Professional Documents

Culture Documents

Questionnaire With Smes

Uploaded by

Mark Angelo Solis AntiolaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questionnaire With Smes

Uploaded by

Mark Angelo Solis AntiolaCopyright:

Available Formats

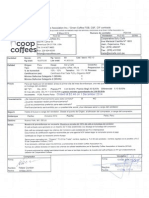

A Survey on RATIONALIZING THE EFFECTS OF PHILIPPINE ACCOUNTING STANDARDS AND PHILIPPINE FINANCIAL REPORTING STANDARDS AMENDMENTS WITH THE

TEACHINGN PROBLEMS ENCOUNTERED BY ACCOUNTING PROFESSORS Questionnaire for Accounting Professors Part I. Profile Direction: Please check the space provided that corresponds to your answers. A. Personal Data 1. Age [ [ [ [ ] 30 and below ] From 31 up to 40 ] From 41 up to 50 ] From 51 and above

2. Sex [ ] Male 3. Civil Status [ ] Single [ ] Married B. Employment Data 1. Employment Status [ ] Full-time 2. Length of Service [ ] 15 years and below [ ] 16 years up to 25 years [ ] Above 26 years [ ] Part-time [ ] Widow/er [ ] Separated [ ] Female

Part II. Standard Modifications Direction: Please check for the corresponding space provided that shows your degree of agreement with the following statement. 5 To a Maximum Extent 4 To a Great extent 3 To an Average Extent 2 To Some Extent 1 To No Extent What is the extent of awareness of accounting professors on these key modifications in the Philippine Accounting Standards (PASs) and Philippine Financial Reporting Standards (PFRSs)? 5 4 3 2 1 A. PFRS 1 First time Adoption of PFRS 1. Requires an entity to prepare a PFRS opening balance sheet at January 1, 2004 and 2005, the date of transition to PFRS. (effective date January 1, 2005) 2. Amendments to PFRS 1: Additional exemption for first time adopters (effective date January 1, 2010) 3. Amendments to PFRS 1: Limited Exemption for Comparative PFRS 7 Disclosures for First Time Adopters A. PFRS 2 Stock-based Compensation 1. Requires recognition of the fair value of the stock options granted to employees at grant date. (effective date January 1, 2005) 2. Include an expanded definition of vesting conditions (i.e. payment of counterpart contributions) (effective date January 1, 2007) 3. Group Cash-settled Share Based Payment Transactions (effective date January 1, 2010) B. PFRS 3 Business Combination (effective date July 1, 2009) 1. Allows only the application of purchase for all business combinations (pooling of interest allowed under old GAAP). [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 2. Requires an acquirer to be identified for every business combination. 3. Acquirer recognized liabilities for terminating or reducing the activities of the acquiree only when it has an existing liability for restructuring at the acquisition date. 4. Acquirer recognized contingent liabilities of the acquireee provided its fair value measure reliably. 5. Reassess the acquirees identifiable assets, liabilities and contingent liabilities identification and measurement of the cost combination. 6. Negative goodwill no longer allowed. It will have to be credited to profit or loss. 7. Recognized immediately in profit or loss any excess remaining after assessment. 8. Goodwill no longer subject to amortization but now required to be tested for impairment annually. 9. Business combination between entities under common control need to be accounted at cost. [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

C. PFRS 5 Non-current Held for Sale and Discounted Operations (effective date January 1, 2005) 1. Requires non-current assets to be classified as non-current assets held for sale if its carrying amount will be recovered through sales rather than through continuing use. 2. These assets need to be stated at the lower of carrying amount and fair value less cost to sell. [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 PFRS 7 Financial Instruments Disclosure (effective date January 1, 2009) Improves the disclosure requirements on fair value measurements and disclosures of liquidity. Limited Exemption from Comparative PFRS 3 (effective date January 1, 2010) Financial Instruments: Disclosures (effective date January 1, 2011) D. PAS 1 Financial Statements Presentation (effective date January 1, 2009) Changes the presentation of financial Statements E. PAS 2 Inventories (effective date January 1, 2005) 1. LIFO no longer allowed. 2. Inventory needs to be carried at lower of cost or net realizable value. 3. Reversal of write-down now allowed by PFRS (not allowed by previous GAAP) 4. Forex loss can no longer be capitalized as a part of inventory cost under PAS 21. F. PAS 12 Income Tax (effective date January 1, 2005) Requires recognition of deferred income tax liability on appraisal increase arising from revaluation of property, plant and equipment. G. PAS 14 Operating Segments (effective date January 1, 2005) Increase in the reported segments to see through the eyes of management. H. PAS 16 Property, Plant and Equipment (effective date January 1, 2005) [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ] [ ]

[ ] [ ]

[ ] [ ]

[ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 1. Asset retirement obligation (ARO) is required to be capitalized at the date of acquisition and/or installation. 2. Cost of commissioning/testing an asset, net of proceeds from selling any items produced while the assets is being tested such as sample products. 3. Interest on qualifying asset may be capitalized as a part of the asset account during the construction period (IAS 23 Borrowing costs allowed alternative treatment). I. PAS 17 Leases (effective date January 1, 2005) 1. A lease is capital lease if the indicators exist such as transfer of ownership, purchase option, term is major part of economic life of an asset, and it is specialized in nature. 2. Operating lease income/cost, including lease incentives such as free rent, to be recognized under the straight-line method over the term of the lease. 3. Lessee shall recognized finance leases as assets and liabilities in its balance sheets at amounts equal to the fair value of the leased property, or if lower, the present value of the minimum lease payments each determined at the inception of the lease. 4. Each payment will be allocated between lease and interest. The lease payment will be applied against the liability under capital lease. 5. The lessee will also record a regular depreciation expense for the leased asset. J. PAS 18 Revenue Recognition (effective date January 1, 2005) 1. Revenue recognition should be applied to individual separately identifiable components of a single transaction. [ ] [ ] [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 2. For sale of services (i.e. consultancy), revenue recognition should be based on percentage of completion method (revenue recognized by reference to the stage of completion) at balance sheet date. 3. Certain deflators (i.e. display rental given to retailers) need to be presented as sales deduction rather than advertising and promotions. K. PAS 19 Employee Benefits (focus on pension plans)(effective date January 1, 2005) 1. Annual pension cost charge now composed of current service cost, interest cost on liabilities, return on plan asset, recognized actuarial gains and losses, past service costs and amortization liability. 2. Past service costs need to be amortized over the vesting period (used to be amortized over the average remaining lives of employees). 3. Allows only projected credit method as acceptable valuation model. 4. Actuarial gains and losses, group plans and disclosures. (effective date January 1, 2006) [ ] [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

L. PAS 21 Effects on Changes in Foreign Exchange Rates (effective date 2005) 1. Requires that functional currency be determined by an entity. The functional currency is the basis of recording transactions. 2. Capitalized foreign exchange losses no longer allowed. M. PAS 23 Borrowing Costs (effective date 2008) 1. Requires an entity to capitalize borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of the asset. [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 N. PAS 24 Related Party Disclosures (effective date 2005) 1. Requires disclosure of details of transaction with related parties during the reporting period. 2. Related Party Disclosures (revised) (effective date January 1, 2011) [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

3. Requires disclosure of key management personnel compensation in total and the short term benefits (i.e. SSS), post employment benefits, other long term benefits, termination benefits and sharebased payments (stock option).

[ ]

[ ]

[ ]

[ ]

[ ]

O. PAS 27 Consolidated and Separate Financial Statements (effective date July 1, 2009) 1. Exemption from the preparation of consolidated financial statements under certain circumstances. 2. Cost method for investment be applied to all investment in subsidiaries. 3. Special purpose entities need to be consolidated (i.e. landholding companies). P. PAS 32 Financial Instruments : Presentation (effective date 2005) 1. Requires measurement and recognition of the fair value of derivatives, including embedded derivatives. [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

2. Financial assets/liabilities need to be measured initially at FV less cost of transaction. 3. Equity and liability elements of compound instruments need to be valued and treated separately in the balance sheet.

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 4. Long term financial assets and liabilities which are non- interest bearing need to be stated at present value by discounting the balance using a rate that is implicit to the agreement/balance. 5. Classification of Rights Issues (effective date February 1, 2010) Q. PAS 36 Impairment of Assets (effective date 2005) 1. Requires long term assets and investments to be tested for impairment. Impairment exists when the carrying value of the asset is less than its recoverable value. 2. Previously recognized impairment losses can be reversed if market conditions improved. [ ] [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

R. PAS 37 Provisions, Contingent Assets and Contingent Liabilities (effective date 2005) Materials accruals that are expected to be settled beyond 1 year may need to be discounted at present value. S. PAS 38 Intangible Assets (effective date 2005) 1. Recognize only intangible assets if it is identifiable, probable economic benefits and can measured reliably. 2. Pre-operating expenses/start up costs no longer allowed to be deferred in the balance sheet. Need to be charged to expense as incurred. [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

T. PAS 39 Financial Instruments: Recognition and Measurement (effective date 2006) Fair Value Option on initial recognition of assets and liabilities through profit or loss. [ ] [ ] [ ] [ ] [ ]

5 U. PAS 40 Investment Properties (effective date 2005) 1. Requires assets that are held for appreciation or for rental be classified as Investment properties. 2. Investment properties can either be carried at cost (with annual charges) or fair value (subject to annual impairment testing). V. PFRS for Small and Medium-sized Entities (SMEs) (effective date July 2009) 1. Options in full IFRSs not included in the IFRS for SMEs: financial instrument options, including available-for-sale, held-to-maturity and fair value options; the revaluation model for property, plant and equipment, and for intangible assets; proportionate consolidation for investments in jointly-controlled entities; for investment property, measurement is driven by circumstances rather than allowing an accounting policy choice between the cost and fair value models various options for government grants. 2. Financial instruments: those meeting specified criteria are measured at cost or amortised cost; simple principle for derecognition; hedge accounting requirements, including the detailed calculations. 3. Goodwill and other indefinite-life intangible assets are always amortised over their estimated useful lives (ten years if useful life cannot be estimated reliably). 4. Goodwill and other indefinite-life intangible assets are always amortised over their estimated useful lives (ten years if useful life cannot be estimated reliably). 5. Investments in associates and joint ventures can be measured at cost unless there is a published price quotation (when fair value must be used) [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

5 6. Research and development costs and borrowing costs must be recognised as expenses. 7. Residual value, useful life and depreciation method for items of property, plant and equipment, and amortisation period/method for intangible assets, need to be reviewed only if there is an indication they may have changed since the most recent annual reporting date. 8. Defined benefit plans: all past service cost must be recognised immediately in profit or loss; all actuarial gains and losses must be recognised immediately either in profit or loss or other comprehensive income; an entity is required to use the projected unit credit method to measure its defined benefit obligation and the related expense only if it is possible to do so without undue cost or effort. 9. No separate held-for-sale classification, instead, holding an asset (or group of assets) for sale is an impairment indicator. 10. The fair value through profit or loss model is required for biological assets only when fair value is readily determinable without undue cost or effort. Otherwise, SMEs follow the cost-depreciation-impairment model. 11. The directors best estimate of the fair value of the equity-settled share-based payment is used to measure the expense if observable market prices are not available. III. Problems Encountered How do these problems relate to the said modifications? 5 1. Hassle of reading and learning constant modifications. 2. Learning updates are time-consuming. 3. Costly revised materials such as books and other references. [ ] [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ] [ ]

[ ] [ ]

[ ] [ ]

[ ] [ ]

[ ] [ ]

5 4. Hassle of attending refreshment and standard updates seminar. 5. Confusions on application between old and revised standards. 6. Confusions of students between previously known standards and the revised. 7. Struggle of interpreting the new standards to students. 8. Lack of updated learning and teaching materials. 9. Others please specify___________________ IV. Possible Solutions How do these possible solutions relate to the said modifications? 5 1. Welcoming changes unconditionally. 2. Proper time management. 3. Fund raising to support cost of seminar. 4. Squeezing budget to buy reading materials. 5. Initiative of checking standards updates. 6. Patience in teaching. 7. Search for more effective approach of pointing-out differences between old and revised standards. 8. Provide more exercises and quizzes to the students for them to cope up with the changes. 9. Consultation to other professors for more clarifications about the changes. 10. Others please specify_______________________ [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

4 [ ]

3 [ ]

2 [ ]

1 [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

4 [ ] [ ] [ ] [ ] [ ] [ ] [ ]

3 [ ] [ ] [ ] [ ] [ ] [ ] [ ]

2 [ ] [ ] [ ] [ ] [ ] [ ] [ ]

1 [ ] [ ] [ ] [ ] [ ] [ ] [ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Letter To Builder For VATDocument5 pagesLetter To Builder For VATPrasadNo ratings yet

- LIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SDocument1 pageLIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SMohammad ShuaibNo ratings yet

- MD - Nasir Uddin CVDocument4 pagesMD - Nasir Uddin CVশুভবর্ণNo ratings yet

- Stacey Burke Trading - YouTubeDocument1 pageStacey Burke Trading - YouTubeddhx9vhqhkNo ratings yet

- IDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleaseDocument50 pagesIDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleasekinzaNo ratings yet

- Expertise in trade finance sales and distributionDocument4 pagesExpertise in trade finance sales and distributionGabriella Njoto WidjajaNo ratings yet

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDocument1 pageSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNo ratings yet

- SAVAYA The Martinez-Brothers PriceListDocument2 pagesSAVAYA The Martinez-Brothers PriceListnataliaNo ratings yet

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- Paper 5 PDFDocument529 pagesPaper 5 PDFTeddy BearNo ratings yet

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- Ba206 Quiz1 ch1 3 Answers 2007Document4 pagesBa206 Quiz1 ch1 3 Answers 2007Lonewolf BraggNo ratings yet

- Vault Guide To The Top Insurance EmployersDocument192 pagesVault Guide To The Top Insurance EmployersPatrick AdamsNo ratings yet

- 03-F05 Critical Task Analysis - DAMMAMDocument1 page03-F05 Critical Task Analysis - DAMMAMjawad khanNo ratings yet

- Deloitte Supply Chain Analytics WorkbookDocument0 pagesDeloitte Supply Chain Analytics Workbookneojawbreaker100% (1)

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- Evolution of Supply Chain ManagementDocument7 pagesEvolution of Supply Chain ManagementBryanNo ratings yet

- Cases in Civil ProcedureDocument3 pagesCases in Civil ProcedureJaayNo ratings yet

- GAO Report On Political To Career ConversionsDocument55 pagesGAO Report On Political To Career ConversionsJohn GrennanNo ratings yet

- PositioningDocument2 pagesPositioningKishan AndureNo ratings yet

- Global Marketing Test Bank ReviewDocument31 pagesGlobal Marketing Test Bank ReviewbabykintexNo ratings yet

- Credit Assessment On Agricultural LoansDocument84 pagesCredit Assessment On Agricultural LoansArun SavukarNo ratings yet

- 3m Fence DUPADocument4 pages3m Fence DUPAxipotNo ratings yet

- Emcee Script For TestimonialDocument2 pagesEmcee Script For TestimonialJohn Cagaanan100% (3)

- Chapter1 - Fundamental Principles of ValuationDocument21 pagesChapter1 - Fundamental Principles of ValuationだみNo ratings yet

- Parked Tank LayoutDocument1 pageParked Tank LayoutAZreen A. ZAwawiNo ratings yet

- QSP 7.1. Control of Personnel (Preview)Document3 pagesQSP 7.1. Control of Personnel (Preview)Centauri Business Group Inc.No ratings yet

- DPR Plastic Waste ManagementDocument224 pagesDPR Plastic Waste ManagementShaik Basha100% (2)

- IB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Document11 pagesIB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Pablo TorrecillaNo ratings yet