Professional Documents

Culture Documents

Deutsche Lufthansa

Uploaded by

sandlegionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deutsche Lufthansa

Uploaded by

sandlegionCopyright:

Available Formats

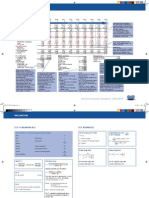

INDEPENDENT EQUITY RESEARCH

Deutsche Lufthansa

Airlines / Germany

34 rue Mdric, 75017 Paris - France Tel +33 (0) 1 70 61 10 58 Email sales@alphavalue.eu Web ALPHAVALUE.COM

Latest

13/07/2011

Add

Target Price (6 months) Share Price

Upside : 20.4 %

17.1 14.2 6,519

NEGATIVE

Fact

Lufthansa increased the number of passengers by 6.4% to 5.88m in June which brings the ytd number to 31.2m (+14.8%). Simultaneously, the cargo volume was up by 3.7% to 159k tons and 14.8% to 953k tons, respectively.

Market Capitalisation M Price Momentum Extremes 12Months Newsflow Bloomberg Reuters

11.8

17.7 Neutral

LHA GR Equity LHAG.DE

Analysis

The carrier continued increasing the offer more sharply than demand moved up. Consequently, the groups seat load factor (SLF) fell by 2.4pp to 81.0% in June and by 2.1pp to 75.7% in H1. The freight load factor (FLF) fell by 3.9pp to 68.6% in the past month and by 3.3pp to 69.1% in H1. The SLF continued to fall quite sharply on Asian/Pacific destinations. The number of passengers flying to/from these destinations is still rising strongly, but Lufthansa is continuing to increase the offer disproportionately (+14.5% in June and +13.1% in H1).

Download Full Analysis

Company Page

PERF Deutsche Lufthansa Transport DJ STOXX 600

1w -7.02 % -7.02 % -2.71 %

1m 2.30 % -6.72 % 0.01 %

3m -4.14 % -4.14 % -2.92 %

12m 17.2 % -5.05 % 6.76 %

Sector Opinion Strongest upside Worst potential

Overweight Air France-KLM Kuehne & Nagel Intl

Complete Sector Analysis

Last updated: 08/05/2011 Adjusted P/E (x) Dividend yield (%) EV/EBITDA (x) Adjusted EPS () Growth in EPS (%) Dividend () Sales (M) EBIT margin (%) Attributable net profit (M) ROE (after tax) (%) Gearing (%)

12/09A -20.8 0.00 8.29 -0.49

12/10A 8.24 4.60 5.15 1.58

12/11E 12.6 4.21 4.52 1.13 -28.7

12/12E 8.71 4.92 4.30 1.63 45.0 0.70 30,400 4.57 748 9.10 25.1

0.00 22,283 0.58 -112 -1.73 21.9

0.60 27,324 3.21 1,131 15.8 25.3

0.60 29,300 4.30 516 6.34 24.7

Company Valuation - Company Financials

Sales by Geography

Valuation Summary

Benchmarks DCF NAV/SOTP per share P/E EV/Ebitda P/Book Dividend Yield TARGET PRICE DCF Calculation Value 16.2 15.9 20.1 19.0 18.7 28.5 17.1 Weight 40 % 40 % 5% 5% 5% 5% 100 %

Largest comparables IAG (International A... Amadeus IT Holding Ryanair Air France-KLM EasyJet

NAV/SOTP Calculation

Consolidated P&L Account

Sales Change in sales Change in staff costs EBITDA EBITDA margin Depreciation Underlying operating profit Operating profit (EBIT) Net financial expense of which related to pensions Exceptional items & other Corporate tax Equity associates Minority interests Adjusted attributable net profit NOPAT M % % M % M M M M M M M M M M M

12/10A 27,324 22.6 11.1 2,570 9.41 -1,591 1,123 1,095 -357 -182 194 165 46.0 -12.0 724 904

12/11E 29,300 7.23 2.51 3,249 11.1 -1,679 1,490 1,430 -746 -113

12/12E 30,400 3.75 2.55 3,458 11.4 -1,785 1,598 1,533 -552 -140

Balance Sheet

Goodwill Tangible fixed assets Financial fixed assets WCR Other assets Total assets (net of short term liab.) Ordinary shareholders' equity Quasi Equity & Preferred Minority interests Provisions for pensions Other provisions for risks and liabilities M M M M M M M M M M M M M M M M

12/10A 605 14,150 1,763 -4,130 2,177 16,221 8,242

12/11E 605 15,020 1,514 -4,472 2,384 16,677 8,027

12/12E 605 15,600 1,514 -4,596 2,507 17,256 8,421

98.0 2,571 1,524 4,095 642 1,340 1,804 16,221

88.0 3,113 1,380 4,493 471 1,430 2,168 16,677

88.0 3,265 1,450 4,715 471 1,500 2,061 17,256

-177 25.0 -16.0 516 1,105

-255 40.0 -18.0 748 1,211

Total provisions for risks and liabilities Tax liabilities Other liabilities Net debt (cash) Total liab. and shareholders' equity

Cashflow Statement

EBITDA Change in WCR Actual div. received from equity holdi... Paid taxes Exceptional items Other operating cash flows Total operating cash flows Capital expenditure Total investment flows Net interest expense Dividends (parent company) Dividends to minorities interests New shareholders' equity Total financial flows Change in cash position Free cash flow (pre div.) M M M M M M M M M M M M M M M M 14.0 1,005 240 -593 -0.03 -274 -751 0.34 199 27.0 2,765 -2,168 -1,838 -357 0.00 -18.0 -570 2,922 -2,450 -2,329 -746 -275 -20.0 -108 3,301 -2,550 -2,550 -552 -275 -21.0 2,570 204 74.0 -110 3,249 342 78.0 -177 3,458 124 82.0 -255

Capital Employed

Capital employed after depreciation M 16,931 17,293 17,849

Profits & Risks Ratios

ROE (after tax) ROCE Gearing (at book value) Adj. Net debt/EBITDA(R) Interest cover (x) % % % x x 15.8 6.35 25.3 1.67 6.42 6.34 7.50 24.7 1.47 2.35 9.10 7.96 25.1 1.37 3.88

Valuation Ratios

Reference P/E (benchmark) Free cash flow yield P/Book Dividend yield x % x % 8.24 4.02 0.72 4.60 12.6 -4.20 0.81 4.21 8.71 3.05 0.77 4.92

AlphaValue EV Calculation

Market cap + Provisions + Unrecognised acturial losses/(gains) M M M M M M M M x x 5,969 4,095 0.00 1,804 2,887 350 98.0 14,503 5.15 0.53 6,519 4,493 0.00 2,168 3,000 350 98.0 15,928 4.52 0.54 6,519 4,715 0.00 2,061 3,100 350 98.0 16,143 4.30 0.53

Per Share Data

No. of shares net of treas. stock (year... Number of diluted shares (average) Benchmark EPS Restated NAV per share Net dividend per share Mio Mio 458 458 1.58 13.8 0.60 458 458 1.13 14.4 0.60 458 458 1.63 15.5 0.70

+ Net debt at year end + Leases debt equivalent - Financial fixed assets (fair value) + Minority interests (fair value) = EV EV/EBITDA EV/Sales

Analyst : Hans-Peter Wodniok, Changes to Forecasts : 08/05/2011.

2011, AlphaValue All rights reserved. This publication is strictly for subscribers own, non-commercial, internal use. No part of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product. All opinions and estimates included herein represent the personal, technical judgment of the analyst as of the date of this report and are subject to change without prior notice. The information contained herein has been compiled from sources believed to be reliable, but while all reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at the time of publication, we make no representation that it is accurate or complete and it should not be relied upon as such. AlphaValue does not accept any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents, including the investment view held in this report.

You might also like

- Annual report 2010-11 financial ratiosDocument1 pageAnnual report 2010-11 financial ratiosAbhishek RampalNo ratings yet

- Beta SecuritiesDocument5 pagesBeta SecuritiesZSNo ratings yet

- First Global: DanoneDocument40 pagesFirst Global: Danoneadityasood811731No ratings yet

- InfraDocument11 pagesInfrakdoshi23No ratings yet

- Half-Year 2013 Results: Belek - TurquieDocument28 pagesHalf-Year 2013 Results: Belek - TurquieEugen IonescuNo ratings yet

- Annual Report 2012Document344 pagesAnnual Report 2012kirdan011No ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Wind Turbines SectorDocument35 pagesWind Turbines SectorDylan SlhtNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- WOLSELEY (Outperform)Document1 pageWOLSELEY (Outperform)libertarianismrocksNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- CRISIL Event UpdateDocument4 pagesCRISIL Event UpdateAdarsh Sreenivasan LathikaNo ratings yet

- Misc (Hold, Eps ) : HLIB ResearchDocument3 pagesMisc (Hold, Eps ) : HLIB ResearchJames WarrenNo ratings yet

- Restaurant: RTN 581.5pDocument2 pagesRestaurant: RTN 581.5papi-254669145No ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Unit 5Document40 pagesUnit 5siyumbwanNo ratings yet

- 2013 Mar 13 - Pernod Ricard SADocument21 pages2013 Mar 13 - Pernod Ricard SAalan_s1No ratings yet

- Sales and Expenses 1994-2001Document23 pagesSales and Expenses 1994-2001arnabpramanikNo ratings yet

- Corporate Finance Presentation EditorialDocument96 pagesCorporate Finance Presentation EditorialtozammelNo ratings yet

- First Resources 4Q12 Results Ahead of ExpectationsDocument7 pagesFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNo ratings yet

- 01 Valuation ModelsDocument24 pages01 Valuation ModelsMarinaGorobeţchiNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Promoters Likely To Raise Stake: CMP '83 Target Price '104Document6 pagesPromoters Likely To Raise Stake: CMP '83 Target Price '104Angel BrokingNo ratings yet

- Valeo DCF Model - Final VersionDocument14 pagesValeo DCF Model - Final VersionPham Minh-QuangNo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinNo ratings yet

- Mercury Athletic Footwear: Ashutosh DashDocument49 pagesMercury Athletic Footwear: Ashutosh DashSaurabh ChhabraNo ratings yet

- HOBEE INVESTMENT REVIEWDocument8 pagesHOBEE INVESTMENT REVIEWTheng RogerNo ratings yet

- Chocolat AnalysisDocument19 pagesChocolat Analysisankitamoney1No ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- An adventure of enterprise: PPR's 2008 results and outlookDocument47 pagesAn adventure of enterprise: PPR's 2008 results and outlooksl7789No ratings yet

- DCF FCFF ValuationDocument0 pagesDCF FCFF ValuationSneha SatyamoorthyNo ratings yet

- China Telecom: Smartphones For All Segments and SeasonsDocument4 pagesChina Telecom: Smartphones For All Segments and SeasonsNate Joshua TanNo ratings yet

- Kuoni Gb12 Financialreport en 2012Document149 pagesKuoni Gb12 Financialreport en 2012Ioana ElenaNo ratings yet

- GP MIS ReportDocument16 pagesGP MIS ReportFarah MarjanNo ratings yet

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Praktiker ThesisDocument5 pagesPraktiker Thesis1238912No ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Balance sheet and cash flow analysisDocument1,832 pagesBalance sheet and cash flow analysisjadhavshankar100% (1)

- Bulgari Group Q1 2011 Results: May 10th 2011Document10 pagesBulgari Group Q1 2011 Results: May 10th 2011sl7789No ratings yet

- Redco Textiles LimitedDocument18 pagesRedco Textiles LimitedUmer FarooqNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- VENTURE CAPITAL FUND Financial ModelDocument11 pagesVENTURE CAPITAL FUND Financial ModelManuel Lacarte67% (6)

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- DMX Technologies 3Q13 results above expectations on higher salesDocument4 pagesDMX Technologies 3Q13 results above expectations on higher salesstoreroom_02No ratings yet

- Financial Statements Review Q4 2010Document17 pagesFinancial Statements Review Q4 2010sahaiakkiNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- FXG10 UPDATEDocument7 pagesFXG10 UPDATEShahbaz AslamNo ratings yet

- Banks DIH Financial AnalysisDocument15 pagesBanks DIH Financial AnalysisRetishaLoaknauthNo ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Financials at A GlanceDocument2 pagesFinancials at A GlanceAmol MahajanNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Business Plan SMOOTH CAFEDocument5 pagesBusiness Plan SMOOTH CAFECherry PieNo ratings yet

- Hippo Case StudyDocument3 pagesHippo Case StudyAditya Pawar 100100% (1)

- SM AssignmentDocument17 pagesSM AssignmentElvinNo ratings yet

- Trade Union-SEUSL-2Document41 pagesTrade Union-SEUSL-2dinukadamsith_287176No ratings yet

- Assignment On Mid-Term ExamDocument12 pagesAssignment On Mid-Term ExamTwasin WaresNo ratings yet

- Supply Chain Management Part 1 Lecture OutlineDocument17 pagesSupply Chain Management Part 1 Lecture OutlineEmmanuel Cocou kounouhoNo ratings yet

- Google's Dominance and Continued Innovation in the Search Engine MarketDocument13 pagesGoogle's Dominance and Continued Innovation in the Search Engine MarketMamta Singh RajpalNo ratings yet

- Extended Warranties-Scope As Insurance Under Indian Contract ActDocument4 pagesExtended Warranties-Scope As Insurance Under Indian Contract ActPISAPATI VISHNUVARDHAN 1950221No ratings yet

- SCDL Solved International Finance AssignmentsDocument19 pagesSCDL Solved International Finance AssignmentsShipra GoyalNo ratings yet

- Two New Alternatives Have Come Up For Expanding Grandmother S CHDocument1 pageTwo New Alternatives Have Come Up For Expanding Grandmother S CHAmit Pandey0% (1)

- Business Studies Redspot 2011-2019Document943 pagesBusiness Studies Redspot 2011-2019amafcomputersNo ratings yet

- # An - Je - 100k - 2-0 - 3-29-19 - v2Document5 pages# An - Je - 100k - 2-0 - 3-29-19 - v2Collblanc Seatours Srl Jose LahozNo ratings yet

- ABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1Document251 pagesABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1autumn100% (26)

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Laporan Keuangan Triwulan III September 2020 PDFDocument176 pagesLaporan Keuangan Triwulan III September 2020 PDFSatria MegantaraNo ratings yet

- BCG Most Innovative Companies 2023 Reaching New Heights in Uncertain Times May 2023Document28 pagesBCG Most Innovative Companies 2023 Reaching New Heights in Uncertain Times May 2023Ashmin100% (1)

- Vietcombank Corporate Governance Assignment EMFB8Document20 pagesVietcombank Corporate Governance Assignment EMFB811duongso9No ratings yet

- Review Question in Engineering Management Answer KeyDocument9 pagesReview Question in Engineering Management Answer KeysephNo ratings yet

- Standard Costs and Variance Analysis PDFDocument3 pagesStandard Costs and Variance Analysis PDFMister GamerNo ratings yet

- Vishal JainDocument2 pagesVishal JainVishal JainNo ratings yet

- Ifrs 2: Share Based PaymentsDocument7 pagesIfrs 2: Share Based PaymentsNomanNo ratings yet

- Bank Panin Dubai Syariah GCG Report 2018Document117 pagesBank Panin Dubai Syariah GCG Report 2018kwon jielNo ratings yet

- OpenText Vendor Invoice Management For SAP Solutions 7.5 - Scenario Guide English (VIM070500-CCS-En-1)Document96 pagesOpenText Vendor Invoice Management For SAP Solutions 7.5 - Scenario Guide English (VIM070500-CCS-En-1)HarshaNo ratings yet

- Mock Exam A - Afternoon Session (With Solutions) PDFDocument65 pagesMock Exam A - Afternoon Session (With Solutions) PDFJainn SNo ratings yet

- Aditya Birla Capital Risk Management PolicyDocument6 pagesAditya Birla Capital Risk Management Policypratik zankeNo ratings yet

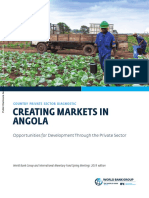

- Creating Markets in Angola Opportunities For Development Through The Private SectorDocument164 pagesCreating Markets in Angola Opportunities For Development Through The Private SectorMiguel RochaNo ratings yet

- HTTP WWW - Aiqsystems.com HitandRunTradingDocument5 pagesHTTP WWW - Aiqsystems.com HitandRunTradingpderby1No ratings yet

- How To Think Like A Marketing Genius - Table of ContentsDocument10 pagesHow To Think Like A Marketing Genius - Table of Contentsbuymenow2005No ratings yet

- FM59 New GuideDocument190 pagesFM59 New GuideDr. Naeem MustafaNo ratings yet

- 4 Capitalized Cost BondDocument32 pages4 Capitalized Cost BondkzutoNo ratings yet