Professional Documents

Culture Documents

Copper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities Lower

Uploaded by

Nityanand GopalikaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities Lower

Uploaded by

Nityanand GopalikaCopyright:

Available Formats

Visit us at www.sharekhan.

com

September 20, 2011

Copper drops to 9 month low level on Europe Concerns

"Silver is a true supply and demand story. It is a very small industry, at just 900 million ounces or $40 billion a year, and we don't see silver supply substantially increasing. Meanwhile, fabrication eats up the majority of annual supply," Som Seif, chief executive of Claymore Investments Inc. This is a time of year when refineries cut back on imports because they are performing seasonal maintenance and they dont want to see their stocks balloon This trend should run through the end of the year, with only the small, incidental inventory gain over the next few months. Tim Evans, an energy analyst at Citi Futures Perspective in New York. CommoditiesCopper, crude oil lead commodities lower Copper Drops to 9-Month Low on Europe Concerns Oil Trades Near Three-Week Low on Signs of Weaker Global Demand Asia Currencies at Six-Month Low on Europe Woes, Growth Concern Fed Likely to Announce Operation Twist Easing, Economists Say Builders Probably Began Work on Fewer U.S. Houses in August Gold declines as US Dollar surges Chinas Stocks Rise From 14-Month Low; Commodity Producers Gain

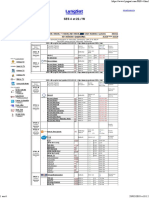

Europe WatchS&P Cuts Italy Rating on Weak Growth Outlook Date 9/19/11 9/19/11 9/20/11 9/20/11 9/20/11 9/20/11 9/20/11 Country - Region Euro Zone Euro Zone Germany Euro Zone Germany Euro Zone Germany Data Construction Output (MoM) Construction Output (YoY) Producer Prices (MoM) Producer Prices (YoY) Zew Survey (Current Situation) Zew Survey (Econ Sentiments) Zew Survey (Econ Sentiments) Period Jul Jul Aug Aug Sep Sep Sep -45 0% 5.8% 45 Survey Actual 1.4% 1.2% -0.3% 5.5% 43.6 -44.6 -43.3 Prior -1.8% -11.3% 0.7% 5.78% 53.5 -40 -37.6 Revised -1.3% -11.5%

Gold Will Finish 2011 at $2,000/Oz, Newmont CEO Says China Would Need to Be Insane to Buy Europe Debt: CLSAs Wood Greek Default Specter Leaves Germans With Bill S&P Cuts Italy Rating on Weak Growth Outlook Merkel Signals Shell Dodge Coalition Breakup FOMC meeting starts today German Sept. ZEW investor sentiment index falls European equities rise ignoring Italian downgrade All the commodities natural gas closed sharply lower yesterday as copper and crude oil led the decline in the complex. US Dow JIAI was down as much as 250 points before recovering to close around 100 points lower. Equities recovered on optimism Greece would get its next tranche of the bailout fund. Prime Minister George Papandreous government will hold another call with its main creditors. Finance Minister Evangelos Venizelos held substantive discussions with European Union and International Monetary Fund officials about securing a sixth installment of rescue funds. A second call will be held tonight. Greece has got enough funds to pull through October, however it would need funds thereafter to pay its public sector. The next rollover is due in December. Standard & Poors cut Italys credit rating, the countrys first downgrade in five years.

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai 400 042, Maharashtra. Tel: 022 - 61150000. BSE Cash-INB011073351; F&OINF011073351; NSE INB/INF231073330; CD - INE231073330; MCX Stock Exchange: CD - INE261073330 DP: NSDL-IN-DP-NSDL233-2003; CDSL-IN-DP-CDSL-271-2004; PMS INP000000662; Mutual Fund: ARN 20669. Sharekhan Commodities Pvt. Ltd.: MCX10080; (MCX/TCM/CORP/0425); NCDEX -00132; (NCDEX/TCM/CORP/0142)

sharekhan S&P lowered its rating last night to A from A+, saying that weakening economic growth, a fragile government and rising borrowing costs would make it difficult to reduce Europes second-biggest debt load. Italy follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries having their credit rating cut this year. Swiss Government Lowers Growth Forecasts The Swiss government lowered its economic-growth forecasts for this year and next, calling the franc still very highly valued after the central bank imposed a currency ceiling against the euro. Swiss gross domestic product will rise 1.9 percent this year and 0.9 percent in 2012, the State Secretariat for Economic Affairs in Bern said in statement today. In June, it had forecast the economy to expand 2.1 percent and 1.5 percent this year and next, respectively. Merkel Signals Shell Dodge Coalition Breakup German Chancellor Angela Merkel said shell hold the government together even after her coalition partner defied a call to stop talking down Greece and was flattened in a state election. We will continue our work as a government and I dont think its become more difficult, Merkel told reporters in Berlin yesterday. The coalition is on the job and we have a whole lot of tasks ahead. All coalition partners know what their task is and will pursue them with great diligence. German Sept. ZEW investor sentiment index falls - The ZEW economic sentiment index for Germany fell to minus 43.3 in September from minus 37.6 in August. The index, which is based on a survey of investment professionals, was forecast to fall to minus 45. The index measures investor expectations for the upcoming six months. The current conditions index remained in positive territory but fell 9.9 points to 43.6 in September. Fed officials will probably announce a new program for monetary easing tomorrow, according to economists in a Bloomberg News survey.

commodities buzz The Federal Open Market Committee will decide to replace short-term Treasuries in its $1.65 trillion portfolio with long- term bonds, according to 71 percent of 42 surveyed economists. The move, known as Operation Twist for its goal to bend the yield curve, will probably fail to reduce the 9.1 percent unemployment rate, 61 percent of the economists said. No QE3 and a possible pick up in short-term yields on operation twist would be supportive for the US Dollar. Market watchEuropean Stocks Climb European stocks climbed, erasing earlier losses, as technology and construction companies rose. Chinas stocks rose - China stocks rose, with the benchmark index climbing from a 14-month low, as investors speculated recent declines were overdone. Commodity producers gained. Our take We are likely to see a rebound in industrial commodities following a vicious sell-off. Traders could be a bit optimistic ahead of the US Fed meet. Bullions are likely to trade with a downward bias. Base metals summary Copper fell to nine-month low as it tumbled to $8323 level. US housing index fell short of expectation, which weighed on the metals like copper and aluminium, which have got extensive use in housing. Copper has been the worst performer in this sell-off as it is the only metal to make fresh cycle low. By looking at the rebound in the commodity producers and performance of the European and US equities, we are likely to see a rebound in the complex. That said industrial commodities are still vulnerable. AluminiumDown 1.68% LME 3-month aluminium closed with a loss of $40 at $2340. The light metal is likely to outperform in short-term on account least speculative premium and the fact that prices are close to cost of production.

US WatchTwo-day FOMC meeting starts today Date 9/19/11 9/20/11 9/20/11 9/20/11 9/20/11 Country - Region US US US US US Data NAHB Housing Market Index Housing Starts Housing starts (MoM) Building Permits Building Permits (MoM) Period Sep Aug Aug Aug Aug Survey 15 590K -2.3% 590K -1.8% Actual 14 Prior 15 604K -1.5% 597K -3.2% 601K Revised

For Private Circulation only

Commodity Buzz

September 20, 2011

sharekhan Support is seen at Rs 110.50/ Rs 109.30. Resistance is at Rs 111.90/ Rs 112.90. CopperDown 3.81% LME 3-month copper closed with a whooping loss of $332 at $8364. The red metal can test the support around Rs 398 in nearterm. Resistance is at Rs 409. NickelDown 2.48% LME 3-month nickel closed with a loss of $535 at $20975. Support is at Rs 1002/ Rs 985. Resistance is at Rs 1029/ Rs 1039. ZincDown 2.73% LME 3-month zinc closed with a loss of $59 at $2100. Zinc can fall sharply as LME inventories are quite high. Support is at Rs 100.50/ Rs 97. Resistance is at Rs 101.50/ Rs 103.20. LeadDown 2.70% LME 3-month lead closed with a loss of $64 at $2301. Tight spreads are prompting delivery ahead of the Third Wednesday. Huge deliveries show no major tightness in the market contrary to what is depicted by the cash-to3 month spread, thus lead can fall sharply if the markets lose confidence. Support is at Rs 111.50/ Rs 110. Resistance is at Rs 115.20. Precious metals summary The complex tumbled on stronger US Dollar as the Dollar Index rose 0.71%. Once again, the complex is highly volatile as gold traded in $60 range, while silver saw a swing of nearly $2. Weaker Rupee helped the complex cut losses. We are not expecting any major support to the complex from the ongoing Fed meeting. US Dollar looks like moving further higher, which is likely to reduce the appeal of the complex. Although Italian downgrade is supportive for the metals, we look for lower prices in short-term as equities might stabilize and the US Dollar remains firm. Overall, outlook remains bullish. GoldDown 1.79% Spot gold closed with a loss of $32.53 at $1778.85.

commodities buzz Newmont Mining CEO Richard OBrien says gold will finish 2011 at $2,000/oz., may reach $2,300/oz. in 2012, will average $1,950/oz. for next year. Franco-Nevada chairman Pierre Lassonde said Asia central bank buying will define gold over next 10-20 yrs. The price of gold should break $2,000 a troy ounce later this year, with sister metal silver following higher and breaking $50 an ounce as investment demand for bullion continues to grow, the chief executive of Claymore Investments Inc. said Monday. Speaking at the London Bullion Market Association's annual conference in Montreal, Som Seif said that while he sees gold extending its gains amid the current economic climate, he expects silver -- which benefits from both investment and industrial demand -- to outperform as investors continue to diversify into precious metals over the next three years or so. "Our view for gold to cross $2,000 an ounce this year. In that eventuality, silver would be above $50 an ounce, but we then see a silver price of $75 an ounce if not more" as investment demand drives an implied deficit in the market, Seif said. Seif said silver's longer-term supply and demand fundamentals should help it outpace gold, which is currently hovering just below fresh record highs. He says growing investment demand in silver is meanwhile creating a significant imbalance in the market. The silver market has continued to firm after a bumper 2010, when world investment in the metal rose by 40% to 279.3 million ounces, resulting in a net investment flow of $5.6 billion, almost double 2009's investment, according to the GFMS's World Silver Survey earlier this year. "[But] here's no room for it [investment in the market] like there is in gold," he said. While silver has traditionally been purchased for industrial and jewelry demand, it is increasingly been viewed as an alternate store of value as "all three major currencies [the U.S. dollar, the euro and the yen] are in a difficult period." At some point the markets will turn bearish on the precious metals -- although it is unlikely this will occur in the foreseeable future, Seif said. "The reality is that gold and silver will one day be the biggest shorts on this earth. But it won't be soon -- you would get very hurt doing something like that today," he added. (Dow Jones)

For Private Circulation only

Commodities Buzz

3 3

September 20, 2011

sharekhan Gold can decline to Rs 27000 level in near-term. Resistance is at Rs 28300. Silver Down 2.47% Spot silver closed with a loss of $1 at $39.66. Support is at Rs62900. Resistance is at Rs 65000. Energy Complex Summary The complex closed mixed as crude oil fell on demand concerns due to European Sovereign debt issues and lackluster US housing Index data. Natural gas rose on bargain hunting. Crude oil is still stuck in $75-$90 range. Spreads are tight as Brent trades in backwardation. We think that there is a possibility of the counter rising to $95 should the European concerns abate. Overall, we still look for a range trading in foreseeable future. Natural gas is likely to be sideways. Approaching winter should help the counter, however in short-term further correction is not ruled out. Crude oilDown 2.56% Crude oil closed with a loss of $2.26 at $85.70. U.S. crude oil supplies declined to an eight-month low as refineries cut deliveries with the start of a maintenance cycle, a Bloomberg News survey showed. Stockpiles fell 1.5 million barrels, or 0.4 percent, to 344.9 million in the seven days ended Sept. 16, according to the median of nine analyst estimates before a weekly Energy Department report tomorrow. It was the lowest level since Jan. 28.

commodities buzz Refineries idle units for work in September and October as demand for gasoline slows and before sales of heating oil rise. Companies have cut operating rates in September for the past nine years. Plants reduced operating rates in the previous three weeks, the longest stretch of reductions since January. Inventories have decreased during September in the past seven years. Stockpiles are down 7.3 percent since reaching a two-year high of 373.8 million barrels in the week ended May 27. Refinery margins as expressed by the so-called crack spread dropped 15 percent from a record $37.957 a barrel on Aug. 19 to $32.119 at the end of last week. The profit to process three barrels of oil into two barrels of gasoline and one of heating oil, based on New York futures prices, has averaged $21.546 in the past year. Inventories of distillate fuel, a category that includes heating oil and diesel, advanced 1 million barrels, or 0.6 percent, to 159.5 million barrels last week, the survey showed. Support is at Rs 4100. Resistance is at Rs 4225. Natural gasUp 0.52% Natural gas closed with a gain of $0.02 at $3.829. The northern and eastern U.S. will probably be cooler than normal from October to December, increasing natural gas consumption, according to a joint forecast by Weather Services International and Energy Security Analysis Inc. Support is at Rs 183/ Rs 180. Resistance is at Rs 189.

Home To know more about our products and services click here.

"This document has been prepared by Sharekhan Commodities Pvt. Ltd. and is intended only for the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, only For Private Circulationretransmission, or any other use is prohibited. Kindly note thatBuzz 4 does not constitute05,offer or solicitation for the purchase or sale of any financial instrument Commodities this document November an 2007 Home Next or as an official confirmation of any transaction. If you have received this in error, please contact the sender and delete the material immediately from your computer/mailbox. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may from time to time have positions in, or options on, and buy and sell securities Commodity other September 2008 Commodities Buzz 44 January 01, 20, 2011 referred to herein. We may from time to time solicit from, or perform investment banking, orBuzzservices for, any company mentioned. Any comments or statements made herein do not necessarily reflect those of Sharekhan Commodities Pvt. Ltd."

For Private Circulation only For Private Circulation only

You might also like

- Commodities Primer - RBS (2009)Document166 pagesCommodities Primer - RBS (2009)tacolebelNo ratings yet

- Portable IT Equipment PolicyDocument3 pagesPortable IT Equipment PolicyAiddie GhazlanNo ratings yet

- Week Summary: Macro StrategyDocument10 pagesWeek Summary: Macro StrategyNoel AndreottiNo ratings yet

- Tafseer: Surah NasrDocument9 pagesTafseer: Surah NasrIsraMubeenNo ratings yet

- Judicial Affidavit - Arselita AngayDocument6 pagesJudicial Affidavit - Arselita AngayJay-ArhNo ratings yet

- DefaultDocument2 pagesDefaultBADER AlnassriNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Base Metals Weekly - 03102011Document6 pagesBase Metals Weekly - 03102011luckydhruvNo ratings yet

- Daily Metals Newsletter - 01-29-16Document1 pageDaily Metals Newsletter - 01-29-16Jaeson Rian ParsonsNo ratings yet

- Buzz (Metal) Oct28 11Document3 pagesBuzz (Metal) Oct28 11Mishra Anand PrakashNo ratings yet

- International Commodities Evening Update, August 7 2013Document3 pagesInternational Commodities Evening Update, August 7 2013Angel BrokingNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Daily Metals and Energy Report October 22Document6 pagesDaily Metals and Energy Report October 22Angel BrokingNo ratings yet

- International Commodities Evening Update May 10 2013Document3 pagesInternational Commodities Evening Update May 10 2013Angel BrokingNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- International Commodities Evening Update, July 30 2013Document3 pagesInternational Commodities Evening Update, July 30 2013Angel BrokingNo ratings yet

- Morning Communique 13 December 2011: Key IndicesDocument4 pagesMorning Communique 13 December 2011: Key IndicesRony TriwardhanaNo ratings yet

- Standard Jan042012Document6 pagesStandard Jan042012Mohmad AnsaryNo ratings yet

- Daily Metals and Energy Report September 13Document6 pagesDaily Metals and Energy Report September 13Angel BrokingNo ratings yet

- International Commodities Evening Update July 25 2013Document3 pagesInternational Commodities Evening Update July 25 2013Angel BrokingNo ratings yet

- IBT Markets Outlook 31 January 2012Document3 pagesIBT Markets Outlook 31 January 2012Lawrence VillamarNo ratings yet

- International Commodities Evening Update July 18 2013Document3 pagesInternational Commodities Evening Update July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 27Document6 pagesDaily Metals and Energy Report September 27Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12Document6 pagesDaily Metals and Energy Report September 12Angel BrokingNo ratings yet

- International Commodities Evening Update, June 20 2013Document3 pagesInternational Commodities Evening Update, June 20 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, August 20 2013Document3 pagesInternational Commodities Evening Update, August 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report December 03Document6 pagesDaily Metals and Energy Report December 03Angel BrokingNo ratings yet

- Daily Metals and Energy Report November 9Document6 pagesDaily Metals and Energy Report November 9Angel BrokingNo ratings yet

- METALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsDocument3 pagesMETALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsLucas JangNo ratings yet

- Daily Metals and Energy Report October 11Document6 pagesDaily Metals and Energy Report October 11Angel BrokingNo ratings yet

- International Commodities Evening Update December 11Document3 pagesInternational Commodities Evening Update December 11Angel BrokingNo ratings yet

- MMR - June-15 PDFDocument20 pagesMMR - June-15 PDFBrahmpal BhardwajNo ratings yet

- 1/13/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesDocument1 page1/13/2016 - Good Morning From Chicago - : Learn More About Our Metals ServicesJaeson Rian ParsonsNo ratings yet

- Global Investor: Highlights of The International Arena: Executive SummaryDocument7 pagesGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisNo ratings yet

- International Commodities Evening Update December 3Document3 pagesInternational Commodities Evening Update December 3Angel BrokingNo ratings yet

- Goldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Document7 pagesGoldtrades - Info Your Gold Information Portal Daily Gold Report Know - Learn - Trade 1Muhammad Billal ButtNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- International Commodities Evening Update, May 30 2013Document3 pagesInternational Commodities Evening Update, May 30 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 10 2013Document3 pagesInternational Commodities Evening Update, July 10 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 29 2013Document3 pagesInternational Commodities Evening Update, July 29 2013Angel BrokingNo ratings yet

- International Commodities Evening Update November 16Document3 pagesInternational Commodities Evening Update November 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 11Document6 pagesDaily Metals and Energy Report September 11Angel BrokingNo ratings yet

- Currency Daily Report October 22Document4 pagesCurrency Daily Report October 22Angel BrokingNo ratings yet

- International Commodities Evening Update, July 24 2013Document3 pagesInternational Commodities Evening Update, July 24 2013Angel BrokingNo ratings yet

- Gold Public Monthly Commentary 2011 05Document3 pagesGold Public Monthly Commentary 2011 05Sara CostaNo ratings yet

- Daily Metals and Energy Report August 31Document6 pagesDaily Metals and Energy Report August 31Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28Document6 pagesDaily Metals and Energy Report August 28Angel BrokingNo ratings yet

- China'S Mixed Slowdown: KWH (BN) 230.5 250.5 BN MT KMDocument7 pagesChina'S Mixed Slowdown: KWH (BN) 230.5 250.5 BN MT KMfakepocNo ratings yet

- Daily Metals and Energy Report October 25Document6 pagesDaily Metals and Energy Report October 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 21Document6 pagesDaily Metals and Energy Report September 21Angel BrokingNo ratings yet

- Weekly CommentaryDocument3 pagesWeekly Commentaryapi-150779697No ratings yet

- Minerals and Metal Review July 2012 - 2Document20 pagesMinerals and Metal Review July 2012 - 2Sundaravaradhan IyengarNo ratings yet

- International Commodities Evening Update November 8Document3 pagesInternational Commodities Evening Update November 8Angel BrokingNo ratings yet

- International Commodities Evening Update, July 12 2013Document3 pagesInternational Commodities Evening Update, July 12 2013Angel BrokingNo ratings yet

- International Commodities Evening Update, July 15 2013Document3 pagesInternational Commodities Evening Update, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 25Document6 pagesDaily Metals and Energy Report September 25Angel BrokingNo ratings yet

- Gold: - A Commodity Like No OtherDocument6 pagesGold: - A Commodity Like No OtherVeeresh MenasigiNo ratings yet

- Daily Metals and Energy Report December 11Document6 pagesDaily Metals and Energy Report December 11Angel BrokingNo ratings yet

- International Commodities Evening Update, July 23 2013Document3 pagesInternational Commodities Evening Update, July 23 2013Angel BrokingNo ratings yet

- Digital Radiography: A-Si Array Detectors For Industrial ApplicationsDocument33 pagesDigital Radiography: A-Si Array Detectors For Industrial ApplicationsNityanand GopalikaNo ratings yet

- Greece Referendum News Weighs Down CommoditiesDocument5 pagesGreece Referendum News Weighs Down CommoditiesNityanand GopalikaNo ratings yet

- ChatLog Sharekhan Presents Free Workshop - Learn To Trade in Gold - Silver and Other Commodities 2011-09-15 17 - 57Document1 pageChatLog Sharekhan Presents Free Workshop - Learn To Trade in Gold - Silver and Other Commodities 2011-09-15 17 - 57Nityanand GopalikaNo ratings yet

- India Giant Appetite For Medical Imaging EquipmentDocument6 pagesIndia Giant Appetite For Medical Imaging EquipmentNityanand GopalikaNo ratings yet

- ChatLog Sharekhan Presents Free Workshop - Learn To Trade in Gold - Silver and Other Commodities 2011-09-15 17 - 57Document1 pageChatLog Sharekhan Presents Free Workshop - Learn To Trade in Gold - Silver and Other Commodities 2011-09-15 17 - 57Nityanand GopalikaNo ratings yet

- M Fitra Rezeqi - 30418007 - D3TgDocument6 pagesM Fitra Rezeqi - 30418007 - D3TgNugi AshterNo ratings yet

- Rebecca Sanchez Resume 2016Document2 pagesRebecca Sanchez Resume 2016api-311997473No ratings yet

- Open Book Contract Management GuidanceDocument56 pagesOpen Book Contract Management GuidanceRoberto AlvarezNo ratings yet

- A List of The Public NTP ServersDocument11 pagesA List of The Public NTP ServersavinashjirapureNo ratings yet

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarNo ratings yet

- SES 4 at 22. °W: Advertisements AdvertisementsDocument6 pagesSES 4 at 22. °W: Advertisements Advertisementsemmanuel danra10No ratings yet

- Delhi To AhmedabadDocument2 pagesDelhi To Ahmedabad02 Raihan Ahmedi 2997No ratings yet

- PDHONLINE - Google SearchDocument2 pagesPDHONLINE - Google SearchThanga PandiNo ratings yet

- Home / Publications / Questions and AnswersDocument81 pagesHome / Publications / Questions and AnswersMahmoudNo ratings yet

- Westernization of East Asia: Asian Civilizations II Jervy C. Briones Lecturer, Saint Anthony Mary Claret CollegeDocument29 pagesWesternization of East Asia: Asian Civilizations II Jervy C. Briones Lecturer, Saint Anthony Mary Claret CollegeNidas ConvanterNo ratings yet

- Mordheim - Cities of Gold Slann Warband: Tommy PunkDocument5 pagesMordheim - Cities of Gold Slann Warband: Tommy PunkArgel_Tal100% (1)

- B.ed SyllabusDocument9 pagesB.ed SyllabusbirukumarbscitNo ratings yet

- Introduction To Marketing - KotlerDocument35 pagesIntroduction To Marketing - KotlerRajesh Patro0% (1)

- Problem Set 1Document2 pagesProblem Set 1edhuguetNo ratings yet

- C - WEST SIDE STORY (Mambo) - Guitare 2Document1 pageC - WEST SIDE STORY (Mambo) - Guitare 2Giuseppe CrimiNo ratings yet

- Madhu Limaye Vs The State of Maharashtra On 31 October, 1977Document13 pagesMadhu Limaye Vs The State of Maharashtra On 31 October, 1977Nishant RanjanNo ratings yet

- Formation Burgos RefozarDocument10 pagesFormation Burgos RefozarJasmine ActaNo ratings yet

- Consejos y Recomendaciones para Viajar A Perú INGLESDocument3 pagesConsejos y Recomendaciones para Viajar A Perú INGLESvannia23No ratings yet

- THE-CLAT POST-March 2023 Final5284208Document123 pagesTHE-CLAT POST-March 2023 Final5284208Vedangi JalanNo ratings yet

- School Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementDocument2 pagesSchool Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementNeølie Abello LatúrnasNo ratings yet

- Introduction To NstpiiDocument15 pagesIntroduction To NstpiiSIJINo ratings yet

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDocument10 pagesMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyNo ratings yet

- Yasser ArafatDocument4 pagesYasser ArafatTanveer AhmadNo ratings yet

- Blockchain PaperDocument33 pagesBlockchain PaperAyeshas KhanNo ratings yet

- WT Unit IDocument69 pagesWT Unit ISreenivasulu reddyNo ratings yet

- Admission Fee VoucherDocument1 pageAdmission Fee VoucherAbdul QadeerNo ratings yet