Professional Documents

Culture Documents

Pattern of Household Consumption Expenditure U Eng

Uploaded by

Pugh JuttaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pattern of Household Consumption Expenditure U Eng

Uploaded by

Pugh JuttaCopyright:

Available Formats

National Workshop on Reforms for Economic Development of Myanmar Myanmar International Convention Center (MICC) Naypyitaw, 19 21 August, 2011

Myanmar: Pattern of Household Consumption Expenditure U Myint1 (a) Household expenditure pattern 1. The pattern of consumption expenditure of an average Burmese family is given in table (1). The figures are published by the Central Statistical Organization (CSO) and are based on its sample survey of monthly consumer expenditures of an average household in Yangon. The table gives data for two years, 1986 and 2001, and thus shows how the pattern of consumption expenditure has evolved over a fifteen year period.2 It reveals the following. 2. The size of the average household in Yangon has declined from 5.78 in 1986 to 5.20 in 2001. The monthly expenditure of this smaller household, mostly to meet daily necessities, rose from K997 to K37,428 over this period a thirty-seven fold increase. 3. There has been an increase of 3.43% in the share of food in the household expenditure of an average family in Yangon over the 15 year period. But no significant shifts seemed to have taken place in the share spent on major food items. There has been small increases in the share of expenditures on meat amounting to 0.12% and on rice amounting to 0.78%. The increase in share spent on fruits and vegetables is higher at 2.85%. On the other hand, there has been declines in shares spent on fresh fish amounting to 0.89% and on oil and fats amounting to 2.1%. 4. As for the nonfood category, a significant change is the rise in the share of charity and ceremonials (C&C) in total expenditure. In 1986, the average family in Yangon spent K13 per month on this item and of the 16 items listed under the nonfood category, C&Cs share (1.3%) is ranked tenth. In 2001, C&C became a major item of expenditure. The amount spent on it (K1,233), is ranked third on the list of nonfood expenditures, behind fuel and light (K2,364) and travel (K2,363). The amount spent on C&C in 2001 is higher than the money the household spends on house rent and home improvements (K1,148), on education (K897), on clothes (K847), as well as on health (K637). 5. There are several possible reasons why C&C has become more important in the everyday life of an average Burmese city dweller. It could be that the family is performing more meritorious deeds because its members have become more interested in the next life than in the present one. Or it could be that the family is taking advantage of (or is being persuaded to take advantage of) the many new opportunities for making contributions to charities, welfare activities, community self-help schemes and other worthy causes (such as building roads and public works) that have mushroomed in the country in the process of transformation into a market-oriented economy. Or it could simply be that the household is playing an active part in numerous ceremonies, celebrations, festivals, mass rallies and rituals that have become a major national preoccupation in recent years. (b) Comparison with other countries

1

Chief, Centre for Economic and Social Development, Myanmar Development Resource Institute (MDRI), Yangon.

2

As of writing this paper, 2001 is the latest year for which data are available on household consumption expenditure.

6. How does Myanmars current pattern of household consumption expenditure compare with others in the region and with those in the developed world? The structure of a countrys consumption expenditure is influenced by its culture, traditions, customs, values, tastes and preferences and hence making inter-country comparisons in this area is hazardous. Keeping this in view, it will nevertheless be useful to recall a generally accepted principle in economics, known as Engel's Law, which states that for any country or society, a family at a lower level of income devotes a larger proportion of its expenditure to food. Then with rising incomes, the share of food declines while there is a corresponding increase in the share of other items such as housing, consumer durables, transport, education, health, recreation and family welfare services. As shown in table (1), 68.36% of the consumption expenditure of an average family in Yangon in 2001 is on food. For the country as a whole, the share of food for the same year is estimated to be 72%, with rice making up 15.8%.3 In the countryside and villages, the share of food (and especially rice) in total consumption expenditure is higher. This is particularly so in the rural areas of Chin State where food accounted for 76% of total household consumption expenditure with the share of rice amounting to 17.8%.4 Compared to this, the proportion spent on food for an average household in a developed country like the USA is around 14%.5 Even then, not all countries are happy with the amount of food consumed by their citizens. Consider for example, this observation on the eating habits of the citizens of America. Numerous nutrition experts of the U.S. Department of Agriculture and of Health and Human Services have voiced concern that Americans generally eat too much food and, specifically, too much fat, cholesterol, sugar, and salt. Pointing to the incidence of obesity, diabetes, heart attacks, high blood pressure, and tooth decay, the Senate Select Committee on Nutrition and Human Needs has suggested that Americans eat 30% fewer calories from fats, 45% fewer calories from refined sugars, ... and that they reduce cholesterol intake by one-half, and salt intake by two-thirds.6 7. Not only in a developed country like the United States, in no other country in the Asian region does an average family devotes such a high share of household consumption expenditure to food as in Myanmar. In Singapore the share of household consumption on food is 14%, in Thailand it is 32% and in Malaysia, 37%. The share spent on food is lower in other least developed countries as well. For example, in Bangladesh the share is 52%, in Cambodia 57% and in Laos 61% (see footnote 7 below).7

3 4 5

Central Statistical Organization, Statistical Yearbook 2002 (Yangon: CSO,2002), table 22.04, p. 423.

Ibid.; table 22.05; p. 431. The distribution of household spending in the United States in 1995 was as follows: Housing (32.4%), Transportation (18.6%), Food (14%), Personal insurance and pensions (9.2%), Health care (5.4%), Apparel and services (5.3%), Entertainment (5%) and Other expenditures (10.1%). See United States, Bureau of Labor Statistics, Distribution of Household Spending, 1995 BLS Consumer Expenditure Survey [http://www.nnfr.org/econ/bls95.htm]. Three decades earlier in 1963, the share of food and beverages in the household consumption expenditure in the United States was 25.2% and the share fell to 17.5% in 1981. See Eugene A. Diulio, Money and Banking (New York: Schaum's Outline Series, McGraw-Hill Book Company, International Editions, 1987), p. 19. 6 Michael C. Lathams contribution on Dietary Guidelines, available on Microsoft Encarta 95, CD-Rom.

7

For the latter half of the 1990s, the share of food and beverages in the household consumption expenditure of countries in the Asia and Pacific region were as follows: Singapore (14%), Japan (23%), Taiwan (24%), Hong Kong (26%), Republic of Korea (27%), Thailand (32%), Malaysia (37%), Sri Lanka (41%), China (44%), Mongolia (45%), Philippines (47%), Bangladesh (52%), India (54%), Pakistan (55%), Cambodia (57%), Indonesia (59%),

8. While the share spent on food has increased slightly relative to nonfood items in the consumption pattern of the average household in Yangon over the past decade and a half, there have been reports of vast changes in lifestyles in neighbouring countries over a similar period. For instance, a study completed in 1997 in Thailand is said to have found enormous changes in the spending pattern of consumers in that country with money going into family welfare, sanitation, clothing, accommodation, transport and recreation. According to the study, the share of expenditure on clothes and personal items went up from 9.5% in 1981 to 13.4% in 1996. The percentage spent on furniture, home accessories and appliances increased from 5.2% to 6.6%, the percentage spent on recreation jumped from 11.4% to 14.4%, while eating out at restaurants and hotels rose from 7.8% to 10% over the same period. The study is also reported to have found sharp rises in the shares spent on health care as well as on communications and transport.8 9. Myanmar with its cherished traditions and customs need not emulate the spending patterns of others. Nevertheless, the structure of household consumption expenditure reflected in table (1) points to several challenges. First, the large percentage spent on food indicates a low level of income. The income level of the average household must be substantially increased so that the family has enough to spend on other items that are considered desirable in any modern developed society. Second, although the increased preference for charity and ceremonies is understandable, the lack of significant change in the pattern of household consumption expenditure for one and a half decade is disturbing. Third, with regard to food, it is important that the family gets a balanced diet. It is particularly important for children to get a diet that promotes their mental and physical development. Finally, as regards nonfood items, the proportions and the absolute amounts spent on items such as health, education and recreation are too small. Given todays prices, most residents of Yangon would agree that it would not be adequate for a family of five to spend K897 per month on education, K637 on health care, and K141 on recreation. At the market exchange rate of K615 per US dollar that prevailed in 2001, these amounts translate into $1.46 per month on education, $1.04 per month on health care, and 23 cents per month on recreation. (c) Imbalance in household income and expenditure 10. The household income and expenditure survey of 1997 further reveals that average incomes of families in many parts of Myanmar are inadequate to meet household consumption expenditures.9 Table (2) shows that except in Yangon and Ayeyarwady divisions, estimated monthly incomes of average households were insufficient to cover consumption costs in the remaining 12 states and divisions. The situation appears particularly acute in Kayah, Shan, Magway, Rakhine, and Sagaing state/divisions where estimated incomes accounted for between 42% to 57% of the respective expenditures. For the country as a whole the income of the average family can only meet 73% of its consumption expenditure. Table (2) also indicates that income distribution has been uneven

Nepal (61%), Laos (61%), Viet Nam (62%), North Korea (65%), and Myanmar (71%) [ Source: SSII, Asian Agrifood Demand Trends to 2010]. 8 See news article entitled "Thais becoming big spenders", in the New Light of Myanmar, 12 March 1997, p. 4. The study was undertaken by the Thai Farmers Bank Research Centre and it became available in March 1997.

9

I understand that a household income and expenditure survey for the states and divisions of Myanmar for the year 2001 has already been completed by the Central Statistical Organization. However, the year 2001 survey is awaiting clearance from the authorities for release, and is not available as of writing this paper. Hence, the 1997 household income expenditure survey is the latest available to the general public at this time.

among states and divisions. For example, the estimated income of an average household in Yangon Division (K16,661) is over three and a half times higher than the income of an average household in the Kayah State (K4,622). 11. According to CSO, sources of income include wages and salaries (in cash and kind), entrepreneurial income, pension, rent, interest, remittances, bonuses, and others (in kind). When incomes are substantially below expenditures, a family has the following options to make ends meet: (i) Draw down savings, if any; (ii) Sell off assets; (iii) Borrow and get into debt; (iv) Get handouts from relatives and friends; and (v) Tighten belt eat less, reduce standard of living, take children out of school. 12. Obviously, there are limits to which these measures can be pursued and they are not sustainable in the long run. The large gap between income and expenditure also raises the question of underreporting of incomes. This possibility appears likely as most low-income employees moonlight, seek side income in the informal sector, and wife and children undertake casual work to supplement family earnings.

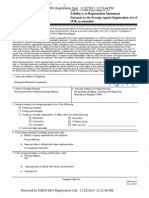

Table 1. Household Expenditure per Month in Yangon, 1986 and 2001 Expenditure 1986 (Household size = 5.78) (a) Value (Kyats) 996.84 647.29 106.44 97.61 103.08 91.44 40.31 56.58 18.39 16.67 19.01 5.56 21.02 8.95 15.58 46.65 349.55 71.50 47.78 13.20 30.37 22.11 51.19 19.26 18.61 30.19 n.a 23.26 4.27 12.13 2.77 1.35 1.56 (b) Share (%) 100.00 64.93 10.68 9.79 10.34 9.17 4.04 5.68 1.84 1.67 1.91 0.56 2.11 0.90 1.56 4.68 35.07 7.17 4.79 1.33 3.05 2.22 5.14 1.93 1.87 3.03 n.a 2.33 0.43 1.22 0.28 0.14 0.16 Expenditure 2001 (Household size = 5.20) (c) Value (Kyats) 37,428.06 25,585.87 4,041.07 3,955.03 3,537.41 2,647.41 2,576.47 1,158.76 951.67 787.15 747.21 707.35 524.08 336.78 273.93 3,341.55 11,842.19 2,363.90 2,363.28 1,233.15 1,147.79 897.01 847.14 645.17 636.81 540.10 292.35 251.12 140.74 133.65 60.63 11.13 278.23 (d) Share (%) 100.00 68.36 10.80 10.57 9.45 7.07 6.89 3.10 2.54 2.10 2.00 1.89 1.40 0.90 0.73 8.92 31.64 6.32 6.32 3.29 3.07 2.40 2.26 1.72 1.70 1.44 0.78 0.67 0.38 0.36 0.16 0.03 0.74 Share Change

Year

Increase Ratio

(%)

Item of household expenditure Total FOOD (1) Meat (2) Rice (3) Fish (fresh) (4) Cooking oil and fats (5) Fruits and vegetables (6) Spices and condiments (7) Eggs (8) Beverages (9) Pulses (10) Fish (dried) (11) Ngapi & nganpyaye (12) Milk & milk products (13) Sugar and other food (14) Other NON-FOOD (1) Fuel & light (2) Travel expenses (3) Charity and ceremonials (4) House rent and repairs (5) Education (6) Clothing and apparel (7) Personal use goods (8) Medical care (9) Cleansing and toilet (10) Other household goods (11) Tobacco (12) Recreation (13) Stationery & school sup. (14) Furniture (15) Crockery (16) Other

(c/a) Ratio 37.55 39.53 37.97 40.52 34.08 28.95 63.92 20.48 51.75 47.22 39.31 127.22 24.93 37.63 17.58 71.63 33.88 33.06 49.46 93.42 37.79 40.57 16.55 33.50 34.22 17.89 n.a. 10.80 32.96 11.02 21.89 8.24 178.35

(d-b) (+)increase (-)decrease n.a. +3.43 +0.12 +0.78 -0.89 -2.10 +2.85 -2.58 +0.70 +0.43 +0.09 +1.33 -0.71 0.00 -0.83 +4.24 -3.43 -0.85 +1.53 +1.96 +0.02 +0.18 -2.88 -0.21 -0.17 -1.86 n.a. -1.66 -0.05 -0.86 -0.12 -0.11 +0.58

Source: Central Statistical Organization, Statistical Yearbooks 1995 and 2001. Notes: Expenditure items under both food and nonfood categories have been listed in order of magnitude for 2001. "n.a" means data not available or not applicable.

Table 2. Average Household Monthly Income and Expenditure in Myanmar in 1997 (a) Income (Kyats) (b) Expenditure (Kyats) States and Divisions 01. 02. 03. 04. 05. 06. 07. 08. 09. 10. 11. 12. 13. 14. Yangon Kachin Tanintharyi Ayeyarwady Kayin Mon Bago Mandalay Shan Sagaing Chin Rakhine Magway Kayah 16,660.99 13,196.61 12,712.76 12,311.42 11,800.54 10,767.66 8,673.64 8,650.39 8,393.82 7,760.88 6,836.21 6,660.56 6,560.61 4,622.15 15,499.75 16,368.98 19,294.50 12,267.99 14,944.75 13,708.00 13,595.22 13,834.31 16,649.91 13,565.15 10,820.20 12,033.68 11,773.30 11,017.56 Cities 01. 02. Yangon Mandalay 18,997.36 11,058.03 16,234.81 18,273.60 Whole Country 01. Union 10,122.98 13,784.51 -3,661.53 73.44 +2,762.55 -7,215.57 117.02 60.51 +1,161.24 -3,172.37 -6,581.74 +43.43 -3,144.21 -2,940.34 -4,921.58 -5,183.92 -8,256.09 -5,804.27 -3,983.99 -5,373.12 -5,212.69 -6,395.41 107.49 80.62 65.89 100.35 78.96 78.55 63.80 62.53 50.41 57.21 63.18 55.35 55.72 41.95 (a-b) (c):Balance (Kyats) (a/b) Ratio of income to expenditure (%)

State/Division

Source: Central Statistical Organization, Report of 1997 Household Income and Expenditure Survey (Yangon: CSO, 1999).

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- HARVARD REPORT :myanmar Officials Implicated in War Crimes and Crimes Against HumanityDocument84 pagesHARVARD REPORT :myanmar Officials Implicated in War Crimes and Crimes Against HumanityPugh JuttaNo ratings yet

- ACHC"social Responsibility" Report Upstream Ayeyawady Confluence Basin Hydropower Co., LTD.Document60 pagesACHC"social Responsibility" Report Upstream Ayeyawady Confluence Basin Hydropower Co., LTD.Pugh JuttaNo ratings yet

- #NEPALQUAKE Foreigner - Nepal Police.Document6 pages#NEPALQUAKE Foreigner - Nepal Police.Pugh JuttaNo ratings yet

- HARVARD:Crackdown LETPADAUNG COPPER MINING OCT.2015Document26 pagesHARVARD:Crackdown LETPADAUNG COPPER MINING OCT.2015Pugh JuttaNo ratings yet

- #Myanmar #Nationwide #Ceasefire #Agreement #Doc #EnglishDocument14 pages#Myanmar #Nationwide #Ceasefire #Agreement #Doc #EnglishPugh JuttaNo ratings yet

- MNHRC REPORT On Letpadaungtaung IncidentDocument11 pagesMNHRC REPORT On Letpadaungtaung IncidentPugh JuttaNo ratings yet

- SOMKIAT SPEECH ENGLISH "Stop Thaksin Regime and Restart Thailand"Document14 pagesSOMKIAT SPEECH ENGLISH "Stop Thaksin Regime and Restart Thailand"Pugh JuttaNo ratings yet

- United Nations Office On Drugs and Crime. Opium Survey 2013Document100 pagesUnited Nations Office On Drugs and Crime. Opium Survey 2013Pugh JuttaNo ratings yet

- Davenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressDocument4 pagesDavenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressPugh JuttaNo ratings yet

- Justice For Ko Par Gyi Aka Aung Kyaw NaingDocument4 pagesJustice For Ko Par Gyi Aka Aung Kyaw NaingPugh Jutta100% (1)

- Children For HireDocument56 pagesChildren For HirePugh JuttaNo ratings yet

- U Kyaw Tin UN Response by PR Myanmar Toreport of Mr. Tomas Ojea QuintanaDocument7 pagesU Kyaw Tin UN Response by PR Myanmar Toreport of Mr. Tomas Ojea QuintanaPugh JuttaNo ratings yet

- BURMA Economics-of-Peace-and-Conflict-report-EnglishDocument75 pagesBURMA Economics-of-Peace-and-Conflict-report-EnglishPugh JuttaNo ratings yet

- Rcss/ssa Statement Ethnic Armed Conference Laiza 9.nov.2013 Burmese-EnglishDocument2 pagesRcss/ssa Statement Ethnic Armed Conference Laiza 9.nov.2013 Burmese-EnglishPugh JuttaNo ratings yet

- Myitkyina Joint Statement 2013 November 05.Document2 pagesMyitkyina Joint Statement 2013 November 05.Pugh JuttaNo ratings yet

- Modern Slavery :study of Labour Conditions in Yangon's Industrial ZonesDocument40 pagesModern Slavery :study of Labour Conditions in Yangon's Industrial ZonesPugh JuttaNo ratings yet

- Asia Foundation "National Public Perception Surveys of The Thai Electorate,"Document181 pagesAsia Foundation "National Public Perception Surveys of The Thai Electorate,"Pugh JuttaNo ratings yet

- Poverty, Displacement and Local Governance in South East Burma/Myanmar-ENGLISHDocument44 pagesPoverty, Displacement and Local Governance in South East Burma/Myanmar-ENGLISHPugh JuttaNo ratings yet

- UNODC Record High Methamphetamine Seizures in Southeast Asia 2013Document162 pagesUNODC Record High Methamphetamine Seizures in Southeast Asia 2013Anonymous S7Cq7ZDgPNo ratings yet

- KIO Government Agreement MyitkyinaDocument4 pagesKIO Government Agreement MyitkyinaPugh JuttaNo ratings yet

- KNU and RCSS Joint Statement-October 26-English.Document2 pagesKNU and RCSS Joint Statement-October 26-English.Pugh JuttaNo ratings yet

- Laiza Ethnic Armed Group Conference StatementDocument1 pageLaiza Ethnic Armed Group Conference StatementPugh JuttaNo ratings yet

- MON HUMAN RIGHTS REPORT: DisputedTerritory - ENGL.Document101 pagesMON HUMAN RIGHTS REPORT: DisputedTerritory - ENGL.Pugh JuttaNo ratings yet

- Brief in BumeseDocument6 pagesBrief in BumeseKo WinNo ratings yet

- The Dark Side of Transition Violence Against Muslims in MyanmarDocument36 pagesThe Dark Side of Transition Violence Against Muslims in MyanmarPugh JuttaNo ratings yet

- Karen Refugee Committee Newsletter & Monthly Report, August 2013 (English, Karen, Burmese, Thai)Document21 pagesKaren Refugee Committee Newsletter & Monthly Report, August 2013 (English, Karen, Burmese, Thai)Pugh JuttaNo ratings yet

- Taunggyi Trust Building Conference Statement - BurmeseDocument1 pageTaunggyi Trust Building Conference Statement - BurmesePugh JuttaNo ratings yet

- Ceasefires Sans Peace Process in Myanmar: The Shan State Army, 1989-2011Document0 pagesCeasefires Sans Peace Process in Myanmar: The Shan State Army, 1989-2011rohingyabloggerNo ratings yet

- TBBC 2013-6-Mth-Rpt-Jan-JunDocument130 pagesTBBC 2013-6-Mth-Rpt-Jan-JuntaisamyoneNo ratings yet

- SHWE GAS REPORT :DrawingTheLine ENGLISHDocument48 pagesSHWE GAS REPORT :DrawingTheLine ENGLISHPugh JuttaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Diet and Dental CariesDocument173 pagesDiet and Dental CariesReenaChauhan100% (1)

- Quizzes and Midterm Test BanksDocument69 pagesQuizzes and Midterm Test BanksJuli Aprosoff100% (1)

- Vintage Candy GuideDocument22 pagesVintage Candy Guideadam.leiphart.bsNo ratings yet

- FA19-CHE-083 (A) - CPI - Assignment 1Document9 pagesFA19-CHE-083 (A) - CPI - Assignment 1Maryam FatimaNo ratings yet

- Fatima AkramDocument10 pagesFatima AkramMian AdeelNo ratings yet

- A Young Entrepreneur and Dost V Setup Beneficiary Ventures in Muscovado Based Delicacies in Polangui AlbayDocument2 pagesA Young Entrepreneur and Dost V Setup Beneficiary Ventures in Muscovado Based Delicacies in Polangui Albays.sabapathyNo ratings yet

- List of Approvals Accorded Under Notification Dated 22.4.2022Document19 pagesList of Approvals Accorded Under Notification Dated 22.4.2022chaitanya.sharmaNo ratings yet

- Components of FoodDocument3 pagesComponents of FoodRAndy rodelas100% (1)

- Jurnal PemanisDocument10 pagesJurnal PemanisNi Putu WidayantiNo ratings yet

- Carbonation VS Phos Floation PDFDocument48 pagesCarbonation VS Phos Floation PDFRAJKUMARNo ratings yet

- Intense Sweeteners ReportDocument6 pagesIntense Sweeteners ReportdivyaNo ratings yet

- Nutrient Profile Models For Nutrition Health Policies 1666250725Document90 pagesNutrient Profile Models For Nutrition Health Policies 1666250725Philippe CarlosNo ratings yet

- Returning to Silence: *transcribe: 옮겨 쓰다Document15 pagesReturning to Silence: *transcribe: 옮겨 쓰다gy5f5pfpjcNo ratings yet

- Frappe RecipesDocument1 pageFrappe Recipesc3praiseNo ratings yet

- Christopher Ebert - Between Empires - Brazilian Sugar in The Early Atlantic Economy, 1550-1630 (The Atlantic World) (2008) PDFDocument224 pagesChristopher Ebert - Between Empires - Brazilian Sugar in The Early Atlantic Economy, 1550-1630 (The Atlantic World) (2008) PDFSonia Jaimes100% (2)

- Mango Pulp and BeveragesDocument15 pagesMango Pulp and BeveragesTri YuliNo ratings yet

- CaramelDocument39 pagesCaramelTuti MontillaNo ratings yet

- 40 Day Fasting InstructionsDocument6 pages40 Day Fasting InstructionsFrank Njoro100% (1)

- Summer Internship Report-Final Sakthi SugarsDocument12 pagesSummer Internship Report-Final Sakthi SugarsSangeetha Prabha80% (5)

- Nutrition and Diet Program-CompressedDocument89 pagesNutrition and Diet Program-CompressedCosmin Dospinescu100% (8)

- M&M Cookies by A. Romney: IngredientsDocument4 pagesM&M Cookies by A. Romney: IngredientsJessica WinstonNo ratings yet

- Ingredients: For The Caramel MousseDocument3 pagesIngredients: For The Caramel Mousseprerna9486No ratings yet

- Hard Sugar Panning W Vink (Read-Only)Document50 pagesHard Sugar Panning W Vink (Read-Only)Santiago Del Rio Oliveira100% (1)

- Middle School Argumentative Essay: Chocolate Milk at School?Document2 pagesMiddle School Argumentative Essay: Chocolate Milk at School?Suresh ReddyNo ratings yet

- Classes of Food-SpDocument2 pagesClasses of Food-SpDavendran SelvarathunamNo ratings yet

- Training Report On Manufacturing of SugarDocument33 pagesTraining Report On Manufacturing of SugarShivam Mittal50% (6)

- Candida DietDocument2 pagesCandida Dietgsekar74No ratings yet

- Nutrition Study GuideDocument3 pagesNutrition Study GuidedianaAZPNo ratings yet

- NB Oriya Bengali CuisineDocument4 pagesNB Oriya Bengali CuisineUjjwal Kr. AcharyyaNo ratings yet

- Organization Study at Chamundeshwari SugarDocument18 pagesOrganization Study at Chamundeshwari SugarArun Sankar PNo ratings yet