Professional Documents

Culture Documents

Cfa Income Tax2 (Ch9)

Uploaded by

Shekar MenonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfa Income Tax2 (Ch9)

Uploaded by

Shekar MenonCopyright:

Available Formats

ACCOUNTING FOR INCOME TAXES

A. Scope and Principle

SFAS 109 refers to some differences between the amount of taxable income and pretax financial income for a year as temporary differences. This statement requires that assets and liability method be used in accounting and reporting for temporary differences. The measurement of current and deferred tax liabilities and assets is based on provisions of the enacted tax law. The effects of future changes in tax laws or rates are not anticipated.

B. Temporary and Permanent Differences

The circumstances that create an asset or a liability for deferred income taxes. - Accounting income measures the results of business operations in accordance with GAAP. Taxable income, on the other hand, measures the results of operations in accordance with the rules of tax law. So, the dollar amount of accounting income often differs from the amount of taxable income. The items causing this difference are classified as either permanent differences or temporary differences. Permanent difference - is an event that is recognized either in pretax financial income or in taxable income but never in the other. It does not result in a deferred tax asset or liability. Ex) State and municipal bond interest, Life insurance proceeds received on insurance policies for key executive Premiums paid for life insurance on officers when the enterprise is the beneficiary. Fines, penalties. Temporary differences - include differences that will result in taxable or deductible amounts in future years. a. Future deductible amount - warranty liability () subscriptions revenue received in advance () b. Future taxable amount - quicker depreciation for tax purpose () installment receivable for cash basis () Ex ) A corporation has pretax financial accounting(book) income of $146,000 in 1996. Additional information is as follows: 1. Municipal bond interest income is $35,000 2. Life insurance premium expense, where the corporation is the beneficiary, on books is $4,000. 3. Accelerated depreciation is used for tax purposes, while straight-line is used for books. Tax depreciation is $10,000; book depreciation is $5,000. 4. Estimated warranty expense of $500 is accrued for book purposes. When the tax rate is 30%, make an entry for income taxes Income tax expense 34,500 / Deferred tax asset 150 / Income tax payable 33,150 Deferred tax liability 1,500

C. Recognition and Measurement

Income tax expense = Income taxes payable + changes in deferred income taxes Enacted tax rate The tax rate that is used to measure deferred tax liabilities and deferred tax assets is the enacted tax rate(s) expected to apply to taxable income in the years that the liability is expected to be settled or the asset recovered. Ex) Bensons first year of operations is 1991. Benson has pretax financial income of $150,000 and taxable income of $50,000. Taxable income is expected in all future years. a. Tax rates enacted by the end of 1991 are as follows. 1991 40%, 1992 35%, 1993-1996 30%, 1997 25% b. Temporary differences existing at the end of 1991 are as follows. Installment sale difference (taxable in 1992) $30,000 Depreciation difference (taxable in 1993) 50,000 (taxable in 1994) 40,000 Estimated expenses (deductible in 1997) (20,000) Net temporary difference $100,000 Income tax expense Deferred tax asset 52,500 / Income tax payable 20,000 5,000 / Deferred tax liability 37,500

Valuation Allowances - Deferred tax assets are to be reduced by a valuation allowance if, based on the weight of available evidence, it is more likely than not (a likelihood of more than 50%) that some portion of all of the deferred tax assets will not be realized.

D. Additional Issues

Revision of future tax rates - The effect is reported as an adjustment to income tax expense in the period of the change Ex) Assume that on December 10, 1996, a new income tax act is signed into law that lowers the corporate tax rate from 40% to 35%, effective January 1,1998. If Hostel Co. has one temporary difference at the beginning of 1996 related to $3 million of excess tax depreciation and if they reverse $1 million dollar every year from 1997, what entry should be made at the end of 1996? Deferred tax liability 100,000 / Income tax expense 100,000

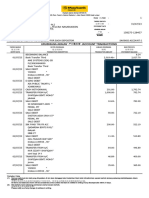

Loss Carryback and Loss Carryforward Year 1994 1995 1996 1997 1998 Taxable Income or Loss $75,000 50,000 100,000 200,000 (500,000) Tax Rate 30% 35% 30% 40% Tax paid $22,500 17,500 30,000 80,000 -0-

If the company decides to use 2 years loss carryback and loss carryforward, what journal entry will be appropriate?

Income tax refund receivable Benefit due to loss carryback Deferred tax asset Benefit due to loss carryback Operating loss before income taxes Income tax benefit Benefit due to loss carryback Benefit due to loss carryforward Net loss

110,000 110,000 80,000 80,000 $(500,000) $110,000 80,000 190,000 $(310,000)

Financial Statement Presentation a. Whether an item is current or noncurrent depends on the classification of the related asset or liability. b. If a deferred tax item is not related to an asset or liability for financial reporting, it is classified based on the expected reversal date of the temporary differences.(e.g. a loss carryforward) c. Current deferred tax assets and liabilities are netted. Noncurrent deferred tax assets and liabilities are also offset and shown as a single amount.

You might also like

- Game Option LauncherDocument1 pageGame Option LauncherShekar MenonNo ratings yet

- Battle Reload StatusDocument1 pageBattle Reload StatusShekar MenonNo ratings yet

- ReadmeDocument1 pageReadmeShekar MenonNo ratings yet

- ARTICLE - Evolutionary Decision Trees For Stock Index OptionDocument26 pagesARTICLE - Evolutionary Decision Trees For Stock Index OptionShekar MenonNo ratings yet

- ARTICLE - W. Clay Allen CFA - Technical Analysis For Long-TeDocument68 pagesARTICLE - W. Clay Allen CFA - Technical Analysis For Long-TeShekar Menon100% (1)

- Variability and Volatility in Financial MarketsDocument9 pagesVariability and Volatility in Financial MarketsShekar MenonNo ratings yet

- Guidelines For Financial Forecasting With Neural NetworksDocument6 pagesGuidelines For Financial Forecasting With Neural NetworksjspinsightNo ratings yet

- (Trading Ebook) Managing Global Financial Risk Using Currency Futures and Currency OptionsDocument16 pages(Trading Ebook) Managing Global Financial Risk Using Currency Futures and Currency OptionswillgabeNo ratings yet

- Trading Ebook - Stock-Market Patterns and Financial AnalysisDocument11 pagesTrading Ebook - Stock-Market Patterns and Financial Analysisapi-3798255No ratings yet

- ARTICLE - Inflation-Indexed Securities - Description and MarDocument35 pagesARTICLE - Inflation-Indexed Securities - Description and MarShekar MenonNo ratings yet

- ARTICLE - Evolutionary Decision Trees For Stock Index OptionDocument26 pagesARTICLE - Evolutionary Decision Trees For Stock Index OptionShekar MenonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax benefits non-profit organisations PakistanDocument4 pagesTax benefits non-profit organisations PakistanNoor ArfeenNo ratings yet

- GST Aftab 2.0Document76 pagesGST Aftab 2.0AFTAB PIRJADENo ratings yet

- LMT MercDocument128 pagesLMT MercCj GarciaNo ratings yet

- Online BankingDocument35 pagesOnline BankingShanzaiNo ratings yet

- SSN School of Management: Final Semester Project-Internship in The Mba ProgramDocument14 pagesSSN School of Management: Final Semester Project-Internship in The Mba ProgramSmart BalaNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument47 pagesMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- Financial Planning, Tools EtcDocument31 pagesFinancial Planning, Tools EtcEowyn DianaNo ratings yet

- TVOMDocument55 pagesTVOMSamson CottonNo ratings yet

- Paper 3 1 1Document7 pagesPaper 3 1 1api-593075882No ratings yet

- Intengan v. CA DigestDocument2 pagesIntengan v. CA DigestCaitlin KintanarNo ratings yet

- Baclays Bank Draft 250m Sell ProposalDocument1 pageBaclays Bank Draft 250m Sell ProposalbagalincurNo ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- Create Settlement Rules for Asset CapitalizationDocument18 pagesCreate Settlement Rules for Asset CapitalizationnguyencaohuyNo ratings yet

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38No ratings yet

- Guide To Retail Math Key Formulas PDFDocument1 pageGuide To Retail Math Key Formulas PDFYusuf KandemirNo ratings yet

- Valuation Report: Wilanow One ProjectDocument87 pagesValuation Report: Wilanow One ProjectVNNo ratings yet

- Lifo and Fifo MethodDocument12 pagesLifo and Fifo MethodSrinivas R. Khode67% (6)

- IRCTC Next Generation ETicketing SystemDocument1 pageIRCTC Next Generation ETicketing SystemsureshNo ratings yet

- HandoutDocument12 pagesHandoutDaniela AvelinoNo ratings yet

- Assessment of Effectiveness of Internal Control in Government MinistriesDocument11 pagesAssessment of Effectiveness of Internal Control in Government MinistriesRonnie Balleras Pagal100% (1)

- Prog AngDocument6 pagesProg AngZakaria ImoussatNo ratings yet

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Document16 pagesHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908No ratings yet

- Ge Capital Mar19-09 PresentationDocument88 pagesGe Capital Mar19-09 PresentationCarneades100% (2)

- Book Principles of Accounting PDFDocument268 pagesBook Principles of Accounting PDFYosuva JosuvaNo ratings yet

- Basics of CandleStick - SreeDocument22 pagesBasics of CandleStick - SreeManikanta SatishNo ratings yet

- Percentage Completion Revenue RecognitionDocument31 pagesPercentage Completion Revenue RecognitionGigo Kafare BinoNo ratings yet

- fm4 1 PDFDocument15 pagesfm4 1 PDFMansoor SheikhNo ratings yet

- SEC Amends FRB No. 6 on Deposits for Future Stock SubscriptionDocument5 pagesSEC Amends FRB No. 6 on Deposits for Future Stock SubscriptionAbraham GuiyabNo ratings yet

- Elliot Advisors 2020 Q1 LetterDocument10 pagesElliot Advisors 2020 Q1 LetterEdwin UcheNo ratings yet

- Lo Vs KJS Dacion en Pago. Existing CreditDocument1 pageLo Vs KJS Dacion en Pago. Existing CreditVen BuenaobraNo ratings yet