Professional Documents

Culture Documents

Capital Gain

Uploaded by

kumargaurav21281Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gain

Uploaded by

kumargaurav21281Copyright:

Available Formats

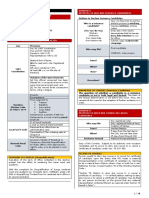

INCOME UNDER THE HEAD CAPITAL GAINS

LTCG arising from the transfer of RHP and is reinvested in new RHP(exemption u/s 54)

Name of the assessee : Status : PY : AY : Computation of LTCG : Sale consideration RHP Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54 Less : Exemption u/s 54 : A) LTCG before exemption u/s 54 Or B) a) amount invested New RHP b) amount deposited in Capital Gains Account Scheme[CGAS] A or B whichever is less is exempt Taxable LTCG XXXX XXX XXX XXX

XXXX XXXX

XXX XXX XXX XXX XXXX XXXX

Consequences if the new RHP is transferred within three years Name of the Assessee: Status : PY : AY : computation of STCG on transfer of new RHP Sale consideration of new RHP Less: i) expenses on transfer ii) COA Original cost of new RHP Less : exemption given earlier u/s 54 STCG XXXX XXX XXX XXX

XXX

XXXX XXXX

What happens if the amount deposited in capital gains deposit account scheme is not fully utilised ?

If the amount deposited is not utilized fully for the purchase or construction of new RHP within stipulated period, then amount not so utilized shall be treated as LTCG of the previous year in which the period of 3 years from the date of transfer of original assets expires.

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 1

What happens if the assesses dies before the expiry of the stipulated period ? If the assessee dies before the expiry of stipulate period (for purchasing the new RHP and later on the unutilized amount is refunded to the legal heirs, body of the opinion that in such cases the said amount can not be taxed in the hands of the deceased. This amount is not taxable in the hands of the legal heirs also as the unutilized portion of the deposit does not take part of the character income in their hands but is only a part of the estate devolving upon them. LTCG OR STCG arising from the transfer of Agricultural Land[AL] and is reinvested in New Agricultural Land[NAL] ( exemption u/s 54B) Name of the assessee : Status : PY : AY : Computation of STCG Sale consideration AL Less: i) expenses on transfer ii) COA iii) COI STCG before exemption u/s 54B Less : Exemption u/s 54B : A)STCG before exemption u/s 54B Or C) a) amount invested new AL b) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt Taxable STCG XXXX XXX XXX XXX

XXXX XXXX

XXX XXX XXX XXX XXXX XXXX

Consequences if the new AL is transferred within three years Name of the Assessee: Status : PY : AY : Calculation of STCG on transfer of new AL Sale consideration of new AL Less: i) expenses on transfer ii) COA Original COA of new AL XXXX XXX XXX

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 2

Less : exemption given earlier u/s 54 B XXX XXX XXXX STCG XXXX NOTE (1); if the new AL is situated in a rural area, the gain arising on its transfer is not chargeable to tax as an AL situated in rural area is not a Capital asset u/s 2(14). NOTE (2): if it is transfer by way of compulsory acquisition, one may claim exemption u/s 10(37). Name of the assessee : Status : PY : AY : Computation of LTCG or LTCL Sale consideration Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54B Less : Exemption u/s 54B : A)LTCG before exemption u/s 54B Or B) 1) amount invested new AL 2) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt Taxable LTCG or( LTCL) XXXX XXX XXX XXX

XXXX XXXX

XXX XXX XXX XXX XXXX XXXX

Consequences if the new AL is transferred within three years Name of the Assessee: Status : PY : AY : Computation of STCG on transfer of new AL Sale consideration of new AL Less: i) expenses on transfer ii) COA Original COA of new RHP Less : exemption given earlier u/s 54B STCG XXXX XXX XXX XXX

XXX

XXXX XXXX

What happens if the amount deposited in capital gains deposit account scheme is not fully utilized ?

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 3

If the amount deposited is not utilized fully for the purchase of new AL within stipulated, then amount not so utilized shall be treated as STCG or LTCG depending up on the ORIGINAL CAPITAL GAIN of the previous year in which the period of 2 years from the date of transfer of original assets expires. What happens if the assesses dies before the expiry of the stipulated period ? If the assessee dies before the expiry of stipulate period (for purchasing the new AL and later on the unutilized amount is refunded to the legal heirs, body of the opinion that in such cases the said amount can not be taxed in the hands of the deceased. This amount is not taxable in the hands of the legal heirs also as the unutilized portion of the deposit does not take part of the character income in their hands but is only a part of the estate devolving upon them.

STCG or LTCG on compulsory acquisition of Land and Building, forming part of industrial undertaking and is reinvested in purchase of any other Land or Building or construction of a Building to be used for the purpose of shifting or reestablishing the said undertaking or setting up of another industrial undertaking.(Exemption u/s 54D)

W.NOTE SITUATION ONE : Computation of COA when WDV is zero Section 50(1) WDV at the beginning of the PY Add : cost of asset falling in the block acquired during the PY Add : Expenses on transfer COA XXX XXX XXX XXX

SITUATION TWO : Computation of COA when block is empty ( Section 50(2) ) WDV at the beginning of the PY Add : cost of asset falling in the block acquired during the PY COA XXX XXX XXX

SITUATION THREE : Computation of COA in the case of depreciable asset in a power unit as per Section 50A Step-1 computation of WDV at the beginning of the PY. Actual cost Less : depreciation up to the beginning of the PY WDV at the beginning of the PY XXX XXX XXX

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 4

STEP-2: Computation of surplus or terminal depreciation (i.e deficit) S.No. A B C D E Particualrs Sale proceeds of Land &Building or Building Add : Scrap value ( if any ) Less : WDV at the beginning of the PY Surplus or ( Terminal Depreciation ) Rs. XXXX XXXX XXXX XXXX XXXX

Note 1) Balancing charge : surplus [ i.e. (sale proceeds add scrap value ) minus WDV at the beginning of the PY ] which is equal to the amount of depreciation already claimed is known as balancing charge.

STEP-3; Computation of Balancing Charge : S.No. A B C Particualrs Surplus ( as above ) Or Depreciation already claimed Whichever is less = Balancing charge Rs. XXXX XXXX XXXX

2] Terminal depreciation : if the WDV at the beginning of the PY is more than the sale proceeds plus scrap value ( if any ) is known as terminal depreciation. STEP-4 ; Computation of COA as per Section 50A XXX XXX XXX XXX

WDV at the beginning of the PY Add : balancing charge Less; terminal depreciation COA

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 5

STEP-5 : Name of the asseesee: Status: PY: AY Computation of STCG Sale proceeds of Land &Building or Building Less : COA as per Section 50 STCG or (STCL) before exemption u/s 54D Less : Exemption u/s 54D ; XXX XXX XXX

A) STCG before exemption u/s 54D Or B) i) amount invested in new Land and Buildings ii) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt Taxable STCG or (STLC) Name of the assessee : Status : PY : AY : Computation of STCG Sale consideration land (if it is STCA) Less: i) expenses on transfer ii) COA iii) COI STCG before exemption u/s 54D Less : Exemption u/s 54B : A)STCG before exemption u/s 54D Or A) a) amount invested new Land &Building b) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt

XXX XXX XXX XXX XXX XXX

XXXX XXX XXX XXX

XXXX XXXX

XXX xxx XXX XXX XXXX

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 6

Taxable STCG or STCL

XXXX

Name of the assessee : Status : PY : AY : Computation of LTCG : Sale consideration Land(if it is LTCA) Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54D Less : Exemption u/s 54 D: A) LTCG before exemption u/s 54D Or B) a) amount invested new Land &building b) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt Taxable LTCG or LTCL XXXX XXX XXX XXX

XXXX XXXX

XXX xxx XXX XXX XXXX XXXX

Note : As tax incidence is higher in the case of STCG, the exemption is first utilized against STCG. Then against LTCG. Consequences if the new land and building is transferred within the three years. Sale proceeds of new land and building Less : COA : Original COA of the new land and building XXX Less : Exemption given earlier u/s 54D XXX Taxable STCG ( or STCL ) What happens if the amount deposited in capital gains deposit account scheme fully utilized ? XXX

XXX XXX is not

If the amount deposited is not utilized fully for the purchase or construction of new land and building within stipulated, then amount not so utilized shall be treated as STCG or LTCG depending up on the ORIGINAL CAPITAL GAIN of the previous year in which the period of 2 years from the date of transfer of original assets expires.

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 7

LTCG arising on transfer of any LTCA and is reinvested in certain Specified Bonds ( Exemption u/s 54EC ) Name of the assessee : Status : PY : AY : Computation of LTCG : Sale consideration of RHP Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54 Less : Exemption u/s 54 : A)LTCG before exemption u/s 54 Or B)a) amount invested new RHP b) amount deposited in capital gains deposit account scheme A or B whichever is less is exempt Taxable LTCG Sale consideration of AL Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54B Less : Exemption u/s 54B : A)LTCG before exemption u/s 54B Or B) 1) amount invested new AL XXX 2) amount deposited in capital gains deposit account scheme XXX A or B whichever is less is exempt Taxable LTCG Sale proceeds of Bonus shares Less :1) Expenses on transfer 2] ICOA Taxable LTCG Sale proceeds of Gold Less : 1) Expenses on transfer 2] ICOA 3] ICOI

XXXX XXX XXX XXX XXXX XXXX XXX XXX xxx XXX XXXX XXX XXXX XXX XXX XXX XXXX XXXX XXX

XXX XXXX XXX XXX XXX NA XXX XXX XXX XXX XXX XXX XXX

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 8

Taxable LTCG Sale proceeds of Silver Less : 1) Expenses on transfer 2] ICOA 3] ICOI Taxable LTCG Sale proceeds of Diamond Less : 1) Expenses on transfer 2] IC1OA 3] ICOI Taxable LTCG TOTAL LTCG BEFORE EXEMPTION U/S 54EC Less : Exemption u/s 54EC A] Total LTCG before exemption u/s 54EC Or B] Amount invested in specified assets ; i] bonds of NHAI ii] bonds of REC Ltd. Or C] Maximum limit A, B or C whichever is less is exempt u/s 54EC

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXXX XXX

XXX XXX XXX 50 lakh XXXX

TOTAL TAXABLE LTCG

Consequences if the new asset is transferred within three years :

XXXX

The amount of exemption given earlier u/s 54EC will be deemed to be the income by way of LTCG of the previous year in which specified assets are transferred or converted into money or any loan/advance is taken on the security of specified assets.

LTCG arising on transfer of any LTCA other than a RHP & is reinvested in RHP.(Exemption u/s 54F) Name of the assessee : Status : PY : AY : Computation of LTCG : Sale consideration of other than RHP Less: expenses on transfer Net sale consideration XXXX xxx xxxx

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 9

Less i) ICOA ii)ICOI LTCG before exemption u/s 54F Less :Exemption u/s 54F LTCG before exemption/s 54F

XXX XXX

XXXX XXXX

Cost of new house &

XXX

Net sale consideration Amount deposited Taxable LTCG XXXX NOTE: the tax payer has to submit his return of income on or before the due date of submission of return of income (i e, generally July 31 or September 30 of the AY )

What happens if the amount deposited in capital gains deposit account scheme is not fully utilised ?

If the amount deposited is not utilized fully for the purchase or construction of new RHP within stipulated, then amount not so utilized shall be treated as LTCG of the previous year in which the period of 3 years from the date of transfer of original assets expires Unutilized amount in the deposit account in respect of which exemption was claimed X under section 54F but which is not utilized within the specified time limit for purchasing/constructing a residential house.

Amount of original capital gain Net sale consideration

LTCG or STCG arising on the transfer of assets ( being Plant, Machinery, Land or Building or any right in land or building ) in case of shifting of industrial undertakings from urban area and is reinvested in purchase of new machinery or plant or building or land for the purpose of industrial undertaking. (Exemption u/s 54G)

W.NOTE SITUATION ONE : Computation of COA when WDV is zero Section 50(1) WDV at the beginning of the PY Add : cost of asset falling in the block acquired during the PY Add : Expenses on transfer COA XXX XXX XXX XXX

SITUATION TWO : Computation of COA when block is empty ( Section 50(2) ) WDV at the beginning of the PY Add : cost of asset falling in the block acquired during the PY COA XXX XXX XXX

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 10

SITUATION THREE : Computation of COA in the case of depreciable asset in a power unit as per Section 50A Step-1 computation of WDV at the beginning of the PY. Actual cost Less : depreciation up to the beginning of the PY WDV at the beginning of the PY XXX XXX XXX

STEP-2: Computation of surplus or terminal depreciation (i.e deficit) S.No. A B C D E Particualrs Sale proceeds Add : Scrap value ( if any ) Less : WDV at the beginning of the PY Surplus or ( Terminal Depreciation ) Rs. XXXX XXXX XXXX XXXX XXXX

Note 1) Balancing charge : surplus [ i.e. (sale proceeds add scrap value ) minus WDV at the beginning of the PY ] which is equal to the amount of depreciation already claimed is known as balancing charge.

STEP-3; Computation of Balancing Charge : S.No. A B C Particualrs Surplus ( as above ) Or Depreciation already claimed Whichever is less = Balancing charge Rs. XXXX XXXX XXXX

2] Terminal depreciation : if the WDV at the beginning of the PY is more than the sale proceeds plus scrap value ( if any ) is known as terminal depreciation. STEP-4 ; Computation of COA as per Section 50A XXX XXX XXX XXX

WDV at the beginning of the PY Add : balancing charge Less; terminal depreciation COA

STEP-5 : Name of the asseesee: Status:

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 11

PY: AY Computation of STCG Sale proceeds of Plant, Machinery, Land &Building or Building Less : COA as per Section 50 STCG before exemption u/s 54G Less : Exemption u/s 54D ; XXX XXX XXX

A) STCG before exemption u/s 54G XXX Or B) i) amount invested in new Plant, Machinery, Land &Building or Building xxx ii) amount deposited in capital gains deposit account scheme XXX XXX A or B whichever is less is exempt XXX Taxable STCG or (STCL) XXX NOTE: the tax payer has to submit his return of income on or before the due date of submission of return of income (i e, generally July 31 or September 30 of the AY ) Name of the assessee : Status : PY : AY : Computation of STCG Sale consideration land (if it is STCA) Less: i) expenses on transfer ii) COA iii) COI STCG before exemption u/s 54G Less : Exemption u/s 54G: A)STCG before exemption u/s 54G Or B) a) amount invested new Plant, Machinery, Land or Building XXX b) amount deposited in capital gains deposit account scheme XXX A or B whichever is less is exempt Taxable STCG or STCL XXXX XXX XXX XXX

XXXX XXXX

XXX

XXX XXXX XXXX

Name of the assessee : Status : PY :

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 12

AY : Computation of LTCG : Sale consideration of Land(if it is LTCA) Less: i) expenses on transfer ii) ICOA iii) ICOI LTCG before exemption u/s 54G Less : Exemption u/s 54 G: C) LTCG before exemption u/s 54G Or D) a) amount invested new plant, Machinery, land and building or Building xxx b) amount deposited in capital gains deposit account scheme XXX A or B whichever is less is exempt Taxable LTCG or LTCL XXXX XXX XXX XXX

XXXX XXXX

XXX

XXX XXXX XXXX

Note : As tax incidence is higher in the case of STCG, the exemption is first utilized against STCG. Then against LTCG.

Consequences if the new plant, Machinery, land and building is transferred within the three years. Sale proceeds of new plant, Machinery, land and building or Building Less : COA : Original COA of the new land and building Less : Exemption given earlier u/s 54G Taxable STCG ( or STCL ) XXX XXX XXX

XXX XXX

What happens if the amount deposited in capital gains deposit account scheme is not fully utilized ?

If the amount deposited is not utilized fully for the purchase or construction of new land and building within stipulated, then amount not so utilized shall be treated as STCG or LTCG depending upon the ORIGINAL CAPITAL GAIN of the previous year in which the period of 2 years from the date of transfer of original assets expires.

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 13

anilkaranavat@ymail.com

Compiled By Anil J. karanavat

Page 14

You might also like

- Income Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)Document14 pagesIncome Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)dosadNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Capital GainDocument41 pagesCapital GainKrrish KelwaniNo ratings yet

- 1240330838-47 - Capital GainsDocument32 pages1240330838-47 - Capital GainsSHASWAT DROLIANo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Tax Audit Reporting (GBCA) - Sanjeev LalanDocument59 pagesTax Audit Reporting (GBCA) - Sanjeev LalanVenkateshNo ratings yet

- 27 Capital Gain PCCDocument44 pages27 Capital Gain PCCbshah1989No ratings yet

- Questions Leb Grou2Document7 pagesQuestions Leb Grou2Rohit VermaNo ratings yet

- Income From Capital GainsDocument5 pagesIncome From Capital Gainskeenu23No ratings yet

- Income From Capital Gain, Income From Household Property, Income From Other SourcesDocument24 pagesIncome From Capital Gain, Income From Household Property, Income From Other Sourcesamol_more37No ratings yet

- Chapter - 6 Taxation of Capital Gains: Important Sections Sections ParticularsDocument23 pagesChapter - 6 Taxation of Capital Gains: Important Sections Sections Particularsmohanraokp2279No ratings yet

- Revised Form 3CD by Pankaj GargDocument17 pagesRevised Form 3CD by Pankaj GargAditya HalderNo ratings yet

- Income From Capital GainsDocument31 pagesIncome From Capital GainsMEGHENDRA DEV SHARMANo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions ManualDocument36 pagesPrentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manualcreptclimatic0anwer100% (50)

- Full Download Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manual PDF Full Chapteruraninrichweed.be1arg100% (17)

- Capital Gain: Prof. Madhumathi Department of Commerce Kristu Jayanti College BengaluruDocument13 pagesCapital Gain: Prof. Madhumathi Department of Commerce Kristu Jayanti College BengalurumadhumathiNo ratings yet

- TH THDocument2 pagesTH THkeerthanaNo ratings yet

- Final Tax Audit-JigarDocument20 pagesFinal Tax Audit-JigarJigar MehtaNo ratings yet

- Income Under Head Profits and Business or ProfessionDocument19 pagesIncome Under Head Profits and Business or ProfessionYogesh ParchaniNo ratings yet

- Issues On Capital GainDocument35 pagesIssues On Capital GainashbasalNo ratings yet

- Capital Gains Tax Planning - EXEMPTEDDocument8 pagesCapital Gains Tax Planning - EXEMPTEDahanaghosal2022No ratings yet

- Aakash Bhardwaj Esha Shah Anoop Kaur Jatin Khanna Arun Sharma Pravin ChauhanDocument44 pagesAakash Bhardwaj Esha Shah Anoop Kaur Jatin Khanna Arun Sharma Pravin ChauhanEsha ShahNo ratings yet

- Partnership Tax Outline - USE THISDocument74 pagesPartnership Tax Outline - USE THIScrowlan280% (5)

- EContent 3 2024 02 28 06 43 20 CAPITALGAINdocx 2024 02 20 11 29 41Document22 pagesEContent 3 2024 02 28 06 43 20 CAPITALGAINdocx 2024 02 20 11 29 41solanki YashNo ratings yet

- Paper 18Document153 pagesPaper 18ahmedNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 12 Intermediate ExaminationDocument23 pagesSuggested Answer - Syl12 - Dec13 - Paper 12 Intermediate ExaminationsmrndrdasNo ratings yet

- Information Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapiDocument12 pagesInformation Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapifatmaaleahNo ratings yet

- Taxation Builders Developers Flat Purchasers VimalPDocument63 pagesTaxation Builders Developers Flat Purchasers VimalPS M SHEKAR AND CONo ratings yet

- 6681606Document3 pages6681606Jay O CalubayanNo ratings yet

- Capital Gains Tax For Real Estate Taxation and LegalDocument2 pagesCapital Gains Tax For Real Estate Taxation and LegalAbhay MandeyNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Document6 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Bhupen SharmaNo ratings yet

- Capital Gains Section ParticularsDocument15 pagesCapital Gains Section ParticularsNiyati DholakiaNo ratings yet

- Capital Gains 1Document55 pagesCapital Gains 1apurvaapurvaNo ratings yet

- 5a.capital Gains - Important NoteDocument3 pages5a.capital Gains - Important NoteKansal AbhishekNo ratings yet

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocument16 pagesForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AVidhi MiraniNo ratings yet

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocument16 pagesForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - Ak.leela.kNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- CMKTQT HGDocument32 pagesCMKTQT HGGiang Thái HươngNo ratings yet

- Capital Gain Tax in Special Cases: Presented By: Kartik Tripathi (A017), Suhail Desai (A028), Vaibhav Kumar (A030)Document19 pagesCapital Gain Tax in Special Cases: Presented By: Kartik Tripathi (A017), Suhail Desai (A028), Vaibhav Kumar (A030)Kartik TripathiNo ratings yet

- Taxation ManagementDocument11 pagesTaxation Managementshreya chhajerNo ratings yet

- Major Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIADocument4 pagesMajor Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIAశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Capital GainDocument4 pagesCapital GainOnkar BandichhodeNo ratings yet

- A Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingDocument12 pagesA Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingSipoy SatishNo ratings yet

- Tax AuditDocument3 pagesTax AuditForam ShahNo ratings yet

- Dtax Ii 2018Document11 pagesDtax Ii 2018GYANDEEP BONIANo ratings yet

- Sec 54 and 54BDocument49 pagesSec 54 and 54BMaan91No ratings yet

- 1702-2012 Biocare Lifesciences, Inc. FinalDocument9 pages1702-2012 Biocare Lifesciences, Inc. FinalMarvin CeledioNo ratings yet

- Chapter 9 MCQs On Capital GainDocument34 pagesChapter 9 MCQs On Capital GainNiraj Pandey100% (1)

- Welcome To Presentation On Taxability of House PropertyDocument77 pagesWelcome To Presentation On Taxability of House PropertyAtul BaliNo ratings yet

- 08-Capital Gain - TY 2019Document19 pages08-Capital Gain - TY 2019jafferyasim100% (1)

- Sababan Magic NotesDocument45 pagesSababan Magic NotesDonna HillNo ratings yet

- MCQ Direct TaxDocument53 pagesMCQ Direct TaxSwetha MalladiNo ratings yet

- Income From Capital GainDocument9 pagesIncome From Capital Gain6804 Anushka GhoshNo ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- Capital Gains ComputationDocument19 pagesCapital Gains ComputationNandini AgarwalNo ratings yet

- Basics of Direct TaxesDocument41 pagesBasics of Direct TaxesrokuveNo ratings yet

- Lec 3 4 Capital Investment PDFDocument50 pagesLec 3 4 Capital Investment PDFMuhammad Saleh AliNo ratings yet

- Understanding On: Tax Audit U/s 44AB of I.T. ActDocument29 pagesUnderstanding On: Tax Audit U/s 44AB of I.T. Actspchheda4996No ratings yet

- Central Excise Rules, 2002: Notification no.-08/2014-C.E. Effective Date of Amendment - 01 April'14Document2 pagesCentral Excise Rules, 2002: Notification no.-08/2014-C.E. Effective Date of Amendment - 01 April'14kumargaurav21281No ratings yet

- GST Law Practice Part 1Document21 pagesGST Law Practice Part 1kumargaurav21281No ratings yet

- Central Excise Rules, 2002: Notification no.-08/2014-C.E. Effective Date of Amendment - 01 April'14Document2 pagesCentral Excise Rules, 2002: Notification no.-08/2014-C.E. Effective Date of Amendment - 01 April'14kumargaurav21281No ratings yet

- A Treatise On The Law Practice of Stay Recovery of Tax ArrearsDocument24 pagesA Treatise On The Law Practice of Stay Recovery of Tax Arrearskumargaurav21281No ratings yet

- CPC Instruction 271112 Adjustment RefundsDocument3 pagesCPC Instruction 271112 Adjustment Refundskumargaurav21281No ratings yet

- Will &Document19 pagesWill &kumargaurav21281No ratings yet

- Rectification ManualDocument25 pagesRectification Manualwww.TdsTaxIndia.comNo ratings yet

- Wealth Tax Flow ChartDocument3 pagesWealth Tax Flow ChartParasuram IyerNo ratings yet

- Ceiling On Land Holdingsaugust Measures To Hoodwink PeopleDocument4 pagesCeiling On Land Holdingsaugust Measures To Hoodwink Peoplekumargaurav21281No ratings yet

- Fi NotesDocument191 pagesFi Notessravan_basa100% (1)

- Rectification ManualDocument25 pagesRectification Manualwww.TdsTaxIndia.comNo ratings yet

- Kansai Nerolac Software TDSDocument17 pagesKansai Nerolac Software TDSkumargaurav21281No ratings yet

- 4 Introduction To Indian Capital MarketDocument10 pages4 Introduction To Indian Capital Marketkumargaurav21281No ratings yet

- Oxycontin Robbery Case - Well, I'll Be Back and There's Going To Be TroubleDocument4 pagesOxycontin Robbery Case - Well, I'll Be Back and There's Going To Be TroubleJames LindonNo ratings yet

- Leese Arnold - PamphletsDocument171 pagesLeese Arnold - Pamphletsnautilus81100% (2)

- Understanding The Concept of Hindu Undivided FamilyDocument21 pagesUnderstanding The Concept of Hindu Undivided FamilyneelsterNo ratings yet

- Motion To Withdraw FundsDocument2 pagesMotion To Withdraw FundsTenshi FukuiNo ratings yet

- Simeen Hussain Rimi: Early Life and EducationDocument1 pageSimeen Hussain Rimi: Early Life and EducationDr. Molla Abdus SattarNo ratings yet

- BPSSC Sub InspectorDocument2 pagesBPSSC Sub InspectorAnonymous tOgAKZ8No ratings yet

- Adel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesDocument10 pagesAdel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesJoesil Dianne0% (1)

- 53 Goquiolay V Sycip (Resolution)Document13 pages53 Goquiolay V Sycip (Resolution)slumbaNo ratings yet

- ERNESTINA BERNABE, Petitioner, vs. CAROLINA ALEJO As Guardian Ad Litem For The Minor ADRIAN BERNABE, RespondentDocument9 pagesERNESTINA BERNABE, Petitioner, vs. CAROLINA ALEJO As Guardian Ad Litem For The Minor ADRIAN BERNABE, RespondentAnsai CaluganNo ratings yet

- HPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Document1 pageHPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Sangram MundeNo ratings yet

- 7 The Crown As Corporation by Frederick MaitlandDocument14 pages7 The Crown As Corporation by Frederick Maitlandarchivaris.archief6573No ratings yet

- Spot Report Hacking IncidentDocument10 pagesSpot Report Hacking IncidentRofilR.AlbaoNo ratings yet

- Bank CertificateDocument1 pageBank CertificateUCO BANKNo ratings yet

- Vda Vs ReyesDocument3 pagesVda Vs ReyesJohn AbellanidaNo ratings yet

- 13 Reyes Vs MosquedaDocument5 pages13 Reyes Vs MosquedaIshNo ratings yet

- R V Robb (1991) 93 CRDocument2 pagesR V Robb (1991) 93 CRJeree Jerry AzreeNo ratings yet

- Bench Guidelines and PoliciesDocument3 pagesBench Guidelines and PoliciesEscalation ACN Whirlpool50% (2)

- Certificado de Penales Modelos Provinciales ESPAÑADocument5 pagesCertificado de Penales Modelos Provinciales ESPAÑAAnaMabel MirandaNo ratings yet

- Buy Back of Shares: - Secretarial PracticeDocument6 pagesBuy Back of Shares: - Secretarial PracticecoolsikhNo ratings yet

- Unit Clearance Record: (Last, First, Middle)Document2 pagesUnit Clearance Record: (Last, First, Middle)DouglasNo ratings yet

- Mayor Miguel Paderanga Vs Judge Cesar AzuraDocument2 pagesMayor Miguel Paderanga Vs Judge Cesar AzuraewnesssNo ratings yet

- Ltia OrientationDocument16 pagesLtia OrientationCA T He100% (3)

- Central Bank of The Phils. v. CADocument4 pagesCentral Bank of The Phils. v. CAJazem AnsamaNo ratings yet

- Privacy Statement and ConsentDocument2 pagesPrivacy Statement and ConsentJoanna Geredel VestilNo ratings yet

- Recovering Possession of PropertyDocument18 pagesRecovering Possession of Property19140 VATSAL DHAR100% (1)

- Real RightsDocument6 pagesReal RightsPinky Bee MajoziNo ratings yet

- Itc Model Contract For The Interntional Sale of GoodsDocument20 pagesItc Model Contract For The Interntional Sale of GoodswebmanyaNo ratings yet

- LITERATUREDocument21 pagesLITERATUREArchie alabaNo ratings yet

- Dear ColleagueDocument3 pagesDear ColleaguePeter SullivanNo ratings yet

- The Law and The LawyerDocument130 pagesThe Law and The LawyerAshu Garg67% (12)