Professional Documents

Culture Documents

Example of Interview Prep

Uploaded by

Opclash21Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example of Interview Prep

Uploaded by

Opclash21Copyright:

Available Formats

MORGAN STANLEY INFO

Company Synopsis o President: John Mack Regained helm in 2005 after Purcell was ousted by group of eight o First class business, in a first class way Said by Jack Morgan when they split from JP Morgan in 1935 b/c of the Glass Steagall Act. o Since our inception, we have been dedicated to serving our clients through a relationship based on intimacy, integrity and mutual trust Valuation o $51.97/share o Price fell by 24% in the past five trading days and two analysts on Tuesday predicted the firm faced possible fourth-quarter write-downs of $3 billion to $6 billion. o Earnings 1.38/share o P/E: 8.2 vs Industry: 13 Industry high: 30 o Gross Margin: 34.8 5 YR: 43.8 o Profit Margin: 9.2 5 YR: 10.4 o Fitch and S&P: AAo Revenues in Q3 07 up 21% GWP 62% Institutional securities 17% Asset Management o $0.81 dividend o 324.4% Return since merger in 97 o $739 billion assets under management Recent News o Morgan Stanley, which recently became a lead player in underwriting subprime-mortgage securities, said it has taken a $3.7 billion hit, or $2.5 billion after tax, from its subprime exposures in the first two months of the fourth quarter. o Morgan Stanley ranked No. 1 in underwriting securities backed by subprime mortgages o Morgan Stanley indicated the write-downs were generated by subprime net exposures of $10.4 billion at the end of its third quarter on Aug. 31, which had declined to $6 billion as of Oct. 31 -- a month before the end of the firm's fourth quarter this month. o A "sharp decline" in the market value of asset-backed securities in the first two months of the quarter accounted for the drop in value, Morgan Stanley said, noting that the actual impact for the full quarter will depend on market moves during the rest of this month. The remaining $6 billion exposure, said Morgan Stanley Chief Financial Officer Colm Kelleher, was the most it could lose additionally in a worst-case scenario.

MARKETS AND ECONOMY DOW 13870.26 NASDAQ - 2817 S&P 1540 CREDIT MARKET Fed Funds: 4.50 2YR-10YR: 3.07 3.94 Libor: 5.10 Swap Spreads: 70 bps Prime: 7.50 30YR MTG (fixed): 5.89 5 YR ARM: 5.46 HOUSING New-home sales were 23.3% lower than the level in September 2006 Sales of single-family homes increased 4.8% last month Existing-home sales last month was down 8% from a year earlier Inventories of homes rose 0.4 national median price of existing-homes sold was off 4.2% year-over-year Countrywide expects the housing market to remain weak "at least" through 2008 COMMERCIAL Commercial side of construction, which had remained strong at a time when the residential sector has been tanking, is showing signs of slowing, the Journal notes. FINANCIALS Merrill Lynch Write Downs - $8.4 billion, up from the $5 billion it estimated earlier this month Bank of America, which reported $1.45 billion in quarterly trading losses responsible for a 32% tumble in profit, is forcing out its investment-banking chief and shrinking those operations Bank of America, which reported $1.45 billion in quarterly trading losses responsible for a 32% tumble in profit, is forcing out its investment-banking chief and shrinking those operations DOLLAR Pound = 2.05, Euro = 1.44, CAD = 1.04, Yen = 114/$ OIL Crude prices have surged 27% in the past two months, thanks to the weak dollar and a mlange of supply concerns. trouble between Turkey and rebel Kurds taking refuge in the oil-rich north of Iraq has raised fears of another kink in global production. ECONOMY GDP 3.9% yoy third quarter Growth was solid in the third quarter but likely to slow with the "intensification of the housing correction," the Fed said in its statement Chicago regional manufacturing activity dropped to an eight-month low US Personal Spending 0.6% 0.4% 0.1% US Personal Income 0.3% 0.4% 0.3% US Jobless Claims 331K 330K 327K US ISM Manufacturing 52.0 51.5 50.9

US US US US

Personal Spending 0.6% 0.4% 0.1% Personal Income 0.3% 0.4% 0.3% Jobless Claims 331K 330K 327K ISM Manufacturing 52.0 51.5 50.9

FED.

Fed said, "after this [rate cut], the upside risks to inflation roughly balance the downside risks to growth." Plunging home construction and eroding real-estate values could hit the broader economy, while rising oil and commodity prices, combined with a falling dollar, could spoil the Fed's hopes to contain inflation. The Fed, according to minutes of recent meetings and statements by its policy makers, has expected more pain in the housing market. When judging whether to cut rates again and lower the cost of borrowed money, what it wants to know is how much that pain -- as well as the related pain felt by banks and credit markets -- could undermine employment and consumer spending and the rest of the non-housing economy MY STANCE: 25bps rate cut on 10/29/07 o Futures priced in 100% chance of 25 bps rate cut o Bond yields too low o Dollar has weakened pricing in rate cut o Housing is starting to bleed into other parts of the economy o Existing home sales -8% o Inventories up 0.4% o Median home prices of existing homes -4.2% yoy o Capex down o Durable good orders -1.7% o PCE is in FED comfort zone of 1.8% yoy in August INFLATION PCE: 1.8% yoy August Previous 1.9% "About 40% of our full-year commodity inflation will hit in the fourth quarter," referring to higher costs for wheat, corn and edible oils Oil 94 Gold 792 POLITICS Turkey wont move until they meet with the US next month "unprecedented package of unilateral sanctions against Iran today, including the long-awaited designations of its Revolutionary Guard Corps as a proliferator of weapons of mass destruction and of the elite Quds Force as a supporter of terrorism," o "the first time that the United States has tried to isolate or punish another country's military" o "has long labeled Iran as a state sponsor of terrorism, the decision to single out the Guard reflects increased frustration in the administration with the slow pace of diplomatic negotiations over Tehran's nuclear program." PEOPLE Nicolas Sarkozy President of France, in talks with UN about supporting Iraq Angelo Mozilo: 38 yr CEO Countrywide Financial said they will not go into bankruptcy Stan ONeal: departing CEO Merrill Lynch ($8.4 b write down from est $7.9 & contacting Wachovia to buy Merrill without consultation of board) NEWS 695 square miles burned and 1,609 homes destroyed, with damage estimated by the state Department of Insurance at more than $1 billion

KNOW Print out o Market Data Center from WSJ.com o TOP BOND from Bloomberg DCF or DDR Stock pitch Risk Return Relationship for asset classes Valuation of Equities, Fixed Income, Options and possibly commodities, currency, and real estate o Discounted Cash Flow - DCF o Economic Value Added - EVA o Fundamental Analysis o Intrinsic Value o Price-Earnings Ratio - P/E Ratio o Price-To-Book Ratio - P/B Ratio o Quantitative Analysis o Ratio Analysis o Valuation Re = cost of equity Rd = cost of debt E = market value of the firm's equity D = market value of the firm's debt V=E+D E/V = percentage of financing that is equity D/V = percentage of financing that is debt Tc = corporate tax rate Black-Scholes Model

You might also like

- Daily 28.05.2013Document1 pageDaily 28.05.2013FEPFinanceClubNo ratings yet

- The Day Ahead - March 27 2013Document8 pagesThe Day Ahead - March 27 2013wallstreetfoolNo ratings yet

- Month in Review:: December 2011Document8 pagesMonth in Review:: December 2011api-117755361No ratings yet

- RBS: Round Up For 27 August 2010Document11 pagesRBS: Round Up For 27 August 2010egolistocksNo ratings yet

- Factiva 20180607 1025Document204 pagesFactiva 20180607 1025Lucas GodeiroNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Economics Group: Weekly Economic & Financial CommentaryDocument9 pagesEconomics Group: Weekly Economic & Financial Commentaryamberyin92No ratings yet

- The Day Ahead - April 17th 2013Document7 pagesThe Day Ahead - April 17th 2013wallstreetfoolNo ratings yet

- Closing Recap: Index Up/Down % LastDocument5 pagesClosing Recap: Index Up/Down % LastTheHammerstoneReportNo ratings yet

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsDocument5 pagesOrmalization: ECONOMIC DATA With Impact Positive Impactsfred607No ratings yet

- July 012010 PostsDocument41 pagesJuly 012010 PostsAlbert L. PeiaNo ratings yet

- Max Keiser and Gerald Celente Deconstruct Financial FraudDocument14 pagesMax Keiser and Gerald Celente Deconstruct Financial FraudAlbert L. PeiaNo ratings yet

- Economic Analysis: Sub Prime Crisis Us & World EconomyDocument29 pagesEconomic Analysis: Sub Prime Crisis Us & World EconomyTushar PanchalNo ratings yet

- The Day Ahead - April 10th 2013Document8 pagesThe Day Ahead - April 10th 2013wallstreetfoolNo ratings yet

- Phatra Wealth Daily 20141211 RCDocument13 pagesPhatra Wealth Daily 20141211 RCbodaiNo ratings yet

- JPM Weekly Commentary 12-26-11Document2 pagesJPM Weekly Commentary 12-26-11Flat Fee PortfoliosNo ratings yet

- State of Market Feb 2008Document42 pagesState of Market Feb 2008azharaqNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- The Impact of Lower RatesDocument17 pagesThe Impact of Lower RatesSoberLookNo ratings yet

- The Pensford Letter - 10.31.11Document5 pagesThe Pensford Letter - 10.31.11Pensford FinancialNo ratings yet

- E IBD102008Document36 pagesE IBD102008cphanhuyNo ratings yet

- RBS Round Up: 01 September 2010Document11 pagesRBS Round Up: 01 September 2010egolistocksNo ratings yet

- ReviewPreview07 30 10scribdDocument6 pagesReviewPreview07 30 10scribdLeo IsaakNo ratings yet

- The Day Ahead - March 25 2013Document10 pagesThe Day Ahead - March 25 2013wallstreetfoolNo ratings yet

- Week of October 24, 2022Document17 pagesWeek of October 24, 2022Steve PattrickNo ratings yet

- Inside Debt: Markets Today Chart of The DayDocument6 pagesInside Debt: Markets Today Chart of The Dayitein74No ratings yet

- Untitled 1Document6 pagesUntitled 1Kyle HartiganNo ratings yet

- Breakfast With Dave June 8Document17 pagesBreakfast With Dave June 8variantperception100% (1)

- Market Buzz: U.S. & Global MarketsDocument8 pagesMarket Buzz: U.S. & Global MarketsLes SangaNo ratings yet

- IBD Mon Jul 25 2001Document53 pagesIBD Mon Jul 25 2001deerfernNo ratings yet

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Document15 pagesRegulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Albert L. PeiaNo ratings yet

- Commodities-Mostly Up On European Optimism, US DataDocument5 pagesCommodities-Mostly Up On European Optimism, US DataUmesh ShanmugamNo ratings yet

- Breakfast With Dave May 29Document8 pagesBreakfast With Dave May 29variantperceptionNo ratings yet

- The Monarch Report 4/1/2013Document3 pagesThe Monarch Report 4/1/2013monarchadvisorygroupNo ratings yet

- Weeklymarket: UpdateDocument2 pagesWeeklymarket: Updateapi-94222682No ratings yet

- May 22 The Small-Cap BeatDocument7 pagesMay 22 The Small-Cap BeatStéphane SolisNo ratings yet

- Market Notes - June 6, 2011 - MondayDocument2 pagesMarket Notes - June 6, 2011 - MondayJC CalaycayNo ratings yet

- Fed Policy Minutes Shows Double-Dip ConcernDocument5 pagesFed Policy Minutes Shows Double-Dip ConcernValuEngine.comNo ratings yet

- Market Week-June 4, 2012Document2 pagesMarket Week-June 4, 2012Janet BarrNo ratings yet

- The King Report: M. Ramsey King Securities, IncDocument3 pagesThe King Report: M. Ramsey King Securities, InctheFranc23No ratings yet

- The Daily Shot Demand For Labor Is SlowingDocument109 pagesThe Daily Shot Demand For Labor Is SlowingBernardo ValleNo ratings yet

- 2nd Quarter 2005 CommentaryDocument2 pages2nd Quarter 2005 CommentaryNelson Roberts Investment AdvisorsNo ratings yet

- 03-November - MNC - USDocument10 pages03-November - MNC - USshaheenshaikh4940No ratings yet

- August 122010 PostsDocument185 pagesAugust 122010 PostsAlbert L. PeiaNo ratings yet

- Morning News Notes: 2010-06-10Document2 pagesMorning News Notes: 2010-06-10glerner133926No ratings yet

- Market Commentary 06-27-11Document3 pagesMarket Commentary 06-27-11monarchadvisorygroupNo ratings yet

- 2011-10-24 Horizon CommentaryDocument3 pages2011-10-24 Horizon CommentarybgeltmakerNo ratings yet

- I Bet You Had To Read This Twice: Today's Market HeadlineDocument6 pagesI Bet You Had To Read This Twice: Today's Market Headlineapi-148748282No ratings yet

- Market Research Dec 16 - Dec 20Document2 pagesMarket Research Dec 16 - Dec 20FEPFinanceClubNo ratings yet

- Latest Mortgage RateDocument2 pagesLatest Mortgage RateManeet TutejaNo ratings yet

- Gis CMR 20060707Document13 pagesGis CMR 20060707rotterdam010No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Does New Data Really Suggest A Housing Market BottomDocument4 pagesDoes New Data Really Suggest A Housing Market BottommatthyllandNo ratings yet

- The Weekly Market Update For The Week of February 16, 2015.Document2 pagesThe Weekly Market Update For The Week of February 16, 2015.mike1473No ratings yet

- US Economy and Financial CrisisDocument31 pagesUS Economy and Financial CrisisTalal SiddiquiNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- The World'S Economies Are Growing in Rare HarmonyDocument8 pagesThe World'S Economies Are Growing in Rare HarmonypavanNo ratings yet

- Today Strategy by Kavee (08 Mar 2023)Document9 pagesToday Strategy by Kavee (08 Mar 2023)Wimala HorwongsakulNo ratings yet

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- Intermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFchanelleeymanvip100% (11)

- Nova Chemical CorporationDocument28 pagesNova Chemical Corporationrzannat94100% (2)

- SaranshYadav Project Report GoldDocument25 pagesSaranshYadav Project Report Goldanon_179532672No ratings yet

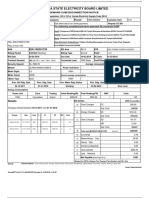

- KsebBill 1165411013809Document1 pageKsebBill 1165411013809Jio CpyNo ratings yet

- Annual-Report-Eng-2017 Ing DiBa PDFDocument262 pagesAnnual-Report-Eng-2017 Ing DiBa PDFEbalah ZumbabahNo ratings yet

- KPMG - IFRS vs. US GAAP - RD CostsDocument8 pagesKPMG - IFRS vs. US GAAP - RD CoststomasslrsNo ratings yet

- Quiz 2 Mô PhỏngDocument11 pagesQuiz 2 Mô PhỏngTường LinhNo ratings yet

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Methods of LendingDocument2 pagesMethods of Lendingmuditagarwal72No ratings yet

- Lords of Finance - Liaquat Ahamed PDFDocument12 pagesLords of Finance - Liaquat Ahamed PDFasaid100% (2)

- Accounting Standard 1Document27 pagesAccounting Standard 1Sid2875% (4)

- AACAP - Exercise 2Document4 pagesAACAP - Exercise 2sharielles /No ratings yet

- Optimal Risky Portfolios Chapter 7 PracticeDocument2 pagesOptimal Risky Portfolios Chapter 7 PracticeRehabUddinNo ratings yet

- Step 1 Analsis of Source DocumentsDocument5 pagesStep 1 Analsis of Source DocumentsSittie Hafsah100% (1)

- AFE3691 Tutorial QuestionsDocument29 pagesAFE3691 Tutorial QuestionsPetrinaNo ratings yet

- Residential Rental Application: Applicant InformationDocument3 pagesResidential Rental Application: Applicant Informationapi-115282286No ratings yet

- Periodic MethodDocument14 pagesPeriodic MethodRACHEL DAMALERIONo ratings yet

- Etf Gold VS E-GoldDocument22 pagesEtf Gold VS E-GoldRia ShayNo ratings yet

- 2015 Pru Life UK Annual Report PDFDocument61 pages2015 Pru Life UK Annual Report PDFMichael S LeysonNo ratings yet

- Definition of InflationDocument28 pagesDefinition of InflationRanjeet RanjanNo ratings yet

- 10 M Shefaque Ahmed Oct 11Document8 pages10 M Shefaque Ahmed Oct 11Anonymous uRR8NyteNo ratings yet

- Federal RetirementDocument50 pagesFederal RetirementFedSmith Inc.100% (1)

- REO CPA Review: Business CombinationDocument9 pagesREO CPA Review: Business CombinationRoldan Hiano ManganipNo ratings yet

- Intro To MA Aug 2013Document14 pagesIntro To MA Aug 2013Nakul AnandNo ratings yet

- CSEC POA June 2012 P1 PDFDocument12 pagesCSEC POA June 2012 P1 PDFjunior subhanNo ratings yet

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDocument12 pagesA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagargmb117No ratings yet

- 7Document31 pages7Chinzorig Tsevegjav100% (1)

- AOM 2023 001 Tuy ADocument18 pagesAOM 2023 001 Tuy AKean Fernand BocaboNo ratings yet

- Treasury Bond Claim Form Sav1048Document7 pagesTreasury Bond Claim Form Sav1048aplaw100% (1)

- ASSIGNMENT ms2 Ra PDFDocument2 pagesASSIGNMENT ms2 Ra PDFBeomi0% (1)