Professional Documents

Culture Documents

Starbucks Case Write Up

Uploaded by

Jess RazzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Starbucks Case Write Up

Uploaded by

Jess RazzCopyright:

Available Formats

Jessica P INT 4363 Oct 14, 2008 Case Write-Up Starbucks International Operations-2006 Part 1: Problem identification In several

international operations, Starbucks faced problems dealing with mode of entry, pricing, political environments and business environments which inhibited the success of operations in those countries. External growth strategies (mode of entry) used by Starbucks include joint ventures, licensees, and wholly owned subsidiaries. Amongst these, the widely used entry for Starbucks was the joint venture. An already dominant chain in its domestic country, Starbucks began its international expansion by focusing on the Asia-Pacific rim markets. The process for deciding entry into a country began with studying the foreign markets conditions followed by deciding what local partner to enter with, if in fact required. Starbucks first international operation began in Japan in a joint venture with Sazaby Inc. This partnership proved a good mode of entry for Starbucks, initially, that was until high losses after a couple of years. In the European Market, Starbucks faced problems which included competition from wellestablished coffee shops, imitation, high prices, high real estate costs and labor costs, customs, economic recession. Competition largely inhibited growth within the European Market, as well as failing to adopt customs in France. Perception from the European market also had a large impact on Starbucks, for it was generally perceived too expensive and as a form of overpriced imitation coffee. Middle Eastern markets posed to be very politically volatile. Country risk within those countries was rather high. Starbucks was forced to close six stores in Israel because of this. Part 2: Information from the text/supplemental reading In an attempt to identify why Starbucks faced problems in their international operations, it is essential to understand the procedures on deciding what country to enter. Further, understanding the potential risks to vie for is another very important step to analyze. Environmental assessment includes monitoring for contingency within the environment. Its a process of gathering info based on political, environmental, legal, cultural, social, demographic, and competitive factors that can affect your firm. Within the grasp of environmental scanning, companies must analysis variables such as political instability, as it notes in the textbook, particularly in the Middle East, because of the probable loss of profits and even ownership. Another factor, currency instability, is the fluctuation of the countrys currency. Nationalism often influences foreign companies. The home government participates heavily in business functions, as well as imposes several policies that can adversely affect a firm, such as excessive taxation, import controls, limitations, repatriation of profits. International Competition is one of the most important factors to analyze. This is done to indentify which are your companys relevant competitors in that country/industry. In order to

understand the game, you need to understand your enemies, great advice from a great strategic management professor. Finding weakness and strengths within them can provide either for opportunities or threats for your organization. Risks within a country that are increasingly important include strategic risk, operational risk, political risk, country risk, amongst others. Strategic risk include qualitative analysis of the industry, which include the use of the Porter 5 diamond, which analyzes the industry under the following five forces; threat of new entrants, threat of substitution, threat of competitors, bargaining power of supplies and bargaining power of customers. Operational risk includes internal factors that affect the efficiency of the organization. Political risk, which encompasses risk from political actions within a country that can affect a firms operations, is another important factor. Country risk, which is the risk acquired within a country, includes and is not limited to economic, government, political, security factors inherited when entering a country. Part 3: Problem resolution Well, it seems as though Starbucks failed to properly analyze the probably risks that would occur in the countries they entered. It is important for firms to perform external assessments in order to avoid such situations.

You might also like

- Starbucks Case Study: Marketing 337, Fall 2009 by Elizabeth KulinDocument4 pagesStarbucks Case Study: Marketing 337, Fall 2009 by Elizabeth KulinArul ChamariaNo ratings yet

- Group Assignment SM.Document6 pagesGroup Assignment SM.Waheed LangahNo ratings yet

- StarbucksDocument16 pagesStarbucksEl Shahir0% (1)

- Overview of The Analysis: - Porter's 5 Forces - PEST AnalysisDocument15 pagesOverview of The Analysis: - Porter's 5 Forces - PEST AnalysisTaraRajagopalanNo ratings yet

- Starbucks AnalysisDocument24 pagesStarbucks Analysis강철우100% (1)

- The Brita Products Company Case ReportDocument3 pagesThe Brita Products Company Case ReportSojung Yoon100% (1)

- Starbucks ReinventedDocument8 pagesStarbucks ReinventedCristina Landim DuarteNo ratings yet

- Starbucks International Marketing StrategyDocument9 pagesStarbucks International Marketing StrategyKrishna NaNo ratings yet

- Ad Lider CaseDocument5 pagesAd Lider CaseSanchit DekateNo ratings yet

- Pillsbury Cookie Challengev7 PDFDocument28 pagesPillsbury Cookie Challengev7 PDFMayank TewariNo ratings yet

- IBS3807 Unit2c0 CAGE FrameworkDocument33 pagesIBS3807 Unit2c0 CAGE FrameworkkareenabhatiaNo ratings yet

- UnMe Jeans - AnalysisDocument5 pagesUnMe Jeans - AnalysisAvni MisraNo ratings yet

- Storm in A Coffee Cup - The Barista StoryDocument23 pagesStorm in A Coffee Cup - The Barista StoryKuldip BarmanNo ratings yet

- Carrot Rewards Case SolutionsDocument2 pagesCarrot Rewards Case SolutionsAditya HonguntiNo ratings yet

- Presented By: Ashish Khatter Rollnoa10 JULY 2012-2014 BATCHDocument23 pagesPresented By: Ashish Khatter Rollnoa10 JULY 2012-2014 BATCHNguyễn Tiến100% (1)

- Answer To The Question 1: ResourcesDocument9 pagesAnswer To The Question 1: ResourcesashabNo ratings yet

- Summary/ Conclusions Summary of Starbucks Differentiation and GrowthDocument3 pagesSummary/ Conclusions Summary of Starbucks Differentiation and Growthcoke2juiceNo ratings yet

- Case Study KFC Communication CrisisDocument2 pagesCase Study KFC Communication CrisisAsmitaNo ratings yet

- Final Paper - Trader Joes Marketing CampaignDocument14 pagesFinal Paper - Trader Joes Marketing Campaignapi-663750031No ratings yet

- BM AssignmentDocument7 pagesBM AssignmentAntony LawrenceNo ratings yet

- Star BucksDocument6 pagesStar BucksSyed Asrar AlamNo ratings yet

- Finnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Document4 pagesFinnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Ngỗng Ngáo NgácNo ratings yet

- Filipinos Go GlobalDocument5 pagesFilipinos Go GlobalKrish Rainjit Redor SalasNo ratings yet

- Marketing Case-STARBUCKDocument5 pagesMarketing Case-STARBUCKsalman_nsuNo ratings yet

- CCD VS BaristaDocument11 pagesCCD VS BaristaShibnathRoyNo ratings yet

- Zoe Nguyen-ID114818198-MKM916 - POV Assignment PDFDocument12 pagesZoe Nguyen-ID114818198-MKM916 - POV Assignment PDFZoe NguyenNo ratings yet

- DODOT CaseDocument3 pagesDODOT CaseScribdTranslationsNo ratings yet

- Starbucks Delivering Customer ServiceDocument18 pagesStarbucks Delivering Customer ServiceMadhur PahujaNo ratings yet

- Starbucks in 2012: Evolving Into A Dynamic Global OrganizationDocument1 pageStarbucks in 2012: Evolving Into A Dynamic Global OrganizationTony Hancook100% (1)

- Case Analysis - Gillete - Group1 - BM - Sec CDocument5 pagesCase Analysis - Gillete - Group1 - BM - Sec CShubhendu TiwariNo ratings yet

- Final Coke Zero Presentation New-1Document16 pagesFinal Coke Zero Presentation New-1api-282840138No ratings yet

- Crafting and Executing StarbucksDocument10 pagesCrafting and Executing StarbucksBhuvanNo ratings yet

- CadburyDocument12 pagesCadburyAjeet YadavNo ratings yet

- Case 3 OBDocument3 pagesCase 3 OBAlvaro Sierra100% (1)

- Herborist CaseDocument7 pagesHerborist CaseRanjani Cool Ranjani0% (1)

- Hanover Bates Analysis - Intro N Case FactsDocument8 pagesHanover Bates Analysis - Intro N Case FactsMuhammad Jahanzeb AamirNo ratings yet

- OPM ReportDocument7 pagesOPM ReportMazhar AliNo ratings yet

- Case Example - LululemonDocument4 pagesCase Example - LululemonFranky HuangNo ratings yet

- Case Study - LEVI STRAUSS & CO. AND CHINADocument7 pagesCase Study - LEVI STRAUSS & CO. AND CHINAakashkr619No ratings yet

- Loreal CaseDocument11 pagesLoreal CasePraveen Abraham100% (1)

- Colgate PalmoliveDocument50 pagesColgate PalmoliveRabiZzzNo ratings yet

- Classic Ltd.Document3 pagesClassic Ltd.Alexandra CaligiuriNo ratings yet

- Ladder Case StudyDocument3 pagesLadder Case StudyPraveen PandeyNo ratings yet

- Silvia Caffe - Case - TextDocument1 pageSilvia Caffe - Case - TextShubhankar AsijaNo ratings yet

- BMWDocument28 pagesBMWVivek KumarNo ratings yet

- Tanya: Product Life CycleDocument8 pagesTanya: Product Life CycleJoey G CirilloNo ratings yet

- Starbucks in IndiaDocument18 pagesStarbucks in Indiamintmilk888No ratings yet

- Barista Coffee Company Limited: - Group B2Document6 pagesBarista Coffee Company Limited: - Group B201202No ratings yet

- C05 - Starbucks - Staying Local While Going Global Through Marketing ResearchDocument2 pagesC05 - Starbucks - Staying Local While Going Global Through Marketing ResearchSafowanNo ratings yet

- Bank of AmericaDocument4 pagesBank of AmericaMichelle WaughNo ratings yet

- StarbucksDocument2 pagesStarbucksAnonymous nfLFi1q1No ratings yet

- Consumer BehaviourDocument20 pagesConsumer BehaviourNeelam MahatoNo ratings yet

- Starbucks Coffee Case AnalysisDocument3 pagesStarbucks Coffee Case Analysisvane rondinaNo ratings yet

- Computer AssociatesDocument18 pagesComputer AssociatesRosel RicafortNo ratings yet

- AMUL-STP N SWOTDocument9 pagesAMUL-STP N SWOTAmol Gade100% (2)

- Group 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaDocument8 pagesGroup 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaAmit SardaNo ratings yet

- Wood - Eurocentric Anti-EurocentrismDocument8 pagesWood - Eurocentric Anti-EurocentrismJennifer PadillaNo ratings yet

- M&A Pitch Deck ExampleDocument18 pagesM&A Pitch Deck ExampleMark Elakawi100% (1)

- Modern Marketing Assignment II Sem PDFDocument2 pagesModern Marketing Assignment II Sem PDFmartin santuroNo ratings yet

- HDB Resale Transactions - Jan 09Document4 pagesHDB Resale Transactions - Jan 09pinkcoralNo ratings yet

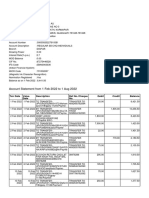

- Account Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Feb 2022 To 1 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceFIRDUS ALINo ratings yet

- ParallelAccounting SAP ERPDocument48 pagesParallelAccounting SAP ERPradmilhfNo ratings yet

- 10.allocative EfficiencyDocument5 pages10.allocative EfficiencySpartanNo ratings yet

- Swift Transportation Company Porter Five Forces AnalysisDocument5 pagesSwift Transportation Company Porter Five Forces AnalysisAshrafulNo ratings yet

- Any Questions From Last Class?Document15 pagesAny Questions From Last Class?chdx21479No ratings yet

- "Business Economics-II: "Foreign Exchange Market"Document19 pages"Business Economics-II: "Foreign Exchange Market"Himani ShahNo ratings yet

- Operation Management Case Studies - NewDocument38 pagesOperation Management Case Studies - NewSammir MalhotraNo ratings yet

- BIBM Academic 2011Document113 pagesBIBM Academic 2011PaulNo ratings yet

- HBS Note On CommercialBankingDocument16 pagesHBS Note On CommercialBankingJatin SankarNo ratings yet

- The Ask Method PhenomenonDocument11 pagesThe Ask Method PhenomenonRickie AmánNo ratings yet

- ELEC2 - Module 1 - Fundamentals Principles of ValuationDocument32 pagesELEC2 - Module 1 - Fundamentals Principles of ValuationMaricar PinedaNo ratings yet

- Iii. The Marketing Plan Target MarketDocument2 pagesIii. The Marketing Plan Target MarketRoan Eam TanNo ratings yet

- Market Timing Via Monthly and Holiday PatternsDocument10 pagesMarket Timing Via Monthly and Holiday PatternsSteven KimNo ratings yet

- Payment 380 490413BDocument2 pagesPayment 380 490413BJohanny SantosNo ratings yet

- Porter's Five Forces ModelDocument2 pagesPorter's Five Forces ModelHarsh AnchaliaNo ratings yet

- CRM in Banking Industry: Executive SummaryDocument7 pagesCRM in Banking Industry: Executive SummaryŠyȜd Šåqîb HũXsåînNo ratings yet

- Nutrition App Pitch Deck by SlidesgoDocument41 pagesNutrition App Pitch Deck by Slidesgofuad halyaNo ratings yet

- CPG Analytics - MarketelligentDocument2 pagesCPG Analytics - MarketelligentMarketelligent100% (3)

- UAS International-SiPDocument1 pageUAS International-SiPabhishek panwarNo ratings yet

- CIX1001 Course InformationDocument4 pagesCIX1001 Course Informationivyling29No ratings yet

- Financial Management Presentation Part I - Summer Class 2017Document44 pagesFinancial Management Presentation Part I - Summer Class 2017Juan Sebastian Leyton ZabaletaNo ratings yet

- Angel PlatinumDocument14 pagesAngel Platinumvishal royNo ratings yet

- Theoretical Frame Work 1Document2 pagesTheoretical Frame Work 1Lourd Amethyst OmanaNo ratings yet

- Cfas Chapter 10Document16 pagesCfas Chapter 10Str PNo ratings yet

- Chapter 10Document44 pagesChapter 10emmaNo ratings yet

- Hoàng Phúc Long - 45k15.1Document5 pagesHoàng Phúc Long - 45k15.1Hoàng Phúc LongNo ratings yet