Professional Documents

Culture Documents

CC Fees Normal New

Uploaded by

Danach Mohamad0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageCC Fees Normal New

Uploaded by

Danach MohamadCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

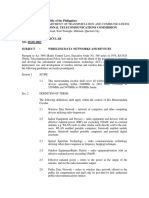

Gold Classic / Sillver

Annual Membership (Primary) SR 1000 SR 300 SR 150 SR 400 SR 200

Annual Membership (Supplementary) SR 500 Free Free Free Free

Annual Membership (Taqseet Card) Free Free Free Free Free

Annual Membership (Low Limit Card) Free Free Free Free Free

Returned Cheque SR 50 per SR 50 per SR 50 per SR 50 per SR 50 per

incidence incidence incidence incidence incidence

Finance Charge for Accountholder

Finance Charge for non accountholder

Cash Withdrawal 3.5%Or SR 75 Whichever is higher

Installment Service Fee 2.55%per month on total amount due based on the date of transaction

International Transaction Up to 2.75% Up to 2.75% Up to 2.75% Up to 2.75% Up to 2.75%

Management Fee NA NA NA NA NA

Monthly Minimum Payment 5%of the total due amount, or SR 200, whichever is the higher

Samba Credit shield %per month 0.49%of the total outsatanding balance

Disputed Transaction SR 250 will be charged for investigating disputed transactions if the result is against the Card Member.

Late Payment SR 100 to SR 450 depending on the Card Member's outstanding

Over limit SR 75 SR 75 SR 75 SR 75 SR 75

: , . . . : . . . : , : . . . : , . . . . . .

: , . . . : . . . : , : . . . . . . . . .

: , . . . : . . . : , : . . . . . : . . . . . . . _ : . . . . _

: , . . . : . . . : , : . . . . . . . L

. . . . , . .

: , . . . : . . , , : . . . . . : . . . . .

: , . . . : . . , , : . : . . _ : . . - . . . . .

: . . . . . . . , . . , . , . . s . , ( . s . . . .

. . : . . . . L . . _ : . . , , . . . . : _ : . , : . . . . . . . . . . : . . . .

: . . . . . : . , : . .

. . . . .

: . . . . : . : . . . . . . . , , . . . . . . . : _ : . , : . . . . . , . . . . , . . s . ,

: . . . . . . . _ . . . . . . : _ : . , : . . . . . . : , : . . .

. . . . . . , . _ . . . s . . . . . . , . _ . s . . . . . . . . : . . . . . . . : , : . . .

. , . . . . . . , . . , , . . . . . . . , . . . . . . . . : . , : . . . . .

. . . , : . . . . . . . _

G J b Y j G d b h N e S e a , S e GC h j h GC L I G d G E d h f P G G d

. . : , : . . , , : . . : . . . s . . . . . . : . . . . . . . . . , . : . . : . . . . . . . . . : . . . . . . . . _ , : . . , . . . . . . , s . . ( , . . . . . . . : . . . . . . . . . . , . . _ . . . . . , . , _ . : . . , . : _ , : . _ . . : . . : , : . . . , . . : , : . . . ( , . . . . _ . ,

. . . . . . . . _ : . . . . . .

1 - . . . _ . . . . , : . : . . . . . . . s _ . . . : , : . . . . . . . . . . . . . . . : , : . . . . . . . . . . , : , : . . . ( , . . . . . . : , . . . : , , . . : . . . . , : . . . . . . : . . . - : , , . . , . . . . : : . . - . , . . . . . . : , : . . . . . . . : , : . . . . . . : . . .

. : . s . _ : . . . . . _ : . : . : . , . : . . . . . : , : . . . . _ . . . . . . : , : . . . , : . . . . . : . . s . . . . . . . s . , . . . . . . . : , : . . . : . . , , , . s . . . . . . . . . . , . . . : , : . . . . : . . . . . . . . . : , : . . . . : , .

. . . . : , . . . _ .

2 - . . . , . . . : , : . . . . . . . . . . . . . , . . . . . . . . . , . . . . . . . . . . . . - , . . . . . . - , , : . . . . . : , : . . . . , . . : . . . . , . . . . . . . . . . . . . : , : . . . . _ . . : . . . . . . . . : . . . . . : . . . . . , : . . . - : . . . . . . . , . , , . . . . . . , . . . . . . , . . ,

. . , . . . . . . . , . .

3 - . . : . . : , : . . . . , . . . . . . . . . . , . . _ . . . . . . . . . : . . . . . . . . . . , : , : . . . . . . . . . . ( . . . . . . . - : . , . . . , . . . . . . _ . . : . . . . . . . . , , ( . : . . , . , . . , . . : , : . . . . . : . . . . . . . : . , . . . : . . . . : . . .

: , : . . . , : , : . . . . . . . . . . .

4 - . , . . : , : . . . s . . : . . . , : . . . . . . : . . . . . : . _ . . . . . . . . . . . . : . . . - , . : . . . , . : . . . . . , . . . . . . : . . . . : . . . . . : , . s . . . . . . . . . : . . . . : . s . , , . . . , . . , . . s . . , . , _ . s _ . . . . : , . : . . . . . . . : . . . . .

. , . . . . , . , . . : - . , . . . : , : . . . . . . . . . . . . . . . . . . - , . . . . . . , . . : . . . . . , _ . . . . . , : . . . . . . . , . .

5 - . . . . : , : . . . . . - . . : . . . . , . . _ , . . . , . . , _ : . . . . : . . . . . . . , . : . . . , . . . , . . . . . . . . . . . . . , . : . . . . . . . . . : , : . . . . . . . , . : . . . . . _ . . . . . : . . : , : . . . : . . . . . . , . .

6 - . . . . . , . . . . . . . . . . . . . . . . . . : , : . . . , . . : . . . . , : . . . . . . , . , . . : . . . , . , . : . . . . . : , : . . . , : . , . . . . , . : . _ . . s , . . . , . . . . . . . . . . . , , . . , . . s , . . . . . . . , . . . . . . . . . . . . : , : . . . . , .

. . : , : . . . . . . . . . : . , . : . : . . . . , . . . , : : . . s . . : , : . . . . . , . . . . . . . . , . , . . . . . . .

7 - . . . : , : . . . . . . . . . . . . , , . . . _ . . . . . - , . . . . . , . . _ : . , . . : . . . . . . . . - , : . . . . . _ . . . . . - , . . . . . , . . . . . s _ . . , . . s . , : - . . , , . . . . . : , : . . . . , . : . . . . : . . . . : . . . , . . . . , : . . . . . . . _

. . . s _ . . . . . . . . . . . . . . . . : . . . . , . . . , : , . . . . : . . s . , : . _ . . . s _ . . . . . . : . . : . .

8 - . . . . : , : . . . . : . . . . . : _ , . . , _ . , . . : , . . . : , : . . . ( : . . : , . . . . : . . . , . : , . : , : . . . . : s . , , . . . . . . . . . , : . _ . . . . : . . : , : . . . : . . . , . . . . . . . . : . . . , : . . , , . . .

9 - . . . , , . . . . . : . . . . . . , . . . . . . . . . . . . . . . . . . r . . . . , . , . . . . . . . . : - . . : , , . . , . . : . . s . _ . : . . _ : . . : . . , . . : , : . . . , . . . . , . . . . . , . . , . . . . . . , . . . . . _ . . . . . . . . . . , . .

0 1 - _ . . . , . : . . . . _ . . . . . . . : , : . . . . . . . . . : . . . : . : . . . . . . . . . . . : . , . : : . . . . . . . . , . . . . , . . , . . . . _ . . . . . . . : , : . . . , . . . : . . . : . : . . . . . . L . . . . . . . . . . , . . . . . . . . . . . . . . s . r . . _ .

1 1 - . _ . . : . , . . . . . : , : . . . . . _ : . . . . , . : . . _ . : . : , . , . . - , , . . , . . s . . : . , : . . . . . . : , : . . . . _ : . . . , . _ . . . _ . . : , : . . . . . . - . . . _ . . . : . , . : : . . . . . . . . . : , : . . . . . . . . . , . . . . . . . : . . . .

2 1 - . . . . . . . . . . . . . . . . . : . . : , : . . . . . : , . . : . . . . , . s _ . . : , : . . . . . . , . . , _ . . . , : . . . . . . , . . . . _ . . : . . . . . . . . , . , : , . . , . . . . . . . . . . . . . . . , . . : : , . . : . . . . .

3 1 - . : , . . : . . : . . r . . . . . . : . . - . : . . . . , . s . . : . . _ . . . . . . : . . . . : . . : . . . . . . - : , : . . . . . . . . : . . . . . . . _ : . . : , : . . . . . . . . . . r , , . . . . . . . - . . . . . . : , . .

4 1 - . . . . . . . : , : . . . . . . . , . . : . , . . . . . _ . . : . . . . . . , . . s : . . : , : . . . . . : . , . . . . . _ . . : . . . . . , s . . : . , . . . . . _ : . . . . . . . . . s . . : . . . . . : . . . _ . . : , : . . . .

5 1 - . . . . . . : , : . . . . , : . . . - , . , : . . . , . . _ . s . _ . . , . . . . . : . . . . . , . . . : , . . . . _ . _ . : . . . . . . : _ . . : . . s . _ , . . : . . . . _ . . : . . . _ , . . , . . . : , : . . . . . , . , . . : , : . . . . . . , . . . . . . . . . . . . . .

. . . - , . . . , . , . . , . . . : . . . - , . : . . . , . . . : . . . . . . . . . . , . . . . . , . : . . . . _ . , . . , . . . . . : . . . . . .

6 1 - . . : . . : , : . . . _ . . _ , . . . . . , . . . . . . . . . . . . . . . . . . . : _ : . . . . , . . , . s _ . . . . . . . . . . . . . . . . . . . . , . : . . . : , : . . . . , : , : . . . . . . . . . . . : . . : . . . . . , . . . . . . . . : , : . . . . . . . . . : . , . :

: . _ . s _ . . . : . . . . . . . . . - .

7 1 - . . : . . . . , . _ . . _ , . . . . . , . . . . . . . . . . , . . . . . . . . . . : , : . . . . , . . . , , s , . . . s . : . . . . , . ( , . : . , _ . . . . . , : . . . . . . . : , : . . . , . . . . . . . , : - , : , . . , . . . : , : . . . : . . . . . . . . . . . . : , : . . . . . : . . :

. . . . . : . . . . , . . , . . . . , . . . . . . . . . . . . . _ s . . : , . . . . : . . . . _ . . . . . : , : . . . . . . , . . . . . . : . . : , . . . . . . _ . . : . . : . . . . . . . _ , : . . s . . . . . - . . : . . : , : . . . : . . . . . . . . . . , . . . . . . . : . s . . . . : . . , s . .

. . , : . . . . . . . . , . . . . . . , , . . . . . . . . . . . . . . . , . . . . . . . . . . . . , . . . . , . .

8 1 - . _ . . : . . . _ . . : , : . . . . . . . - , . . . . , . . _ : . . s . : . , . . . : . . . . . . . . . _ : , . : . . _ : . . . . : . . . - , . : . . . , . . . . . . . . , . : . . . . . . . . . : . , . : : . . . . . . .

9 1 - . . : . . . . , . . _ , . . , . , _ . . . . . . : , : . . . . . . . , , . . . . . . s . . . . . . . . . . . . . . . . . . , . . . . . . . . : , : . . . . , . : . . . . , . , . _ . . . . . . . . . : , : . . . . : . . . . , . . . . . . . . . . . . , . . . . . . . -

. . : : . . . . , . . . . . . . . . . . . . : . . . . , : . . . : , : . . . . , : . . . . . , . . . . . . . . . . , . . : . . . . , ( . . , . . . , , . . . . . . : , : . . . . , : . . . - . . . . . . . . . - . . : : . . . . , . , . . . . . . , . . , . . . , , . . . . , -

. . : .

0 2 - . . : . . . . , . . _ , . . . , . . , _ : . , . . - . . . : . . . . . . . , , . . , . : . . : , : . . . . _ . , . _ . , . . . . . . . . . , . . . : , : . . . . . : . . . - . . . . . . . . _ . . . . : , . _ . . . . . , . . , . . - . . , . . . . . , : s . . , _ . . . . . . . . . . .

: . . : , : . . . . . . . _ . . , . . _ . . . . . . _ . s . . . . . . . . . , . . . . . . : . . . . . . . _ . _ . . . . . . . . . . , . . , . . . . . . , . . : . . : . . . . . . : . , . . . , , , . . . . . . . . . _ . . . . . . . . . . . . . , : . s _ . . . . , . . . . , . . . . . . . . ,

, . . , , . . . . . , . , . . . , . , . . , . , . . . , . . . . , . . , . . ( . . s , . . . . . : , : . . . . . . , . . _ . . . . , . . , . . . . . . . . . . , . . . : , : . . . . . . . . . . . , . . . . . . , . . . : , : . . . . . , _ . . . . , . . _ . . . . , . . . . . . . ,

. . . . . . . s . . . . , . : . . . .

1 2 - . . . . , : : . , . . . _ . . . , . . . : s . : , : . . . . . . . , . . . . . , . : . . . . , . : . . : . , : . . . . . . . . . . . : , : . . . , . . . . . - . _ . . . . , . . : . . . . , . . . . . . . . : . , . : . . . . : . . . . . . _ . . . . : , , . . . , . : , : . . , , , . s . : . . . . . .

. . . . , . . : . . . . , . s _ . , . . : s : : , . . , . s _ . . . , . . : : . .

2 2 - . _ . . : . , . . . . . . . . , . . . . . . . . , . . . . . . - . . : , : . . . , . . . , . . . r , , . _ . . . . . . . : , . . . s _ : . . . . . . : . . . . . . . . . . . , . . , . . . . : . . . : , : . . . . . . . : . . . .

3 2 - . . : . . . . . , , . . . . . . , . . . . . . . . . . . : , , . . . - : . . . . . . _ . . . . . - : . . . . . . , . , , , : . , . . . - , , , . . - . , . . . _ : . . . . . . . , . . . _ . . . . . , _ . . . . . . , . - . . . . . . s . . . , . , . . . . . . . . _ : . . . , . . . . . . . - , . . . , . . - .

. s . . . . . . _ : . . . . , . . . - ( , _ . s . . . . : . . . . . : : . . , s . : . . s . , . . . - ( , , s . : . . . . . , . . . . . . . : . . : . , . _ : . . . . , . . . . . ( .

4 2 - . . : . . . . , . . _ , . . . . : . . . . - : . . . . . : . , . . , . . , _ . . . . , . . . . . : , : . . . .

5 2 - . . . . : , : . . . . _ . . _ : . . . . . . . . . . - , . . . - . . s . , , . . . . : : , . . , . . . . : . . . . . . . . . . : . . : . , . _ : . . . . , . . . . . ( . . . . - . , . : , . . . . , . . . . . . . : . . . . . : . . . . . , . . . . . . : . . : , . . : . r . . . . , . : . , . _

: . . . . , . , . _ : . . . . . . , : . . . . . . , . : , . . . : . . . . s . _ . . . . . : , . . r . . . _ . s . . . . . _ : . . . . . . : . . . . . . _ : , . . . . . . . . . . : .

6 2 - : . . . . . . . . . . . . . , . . _ , . , , . : . . , . : . s . , , . _ : . . . . . . . . : , : . . . . . . . . . . . . . , : . . . , . . . , , . . . . . , . , . : , . . : . . , , : . . s . . . . .

7 2 - . . . . . : , . . : . . , . . : . . . : . . _ , . s _ : . . . . . . : . . : . . . : , . - . , . . : . . : , : . . . . . . . . . . . . , . . . . . . . . . . _ . , . , . . : . . . . , . _ . . . . . . . , . . . . . . .

8 2 - . . . . . . . : , . . : . . , : . . , , . . . . . : , : . . . , . . . . . , . . . . . . . : . , . . . . . . : , : . . . . . _ : , . . . . . . . , , . . . . . . . . - , . . , . : . . . . . . : . : , . , . . . . , : , . . : . . , . , . : . . . . . . . . . . . , : , . . : . . , . . . .

, _ . . . . . . . . . . . . . . . . , s . , . . . : . . . . . . , . : . . . . : . . , . . . . . , : . , . . . . . . . . . . . . . . : . _ . . s . . . . . , . . . . , : . .

9 2 - . . . . . . . . , . . . : . : . : . _ . _ . . . . . . . . . . . . . . . . . . . . . . : , . . , . : , . . , . : . . , . : . s . , , . _ . . . . . . . - . . . . . . : _ . . . , : . : . . . . . . . , . . : . . . . , . : . . . : , . . . , . . . . . : . . . . . . : . . . . . . : , .

: , . . , . , . : . . , . : s . , , . _ , : . . . . . . . , . . . . . s , , . . . . , . . . s . : . : , . . . , : . . : . . . . . . . . s , , . . . . . . . . , : . , . , . . . . . . . . . . . . . . . . , . . , . . : . . . . , . . . . . . . : , . . _ . . . . , . _ . . . . _ . : . , . .

: . . . . _ .

0 3 - : . s _ . . . . , . . . . , . . . . . . . . , , . . , , . . . . . , . , . . . , . , . . , . , . . . , . . . , . . . . , . . , . ( . . s , . . . . . : , : . . . . . . , . . . . . . . . , . . . : . . , , . _ : . . ( . . . . . . . . . . . . . . . . . . , , . . . . , . . _ , . , , . : . . , . : s . , , . _

, . . . , . . . . . . : , : . . . . _ : . . . . : . . . . . . . , . s . _ . . . . . , . . . : . . s . : . , . . . : . . . . . . . , . . . . . : . , _ . . . , . . . - . _ : . , . . . : , . . . . s . . . . . . . . . . _ . . : , : . . . . . , . . . . _ . . . . , . .

. . . . : . . . . . , , . . , , : . . . . . .

1 3 - _ : . . . . . . : . . . . . , . . . . . . . . . , . . . . . _ . : . . . . . . . . . . . . . . . : . . . . , . . , . . . . , . . _ , . . . , _ . . . . . . . , . , . . : . . . . , . . . . . . . . . . . . . . s . . . , . . _ : . . . . , . _ . . . . : . . . . , . , . . . . . . . . . . . . . : .

. . : , : . . . . , . , . . . s _ . , . . : - , : , . . , . . . . . . . . . , . . , . . . : . . . . , . . . . . . . . . : , . . . . . . . . . . . : , . . : . . , . : . . . . . . . . . . . , . . : . . , . : . . . . . : . . . . : . . . . . . - .

2 3 - . . : . . . . , . . _ , . . . , . _ . . , . . . . . . , . . . , . . . . . . . , . . . . . . . . . . : . . . . . . , . , . . s _ . . . . , . . . . . . . . : . . . , . . . , . , . , _ : , . . : . . : , : . . . . . . . . . . . . . : , . . , : . . . . . . . , . . . . . . . . . , . . _ s . . . : . . . . .

: . . , , . . . . . . . . : . . : , : . . . : . . . . . . , . . _ : s . . . : . . , , . . . . . . . . , , . , . . . . , . . . . . . . . . . . , . _ . . , . . : . . . . . : . . . : , : . . . . . . . .

3 3 - . . . . . . . . . . . . s . . r . . : . . . . . . . . : . . . , , , . r . . : . . . . . . . _ : . s . _ : . . . . . . - . . . . . . . . . . . . . . . . . . . , . . . . . . . . . , . . . : , . _ . . . . . . . . . . . . . . , . . . . . . . : . : . . . . . . . . : . , . . . : . . . , . . . . _

. . . . . . : . . : . . . . .

4 3 - _ . . , , , . s . . . . . . . . . . , . , . . : . . . . . s _ : , . . . . : . . , . . . . , . : , . . . . , . . . . . . . . . . s . . . . . . . . . . . : . : . . s _ . : . . : . . . . . . . . . . . . . . . , : , . : . , . _ . . . _ . . _ . . . : . _ . . . . . . . . . : . . .

. , . , . . : . . . . . . . . . . , , . . . . : , . . . . . . . . . . . : . . . . , ( . .

5 3 - . . : . . . , . . . . . : , : . . . . . . . . . . _ . , . . . . . . . . L . . _ . . : . : . . . . , , . . : . . . _ : . . . . : . . . . . . . . . . . : . . . : . . . . L , . . . , . : . , : . . . . . , . . : . . . .

6 3 - . . . , . . . : , : . . . . . . . . . . . . : . . . - . _ . . . . . . . . . , . . . , . . . . . . . . . . . . . . . r . . , . s . : . . . . . . _ : . . s . : . , . . . : . . . . . . .

7 3 - . . . . . . . . , : . . , . . . . . . : . . . . , . . . s . . : . . . . . . . . . , : . . , . . _ : . . _

8 3 - : . . . . _ : . . . . . . . . . . : . . _ : . . - . . . . . . . , . . . . . . . . , : . . . . . . , . . . . . . . : , - : , : . . . . . . . , . . . . . . . . . , . . . , , . . . . . . . . , . . _ . . : . . . . _ . , . . : : , . . , . , . . . . .

9 3 - . . : : , . : . . . _ . . . . : : , . , . . : . . . . . . . . . . . . . - . . , _ . . . . : : , . : . . . _ . , . : . _ . . : . . . . . . : . . . . . - . , . . . , . . . . . . , . . . : , . . . . : , . : . _ . . . . , , . . . . : : , . , ,

. _ . . : . . . . . . . . , . , . . . . , . . . , _ . : : , . , . . : , . . . . : : , . : . . . _ . . . . . . . , . , . . . : .

0 4 - . . : , . . . . . . : . . . . . . . . . . , . . . . . . . . . . : . . . , , , . . . . . . . . . . : , . . . . . : . . . . . . . , : . . . , . , . . . . . : . . , : . . . . . , , . , . , : . , . . . . . . . . . . . . . . . . . . . _ : . . . . . . . : . : . . . : , . . . .

, s . . . . . . . . . , : , . ( . . . . . . . . , . . . . . s . . . . , . . . . . . . . . _ : . . . . . , . : . . . , . . . , . . . . . . . . . . _ : . . : . . . , . , , . . , . . _ . . : . . . . . . . _ . . : . . . . . . . . . . : , . . . . . . . . . . . _ .

1 4 - . , , . . . . . _ : . . . . . . : . . . . . . . . . . : . . . . . . , . . , _ s _ . . . : . . . . . : . . . . . _ . . . . . _ . . . . . , _ , . . , . . , . . , _ . . _ . , _ s _ . . : . . : _ . . . : . . . . . . . : . . . . . _ . . . . . _ . . . . .

: . , . . . , . . . . . . : , . . s . . . . , . . . _ . . . . : . . . . . . . . . . _ . . . . . . : . . . . , . . _ . . . , . s . , . . . : . . . . , , . , , . , . . , . _ . . : . . . . : , . . . _ . . , . . . . . . . . . , . . . , . . . . : . . . , . . , : . . . _ . : , . .

2 4 - : , . . . . , . . . . . , . . . . . . _ , . , . . . : . . . . , , : , . . . . . . . . . . . . : , . . : . , . : : . . . . . . , . . , . . . . . . , : . . . . . : . . . . . : . , : . . .

. . . . . . : , . . . . . . . _ . . , : . . . . : . _ : . . . . . . . : . , : . . . . . , : . . . . . . . . . . . . . . . . . _ . . , . . . . . . . s . . : . , . , . . . . . . _ .

M G d H

. . . . . . _ , . . . . . . (

. . . . . . . . . . . . _ . . . . , . . . , , . . . : . , . . . : _ : . . . . . . _ s . . : . . . . . . . . . . : . . . . . . . , : . . . : . . . . . . : . , . _ : . , : . . . . . .

. . . . . . . . . _ . . . . . . : . . . . . . . . . . . . s . . : . , : . . . . .

: . . , . : , . . . . : . . . . . . . . . . . _ .

. s _ : . . , . : , . . . . : . . . . . . , . . , . . . . . . . . . . . _ . : . . . . . . , , . . . . . , . . . . . . . . : , . . : . . . . : , . .

e J V

. s . _ . . : , : . . . . . . . : - s . . : . . . . . . . . . . . s . . , , . , . . . . . . : . . . . . : . . : . . . : . . . . . . . . . . , , : . . . . . , , . : . . . . .

. . . . . . . , . . . , . . . . . . . . . . , , .

. . . . . . . . . . . . . , . . . . . . . . . . . . , , .

, . . . , . . . . . - . . . . , . : . . . . . . . : , : . . . : s . . . . . . . . . . , , . . . _ . . : , : . . . . . . . . . . s . . . . . . . . . . . . , , . . , . . . : _ . . . . . . . . . . , . . . : , : . . . . . . . : . , : . . . . . . . . . . . . . . . . . . . : s . . s . . . . . .

, : . . . . : , : . . . : . . . . . . : . , : . . . . . s . . , . . . - . , . _ . . : . . - . . : . , : . . . . . . s . . : . . . . . . . : s . . . . . . . . . . . . _ . . . . - : . . . . . . . . , . . . : . , : . . . . . .

. . . _ . . : . : . . : . , . _ . . , . . . . . . . . . . . , . . _ . . . . : , . . . . . . . . . . s . : . . : _ .

Y e j :

. . . . . , - . . , . . . . , - . . .

Y S f : , . . . . . : . . . . : . . . . : . . . . (

. . . . . , - . . , . . . . , - . .

Y S f : , . . . . . : . . . . : . . . . s . . : . . . . . : . . . . (

. . . . . . , - . . . , . . . . . , - . .

: . . . . . . . . , . . .

Q S G d e Y G d G d h d

. . . . . . . . . . . . . . . . . . . . . , : . . . . . : . , : . . : . _ . . . . : , : . . . . . . . . . . .

e J V

. , : . . . . : . , : . . .

. . . : . . . . . , (

. . . , . : . . . . . . . : . . . . , ( : : , . . : . . . . . _ . .

: . , . . : , . . - . - . . .

. . : . . . . . : . . . . : . , : . . - . . . . - . .

. . . . : . . . . . . . : , . . . , s . . . , , . . . . . , s . . . . . . . . . . , . : . . . : . . . . : . . . .

. , . , . . : . . . : : . : , : . . . . . . . . . . . _ . . . . . . . . . . . . . , . . . . . . . : , : . . . . . . . . . . s . , . : . . .

: , . . . . , . . . . . , . . . . . . . : , : . . . . . . . . . . , . m o c . a b m a s . w w w

. : . . . . . . _ . _ . : . . . . . . . . . . . . . . . . . . , . . . . . . . , . . . . . . : . . . . . . : . , , . . . . . . . . , . , . . . _ : . . . . . : . . . . . . _ - . . . . , . : . , . , . . . _ : . . s . : . , . . . : . . . . . . , . , , . . . , . . . . , . . .

. . s : . . : , : . . . . . s . , . . : . . _ : . . . . . , . . s . _ . . . : _ : . . , . . . : . . . . . . _ .

. . . : . . . . . . _ . . . : . . : . . . . . . . . . , . . . , . . , , . : . . . . : . . . . . : . _ . . . . , . s . . . . . : . . , . . . , . : . r , . , . . . . . . . . . . . . . , . . : . . . . . .

. : . . . : . . s . , : , : . . . ( . _ . : . . . . . . . . . . . . . . . . . . , . . . . . . . , . . . . . . : . . . . . . : . , , . . . . . . . . , . , . . , s . : . , s , : . . . : . . . , . . , . . , s . : . , s , : . . . : . . . , . . (

: . . . . . : . . . : . . s . , . . . . , . : . , . , . . . _ : . . s . : . , . . . : . . . . . . , . , , . . . , . . . . s . . . . . , . , . . , s . : . , s , : . . . : . . . , . . .

. . s : . . : , : . . . . . s . , . . : . . _ : . . . . . , . . s . _ . . . : _ : . . , . . . : . . . : . . s . .

. . . : . . . : . . s . . . . : . . : . . . . . . . . . , . . . , : . . , , . : . . . . : . . . . . : . _ . . . . , . s . . . . . : . . , . . . , . : . r , . , . . . . . . . . . . . . . , . . : . . . . .

Card Member and related SambaPhone, SambaOnline and ATM Services Agreement

The following terms shall apply to any Samba Financial Group (Samba) Credit Card Account (Visa / MasterCard) as well as the related SambaPhone, Samba Online and ATM Services provided

to a Card Member (Card Member) and any person using his / her account:

1- Upon acceptance of the Card Member's application, the Credit Card (Card) may be collected by the Card Member personally, or will be sent by Samba by registered mail or by courier

to the Card Member's mailing address at the Card Member's risk. Upon receipt of the Card, the Card Member shall immediately sign the signature space on the backside thereon. Any

use of the Card/services shall constitute the Card Member's acceptance of the terms hereof. The Card Member will request activation of the Card via a telephone call.

2- The Card Member undertakes to notify Samba of any changes in the Card Member's address, telephone numbers or employment, and Samba will have the right to freeze the Card

Member's Account if he/she fails to update Samba with a copy of the renewed ID, before expiration.

3- The Card Member may, at Samba's discretion, get upto a maximumof four supplementary cards (Supplementary Cards) for immediate relatives (spouse, parents, siblings and children)

over 18 years of age. The Card Member shall honor all obligations incurred on the Supplementary Card(s).

4- The Card Member accepts full responsibility for all transactions processed by use of his/her Card / Supplementary Cards to effect banking transactions by electronic means or otherwise

and that Samba's records thereof shall be binding on the Card Member. The Card Member shall settle all his/her disputes with the merchants with no responsibility to Samba.

5- The Card Member agrees that Samba may at any time and without prior notice, set-off any money in any Card Member's Account maintained with Samba, against all sums due to Samba.

6- Samba shall debit the Card Account with the amounts of all Card transactions, the membership fees and other fees, finance charges payable by the Card Member and other liabilities

incurred by the Card Member as well as loss or damage incurred by Samba arising fromthe use of the Card. The Card Member shall pay to Samba all amounts to be debited regardless

of whether a sale or cash advance voucher is signed by the Card Member.

7- The Card Member shall make a monthly payment on his/her account. The minimum payment due shown on his/her statement will be the least amount payable each month before the

payment due date. If the credit limit is exceeded, additional finance charges shall be billed on such excess and the exceeded amount will be due immediately.

8- The Card Member agrees to be enrolled automatically (without any further action on the part of the Card Member) to any card Electronic Bill Payment Platform(EBPP) such as SADAD

that may be offered to the Card Member to facilitate monthly Card bill payments.

9- Any notice required fromSamba hereunder shall be deemed valid if mailed to the address given by the Card Member or faxed to a number given by the Card Member, or by any suitable

means at Samba's discretion, and as such, shall be fully binding.

10- The Card Member's Account will be credited only after the cleared funds are received by Samba. Credits to the Card Member's Account, will be made only when Samba receives a

properly issued credit voucher.

11- Incase of death of the Card Member, Samba shall have the right to ask his/her estate to settle the due amount immediately. If the Card Member declares a bankruptcy, all amounts due

from the Card Member shall become immediately payable to Samba.

12- The Card Member shall be billed on Saudi Riyal and any conversion rate from foreign currency to Saudi Riyal either by Samba or any other related party may vary and will be binding

on the Card Member.

13- The Card Member may use his/her Card for withdrawing cash. Subject to applicable regulatory requirements, Samba shall have the absolute right to determine the cash advance level

which is subject to change based on the Card Member's credit history as well as his/her credit behavior that is determined by Samba's records.

14- The Card will be issued on a minimumpayment instruction. The Card Member will get the option to pay either the minimumpayment due or the full amount shown on his/her statement.

15- The Card Member shall keep the Card(s) securely and shall immediately notify Samba, by telephone and confirm the same in writing by fax or by hand delivery, if the Card is lost or

stolen. The Card Member shall remain liable for any transaction performed through his/her lost or stolen Card(s) unless Samba has received a notification to that effect prior to such

transaction taking place.

16- The Card Member may at any time terminate this agreement by giving a written notice to Samba; to be effective only on receipt of the Card/Supplementary Cards by Samba cut in half

and on payment of all Card Member's liabilities.

17- Samba may at any time terminate this agreement and recall all Cards (which are deemed to be Samba's Property) without any responsibility towards, or prior notice to, the Card

Member. The Card Member shall immediately return all Cards cut in half to Samba. If this agreement is terminated, all the outstanding balance in the Card Account shall become

immediately due and payable to Samba. However, in case of Sony/Mamlaka cards, the Card Member shall be entitled to claimredemption vouchers against his outstanding accumulated

reward points, within three (3) months of such notice of termination of this agreement by Samba.

18- In the event of the Card Member losing his/her residency status in the Kingdomof Saudi Arabia, Samba will cancel his/her Cards and all amounts outstanding shall become immediately

due and payable.

19- Samba may at any time and without prior written notice to the Card Member modify or change any terms herein. However, post any such changes, SAMBA will notify the Card Member

about the changes and the Card Member, if he/she does not accept the changes, then he/she must within 10 days of receipt of the notification of such changes, informSAMBA in writing

and cancel the Card and terminate this Agreement as per Article 16.0 above. The retention of the Card by the Card Member after the effective date of such change shall constitute the

Card Member's unconditional acceptance thereof.

20- Samba may at any time without obligation to give explanations or reasons to the Card Member refuse to honor any of the transactions that the Card Member initiated on his/her Card

including but not limited to, parallel use of same Card in transactions in two different places, or use of the Card in prohibited or illegal transactions according to applicable Saudi Laws

and / or the laws of the jurisdiction where any transaction hereunder is made. Samba shall not be liable for any loss, damage or expense (direct or indirect, consequential or otherwise)

incurred by the Card Member due to Samba's refusal to honor any of the transactions initiated by the Card Member. Samba shall inform the Card Member without delay of Samba's

refusal to honor any of the transactions initiated by the Card Member.

21- Once the Card Member's application is accepted and the Card Member becomes a Samba Cardholder, Samba shall have the authority and power to enroll the Card Member into the

various insurance related programs based on the Card Member's prior acceptance and agreement to the terms and conditions of such programs. Specific Terms & Conditions apply for

the different insurance programs, which will be binding to both parties and shall be available upon the Card Member's request.

22- In the event of a discrepancy between the amount of any cash deposit as stated by the Card Member and Samba's counting, Samba's counting shall prevail. The Card Member shall be

notified of any such discrepancy.

23- The Card Member agrees to provide Samba with any information that it requires for the establishing and / or auditing and / or administrating the Card Member Account and facilities

therewith and the Card Member authorizes Samba to obtain and collect any information as it deems necessary or in need for regarding the applicant, his/her accounts and facilities

therewith, from the Saudi Credit Bureau (Simah) and to disclose that information to the said company (Simah) or to any other agency approved by Saudi Arabian Monetary Agency

(SAMA).

24- Samba may at any time, assign any of its rights hereunder to any other party without notice to, or seeking consent of, the Card Member.

25- The Card Member understands and consents that information, such as, but not limited to his/her name and address, may be provided to certain third parties as approved by SAMA,

that Samba deems reputable subject to regulatory requirements and that the third parties may use the information for marketing purpose to offer products or services. Of course if

Samba is required by law to disclose certain Card Member information, Samba will comply.

26- To avail SambaPhone, SambaOnline and / or ATMservice (the services), the Card Member shall select at any Samba branch or through SambaPhone, a secret code subject to the terms

set forth herein below.

27- Instructions given by the secret code, being in lieu of physical signature, shall be binding on the Card Member even if alleged to be given by another person, and shall be conclusively

relied upon by Samba.

28- The secret code shall not be disclosed to anyone; otherwise the Card Member shall solely be responsible for any and all consequences thereof. If the Card Member believes that such

disclosure has taken place, he/she shall promptly notify Samba and have the said numbers changed. The Secret code is to be changed regularly, usage of two or more consecutive

identical numbers, usage of leading or trailing blanks and, generally, easily identifiable numbers are to be avoided.

29- Samba has the absolute right not to act upon on any SambaPhone, SambaOnline or ATM instructions and / or to request a prior written confirmation. Samba may tape, or record or

microfilm the phone or ATM instructions. Such taping, recording and microfilming shall be conclusive evidence of the contents thereof and can be used for all purposes including legal

proceedings.

30- Samba shall not be liable for any loss, damage or expense (direct or indirect, consequential or otherwise) incurred by the Card Member due to Samba acting / not acting on any

SambaPhone, SambaOnline or ATMinstructions; or due to the Card Member failing to avail the services for any reasons inside or outside Saudi Arabia; including, without limitation, the

failure to comply with any term(s) hereof. The Card Member indemnifies Samba against all such losses, damages and expenses no matter how it is caused.

31- The instructions pertinent hereto are contained in a separate Usage Guide which Samba may change at any time without prior notice. More products may be added by Samba in the

future. Such changes and additions shall be communicated to and binding on the Card Member. In relation hereto, Samba may, in addition to or in lieu of the secret code use its own

internal manual verification procedures.

32- Samba is entitled to, impose fees/charges as it deems appropriate for the SambaPhone, SambaOnline and ATMservices. At any time Samba is hereby authorized to, directly and without

recourse to the Card Member, debit any of the Card Member's Accounts with Samba for such fees/charges; as the same is reflected in the monthly statements. The monthly statements

shall be deemed final and correct unless objected to in writing by the Card Member within 30 days of receiving the statement.

33- This agreement is governed by the applicable Saudi Laws, associations, by-laws and/or the laws of the jurisdiction where any transaction hereunder is made. Disputes between the two

parties hereto shall be finally settled by SAMA's committee for resolution of Banking Disputes.

34- The terms and conditions of any Cobranded Card Agreement (CCA) that Samba is, now or hereafter, a party to, shall supplement the terms hereof to the extent needed to remove any

conflict between the two agreements. So, any conflicting term in any such CCA shall be deemed a change effected by Samba as per 19 hereinabove.

35- For Card Members using Taqseet program, in case the Card Member is delinquent/does not make Card payment by the due date, Taqseet will be cancelled and the entire Taqseet

outstanding amount will become due for immediate payment.

36- The Card Member undertakes not to use his card for any unlawful purchase, including the purchase of goods or services prohibited by the laws in Saudi Arabia.

37- The exchange rate between the transaction currency and the billing currency is based on the wholesale market rate.

38- Non accountholder shall refer to persons who at the time of his/her Card application being reviewed by Samba does not have a saving or current account with Samba. Sambas record

to this effect shall be binding and final.

39- The second party agrees that the first party may contact his/her relatives without informing the second party in case the first party finds it hard to communicate with the second

party directly, either because of lack of response at the contact phone numbers provided by the second party, or failure to provide his/ her new contact numbers in case those

numbers have been changed/ become invalid. The second party will be responsible for any consequences in this respect.

40- The bank has the right to freeze the account upon the expiration of the customers ID or and when customer does not update his personal data and information, addresses, income

sources and signature. I understand and commits myself for updating my personal data when requested by the bank or for a period (as specified by the bank) not exceeding 5

years. I also undertake to provide a renewed ID upon the expiration of the existing ID, and I acknowledge that if I fail to do so, the bank will have the right to freeze my account.

41- I declare that I am not legally prohibited to be dealt with and I would be liable in front of the competent authorities for the funds deposited to my account by myself, or deposited

by others with or without my knowledge. I would be also liable whether or not I subsequently disposed personally of these funds, but failed to formally report to the bank the

existence of such funds. All funds deposited to my account are from legal sources, and I am liable for their being free from any forgery or counterfeiting, and that if the bank

receives from me any counterfeit notes, which will not be refunded or compensated to me by the bank.

42- Please refer to Disclosure Statement, below, for Cost of Credit table, a summary of charges as well as examples of Finance Charge, and Foreign Exchange transactions.

Finance Charge is charged by the Bank from the date of the unpaid transaction. To avoid any charging of finance charge, please pay full amount within the due date.

INTEREST CALCULATION

Finance Charges (Service Charges)

Finance charges are payable at the monthly percentage rate on all transactions fromthe date of transaction in the event of the Card Member choosing not to pay his balance

in full. Finance charges, if payable, are debited to the Card Member's account till the outstanding on the card is paid in full.

Interest Free Grace Period

The interest free credit period could range from 21 to 50 days subject to submission of claims by the merchant.

Example

If the Card Member has his billing statement generated 15th day of every month and he does the following transactions between the period 15th November and 15th

December in a year.

Retail purchases for SAR 5,000 on 20th November

Cash withdrawal for SAR 7,000 on 10th December

Assuming No Previous Balance carried forward from the 15th November statement, the Card Member will get his 15th December statement showing SAR.12,000 of

transactions. The Card Member needs to make payment against the outstanding 21 days from the Statement Date, for anything between the entire amount or 5%of the

amount outstanding.

In case the balance outstanding on the statement date is paid in full by the payment due date, No interest is charged on such balances.

In case a partial payment of e.g. SAR 3600 is received for the account on 6th January the interest is calculated as follows:

Retail Transaction

SAR 5000 X 57 days X 26.4%/ 365 = SAR 206.13 or SAR 5000X57 days x 30%/ 365= SAR 234.25

Cash Transaction (From Effective Date to Payment Date)

SAR 7000 X 27 days X 26.4%/ 365 = SAR 136.70 or SAR 7000X27 days x 30%/ 365= SAR 155.35

Cash Transaction (From Payment Date to Next Statement Date)

SAR 3400 X 10 days X 26.4%/ 365 = SAR 24.59 or SAR 3400X10 days x 30%/ 365= SAR 27.95

Total SAR 367.42 or SAR 417.55

Finance Charge Foreign Transactions

A finance charge of 2.75%is charged on the Foreign Transactions.

Example

Transaction Amount: 1000

Transaction Currency: A

Conversion Rate from currency A to SAR: 4.5

SAR Amount = 1000 X 4.5 = SAR 4500

Foreign Transaction finance charge: SAR 4500 * 2.75%= SAR 123.75

The conversion from Foreign currency to Saudi Riyal is done by the respective schemes that are VISA / MasterCard as per their prevailing rates for that day.

Dear applicant, we recommend you to retain a copy of the Disclosure statement for your records.

Card Member can view the above Disclosure statement on www.Samba.com

* Sony card is a credit card issued exclusively by Samba in pursuance of their agreement to market a Sony/Samba co-brand card in the Kingdom

of Saudi Arabia, to promote the sales of their respective products.

A Card Member can not accumulate more than 100,000 reward points in a year, regardless of his/her spent on the Sony* cards.

The Sony reward points will expire at the end of two years from the last month of the year in which they have been earned notwithstanding

the status of this agreement at the time of expiration.

* Al Mamlaka card (the Card) is a credit card issued exclusively by Samba in pursuance of its agreement with Trade Centre Company

Limited (Trade Centre Company Ltd.) to market Al Mamlaka / Samba co-brand card in the Kingdom of Saudi Arabia, to promote the sales of their respective products.

A Card Member can not accumulate more than 100,000 reward points in a year, regardless of his/her spent on the Mamlaka* cards.

The Mamlaka reward points will expire at the end of two years from the last month of the year in which they have been earned notwithstanding the status

of this agreement at the time of expiration.

Type of Fee Samba Conventional Cards

H b S e G F f f G d S

: , . . . . . ,

. . . _ : , . . . . .

. .

. . . . . . . . . .

. . . . . . . . . .

. .

. . . . .

. . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

. . . . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . . . . . . . . . . . . . . . . . . .

. . . . . . . . .

: . . , . .

, . . . _ : . . s . (

: . . , . .

: s . . . s . . ,

: . . . .

: s . . . s . . ,

: . . . . , . . . _ : . . s . (

. . . , , . .

, . . . . . . . (

. . . , , . .

, . . . . . . (

. . . , , . .

, . . . . . . (

. . . , , . .

, . . . . . . (

. . . , , . .

, . . . . . . (

. . . , , . .

, . . . . . . (

. . . , , . .

, . . . . . . . (

. . . , , . .

, . . . . . . . (

. . . , , . .

, . . . . . . . (

. . . , , . .

, . . . . . . . (

3 4 - . . , , , . s . : . . . . . . . _ .

( . . . . . . . . . _ : . . . . : . . . . . . _ . . : _ . . . : . . . . s . : . . . , . . . . . . , . : . . . . . . . _ .

. ( : . , : . . : . . : . . . . . : , . . . . : . . . . . : . . . . s . .

. ( : . . . : . _ . . . . . : . . : . . . . .

- . _ . . : . : . . . . . , . . . . . , . , . _

- . _ . . : . : . . , : s _ . . . , . . . . . , . , . _

- . _ . . : . : . . , : . , . . . . , . . . . . , . , . _ . . . . . . . . . . . - . . . . . . . . . .

. ( : . . , : . . . . . : . . : , , . . . . .

( : . . . : . . , . . . . , . . . . . . . . ( , . . . . . . : . . . . : . . .

( : . . . . : . . , . . . . , . . . , . . . . . ( , . . . . . . : . . . . : . . .

. ( : . . , : . , . . _ . : . : . . . . . , _ : . . . . . _ . . : . . . . , , : . . . . . . , : . . . . ( .

, ( : . , . . . : . . . . . . . . . . . . . . . . , . . _ .

43- Credit Shield Terms & Conditions:

a) Credit Shield Group Credit Insurance covers all of participants of Samba Credit Shield Program.

b) Sum Covered is outstanding balance of participant

c) Events covered:

i. Death due to accident or sickness

ii. Total permanent disability due to accident or sickness

iii. Temporary total disability due to accident or sickness unless excluded as defined herein.

d) Entry Age into Scheme:

i. Maximum age is sixty (60) based on the Gregorian calendar.

ii. Minimum age is twenty (20) based on the Gregorian calendar.

e) Termination age:

Cover shall terminate upon the participant attaining age sixty five (65)

f) For any clarifications call Samba Phone (800 124 2000)

Classic/ Sillver

(Sony & AlMamlaka)

Gold

(Sony & AlMamlaka)

Platinum /

Sony Platinum

2.2%per month

(26.4%per annum)

2.2%per month

(26.4%per annum)

2.2%per month

(26.4%per annum)

2.2%per month

(26.4%per annum)

2.2%per month

(26.4%per annum)

2.5%per month

(30%per annum)

2.5%per month

(30%per annum)

2.5%per month

(30%per annum)

2.5%per month

(30%per annum)

2.5%per month

(30%per annum)

0 1 0 2 t s u g u A

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Uyguangco v. CADocument7 pagesUyguangco v. CAAbigail TolabingNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Concessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipuraDocument113 pagesConcessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipurapelicanbriefcaseNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- MC 09-09-2003Document5 pagesMC 09-09-2003Francis Nicole V. QuirozNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Professional Regulation Commission (PRC) - LuceroDocument9 pagesProfessional Regulation Commission (PRC) - LuceroMelrick LuceroNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Salcon Berhad PDFDocument9 pagesSalcon Berhad PDFRachmatt RossNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Jurnal Deddy RandaDocument11 pagesJurnal Deddy RandaMuh Aji Kurniawan RNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Ejercito V. Sandiganbayan G.R. No. 157294-95Document4 pagesEjercito V. Sandiganbayan G.R. No. 157294-95Sabel FordNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- MSDS for Concrete Curing Compound Estocure WBDocument3 pagesMSDS for Concrete Curing Compound Estocure WBSyerifaizal Hj. MustaphaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Cins Number DefinitionDocument3 pagesCins Number DefinitionJohnny LolNo ratings yet

- Admin Cases PoliDocument20 pagesAdmin Cases PoliEunice Iquina100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Neil Keenan History and Events TimelineDocument120 pagesNeil Keenan History and Events TimelineEric El BarbudoNo ratings yet

- Long Questions & Answers: Law of PropertyDocument29 pagesLong Questions & Answers: Law of PropertyPNR AdminNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Documents Required for Exporting to SenegalDocument2 pagesDocuments Required for Exporting to SenegalfionaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Joseph S. Nye JR 1974Document24 pagesJoseph S. Nye JR 1974joaoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Tacas Vs Tobon (SC)Document7 pagesTacas Vs Tobon (SC)HenteLAWcoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Guide To Plan Management PDFDocument20 pagesGuide To Plan Management PDFArrigo Lupori100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Deed of Donation for Farm to Market Road ROWDocument2 pagesDeed of Donation for Farm to Market Road ROWAntonio Del Rosario100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Ra 3720 - Safety and Purity of Foods, and CosmeticsDocument70 pagesRa 3720 - Safety and Purity of Foods, and CosmeticsShehana Tawasil MusahariNo ratings yet

- The Meaning of The CrossDocument3 pagesThe Meaning of The CrossJade Celestino100% (1)

- 636965599320795049Document210 pages636965599320795049AakshaNo ratings yet

- JNU Prospectus 2014Document97 pagesJNU Prospectus 2014Rakesh KashyapNo ratings yet

- Caoile EFT Authorization Form - EnglishDocument2 pagesCaoile EFT Authorization Form - EnglishSaki DacaraNo ratings yet

- Chapter06 ProblemsDocument2 pagesChapter06 ProblemsJesús Saracho Aguirre0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Solomon Islands School Certificate 2007 New Testament Studies Question BookletDocument14 pagesSolomon Islands School Certificate 2007 New Testament Studies Question BookletAndrew ArahaNo ratings yet

- NdpsDocument22 pagesNdpsRaviKumar VeluriNo ratings yet

- 0452 w16 Ms 13Document10 pages0452 w16 Ms 13cheah_chinNo ratings yet

- Manage Your Risk With ThreatModeler OWASPDocument39 pagesManage Your Risk With ThreatModeler OWASPIvan Dario Sanchez Moreno100% (1)

- Honeywell Acumist Micronized Additives Wood Coatings Overview PDFDocument2 pagesHoneywell Acumist Micronized Additives Wood Coatings Overview PDFBbaPbaNo ratings yet

- StaRo Special Steel Items and Surplus StockDocument2 pagesStaRo Special Steel Items and Surplus StockmelainiNo ratings yet

- History of Freemasonry Throughout The World Vol 6 R GouldDocument630 pagesHistory of Freemasonry Throughout The World Vol 6 R GouldVak AmrtaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)