Professional Documents

Culture Documents

Class of Companies: WWW - Mca.gov - in

Uploaded by

Parvathalu NeelaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class of Companies: WWW - Mca.gov - in

Uploaded by

Parvathalu NeelaCopyright:

Available Formats

We provide Intelligent Solutions to businesses

XBRL

It has been decided by the Ministry of Corporate Affairs to mandate certain class of companies to file balance sheets and profit and loss account for the Financial Year 2010-11 onwards by using XBRL taxonomy. The Financial Statements required to be filed in XBRL format would be based upon the Taxonomy on XBRL developed for the existing Schedule VI, as per the existing, (non converged) Accounting Standards notified under the Companies (Accounting Standards) Rules, 2006. The said Taxonomy is being hosted on the website of the Ministry at www.mca.gov.in shortly.

CLASS OF COMPANIES The following classes of companies have to file the Financial Statements in XBRL Form only from the Financial Year 2010-2011(i.e. year ended 31/03/2011 would be included):i. ii. iii. All companies listed in India and their subsidiaries; All companies having a paid up capital of Rs. 5 Crore and above All companies having a turnover of Rs. 100 Crore or above.

ADDITIONAL FEE EXEMPTION All companies falling in Phase -I are permitted to file upto 30-09-2011 without any additional filing fee.

WHAT IS XBRL XBRL is a language for the electronic communication of business and financial data which is revolutionizing business reporting around the world. It provides major benefits in the preparation, analysis and communication of business information. It offers cost savings, greater efficiency and improved accuracy and reliability to all those involved in supplying or using financial data. XBRL stands for extensible Business Reporting Language. It is already being put to practical use in a number of countries and implementations of

Confidential All Rights Reserved 1

We provide Intelligent Solutions to businesses

XBRL are growing rapidly around the world. DEVELOPMENT XBRL is an open, royalty-free software specification developed through a process of collaboration between accountants and technologists from all over the world. Together, they formed XBRL International which is now made up of over 650 members, which includes global companies, accounting, technology, government and financial services bodies. XBRL is and will remain an open specification based on XML that is being incorporated into many accounting and analytical software tools and applications. ADVANTAGES OF XBRL

XBRL offers major benefits at all stages of business reporting and analysis.

The benefits are seen in automation, cost saving, faster, more reliable and more accurate handling of data, improved analysis and in better quality of information and decision making. XBRL enables producers and consumers of financial data to switch resources away from costly manual processes, typically involving time-consuming comparison, assembly and re-entry of data. They are able to concentrate effort on analysis, aided by software which can validate and process XBRL information. XBRL is a flexible language, which is intended to support all current aspects of reporting in different countries and industries. Its extensible nature means that it can be adjusted to meet particular business requirements, even at the individual organization level. XBRL is estimated to reduce the bank regulatory data and processing efforts by one-third XBRL based reports will eliminate manual labor associated with the re-keying of data between parties Due to the standard format the data is reusable for other regulatory reports and may be repurposed with changes in the external business environment Improves data accuracy Improves flexibility Simplifies programming Improves data timelines Decreases cycle times Automates data validation Reduces reporting burden Reusable data Reduces production cost

BETTER

FASTER

CHEAPER

Confidential All Rights Reserved

We provide Intelligent Solutions to businesses

BENEFITS All types of organizations can use XBRL to save costs and improve efficiency in handling business and financial information. Because XBRL is extensible and flexible, it can be adapted to a wide variety of different requirements. All participants in the financial information supply chain can benefit, whether they are preparers, transmitters or users of business data.

FUTURE OF XBRL XBRL is set to become the standard way of recording, storing and transmitting business financial information. It is capable of use throughout the world, whatever the language of the country concerned, for a wide variety of business purposes. It will deliver major cost savings and gains in efficiency, improving processes in companies, governments and other organizations.

BENEFIT IN THE COMPARIBILITY OF FINANCIAL STATEMENTS XBRL benefits comparability by helping to identify data which is genuinely alike and distinguishing information which is not comparable. Computers can process this information and populate both pre defined and customized reports. CHANGE IN ACCOUNTING STANDARDS No. XBRL is simply a language for information. It must accurately reflect data reported under different standards it does not change them.

Confidential All Rights Reserved 3

We provide Intelligent Solutions to businesses

BENEFITS TO A COMPANY FROM PUTTING ITS FINANCIAL STATEMENTS INTO XBRL XBRL increases the usability of financial statement information. The need to re-key financial data for analytical and other purposes can be eliminated. By presenting its statements in XBRL, a company can benefit investors and other stakeholders and enhance its profile. It will also meet the requirements of regulators, lenders and others consumers of financial information, who are increasingly demanding reporting in XBRL. This will improve business relations and lead to arrange of benefits. With full adoption of XBRL, companies can automate data collection. For example, data from different company divisions with different accounting systems can be assembled quickly, cheaply and efficiently. Once data is gathered in XBRL, different types of reports using varying subsets of the data can be produced with minimum effort. A company finance division, for example, could quickly and reliably generate internal management reports, financial statements for publication, tax and other regulatory filings, as well as credit reports for lenders. Not only can data handling be automated, removing time-consuming, error-prone processes, but the data can be checked by software for accuracy.

WORK XBRL makes the data readable, with the help of two documents Taxonomy and instance document. Taxonomy defines the elements and their relationships based on the regulatory requirements. Using the taxonomy prescribed by the regulators, companies need to map their reports, and generate a valid XBRL instance document. The process of mapping means matching the concepts as reported by the company to the corresponding element in the taxonomy. In addition to assigning XBRL tag from taxonomy, information like unit of measurement, period of data, scale of reporting etc., needs to be included in the instance document. WAYS COMPANIES CREATE STATEMENTS There are a number of ways to create financial statements in XBRL:

XBRL-aware accounting software products are becoming available which will support the export of data in XBRL form. These tools allow users to map charts of accounts and other structures to XBRL tags. Statements can be mapped into XBRL using XBRL software tools designed for this purpose Data from accounting databases can be extracted in XBRL format. It is not strictly necessary for an accounting software vendor to use XBRL; third party products can achieve the transformation of the data to XBRL. Applications can transform data in particular formats into XBRL. The route which an individual company may take will depend on its requirements and the accounting software and systems it currently uses, among other factors.

4

Confidential All Rights Reserved

We provide Intelligent Solutions to businesses

GUIDANCE The List of vendors for XBRL Software can be accessed from MCA Website1.

If any further clarification is required, kindly contact us at: Tel No: +91 11 4370 3300 Fax No: +91 11 41513666 Email: srdinodia@srdinodia.com Website : www.srdinodia.com

www.mca.gov.in

5

Confidential All Rights Reserved

You might also like

- XBRL in IndiaDocument23 pagesXBRL in Indiaksmuthupandian2098No ratings yet

- Faqs On XBRLDocument5 pagesFaqs On XBRLDarshan ShahNo ratings yet

- MCA Circular - 31.3.2011Document8 pagesMCA Circular - 31.3.2011Karishma ThakkarNo ratings yet

- XBRL FaqDocument6 pagesXBRL FaqaauchityaNo ratings yet

- All About XBRL: 2. What Are The Potential Uses of XBRL?Document9 pagesAll About XBRL: 2. What Are The Potential Uses of XBRL?Rohit AggarwalNo ratings yet

- What Is XBRLDocument3 pagesWhat Is XBRLpawan kumar dubeyNo ratings yet

- Study On XBRL Implementation For Financial Reporting.Document41 pagesStudy On XBRL Implementation For Financial Reporting.sa281289100% (1)

- C15. XBRL New ToolDocument20 pagesC15. XBRL New ToolHayderAlTamimiNo ratings yet

- Financial Reporting and XBRLDocument13 pagesFinancial Reporting and XBRLMhmood Al-saadNo ratings yet

- XBRLDocument9 pagesXBRLKiran Kumar Mc GowdaNo ratings yet

- XBRLDocument9 pagesXBRLkiranNo ratings yet

- Referencer On XBRLDocument19 pagesReferencer On XBRLasksubirNo ratings yet

- Article 2 PDFDocument4 pagesArticle 2 PDFAllan CintronNo ratings yet

- XBRL - A Global Fi Nancial Reporting Standard: ThemeDocument7 pagesXBRL - A Global Fi Nancial Reporting Standard: Themeksmuthupandian2098No ratings yet

- Business Wire White Paper - XBRL Next Steps: What You Need To Know For 2010 and BeyondDocument9 pagesBusiness Wire White Paper - XBRL Next Steps: What You Need To Know For 2010 and BeyondIR Global RankingsNo ratings yet

- Financial Accounting - Accounting TheoryDocument62 pagesFinancial Accounting - Accounting TheoryKagaba Jean BoscoNo ratings yet

- 5 XBRL: A New Tool For Electronic Financial Reporting: January 2004Document21 pages5 XBRL: A New Tool For Electronic Financial Reporting: January 2004Voiceover SpotNo ratings yet

- CG CHP 12 PDFDocument12 pagesCG CHP 12 PDFlani anggrainiNo ratings yet

- XBRLDocument10 pagesXBRLAnup VermaNo ratings yet

- Fujitsu Inter Stage XWand V10 DSDocument2 pagesFujitsu Inter Stage XWand V10 DSCorina BradeaNo ratings yet

- ICAI Guidance Note On XBRLDocument64 pagesICAI Guidance Note On XBRLSHIV KUMAR KAULNo ratings yet

- Lecture Corporate Governance and Ethics Chapter 12 - Rezaee (Download Tai Tailieutuoi - Com)Document13 pagesLecture Corporate Governance and Ethics Chapter 12 - Rezaee (Download Tai Tailieutuoi - Com)hieuvu2000No ratings yet

- 0905 XBRLDocument2 pages0905 XBRLshrikantgarudNo ratings yet

- Iris Where Information Meets TechnologyDocument32 pagesIris Where Information Meets Technologygaurav_indira089702No ratings yet

- CA XBRL Preparers GuideDocument98 pagesCA XBRL Preparers GuideGaurav RamrakhyaNo ratings yet

- Infor SunSystems For Oil and Gas BrochureDocument4 pagesInfor SunSystems For Oil and Gas BrochureDidik HariadiNo ratings yet

- The Impact of XBRL On Financial Reporting: A Conceptual AnalysisDocument8 pagesThe Impact of XBRL On Financial Reporting: A Conceptual AnalysisChima EmmanuelNo ratings yet

- Hot Topic: XBRL-A New Era in The Delivery of Financial Information?Document5 pagesHot Topic: XBRL-A New Era in The Delivery of Financial Information?urkerNo ratings yet

- Vaibhavdwivedi Bcom2e CADocument4 pagesVaibhavdwivedi Bcom2e CAPsyc GamingNo ratings yet

- Addressing XBRLDocument36 pagesAddressing XBRLBooksyBNo ratings yet

- Financial Reporting and Management Reporting SystemsDocument71 pagesFinancial Reporting and Management Reporting SystemscamsNo ratings yet

- AlphaBricks AutoXBRL BrochureDocument2 pagesAlphaBricks AutoXBRL BrochureMahesh BangaliNo ratings yet

- XBRL TechnologyDocument2 pagesXBRL TechnologyCris R. HatterNo ratings yet

- Oracle Lease and Finance Management For Manufacturers: Increase Equipment Sales PenetrationDocument4 pagesOracle Lease and Finance Management For Manufacturers: Increase Equipment Sales PenetrationSrinibas MohantyNo ratings yet

- 11 12 13 15Document8 pages11 12 13 15Vanilla GirlNo ratings yet

- Nel & Steenkamp (7.08) - Meditari Vol 16 No 1 2008Document15 pagesNel & Steenkamp (7.08) - Meditari Vol 16 No 1 2008Essam AminNo ratings yet

- Why Accounting Method As 4th C in R12Document4 pagesWhy Accounting Method As 4th C in R12Balaji ShindeNo ratings yet

- Microsoft Dynamics 365 Business Central Capability GuideDocument28 pagesMicrosoft Dynamics 365 Business Central Capability GuideMatarNo ratings yet

- Audit1a Summary CAA & XBRLDocument2 pagesAudit1a Summary CAA & XBRLVenz Karylle CapitanNo ratings yet

- A Training ProgrammeDocument16 pagesA Training Programmewarezisgr8No ratings yet

- HA2042 Accounting Information Systems Assessment 2: Individual Assignment System Analysis and Selection Student Name and NumberDocument13 pagesHA2042 Accounting Information Systems Assessment 2: Individual Assignment System Analysis and Selection Student Name and NumberShivansh KumarNo ratings yet

- Lecture Week: 5 Chapter 6: Technology Concepts: Tutorial: Bap 71 Ais Discussion Questions & ProblemDocument5 pagesLecture Week: 5 Chapter 6: Technology Concepts: Tutorial: Bap 71 Ais Discussion Questions & ProblemOdria ArshianaNo ratings yet

- XBRLDocument33 pagesXBRLShi SyngeNo ratings yet

- R12 Inter Company BalancingDocument6 pagesR12 Inter Company BalancingRaghurami ReddyNo ratings yet

- Activity 2092Document14 pagesActivity 2092Joie Cyra Gumban PlatonNo ratings yet

- Accounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054Document6 pagesAccounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054BAVYA RNo ratings yet

- Gartner-Microsoft Joint Newsletter - Implementing Your Next-Generation Integration PlatformDocument31 pagesGartner-Microsoft Joint Newsletter - Implementing Your Next-Generation Integration Platformaaaqqq326No ratings yet

- 5IR Bookkeeping - BP (Draft DBK) 1.0Document27 pages5IR Bookkeeping - BP (Draft DBK) 1.0Pro Business Plans50% (2)

- Accounting PackageDocument21 pagesAccounting PackageSha dowNo ratings yet

- Team Action Plan Business Presentation in Black and White Neon Pink Turquoise Bold Gradient StyleDocument33 pagesTeam Action Plan Business Presentation in Black and White Neon Pink Turquoise Bold Gradient StyleGungun SharmaNo ratings yet

- HFM Traning HITATHIDocument83 pagesHFM Traning HITATHIRakesh Jalla100% (1)

- An XBRL Starter GuideDocument4 pagesAn XBRL Starter GuideJill Edmonds, Communications DirectorNo ratings yet

- XBRL I.E Extensible Business Reporting LanguageDocument15 pagesXBRL I.E Extensible Business Reporting Languagemeenakshi56No ratings yet

- Harsh Acc InfoDocument25 pagesHarsh Acc InfoGurleen KaurNo ratings yet

- Accounting Information Systems 2nd Edition Richardson Solutions Manual Full Chapter PDFDocument36 pagesAccounting Information Systems 2nd Edition Richardson Solutions Manual Full Chapter PDFletitiaesperanzavedhd100% (14)

- Multi-Orgs Chapter 3 - Page 1Document34 pagesMulti-Orgs Chapter 3 - Page 1rpgudlaNo ratings yet

- Dynamics 365 Business Central Capability Guide - En-En - Final - v2Document30 pagesDynamics 365 Business Central Capability Guide - En-En - Final - v2Jesus CastroNo ratings yet

- Assignment On XBRLDocument11 pagesAssignment On XBRLArijit B Chowdhury100% (1)

- SAP AccountingDocument2 pagesSAP AccountingSultanNo ratings yet

- Chapter 2: Related Theoretical Design Inputs 2.1 Sihwa Lake Tidal Power StationDocument9 pagesChapter 2: Related Theoretical Design Inputs 2.1 Sihwa Lake Tidal Power Stationaldrin leeNo ratings yet

- Seven Steps To Passing The CBAP® or CCBA® Exam - A Foolproof PlanDocument10 pagesSeven Steps To Passing The CBAP® or CCBA® Exam - A Foolproof PlanHoang Tri MinhNo ratings yet

- Deep Learning With Keras and TensorflowDocument557 pagesDeep Learning With Keras and TensorflowCleiber NichidaNo ratings yet

- FV/FRV Series Throttle Valves/Throttle Check Valves: SymbolDocument2 pagesFV/FRV Series Throttle Valves/Throttle Check Valves: SymbolThyago de PaulaNo ratings yet

- 1118mm - Thickness Calculator For MS or DI PipesDocument8 pages1118mm - Thickness Calculator For MS or DI Pipesanirbanpwd76No ratings yet

- Radovan Damjanović Srbsko Srbski Rečnik: Download NowDocument9 pagesRadovan Damjanović Srbsko Srbski Rečnik: Download NowTinamou0001No ratings yet

- Temenos - COB - Error Messages - T24 Wiki PinakesDocument2 pagesTemenos - COB - Error Messages - T24 Wiki PinakesNett2k100% (1)

- (PDF) 14 Websites To Download Research Paper For Free - 2022Document19 pages(PDF) 14 Websites To Download Research Paper For Free - 2022hatemaaNo ratings yet

- Lightweight Asynchronous Snapshots For Distributed Dataflows (Flink)Document8 pagesLightweight Asynchronous Snapshots For Distributed Dataflows (Flink)SiuMing ChanNo ratings yet

- Software Requirement SpecificationDocument10 pagesSoftware Requirement SpecificationAyush Agrawal0% (1)

- ANT-60A CPN 622-2363-001/002 ANT-60B ADF Antennas CPN 622-3710-001Document4 pagesANT-60A CPN 622-2363-001/002 ANT-60B ADF Antennas CPN 622-3710-001Eka KrisnantaNo ratings yet

- Project Management Skills Unit-5Document26 pagesProject Management Skills Unit-5ಹರಿ ಶಂ100% (1)

- NDC96 NDC 96 24-75VDC 1.9-6.0a Stepping Motor Drive Boxed Rta Pavia ManualDocument9 pagesNDC96 NDC 96 24-75VDC 1.9-6.0a Stepping Motor Drive Boxed Rta Pavia Manualrenato vitaliNo ratings yet

- Prueba de ConfirmacionDocument4 pagesPrueba de ConfirmacionLuis Fernando deoleo FurcalNo ratings yet

- Allplan 2006 - SchedulesDocument240 pagesAllplan 2006 - SchedulesbathcolNo ratings yet

- TeM-9007 enDocument238 pagesTeM-9007 eneugeniuciobanu100% (3)

- After Resetting Frame Counters, Payload Is Shown On Gateway Traffic But Not in Application - Application Development - The Things NetworkDocument8 pagesAfter Resetting Frame Counters, Payload Is Shown On Gateway Traffic But Not in Application - Application Development - The Things NetworkWilliam VizzottoNo ratings yet

- Understanding Commercial and Government EntityDocument5 pagesUnderstanding Commercial and Government EntitystackedaerospaceNo ratings yet

- COMP1115 Week 11 Microsoft Access Relationships and Queries Part 1 W19Document21 pagesCOMP1115 Week 11 Microsoft Access Relationships and Queries Part 1 W19Raquel Stroher ManoNo ratings yet

- Mud-Pump-Parts-Expendables PZ11Document1 pageMud-Pump-Parts-Expendables PZ11rezandriansyahNo ratings yet

- Invitation and Detailed Programme 17 March 23 ConferenceDocument5 pagesInvitation and Detailed Programme 17 March 23 ConferenceNeerajNo ratings yet

- Commercial Invoice: Hikvision Panama Commercial, S.ADocument1 pageCommercial Invoice: Hikvision Panama Commercial, S.AUzzielNo ratings yet

- Effect of Area Ratio On Flow Separation in Annular Diffuser PDFDocument9 pagesEffect of Area Ratio On Flow Separation in Annular Diffuser PDFArun GuptaNo ratings yet

- 2023bske PCVL For Barangay 7216005 JatianDocument56 pages2023bske PCVL For Barangay 7216005 JatianBhin BhinNo ratings yet

- Exin Light Zone 0 EX90L-T4-Brochure-V26032019Document1 pageExin Light Zone 0 EX90L-T4-Brochure-V26032019Alexa Burlacu0% (1)

- CBAP Cheat SheetDocument18 pagesCBAP Cheat SheetShruti GuptaNo ratings yet

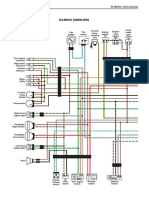

- Small Engine Repair Reference Center Wiring Diagram KawasakiDocument3 pagesSmall Engine Repair Reference Center Wiring Diagram Kawasakiotto moranNo ratings yet

- B737-B787 QRH Differences: 787 NNC Includes Emergency DescentDocument13 pagesB737-B787 QRH Differences: 787 NNC Includes Emergency DescentUfuk AydinNo ratings yet

- CDS VAM TOP ® 3.5in. 9.2lb-ft L80 Type 1 API Drift 2.867in. 87.5%Document1 pageCDS VAM TOP ® 3.5in. 9.2lb-ft L80 Type 1 API Drift 2.867in. 87.5%anon_798581734100% (1)

- Sunny Steel Enterprise LTD.: Collect Steel Pipe and Fitting ResourcesDocument7 pagesSunny Steel Enterprise LTD.: Collect Steel Pipe and Fitting ResourcesAngirekula gopi krishnaNo ratings yet