Professional Documents

Culture Documents

Bank of Maharashtra Company Profile

Uploaded by

Bablu InampudiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank of Maharashtra Company Profile

Uploaded by

Bablu InampudiCopyright:

Available Formats

Bank of Maharashtra

BSE: 532525 | NSE: MAHABANK | ISIN: INE457A01014 Market Cap: [Rs.Cr.] 3,001 | Face Value: [Rs.] 10 Industry: Banks - Public Sector Discuss this stock Company Profile Bank of Maharashtra is a public sector bank in Maharashtra, which offers personal banking, cash management, retail loans and other financial services. Their services include deposits, savings/current bank account, vehicle loans, personal loans, retail trade finance, global banking, lending to priority sector and small scale sector, foreign exchange and export finance, corporate loans and equipment loans. The Bank has one subsidiary, namely The Maharashtra Executor & Trustee Company Pvt Ltd, which undertakes management of public/ private trusts and administration/ execution of Will. They also sponsored three Regional Rural Banks, namely Aurangabad Jalna Gramin Bank, Thane Gramin Bank and Marathwada Gramin Bank with head office at Aurangabad, Thane and Nanded respectively. Bank of Maharashtra was incorporated on September 16, 1935 and started their business on February 8, 1936. In April 10, 1946, The Maharashtra Executor & Trustee Company Pvt Ltd was incorporated as a wholly owned subsidiary of the Bank. In July 1969, Bank of Maharashtra was nationalized along with 13 other banks. After nationalization, the Bank expanded rapidly. In the year 1998, the Bank attainted the autonomous status, which helped the Bank in providing more and more services with simplified procedures without intervention of Government. In the year 2000, they incorporated Magic eMoney Ltd (MeM) a joint venture of Bank of Maharashtra, Dena Bank, NextStep Infotech P. Ltd. (NSIPL) and Magic Software Enterprises (MSE) Israel continued to undertake departmental projects. During the year 2003-04, the Bank came with their initial public offer of 10 crore shares of Rs. 10/- each at a premium of Rs. 13/- amounting to Rs. 230 crore. The issue received overwhelming response and was over subscribed by more than 11 times. Also, they opened 34 new branches and upgraded 10 extension counters into full fledged branches during the year. During the year 2004-05, the Bank opened 14 new branches, 2 extension counters and up-graded 1 extension counter into a full-fledged branch. Also, they opened Holiday Home at Shirdi in addition to 5 existing Holiday Homes at different places. The Bank acquired a stake of 9% in Global Trade Finance Pvt Ltd, a non banking finance company promoted by the EXIM Bank. In January 2006, the Bank signed a MoU with Life Insurance Corporation of India, for distribution of their insurance products. Also, they launched a scheme of money transfer service for Non Resident Indians and other foreign account customers, using the Western Union Money Transfer Services provided by Western Union Financial Services Inc. For this regard, the Bank has entered into agreement with Weizmann Forex Ltd, the primary agent of Western Union Financial Services Inc. During the year 2006-07, the Bank opened 29 new branches and upgraded 16 extension counters into full fledged branches. They expanded the ATM Network from 145 ATMs to 302 ATMs during the year and entered into collaboration with VISA for issuance of Debit cards.

The Bank commissioned their own Data Center at Pune and Disaster Recovery (DR) site at Hyderabad. Also, they established six IT Labs at Delhi, Kolkata, Chennai, Hyderabad, Bangalore and Lucknow in order to take care of the massive training requirement for the CBS project. The Bank launched new schemes like Mahalaxmi Term Deposit Scheme (3 years term deposit scheme), Mahadeep Scheme (Financing of Solar Water Heating System), Insta Remit Scheme (RTGS scheme for instant fund transfer), etc during the year. In May 2006, they entered into tie up with United Insurance Company Ltd for distribution of their non-life insurance products. During the year 2007-08, the Bank also launched two group insurance schemes, namely Maha Suraksha Deposit Scheme for all types of deposit account holders and Maha Grih Suraksha for home loan borrowers. Also, they entered into distribution agreement with 15 select Asset Management Companies during the year. They opened 20 new branches upgraded 10 extension counters into full fledged branches. They also opened 3 Currency Chests during the year. In March 2008, the two Regional Rural Banks, namely Aurangabad Jalna Gramin Bank and Thane Gramin Bank were amalgamated into one unit in the name of Maharashtra Godavari Gramin Bank with head office at Aurangabad and having area of operation in nine districts of Maharashtra.As at March 31, 2008, the total branch network comprised of 1,375 branches and three extensions counters spread over 22 states and two union territories.

YEAR EVENTS 1969 - The Comp. was Incorporated on 19th July. The Bank is a Government of India undertaking & carries on all types of banking business. The Bank was brought into existence by an ordinance issued on 19th July, by Central Government. In terms of Ordinance, the undertaking of `The Bank of Maharashtra Ltd.' was transferred to & vested in the new bank. The ordinance was replaced by Banking companies [Acquisition & Transfer of Undertakingss] Act, 1969. The Act was declared null & void by Supreme Court on 10th February, 1970. An Ordinance was thereupon promulgated which was latter replaced by the Banking Companies [Acquisition & Transfer of Undertakings] Act, 1970 which was made effective retrospectively from 19th July. - Under the `Lead Bank Scheme' the Bank was allotted 5 districts of Maharashtra, viz. Pune, Satara, Nasik, Aurangabad [jointly with Central Bank of Indias] & Thane. Surveys were carried out in these districts for identification of growth centres. 1970 - The Bank opened 39 branches in these five `Lead Bank' districts out of total of 47 branches opened. The Bank continued to follow the scheme in the subsequent years & another district was allotted to it. 1976 - In August, the Bank sponsored a regional rural bank under the name `The Marathwada Gramin Bank Ltd.,' Nanded. 1980 - Rs.81,30,725 capitalised from Reserve Fund. 1982 - One more Regional Rural Bank was sponsored on 7th December, under the name AurangabadJalna Gramin Bank limited In the subsequent years, another RRB under the Thane Gramin Bank was

sponsored by the Bank. These three RRBs together had 312 branches as at the end of March 1994. 1984 - Rs.12 lakhs contribution by Government. 1985 - Rs.1,308 lakhs contributed by Government. 1986 - Rs.800 lakhs contributed by Government. 1988 - Rs.2,100 lakhs contributed by Government. 1991 - Rs.10,500 lakhs contributed by Government. 1992 - Rs.3,500 lakhs contributed by Government. 1993 - Rs.15,000 lakhs contributed by Government. 1996 - The bank opened two extension counters at Gogal [Goas] & Khandala [Ratnagiris] during the year. - The bank introduced a new motivational scheme titled 'The Best Colleague Schemes] to encourage, recognise & motivate sincere, meritorious & helpful staff members. - The Bank launched a major computerisation programme with the basic objective of making use of latest developments in information technology towards betterment of customer service & improvement in housekeeping. - Shri. V. Leeladhar, has been appointed as the Executive Director of Bank vide the Government of India, Ministry of Finance, Department of Economy Affairs. 1999 - The bank introduced its telebanking service, which is the first of its kind by any of nationalised bank in the region. - The bank has also set up a core credit monitoring cell at its headquarters in Pune to continuously assess the performance report of borrowers [above Rs. 25 lakhss], which would be provided by regional & zonal centres. 2000 - Bank of Maharashtra [BoMs] is launching its new cash management product. - The Export Import Bank of India [Exim Banks] is slated to sign a Memorandum of Understanding [MoUs] with Bank of Maharashtra [BoMs] on February 28 for providing advisory services on export finance. - BoM launched its information technology training institute, the first of its kind in banking industry in the country. - Sukomal Chandra Basu has succeeded Madan Mohan Vaish as the Chairman & Managing Director of Company. - Bank of Maharashtra [BoMs], a public sector [PSUs] bank, has formed an equal joint venture with Magic Software, an Israeli software developer & its Indian subsidiary. 2004 -Comes out with Rs 230 crore public issue of equity shares [100,000,000 equity shares of Rs 23 eachs], issue oversubscribed 10.5 times -Bajaj Auto & Bank of Maharashtra [BoMs] have signed a strategic alliance to offer two-wheeler loans in India. 2005 -Bank of Maharashtra has informed that Mrs. Lila F Poonawalla, Director resigned from the Directorship of Bank & she stands relieved from her Directorship with effect from August 01, 2005

2006 -Bank of Maharashtra ties up with United Insurance Company 2007 - Bank of Maharashtra & Life Insurance Corporation of India have together unveiled two products, Maha Suraksha Deposit Scheme & MahaGrih Suraksha scheme. 2009 - Bank of Maharashtra has informed that in terms of guidelines of RBI vide letter dated December 01, 2008, the Bank has appointed following five Chartered Accountants firms as Statutory Central Auditors [SCAss] of Bank for year 2008-09. 1. M/s. C R Sagdeo and Co., Nagpur 2. M/s. Shah Baheti Chandak and Co., Nagpur 3. M/s. Wahi and Gupta, New Delhi 4. M/s. V C Gautam and Co., New Delhi 5. M/s. B Chhaawchharia and Co., Kolkata The appointment M/s. B Chhawchharia and Co., Kolkata is made in place of M/s. S K Mehta and Co., whose term was completed. The other auditors are reappointed for continuing as SCAs for year 2008-09.

Source : Dion Global Solutions Limited Peer Comparison Market Cap (Rs. in Cr.) 181,540 .47 37,961. 76 37,080. 06 28,352. 00 26,296. 62 P/E (TT M) (x) 17.9 6 8.80 8.74 7.81 10.8 5 P/B V EV/EBID RO (TT TA E M) (x) (%) (x) 14. 2.75 15.16 8 26. 2.31 14.53 6 21. 1.88 15.92 9 26. 1.95 14.09 8 14. 1.90 16.23 2 RO D/ CE E (%) (x) 0.0 0.0 0.0 0.0 0.0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0

Company

St Bk of India Punjab Natl.Bank Bank of Baroda Canara Bank Bank of India

Union Bank (I) IDBI Bank Oriental Bank Indian Bank Allahabad Bank IOB Central Bank Corporation Bank Andhra Bank UCO Bank

17,131. 14 14,483. 02 10,742. 60 10,553. 00 10,250. 64 9,680.3 4 8,971.7 1 8,916.6 9 7,971.2 2 7,203.9 3

8.24 1.95 8.78 1.15 7.23 1.19 6.16 1.33 7.37 1.56 11.8 1.31 1 6.95 1.31 6.46 1.47 6.67 1.43 6.79 1.58

14.73 14.79 13.12 12.67 14.39 14.07 14.01 14.37 13.58 15.00

26. 2 13. 2 16. 5 25. 0 22. 2 11. 5 25. 6 21. 9 26. 0 31. 6

0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0

ompetitors Compan Curre y nt Price State Bank of India

Book P/E Market Value Rati Cap o (Rs. Cr.)

2,811. 1,038. 19. 50 57 48

178,529 .97

Punjab 1,186. 512.3 National 00 7 Bank Bank of Baroda 915.6 5 413.2 7

9.6 2

37,573. 92

7.8 9

33,469. 76

State Bank of Travanc ore State Bank Of Mysore Canara Bank

777.1 5

713.6 6

5.3 4

3,885.7 5

682.5 0

567.6 5

7.1 7

3,194.1 0

633.3 0

283.7 9 390.1 6

9.2 9 7.3 9

28,055. 19 8,643.5 3

Corporat 583.5 ion Bank 0 State Bank Of Bikaner and Jaipur Bank of India

551.4 0

456.7 7

7.0 1

3,859.8 0

459.7 0

243.4 1

13. 89

24,176. 08

Oriental Bank of 345.4 Commer 5 ce Union Bank of India Indian Bank

292.1 9

7.6 3

8,654.8 9

319.8 0

168.3 5

8.0 8

16,768. 15

241.5 5

194.5 5 124.1

6.0 6 8.1

10,381. 09 9,800.5

Allahaba 205.8

d Bank

Indian 152.5 Oversea 0 s Bank IDBI Bank Ltd. Andhra Bank Central Bank of India

103.8 1

13. 35

9,435.9 3

144.1 0

102.9 6

8.6 0

14,187. 63

139.0 0

80.14

7.4 4

7,778.1 7

135.3 5

106.1 0

8.2 7

8,752.0 9

Syndicat 116.9 5 e Bank United Bank of India Dena Bank UCO Bank Vijaya Bank

92.00

8.2 4

6,704.5 8

110.5 0

85.05

11. 81

3,805.8 5

104.6 0 104.6 0

73.18

6.8 2 6.4 8 7.5 2

3,487.2 5 6,563.8 3 3,937.3 1

58.80

83.30

68.26

http://www.valuenotes.com/research-analysis/company/companyoverview.php?cc=MTQwMzAwMTIuMDA=

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

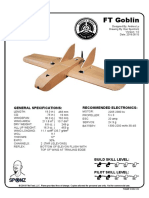

- FT Goblin Full SizeDocument7 pagesFT Goblin Full SizeDeakon Frost100% (1)

- 4Q Labor Case DigestsDocument53 pages4Q Labor Case DigestsKaren Pascal100% (2)

- Quezon City Department of The Building OfficialDocument2 pagesQuezon City Department of The Building OfficialBrightNotes86% (7)

- Prestressing ProductsDocument40 pagesPrestressing ProductsSakshi Sana100% (1)

- Trinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Document13 pagesTrinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- C79 Service Kit and Parts List GuideDocument32 pagesC79 Service Kit and Parts List Guiderobert100% (2)

- Backup and Recovery ScenariosDocument8 pagesBackup and Recovery ScenariosAmit JhaNo ratings yet

- 1990-1994 Electrical Wiring - DiagramsDocument13 pages1990-1994 Electrical Wiring - Diagramsal exNo ratings yet

- Comparing Time Series Models to Predict Future COVID-19 CasesDocument31 pagesComparing Time Series Models to Predict Future COVID-19 CasesManoj KumarNo ratings yet

- Econometrics Chapter 1 7 2d AgEc 1Document89 pagesEconometrics Chapter 1 7 2d AgEc 1Neway AlemNo ratings yet

- Chaman Lal Setia Exports Ltd fundamentals remain intactDocument18 pagesChaman Lal Setia Exports Ltd fundamentals remain intactbharat005No ratings yet

- 6vortex 20166523361966663Document4 pages6vortex 20166523361966663Mieczysław MichalczewskiNo ratings yet

- Customer Satisfaction and Brand Loyalty in Big BasketDocument73 pagesCustomer Satisfaction and Brand Loyalty in Big BasketUpadhayayAnkurNo ratings yet

- Defect Prevention On SRS Through ChecklistDocument2 pagesDefect Prevention On SRS Through Checklistnew account new accountNo ratings yet

- Abb Drives: User'S Manual Flashdrop Mfdt-01Document62 pagesAbb Drives: User'S Manual Flashdrop Mfdt-01Сергей СалтыковNo ratings yet

- UKIERI Result Announcement-1Document2 pagesUKIERI Result Announcement-1kozhiiiNo ratings yet

- Wind EnergyDocument6 pagesWind Energyshadan ameenNo ratings yet

- Entrepreneurship Style - MakerDocument1 pageEntrepreneurship Style - Makerhemanthreddy33% (3)

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDocument3 pagesBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNo ratings yet

- Operation Roman Empire Indictment Part 1Document50 pagesOperation Roman Empire Indictment Part 1Southern California Public RadioNo ratings yet

- Social EnterpriseDocument9 pagesSocial EnterpriseCarloNo ratings yet

- Teleprotection Terminal InterfaceDocument6 pagesTeleprotection Terminal InterfaceHemanth Kumar MahadevaNo ratings yet

- Gates em Ingles 2010Document76 pagesGates em Ingles 2010felipeintegraNo ratings yet

- Iitk Syllabus PDFDocument520 pagesIitk Syllabus PDFcombatps1No ratings yet

- Variable Displacement Closed Circuit: Model 70160 Model 70360Document56 pagesVariable Displacement Closed Circuit: Model 70160 Model 70360michael bossa alisteNo ratings yet

- (Free Scores - Com) - Stumpf Werner Drive Blues en Mi Pour La Guitare 40562 PDFDocument2 pages(Free Scores - Com) - Stumpf Werner Drive Blues en Mi Pour La Guitare 40562 PDFAntonio FresiNo ratings yet

- BA 9000 - NIJ CTP Body Armor Quality Management System RequirementsDocument6 pagesBA 9000 - NIJ CTP Body Armor Quality Management System RequirementsAlberto GarciaNo ratings yet

- RAP Submission Form, OBIDocument3 pagesRAP Submission Form, OBIAhmed MustafaNo ratings yet

- Unit 5 - FitDocument4 pagesUnit 5 - FitAustin RebbyNo ratings yet