Professional Documents

Culture Documents

Exgratia

Uploaded by

Jake BlackOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exgratia

Uploaded by

Jake BlackCopyright:

Available Formats

Bonus Pay commission: Wages and allowances of Central and state government employees are determined through the

pay commission appointed by the appropriate government So far the Central Government has appointed five pay commissions. The dispute arising out of pay commission awards and their implementation are decided by commissions of inquiry adjudication machinery and the joint consultative machinery. An important component of employees earnings besides salary, is bonus. Starting as an adhoc and exgratia payment, Bonus was claimed as dearness allowance during World war II . In the course of labour history, it has metamorphosed from a reward or an incentive for good work into a defendable right and a just claim. Subsequently under the Payment of Bonus Act 1965 it secured the character of a legal right. The dictionary meaning of bonus is extra payment to the workers beyond the normal wage. It is argued that bonus is a deferred wage payment which aims at bridging the gap between the actual wage and the need based wage. It is also said that bonus is a share of the workers in the prosperity of an organization. The third argument is that bonus is primarily a share in the surplus. But it is only incidentally treated as a source of bridging the gap between the actual wage and the need based wage. The payment of bonus act 1965: The act defines an employee who is covered by it as one earning Rs 2,500 pm. (w.e.f. 1.4.93) basic plus dearness allowance And specifies the formula for calculating the allocable surplus from which bonus is to be distributed. The minimum bonus to be paid has been raised from 4 per cent to 8.33 per cent (w.e.f. 25.9.75) and is sought to be linked to increased productivity in recent times through collective bargaining. The workers through their representative union, can negotiate for more than what the Act provides and get the same ratified by the government if necessary. In the absence of such a process, the Act makes it mandatory to pay bonus to employees (who have

worked in the unit for not less than 30 working days in a year) following a prescribed formula for calculating the available surplus. The available surplus is normally the gross profits for that year after deducting depreciation. Development rebate / investment allowances / development allowance direct tax and other sums referred to in Sec 6. The Act applies to every factor or establishment in which 20 or more persons are employed in an accounting year. Currently the position is such that even if there is a loss, a minimum bonus needs to be paid treating the same as deficit to be carried forward and set off against profits in subsequent years ( Sec 15). The Act is proposed to be changed since the amount of bonus, the formula for calculating surplus and the set of provisions have all been under serious attack from various quarters. Wage Differentials: Wage differentials perform important economic functions like labour productivity, attracting the people to different jobs. Since most of the workers are mobile with a view to maximizing their earnings. Wage differentials reflect the variations in productivity, efficiency of management, maximum utilization of human force, attracting efficient workers, maximization of employees commitment, development of skills, knowledge utilization of human resources etc. Maximization of productivity can be fulfilled through wage differentials as the latter determines the direct allocation of manpower among different units, occupations and regions so that the overall production can be maximized. Thus, wage differentials provide an incentive for better allocation of human force labour mobility among different regions and the like. Source: HRM

THE

PAYMENT

OF

BONUS

ACT,

1965

INTRODUCTION

The practice of paying bonus in India appears to have originated during First World War when certain textile mills granted 10% of wages as war bonus to their workers in 1917. In certain cases of industrial disputes demand for payment of bonus was also included. In 1950, the Full Bench of the Labour Appellate evolved a formula for determination of bonus. A plea was made to raise that formula in 1959. At the second and third meetings of the Eighteenth Session of Standing Labour Committee (G. O.I.) held in New Delhi in March/April 1960, it was agreed that a Commission be appointed to go into the question of bonus and evolve suitable norms. A Tripartite Commission was set up by the Government of India to consider in a comprehensive manner, the question of payment of bonus based on profits to employees employed in establishments and to make recommendations to the Government. The Government of India accepted the recommendations of the Commission subject to certain modifications. To implement these recommendations the Payment of Bonus Ordinance, 1965 was promulgated on 29th May, 1965. To replace the said Ordinance the Payment of Bonus Bill was introduced in the Parliament.

Eligibility for bonus.Every employee shall be entitled to be paid by his employer in an accounting year, bonus, in accordance with the provisions of this Act, provided he has worked in the establishment for not less than thirty working days in that year.

Disqualification for bonus.Notwithstanding anything contained in this Act, an employee shall be disqualified from receiving bonus under this Act, if he is dismissed from service for -(a) fraud; or

(b) riotous or violent behaviour while on the premises of the establishment; or (c) theft, misappropriation or sabotage of any property of the establishment. Payment of minimum bonus.Subject to the other provisions of this Act, every employer shall be bound to pay to every employee in respect of the accounting year commencing on any day in the year 1979 and in respect of every subsequent accounting year, a minimum bonus which shall be 8.33 per cent of the salary or wage earned by the employee during the accounting year or one hundred rupees, whichever is higher, whether or not the employer has any allocable surplus in the accounting year:

Provided that where an employee has not completed fifteen years of age at the beginning of the accounting year, the provisions of this section shall have effecting relation to such employee as if for the words one hundred rupees, the words sixty rupees were substituted.]

Payment of maximum bonus.(1) Where in respect of any

accounting year referred to in section 10, the allocable surplus exceeds the amount of minimum bonus payable to the employees under that section, the employer shall, in lieu of such minimum bonus, be bound to pay to every employee in respect of that accounting; year bonus which shall be an amount in proportion to the salary or wage earned by the employee during the accounting year subject to a maximum of twenty per cent, of such salary or wage.

(2) In computing the allocable surplus under this section, the amount set on or the amount set off under the provisions of section 15 shall be taken into account in accordance with the provisions of that section.]

Calculation of bonus with respect to certain employees.Where the salary or wage of an employee exceeds 4[two thousand and five hundred rupees] per mensem, the bonus payable to such employee under section 10 or, as the case may be, under section 11, shall be calculated as if his salary or wage were [two thousand and five hundred rupees] per mensem.]

Proportionate reduction in bonus in certain cases.Where an employee has not worked for all the working days in an accounting year, the minimum bonus of one hundred rupees or, as the case may be, of sixty rupees, if such bonus is higher than 8.33 per cent, of his salary or wage for the days he has worked in that accounting year, shall be proportionately reduced.]

Set on and set off of allocable surplus. (1) Where for any accounting year, the allocable surplus exceeds the amount of maximum bonus payable to the employees in the establishment under section 11, then, the excess shall, subject to a limit of twenty per cent. of the total salary or wage of the employees employed in the establishment in that accounting year, be carried forward for being set on in the succeeding accounting year and so on up to and inclusive of the fourth accounting year to be utilized for the purpose of payment of bonus in the manner illustrated in the Fourth Schedule. (2) Where for any accounting year, there is no available surplus or the allocable surplus in respect of that year falls short of the amount of minimum bonus payable to the employees in the establishment under section 10, and there is no amount of sufficient amount carried forward and set on under sub-section (1) which could be utilized for the purpose of payment of the minimum bonus, then, such minimum amount or the deficiency, as the case may be, shall be carried forward for being set off in the succeeding accounting year and so on up to and inclusive of the fourth accounting year in the manner illustrated in the Fourth Schedule.

Deduction of certain amounts from bonus payable under the Act. Where in any accounting year, an employee is found guilty of misconduct causing financial loss to the employer, then, it shall be lawful for the employer to deduct the amount of loss from the amount of bonus payable by him to the employee under this Act in respect of that accounting year only and the employee shall be entitled to receive the balance, if any. Bonus A Legal Right

BONUS The dictionary meaning of bonus is an extra payment to the workers beyond the normal wage. It is argued that bonus is deferred wage which aims at bridging the gap between actual wage and the needbased wage. It is also agued that bonus is a share of the workers in the prosperity of an organization. The third argument is that bonus is primarily a share in the surplus. But it is only incidentally treated as a source for bridging the gap between the actual wage and the need-based wage. Bonus: A Legal Right and as paid in India Employees demanded the payment of bonus with a view to bridging the gap between money wages and real wages, the gap between the actual wage and need-based wage. Some employees were paying the bonus voluntarily out of their increased profits. The Government appointed the Bonus Commission in December, 1961, because of the persisting demands made by the employees and their trade unions. Bonus commission submitted its report in the year 1964 recommending for payment of bonus to the workers. The important recommendations of the commission include: 1. Bonus is a right of worker as the worker has share in the prosperity of the company. 2. Bonus should be paid unit-wise, with a view to creating a sense of belongingness among the workers. 3. Bonus should be paid from the available surplus. Available surplus = Gross Profit (Depreciation + Actual return of Preference Capital + 7% Return on Equity capital + 4% Reserves and Surplus). 4. Allocation of surplus for the payment of bonus should be 60% of the available surplus. Minimum bonus payable to a worker is 4% of the

basic +DA or Rs. 400 whichever is higher. If the minimum bonus is more than 60% of the surplus, the industry has to pay Minimum bonus. Maximum bonus allowed is 20% of the basic. 5. The bonus should be paid to employees whose salary is up to Rs. 1,600. In case of employees whose salary is beyond Rs. 700, this salary would be taken as Rs. 700 for the purpose of calculation of bonus. 6. Employees in Public Sector competing with the private sector to the tune of 20% are eligible to get the bonus. 7. Employees working in the factories under the Factories Act, 1948, except the employees of General Insurance Companies, Universities, Colleges, Schools, Hospitals, Government Departments and departments run by Public Sectors, Undertaking are eligible to receive bonus. The Government accepted the recommendation in September, 1964 with the following modification. 1. All direct taxes should be treated as prior charges. 2. Tax concessions provided for development should be treated as prior charges. 3. Return on capital should be allowed up to 8.5%. 4. Bonus beyond certain limit should be paid in the form of securities. The Government amended the Act again in 1977. The important provisions of this amendment re: a) The industrial undertaking covered by the Act to pay the minimum bonus of 8.33%, irrespective of profit or loss from the year 1976. b) Investment allowance should be taken as prior charge. c) Banking companies and industrial reconstruction Bank of India are covered by the Act. The Act was again amended in the year 1980. According to this amendment, all the industrial units covered by the Act have to pay the

minimum bonus of 8.33% of salary, irrespective of allocable surplus in that financial year. The maximum bonus is 20% of the salary. The Act was amended in the year 1985. According to this amendment, the employees whose salary is up to Rs. 2,500 are eligible for bonus. If the salary of an employee is beyond Rs.1,600, it will be taken as Rs.1,600 for the purpose of calculation bonus. For the executive cadres in private sector the managements started payment as ex-gratia once in a year in lieu of bonus as an encouragement for the good performance of the entire company or that unit belonging to a group of companies. Some companies like Larsen & Toubro were taking an undertaking from employees in supervisory and officer cadres accepting the money on the condition that the ex-gratia is paid for that year only and is not going to be a part of remuneration in the subsequent years. However this was paid regularly year after year. EXGRATIA 1 Definition: An ex-gratia payment in this context is a payment made to an individual in respect of loss or damage to personal property in a situation where the County Council accepts no liability for the loss or damage but is willing to make some reimbursement without accepting liability. Most commonly such payments are made to employees in respect of personal property (including clothing or personal items such as spectacles) damaged or lost accidentally. Ex gratia payments are not made in situations where the loss is fully insured, either by the individual or the County Council 2. Funding: In the case of schools with delegated budgets, funding to make ex-gratia payments is included within the general delegated budget. There is no specific budget heading for this item as the payments concerned would normally be too small and infrequent to warrant specific provision. The decision as to whether or not to make an exgratia payment in individual cases rests with individual schools.

Although this is not a matter for the Director of Education, in specific cases advice on practice may be sought from the County Council's Insurance Manager. 3. When to Consider Making an Ex Gratia Payment: Most claims are likely to be made by employees. These claims will normally relate to clothing or small personal items brought into school in the course of the working day. The loss or damage will normally be accidental. It does not have to be attributable to any fault or negligence on the part of the school and the making of an ex-gratia payment is not an admission of liability. Teachers' conditions of service (Appendix of the Burgundy Book) acknowledge that the school environment is one in which personal property might be subject to a greater than average risk of accidental loss or damage. They require schools to consider sympathetically any claims made by teachers in respect of loss or damage to property in the course of their job. 4. Making an Ex Gratia Payment: Ex gratia payments are intended to cover small losses. If a claim is made in respect of loss of more than 100 value, schools should seek advice from the insurance manager. If the object concerned is high in value, schools should consider whether or not is should have been brought into school in the first place, and whether it is or should be insured by the owner. Ex gratia payments are not intended to cover fair wear and tear. There should be evidence that the loss or damage is outside the usual areas such as spillage of food or drink, damage to vulnerable items of clothing, etc. 5. Motor Vehicles: The County Council does not accept any obligation to provide parking for employees' motor vehicles nor does it accept liability for loss or damage sustained while an employees vehicle is parked on County premises. The responsibility for insurance of a motor vehicle rests with the owner. Employees who use their vehicle on County business are required to have suitable insurance cover. Uninsured losses are (at least in principal) recoverable from any third party responsible for the damage. However, staff cars parked in school

car parks may be at greater risk of suffering malicious damage by unknown persons and in such exceptional circumstances an ex-gratia payment may be appropriate. If, for instance, a school is satisfied that damage was caused maliciously in a way which relates to the teacher's (or other employee's) employment (e.g. by a pupil or parent) it should consider whether an ex-gratia payment is appropriate because the uninsured loss will not in practice be recoverable. The uninsured loss could include some compensation for loss of no-claims bonus or to help cover a reasonable excess in the employee's insurance policy. 6. Payments to People Who are Not Employees: In general ex-gratia payments will not be appropriate to people who are not employees. Contractors should have suitable insurance for themselves and their employees to cover such eventuality. Casual visitors such as parents or those attending school functions should not normally be considered unless there is clear fault on the part of the school, in which case the Insurance Manager should be consulted.. However, it may be reasonable to treat volunteers and school governors who have frequent business on school premises in the same way as employees. 7. Delegation: It is recommended that schools have a system which delegates to the headteacher the power to make occasional ex-gratia payments to employees - up to a specified amount of not more than (say) 100 on any one occasion and nor than a specified number of occasions in a year.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- NIAGARA N4, EN - N4.4 - LabExercisesBook 10Document118 pagesNIAGARA N4, EN - N4.4 - LabExercisesBook 10Hugo Alberto Hernández Clemente91% (11)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shay Eshel - The Concept of The Elect Nation in Byzantium (2018, Brill) PDFDocument234 pagesShay Eshel - The Concept of The Elect Nation in Byzantium (2018, Brill) PDFMarko DabicNo ratings yet

- Santos vs. BuencosejoDocument1 pageSantos vs. BuencosejoLiana AcubaNo ratings yet

- Commercial Banking Operations:: Types of Commercial BanksDocument6 pagesCommercial Banking Operations:: Types of Commercial BanksKhyell PayasNo ratings yet

- Copyreading and Headline Writing Exercise 2 KeyDocument2 pagesCopyreading and Headline Writing Exercise 2 KeyPaul Marcine C. DayogNo ratings yet

- PS Form 6387 Rural Money Order TransactionDocument1 pagePS Form 6387 Rural Money Order TransactionRoberto MonterrosaNo ratings yet

- FusionAccess Desktop Solution V100R006C20 System Management Guide 09 (FusionSphere V100R006C10 or Earlier)Document306 pagesFusionAccess Desktop Solution V100R006C20 System Management Guide 09 (FusionSphere V100R006C10 or Earlier)ABDEL PAGNA KARIM100% (1)

- Aetna V WolfDocument2 pagesAetna V WolfJakob EmersonNo ratings yet

- Why I Love This ChurchDocument3 pagesWhy I Love This ChurchJemicah DonaNo ratings yet

- What Is Cybercrime?Document3 pagesWhat Is Cybercrime?JoshuaFrom YTNo ratings yet

- Ruckus FastIron 08.0.91 MIB Reference GuideDocument528 pagesRuckus FastIron 08.0.91 MIB Reference GuiderbrtdlsNo ratings yet

- Facebook Expose Part 1 of WitnessesDocument5 pagesFacebook Expose Part 1 of WitnessesByronHubbardNo ratings yet

- Sinif Matemati̇k Eşli̇k Ve Benzerli̇k Test PDF 2Document1 pageSinif Matemati̇k Eşli̇k Ve Benzerli̇k Test PDF 2zboroglu07No ratings yet

- CESSWI BROCHURE (September 2020)Document2 pagesCESSWI BROCHURE (September 2020)Ahmad MensaNo ratings yet

- Newton 2nd and 3rd Laws Chapter 4-3Document20 pagesNewton 2nd and 3rd Laws Chapter 4-3Jams FlorendoNo ratings yet

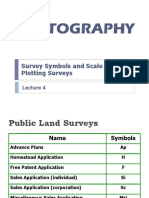

- GE 103 Lecture 4Document13 pagesGE 103 Lecture 4aljonNo ratings yet

- What Is Corporate RestructuringDocument45 pagesWhat Is Corporate RestructuringPuneet GroverNo ratings yet

- Karnataka Current Affairs 2017 by AffairsCloudDocument13 pagesKarnataka Current Affairs 2017 by AffairsCloudSinivas ParthaNo ratings yet

- Airey V Ireland (App. No. 6289 73)Document20 pagesAirey V Ireland (App. No. 6289 73)Christine Cooke100% (1)

- Important Notice For Passengers Travelling To and From IndiaDocument3 pagesImportant Notice For Passengers Travelling To and From IndiaGokul RajNo ratings yet

- Previews 2700-2011 PreDocument7 pagesPreviews 2700-2011 PrezrolightNo ratings yet

- REQUIREMENTS FOR Bfad Medical Device DistrutorDocument3 pagesREQUIREMENTS FOR Bfad Medical Device DistrutorEvanz Denielle A. OrbonNo ratings yet

- Friday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleDocument11 pagesFriday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleTom TuttleNo ratings yet

- Neelam Dadasaheb JudgementDocument10 pagesNeelam Dadasaheb JudgementRajaram Vamanrao KamatNo ratings yet

- Famous Slogan PDFDocument16 pagesFamous Slogan PDFtarinisethy970No ratings yet

- Biden PollDocument33 pagesBiden PollNew York PostNo ratings yet

- Chapter 13Document30 pagesChapter 13Michael Pujalte VillaflorNo ratings yet

- Entrant Status Check Web SiteDocument1 pageEntrant Status Check Web SitetoukoalexandraNo ratings yet

- Reaction Paper Nature of LawDocument2 pagesReaction Paper Nature of LawRolando Abangtao Racraquin60% (5)

- 8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Document8 pages8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Scribd Government DocsNo ratings yet