Professional Documents

Culture Documents

BNZ Currency Research (New Zealand 24-5-2011) 5054

Uploaded by

Yusuke IkawaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BNZ Currency Research (New Zealand 24-5-2011) 5054

Uploaded by

Yusuke IkawaCopyright:

Available Formats

Interest Rate Research

24 May 2011

Whats Up With Swap Spreads?

The unusual period of negative NZ swap-bonds spreads appears to be coming to an end. We expect positive swap spreads to be sustained and increase. A more balanced supply to demand ratio for Government bonds should see long bond yields decline relative to swap yields. A tight Budget should also limit further risk premium being applied to long Government bond yields relative to swap yields. Some expected flattening in the yield curve, as interest rates rise should also be associated with a sustained positive swap spread. Positive swap spreads should see increased issuance in areas such as S.S.A1 Kauri bonds where swapreferenced yields will appear more attractive to investors, relative to NZ Government bond yields.

Global 10-year swap to bond spreads

1.5 1.2 0.9 0.6 0.3 0 -0.3 18/04/1996

18/04/1999

Source: Bloomberg

18/04/2002 18/04/2005 AU 10-year swap spread US 10-year swap spread Germany 10-year swap spread UK 10-year swap spread

18/04/2008

18/04/2011

Recently there have been some interesting developments in the relationship between NZ long bond and swap yields. In the last few weeks, swap-bond spreads have returned to positive territory after almost a year below zero. Generally swap yields trade above bonds of similar maturity. Over the past year or so, however, NZ swap yields have traded below bonds at the long end of the curve (5, 7 and 10 year). This has been an aberration in the 15 year history of NZ swap spreads and is also unusual on a global basis. A positive swap spread is the norm globally. Australian and German 10-year swap spreads have always been

(%) 1.5 1.3 1.1 0.9 0.7 0.5 0.3 0.1 -0.1 -0.3 -0.5 18/04/1996

Source: Bloomberg

positive. The UK and the US have experienced only very short-lived periods of negative 10-year swap spreads in the last couple of years. At the very long end of the curve (25-30 years), however, markets such as the US and UK have seen more prolonged periods of negative swap spreads. We will therefore attempt to answer four questions: (i) (ii) (iii) (iv) Why does the swap spread matter? What determines swap spreads over bonds? What caused NZ swaps to trade below bonds and what drove the normalisation? Where to with swap spreads from here?

(I) Why do swap spreads matter?

They matter to corporate, supranational and agency credit issuers and their investors. These entities issue credit with reference to swap rates. Investors compare the attractiveness of these investments, relative to Government bonds, which can have greater liquidity and should represent lower default risk. The swap-bond spread is therefore critical in determining the relative attractiveness of fixed interest investments. In addition, some fixed income funds are benchmarked to swaps making the swap spread critical to investment decisions. They matter to sovereign debt issuers making decisions around whether to shorten the duration of public debt through engaging in swaps. They matters to traders who hope to benefit from trading the spread, know as EFP (Exchange For Physical). i.e. A transaction in which one party buys the physical commodity (bond) and simultaneously sells the derivative (swap), and the other party does the opposite.

New Zealand 5 and 10 year swap-bond spreads

18/04/1999

18/04/2002

18/04/2005

18/04/2008

18/04/2011

NZ 5-year swap spread NZ 10-year swap spread

AAA rated Supranationals, Sovereigns and Agencies

research.bnz.co.nz

Page 1

Currency Research

24 May 2011

(II) What determines swap spread over bonds?

There is a swathe of financial literature as to why swaps theoretically trade above bonds and what determines the spread. Most of these concentrate on the US market, but recurring themes are; 1/ Government bond supply issues 2/ relative credit risk inherent in the two instruments 3/ the slope of the yield curve. 1/ Government bond supply relative to demand has the potential to shift bond yields. Bonds have a scarcity or abundance factor which swaps do not. All else equal, swap spreads should narrow when bond issuance increases. 2/ Relative credit risk. The risk of default for a bond lies with the credit-worthiness of the sovereign. Swaps contain an inherent risk of counterparty default. Ultimately the bank quoting the floating rate could default, although in recent years banks have put in place 2C.S.A. agreements that reduce much of the credit risk. 3/ The shape of the yield curve. When the curve is steep the demand to be a fixed rate receiver in a swap increases. Hence a steeper yield curve could be expected to be associated with tighter swap spreads. Therefore if these findings hold, the spread between swaps and bonds would be expected to narrow when bond supply increased, when perceived risk of Government default relative to banks increased, and when the yield curve steepened.

expanded its deficit during the recession. NZ 10-year bond yields moved below swap yields for the first time in March 2010. They moved more convincingly into negative territory in July 2010. Second, in addition to pure supply/demand dynamics the related issue is perceived Government default risk associated with a pick up in debt issuance. An increase in the overall bonds outstanding incrementally raises the risk of holding those bonds. Hence an increased risk premium is applied to the bond yield relative to the credit risk inherent in the swap yield. An exaggerated example of the phenomena is Ireland. From 1996 to early 2008 Irelands sovereign 10-year bonds showed a typical relationship, trading 20bp below swaps on average. More recently as Irelands Government debt issues have reached crisis point, 10-year bond yields have soared to around 10%, well above 10-year swap rates at 3.4%. Irish swap spreads are therefore massively negative. While NZ Govt debt levels are far from Irelands a marginal increase in perceived default risk has also been at play in the NZ market.

NZ 10-year swap spread vs yield curve

1.5

-1.5

-1

-0.5

(III) What caused NZ swap spreads to narrow to the point of being negative?

NZ Government bonds outstanding

NZD bn 45 40

0.5

0.5

1.5

-0.5 1/01/2000

2.5

1/01/2002

1/01/2004

1/01/2006

1/01/2008

1/01/2010

NZ 10-year swap spread

Source: Bloomberg

35 30 25 20 15 10 5 0 1/01/2000

10 year swap minus 2 year swap

1/01/2002

1/01/2004

1/01/2006

1/01/2008

1/01/2010

Source: RBNZ

NZ Government bonds outstanding

Third, the recent decline in 10-year swap spreads into negative territory has coincided with the steepening in the yield curve to the steepest in history. As the OCR has been slashed to the historically low level of 2.5% the curve has steepened dramatically. Steeping in the yield curve has also been associated with the cyclical dips of NZ GDP growth (qoq) into negative territory, and troughs in investor sentiment post the Christchurch earthquakes. Expressing the view that the RBNZ will cut rates/stay lower for longer can be done effectively through swaps without the upfront cost of purchasing bonds. Swaps are therefore a more leveraged way (with greater liquidity in the context of the NZ market) of expressing negative economic sentiment. Participants are motivated to receive high fixed rates while paying low current floating rates through swaps. Hence swap yields fell further and more rapidly than bond yields.

First, the period of negative swap spreads has coincided with the meaningful pick-up in net debt issuance by the NZ Government. Total Government bonds outstanding began a steep ascent from the start of 2010, having been fairly stable over the previous decade. Bonds outstanding have almost doubled since late 2009, as the Government

2

Credit Support Annex

www.research.bnz.co.nz

Page 2

Currency Research

24 May 2011

NZ GDP

3 2.5 2 1.5 1 0.5 0 -0.5 -1 -1.5 30/06/1996

(IV) Where to with swap spreads from here?

We turn to the three recent drivers of the swap spread. First, the spike in recent weeks in the bid-to-cover ratio for NZ bonds is unlikely to be sustained. (indeed in last weeks auction much lower levels were achieved). However, the Government has recently built up cash balances through pre-funding. In the 2011/12 Budget it has also announced a gradual reduction in gross bond issuance over the next few years from 13.5bn in 2011/12 to 8bn in 2014/15. This will mean net bond issuance of just 5.9bn in the coming fiscal year. We therefore believe demand relative to supply is likely to move back to more normal levels. During the period of negative swap spreads of the past year, the average bid-to cover ratio was a relatively low 2.8x. The average ratio from 1983 is around 3.2x, and we would expect to move back toward these levels. Second, a tighter Budget may also limit any further increase in default risk premium being applied to NZ long bond yields relative to swap yields. With the release of the Budget, rating agency S&P confirmed their current sovereign rating of NZ. However, they have kept NZs foreign currency rating on negative watch, with the risk of downgrade if NZs external position does not improve. Rating agency Fitch described NZs Budget as appropriate, while Moodys said NZs Budget supports a path to surplus and reiterated their AAA rating. Finally, we expect economic sentiment to gradually improve and the market to factor in a removal of highly accommodative monetary policy. We expect that once the RBNZ gets underway they will move steadily toward a 5% peak in the OCR. In line with this view, we anticipate some flattening in the curve from current historically steep levels.

30/06/1998

30/06/2000

30/06/2002

30/06/2004

30/06/2006

30/06/2008

30/06/2010

So urce: Bloo mb erg

NZ GDP (qoq %)

In summary, the recent decline in NZ swap spreads to negative territory was driven by a combination of a pick-up in Govt debt issuance, marginal increase in Govt default risk, and severe steepening in the yield curve. The NZ swaps and bond markets are also in some ways quite separate with different customer/investor bases, responding to different demand/supply dynamics. The ability to engage in a relative value trade (EFP), across the two markets, though theoretically possible, is more difficult in practise. Cross market anomalies can therefore persist for some time.

What drove the normalisation?

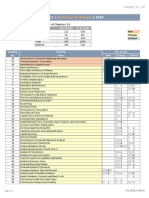

Bid-to-cover at NZ bond auctions

1200% 1000% 800% 600% 400% 200% 0% 15/01/2009

15/07/2009

15/01/2010

15/07/2010

15/01/2011

Bid-to-cover ratio (%)

Source: NZ DMO

Strategy implications

Therefore, we expect that long end swap-bonds spreads will move in the direction of more normal levels. The 15year average is around 60bp but does disguise some marked trends. In addition, the proliferation of C.S.A agreements, post the Global Financial Crisis, that help to mitigate counterparty risk, may also mean that long-term average swap spreads have shifted lower. However, given the three key drivers, discussed above, are all moving in the same direction, we expect swap spreads to remain positive and move gradually higher in the year ahead. This should see increased issuance in areas such as Kauri bonds by AAA rated Supranationals, Sovereigns and Agencies, as their swap-referenced yields will appear more attractive to investors relative to NZ Government bond yields. Borrowers should also consider the risk of higher swap rates as interest rates rise and swap spreads relative to bonds likely increase.

kymberly_martin@bnz.co.nz

While Government bond issuance has continued apace, in recent weeks there was a spike in demand relative to supply. This brought to an end a period of below average bid-to-cover ratios at auction that had endured since early 2010. The low demand relative to supply spanned the period of negative swap spreads. The recent spike up in demand may partly be attributable to a broadened investor base. Anecdotal evidence suggests that some recent demand for NZ Government bonds may have come from areas such as Asian sovereign wealth funds, diversifying their holdings. In addition, the curve has also flattened slightly in the past few weeks, coinciding with the move in swap spreads back to positive territory. The 2s-10s swap curve has flattened from a peak of 2.14% in mid April to close to 1.9% now.

www.research.bnz.co.nz

Page 3

Currency Research

24 May 2011

Contact Details

BNZ

Stephen Toplis

Head of Research +(64 4) 474 6905

Craig Ebert

Senior Economist +(64 4) 474 6799

Doug Steel

Economist +(64 4) 474 6923

Mike Jones

Strategist +(64 4) 924 7652

Kymberly Martin

Strategist +(64 4) 924 7654

Main Offices

Wellington

60 Waterloo Quay Private Bag 39806 Wellington Mail Centre Lower Hutt 5045 New Zealand Phone: +(64 4) 474 6145 FI: 0800 283 269 Fax: +(64 4) 474 6266

Auckland

80 Queen Street Private Bag 92208 Auckland 1142 New Zealand Phone: +(64 9) 976 5762 Toll Free: 0800 081 167

Christchurch

81 Riccarton Road PO Box 1461 Christchurch 8022 New Zealand Phone: +(64 3) 353 2219 Toll Free: 0800 854 854

National Australia Bank

Peter Jolly

Head of Research +(61 2) 9237 1406

Alan Oster

Group Chief Economist +(61 3) 8634 2927

Rob Henderson

Chief Economist, Markets +(61 2) 9237 1836

John Kyriakopoulos

Currency Strategist +(61 2) 9237 1903

Wellington

Foreign Exchange Fixed Income/Derivatives +800 642 222 +800 283 269

New York

Foreign Exchange Fixed Income/Derivatives +1 800 125 602 +1877 377 5480

Sydney

Foreign Exchange Fixed Income/Derivatives +800 9295 1100 +(61 2) 9295 1166

Hong Kong

Foreign Exchange Fixed Income/Derivatives +(85 2) 2526 5891 +(85 2) 2526 5891

London

Foreign Exchange Fixed Income/Derivatives +800 333 00 333 +(44 20) 7796 4761

24 HOUR FOREIGN EXCHANGE SERVICE Phone Toll Free 6am to 10pm NZT Wellington Office 0800 739 707 10pm to 6am NZT London Office Sam Hehir

ANALYST DISCLAIMER: The person or persons named as the author(s) of this report hereby certify that the views expressed in the research report accurately reflect their personal views about the subject securities and issuers and other subject matters discussed. No part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the research report. Research analysts responsible for this report receive compensation based upon, among other factors, the overall profitability of the Markets Division of National Australia Bank Limited, a member of the National Australia Bank Group (NAB). The views of the author(s) do not necessarily reflect the views of NAB and are subject to change without notice. NAB may receive fees for banking services provided to an issuer of securities mentioned in this report. NAB, its affiliates and their respective officers, and employees, including persons involved in the preparation or issuance of this report (subject to the policies of NAB), may also from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as advisors brokers or commercial bankers in relation to the securities (or related securities and financial instruments), of companies mentioned in this report. NAB or its affiliates may engage in these transactions in a manner that is inconsistent with or contrary to any recommendations made in this report. NEW ZEALAND DISCLAIMER: This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. Bank of New Zealand strongly recommends readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. Neither Bank of New Zealand nor any person involved in this publication accepts any liability for any loss or damage whatsoever may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. US DISCLAIMER: This information has been prepared by National Australia Bank Limited or one of its affiliates or subsidiaries (NAB). If it is distributed in the United States, such distribution is by nabSecurities, LLC which accepts responsibility for its contents. Any U.S. person receiving this information wishes further information or desires to effect transactions in the securities described herein should call or write to nabSecurities, LLC, 28th Floor, 245 Park Avenue, New York, NY 10167 (or call (877) 377-5480). The information contained herein has been obtained from, and any opinions herein are based upon, sources believed to be reliable and no guarantees, representations or warranties are made as to its accuracy, completeness or suitability for any purpose. Any opinions or estimates expressed in this information is our current opinion as of the date of this report and is subject to change without notice. The principals of nabSecurities, LLC or NAB may have a long or short position or may transact in the securities referred to herein or hold or transact derivative instruments, including options, warrants or rights with securities, or may act as a market maker in the securities discussed herein and may sell such securities to or buy from customers on a principal basis. This material is not intended as an offer or solicitation for the purchase or sale of the securities described herein or for any other action. It is intended for the information of clients only and is not for publication in the press or elsewhere. National Australia Bank Limited is not a registered bank in New Zealand.

research.bnz.co.nz

Page 4

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Bonds ValuationDocument33 pagesBonds ValuationDouglas Gazader100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 1 4 Mondello Fixed Income TrainingDocument268 pages1 4 Mondello Fixed Income Trainingveda20No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Hull OFOD10 e Solutions CH 07Document12 pagesHull OFOD10 e Solutions CH 07Vishal GoyalNo ratings yet

- Bond ValuationDocument29 pagesBond ValuationNur Al AhadNo ratings yet

- CFA Level 1 - Changes Outline 2024Document27 pagesCFA Level 1 - Changes Outline 2024esha100% (1)

- Issue 36Document48 pagesIssue 36Anonymous JrCVpuNo ratings yet

- JPM Smooth Interpolation of Zero CurvesDocument48 pagesJPM Smooth Interpolation of Zero CurvesEvgenia SorokinaNo ratings yet

- The IB Business of Trading Prime BrokerageDocument78 pagesThe IB Business of Trading Prime BrokerageNgọc Phan Thị BíchNo ratings yet

- FIxed Income PresentationDocument277 pagesFIxed Income PresentationAlexisChevalier100% (1)

- Lehman Swap Swap Indices PDFDocument28 pagesLehman Swap Swap Indices PDFcvacva1No ratings yet

- Bond Value - YieldDocument40 pagesBond Value - YieldSheeza AshrafNo ratings yet

- Chapter 17-Working Capital Management: Cengage Learning Testing, Powered by CogneroDocument50 pagesChapter 17-Working Capital Management: Cengage Learning Testing, Powered by CogneroMark FloresNo ratings yet

- Security Valuation PriciplesDocument69 pagesSecurity Valuation PriciplesvacinadNo ratings yet

- OCC Interest Rate RiskDocument74 pagesOCC Interest Rate RiskSara HumayunNo ratings yet

- Chapter 8 Interest Rates and Bond Valuation: Corporate Finance, 12e (Ross)Document37 pagesChapter 8 Interest Rates and Bond Valuation: Corporate Finance, 12e (Ross)ZiyadGhaziNo ratings yet

- Saunders Notes PDFDocument162 pagesSaunders Notes PDFJana Kryzl DibdibNo ratings yet

- What Does The DFL of 3 Times Imply?Document7 pagesWhat Does The DFL of 3 Times Imply?Sushil ShresthaNo ratings yet

- Question and Answer - 30Document31 pagesQuestion and Answer - 30acc-expertNo ratings yet

- Fixed Income Portfolio ManagementDocument81 pagesFixed Income Portfolio ManagementYamila VallejosNo ratings yet

- Handout 5Document2 pagesHandout 5DelishaNo ratings yet

- Oati 30 enDocument48 pagesOati 30 enerereredssdfsfdsfNo ratings yet

- Chap005a - The Value of BondDocument35 pagesChap005a - The Value of Bondnt.phuongnhu1912No ratings yet

- MBA Review in Financial ManagementDocument30 pagesMBA Review in Financial ManagementNnickyle LaboresNo ratings yet

- Faculty of Accountancy and Management (Fam)Document37 pagesFaculty of Accountancy and Management (Fam)Lee HansNo ratings yet

- 2013 FRM Part 2 100q 1Document66 pages2013 FRM Part 2 100q 1felipeNo ratings yet

- Private Equity Real Estate: NorthfieldDocument26 pagesPrivate Equity Real Estate: NorthfieldchrisjohnlopezNo ratings yet

- Exam 1 LXTDocument31 pagesExam 1 LXTphongtrandangphongNo ratings yet

- Real Estate - U.S. Real Estate and Inflation - ENDocument9 pagesReal Estate - U.S. Real Estate and Inflation - ENTianliang ZhangNo ratings yet

- Pat Hagan Markovian IR ModelsDocument28 pagesPat Hagan Markovian IR ModelsAndrea PellegattaNo ratings yet

- INTEREST RATES DETERMINATION AND STRUCTURE-finalDocument12 pagesINTEREST RATES DETERMINATION AND STRUCTURE-finalPaula Rodalyn MateoNo ratings yet