Professional Documents

Culture Documents

UCR

Uploaded by

Karna Palanivelu100%(1)100% found this document useful (1 vote)

595 views2 pagesInsurance companies establish "usual, customary and reasonable" fees. A "reasonable" fee is charged by a physician for a specific medical procedure. Heavily populated areas, where the cost of living is higher, have higher medical fees. Geographic differences may not be fairly taken into account when setting fees.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInsurance companies establish "usual, customary and reasonable" fees. A "reasonable" fee is charged by a physician for a specific medical procedure. Heavily populated areas, where the cost of living is higher, have higher medical fees. Geographic differences may not be fairly taken into account when setting fees.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

595 views2 pagesUCR

Uploaded by

Karna PalaniveluInsurance companies establish "usual, customary and reasonable" fees. A "reasonable" fee is charged by a physician for a specific medical procedure. Heavily populated areas, where the cost of living is higher, have higher medical fees. Geographic differences may not be fairly taken into account when setting fees.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

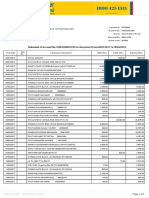

Usual, Customary & Reasonable Fees

Are Sometimes out of the Ordinary

Have you ever submitted a claim to your insurance company for

medical treatment, only to receive a letter from them stating the

charge submitted was in excess of their usual, customary and

reasonable fees? If so you're not alone

What is a UCR fee?

Insurance companies establish UCR fees. Here's how they do it.

A "usual" fee is the fee that an individual physician most frequently

charges for a specific medical procedure.

A "customary" fee is the fee level determined by the administrator of a

medical benefit plan from actual fees submitted for a specific medical

procedure. This fee establishes the maximum benefit payable for that

procedure.

A "reasonable" fee is the fee charged by a physician for a specific

medical procedure that has been modified by complications or unusual

circumstances.

Therefore, it may differ from the physician's usual fee or the benefit

administrator's customary fee.

The concept of using UCR fees to determine how much to reimburse

patients covered by medical insurance for specific treatment was

introduced by the insurance industry in the early 1960s.

How are UCR fees determined?

UCR fees are influenced by the fees physicians charge in various

geographic areas and by the population size. Usually, heavily

populated areas, where the cost of living is higher, have higher medical

fees.

The Health Insurance Association of America (HIAA), an organization of

380 health insurance companies, surveys physicians every six months

on their fees. The fee survey helps insurance companies set UCR fees.

However, insurance companies are not legally required to use HIAA's

fee survey or anyone else's information when setting UCR benefit

levels. In fact, reimbursement calculations by insurance companies

are unregulated and uncontrolled.

How about UCR fees that don't cover all costs?

UCR rates may be outdated. Despite HIAA's attempts to update fee

data to keep up with changing information. It may take up to two years

for physicians to return HIAA's fee surveys, for HIAA to complete the

data, and for member insurance companies and subscribers to receive

it.

Geographic differences may not be fairly taken into account when

insurance companies set UCR rates. While boundaries are commonly

set according to zip code, insurance companies are free to create

boundaries as they choose. They may split a state in half or lump

several small communities together to determine one boundary. If a

large city and a small town are considered to be within the same

boundary, large discrepancies in fees would exist.

UCR fees widely vary among carriers. The Washington State Dental

Association conducted a survey of 41 carriers on how they determine

UCR fees; 28 responded. The data indicated that no two carriers use

the same UCR definition. Carriers use different methods and different

time frames to determine UCR rates. Customary fee determination

made by carriers for the same procedure in the same city at the same

time differed by as much as 136 percent.

What accounts for the difference in physicians' fees and UCR

rates?

In addition to the limitations of UCR fees, any difference between the

fee charged and the benefit paid is due to limitations in the patient's

medical benefit contract.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- X bILL xFINITYDocument6 pagesX bILL xFINITYBryan67% (6)

- Medical Billing-Simple ManualDocument17 pagesMedical Billing-Simple ManualKarna Palanivelu80% (25)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- HIPAADocument40 pagesHIPAAKarna Palanivelu100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Acknowledgment Receipt - Loan AgreementDocument51 pagesAcknowledgment Receipt - Loan AgreementFidelis AijouNo ratings yet

- Downcoding and Bundling ClaimsDocument10 pagesDowncoding and Bundling ClaimsKarna Palanivelu100% (1)

- Indicative Checklist For Tax AuditDocument22 pagesIndicative Checklist For Tax AuditHalf-God Half-ManNo ratings yet

- Medical Billing - An OverviewDocument20 pagesMedical Billing - An OverviewKarna Palanivelu91% (11)

- Medical Billing Flow ChartDocument1 pageMedical Billing Flow ChartKarna Palanivelu100% (6)

- HIPAA BasicsDocument38 pagesHIPAA BasicsKarna Palanivelu100% (5)

- ModifiersDocument8 pagesModifiersKarna Palanivelu100% (6)

- WC GlossaryDocument8 pagesWC GlossaryKarna Palanivelu100% (2)

- John Bala MapsDocument3 pagesJohn Bala MapsJayson80% (10)

- E Passbook 2022 09 13 18 36 57 PMDocument32 pagesE Passbook 2022 09 13 18 36 57 PMManohar NMNo ratings yet

- Andhra Bank StatementDocument2 pagesAndhra Bank StatementLingaraj PadhyNo ratings yet

- Phonetic AlphabetsDocument1 pagePhonetic AlphabetsKarna Palanivelu100% (2)

- Historical Questions & Answers On SNF Consolidated BillingDocument2 pagesHistorical Questions & Answers On SNF Consolidated BillingKarna Palanivelu100% (2)

- Medicare HIC Number SuffixesDocument4 pagesMedicare HIC Number SuffixesKarna Palanivelu100% (15)

- Modifiers 1Document10 pagesModifiers 1Karna Palanivelu100% (6)

- POS CodesDocument5 pagesPOS CodesKarna Palanivelu100% (2)

- Patient CallingDocument2 pagesPatient CallingKarna Palanivelu100% (2)

- Medical BillingDocument10 pagesMedical BillingKarna Palanivelu75% (4)

- NF3Document4 pagesNF3Karna Palanivelu100% (4)

- General Surgery Billing GuideDocument34 pagesGeneral Surgery Billing GuideKarna Palanivelu100% (3)

- General Coding TerminologyDocument7 pagesGeneral Coding TerminologyKarna Palanivelu100% (1)

- CMS 1500Document1 pageCMS 1500Karna Palanivelu100% (2)

- CMS 1500 InstructionsDocument60 pagesCMS 1500 InstructionsKarna PalaniveluNo ratings yet

- CMS 1450 (UB 04) InstructionsDocument12 pagesCMS 1450 (UB 04) InstructionsKarna Palanivelu67% (3)

- Community Transit - 2020-2025 Transit Development Plan DraftDocument69 pagesCommunity Transit - 2020-2025 Transit Development Plan DraftThe UrbanistNo ratings yet

- Mirs White Paper 57023 June2014 PDFDocument20 pagesMirs White Paper 57023 June2014 PDFLawrence TamNo ratings yet

- Transportation Systems HandoutsDocument3 pagesTransportation Systems HandoutsKarla BuenaflorNo ratings yet

- Bank Schedle Sept 2022Document10 pagesBank Schedle Sept 2022Mercy FaithNo ratings yet

- Order Details: Your Order Number Is: RBLSH1401779Document1 pageOrder Details: Your Order Number Is: RBLSH1401779Satish PavuluriNo ratings yet

- Account Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanthoshkalpavally cooldudeNo ratings yet

- Disbursement Summary ReportDocument1 pageDisbursement Summary ReportPolly WollyNo ratings yet

- QuizDocument4 pagesQuizJepte Biliran GaligaoNo ratings yet

- Airtel BillDocument8 pagesAirtel BillSaleem KhanNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- Vietnam - Local Charges/Service Fees/ ThcsDocument1 pageVietnam - Local Charges/Service Fees/ ThcsDoan QuyenNo ratings yet

- REMITADocument1 pageREMITASMART ROBITONo ratings yet

- Gulshan Weaving Mills Limited: 1-Sales and Receivables ChecklistDocument4 pagesGulshan Weaving Mills Limited: 1-Sales and Receivables ChecklistirfanNo ratings yet

- Order To Cash: Current Process of Widget IncDocument13 pagesOrder To Cash: Current Process of Widget IncGowri J BabuNo ratings yet

- Transaction History - 2024-01-26 - 63013852470Document6 pagesTransaction History - 2024-01-26 - 63013852470www.phumudzofrance99No ratings yet

- E-Statement Statement 4902817048779233 15-Mar-2019 PDFDocument4 pagesE-Statement Statement 4902817048779233 15-Mar-2019 PDFshanyu6211No ratings yet

- Reimbursement Expense Receipt: Entity Name: CABUNGAAN ES Fund Cluster: - Date: July 12, 2018 RER No.: 5Document3 pagesReimbursement Expense Receipt: Entity Name: CABUNGAAN ES Fund Cluster: - Date: July 12, 2018 RER No.: 5Mechille Seriño RoqueNo ratings yet

- Qatar Airways - Trip SummaryDocument3 pagesQatar Airways - Trip SummaryWajahat HussainNo ratings yet

- Re: Full and Final Settlement - (Fairfield Colony) : 8 MessagesDocument5 pagesRe: Full and Final Settlement - (Fairfield Colony) : 8 MessagesManoj kumarNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Case Analysis On Merloni Elettrodomestici SpaDocument6 pagesCase Analysis On Merloni Elettrodomestici SpaKrishna Raj ShailNo ratings yet

- Poerodecoil 18.03.2019 - 94Document2 pagesPoerodecoil 18.03.2019 - 94Gomathi SankarNo ratings yet

- Consolidation Warehousing 2Document25 pagesConsolidation Warehousing 2sanjeev kumarNo ratings yet

- Cash Book and Bank Reconciliation 2Document8 pagesCash Book and Bank Reconciliation 2DavidNo ratings yet