Professional Documents

Culture Documents

03 Krispy Kreme

Uploaded by

84112213Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 Krispy Kreme

Uploaded by

84112213Copyright:

Available Formats

Krispy Kreme Doughnuts 2008

Mario Musa: University of Mostar

A.

Case Abstract

Krispy Kreme (www.krispykreme.com) is a comprehensive business policy and strategic management case that includes the companys fiscal year-end January 2007 financial statements, competitor information and more. The case time setting is the year 2008. Sufficient internal and external data are provided to enable students to evaluate current strategies and recommend a three-year strategic plan for the company. Headquartered in Winston Salem, North Carolina, Krispy Kremes common stock is publicly-traded on the New York Stock Exchange under the ticker symbol KKD. Krispy Kreme operates as a wholesaler and retailer of doughnuts in the United States, Great Britain, Australia, Mexico, and much of Southeast Asia. The company makes approximately 20 varieties of doughnuts, and sells milk, coffee and other drinks. Krispy Kreme is led by CEO James Morgan whose base pay was $125K in 2007. The firms major competitor is privately-owned Duncan Donuts.

B.

Vision Statement (proposed)

To become the number one brand name doughnut company in the world.

C.

Mission Statement (proposed)

Our mission is to provide customers (1) with the best tasting doughnuts and coffee (2) possible no matter which Krispy Kreme store they visit in the world (3). We strive to use only the best ingredients in our doughnuts and serve only the best coffee to maintain our reputation as the place for both doughnuts (6) and coffee. Our signature product, the Original Glazed Doughnut (7) is a staple and our most popular offering. We strive to ensure all our franchisees (9) are able to financially back the businesses they operate to help continue our success toward our vision (5). Finally, we at Krispy Kreme strive to be a good corporate citizen and help the communities in which we operate through donations and fundraising for churches, school, and other businesses (8). 1. Customer 2. Products or services 3. Markets

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

29

4. 5. 6. 7. 8. 9.

Technology Concern for survival, profitability, growth Philosophy Self-concept Concern for public image Concern for employees

D.

External Audit

Opportunities

1. 2. 3. 4. 5. 6. 7.

8. 9.

Economies in China and India grew 11.5 and 8 percent in 2007, and are expected to grow 8 and 7 percent respectively in next 5 years. Weak US dollar makes US products and technologies more affordable in Europe and Asia. Popularity of premium coffee drinks and their addition to fast food menus. Growing popularity of canned coffee drinks, especially in Japan and China. The industry growth of 7.9 percent in last 5 years. Consumers demand more foods made out of organic products. Increasing popularity of diets which do not place strict limitations on lower fat, carbohydrate, and sugar content. An average diet costs of $85.79 per week is substantially more than average food expense of $54.44. E-commerce continues to grow, third quarter sales in 2007 were $34.7 billion, a 3.6 percent increase from the previous quarter.

Threats 1. Sluggish US economy is causing a decrease in consumer spending 2. Growing health concerns and correlation between higher risk of diabetes and heart problems caused by excessive weight. 3. The competitors' sales grew by an industry average 7.90 percent in past five years. 4. Starbucks opened 2,199 new stores world wide in 2006. 5. USDA is now projecting 2008 food prices could increase as much as 4.5 percent, which is the top end of their 3.5 percent to 4.5 percent projection. 6. The price increase in raw materials such as sugar, coffee, wheat, cooking oil. 7. The energy prices are on constant rise and cause increase in operational expenses. 8. Dunkin Donuts and other competitors diversified their menus and beverages that they are offering to their customers.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

30

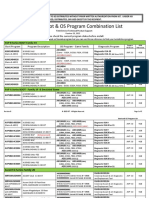

CPM Competitive Profile Matrix

* Estimates for Starbucks focused on similar product lines with KKD and Tim Horton's KKD Starbucks Tim Horton's Critical Success Weight Rating Weighted Rating Weighted Rating Weighted Factors Score Score Score Market Share 0.15 2 0.30 4 0.60 3 0.45 Price 0.10 3 0.30 3 0.30 3 0.30 Financial Position 0.15 1 0.15 4 0.60 3 0.45 Product Quality 0.10 3 0.30 4 0.40 4 0.40 Product Diversity 0.10 2 0.20 3 0.30 3 0.30 Consumer Loyalty 0.15 3 0.45 4 0.60 3 0.45 Employees 0.05 2 0.10 4 0.20 2 0.10 Sales distribution 0.05 3 0.15 3 0.15 2 0.10 Global Expansion 0.10 4 0.40 4 0.40 1 0.10 E-commerce 0.05 2 0.10 3 0.15 3 0.15 Total 1.00 2.45 3.70 2.80

External Factor Evaluation (EFE) Matrix

Key External Factors Opportunities 1. Economies in China and India grew 11.5 and 8 percent in 2007, and are expected to grow 8 and 7 percent respectively in next 5 years. 2. Weak US dollar makes US products and technologies more affordable in Europe and Asia. 3. Popularity of premium coffee drinks and their addition to fast food menus. 4. Growing popularity of canned coffee drinks, especially in Japan and China. 5. The industry growth of 7.9 percent in last 5 years. 6. Consumers demand more foods made out of organic products. 7. Increasing popularity of diets which do not place strict limitations on lower fat, carbohydrate, and sugar content. 8. An average diet costs of $85.79 per week is substantially more than average food expense of $54.44 9. E-commerce continues to grow, third quarter sales in 2007 were $34.7 billion, a 3.6 percent increase from the previous quarter. Threats 1. Sluggish US economy is causing a decrease in consumer spending. 2. Growing health concerns and correlation between higher risk of diabetes and heart problems caused by excessive weight. 3. The competitors' sales grew by an industry average 7.90 percent in past five years. Weight Rating Weighted Score

0.08

0.32

0.08 0.05 0.05 0.12 0.04 0.04 0.04 0.05 0.08 0.07 0.05

4 3 4 3 3 3 4 3 3 4 4

0.24 0.15 0.20 0.36 0.12 0.12 0.16 0.15 0.24 0.28 0.20

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

31

4. Starbucks opened 2,199 new stores world wide in 2006. 5. USDA is now projecting 2008 food prices could increase as much as 4.5 percent, which is the top end of their 3.5 percent to 4.5 percent projection. 6. The price increase in raw materials such as sugar, coffee, wheat, cooking oil. 7. The energy prices are on constant rise and cause increase in operational expenses. 8. Dunkin Donuts and other competitors diversified their menus and beverages that they are offering to their customers. TOTAL

0.03 0.08 0.05 0.04 0.05 1.00

4 3 3 4 3

0.12 0.24 0.15 0.16 0.15 3.36

E.

Internal Audit

Strengths 1. The companys cost cutting practices have reduced negative net income from -$198 million in January 2005 to -$42 million in January 2007. 2. As of January 2007, there are 296 stores open in US and 123 internationaly and there are plans to open additional 200 stores abroad. 3. Brand name recognition, strong tradition, and recognizable menu. 4. Corporate web site is well designed and navigable and offers many items for sale. 5. Addition of frozen drinks to its menu. 6. All Krispy Kreme doughnuts are cooked in 100 percent vegetable oil. 7. Open late hours to cater to travelers. 8. Hot Doughnuts Now sign lures in potential customers. Weaknesses

1. 2.

3. 4. 5. 6. 7.

The company's stock has tumbled from $50 per share to $ 2.50 per share and most Wall Street analysts recommend the stock as a "strong sell." The company recently hired new CEO, James Morgan, to replace the old CEO Daryl Brewster. This makes Mr. Morgan Krispy Kremes third CEO in 4 years Last quarterly revenue growth was -11.70 percent compared to 18.60 percent of direct competitor, Tim Horton's, for the same period. The company has completley withdrawn from the big city markets such as Boston and Chicago. The doughnuts have the high content of calories and fat, such as Original Glazed with 200 calories and 12 grams of fat that is 18 percent of daily value. The coffee brand offered have only 4 different roasts and no other caffeenated drinks except for drip coffee. Force substantioanly large capital of $30 million for foreign franchisees.

32

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Financial Ratio Analysis (January 2007)

Growth Rates % Krispy Kreme Sales (Qtr vs year ago qtr) -11.70 Net Income (YTD vs YTD) NA Net Income (Qtr vs year ago qtr) 88.90 Sales (5-Year Annual Avg.) 3.18 Net Income (5-Year Annual Avg.) NA Dividends (5-Year Annual Avg.) NA Price Ratios Current P/E Ratio NA P/E Ratio 5-Year High NA P/E Ratio 5-Year Low NA Price/Sales Ratio 0.44 Price/Book Value 2.14 Price/Cash Flow Ratio NA Profit Margins Gross Margin 11.2 Pre-Tax Margin -13.5 Net Profit Margin -13.9 5Yr Gross Margin (5-Year Avg.) 18.1 5Yr PreTax Margin (5-Year Avg.) -6.7 5Yr Net Profit Margin (5-Year Avg.) -8.9 Financial Condition Debt/Equity Ratio 0.99 Current Ratio 1.7 Quick Ratio 1.2 Interest Coverage -3.4 Leverage Ratio 2.8 Book Value/Share 1.35 Investment Returns % Return On Equity -62.6 Return On Assets -19.0 Return On Capital -26.6 Return On Equity (5-Year Avg.) -21.3 Return On Assets (5-Year Avg.) -11.2 Return On Capital (5-Year Avg.) -14.4 Management Efficiency Income/Employee -9,375 Revenue/Employee 90,473 Receivable Turnover 14.6 Inventory Turnover 17.1 Asset Turnover 1.4 Adapted from www.moneycentral.msn.com Date 01/07 01/06 01/05 02/04 02/03 Avg. P/E -13.10 -3.00 -7.60 47.50 68.60 Price/Sales 1.73 0.61 0.75 3.42 3.69 Industry 8.30 -6.90 43.50 9.07 12.87 25.84 25.0 12.6 3.8 2.07 2.81 6.20 30.6 11.9 8.0 30.4 12.1 8.3 0.53 0.4 0.4 14.1 1.5 3.84 15.2 4.3 5.9 10.6 3.3 4.6 6,034 86,111 33.9 40.2 0.8 SP-500 9.00 15.40 0.90 13.05 19.88 10.03 22.9 21.4 4.8 2.49 3.53 10.40 33.7 17.5 12.4 33.4 16.6 11.5 1.24 0.9 0.7 42.3 4.2 16.50 21.3 5.8 7.8 15.4 5.0 6.7 52,240 424,626 12.8 5.5 0.6 Net Profit Margin (%) -9.2 -25.0 -22.2 7.7 6.3

Price/Book 10.22 3.03 2.22 5.01 6.26

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

33

Date Book Value/ Share Debt/Equity 01/07 $1.26 1.36 01/06 $1.76 1.13 01/05 $3.90 0.61 02/04 $7.12 0.35 02/03 $4.86 0.27 Adapted from www.moneycentral.msn.com

ROE (%) -53.5 -124.9 -65.2 11.4 11.4

ROA (%) -12.1 -33.0 -32.7 7.6 7.6

Interest Coverage -1.3 -5.9 -20.3 19.7 29.8

Net Worth Analysis (January 2007 in millions)

1. Stockholders Equity + Goodwill = 79 + 28 2. Net income x 5 = $-42 x 5= 3. Share price = $2.75/EPS -0.91 =$NA x Net Income $-42= 4. Number of Shares Outstanding x Share Price = 65 x $2.75 = Method Average $107 $ NA $ NA $ 178 $142

Internal Factor Evaluation (IFE) Matrix

Key Internal Factors Strengths 1. The companys cost cutting practices have reduced negative net income from -$198 million in January 2005 to -$42 million in January 2007. 2. As of January 2007, there are 296 stores open in US and 123 internationally and there are plans to open additional 200 stores abroad. 3. Brand name recognition, strong tradition, and recognizable menu. 4. Corporate web site is well designed and navigable and offers many items for sale. 5. Addition of frozen drinks to its menu. 6. All Krispy Kreme doughnuts are cooked in 100 percent vegetable oil. 7. Open late hours to cater to travelers. 8. Hot Doughnuts Now sign lures in potential customers. Weaknesses 1. The company's stock has tumbled from $50 per share to $ 2.50 per share and most Wall Street analysts recommend the stock as a "strong sell." 2. The company recently hired new CEO, James Morgan, to replace the old CEO Daryl Brewster. This makes Mr. Morgan Krispy Kremes third CEO in 4 years 3. Last quarterly revenue growth was -11.70 percent compared to 18.60 percent of direct competitor, Tim Horton's, for the same period. 4. The company has completley withdrawn from the big city markets such as Boston and Chicago. 5. The doughnuts have the high content of calories and fat, such as Original Glazed with 200 calories and 12 grams of fat that is 18 percent of daily value. Weight Rating Weighted Score

0.10 0.10 0.06 0.04 0.06 0.06 0.06 0.06 0.10 0.05

3 4 4 3 3 4 4 4 2 2

0.30 0.40 0.24 0.12 0.18 0.24 0.24 0.24 0.20 0.10

0.05 0.06 0.10

1 2 1

0.05 0.12 0.10

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

34

6. The coffee brand offered have only 4 different roasts and no other caffeenated drinks except for drip coffee. 7. Force substantioanly large capital of $30 million for foreign franchisees. TOTAL

0.05 0.05 1.00

1 1

0.05 0.05 2.63

F.

SWOT Strategies

SO Strategies Start to offer doughnuts on line to the customers, where the doughnuts can be selected online than picked up without further waiting at the store (S4, O9). 2. Continue to expand outside the US, especially in India, China, Russia (S2, O1, O2). 3. Start offering canned coffee drinks in Asian market (S5, O4). 4. Introduce low-fat and low-sugar frozen drinks and market their dietary content (S5, O7).

1.

WO Strategies Create a new line of doughnuts made out of organic components (flower, fruit additives) and offer them as a new special organic menu (W5, O6). 2. Invest more into existing stores located in the Southeastern United States and try to increase the business here since this is the core customer base for this company (W4, O5). 3. Start up the strategic alliance with Burger King and offer premium coffee and doughnuts as part of their menu (S3, O3).

1.

ST Strategies Offer incentives to the higher performing store managers in order to increase the sales revenues (S1, T1, T3). 2. Switch to cooking in sunflower oil since it is valued for its light taste, frying performance and health benefits (S6, T2,T5). 3. Continue with plans for international expansion in Asia and Europe (S2, T1, T4).

1.

WT Strategies 1. Introduce in-store coffee roasting and develop several new flavors (W6, T3,T7) 2. Close all under performing stores in the US as the additional cost cutting measure (W3,T1, T6). 3. Introduction of the low-fat doughnuts that are baked not fried (W5, T2, T7).

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

35

G.

SPACE Matrix

Con

x-axis: -2.4 + 4.6 = 2.2 y-axis: 1.4 + -3.2 = -1.8

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Financial Strength Return on Assets (RO Competitive Advan Leverage Market Share Net Income Product Quality Income/Employee

36

H.

Grand Strategy Matrix

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

37

I.

The Internal-External (IE) Matrix

The IFE Total Weighted Score Strong 3.0 to 4.0 I Average 2.0 to 2.99 II Weak 1.0 to 1.99 III

High 3.0 to 3.99

Krispy Kreme

Medium The EFE Total 2.0 to 2.99 Weighted Score

IV

VI

Low 1.0 to 1.99

VII

VIII

IX

Grow and Build

Business Segment Company stores Franchise KK Supply Chain % Revenue 72 5 23

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

38

J.

QSPM

Create new line of organic doughnuts AS 0.08 0.08 0.05 0.05 0.12 0.04 0.04 0.04 0.05 0.08 0.07 0.05 0.03 0.08 0.05 0.04 0.05 1.00 4 3 --2 1 2 3 0.28 0.15 --0.16 0.05 0.08 0.15 2.01 3 4 --3 2 3 4 0.21 0.20 --0.24 0,10 0.12 0.20 2.25 3 --2 --3 4 4 3 --TAS 0.24 --0.10 --0.36 0.16 0.16 0.12 --Start up strategic alliance with Burger King AS TAS 4 --4 --4 3 2 2 --0.32 --0.20 --0.48 0.12 0.08 0.08 ---

Strategic Alternatives Key External Factors Opportunities 1. Economies in China and India grew 11.5 and 8 percent in 2007, and are expected to grow 8 and 7 percent respectively in next 5 years. 2. Weak US dollar makes US products and technologies more affordable in Europe and Asia. 3. Popularity of premium coffee drinks and their addition to fast food menus. 4. Growing popularity of canned coffee drinks, especially in Japan and China. 5. The industry growth of 7.9 percent in last 5 years. 6. Consumers demand more foods made out of organic products. 7. Increasing popularity of diets which do not place strict limitations on lower fat, carbohydrate, and sugar content. 8. An average diet costs of $85.79 per week is substantially more than average food expense of $54.44 9. E-commerce continues to grow, third quarter sales in 2007 were $34.7 billion, a 3.6 percent increase from the previous quarter. Threats 1. Sluggish US economy is causing a decrease in consumer spending 2. Growing health concerns and correlation between higher risk of diabetes and heart problems caused by excessive weight. 3. The competitors' sales grew by an industry average 7.90 percent in past five years. 4. Starbucks opened 2,199 new stores world wide in 2006. 5. USDA is now projecting 2008 food prices could increase as much as 4.5 percent, which is the top end of their 3.5 percent to 4.5 percent projection. 6. The price increase in raw materials such as sugar, coffee, wheat, cooking oil. 7. The energy prices are on constant rise and cause increase in operational expenses. 8. Dunkin Donuts and other competitors diversified their menus and beverages that they are offering to their customers. SUBTOTAL Weight

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

39

Create new line of organic doughnuts Key Internal Factors Weight Strengths 1. The companys cost cutting practices have reduced negative net income from -$198 million in January 0.10 2005 to -$42 million in January 2007. 2. As of January 2007, there are 296 stores open in US and 123 internationally and there are plans to open 0.10 additional 200 stores abroad. 3. Brand name recognition, strong tradition, and 0.06 recognizable menu. 4. Corporate web site is well designed and navigable 0.04 and offers many items for sale. 5. Addition of frozen drinks to its menu. 0.06 6. All Krispy Kreme doughnuts are cooked in 100 0.06 percent vegetable oil. 7. Open late hours to cater to travelers. 0.06 8. Hot Doughnuts Now sign lures in potential 0.06 customers. Weaknesses 1. The company's stock has tumbled from $50 per share to $ 2.50 per share and most Wall Street 0.10 analysts recommend the stock as a "strong sell." 2. The company recently hired new CEO, James Morgan, to replace the old CEO Daryl 0.05 Brewster. This makes Mr. Morgan Krispy Kremes third CEO in 4 years 3. Last quarterly revenue growth was -11.70 percent compared to 18.60 percent of direct 0.05 competitor, Tim Horton's, for the same period. 4. The company has completley withdrawn 0.06 from the big city markets such as Boston and Chicago. 5. The doughnuts have the high content of calories and fat, such as Original Glazed with 200 0.10 calories and 12 grams of fat that is 18 percent of daily value. 6. The coffee brand offered have only 4 different roasts and no other caffeenated drinks 0.05 except for drip coffee. 7. Force substantioanly large capital of $30 0.05 million for foreign franchisees. SUBTOTAL SUM TOTAL ATTRACTIVENESS SCORE AS ----3 ----3 ----TAS ----0.18 ----0.18 -----

Start up strategic alliance with Burger King AS TAS ----4 ----2 --------0.24 ----0.12 -----

--3

--0.15

--4

--0.20

3 ---

0.15 ---

2 ---

0.10 ---

0.20

0.10

-----

----0.86 2.87

-----

----0.76 3.01

K.

Recommendations

1. The QSPM strategies assessed creating new organic doughnut menus and starting up new strategic alliances with Burger King. The QSPM reveals that both

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

40

strategies are viable given the current poor financial situation that does not provide many opportunities for vast financial investments. The cost of introducing new menu and starting the strategic alliance with Burger King will be $50 million.

L.

EPS/EBIT Analysis

$ Amount Needed: 50M Stock Price: $2.70 Tax Rate: 35% Interest Rate: 7% # Shares Outstanding: 65M

M.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

EBIT Interest EBIT EBT Interest Taxes EBT EAT Taxes

Epilogue

On January 7, 2008, Krispy Kreme Doughnuts announced that all items on its U.S. menus have zero grams of trans fat. Krispy Kreme is the latest in a long chain of fast-food restaurants to limit the amount of bad trans fat on its menu. Privately held Dunkin' Brands Inc said last August it would cut trans fats from its donuts soon. A Kuwaiti investor reported boosting his stake in Krispy Kreme Doughnuts Inc. from 11.3 percent to 13.8%, in a filing with the Securities and Exchange Commission. He is Mohamed Abdulmohsin Al Kharafi & Sons W.L.L. who now owns about 9.1 million shares, or a 13.8% stake based on 65.5 million shares outstanding. In the weeks leading up to Valentines Day 2008, KKD offered heart-shaped doughnuts, topped with bright white icing and pink, red and white sprinkles.

Rece (100,0 Rece (100,0 (100,0 1,05 (35,0 (101,0 (65,0 (35,3

41

Additionally, as part of its Share the Love program, Krispy Kreme stores offered 12 Valentine's Day cards that featured a coupon good for a free doughnut, to all customers who purchase two dozen doughnuts before Valentines Day. "Forget the typical Valentine's fare of chocolates and flowers, and surprise your loved ones with something they aren't expecting," said Ron Rupocinski, Krispy Kreme's Executive Chef. "A fresh box of Krispy Kreme's heart doughnuts is a great Valentine's Day breakfast treat for classroom parties or just a sweet start to the day at your office." Original Glazed heart-shaped doughnuts are being offered on Valentine's Day only, the sprinkled heart doughnuts and Share the Love Valentine's Day cards are available at participating stores, while supplies last. Large orders can be placed at no additional cost by calling a local Krispy Kreme store at least 48 hours in advance. Chief Executive Daryl Brewster resigned in January 2008. News of the management change sent the KKD's shares climbing 11%. James H. Morgan, the chairman, will assumed the additional posts of chief executive and president.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

42

You might also like

- KraftDocument3 pagesKraftLim Ruey ChyiNo ratings yet

- Hershey's Lecturer BookDocument19 pagesHershey's Lecturer BookAbdel CowoNo ratings yet

- Krispy Kreme DoughnutsDocument31 pagesKrispy Kreme DoughnutsAnkit MishraNo ratings yet

- FedEx Strategic AnalysisDocument30 pagesFedEx Strategic Analysishs138066No ratings yet

- Case QuestionsDocument2 pagesCase QuestionsAhmed Al-BaharNo ratings yet

- Krispy Kreme Doughnuts-Suggested QuestionsDocument1 pageKrispy Kreme Doughnuts-Suggested QuestionsMohammed AlmusaiNo ratings yet

- Financial Management E BookDocument4 pagesFinancial Management E BookAnshul MishraNo ratings yet

- Hutchison Whampoa Capital Structure DecisionDocument11 pagesHutchison Whampoa Capital Structure DecisionUtsav DubeyNo ratings yet

- Explain Why Strategies FailDocument5 pagesExplain Why Strategies FailTasneem Aferoz100% (1)

- Krispy Kreme Growth Forecast AnalysisDocument4 pagesKrispy Kreme Growth Forecast AnalysisThomas PrinceNo ratings yet

- 2003 Edition: This Bibliography Contains Abstracts of The 100 Best-Selling Cases During 2002Document30 pages2003 Edition: This Bibliography Contains Abstracts of The 100 Best-Selling Cases During 2002Raghib AliNo ratings yet

- IB Case 5Document2 pagesIB Case 5s6789a100% (2)

- San Miguel PDFDocument395 pagesSan Miguel PDFChristian RonderoNo ratings yet

- Nike Case Study Analysis: by Ahmed Samir Haitham Salah Magdy Essmat Magdy Mohamed SherifDocument23 pagesNike Case Study Analysis: by Ahmed Samir Haitham Salah Magdy Essmat Magdy Mohamed SherifZin Min HtetNo ratings yet

- Intel Case StudyDocument6 pagesIntel Case StudyhazryleNo ratings yet

- Good Food Served Quietly by Hearing Impaired StaffDocument3 pagesGood Food Served Quietly by Hearing Impaired StaffKishore KintaliNo ratings yet

- Harper Chemical Faces Strategy Issues After Dominite Sales Fall ShortDocument4 pagesHarper Chemical Faces Strategy Issues After Dominite Sales Fall ShortABC527100% (2)

- Jollibee Case StudyDocument2 pagesJollibee Case StudyShadman Shahriar 1925389060No ratings yet

- Markman Individual Paper FinalDocument14 pagesMarkman Individual Paper Finalreizch100% (1)

- Unilever Case StudyDocument5 pagesUnilever Case StudyAzeem KhanNo ratings yet

- Pfizer's Strategic Management Case AnalysisDocument8 pagesPfizer's Strategic Management Case AnalysisRosalie RodelasNo ratings yet

- Strama2 Case 1 PFIZERDocument23 pagesStrama2 Case 1 PFIZERAdonis PajarilloNo ratings yet

- MKTG Analysis - Diversification StrategyDocument29 pagesMKTG Analysis - Diversification StrategyWan Muhammad Abdul HakimNo ratings yet

- Summit Distributors Case Analysis: Lifo Vs Fifo: Bryant Clinton, Minjing Sun, Michael Crouse MBA 702-51 Professor SafdarDocument4 pagesSummit Distributors Case Analysis: Lifo Vs Fifo: Bryant Clinton, Minjing Sun, Michael Crouse MBA 702-51 Professor SafdarKhushbooNo ratings yet

- Space Matrix SampleDocument3 pagesSpace Matrix SampleAngelicaBernardoNo ratings yet

- San Miguel Pure Foods CompanyDocument4 pagesSan Miguel Pure Foods CompanyErica Mae VistaNo ratings yet

- The One-World Airline AllianceDocument4 pagesThe One-World Airline AllianceAthena Hdz GuerraNo ratings yet

- Rationale For Unrelated Product Diversification For Indian FirmsDocument10 pagesRationale For Unrelated Product Diversification For Indian FirmsarcherselevatorsNo ratings yet

- SWOT Analysis of Pizza HutDocument3 pagesSWOT Analysis of Pizza HuthilalamirNo ratings yet

- 2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointDocument4 pages2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointFu Fu XiangNo ratings yet

- L.A. Gear Case AnalysisDocument25 pagesL.A. Gear Case Analysisginarnz05100% (1)

- Tpccaseanalysisver04 130720110742 Phpapp01Document17 pagesTpccaseanalysisver04 130720110742 Phpapp01yis_loveNo ratings yet

- Group-2 - Ben and Jerry CaseDocument13 pagesGroup-2 - Ben and Jerry CaseShilpi Kumar100% (1)

- TDC Case FinalDocument3 pagesTDC Case Finalbjefferson21No ratings yet

- SKIIDocument5 pagesSKIIvkiprickinsNo ratings yet

- Ethics at PMIDocument20 pagesEthics at PMIAadil KhanNo ratings yet

- TOWS Matrix: Sachin UdhaniDocument12 pagesTOWS Matrix: Sachin Udhaniamittaneja28No ratings yet

- I. Company ProfileDocument13 pagesI. Company ProfileCynthia Jayanti Sarosa PuteraNo ratings yet

- Strategic Leadership at AppleDocument16 pagesStrategic Leadership at AppleYMCA Trinidad and Tobago100% (1)

- Alpha Steel Case StudyDocument1 pageAlpha Steel Case StudyFlorin MuscaluNo ratings yet

- Master in Business Administration Managerial Economics Case StudyDocument7 pagesMaster in Business Administration Managerial Economics Case Studyrj carrera100% (1)

- Case Study PfizerDocument3 pagesCase Study PfizerpeeihNo ratings yet

- Stage One (Where Are We Now?) : A. Environment AuditDocument59 pagesStage One (Where Are We Now?) : A. Environment AuditmzakifNo ratings yet

- Case 2 Giovanni Buton (COMPLETE)Document8 pagesCase 2 Giovanni Buton (COMPLETE)Austin Grace WeeNo ratings yet

- Generoso Pharmaceutical and Chemicals, Inc.: Background of The StudyDocument7 pagesGeneroso Pharmaceutical and Chemicals, Inc.: Background of The StudyKristine Joy Serquina67% (3)

- Case 6 Mylans Acquisition of MatrixDocument25 pagesCase 6 Mylans Acquisition of MatrixashmitNo ratings yet

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNo ratings yet

- Market SegmentationDocument23 pagesMarket SegmentationRahul AroraNo ratings yet

- Sol MicrosoftDocument2 pagesSol MicrosoftShakir HaroonNo ratings yet

- This Study Resource Was: Individial Case Analysis of AraucoDocument6 pagesThis Study Resource Was: Individial Case Analysis of AraucofereNo ratings yet

- Review For STRAMA - 082816 (SMB Rev) - 1Document79 pagesReview For STRAMA - 082816 (SMB Rev) - 1Trish BustamanteNo ratings yet

- Case Study NestleDocument5 pagesCase Study NestleRidwan Ridho PuteraNo ratings yet

- Market Entry Strategies of StarbucksDocument14 pagesMarket Entry Strategies of StarbucksImraan Malik50% (2)

- Pfizer, Inc: Company ValuationDocument15 pagesPfizer, Inc: Company ValuationPriyanka Jayanth DubeNo ratings yet

- Accounting Policy Changes That Harnischfeger Had Made During 1984 and The Effect ofDocument4 pagesAccounting Policy Changes That Harnischfeger Had Made During 1984 and The Effect ofAdityaSinghNo ratings yet

- 07 Hewlett PackardDocument16 pages07 Hewlett Packard9874567No ratings yet

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersFrom EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Motorola l6Document54 pagesMotorola l6Marcelo AriasNo ratings yet

- Poka Yoke BDocument31 pagesPoka Yoke BjaymuscatNo ratings yet

- Shrey's PHP - PracticalDocument46 pagesShrey's PHP - PracticalNahi PataNo ratings yet

- Igt - Boot Os List Rev B 10-28-2015Document5 pagesIgt - Boot Os List Rev B 10-28-2015Hector VillarrealNo ratings yet

- Rhetorical Moves in The Literature Review Section of A Sample Research ArticleDocument1 pageRhetorical Moves in The Literature Review Section of A Sample Research ArticleKim Sydow Campbell100% (1)

- IEEE Registration StuffDocument11 pagesIEEE Registration StuffsegeluluNo ratings yet

- LL Baby Carrier Corner Drool Pads TutorialDocument9 pagesLL Baby Carrier Corner Drool Pads TutorialBryan DerryNo ratings yet

- Customer Channel Migration in Omnichannel RetailingDocument80 pagesCustomer Channel Migration in Omnichannel RetailingAlberto Martín JiménezNo ratings yet

- Electricity BillDocument1 pageElectricity BillSushila SinghNo ratings yet

- Air Purification Solution - TiPE Nano Photocatalyst PDFDocument2 pagesAir Purification Solution - TiPE Nano Photocatalyst PDFPedro Ortega GómezNo ratings yet

- Cs614-Mid Term Solved MCQs With References by Moaaz PDFDocument30 pagesCs614-Mid Term Solved MCQs With References by Moaaz PDFNiazi Qureshi AhmedNo ratings yet

- Draft SemestralWorK Aircraft2Document7 pagesDraft SemestralWorK Aircraft2Filip SkultetyNo ratings yet

- JDC Merchanndising ActivityDocument6 pagesJDC Merchanndising ActivityShaira Sahibad100% (1)

- Final Mother DairyDocument59 pagesFinal Mother DairyAnup Dcruz100% (4)

- Dhilshahilan Rajaratnam: Work ExperienceDocument5 pagesDhilshahilan Rajaratnam: Work ExperienceShazard ShortyNo ratings yet

- Project CST 383Document1,083 pagesProject CST 383api-668525404No ratings yet

- Keystone - Contractors - Book 16 05 12 FinalDocument9 pagesKeystone - Contractors - Book 16 05 12 Finalfb8120No ratings yet

- Lecture Notes in Airport Engineering PDFDocument91 pagesLecture Notes in Airport Engineering PDFMaya RajNo ratings yet

- Đề Số 1 - Đề Phát Triển Đề Minh Họa 2023Document20 pagesĐề Số 1 - Đề Phát Triển Đề Minh Họa 2023Maru KoNo ratings yet

- SC upholds invalid donation of land shareDocument3 pagesSC upholds invalid donation of land shareAizza JopsonNo ratings yet

- Chapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaDocument63 pagesChapter-5-Entrepreneurial-Marketing Inoceno de Ocampo EvangelistaMelgrey InocenoNo ratings yet

- Financial Ratios ActivityDocument3 pagesFinancial Ratios ActivityNCF- Student Assistants' OrganizationNo ratings yet

- Training Prospectus 2020 WebDocument89 pagesTraining Prospectus 2020 Webamila_vithanageNo ratings yet

- Proposed Construction of New Kutulo Airstrip - RetenderDocument112 pagesProposed Construction of New Kutulo Airstrip - RetenderKenyaAirportsNo ratings yet

- Chemistry1207 Lab 4Document2 pagesChemistry1207 Lab 4Kayseri PersaudNo ratings yet

- BVM Type B Casing Tong ManualDocument3 pagesBVM Type B Casing Tong ManualJuan Gabriel GomezNo ratings yet

- Wizard's App Pitch Deck by SlidesgoDocument52 pagesWizard's App Pitch Deck by SlidesgoandreaNo ratings yet

- MS For The Access Control System Installation and TerminationDocument21 pagesMS For The Access Control System Installation and Terminationwaaji snapNo ratings yet

- Case Study ON: The Spark Batteries LTDDocument8 pagesCase Study ON: The Spark Batteries LTDRitam chaturvediNo ratings yet