Professional Documents

Culture Documents

Financial Information Sheet: Bal 1 Bal 2 TTL

Uploaded by

Steve MontroseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Information Sheet: Bal 1 Bal 2 TTL

Uploaded by

Steve MontroseCopyright:

Available Formats

Financial Information Sheet

Loan # Borrower Name: Co-Borrower Name:

/

Home Phone: Home Phone: Borrower SSN:

Work Phone: Work Phone:

Cell Phone: Cell Phone:

Is your home for sale:

Co-Borrower SSN:

Current Value: Property Address:

Mailing Address:

Bal 1

Bal 2

Ttl

0 Current LTV:

Cash

Total number of persons living at this address: Borrower Information Employer Name Occupation Gross Monthly (PL or Paystub) 12 Net Monthly (PL or Paystub) Rental Income Social Security Pension/Retirement Disability Alimony/Child Support Food Stamps Welfare/Unemployment Misc Inc Misc Inc

Auto: Gasoline Auto: Insurance Auto: Maintenance Auto: Parking Cable TV/Satellite Telephone Cell Phone Electricity Gas/Heating Furniture/Appliance Groceries Water/Sewer/Trash

Pri Ppty 1st TD (Escrow: Y Primary Property 2ndTD

Total All Other Mortgages Total Income (w/Gross) Total Income (w/Net)

Total Expenses

Number of dependents at this address: Co-Borrower / Additional Household Income Information Employer Name Occupation Gross Monthly (PL or Paystub) 12 Net Monthly (PL or Paystub) Rental Income Social Security Pension/Retirement Disability Alimony/Child Support Food Stamps Welfare/Unemployment Misc Inc Misc Inc Living Expenses Child Care Pri Ppty Maint. 100 School Tuition Credit Card(s) Financial Counsel Entertainment Medical Expenses HOA Dues Health Insurance Auto Loan(s) Dental/Vision Time Share Life Insurance Personal/Private Loan(s) Health Club Student Loan(s) Dry Cleaning Pri Ppty Home Ins Internet Service Pri Ppty RE Taxes Charity Child Support Misc Misc Monthly Mortgages and Rental Expenses Real Estate Rental Expenses 0 Taxes & Ins All Other Properties Totals - Internal Use Only Surplus/Deficit (w/Gross) 0 Surplus/Deficit (w/Net) 0 $0 100 FE DTI w/Gross $0 BE DTI w/Gross FE DTI w/Net BE DTI w/Net

#VALUE! -100 #VALUE! -100

Calculate

I (we) agree that the financial information provided is an accurate statement of my (our) financial status. I (we) understand and acknowledge that any action taken by the lender of my (our) mortgage loan on my (our) behalf will be made in strict reliance on the financial information provided. My (Our) signature(s) below grants the holder of my (our) mortgage the authority to confirm the information I (we) have disclosed in this financial statement, to verify that it is accurate by ordering a credit report.

By: ________________________________________________________________ Signature of Borrower By: ________________________________________________________________ Signature of Co-Borrower / Co - Applicant

Date: ___________________________

Date: ___________________________

Request For Modi cation and A davit (RMA)

REQUEST FOR MODIFICATION AND AFFIDAVIT (RMA) page 1 Loan I.D. Number____________________________________ COMPLETE ALL THREE PAGES OF THIS FORM Servicer ____________________________________

Making Home A ordable Program

BORROWER

Borrowers name Social Security number Home phone number with area code Cell or work number with area code Date of birth Co-borrowers name Social Security number

CO-BORROWER

Date of birth

Home phone number with area code Cell or work number with area code

I want to: The property is my: The property is:

Mailing address

4 Keep the Property

4 Primary Residence

4 Owner Occupied

Sell the Property Second Home Renter Occupied Investment Vacant

Property address (if same as mailing address, just write same) Is the property listed for sale? Yes 4 No Have you received an o er on the property? Yes 4 No Date of o er _________ Amount of o er $_____________________ Agents Name: ___________________________________________ Agents Phone Number: ____________________________________ For Sale by Owner? Yes No Who pays the real estate tax bill on your property? Lender does Paid by condo or HOA 4 I do Are the taxes current? 4 Yes No Condominium or HOA Fees Yes 4 No $ __________________ Paid to: _________________________________________________ Have you led for bankruptcy? Yes 4 Has your bankruptcy been discharged? No If yes: Yes 4 No

E-mail address Have you contacted a credit-counseling agency for help Yes 4 No If yes, please complete the following: Counselors Name: _________________________________________ Agency Name: ____________________________________________ Counselors Phone Number: __________________________________ Counselors E-mail: ________________________________________ Who pays the hazard insurance premium for your property? Lender does Paid by Condo or HOA 4 I do Is the policy current? 4 Yes No Name of Insurance Co.: ______________________________________ Insurance Co. Tel #: _________________________________________

Chapter 7 Chapter 13 Filing Date:_________________________ Bankruptcy case number _________________________________

Additional Liens/Mortgages or Judgments on this property: Lien Holders Name/Servicer Balance Contact Number Loan Number

HARDSHIP AFFIDAVIT

I (We) am/are requesting review under the Making Home A ordable program. I am having di culty making my monthly payment because of nancial di culties created by (check all that apply): My household income has been reduced. For example: unemployment, underemployment, reduced pay or hours, decline in business earnings, death, disability or divorce of a borrower or co-borrower. My expenses have increased. For example: monthly mortgage payment reset, high medical or health care costs, uninsured losses, increased utilities or property taxes. Other: See Attached Hardship Letter My monthly debt payments are excessive and I am overextended with my creditors. Debt includes credit cards, home equity or other debt. My cash reserves, including all liquid assets, are insucient to maintain my current mortgage payment and cover basic living expenses at the same time.

Explanation (continue on back of page 3 if necessary): __________________________________________________________________________ ______________________________________________________________________________________________________________________

page 1 of 3

REQUEST FOR MODIFICATION AND AFFIDAVIT (RMA) page 2

COMPLETE ALL THREE PAGES OF THIS FORM

Number of People in Household:

INCOME/EXPENSES FOR HOUSEHOLD1

Monthly Household Income

Monthly Gross Wages

Monthly Household Expenses/Debt

Household Assets Checking Account(s) Checking Account(s) $ $ $ $ $

First Mortgage Payment

$ $ $ $ $

Overtime (Incl in gross if applicable) $ Child Support / Alimony / Separation2 Social Security/SSDI Other monthly income from pensions, annuities or retirement plans Tips, commissions, bonus and self-employed income Rents Received Unemployment Income Food Stamps/Welfare Other (investment income, royalties, interest, dividends etc.) Total (Gross Income) $ $ $

Second Mortgage Payment

Insurance homeowner insurance only Property Taxes Credit Cards / Installment Loan(s) (total minimum payment per month) Alimony, child support payments Net Rental Expenses HOA/Condo Fees/Property Maintenance Car Payments

Savings/ Money Market CDs

0

0

Stocks / Bonds

$ $ $ $ $

$ $ $ $

Other Cash on Hand

$ $ $ $

0

0

Other Real Estate (estimated value) Other _____________ Other _____________

0

0

Other frn, child care, tuiton, med $ auto exp, cable, telep, util, food internet, dry cln, ins (see attached)

Do not include the value of life insurance or retirement plans when calculating assets (401k, pension funds, annuities, IRAs, Keogh plans, etc.) Total Assets $

Total Debt/Expenses

0.00

INCOME MUST BE DOCUMENTED

1Include combined income and expenses from the borrower and co-borrower (if any). If you include income and expenses from a household 2You are not required to disclose Child Support, Alimony or Separation Maintenance income, unless you choose to have it considered by your servicer.

member who is not a borrower, please specify using the back of this form if necessary.

INFORMATION FOR GOVERNMENT MONITORING PURPOSES

The following information is requested by the federal government in order to monitor compliance with federal statutes that prohibit discrimination in housing. You are not required to furnish this information, but are encouraged to do so. The law provides that a lender or servicer may not discriminate either on the basis of this information, or on whether you choose to furnish it. If you furnish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race, or sex, the lender or servicer is required to note the information on the basis of visual observation or surname if you have made this request for a loan modication in person. If you do not wish to furnish the information, please check the box below. BORROWER

I do not wish to furnish this information Hispanic or Latino Not Hispanic or Latino American Indian or Alaska Native Asian Black or African American Native Hawaiian or Other Pacic Islander White Female Male

CO-BORROWER Ethnicity: Race:

4 I do not wish to furnish this information

Hispanic or Latino Not Hispanic or Latino American Indian or Alaska Native Asian Black or African American Native Hawaiian or Other Pacic Islander White Female Male Name/Address of Interviewers Employer

Ethnicity: Race:

Sex:

Sex:

To be completed by interviewer

This request was taken by: Face-to-face interview Mail Telephone Internet Interviewers Name (print or type) & ID Number Interviewers Signature Date

Interviewers Phone Number (include area code)

page 2 of 3

REQUEST FOR MODIFICATION AND AFFIDAVIT (RMA) page 3

COMPLETE ALL THREE PAGES OF THIS FORM

ACKNOWLEDGEMENT AND AGREEMENT

1. That all of the information in this document is truthful and the event(s) identied on page 1 is/are the reason that I need to request a modication of the terms of my mortgage loan, short sale or deed-in-lieu of foreclosure. 2. I understand that the Servicer, the U.S. Department of the Treasury, or their agents may investigate the accuracy of my statements and may require me to provide supporting documentation. I also understand that knowingly submitting false information may violate Federal law. 3. I understand the Servicer will pull a current credit report on all borrowers obligated on the Note. 4. I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this document, the Servicer may cancel any Agreement under Making Home Aordable and may pursue foreclosure on my home. 5. That: my property is owner-occupied; I intend to reside in this property for the next twelve months; I have not received a condemnation notice; and there has been no change in the ownership of the Property since I signed the documents for the mortgage that I want to modify. 6. I am willing to provide all requested documents and to respond to all Servicer questions in a timely manner. 7. I understand that the Servicer will use the information in this document to evaluate my eligibility for a loan modication or short sale or deed-in-lieu of foreclosure, but the Servicer is not obligated to oer me assistance based solely on the statements in this document. 8. I am willing to commit to credit counseling if it is determined that my nancial hardship is related to excessive debt. 9. I understand that the Servicer will collect and record personal information, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, government monitoring information, and information about account balances and activity. I understand and consent to the disclosure of my personal information and the terms of any Making Home Aordable Agreement by Servicer to (a) the U.S. Department of the Treasury, (b) Fannie Mae and Freddie Mac in connection with their responsibilities under the Homeowner Aordability and Stability Plan; (c) any investor, insurer, guarantor or servicer that owns, insures, guarantees or services my rst lien or subordinate lien (if applicable) mortgage loan(s); (d) companies that perform support services in conjunction with Making Home Aordable; and (e) any HUD-certied housing counselor.

Borrower Signature

Date

Co-Borrower Signature

HOMEOWNERS HOTLINE

Date

If you have questions about the program that your servicer cannot answer or need further counseling, you can call the Homeowners HOPE Hotline at 1-888-995-HOPE (4673). The Hotline can help with questions about

NOTICE TO BORROWERS

Be advised that by signing this document you understand that any documents and information you submit to your servicer in connection with the Making Home Aordable Program are under penalty of perjury. Any misstatement of material fact made in the completion of these documents including but not limited to misstatement regarding your occupancy in your home, hardship circumstances, and/or income, expenses, or assets will subject you to potential criminal investigation and prosecution for the following crimes: perjury, false statements, mail fraud, and wire fraud. The information contained in these documents is subject to examination and verication. Any potential misrepresentation will be referred to the appropriate law enforcement authority for investigation and prosecution. By signing this document you certify, represent and agree that: Under penalty of perjury, all documents and information I have provided to Lender in connection with the Making Home Aordable Program, including the documents and information regarding my eligibility for the program, are true and correct. If you are aware of fraud, waste, abuse, mismanagement or misrepresentations aliated with the Troubled Asset Relief Program, please contact the SIGTARP Hotline by calling 1-877-SIG-2009 (toll-free), 202-622-4559 (fax), or www.sigtarp.gov. Mail can be sent to Hotline Oce of the Special Inspector General for Troubled Asset Relief Program, 1801 L St. NW, Washington, DC 20220.

page 3 of 3

You might also like

- Myob Payslip TemplateDocument1 pageMyob Payslip Templateapi-384163101No ratings yet

- Web Part Type IdsDocument8 pagesWeb Part Type IdsWilliam JansenNo ratings yet

- Steven Finkler Government Sentencing MemoDocument17 pagesSteven Finkler Government Sentencing Memotomwcleary100% (1)

- Citi BanDocument6 pagesCiti Banmsteemo168No ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- REAL 209 Midterm II Study GuideDocument4 pagesREAL 209 Midterm II Study GuidejuanNo ratings yet

- Credit BookDocument115 pagesCredit Bookapi-26366579100% (2)

- Quick-Start Guide - Online Pay Advices: Getting StartedDocument1 pageQuick-Start Guide - Online Pay Advices: Getting StartedFabiola BeltranNo ratings yet

- Getting Paid Math 2.3.9.A1 PDFDocument3 pagesGetting Paid Math 2.3.9.A1 PDFLyndsey BridgersNo ratings yet

- Getting Paid MathDocument3 pagesGetting Paid MathDawson BanksNo ratings yet

- Britany Morris: Talx Home Work Number HomeDocument3 pagesBritany Morris: Talx Home Work Number HomeBRITTAY2No ratings yet

- 9088ce Pay-StubDocument1 page9088ce Pay-Stubapi-255272420No ratings yet

- PaystubDocument1 pagePaystubjeehanhereNo ratings yet

- Easy As 1-2 - 3: Bring Documents From Each Section Below: 1-2-3 Done!Document1 pageEasy As 1-2 - 3: Bring Documents From Each Section Below: 1-2-3 Done!suneelNo ratings yet

- Application To Rent or Lease (Fillable)Document2 pagesApplication To Rent or Lease (Fillable)Victorino ValdezNo ratings yet

- PPGDocument6 pagesPPGSujata KapurNo ratings yet

- City of Carmel-By-The-Sea: City Council Monthly ReportsDocument32 pagesCity of Carmel-By-The-Sea: City Council Monthly ReportsL. A. PatersonNo ratings yet

- F1 Maths PDFDocument84 pagesF1 Maths PDFFook Long WongNo ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- ResponseDocument48 pagesResponseAlfred ReynoldsNo ratings yet

- ResourceProxy PDFDocument3 pagesResourceProxy PDFGuerline PhilistinNo ratings yet

- RecieptDocument1 pageRecieptsadorraeve100% (1)

- Untitled PDFDocument1 pageUntitled PDFAnonymous GUy5EdNfNo ratings yet

- Managing Employee Earnings Statements: Paystub 3.0Document10 pagesManaging Employee Earnings Statements: Paystub 3.0chaheeNo ratings yet

- Aetna 1850 HD PlanDocument10 pagesAetna 1850 HD PlanNaveen ChintamaniNo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Earnings StatementDocument1 pageEarnings Statementkrmita OrtizNo ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- Employee Paystub EditedDocument1 pageEmployee Paystub EditedSandra ChrisNo ratings yet

- Prescription Reimb Claim FormDocument2 pagesPrescription Reimb Claim FormimthedciNo ratings yet

- Barack Obama Foundation Annual Filing Statement New York 2014Document54 pagesBarack Obama Foundation Annual Filing Statement New York 2014Jerome CorsiNo ratings yet

- Paystub ChangableDocument1 pagePaystub ChangableDanny EytchesonNo ratings yet

- Name: in This Lesson, You Will Learn To:: Resources QuestionsDocument2 pagesName: in This Lesson, You Will Learn To:: Resources QuestionsemscnpckNo ratings yet

- 5Document10 pages5John C. LewisNo ratings yet

- Description Rate Hours Earnings Year To Date Taxes Current Year To DateDocument1 pageDescription Rate Hours Earnings Year To Date Taxes Current Year To DateCody BryantNo ratings yet

- Account Ending 1509 Notice of Insufficient/ Unavailable FundsDocument2 pagesAccount Ending 1509 Notice of Insufficient/ Unavailable FundsChristopher TorresNo ratings yet

- 2019-2020 Full PPO 0 Deductible SBC PDFDocument9 pages2019-2020 Full PPO 0 Deductible SBC PDFrgbrbNo ratings yet

- Paystub 202011Document1 pagePaystub 202011Bangkit Fajar NugrahaNo ratings yet

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableWILLIE WRIGHTNo ratings yet

- Documents Form Medical Claim Il PDFDocument4 pagesDocuments Form Medical Claim Il PDFAnonymous isUyKYK1zwNo ratings yet

- Sa Lesson13Document1 pageSa Lesson13api-263754616No ratings yet

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocument8 pagesHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369No ratings yet

- Fee Adjustment FormDocument2 pagesFee Adjustment FormTemple Beth SholomNo ratings yet

- MV 441 EdlDocument4 pagesMV 441 Edltuan nguyenNo ratings yet

- Imelda Onlime Bpi 1Document1 pageImelda Onlime Bpi 1Foxtrot LimaNo ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- Ths Senior Registration Order Form 2019-2020Document1 pageThs Senior Registration Order Form 2019-2020api-104959056No ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDocument6 pagesYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNo ratings yet

- Yopop Frozen YogurtDocument2 pagesYopop Frozen YogurtEmmanuel Apolonio CortesNo ratings yet

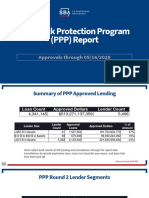

- PPP ReportDocument7 pagesPPP ReportBrittany EtheridgeNo ratings yet

- StabilityDocument3 pagesStabilitykinsonprabuNo ratings yet

- C 4amrDocument2 pagesC 4amrGreen TinaNo ratings yet

- CPP Membership Application: National Institute of Accounting Technicians in The PhilippinesDocument1 pageCPP Membership Application: National Institute of Accounting Technicians in The PhilippinesBev DGNo ratings yet

- Employee Pay Stub: 15094 Dakota StreetDocument1 pageEmployee Pay Stub: 15094 Dakota StreetAnonymous Te07NMbvaNo ratings yet

- Loan Guidelines Us BankDocument12 pagesLoan Guidelines Us BankcraigscNo ratings yet

- 20210131-Payroll Summary-January 2021Document1 page20210131-Payroll Summary-January 2021Yousuff DileepNo ratings yet

- PayStatement 1000139864Document1 pagePayStatement 1000139864ash.payan123No ratings yet

- Rounds April 2020 FecDocument160 pagesRounds April 2020 FecPat PowersNo ratings yet

- Litton FinancialStatementDocument1 pageLitton FinancialStatementZhen WuNo ratings yet

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocument57 pagesProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- RR 1-11 Tax Treatment of OCW or OFWDocument5 pagesRR 1-11 Tax Treatment of OCW or OFWKriszanFrancoManiponNo ratings yet

- Business Plan QuestionnaireDocument4 pagesBusiness Plan Questionnaireshantanu_malviya_1No ratings yet

- Coprorate Finance Question Paper (3 Hours 1000 Words)Document2 pagesCoprorate Finance Question Paper (3 Hours 1000 Words)Vasu PothunuruNo ratings yet

- R & D Report SampleDocument49 pagesR & D Report SampleAkhil PtNo ratings yet

- Invoice 359386-1 - Adv 100% - 1 220,00 EurDocument1 pageInvoice 359386-1 - Adv 100% - 1 220,00 EurАлександр РотарьNo ratings yet

- SBI Clerk Mains 2023 Exam PDF @crossword2022Document196 pagesSBI Clerk Mains 2023 Exam PDF @crossword2022Kannan KannanNo ratings yet

- Work On Sheets! Part I (Problem-Solving) : Name: Date: ScoreDocument1 pageWork On Sheets! Part I (Problem-Solving) : Name: Date: ScoreDong RoselloNo ratings yet

- Usol SyllabusDocument93 pagesUsol SyllabusAkansha KalraNo ratings yet

- WHT ManualDocument166 pagesWHT ManualFaizan HyderNo ratings yet

- Agard Case SummaryDocument4 pagesAgard Case SummaryQuerpNo ratings yet

- Acbp5112+W - Acbp5122+w Assignment 1 - Answer BookletDocument17 pagesAcbp5112+W - Acbp5122+w Assignment 1 - Answer BookletKagiso MahlanguNo ratings yet

- Alex Hosey EssayDocument3 pagesAlex Hosey EssayEric Lacy100% (6)

- The Public Accounting Profession and The Audit Process: Answers To Review QuestionsDocument3 pagesThe Public Accounting Profession and The Audit Process: Answers To Review QuestionsMega Pop LockerNo ratings yet

- SIP PROJECT - Praveen AgarwalDocument90 pagesSIP PROJECT - Praveen AgarwalRohit SachdevaNo ratings yet

- Ladder Top & Bottom OverviewDocument13 pagesLadder Top & Bottom OverviewHiya SanganiNo ratings yet

- SAP Treasury Solutions1Document17 pagesSAP Treasury Solutions1pratikNo ratings yet

- SmartMetalsInvestorKit PDFDocument32 pagesSmartMetalsInvestorKit PDFhorns2034No ratings yet

- Azgard Nine Limited-Internship ReportDocument102 pagesAzgard Nine Limited-Internship ReportM.Faisal100% (1)

- Strategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Document7 pagesStrategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Tabish RehmanNo ratings yet

- Introduction To Bookkeeping FA1 Course Map PDFDocument7 pagesIntroduction To Bookkeeping FA1 Course Map PDFBondhu GuptoNo ratings yet

- Bylaws 2011 Amended 8-1-11Document9 pagesBylaws 2011 Amended 8-1-11cadmorNo ratings yet

- Runnerauto ProspectusDocument401 pagesRunnerauto ProspectusTorifur Rahman BiplobNo ratings yet

- MCQDocument25 pagesMCQAnith PillaiNo ratings yet

- Burgum Gift CardsDocument3 pagesBurgum Gift CardsRob Port50% (2)

- Syllabi Books - MBA Programmes PDFDocument36 pagesSyllabi Books - MBA Programmes PDFKnight riderNo ratings yet

- Indonesia's Coal DynamicDocument48 pagesIndonesia's Coal DynamicCvdNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet