Professional Documents

Culture Documents

Redemption of Debentures

Uploaded by

Lakshmi PanayappanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Redemption of Debentures

Uploaded by

Lakshmi PanayappanCopyright:

Available Formats

1.

2.

Secom limited issued Rs. 150000 10% debentures on which interest is payable half-yearly on 31st march and 30 th September. The company has powers to purchase its debentures in the open market for cancellation thereof. The following purchase were made during the year ended 31st December, 2002 and the cancellations were made on he following 31 st march: 1st march Rs.25000 nominal purchased for Rs. 24725 ex-interest. 1st September-Rs.20000 nominal purchased for Rs..20125 cum-interests. You are required to draw up the following accounts up to the date of cancellation: I. debentures Account; ii. Own debentures investment account; and iii. Debenture interest account. Ignore taxation and make calculations to the nearest rupee. Mukund limited issued Rs. 1200000 debentures during 1987 on the following terms and conditions: a. A sinking fund account to be created with the help of yearly appropriations of profits and similar amount should be invested in giltedged securities. b. The company will have the right to purchase for cancellation debentures from the market if available below par value. c. The debentures should be redeemed on December 31,2002 at a premium of 2 percent On january1, 20002 the sinking fund account had a balance of Rs.886500 while sinking fund investments account also showed a similar amount. Debentures account showed a balance of Rs. 900000. The following transactions took place during 2002: On 1st july,2002 Rs.60000 debentures were purchased for Rs.53328 and cancelled immediately the amount being provided out of sale proceeds of investments of the book value of Rs. 69000 made at Rs.67800; ii. Income from sinking fund investments Rs. 44400 received on 1 st july, 2002 was not invested; iii. On 29th December, 2002, Rs,846000 was received on the sale of remaining sinking fund investments; iv. On 31st December, 20002 the remaining debentures were redeemed. Show the debenture account, sinking fund account sinking fund investment account and debenture redemption account for the year ended 31st December 20002. a. swati associates ltd has issued 10000 12%debentures of Rs.100 each on 1-1-1991. These debentures are redeemable after 3 years at a premium of Rs.5 per debenture. Interest is payable annually. b. on October 1, 1992 it buys 1500 debentures from the market at Rs.98 per debenture. These are sold away on June 30, 1993 at Rs. 105 per debenture. c. on January 1st 1993, it buys 1000 debentures at Rs. 104 per debenture from the open market. These are cancelled on April 1 st 1993. d. on October 1, 1993, it buys 2000 debentures at Rs. 106 per debenture from the open market. These debentures along with other debentures are redeemed on 31st December, 1993. All transactions are ex-interest. Prepare relevant ledger account. Prospectus ltd. Issued Rs.1000000, 6% debenture stock at par on 21-1-1997. Interest was payable on 30th June and 31st December, in each year. Under the terms of the debentures trust the owned stock is redeemable at par. The trust deed obliges the company to pay to the trustees on 31st December, 2000 and annually thereafter the sum of Rs. 100000 to be utilised for the redemption and cancellation of an equalent amount of stock which is to be selected by drawing lots. Alternatively the company is empower as from 1 st January 2000 to purchse it own debenture in the open market. These debentures must be surrendered to the trustees for cancellation and any adjustments for accrued interest recorded in the books of account. If in any year the nominal amount of the alternative does not amount to Rs. 100000 then the short fall is to be paid by the company to the trustees in cash on 31st December. The following purchases of stock were made by the company i.

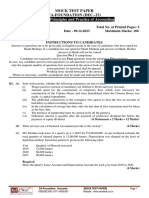

particulars 30th September 2000 31st may 2001 31st july 2002 Nominal value of stock purchased 120000 75000 115000 Purchase price per Rs.100 of stock 98(cum interest) 95(ex interest) 92(cum interest)

3.

4.

The company fulfilled all its obligations under the trust deed. Prepare the a. debentures stock account b. debenture redemption account. C.debenture interest account ignore cost and taxation.

5.

Indebted ltd issued 10% debentures at par for Rs.800000 on 1st January 1984 interest was payable half-yearly on 30th June and 31st December every year. Under the terms of the trust deed, debentures are redeemable at par (after 3 years of issue) by the company purchasing them in open market and cancelling them with a minimum redemption of Rs. 80000 every year. In case, there was a short fall in redemption by the company by open operations, the short fall would be made by the company by payment on the last day of accounting year to the trustees who would draw last and redeem the debentures The company purchased its own debenture for cancellation as under: a. 30th September 1987 Rs.100000 at Rs. 98 cum interest b. 31st may 1988 Rs. 60000 at Rs.95 ex interest c. 31st july 1989 Rs.90000 at Rs. 96 cum interest The company carried out its obligations under the deed prepare the following ledger accounts for calendar years 1987,1988 and 1989. i. Debentures account, ii. Debentures redemption account and debentures interest account ignore taxation.

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Philip Morris KraftDocument4 pagesPhilip Morris Kraftpdshah01100% (1)

- EOC13Document28 pagesEOC13jl123123No ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- William VIX FIX IndicatorDocument7 pagesWilliam VIX FIX IndicatorRajandran RajarathinamNo ratings yet

- Non-Current Assets Held For SaleDocument20 pagesNon-Current Assets Held For Salerj batiyegNo ratings yet

- Structured ProductDocument27 pagesStructured ProductParvesh AghiNo ratings yet

- Examples Self IFRS 9 PDFDocument9 pagesExamples Self IFRS 9 PDFErslanNo ratings yet

- CHAPTER 7 Capital Gains Taxation (Module)Document15 pagesCHAPTER 7 Capital Gains Taxation (Module)Shane Mark CabiasaNo ratings yet

- Private Equity and Venture Capital in The European Economy An Industry Response To The European Parliament and The European CommissionDocument302 pagesPrivate Equity and Venture Capital in The European Economy An Industry Response To The European Parliament and The European Commissionjuranyt2No ratings yet

- Rudy Wong Case StudyDocument7 pagesRudy Wong Case StudyUnknwn Nouwn100% (3)

- Managing Business in VUCA WorldDocument39 pagesManaging Business in VUCA WorldNiko100% (2)

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Debentures Questions 1Document3 pagesDebentures Questions 1Ishant GargNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- QB Ii PDFDocument45 pagesQB Ii PDFabid hussainNo ratings yet

- Fa-Investment Accounting-Tybcom-Firoz SirDocument4 pagesFa-Investment Accounting-Tybcom-Firoz Sirmanoj parmarNo ratings yet

- Investment AccountDocument2 pagesInvestment AccountQuestionscastle Friend67% (3)

- Issue of DebenturesDocument2 pagesIssue of DebenturesSheikh Afeef AyubNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocument153 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.No ratings yet

- Investment AccountingDocument13 pagesInvestment AccountingkautiNo ratings yet

- Adjusting EntiresDocument9 pagesAdjusting EntiresIqra MughalNo ratings yet

- Debentures TestDocument2 pagesDebentures TestVarun BhomiaNo ratings yet

- Sample Problems - Bonds PayableDocument2 pagesSample Problems - Bonds PayableDump DumpNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesDocument3 pagesChapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesAryan JainNo ratings yet

- E3 Adjusting Entries - QuestionsDocument3 pagesE3 Adjusting Entries - QuestionsHuzaifanadeemNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- Accounting - MBA IDocument22 pagesAccounting - MBA ISayyed AliNo ratings yet

- Rs. Up To Last Balance-Sheet 22,500 Additions During The Year 3,00,000 3,22,500 Less: Amount Written of 22,500 3,00,000Document8 pagesRs. Up To Last Balance-Sheet 22,500 Additions During The Year 3,00,000 3,22,500 Less: Amount Written of 22,500 3,00,000Pradip AwariNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Revision Test Paper: Cap Ii (June 2017)Document12 pagesRevision Test Paper: Cap Ii (June 2017)binuNo ratings yet

- Hire PurchaseDocument3 pagesHire PurchaseQuestionscastle FriendNo ratings yet

- 5 Accounts InvestmentsDocument2 pages5 Accounts InvestmentsMurali Krishnan RNo ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- Bonus Issue PDFDocument6 pagesBonus Issue PDFSinsNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- ACC 106 Final ExaminationDocument5 pagesACC 106 Final ExaminationJezz Culang0% (1)

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- CMA April - 14 Exam Question - P-1Document12 pagesCMA April - 14 Exam Question - P-1MasumHasanNo ratings yet

- Accounting Ipcc May10 Paper1Document55 pagesAccounting Ipcc May10 Paper1Luvangel HeartNo ratings yet

- Investment Account NewDocument19 pagesInvestment Account NewNeha MoolchandaniNo ratings yet

- Business Law RTP of IcaiDocument66 pagesBusiness Law RTP of IcaitpsbtpsbtpsbNo ratings yet

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Issuance of Share and DebenturesDocument5 pagesIssuance of Share and DebentureshamdanNo ratings yet

- Investments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsDocument3 pagesInvestments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsHussainNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- Bcoc 131Document5 pagesBcoc 131Anamika T AnilNo ratings yet

- MFAB Oct 2020-Practice Set 1-Isb-V1Document2 pagesMFAB Oct 2020-Practice Set 1-Isb-V1Shashank GuptaNo ratings yet

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- Assignment On CorporationsDocument2 pagesAssignment On CorporationsDr Zaheer AhmedNo ratings yet

- Illustrative Examples - Bonds PayableDocument2 pagesIllustrative Examples - Bonds PayableChuchi SubardiagaNo ratings yet

- 4 5953918248238974494Document8 pages4 5953918248238974494Muktar jibo0% (1)

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 Examinationsksaeed7860No ratings yet

- 18 Bonds PayableDocument3 pages18 Bonds Payableangelienacion8No ratings yet

- Accounts ReceivablesDocument7 pagesAccounts ReceivablesShafiq KhanNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- ACT1106 - Bond ExercisesDocument4 pagesACT1106 - Bond ExercisesPj Dela VegaNo ratings yet

- Assignment 3Document2 pagesAssignment 3Haseeb Ahmed ShaikhNo ratings yet

- Redemption of Debentures NewDocument12 pagesRedemption of Debentures NewDebjit RahaNo ratings yet

- Accounting Long Questions II YearDocument10 pagesAccounting Long Questions II Yeararshad aliNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- PreliminaryDocument3 pagesPreliminaryLakshmi PanayappanNo ratings yet

- Cost of CapitalDocument1 pageCost of CapitalLakshmi PanayappanNo ratings yet

- Accounting VocabularyDocument4 pagesAccounting VocabularyLakshmi PanayappanNo ratings yet

- MechanicsDocument2 pagesMechanicsLakshmi PanayappanNo ratings yet

- As SynopsisDocument1 pageAs SynopsisLakshmi PanayappanNo ratings yet

- Accounting Assignment 1Document6 pagesAccounting Assignment 1Abbas KhanNo ratings yet

- TSPC PDFDocument3 pagesTSPC PDFFITRA PEBRI ANSHORNo ratings yet

- Assumptions of Ideal Capital MKT and Its ViolationsDocument17 pagesAssumptions of Ideal Capital MKT and Its Violationssuchitracool133% (3)

- Bancassurance: The New Challenges: The Geneva Papers On Risk and Insurance Vol. 27 No. 3 (July 2002) 295-303Document9 pagesBancassurance: The New Challenges: The Geneva Papers On Risk and Insurance Vol. 27 No. 3 (July 2002) 295-303sahoosuryamani86No ratings yet

- SLCM PDFDocument382 pagesSLCM PDFEverything RandomlyNo ratings yet

- The Polaris - Orbitech Merger: AbstractDocument4 pagesThe Polaris - Orbitech Merger: Abstractsa030882No ratings yet

- Final Spring07 Solutions SampleDocument15 pagesFinal Spring07 Solutions SampleAnass BNo ratings yet

- Accy 223 Tri 2 2011 ExamDocument5 pagesAccy 223 Tri 2 2011 ExamcrystallinestoneNo ratings yet

- FINA3070 Lecture Notes v6Document215 pagesFINA3070 Lecture Notes v6aduiduiduio.oNo ratings yet

- Managerial Economics (BCOM) - Module VDocument7 pagesManagerial Economics (BCOM) - Module VshamilpokkavilNo ratings yet

- Dabur Annual RepDocument188 pagesDabur Annual RepsameerkmrNo ratings yet

- Unit 1Document48 pagesUnit 1DeshikNo ratings yet

- Unit 8: InvestmentsDocument17 pagesUnit 8: InvestmentsShaqeeb Ahamed 11ANo ratings yet

- Essentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 5Document34 pagesEssentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 5Dylan AdrianNo ratings yet

- Before The Securities Appellate Tribunal Mumbai: Order Reserved On: 25.06.2019Document19 pagesBefore The Securities Appellate Tribunal Mumbai: Order Reserved On: 25.06.2019Meghan PaulNo ratings yet

- How Efficient Is Naive Portfolio Diversification? An Educational NoteDocument18 pagesHow Efficient Is Naive Portfolio Diversification? An Educational NoteAhsan ZaidiNo ratings yet

- Quiz Investment Appraisal - GeorgeDocument16 pagesQuiz Investment Appraisal - GeorgeGABRIELLA GUNAWANNo ratings yet

- Report On Insurance Company Operating in BangladeshDocument36 pagesReport On Insurance Company Operating in BangladeshYeasminAkterNo ratings yet

- Ifrs 7 Financial Instruments DisclosuresDocument70 pagesIfrs 7 Financial Instruments DisclosuresVilma RamonesNo ratings yet

- A Study On Volatality in BSE SensexDocument101 pagesA Study On Volatality in BSE SensexSrinivasan Ponnurangan100% (1)

- Mutual FundsDocument68 pagesMutual FundsShivamitra ChiruthaniNo ratings yet