Professional Documents

Culture Documents

Microeconomics 1: Lecturer: Adam Allanson

Uploaded by

Vicky Ke WangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microeconomics 1: Lecturer: Adam Allanson

Uploaded by

Vicky Ke WangCopyright:

Available Formats

Microeconomics 1

Lecturer: Adam Allanson Lecture 26

5 May 2011

Impact of Quota / VER

Equivalent Tariff

Is a 600,000 quota really equivalent to a 50% tariff? What will happen if domestic demand rises?

Is a 600,000 quota really equivalent to a 50% tariff? What will happen if domestic demand rises?

Is a 600,000 quota really equivalent to a 50% tariff? What will happen if the world price rises?

Assume specific tariff of $10,000 (rather than 50% ad valorem tariff).

Is a 600,000 quota really equivalent to a 50% tariff? What will happen if the world price rises?

Assume specific tariff of $10,000 (rather than 50% ad valorem tariff).

Quotas when domestic demand & world prices change In summary: where domestic demand is increasing, fixed quantitative quotas become more distortionary over time: under a quota the increase in demand is satisfied by local producers rather than (more efficient) foreign producers; where world prices are rising, fixed quotas become less distortionary and may become non-binding; quotas are less transparent than tariffs: their impact on domestic prices is not immediately obvious; and quotas are generally being phased out under World Trade Organisation (WTO) trade agreements.

Thinking about international trade issues

Micro 1 is not about giving you the answers, but giving you an analytical framework to enable you to ask the right questions.

Trade issues are often complex, involving many competing interests, and analysing them requires an understanding of the affected markets and institutions. An understanding of economic history will help understand the current situation and (hopefully) help us avoid repeating the same mistakes.

A brief (and very incomplete) history

1930s: Great Depression caused countries to place tariffs on goods in order to protect jobs.

Others retaliated with tariffs of their own and international trade collapsed, exacerbating the economic downturn. World War II 1939 to 1945. General Agreement on Tariffs and Trade (GATT) was established in 1948: multilateral negotiations aimed at reducing tariffs and reviving trade. The EU Common Agricultural Policy (1950s) EU tries to guarantee food supply (self sufficiency being a key goal). The US Food Security Act (1985) established the US Export Enhancement Program.

The EU Common Agricultural Policy (CAP)

CAP: A system of production, export and storage subsidies and price floors aimed at ensuring that the EU had a viable agricultural sector and that EU was self-sufficient in food production. The CAP was very successful in meeting its objective of moving the EU toward self-sufficiency from the 1980s onward. Suddenly, however, the EU had to contend with almost permanent surpluses of the major farm commodities, some of which were exported (with the help of subsidies), others of which had to be stored or disposed of within the EU. These measures had a high budgetary cost, distorted some world markets, did not always serve the best interests of farmers, to the extent that they quickly became unpopular with consumers and taxpayers. European Commission of Agriculture and Rural Development, The Common Agricultural Policy Explained

The US Export Enhancement Program (EEP)

The Export Enhancement Program (EEP) is designed to help U.S. farm products meet competition from subsidizing countries, especially the European Union. Under the program, the U.S. Department of Agriculture pays cash to exporters as bonuses, allowing them to sell U.S. agricultural products in targeted countries at prices below the exporters cost of acquiring them. The major objectives are to expand U.S. agricultural exports and to challenge unfair trading practices.

US Department of Agriculture Fact Sheet (March 2006)

Thinking about price floors and anti-dumping

Price floor: A government-guaranteed minimum price for producers which is usually above the free market equilibrium price. Price floors, domestic subsidy policies and export enhancement schemes (such as the EU CAP and US EEP) all serve to drive world prices lower than they would otherwise be. EU and US taxpayers pay for these schemes and producers in other countries suffer from the results of lower world prices and reduced market access.

Dumping: Selling a product for a price below its cost of production. The WTO will allow tariffs to be imposed to offset the effects of dumping. But is foreign dumping bad for the domestic (importing) economy?

Dumping and Anti-Dumping Tariffs

Dumping and Anti-Dumping Tariffs

Dumping and Anti-Dumping Tariffs

Dumping and Anti-Dumping Tariffs

Dumping and Anti-Dumping Tariffs

What concerns might you have about this analysis?

Only measures gains in current period What happens next month/year? Is this market perfectly competitive? Is there costless entry and exit in this market? Are there any spill-over benefits from having a local industry? What happens if dumping reduces the number of suppliers such that the market is less competitive? Many concerns about unfair trade relate to potential for abuse of market power (monopoly)

The World Trade Organization (WTO)?

(see www.wto.org)

The World Trade Organization (WTO): is an international organisation (based in Geneva) that enforces international trade agreements between member countries; currently has 153 member countries: member governments use the WTO as a negiating forum to sort out the trade problems they face with each other; was formed in 1995 following the Uruguay Round of the General Agreement on Tariffs and Trade (GATT); works towards reducing tariffs and other trade barriers in order to promote free trade and fair competition (see WTO website and article on Wattle).

The World Trade Organization (WTO)?

(see www.wto.org)

WTO Objective: the WTO works towards reducing tariffs and other trade barriers in order to promote free trade and fair competition (see WTO website and article on Wattle). WTO Trade Agreements: set rules and member governments agree to keep their trade policies within agreed limits and adhere to agreed principles. For example:

Under WTO Most-Favoured-Nation rules, countries cannot normally discriminate between their trading partners. Under National Treatment rules, imported and locally-produced goods should be treated equally. Importantly, WTO note that National Treatment only applies once a good or service has entered the market. Therefore, charging tariffs on an import is not a violation of National Treatment even if locally-produced products are not charged an equivalent tax.

Why do some people oppose the World Trade Organization?

Globalisation: The process of countries becoming more open to foreign trade and investment. Anti-globalisation: Some people believe that free trade and foreign investment destroy the distinctive cultures of many countries, create environmental and health problems, and can lead to the exploitation of workers.

The argument over trade policies and globalisation

Protectionism: The use of trade barriers to shield domestic companies from foreign competition. Protectionism is usually justified on the basis of the following arguments: 1. Saving jobs 2. Protecting high wages

3. Protecting infant industries

4. Protecting national security

The argument over trade policies and globalisation

Radical environmentalism (Hubbards term)

1. Argument that trade restrictions should be put in place against countries who lack environmental protection laws. Poorer countries tend to lack these laws, therefore the WTO does not support this approach. WTO recommends maintaining trade, and wealthier countries offering financial and practical assistance to help improve production techniques and enforce environmental standards. (The WTO may not always be right these are on balance issues that need careful consideration.)

The argument over trade policies and globalisation

Radical environmentalism (Hubbards term)

2. Argument that free trade increases carbon dioxide emissions due to the transportation of goods and services around the world. Transportation emissions are only part of total production emissions. Lower total emissions could occur if production occurred in efficient markets and trade took place. Key issue is whether transportation costs include the external costs to the environment (e.g. appropriate pricing of carbon here and abroad) irrespective of whether transportation is within Australia or from overseas.

The argument over trade policies and globalisation

Positive versus normative analysis

All interferences with free trade make some people worse off, some people better off, and reduces total income and consumption. Positive analysis: The reduction in economic efficiency from a tariff, quota or VER can be measured. This can usefully inform decision making.

Normative analysis: Whether a tariff or quota is bad public policy and should be eliminated is a normative decision.

You might also like

- Bec Notes 17Document87 pagesBec Notes 17Pugazh enthi100% (2)

- International Trade Theory and Development Strategy HandoutsDocument3 pagesInternational Trade Theory and Development Strategy HandoutsHazell D100% (2)

- The Context - Political Economy of Trade - Road MapDocument41 pagesThe Context - Political Economy of Trade - Road MapRoxana BadeaNo ratings yet

- 19b XuanLam Export Refunds EUDocument15 pages19b XuanLam Export Refunds EUBenny DuongNo ratings yet

- Submitted TO: SIR M.Yousaf "International Trade Barriers AND Their Solution"Document7 pagesSubmitted TO: SIR M.Yousaf "International Trade Barriers AND Their Solution"atiqa tanveerNo ratings yet

- Global Trade RegimeDocument6 pagesGlobal Trade RegimeMikaella FernandoNo ratings yet

- Inbustra - Political EconomyDocument8 pagesInbustra - Political EconomyShinichii KuudoNo ratings yet

- What Is International TradeDocument6 pagesWhat Is International Tradejem dela cruzNo ratings yet

- International TradeDocument2 pagesInternational TradeDhivya RamachandranNo ratings yet

- KTEE308 International Economics: Assoc. Prof. Tu Thuy Anh Faculty of International EconomicsDocument25 pagesKTEE308 International Economics: Assoc. Prof. Tu Thuy Anh Faculty of International EconomicsNgọc MinhNo ratings yet

- Redmond Economic IntegrationDocument140 pagesRedmond Economic IntegrationSushant SatyalNo ratings yet

- Chapter 10: The Political Economy of The Trade Policy " Chapter 12:controversies in Trade PolicyDocument75 pagesChapter 10: The Political Economy of The Trade Policy " Chapter 12:controversies in Trade PolicyNate BrienNo ratings yet

- The Economic Costs of Tariffs & The Economics of ProtectionismDocument24 pagesThe Economic Costs of Tariffs & The Economics of ProtectionismBalkan CharyyevNo ratings yet

- The Political Economy of Trade PolicyDocument23 pagesThe Political Economy of Trade PolicyNeha SargamNo ratings yet

- The Political Economy of International TradeDocument26 pagesThe Political Economy of International Tradesonia_hun885443No ratings yet

- (Finals) International Trade Practices and PoliciesDocument4 pages(Finals) International Trade Practices and PoliciesJUDE VINCENT MACALOSNo ratings yet

- The Political Economy of International Trade: By: Ms. Adina Malik (ALK)Document23 pagesThe Political Economy of International Trade: By: Ms. Adina Malik (ALK)Mr. HaroonNo ratings yet

- International Marketing 15 Edition: The Dynamic Environment of International TradeDocument18 pagesInternational Marketing 15 Edition: The Dynamic Environment of International TradeImraanHossainAyaanNo ratings yet

- Unit 1 - Introduction To International EconomicsDocument19 pagesUnit 1 - Introduction To International EconomicsEnock MutengoNo ratings yet

- The Effect On Consumer Welfare of A TariffDocument7 pagesThe Effect On Consumer Welfare of A TariffAmna KashifNo ratings yet

- Barriers To International TradebaDocument6 pagesBarriers To International TradebafhinojosacNo ratings yet

- 14 - Free Trade and ProtectionismDocument4 pages14 - Free Trade and Protectionismalstjq1003No ratings yet

- International Economics Lecture 5Document34 pagesInternational Economics Lecture 5knahmedNo ratings yet

- IB3414 International Trade Policy: Week 7: Multilateral Trade Liberalization: WTO (II)Document35 pagesIB3414 International Trade Policy: Week 7: Multilateral Trade Liberalization: WTO (II)mrvycsyNo ratings yet

- 5.2 AFM Investment Appraisal International 231223Document13 pages5.2 AFM Investment Appraisal International 231223Kushagra BhandariNo ratings yet

- International Trade in Macroeconomics Additional Lecture On Lesson 14 After TaxationDocument34 pagesInternational Trade in Macroeconomics Additional Lecture On Lesson 14 After TaxationNorhaliza D. SaripNo ratings yet

- Tariff and Non TariffDocument18 pagesTariff and Non TariffAjaykumar ChilukuriNo ratings yet

- ECN102 World Economy: DR Rachel MaleDocument62 pagesECN102 World Economy: DR Rachel MaleJaja123y77No ratings yet

- Homework: I. Questions For ReviewDocument16 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Global EconomyDocument42 pagesGlobal EconomyEdelweiss Quirab SiloNo ratings yet

- Global Business Today Canadian 4th Edition Hill Solutions Manual DownloadDocument15 pagesGlobal Business Today Canadian 4th Edition Hill Solutions Manual DownloadAmyBrightdqjm100% (43)

- Torreliza Cortuna Rendon ReportDocument52 pagesTorreliza Cortuna Rendon ReportVidal Angel Glory Borj A.No ratings yet

- General Agreement On Tariffs and TradeDocument34 pagesGeneral Agreement On Tariffs and Tradeprabha.v2018No ratings yet

- The Political Economy of International TradeDocument29 pagesThe Political Economy of International TradeWilsonNo ratings yet

- The Political Economy of Trade PolicyDocument45 pagesThe Political Economy of Trade PolicyMadalina RaceaNo ratings yet

- International Institutions in International Trade: Dr. Mahima MishraDocument19 pagesInternational Institutions in International Trade: Dr. Mahima MishraAdithya MNo ratings yet

- Global Economy Lecture 4 Q 1Document55 pagesGlobal Economy Lecture 4 Q 1Ann BaydaNo ratings yet

- International Trade BarriersDocument19 pagesInternational Trade BarriersYanix SeraficoNo ratings yet

- ECN 138. Chapter 11Document3 pagesECN 138. Chapter 11Louren Pabria C. PanganoronNo ratings yet

- Module 3 Global EconomyDocument28 pagesModule 3 Global EconomyJeprox Martinez100% (1)

- Macroeconomics AssignmentDocument13 pagesMacroeconomics AssignmentAlly SallimNo ratings yet

- TariffDocument5 pagesTariffIrina MiQuiNo ratings yet

- Trade Barriers, Dumping Anti DumpingDocument30 pagesTrade Barriers, Dumping Anti Dumpingqwertyuiop_6421100% (3)

- Team 3 ProjectDocument14 pagesTeam 3 ProjectGabriela LorenaNo ratings yet

- Regional Economic Groups No TaskDocument2 pagesRegional Economic Groups No Taskapi-529669983No ratings yet

- Restrictions On International Trade-Trade WarsDocument7 pagesRestrictions On International Trade-Trade Warsgaby_iulyNo ratings yet

- ECONOMICS & MGMT DecisionsDocument135 pagesECONOMICS & MGMT DecisionsAnand RamachandranNo ratings yet

- International Economic InstitutionsDocument18 pagesInternational Economic Institutionsups upsNo ratings yet

- International TradeDocument80 pagesInternational Tradezihui tanNo ratings yet

- Who Gains and Loses From TradeDocument4 pagesWho Gains and Loses From TradeOsmanNo ratings yet

- Tariff and NonDocument38 pagesTariff and Non14mastermo100% (1)

- International Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFDocument28 pagesInternational Economics 15Th Edition Pugel Solutions Manual Full Chapter PDFcemeteryliana.9afku100% (8)

- International Economics 15th Edition Pugel Solutions ManualDocument7 pagesInternational Economics 15th Edition Pugel Solutions Manualsaintcuc9jymi8100% (25)

- Week 7 - Lecture 6 - UK and The EUDocument8 pagesWeek 7 - Lecture 6 - UK and The EUKunal SharmaNo ratings yet

- Free Trade and Fair TradeDocument5 pagesFree Trade and Fair Tradekanishka singhNo ratings yet

- The Rise of Protectionism and Its Perils On The Domestic Politics and International RelationsDocument5 pagesThe Rise of Protectionism and Its Perils On The Domestic Politics and International RelationsTreblif AdarojemNo ratings yet

- Chapter 06Document20 pagesChapter 06waqas azamNo ratings yet

- Introduction To International TradeDocument46 pagesIntroduction To International TradeBalasingam PrahalathanNo ratings yet

- Tariff and Non-TariffDocument9 pagesTariff and Non-TariffnemchandNo ratings yet

- International Business and Trade3Document41 pagesInternational Business and Trade3rovicabarado99No ratings yet

- Jpepa PDFDocument16 pagesJpepa PDFCharlene DacaraNo ratings yet

- Catalog RSI 2016Document48 pagesCatalog RSI 2016Isa GalNo ratings yet

- Manual For Regulation For Foreign Exchange TransactionsDocument86 pagesManual For Regulation For Foreign Exchange TransactionsKiwi SorianoNo ratings yet

- Modes of Entering IBDocument43 pagesModes of Entering IBDhruv SardanaNo ratings yet

- Mahamud Thesis (Final)Document29 pagesMahamud Thesis (Final)haashi94100% (1)

- Australia Apparel MarketDocument5 pagesAustralia Apparel Marketsoumen biswasNo ratings yet

- Multiculturalism PPT (PDF Fix)Document29 pagesMulticulturalism PPT (PDF Fix)Ayadania RosiphanieNo ratings yet

- International Business of Square PharmaceuticalsDocument16 pagesInternational Business of Square PharmaceuticalsHasibul Hasan0% (1)

- Managing Export Risk PDFDocument23 pagesManaging Export Risk PDFJessica PedrozaNo ratings yet

- Ti Cycles Final PDFDocument20 pagesTi Cycles Final PDFVivek Yadav0% (1)

- Motives of Internationalisation: 1. Profits 2. Growth Prospects 3. Increased Competition 4. Strategic MotivesDocument6 pagesMotives of Internationalisation: 1. Profits 2. Growth Prospects 3. Increased Competition 4. Strategic MotivesPuneet LokwaniNo ratings yet

- Test Bank For International Financial Management 2nd Edition MaduraDocument4 pagesTest Bank For International Financial Management 2nd Edition MaduraAllen Sylvester100% (35)

- International Economics 15Th Edition Robert Carbaugh Solutions Manual Full Chapter PDFDocument26 pagesInternational Economics 15Th Edition Robert Carbaugh Solutions Manual Full Chapter PDFcemeteryliana.9afku100% (9)

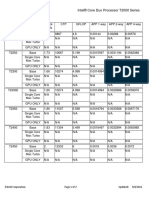

- Intel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedDocument2 pagesIntel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedeuricoNo ratings yet

- Export Credit Insurance Policy PDFDocument2 pagesExport Credit Insurance Policy PDFBrianNo ratings yet

- TCQTTTDocument32 pagesTCQTTTdohongvinh40No ratings yet

- Chang Kicking Away The Ladder, An Unofficial History of Capitalism, Especially in Britain and The United StatesDocument36 pagesChang Kicking Away The Ladder, An Unofficial History of Capitalism, Especially in Britain and The United StatesbrainbucketNo ratings yet

- ECO 561 INTERNATIONAL MICROECONOMIC (Group Assignment Rafie, Redzuan & Helmie)Document8 pagesECO 561 INTERNATIONAL MICROECONOMIC (Group Assignment Rafie, Redzuan & Helmie)MOHD REDZUAN BIN A KARIM (MOH-NEGERISEMBILAN)No ratings yet

- Exchange RateDocument9 pagesExchange RateMariam ShamsNo ratings yet

- Role Functions of Exim Bank1Document19 pagesRole Functions of Exim Bank1Aneesha KasimNo ratings yet

- Navigating 2H23Document256 pagesNavigating 2H23Phương LinhNo ratings yet

- Economic Development Strategies of South KoreaDocument47 pagesEconomic Development Strategies of South KoreaZhibek AkmatovaNo ratings yet

- Effects of Globalization On Bangus IndustryDocument4 pagesEffects of Globalization On Bangus IndustryRomel BucaloyNo ratings yet

- Alligators in TexasDocument32 pagesAlligators in TexasTheo BlevinsNo ratings yet

- Chapter 3 - Chemical Product Design & Innovation Process in EngngDocument54 pagesChapter 3 - Chemical Product Design & Innovation Process in Engngainmnrh100% (1)

- IM Assignment 1Document8 pagesIM Assignment 1Abhishek PathakNo ratings yet

- HealthCaps India Limited - R - 02122020Document8 pagesHealthCaps India Limited - R - 02122020DarshanNo ratings yet

- GTS Case StudyDocument17 pagesGTS Case StudyNitish RanjanNo ratings yet

- Madsen & Servais 1997Document23 pagesMadsen & Servais 1997nlechner12No ratings yet