice quality (>95%) 5. Service Quality 1. Prepaid Prepaid Service Success Rate 2. Number Portability Drop Rate 3. Handover Success Rate 6. Network Availability 1. BTSs Accumulated downtime (<2%) 2. Worst Affected BTSs due to downtime (<2%) Green and Sustainability 1. Energy Consumption/ Sub (10 Kwh)

2. Co2 Emission/ Sub (6.8 Kg ) Financial & Valuation 1. Gearing ( net Debt/ EBIDTA) (2.0) 2. EBIDTA % Revenue (30%) 3. PAT % Revenue (10%) 4. ROIC (EBIDTA/ Gross Capex) (20%) 5. FCF (EBIDTA Capex Tax) % Revenue (5%) 6. Capital Productivity (Revenue / Gross Capex) (67%) 7. EV / EBIDTA (8.0) 8. EV/ Sales (3.0) 9. EV/ Subscribers ($200) 10. EV / GCI (1.0) 11. P/E Country Telecom Sector KPI 1. Penetration 2. Penetration ( >5Years Population) 3. Penetration per House Hold 4. Top 2 Players Share 5. Top 2 Players Share Change 6. HHI Index 7. Pricing Long Distance/ Local Price Ratio (1.5) 8. Average F2M Interconnect Rate ($0.005 / Min) 9. Average M2M Interconnect Rate 10. Sim / User ( Number of Subscribers/ Number of handset Sales) (1.5) 11. ARPU (PPP Adjusted) 12. ARPU % of disposable income 13. Mobile Revenue/ GDP (2%) 14. Regional Roaming Usage (Roaming Travelers / Intra Regional Travelers) Telecom Tower 1. Tenancy Ratio (2.0) 2. Average Rental per Tenant Per Month ($600) Spectrum Efficiency 1. 2. 3. 4. 5. Busy Hour mErlangs carried per sq km per M Hz (4000) Busy Hour mErlangs per subscriber (40) Subs/Km2/MHz (100) Subs/Km2 (Urban) (2000) Spectrum per Operator (MHz) (5)

You might also like

- Telecom MetricsDocument8 pagesTelecom Metricsamit.dhingra73595No ratings yet

- Polystar Roaming AssuranceDocument2 pagesPolystar Roaming Assurances3001698No ratings yet

- GSM 100 KpiDocument4 pagesGSM 100 KpiSloan Ian AriffNo ratings yet

- 100 KPI's For Mobile Telecom OperatorsDocument4 pages100 KPI's For Mobile Telecom Operatorsinitiative1972No ratings yet

- Contoh Business PlanDocument32 pagesContoh Business PlanAmirulhelmiNo ratings yet

- Xplorer QoS: End-to-End Testing for Telecom Operators in AfricaDocument51 pagesXplorer QoS: End-to-End Testing for Telecom Operators in Africapayam12No ratings yet

- Polystar GRQDocument2 pagesPolystar GRQQuân HoàngNo ratings yet

- GSM Key Performance Indicator KPI Guidebook V1.1Document45 pagesGSM Key Performance Indicator KPI Guidebook V1.1Rafi AnsariNo ratings yet

- UMTS Cell Planning ProcessThe provided title "TITLE UMTS Cell Planning ProcessDocument28 pagesUMTS Cell Planning ProcessThe provided title "TITLE UMTS Cell Planning Processnguyen2804No ratings yet

- Report KPIDocument31 pagesReport KPInasircugaxNo ratings yet

- Mobile Quality of Service Continuous ImprovementDocument24 pagesMobile Quality of Service Continuous ImprovementPiedade Acrísio GuambeNo ratings yet

- KPI Reference SummaryDocument137 pagesKPI Reference SummarySameer IbraimoNo ratings yet

- NSN KPI Formulas ReviewDocument15 pagesNSN KPI Formulas ReviewRashed SobujNo ratings yet

- Service Level Agreement Information Security and Network EngineeringDocument4 pagesService Level Agreement Information Security and Network Engineeringwild4bmwNo ratings yet

- Fixed Broadband Wireless AccessDocument2 pagesFixed Broadband Wireless AccessAri SadewaNo ratings yet

- 04-WCDMA Single Site VerificationDocument41 pages04-WCDMA Single Site VerificationqazpoNo ratings yet

- Internal Huawei document outlines single site verification processDocument26 pagesInternal Huawei document outlines single site verification processCedrik PendjiNo ratings yet

- Telecom Life Cycle ManagementDocument14 pagesTelecom Life Cycle ManagementVictor LundNo ratings yet

- Kpi ReferenceDocument49 pagesKpi ReferencemmlipuNo ratings yet

- Documentation Guide - HSS9860 KPIs V1.0Document1 pageDocumentation Guide - HSS9860 KPIs V1.0elhadnizNo ratings yet

- Umts KpiDocument78 pagesUmts KpiKausik RaychaudhuriNo ratings yet

- GSM Dual-Band Network Planning & OptimizationDocument80 pagesGSM Dual-Band Network Planning & Optimizationdiar_asNo ratings yet

- CS Core KPIs For Offer and Field Acceptance TestDocument130 pagesCS Core KPIs For Offer and Field Acceptance TestKumaraguru Sathiyaseelan100% (1)

- GSM Call Drop Problem AnalysisDocument66 pagesGSM Call Drop Problem AnalysisMesfin TibebeNo ratings yet

- Proposal For GSM Network Optimization & Audit-TselDocument16 pagesProposal For GSM Network Optimization & Audit-Tselharrys_2010100% (1)

- Telecom Brochure Hosted OSS BSS Network Inventory Management System 0513 1 PDFDocument4 pagesTelecom Brochure Hosted OSS BSS Network Inventory Management System 0513 1 PDFRoger Parsons100% (1)

- KPIs in Actix Guide Book 0118Document73 pagesKPIs in Actix Guide Book 0118dtvt40No ratings yet

- Alcatel Call Drop AnalysisDocument17 pagesAlcatel Call Drop Analysistawhid_tarek_robi100% (1)

- Mobilink Project On Site Swap SOPDocument17 pagesMobilink Project On Site Swap SOPAung Min Soe100% (1)

- UMTS Performance Measurement Support Document SummaryDocument125 pagesUMTS Performance Measurement Support Document SummaryrvaironNo ratings yet

- LTE KPI Project LearningsDocument9 pagesLTE KPI Project LearningsallieNo ratings yet

- Hierarchical KPI documentDocument112 pagesHierarchical KPI documentRF ConsultantAfricaNo ratings yet

- Limitations of RxQual and Advantages of SQIDocument2 pagesLimitations of RxQual and Advantages of SQIGaurav Chopra100% (3)

- 3G KPI DefinationsDocument3,806 pages3G KPI Definationshimu_05091833% (9)

- TowerXchange Issue 8Document220 pagesTowerXchange Issue 8pennacchiettiNo ratings yet

- CV - Piyush Kahar - 6month ExperienceDocument5 pagesCV - Piyush Kahar - 6month Experiencetonu gulluNo ratings yet

- TEMS Investigation Call Event DefinitionsDocument9 pagesTEMS Investigation Call Event Definitionssa_osman50% (2)

- XCAL-Mobile with Samsung Galaxy S4MiniDocument5 pagesXCAL-Mobile with Samsung Galaxy S4Minitrxopti9100% (1)

- Astellia White Paper QoEDocument16 pagesAstellia White Paper QoEshaan19No ratings yet

- Yenegoa Cutover Drive Report 27-03-15Document24 pagesYenegoa Cutover Drive Report 27-03-15Opeyemi DadaNo ratings yet

- Network Performance KPI DashboardDocument1 pageNetwork Performance KPI DashboardIndrajeet SinghNo ratings yet

- RAN Key Performance Indicators Reference (RAN10.0 - 01)Document77 pagesRAN Key Performance Indicators Reference (RAN10.0 - 01)Bipin TiwariNo ratings yet

- Fraud and RA Dashboard and KPI SampleDocument6 pagesFraud and RA Dashboard and KPI SampleybouriniNo ratings yet

- 2G Data Key Performance IndicatorsDocument54 pages2G Data Key Performance IndicatorsSandjay SinghNo ratings yet

- Sunil Kumar T - CV - LTE - Testing - 4yrsDocument3 pagesSunil Kumar T - CV - LTE - Testing - 4yrssunnytekiNo ratings yet

- GSM BSS Network KPI (Call Setup Success Rate) Optimization Manual V1.0Document17 pagesGSM BSS Network KPI (Call Setup Success Rate) Optimization Manual V1.0Ahmadia Saeed Wedataallah0% (1)

- KPI Formula 2G 3GDocument25 pagesKPI Formula 2G 3GTahitii ObiohaNo ratings yet

- HUAWEI MSOFTX3000 Configuration Guide Failure Cause Code DescriptionDocument27 pagesHUAWEI MSOFTX3000 Configuration Guide Failure Cause Code DescriptionVirgil PeiulescuNo ratings yet

- Formula All VendorDocument16 pagesFormula All VendoraphadaniNo ratings yet

- Telecom KPI GuideDocument10 pagesTelecom KPI GuideVishal ChandnaniNo ratings yet

- KPI For Telecom OperatorsDocument4 pagesKPI For Telecom OperatorsvwvwevwNo ratings yet

- KPI For Telecom OperatorsDocument4 pagesKPI For Telecom OperatorsFahad Sani67% (3)

- 100 KPI's For Mobile Telecom Operators - Consultant Value AddedDocument6 pages100 KPI's For Mobile Telecom Operators - Consultant Value Addedsuru2712No ratings yet

- Telecommunication KPIs for Monitoring Subscribers, Revenue, Usage & MoreDocument13 pagesTelecommunication KPIs for Monitoring Subscribers, Revenue, Usage & MoreTks ManojNo ratings yet

- Major Steps To Improve KPIDocument5 pagesMajor Steps To Improve KPIPragya RaiNo ratings yet

- VoLTE IMS KPI DashboardDocument20 pagesVoLTE IMS KPI DashboardNguyễn Thanh ThủyNo ratings yet

- Optimization ParameterDocument22 pagesOptimization ParametergfrghhhyrddNo ratings yet

- Performance Enhancement of GSM System: Qos Analysis and OptimizationDocument4 pagesPerformance Enhancement of GSM System: Qos Analysis and OptimizationMustafa HussainNo ratings yet

- Quiz 3 (Ramzan Albakov)Document7 pagesQuiz 3 (Ramzan Albakov)Dylan KorNo ratings yet

- Llb-Dissertation FinalDocument38 pagesLlb-Dissertation FinalRudy KameereddyNo ratings yet

- BUS 516 - Chapter 6 - Foundations of Business IntelligenceDocument63 pagesBUS 516 - Chapter 6 - Foundations of Business IntelligenceArju LubnaNo ratings yet

- Financial and Non Financial MotivationDocument40 pagesFinancial and Non Financial MotivationSatya Chaitanya Anupama KalidindiNo ratings yet

- Ch02 The Recording ProcessDocument58 pagesCh02 The Recording ProcessAndi Nisrina Nur Izza100% (1)

- Role of the Sleeping PartnerDocument15 pagesRole of the Sleeping PartnerKhalid AsgherNo ratings yet

- Building 101 - RFIsDocument4 pagesBuilding 101 - RFIspeters sillieNo ratings yet

- NPTEL Assign 5 Jan23 Behavioral and Personal FinanceDocument9 pagesNPTEL Assign 5 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Private Organization Pension Amendment ProclamationDocument8 pagesPrivate Organization Pension Amendment ProclamationMulu DestaNo ratings yet

- Continental CarriersDocument8 pagesContinental CarriersYaser Al-Torairi100% (3)

- Kurt Salmon Etude Digital Pharma - WEB-VersionDocument32 pagesKurt Salmon Etude Digital Pharma - WEB-VersionainogNo ratings yet

- Shipsy Logistics Report SummaryDocument4 pagesShipsy Logistics Report SummaryVaibhav BahetiNo ratings yet

- Realestate Appraiser Course ListDocument33 pagesRealestate Appraiser Course ListcutmytaxesNo ratings yet

- Value of SupplyDocument8 pagesValue of SupplyPratham 5hettyNo ratings yet

- Cambridge SummaryDocument1 pageCambridge SummaryMausam Ghosh100% (1)

- Steps in Registering Your Business in The PhilippinesDocument5 pagesSteps in Registering Your Business in The PhilippinesSherie Joy MercadoNo ratings yet

- Banking ProjectDocument82 pagesBanking ProjectJemini Patil76% (17)

- Vakrangee LimitedDocument3 pagesVakrangee LimitedSubham MazumdarNo ratings yet

- JamaicaDocument10 pagesJamaicaMake khanNo ratings yet

- Factura Tenis PDFDocument1 pageFactura Tenis PDFJuan Pablo VillavicencioNo ratings yet

- Sharekhan Summer Internship Report on Sales ProcessDocument26 pagesSharekhan Summer Internship Report on Sales ProcessSandeep SharmaNo ratings yet

- Business PlanDocument19 pagesBusiness Plansona_ktk100% (2)

- The Measurement of Firm PerformanceDocument26 pagesThe Measurement of Firm PerformanceLara Mae LacidaNo ratings yet

- A Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemDocument19 pagesA Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemCHEIF EDITORNo ratings yet

- Business Ethics at SathyamDocument13 pagesBusiness Ethics at SathyamAnwar Masiha QuereshiNo ratings yet

- Revised Questionnaire - HuaweiDocument11 pagesRevised Questionnaire - HuaweiKomal AlamNo ratings yet

- CRM Project PlanDocument12 pagesCRM Project Planwww.GrowthPanel.com100% (5)

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word DocumentMilan KakkadNo ratings yet

- Overview of Indian Securities Market: Chapter-1Document100 pagesOverview of Indian Securities Market: Chapter-1tamangargNo ratings yet

- MCQ Supply chain management multiple choice questionsDocument53 pagesMCQ Supply chain management multiple choice questionsmoniNo ratings yet