Professional Documents

Culture Documents

MA - Baldwin Individual Case

Uploaded by

CelinaLOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MA - Baldwin Individual Case

Uploaded by

CelinaLCopyright:

Available Formats

Celina Lin Managerial Accounting Prof.

Sarath Baldwin Bicycles Case

According to information given under Exhibit 1, Ms. Leister notes that the bicycle boom had flattened out and in addition, a poor economy had contributed to Baldwins falling sales volume over the past two years. The Baldwin plant is operating at 75% of one-shift capacity, so there is spare capacity available for Hi-Valus order of purchases. On the Hi-Valu deal, Baldwins contribution margin is $577,250.00 for the order of 25,000 bikes ($92.29/bike * 25,000 bikes - $69.20/bike * 25,000 bikes, or $23.09 unit CM 25,000 units = $577,250; Unit price and volume from Exhibit 2, item 3 and $69.20 was calculated from Exhibit 2, item 1: Materials- 39.80 + Labor- 19.60 + OH- 24.50 *.4 (because 40% of OH is variable). This contribution margin is lower than it would be with Baldwins normal sales because HiValu wanted to sell its Challenger bikes at lower prices than the name-brand bikes it carried but still earn the same dollar gross margin on each bike sold. Therefore Hi-Valu will purchase bikes from Baldwin at lower prices than the wholesale prices of comparable bikes sold by Baldwin. The Hi-Valu order should be classified as a special order because Baldwin would need to raise the level it is currently operating at and sell at a lower price than normal. Hi-Valus proposal is noted to have features that make it quite different from Baldwins normal way of doing business, for example the paying process and title requirements are different. Moreover, the Challenger bike is set to be somewhat different in appearance from Baldwins other bikes. When deciding whether to accept this special order, Baldwin should ask whether there are any additional costs specific to this order that must be incurred. Baldwin should also ask whether Hi-Valus order would affect its other sales. In this case, the additional costs include the one time fixed costs of $5,000 (Exhibit 2, item 2) and recurring fixed costs of the additional materials of $39.80 per Challenger bike produced (Exhibit 2, item 1). The acceptance of the Hi-Val order will affect other sales because Ms. Leister thinks Baldwin will lose about 3,000 units of the regular sales volume a year, since Baldwins retail distribution is quite strong in Hi-Valus market regions; Baldwin will lose production of other bikes. There is also the possibility that a few of Baldwins current dealers might drop the Baldwin line if they find out that Baldwin is making bikes for Hi-Valu (Exhibit 2, item 6). It will typically take two months to sell a bicycle Because it will typically take two months to sell a bicycle since Mr. Knott estimates that a bike would remain in a Hi-Valu regional warehouse for two months, this represents a higher opportunity cost of capital as a result of more money being locked in. Thus, there is the pre-tax cost of funds for every dollar they lock up or face and hold for some length of time. Questions that must be asked regarding a long-term special-order arrangement concerning the HiValu deal would include the question of what would happen if the person taking the order decides not to work with you anymore. This could occur if the market goes weak and he or she did not want your product anymore. As for this Hi-Valu deal, two things that must be accounted for are the time value of money if you are locked into the deal. The discounted cash flow analysis to calculate the value of this long-term contract suggests that this is not a profit-increasing deal for Baldwin. Thus, Baldwin would not proceed with this deal for the long-term because the profit does not increase. The new "discount bike" would compete directly with Baldwin's existing lines while generating less profit for the company since the bikes themselves will only differ in cosmetic ways. By selling the bikes to the discount department store chain, Baldwin is not only creating a direct competitor to its regular customers, but also giving that competitor a better price than its regular customers. Possible long-term results of Baldwin entering the discount segment of the market include Baldwin's dealers potentially dropping Baldwin bikes and adopting a competitor's line. This would drive Baldwin further into the discount segment of the market.

First-Year Economic Analysis for Baldwin How much does the Hi Val order contribute? Average Selling Price (Exhibit 2, item 3): Materials (Exhibit 2, item 1) Labor Variable OH ($24.50 * 40% -footnote 3) Incremental Relevant Cost of Each Challenger Pre-Tax Unit Contribution Margin $39.80 19.60 9.80

$92.29

69.20 $23.09

How much capital gets tied up? Assumption 1 Expected production 25,000/12 = 2,084/month or 4,167 for two months (Exhibit 2, item 3) Inventory assumptions - two months raw materials (p.1) - 1000 bikes WIP raw materials added other factors 50% (Exhibit 2, item 5) - Finished goods 500 bicycles (Exhibit 2, item 5) Receivables Assumption -30 days to collect (p.1) Payables Assumption -30 days to pay (p.1) Materials (2 months)

4,167 bikes (calculated above in expected production) *$39.80 Materials per unit as shown in Exhibit 2, item 1

$165,847

Work in process Materials per unit (100% complete) Labor per unit (50% complete =19.6/2) VOH per unit (50% complete =9.8/2) WIP incremental costs per unit Total WIP Investment Finished Inventory in our factory

$39.80 9.80 4.90 $54.50 * 1000 54,500 34,600 $254,947 288,356 $543,303

500 bikes * $69.20 (incremental rel. cost/Challenger as calc above)

Inventories at Baldwin locations Finished Inventory in HV warehouse (2 months)

4,167 bikes (expected production) * $69.20 (incremental rel. cost)

Total inventory investment

Impact on Receivables and Payables Impact on receivables (30 days of sales): 2,084 bikes/month (expected production) * $92.29 (selling price) Impact on short-term payables (30 days of bike sales): Materials vendors 2,084 bikes * $39.80 Wages payables 2,084 bikes * $19.60 A/P for variable OH 2,084 bikes * $9.80 Total short-term payables increase Cost of Capital Tied up in production: Summary Net working capital increase: Inventories A/R Less: short-term payables Incremental working capital investment Tax rate (from financial/income statement) 218/473 = 46%

$192,332 $82,943 40,846 20,423 $144,212

$543,303 $192,332 (144,212) $591,423

After-Tax cost of capital 18% (Exhibit 2, item 4) *.54 (46% taxed, so 54% not taxed)= 9.72% Estimated Opportunity cost of Production 600,000 ($591,423 rounded up) *10% = $60,000 Other Asset-Related Costs Two components to computation: 1. Incremental outlay cost: Inventories: Record keeping Insurance Property tax Pilferage, obsolescence Inventory handling Incremental inventory-related costs (pre-tax) At Hi-Valu 1.00% 0.30% 0.70% 0.50% 2.50% At Baldwin 1.00% 0.30% 0.70% 0.50% 3.00% 5.50%

For receivables plus payables increase: record keeping, pre-tax 1%; 2. Opportunity cost of capital 10%.

You might also like

- Adv Corpfin Cheat SheetDocument2 pagesAdv Corpfin Cheat SheetCelinaLNo ratings yet

- OMCh 7 QuestionsDocument1 pageOMCh 7 QuestionsCelinaLNo ratings yet

- Market Risk Quiz SolutionDocument2 pagesMarket Risk Quiz SolutionCelinaLNo ratings yet

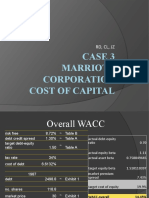

- Marriott Corp CaseDocument8 pagesMarriott Corp CaseCelinaLNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MBA Finance Project Report On Ratio AnalysisDocument82 pagesMBA Finance Project Report On Ratio AnalysisSonalee Parmar60% (5)

- HR Workflows in TOPdeskDocument2 pagesHR Workflows in TOPdeskTOPdesk0% (1)

- Nenita MejoradaDocument2 pagesNenita Mejoradasweetescape167% (6)

- Literature ReviewDocument3 pagesLiterature ReviewChoudhry Usman GhaffarNo ratings yet

- GE - McKinsey MatrixDocument3 pagesGE - McKinsey MatrixPankaj Kumar100% (1)

- Iso 10014-1998Document18 pagesIso 10014-1998Den PamplonaNo ratings yet

- IGCSE Mathematics 2016 SyllabusDocument39 pagesIGCSE Mathematics 2016 SyllabusZahir Sher0% (1)

- Cost AccountingDocument504 pagesCost AccountingSK Lashari100% (2)

- Accountancy PracticalDocument4 pagesAccountancy Practicalkarma wangyalNo ratings yet

- Credit Scoring Systems HandbookDocument79 pagesCredit Scoring Systems HandbookNegovan CodinNo ratings yet

- CA IPCC Company Audit IIDocument50 pagesCA IPCC Company Audit IIanon_672065362No ratings yet

- ACC1115 Mock Exam 2 2015 - 16Document7 pagesACC1115 Mock Exam 2 2015 - 16Andres172No ratings yet

- Carton R.B., Hofer C.W. Measuring Organizational PerformanceDocument291 pagesCarton R.B., Hofer C.W. Measuring Organizational PerformanceMam MamcomNo ratings yet

- Business and Management SL P1msDocument9 pagesBusiness and Management SL P1msniranjanusms100% (1)

- Marginal Costing - DefinitionDocument15 pagesMarginal Costing - DefinitionShivani JainNo ratings yet

- General ManagerDocument4 pagesGeneral Managerapi-121427183No ratings yet

- Scope and Objectives of Financial ManagementDocument20 pagesScope and Objectives of Financial ManagementAnkur Aggarwal100% (1)

- A Project On Cost AnalysisDocument80 pagesA Project On Cost Analysisnet635193% (15)

- Square Pharmaceuticals LTDDocument32 pagesSquare Pharmaceuticals LTDMohiuddin6950% (2)

- PC Farm Business Plan Nov 21 09Document52 pagesPC Farm Business Plan Nov 21 09ali_punjabian1957No ratings yet

- Excel Crop CareDocument61 pagesExcel Crop CareGautam100% (1)

- Responsibility AccountingDocument7 pagesResponsibility AccountingISHFAQ ASHRAFNo ratings yet

- Departmental AccountingDocument21 pagesDepartmental AccountingFarhat Ullah KhanNo ratings yet

- Mango Value Chain Analysis The Case of Boloso Bombe Woreda, Wolaita EthiopiaDocument21 pagesMango Value Chain Analysis The Case of Boloso Bombe Woreda, Wolaita Ethiopiamulejimma100% (1)

- Past Questions As Level BusinessDocument8 pagesPast Questions As Level BusinessShanavaz AsokachalilNo ratings yet

- Performance Comparison in SMEsDocument60 pagesPerformance Comparison in SMEsbajujuNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument16 pagesRatio Analysis: Liquidity RatiosYamen SatiNo ratings yet

- Farhat ProjectDocument49 pagesFarhat ProjectAbdur Rafe Al-AwlakiNo ratings yet

- Example Open Items Via Direct InputDocument8 pagesExample Open Items Via Direct InputSri RamNo ratings yet

- Boscard FMCG Absar Hussain 0049: BackgroundDocument2 pagesBoscard FMCG Absar Hussain 0049: BackgroundArsalan Mushtaq100% (3)