Professional Documents

Culture Documents

Business Organizations Rules Outline

Uploaded by

PeteChemaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Organizations Rules Outline

Uploaded by

PeteChemaCopyright:

Available Formats

I.

Business Organizations Rules Outline Types of Business Organizations A. Sole proprietorship: one person owns the business, one person manages the business, and one person conducts the business 1. BLD: A business in which one person owns all the assets, owes all the liabilities, and operates his/her personal capacity 2.Sole proprietorship can be incorporated. B. General partnership: 2 or more people plan to share profit/losses and share ownership/control. DO not need to file anything to get general partnership. 1. BLD: A partnership in which all partners participate fully in running the business and share equally in profits & losses (though the partners monetary contributions may vary) C. Limited partnership (LP): Need to file form with Secretary of State stating that you intend to form LP. 1. BLD: A partnership composed on one or more persons who control the business and are personally liable for the partnerships debts (called general partners), and one or more persons who contribute capital and share profits but who cannot manage the business and are liable only for the amt of their contribution (called limited partners). a. General partner can be corp or real person 2. Characteristics: a. Investors have limited liability. Limited partner will not lose his/her personal assets but, instead, will lose the persons investment into corp. b. Need at least 1 general partner, who agrees to incur personal liability. D. Limited Liability Partnership (LLP): Need to file a form with Secretary of State stating that u intend to form LLP. (LLP is growing form of bus org) 1. Difference b/w LLP & LP: NO general partner is need for LLP, but is required for LP. Partners in LLP are limited partners 2. Advantage that LP has over LLP: More established law dealing with LP, so u know the roles and responsibilities of LP more clearly than with LLP. E. Corporations: are artificial creations that are formed to make money for the people who own the corp. Corporations form to avoid liability 1. BLD of corporation: An entity (usually a business) having authority under law to act as a single person distinct from the shareholders who own it and having rights to issue stock and exist indefinitely 2. Corporation is a separate person (stemmed from 14th A DPC) a. People apply for a charter to get corp & that corp acts legally as a person. When corp goes for charter, it is state that gives corp power; thus, people of US are ones giving corps power they hold. After filing, corp will get certificate of incorporation. Then, 1st organizational meeting will be held & Bd of Directors will appoint officers & draft constitution establishing internal relationships with Bd of Directors & shareholders & internal relationship with Bd of Directors & officers, & other rules, such as how many bd of directors, how often will bd of directors meet, etc. b. Corps can borrow $, can sue in ct, can enter Ks, own prop b/c corp is a separate person. c. Corp is special person b/c corp is ONLY designed to make profits for shareholders. 3. 4 characteristics of corporations (Corps MUST have ALL 4 characteristics to be corp) a. Limited liability: Shareholders have limited liability, which means that shareholders are ONLY liable to extent that he/she invested w/in corp. Shareholders are NOT held personally liable in breach of K or tort cases. b. Free transferability of shares: shares are freely transferable; this means there is a market for transferring of the shares. i. 2 situations where corporate shares are NOT completely transferable: 1

II.

III.

1.If there is a small closely held corp, there would be no market for these shares AND 2.If P holds shares that are not profitable, but could have been profitable if corp was run better. (remember: Board of Directors manages corp-> centralization of management). c. Continuity of existence: NO matter what happens, corp will continue to exist until it is orally dissolved and state corp law provides for process of dissolution. i. Thus, even if there is a small corp with one person and that one person dies, the corp will continue to exist because the corporation, itself, is an individual person. Death of owners/shareholders does NOT terminate entity, since shares can be transferred. d. Idea of centralized management: NOT everybody gets to manage corp & management of corp is centralized. Management is centralized with officers & directors. Each is charged by law with specific duties to corp & its shareholders 4. Doc of birth for corp: article of incorporation 5.Once corp is born, doc called bylaws is drafted which governing rights of parties 6.People who invest in corp=shareholders 7.Interest investors purchase in corp=stock F. Limited Liability Company (LLC): new bus org that is a limited company (most comparable to corp) 1. LLC investor=member. Members have limited liability (liable only to the extent of percentage of interest in company) 2. LLC provides limited partners with limited liability & 1 person is elected as general partner, who will incur personal liability. a. Note: General partner can either be real person or corp 3. LLC may have 2 characteristics of corporation BUT NO more than 2 of these characteristics. This, LLC can have: a. Limited liability only b. Limited liability + free transferability of shares c. Limited liability + continuity of existence d. Limited liability + idea of centralized management 4.Doc of birth for LLC: article of organization 5. Once LLC is born, doc called operating agreement is drafted which governing rights of parties. 6.People who invest in LLCs= members 7.Interest investors purchase in LLC=LLC interest 8.Types of LLC a. Manager managed LLC: have bd of managers who does management. Management is centralized as does corp. Most analogous to corps. b. Member managed LLC: Most analogous to general partnership. Each member can participate in management. Types of sectors A. Public sector: government B. Private sector: companies 1.Private sector within private sector=public corporation a. Public corporation is a type of corporation where the shares are sold amongst the public and has public shareholders. Public corps are part of the private sectors. Terminology A. Insiders: work for corp & serve as directors 1. Inside directors: serve on bd and work for bd as officers B. Outsiders are bd members but do NOT work for co 1. Outside directors: ONLY serve on bd and do NOT work for corp (NOT officers). NOT all outside directors are independent. Might have outside director that does bus with corp or 2

IV.

serves as consultant. If there is some relationship b/w corp and outside director, then not independent C. Independent: No relationship with co D. Interested: Interested is more narrow than independent. Asks: Does this person have financial interest in the transaction 1. Self interest: direct financial interest or control E. Leverage buyout: a purchase of co financed by relatively small amt of equity (common stock) & large amt of debt, which provides leverage. Often, assets of co are sold to pay off part of debt. F. Market value of co: price of each share of stock G. Stock: equity in co. Stockholder is ONLY paid when co makes profit. Interest depends on future of co. 1. Different classes of stock: Class A stock will have certain rights that favor Class A stock over Class B stock. H. Notes & bonds: promises to the corp where they agree to give specific amt of money at specific date. Bond diametrically opposes the idea of equity & stock. Notes & bonds are a kind of debt. I. Preferred Stock: hybrid of equity & debt. Once co is dissolved & upon that liquidation, debt holders are paid first, then preferred stockholder, and lastly, common stockholders are paid. Preferred stockholders are still NOT debt holders. Stockholder w/ preferred stock is preferred over common shareholder/stockholder, but NOT as preferred as debt holders. 1. Ex: preferred stockholders in Benihana case 2.Preferred stockholders do NOT usually have voting rights unless something happened, such as they have not been paid dividends from time after time. Sometimes, terms will allow preferred to gain voting rights. 3.Preferred shareholders receive income in form of dividends. J. Common stockholder: shareholders typically with the voting rights. Common stockholders are the last ones to receive assets/funds from liquidation. K. Conversion: Idea that one security can be exchanged for another, i.e., common stock for another co. Most instances convertible bond or convertible preferred share is convertible in same stock of same co. 1. Act of conversion: decision to be made of holder of stock/bond that is convertible (when & where to convert) 2. Terms of what is to be converted: set at time that convertible security was issued. L. Redemption: right of co to re-purchase its own shares or call shares in. 1.Co has right of redemption. M. 2 types of options: 1. Puts: right to sell security 2. Call: right to buy security N. Closely held corporations: 1 primary reason for investing in closely held corp to work for co & to get return on investment. Dividends might not be issue in closely held corp. As long as person works for co, then dividends might not be issue because that person would be getting salary (get return on investment because they are getting earnings in return). 1. Problem with closely held corps: investors know each other. By definition, investors are not on exchange (market is only for publicly held co). Thus, in publicly held co, they can buy & sell shares BUT no one in closely held co buys & sells shares O. Book value: accounting net worth of corp, divided by number of shares outstanding (seen in Jordan case) Nature and Purpose of Corporation A. 4 characteristics of corp: (look above) 1.Limited liability 2.Free transferability of shares 3

3.Continuity of existence 4.Idea of centralized management B. Types of people involved in corp 1. Shareholders: person who invests in corp (holds/owns share(s)) a. Equity: As shareholder, shareholder has equity in corp. Shareholder will ONLY benefit if corp is successful. b. Shareholders elect the directors as decision makers for corps (decisions supposed to be in best interest of corp NOT individual interest of directors). 2. Board of Directors: ultimate managers of the corp; set policies, monitor compliance of laws, responsible for big decisions of co, responsible for identifying & appointing officers, who operate corp from day to day a. BLD: The governing body of corp, elected by the shareholders to establish corporate policy, appoint executive officers, and make major business and financial decisions 3. Officers: people operating/monitoring day to day operations of corp a. BLD: A person elected or appointed by the Board of Directors to manage the daily operations of a corp, such as a CEO, president, secretary, or treasurer 4. What about employees who work for corp or consumers or suppliers or creditors? 2 views: a. 1st view: Corporation includes 3 constituents; these include officers, board of directors, & shareholders. This is called contractarianism. b. 2nd view: Corp includes 3 constituents, but also need to include creditors, consumers, suppliers, and employees Officers and directors make decisions & these decisions impact non-shareholder group. This is called communitarianism: corps cannot operate without non-shareholder groups (employees, consumers, suppliers, and creditors). i. 1 argument is that one way to maximize profits is to practice communiatrianism. If u do well by these non-shareholder groups by treating them well, in long run, it will be good for shareholders. c. RULE: Corp may consider all those affected, including non-shareholder groups, but must ultimately serve needs of shareholders (most maximize shareholders profits). C. Role and Purpose of corp: To maximize profit/wealth of shareholders. 1.Managers (bd of directors) manage corp in best interests of corp & shareholders in order to maximize profits. 2. Corp is allowed to make charitable donations but limited to reasonable contributions AND need to be in best interest of corp AND CANNOT be pet charity or pet donation or donation that is made b/c CEO believes in this org (A.P. Smith Mfg Co v. Barlow (NJ case)). a. 1 of power of corps=power to make donations b. Charitable donations benefit corps b/c companies make donation in order to promote good will (public relations-> corps name gets out); AND presuming charities are good for US, then donating to charities is good thing for US & corp benefits b/c corp is a citizen of US (Corp benefits when country benefits). i. Thus, by donating $, corp as citizen of US is promoting US to be better society c. Shareholders position in opposition of charitable donation in A.P. Smith Mfg Co: Elephant bumping: fundraiser for corp always takes an elephant with him when fundraiser goes to call on another elephant. And soliciting elephant, as fundraiser goes though little pitch, nods and receiving elephant listens attentively, and as long as visiting elephant is appropriate large, then fundraiser gets $$. i. Note: $ that these CEOS is donating to charities is not coming out of their pockets b/c if it would be an individual CEOs donation &NOT from corp. Need to make corp look good, so donation comes from corp to promote corps rep NOT individual CEOs rep. 4

d. Different state laws for charitable donations: Basic rule of corporate choice of law in all states is that the law of the state corp controls on issues relating to corps internal affairs. i. DE statute: Every corp created under this chapter shall have the power to . . . (9) Make donation for the public welfare or for charitable, scientific or educational purposes, and in time of war or other national emergency in aid thereof . . . . 1. DE statue states that charitable donations are OK BUT statute does NOT say anything about charitable donation having to benefit corp in addition to benefitting beneficiary. ii. C/L: A.P. Smith Mfg Co case provides C/L rule that charitable donation has to have benefit for corp; cannot be pet donation; and needs to be reasonable donation. iii. NY: general powers of corps, the power to make donations, irrespective of corporate benefit, for the public welfare or for community fund, hospital, charitable, educational, scientific, civic or similar purposes, and in time of war or other national emergency in aid thereof. a. NY statute states that corp can make charitable benefit, but dont care about corp benefit iv. CA: gives corps the power to make donations, regardless of specific corporate benefit, for the public welfare or for community fund, hospital, charitable, educational, scientific, civic or similar purposes. a. CA statute states that corp can make charitable benefit, but dont care about corp benefit. v. PA statute: provides, as part of its rules on duties of directors, that directors may, in considering the best interests of the corp, consider the effects of their actions on any or all groups affected by such actions, including shareholders, employees, suppliers, customers and creditors of the corp, and upon communities in which offices or other establishments of the corp are located. This provision then goes further by providing that the directors shall NOT be required, in considering the best interests of the corp or the effects of any action, to regard any corporate interest or interests of any particular group affected by such action as dominant or controlling interest or factor. a. PA statute says when considering whether to close the factory, may also consider the interests of corp and the non-shareholders, such as employees, suppliers, creditors, and consumers. This is communitarianism view. 3. Deference of judges: judges are not bus experts, cts are going to defer to a controlling shareholder, bd of directors, & officers b/c they are the bus experts. Ct will NOT interfere with bus decisions UNLESS issue deals with something shareholders were receiving from start of corp, such as special dividends (as seen in Dodge v. Ford Motor Co (Mich case)). a. Note: Usually decision about dividends is up to bd of directors, NOT ct. But, here Dodge trying to prohibit Ford brothers from profiting from Ford via special dividends and using these special dividends for Dodge company competing with Ford. b. RULE: Bd of directors alone has power to declare a dividend and to determine its amount, cts will defer to bus judgment of bd of directors unless decision seems capricious or arbitrary, as seen with special dividends in Dodge v. Ford Motor Co. c. Business Judgment Rule: Cts will not substitute their judgment for bd of directors; it will defer unless fraud, illegality or conflict of interest is shown (rule cited in Shlensky v. Wrigley (Ill case)). (Ct in Shlensky stated tat Wrigley did NOT breach fiduciary duty b/c there was no fraud, illegality, or conflict of interest). d. Rule: when P, minority shareholder, is arguing that judgment of director is bad, need concrete ev/facts to show that with installation of Ps idea, shareholders wealth would be maximized. i. For ex, Shlensky did not present concrete ev/facts to show that installation of lights on the baseball field would have been profitable. P here should have forced D to present 5

ev that only having day games was profitable; and this would have shown that Wrigley failed to analyze that having only day games was profitable & in best interests of corp; this would have shown breach of Wrigleys fiduciary duty. e. Note: Both Dodge and Wrigley did not care about maximization of shareholders profits. f. Two Standards of Evaluation of the bus judgment rule: i. Dodge subjective state of mind of CEO considered ii. Schlensky look at objective reality of circumstances. 1. Ex of Schlensky objective reality, hypo on pg 8: if u treat consumers & employees well, that is better for long-term financial interest of shareholders & corp D. Promoters and Corporate Entity: deals with Ks entered into before incorporation of corp. 1. In Southern-Gulf Marine Co No. 9, Inc. v. Camcraft, Inc. (La case), K for sale of vessel had been signed by Mr. Dudley Brown, as Pres of Camcraft, Inc. and by Mr. D.W. Barrett, both individually and as Pres of SGM b/c SGM was NOT incorporated at time K was made. B/c value of vessel had gone up, ct decided as matter of equity that SGM should win. a. If parties enter a K before corp has formally been formed, then the parties may still be treated as corp as a matter of equity. B/c Camcraft acted as if they were dealing with a corp, would not be allowed to get out of it for technicality. Thus, there are equity principles for Ks that occur pre-incorporation. b. When P enters into K with corp; need to make sure that corp exists and make sure that corp has enough capital to cover a judgment (if the corp does NOT have enough capital, then u need to get a written personal guarantee that P can recover by holding account person personally liable) c. If corp is NOT incorporated at time K was made, then enter into the K, but ask to hold person personally liable. Then, once corp is properly formed & incorporated, then personal liability is terminated & corp becomes liable. 2.Important Rules: a. RULE: If it can be shown that there is a de facto corp or corp by estoppel, shareholder is granted limited liability and corporate veil will apply. b. RULE: Promoter owes fiduciary duty to Corp 3.Types of corporations a. De jure corp: corp organized under laws of particular state. i. De jure corp: A corp that has complied strictly with all of the mandatory provisions for incorporation CANNOT be attached by any party (even the state). b. De facto corp: corp that is not formed pursuant to any law, but ct treats entity as corp b/c of facts and circumstances. i. When applying de facto corp, need to look at facts at perspective of organizer of promoters (in SGM case, it was SGM); what were the organizers thinking. ii. To become a de factor corp, need to ask: 1.Whether organizer (Barrett of SGM here) had legal right to incorporate entity (for ex, there is no legal right to incorporate if corp will be involved in illegal activity); 2. Organizer needs to show that organizer made a good faith effort to incorporate; and 3.Organizer acted as though the corp was a corp all along 4. Applied to SGM case, Barrett did all 3 & corp could have been considered a de facto corp. c. Corporation by estoppels doctrine: Person who contracts w/entity he treats as corp is estopped from denying corp existence later i. When a corp is NOT given de jure or even de facto status, its existence as a corp may be attacked by any 3rd party. However, there are situations where cts will hold that attacking party is estopped to treat the entity as other than a corp. 6

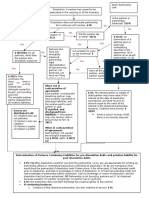

When applying doctrine of corp by estoppel, need to look at facts from perspective dealing w/ entity that did not incorporate correctly (in SGM case, it would be Camcraft) iii. Need to ask: 1. Person dealing with corp thought it was dealing with corp all along (in SGM case, Camcraft acted as if it was working with corp all along); and 2. If person dealing with corp is allowed to argue that it is a not a de jure corp, then that person would be enjoined a benefit/windfall. In SGM case, Camcraft would earn a windfall/benefit b/c it would sell vessel at higher price (value of vessel had gone up during transaction) 3. In SGM case, this is why Camcraft had been stopped from arguing that SGMA was not a de jure corp & SGM could not get out of K. d. Objective of de facto corp & corp by estoppel is the same. Objective is to argue that, even though corp is not de jure corp, corp might still be considered a corp under either de facto corp doctrine or corp by estoppel doctrine. i. Legal significance: Ultimate objective is to establish limited liability. When shareholder invests in corp, shareholder will only incur limited liability to that persons investment in corp & will NOT be held personally liable, meaning that personal assets are protected. e. Note: Do not need to establish de facto corp 1st to apply corp by estoppel doctrine f. Note: One does NOT need both de facto corp & corp by estoppels. E. Corporate Entity and Limited Liability 1. Business Diagram: circles are for flesh and blood individuals, squares are for corp. 2. Piercing corporate veil (aka alter ego): P is suing individual shareholder individually & holding shareholder personally liable. Piercing the corporate veil destroys vertical boundaries. Once these boundaries are pierced, then P can reach D individually for personal liability. When the ct holds that shareholder is personally liable, then P has pierced corporate veil. a. Ex of piercing corporate veil case=Walkovsky v. Carlton (NY case) i. Ct held that Cartlon did NOT operate in its individual capacity & P failed to prove that Carlton used these companies as alter egos (did not pierce corporate veil) or for his personal purposes . Here, Carlton observed corporate formalities; reason why P lost. ii. Inadequate insurance and assets are not enough to pierce corporate veil. And NO fraud was found in Walkovsky case. iii. Note: Carlton did not sue under enterprise liability. b. BLD: The judicial act of imposing personal liability on o/w immune corporate officers, directors, or shareholders for the corps wrongful acts. c. Piercing corporate veil is an equity concept. Fraud or promote injustice is element to prove piercing corporate veil. d. If P pierces corporate veil, then P becomes shareholder /stockholder in the other corps owned by D shareholder (meaning P now has stocks in those corps. As a shareholder, P would ONLY benefit if companies make profits. e. Piercing corporate veil is an exception to limited liability. f. NY: i. In NY, to pierce the corporate veil, need to prove fraud or some injustice. In vast majority of cts, need to prove fraud to pierce corporate veil. ii. In NY, P may be able to pierce the corporate veil if individual does NOT follow corporate formalities. i. decisions are being made for their benefit and NOT the entitys.

ii.

g. Undercapitalization: Prime condition for piercing exists when corp is undercapitalized given liabilities, debts, & risk it reasonably could be expected to incur. Walkovszky case: ex showing that liability insurance as ev of undercapitalization. h. Two part test for piercing corporate veil from Sea Land Services, Inc. v. Pepper Source (Illinois test BUT most jurisdictions apply this 2 part test) (Van Dorn test): i. First, there must be such unity of interest & ownership that the separate personalities of corp & individual [or other corp] no longer exist (unity of interest & ownership b/w individual shareholder (In Sea-Land case, Marchese) and the corp who breached K (In Sea-Land case, Pepper Source)). This has to be shown by P; AND ii. Second, circumstances must be such that adherence to the fiction of separate corporate existence would sanction a fraud or promote injustice (showing of piercing the corporate veil would show a fraud or promote injustice). P must prove this. iii. P MUST show both prongs. iv. If have strong case of unity of interest and ownership can overcome a weak argument of fraud and vice versa. In practical matter, the factors all overlap. v. To show #1: there are 4 factors (for determining whether a corp is so controlled by another to justify disregarding their separate entities): 1.The failure to maintain adequate corporate records or to comply with corporate formalities (complying with corporate formalities); 2.The commingling of funds or assets (commingling of funds b/w the individual shareholders and the corp being sued); 3.Undercapitalization; AND 4.One corp treating the assets of another cop as its own (If there is more than 1 co is owned by individual whose personal assets at risk, has that individual shuffled funds among these co) 5.Note: DO NOT need to prove all 4. The more proven, the stronger the argument. vi. To show #2: P MUST prevent evidence of such wrong (fraud or injustice). 1. Unsatisfied judgment is NOT enough to show fraud or injustice to pierce corporate veil. These Ps are coming to ct b/c of the unsatisfied judgment. Fraud & injustice is much more than an unsatisfied judgment. i. Alter ego theory makes a parent liable for actions of a subsidiary, which it controls, but it does NOT mean that where a parent controls several subsidiaries, each subsidiary then become sliable for the actions of all other subsidiaries. There is NO respondent superior b/w subagents. (from Roman Catholic Archbishop of San Francisco v. Sheffield (CA case)) i. Thus, if there is parent co that owns more than 1 subsidiary, it does not mean that other subsidiaries will be liable even if 1 subsidiary is liable under piercing corporate veil. ii. Remember: Even if parent corp would be liable if 1 of those subsidiaries is liable, piercing corp does not get to assets to subsidiaries, Ps need to argue reverse piercing or enterprise liability. j. Note: When talking about piercing corporate veil, been talking about small closely held corp. Enron was large publicly held co. The veil of a large publicly held co is NEVER pierced. Piercing corporate veil ONLY occurs when dealing w/ closely held co. i. In bankruptcy, shareholders get NOTHING. Any of funds raised on liquidation goes to creditors, NOT shareholders. k. Whether issue of veil-piercing can be resolved by SJ: Ct in In re Silicone Gel Breast Implants Products Liability (Alabama case) held yes. Ordinarily, fact-intensive nature of issue will require that it be resolved only through a trial. SJ can be proper if ev presented could lead to but 1 result. 8

Ct in In re Silicone Gel Breast Implants Products Liability held that need to look at totality of circumstances in determining whether a subsidiary may be found to be the alter ego or mere instrumentality of parent corp. Ct listed factors to consider; these include: (the 1st 5 apply to any parent-subsidiary relationship) 1.Whether parent and subsidiary have common directors or officers 2.Whether parent and subsidiary have common bus depts. 3.Whether parent & subsidiary file consolidated financial statements & tax returns 4.Whether parent finances subsidiary 5.Whether parent caused incorporation of subsidiary 6.Whether subsidiary operates with grossly inadequate capital 7.Whether parent pays the salaries and other expenses of subsidiary 8.Whether subsidiary receives no bus except that given to it by parent 9.Whether parent uses subsidiarys prop as its own 10. Whether daily operations of 2 corps are NOT kept separate 11. Whether subsidiary does not observe basic corporate formalities, such as keeping separate books and records and holding shareholder and bd meetings. 3.Reverse piercing: a. Ex case arguing first piercing corporate veil and then reverse piercing=Sea-Land Services, Inc. v. Pepper Source i. Ct held that SeaLand (P) won. Corporate veil was pierced. 4 factors applied: 1. No corporate formalities (no meetings); 2. Commingling of funds-> M used corporate funds for personal needs; 3. PS has no assets; 4. M did shuffle funds 1. Note: 1 bank account, 1 office would show enterprise liability NOT piercing the corporate veil. b. Once P pierces corporate veil to impose liability on D shareholder, then P could argue reverse piercing. In reverse piercing, P can get to assets of other corps. P is treated as a creditor in reverse piercing and NOT as a stock holder. 1st people to get paid when companies make money are the creditors. If u hold a debt (a creditor of company), u have a promise to be paid a speicic amt of money in some pt of the future. c. In order to show reverse piercing of other cos veils, need to apply 2 part test of Van Dorn in the perspective of other 3 companies. i. Note: CANNOT argue piercing the corporate veil and then argue enterprise liability. d. Note: Reverse piercing and piercing corporate veil show a difference b/w equity & debt. 4. Enterprise Liability: when sole shareholder fails to treat all corps as separate companies, but instead, treats them all as 1 enterprise. NEED to show fraud. a. If P wins, all corps are then liable under enterprise liability. b. Enterprise liability destroys the horizontal boundaries and allows P to get to assets of all the corps BUT not the personal assets of D, sole shareholder. c. Enterprise liability is an equity concept. d. NY: P needs to show fraud to prove enterprise liability. Vast majority of cts have this rule. e. Argument: Under enterprise liability, shareholder treated all corps as 1. f. Note: P could have argued enterprise liability instead of piercing corporate veil & reverse piercing in Sea-Land Services v. Pepper Source. g. Question: Does P become creditor in enterprise liability like in reverse piercing? i. NO. In reverse piercing, need to pierce corporate veil. Once the corporate veil is pierced, then P can hold D personally liable. Once that happens, P becomes creditor and then reverse piercing can be applied. BUT, in enterprise liability, P never becomes creditor. Applying different analysis for enterprise liability. For enterprise 9

i.

liability, need to determine whether several corps are being run as 1 co, if that is happening, then Ps can reach assets. 5. Agency theory: P would have to establish that D as master/principal controls that co so much that he used this co to further his own business. Whether D treated co as an agent. a. If P is able to satisfy agent theory, then P can get to personal assets of D shareholder. 6. Difference b/w piercing the corporate veil, enterprise liability, & agency theory: The language used to get to the result is different. Result of piercing the veil and agency theory leads to the same result (P reaches the shareholders assets), BUT enterprise liability gets a different result (P reaches the assets of corps owned by the shareholder). Enterprise liability and reverse piercing get to the same result. 7. There might be differences depending on who the creditor is (either tort or K creditor). For ex, Walkovszky was a tort creditor, while Marchese in SeaLand case was a K creditor. Difference b/w K and tort creditors is that K creditor gets to research/investigate the credit of the borrower, and if K is breached, it will be limited to the assets of the corp (should have known that there were not enough assets in the borrowers corp). In addition, K creditor can ask for certain thing s to ensure that creditor will be paid (ask for personal guarantee on the debt from the borrower). If tort creditor, will only get the money of the corp, if corp has enough assets. If they do not have enough assets to cover the suit, it seems as if the D is unjustly enriched as opposed to the K creditors. a. Some factors matter more & which factors matter more differ w/ who creditor is (K or tort creditor): i. For tort creditor, need to emphasize as lawyer, most relevant that company was undercapitalized. That argument would not work as much for K creditor b/c he assumed the risk in making that K with borrower 1. Argument: Was company adequately capitalized? Would also have to apply piercing corporate veil test. Ask whether there was a unity of interest of ownership & interest. Would it sanction fraud or injustice. Would look at all factors, but would emphasize other aspects, i.e., capitalization that would weigh much more heavily than in a K case. ii. For K creditor, need to emphasize corporate formalities. Fraud aspect is also very relevant for K creditors. Ask whether borrower is going to breach K or not (will have to investigate creditor worthiness of borrower-> what prop does borrower own). 1.If there is no fraud & K creditor entered into K, then creditor assumed risk that borrower would NOT repay loan. 2. Major difference b/w tort and K cases is that in K cases, P had an opportunity in advance to investigate financial resources of corp and had then chosen to do bus w/ it. Thus, in K cases, intention of parties & knowledge of risks assumed in entering into K are factors to be assessed in making determination as to whether corporate veil should be pierced. iii. In re Silicone Gel Breast Implants Products Liability articulates difference b/w tort & K case. 1st thing need to do is determine whether creditor is K or tort creditor. 8. Parent corporation v. Subsidiary: A corporation owns all shares of common stock of another corp. 1st corp is generally referred to as parent corporation and 2nd as subsidiary. Parent corp is any co that owns 50% or more of the voting share of the subsidiary, which is what the other co is called. a. Why would parent choose this form of org rather than simply run all its activities out of a single corp w/ divisions for separate activities? One reason is generally the parent, like any other shareholder, is not liable for the debts of the subsidiary, so parent can undertake an activity without putting at risk its own assets, beyond those it decides to commit to the subsidiary. Like an individual shareholder, however, a corporate shareholder must be aware of the danger that if it is not careful, the creditors of the subsidiary may be able to 10

pierce the corporate veil of the subsidiary. The parent must also be careful not to become directly liable by virtue of its participation in the activities of the subsidiary. 9. General Partners v. Limited partners: (Frigidiare Sales Corp v. Union Properties, Inc. (Wash case) dealt w/ this & talked about role differentiation & importance of following corporate formalities) a. General partners: personally liable for any debts that partnership has. K/Tort creditor can go after not only assets of partnership, but also personal assets of partner i. RULE: General partner is personally liable, jointly or severarlly, for debts of partnership b. Limited partners: have at least 1 general partner (personally liable) and rest of partners enjoy limited liability. Would confer limited liability to partners, but would also allow for tort/K claimer to be able to look towards personal assets of one of members of partnership (general partner). c. Rule: Once a limited partner engages in management of partnership, limited partner becomes a general partner, which means he/she no longer enjoys limited liability, but can be held personally liable. i. RULE: Limited partners are not personally liable, but may become liable if engage in management of partnership; only limited as long as they are passive ii. Note: All states now allow general partner to be a corp. Rules have been put in place so that no flesh and blood person would be personally liable. iii. Note: Every limited partnership must have at least one general partner F. Shareholder Derivative Actions (Procedural aspect of Derivative Suit) 1.Direct v. Derivative suits: a. Direct suit: suit where shareholder suffering direct harm. harm is to shareholder, him/herself NOT to corp. i. BLD: A lawsuit to enforce a shareholders rights against a corp. ii. Ex of direct suits: class action and individual action iii. Ex of direct suit: Eisenberg v. Flying Tiger Line. Inc., where NY ct held that voting right is about harm to shareholder himself NOT corp. iv. Abdication claim is direct suit according to ct in Grimes v. Donald b. Derivative suit: suit where shareholders are indirectly harmed, it was corp that was directly harmed. Harm is to corp. i. BLD: A suit by a beneficiary of a fiduciary to enforce a right belonging to the fiduciary; esp., a suit asserted by a shareholder on corps behalf against third party (usually a corporate officer) b/c of corps failure to take some action against 3rd party. ii. When corporate manager (officer or director) fails to act or conduct, shareholders have right to step in foot of the corporation and bring suit in behalf of corporation against the officer. Derivative suit is an equitable remedy as measure of fairness. If the shareholders do not hold bd accountable, then who will? iii. Corporation can only act through its managers or directors on its behalf, even though, corp is its own person. Officers & managers have complete control over shareholders $. B/c shareholders have $ in corp, they can hold directors accountable 1. Need to balance the interest of shareholders to hold officers and directors accountable when they breach their fiduciary duty against the directors in making the decisions that they were appointed to make iv. Derivative action is one in equity rather than at law b/c at law, shareholder cannot bring suit b/c shareholder has no standing b/c harm that occurred is harm against corp. But as matter of equity, ct can create this remedy in order to avoid injustice. v. Derivative litigation is subject to abuse by Ps. 11

Threat of Derivative Strike Suits: A person w/ relatively small stake in residual value of bus might be tempted to bring derivative suit for primary purpose of being bought off. Requiring Ds to make payment to corp reduces this temptation for complaining shareholder. It makes little difference to complaining shareholders attorney, however, who is usually real party in interest. Attorney for a prevailing shareholder suing derivatively may obtain his fee from corp. He may therefore legitimately demand some payment in connection with a settlement 1.Most people who have small interest in co will NOT bring derivative action. vii. Limits on Derivative Action: In an effort to limit strike suits and o/w protect against over-deterrence, virtually all corp statutes limit shareholders who may bring derivative suits, & many states have enacted statutes requiring P-shareholder in a derivative suit, under certain circumstances, to post a bond or other security to indemnify corp against certain of its litigation expenses in event that P loses suit. NY is one who has posting of bond/security before P brings derivative suit. 1.P has to post security before they initiate proceedings in amt equal to reasonable amt for expenses incurred by corp for the suit if corp loses. If P wins, then bond $ is given back. Posting of bond prevents frivolous suits. a) States have plenary powers to require individuals with small holdings to post security for expenses (from Cohen v. Beneficial Industrial Loan Corp (SCT case dealing with NJ statute). 2. NY Business Corporation Law section 627: required P suing derivatively on behalf of corp to post security for corporations costs viii. Settlements & Attorney Fees in derivative action: 1.If a derivative action is settled before judgment, corp can pay legal fees of P & of Ds. If, on the other hand, a judgment for $ damages is imposed on Ds, except to extent that they are covered by insurance, they will be required to pay those damages & may be required to bear the cost of their defense as well. a) It is in the interest of D to settle. ONLY way directors can be indemnified, i.e., pay for their legal fees, is if they settle case before allowing it to go to judgment. Thus, when settled, directors are covered by insurance & entitled to indemnification (co pays for the cost of the defense). 1. If a judgment is entered against D, D may not be entitled to indemnifications, but corp may be able to party of it through insurance b) P is anxious to settle case b/c P wants to avoid litigation costs. 1. On Ps side real party in interest in derivative action often is attorney b/c Ps attorneys earn huge fees. c) Ex: Occidental case (pg 22 of big outline) 2.Ct in which derivative suit is filed MUST approve any settlement. c. DE Law: Grimes v. Donald provides another distinction for direct v. derivative suits: Grimes says NOT ONLY going to look at who is harmed, but also going to look at what remedy P is seeking. i. If P is seeking monetary or compensation for corp b/c corp has been harmed, then that is derivative suit. ii. If P is asking to undo something (injunctive effect), then that is direct suit. iii. Note: DE cts still look at harm. iv. NY only look at harm!!!!! NY does not follow this distinction 2.Other definitions: a. Holding co.: co that confines its activities to owning stock in another co, a subsidiary company. All holding co are parents and involve parent subsidiary relationship. NOT all holding co are parents. 12

vi.

b. Operating co.: co that provides goods and services c. Merger: occurs when 1 company is absorbed into another. Absorbed co seeks to exist as a separate entity. Absorbing co usually maintains its name and its identity (not the case in Eisenberg v. Flying Tiger Line, Inc. (NY case)). As consideration, shareholders are given shares in new merged company. In order to get merger, need 2/3 approval from shareholders. d. Abdication claim: The act of renouncing or abandoning privileges or duties, esp. those connected with high office (BLD) i. Abdication claim-> based on DE corp law 141(a): bus is managed by bd NOT CEO (Chief Executive Officer) (from Grimes v. Donald (DE case)). e. Outside directors: ONLY serve on bd & do NOT work for corp (NOT officers). NOT all outside directors are independent. Might have outside director that does bus with corp or serves as consultant. If there is some relationship b/w corp & outside director, then not independent. f. Inside directors: serve on bd & work for bd as officers g. Independent: NO relationship with co h. Interested: Interested is more narrow than independent. Interested asks: does this person have financial interest in the challenged transaction. 3.Timeline of Derivative Action a. MUST Post security/bond in NY& NJ before derivative action can be brought. Also need to know amt of shareholders shares. i. Note: DE do NOT have to post security/bond & do NOT need to know amt of shareholders shares. b. Before P can file derivative suit, P needs to make demand on board, which requires writing letter to bd & asking bd to initiate suit; this prevents frivolous suit & saves times & $ for corp. 1.Two types of demand: a) Demand to initiate suit OR b) Demand for bd to take corrective action c. When P makes demand, bd has right to refuse shareholder (P) demand. In most cases, bd refuses demand. Bd needs to explain why as a matter of law bd is refusing demand. i. Bds decision to refuse demand is protected by the bus judmgnet rule d. P will then argue that refusal of demand was wrongful. If refusal of demand is valid exercise of P judgment, then P loses. P has no other recourse. Ps ultimately lose these cases b/c directors and officers managing affairs is protected by business judgment rule. P will need to show that bus judgment rule does not apply, to do this, P would need to show that bd breached fiduciary duty (this is substantive-> chapter 5) e. Q becomes whether demand was required or excused. Demand will be excused, if demand was futile. f. If demand is excused, then P can go to ct and file derivative suit. g. Corp can then motion to dismiss suit or motion for Summary Judgment. Bd appoints special litigation committee to determine whether suit should proceed or be dismissed. 1 reason why special litigation committee would chose to have case dismissed is b/c it is not in best interest of corp to litigate case. h. This ends procedural part of derivative litigation 4. Business judgment rule: rule of the ct to defer to decision made cos officers & directors, ct is not going to let shareholders interfere with those decisions a. Bus judgment rule=rule of deference.

13

Deference b/c we want to encourage good people to take position of directors b/c if they are constantly under risk of personal liability, then would not have able bodied directors. 5.Requirement of Demand on Directors a. Issue: Whether demand was required or excused. b. Demand ONLY applies when have derivative suit. Demand does NOT apply to direct suits. c. Rule: If demand is required & P does NOT make it & brings suit directly to ct, suit will be dismissed. d. Rule: Once P makes demand and bd refuses demand, that judgment is protected by bus judgment rule (Grimes v. Donald). e. RULE: Demand is excused when it is futile f. 3 purposes of demand requirement: i. Relieve cts from deciding matters of internal corporate governance by providing corporate directors with opportunities to correct alleged abuses; ii. Provide corporate bds with reasonable protection from harassment by litigation on matters clearly within discretion of directors; and iii. Discourage strike suits commenced by shareholders for personal gain rather than for benefit of corp. g. DE law of demand excusal (for derivative suits ONLY): Grimes v. Donald (DE case) i. DE General Corporations Law 141(a): bus affairs are to be managed by bd and those decisions are protected. 1.It is NOT the shareholders role to manage decisions; instead, shareholders have passive role unless shareholders are also directors & officers. ii. DE law is derived from futility exception to demand in Aronson v. Lewis (DE ct stated that demand requirement is a recognition of fundamental precept that directors manage business and affairs of corp). Q is whether this bd is unable to make an unbiased, unprejudiced decision because bd has some interest in the transaction. There are three bases for excusing demand (P only needs to prove 1 out of 3) (if P can prove 1 of these, then demand is excused & P can go straight to ct): 1. Is there a possibility of arguing on behalf of P that majority of bd has material interest in transaction? P has to come up with particularized facts & these facts have to create a reasonable doubt about bds independence/bias by stating that bd had material interest in transaction that P is complaining about. Interest can be financial, familial, self-interest. This deals with self interest of the bd & deals w/ majority of bd a) Self interest: direct material financial interest. It can be your own financial interest or your familys financial interest. Very narrow def of self interest in DE. Note that this def was criticized in Oracle BUT this is still def b) Just b/c majority of bd approves a transaction does NOT mean demand should be refused b/c of self-interest. 2. Even if bd is not conflicted & do not have direct material interest, are they in some way controlled or dominated by an individual that does have a material interest OR a) Whatever P is challenging, need to take a look at underlying transaction, & ask is challenged transaction a result of valid exercise of bds business decision. (Difficult to prove). 3. Need to prove these prongs from Aronson test with particularity. How is this done without discovery? Ct states in Fn 11: In Rales, ct undertook to describe some of those tools at hand: Although derivative Ps may believe it is difficult to meet the particularization requirement of Aronson b/c 14

i.

they are NOT entitled to discovery to assist their compliance with Rule 23.1, they have many avenues available to obtain information bearing on subject of their claims. For ex, there is a variety of public sources from which details of a corporate act may be discovered, including the media and governmental agencies such as SEC. In addition, a stockholder who has met procedural requirements and has shown a specific proper purpose may use summary procedure embodied in 8 Del.C. section 220 (shareholder right to inspect books and records; this is true in both NY and DE) to investigate the possibility of corporate wrongdoing. iii. DE law: Once demand is made, it is deemed to be required and P cannot argue that P should not have made demand and demand was really excused here, so therefore, demand is excused. h. NY law for demand excusal: Marx v. Akers (NY case) i. 3 bases for demand excusal: Need particularity, not conclusory statements (Only need 1 of 3 bases for demand to be excused) (elaborated from demand futility of Barr v. Wacktman) 1.If the majority of the bd is self interested in challenged transaction, then demand should be excused. a) Self interest: direct financial interest or control. 2.P needs to show that a majority of bd failed to fully inform themselves of challenged transaction to degree that is reasonably necessary 3.Decisions that are protected business judgment rule need to be fully informed ii. That transaction itself was not a valid exercise of business judgment (like DE). i. Universal demand i. ALI would require a written demand unless P makes a specific showing that irreparable injury to corp would o/w result. If bd rejects a demand, ALI would subject bds decision to an elaborate set of standards that calibrates deference afforded decision of directors to character of claim being asserted. ii. Model Bus Corp Act section 7.42 requires demand, but permits derivative P to file suit within 90 days of demand unless demand is rejected earlier and to file even earlier if corp would o/w suffer irreparable injury. iii. Legislatures of at least 12 states-Arizona, CT, Florida, Georgia, Michigan, Mississippi, Montana, Nebraska, NH, NC, Virginia, & Wisconsin-have adopted universal demand requirement. iv. Universal demand minority approach where demand is automatically required. NY and DE do not follow universal demand j. Individual recovery in derivative action i. Ex: Lunch v. Patterson (Wyo 1985): Pat Patterson, Birl Lynch, and RC Lynch had carried on an oil-field consulting bus in corporate form. Patterson owned 30% of common stock and Birl Lynch and RC Lynch each owned 35% each. Patterson quit working for corp and set up his own consulting bus. Thereafter, Birl Lynch and RC Lynch increased their own pay and paid excess compensation. Patterson filed a derivative action to recover excess salaries from the Lynches. Wyoming Supreme Ct awarded damages as an individual in amt 30% of amt in excess. ii. This prevents from wrongdoers from benefitting. 6. Role of Special Committees in derivative actions: Demand has been excused but corp does NOT want litigation & corp selects special litigation committee to determine whether to proceed w/ litigation or not. a. Issue: Should ct defer to decision of special litigation committee & apply bus judgment rile to decision made by special litigation committee?

15

b. DE General Corporations Law 141(a) & 141(c): This gives the board the power to form a committee even if demand was made. This committee can be adopted to hear the case and decide whether refusal should be accepted or not. c. Fn 10 in Zapata Corp v. Maldonado: When stockholders, after making demand & having their suit rejected, attack bds decision as improper, bds decision falls under bus judgment rule & will be respected if the requirements of rule are met . . . . That situation should be distinguished from instant case, where demand was NOT made, & power of bd to seek a dismissal, due to disqualification, presents a threshold issue. . . . i. Distinction: Decision of bd to refuse demand is automatically protected by bus judgment rule. Bds decision to terminate a suit that P filed b/c P concluded that demand was excused & special litigation committee moves to dismiss it, q becomes whether ct will apply bus judgment rule & defer decision. d. NY Rule: Auerbach v. Bennett (NY case) i. Cts do NOT automatically apply bus judgment rule where demand has been excused b/c dealing w/ bd w/ problems. Thus, cts intervene by looking at special litigation committees good faith, process followed, & if members on committee were independent. e. DE Rule: Zapata Corp. v. Maldonado (DE law) i. Ct in Zapata Corp states that shareholders have right to initiate, while bd has right to control suit. ii. DE takes it 1 step further than NY by stating that DE ct will give its own analysis 1. First, Ct should inquire into independence & good faith of committee & bases supporting its conclusions. Limited discovery may be ordered to facilitate such inquiries. Corp should have the burden of proving independence, good faith and a reasonable investigation rather than presuming independence, good faith and reasonableness. If ct determines either that committee is NOT independent or has NOT shown reasonable bases for its conclusions, or if ct is not satisfied for other reasons relating to process, including but not limited to good faith of committee, ct shall deny corps motion. If ct is satisfied under Rule 56 standards that committee was independent and showed reasonable bases for good faith findings and recommendations, ct may proceed, in its discretion to next step. 2. Second step provides the essential key in striking balance b/w legitimate corporate claims as expressed in a derivative stockholder suit and a corps best interests as expressed by independent investigating committee. Ct should determine, applying its own independent bus judgment, whether motion should be granted. 3. Difference b/w NY & DE approach: DE will exercise independent deference when demand has been excused, but NY does not. a) Note: Suppose u are counsel to special litigation committee of DE corp, appointed to decide whether to seek dismissal of a derivative suit. What advice would u give as to how committee should proceed? How, if at all, would your advice be difference in case of NYcorp? 1. In all jurisdictions, the procedure should be the same. Different approaches to judicial deference with regard to special litigation committee. Need to make sure no connections b/w special litigation committee & corp (independence) & that there is good faith and adequate procedure is followed (Need advise need to hire experts that are needed to ensure a thorough investigation). Make sure person in special litigation committee is disinterested. 2. Difference is that in DE Ps have slight chance of winning because DE cts exercise own investigation. 4. DE law: In re Oracle Corp. Derivative Litigation (DE case): dealt with independence of special litigation committee (NY also requires this). a) Ct here applied Zapata rule. To be independent for requirement of special litigation committee, cannot have connections, such as old university, which u 16

V.

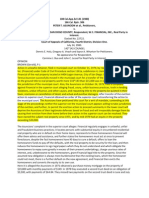

teach at or donate money to, or continuing relationship b/w prof & student, small, tight knit community. These in turn depend on the nature of the relationship. f. Two Alternatives for Special Litigation Committee Selection i. Ask judges to appoint the special master; this takes it out of the bds hands completely ii. Have nomination committee under Rule 141(c) and should ONLY composed of major shareholder, institutional shareholders, such as pension funds or banks that hold huge shares or large holdings in public companies Duties of Officers, Directors, & Other Insiders (substantive aspect of derivative suit) A. Obligations of Bd of Directors: Bd of directors owes fiduciary duties to shareholders & corp 1. DUTY OF CARE: mitigated by DE General Corp Law section 102(b)(7) 2. DUTY OF LOYALTY (involves conflict of interest (such as self-dealing, unfairness standard applied to disinterested ratification by bd v. wasteful standard applied to disinterested ratification by controlling shareholder), corporate opportunity doctrine) (NY section 713: only says directors; ct likely to treat officers the same way, only minority say no; ratification AND DE section 144: says both officers and directors) 3. OBLIGATION OF GOOD FAITH (Good faith is NOT a fiduciary duty that stands alone BUT an obligation and, according to Stone v. Ritter, is part of duty of loyalty) (arises in 2 contexts: executive compensation AND oversight) B. Duty of care 1.Duty of care is ONLY relevant to bd of directors a. Issue: Is this transaction a satisfaction of bds duty of care or breach of care? i. Need to determine this issue in order to determine whether bus judgment applies or not. 2.Directors are normally, by law, held to have duty of management of corp. These duties are normally delegated to officers; thus, directors must supervise officers. Legal duties of directors & officers are owed to corp; thus, performance of these duties is usually enforced on behalf of corp brought by an individual shareholder in derivative suit. 3. Kamin v. American Express Co (NY case) Derivative suit (brought by American Express shareholders) a. NY statute protecting duty of care: Articulation of duty of care that ordinarily prudent person would exercise. b. Standard from this case for whether directors breach duty of care= gross negligence i. Cts will defer to directors decision as long as there is no fraud, illegality, no breach of duty of loyalty, no breach of duty of care where it was gross negligence. Business judgment rule provides broad immunity rule for mistakes. Mistakes are to be expected. c. Policy reasons for applying bus judgment rule: i. Cts are NOT in best positions to decide these business decisions. ii. Directors would NOT take any risks (over cautious decision making where no risks or very little risks are taken & profits of shareholders will NOT be maximized. 4. Smith v. Van Gorkom (DE law): Direct suit b/c harm to shareholders NOT to corp (unusual case which ct held bd liable for breach of duty of care) (brought by Trans Union shareholders a. Holding: Here, bd breached duty of care to directors by failing to investigate. Van Gorkom had failed to investigate intrinsic value of the co was. Bd voted on merger without seeing merger agreement & voted on amendments without seeing amendments. And, bus judgment rule did NOT apply. b. Rule: Smith v. Van Gorkom requires bd to undertake certain process that shows due deliberation & consideration & if bd engaged in such process that would satisfy duty of care. Bd NEEDS to get all information possible regarding transaction. 17

CEO, Van Gorkom, cannot just boss bd around. It is about the process. Bd needs to exercise due care during this process. 1.For ex, if bd needs outside experts, such as financial advisors, then for bd to exercise due care, need to get them. ii. Note: Case does NOT give a formula on how to satisfy this duty of care. c. DE General Corporations Law section 141(e): directors are fully protected in relying in good faith on reports made by officers. i. BOD is able to rely on reports & info prepared by exec & experts if BOD (1) reasonably relied (2) in good faith (3) on expert who was competent to advise and was (4) selected w/ reasonable care ii. ONLY protects directors who relied on reports in good faith. Here, oral report was not a report that would qualify under section 141(e) b/c it was given by Van Gorkom for 20 minutes, who himself was uninformed about value of co. Also, bd cannot say that it was reasonable to rely on this oral report in good faith b/c bd never asked qs that would have found out that Van Gorkom did not know the answers himself. d. Duty of care includes: i. Duty to carefully investigate; ii. Duty of inquiry; AND iii. Duty of due deliberation e. Legislative response to Smith v. Van Gorkom: i. DE General Corporation Law section 102(b)(7): (In suit for damages ONLY) allows any corp to include in its certification of incorporation: A provisions eliminating or limiting personal liability of a director to corp or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provisions shall NOT eliminate or limit liability of a directors: (i) For any breach of the directors duty of loyalty to corp or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under section 174 of this title [relating to payment of dividends]; or (iv) for any transaction from which the director derived an improper personal benefit . . . . 1.Allows corp to provide provision in Articles of Incorporation for eliminating personal liability of directors for breach of fiduciary duty UNLESS: 1. Breach of duty of loyalty; 2. Acted in Bad faith 2.B/c of passage of statute, this has made it hard to hold bd liable for duty of care. 5.Two ways to approach bus judgment rule: a. Minority approach: ct provided a standard of review/liability (gross negligence) by which ct will judge directors behaviors. If we take the standard of review approach, then directors have to exercise care that an ordinarily prudent person would take and look at gross negligence standard (Kamin v. American Express Co) i. Should not act recklessly or grossly negligently; if so, Business Judgment Rule does NOT apply b. Abstention approach (more popular approach): cts will abstain from duty of care qs & will not entertain idea of breaching duty of care standard unless there is some other allegation of conduct against bd (one of following: 1.fraud or illegality in making its interest, 2. bd has not have self interest or COI and has not breached its duty of loyalty, or 3. acted in bad faith.) i. Rule of judicial deference, based on presumption that Board of Directors acts in good faith ii. Cts will abstain from duty of care analysis UNLESS fraud, illegality, or COI or some egregious process irregularity iii. SPLIT (NOT jurisdictional) 18

i.

1.Majority: ONLY Fraud, Illegality, or COI 2.Minority: all 4 above 6. Francis v. United Jersey Bank (NJ case) a. This case is NOT brought by shareholder BUT by bankruptcy trustee (creditor). When co becomes bankrupt, creditors step in shoes of shareholders. (different than Kamin v. American Express Co. AND Smith v. Van Gorkom) b. Another difference: This case deals with nonfeasance (failure to monitor under duty of care), while American Express AND Van Gorkom deal with misfeasance. i. Nonfeasance: failure to act when duty to act existed 1.Ex: Mrs. Ps failure to monitor. Ct held that she needed to stay informed, read the books & records & listen to minutes of meetings. 2.In cases involving nonfeasance, causation issue requires determining what reasonable steps a director could have taken and whether those steps would have prevented loss. Failure to act must be substantial factor in producing harm. ii. Misfeasance: lawful act performed in wrongful manner 1. Ex: Misfeasance is grossly neg decision seen in Trans Union & American Express cases. c. Rule: Bus judgment rule protects both misfeasance & nonfeasance. d. Rule: Duty of care=monitor/supervise i. Bd of directors must take steps to be reasonably informed to corp activities; should be up to date on financial affairs of corp ii. RULE: BOD members can generally rely on honesty of subordinate, execs UNLESS on notice of possible illegal acts. e. Generally, a director should have a basic understanding of corps bus & knowledge about its ongoing activities, which require a general monitoring of its affairs & policies. Director has responsibility to attend bd meetings & regularly review financial statements. If there is illegal conduct, director has duty to object, & possibly take reasonable means to prevent such conduct or resign. In this case, Mrs P did not fulfill any of directors obligations. Director also has duty to corporate clients. C. Duty of Loyalty a. Conflict of interest is breach of duty of loyalty. i. Ct is skeptical & will scrutinize transaction & would NOT defer to bds decision to enter into transaction with director. Thus, bus judgment rule will NOT apply when there is conflict of interest. There is NO presumption in favor of businesss decision making. b. Issue: deals with what should happen when there is officer or director interested in challenged transaction. c. Directors owe duty of loyalty to corp. This means that directors MUST place interests of corp above their own personal gains. d. Statutes dealing with COI situations: deals with what should happen when there is director OR officer interested in a challenged transaction i. NY Section 713 Interested Directors (a) No K or other transaction b/w a corp and one or more of its directors, or b/w a corp and any other corp, firm, assn or other entity in which one or more of its directors are directors or officers, of have a substantial financial interest, shall be either void or voidable for this reason alone or by reason alone that such director or directors are present at the meeting of the board, or of a committee thereof, which approves such K or transaction, or that his or their votes are counted for such purpose: [This defines COI] (1) If the material facts as to such directors interest in such K or transaction and as to any such common directorship, officership or financial interest are disclosed in good faith or known to that bd or committee, and the bd or committee approves such K or transaction by a vote sufficient for such 19

purpose without counting the vote of such interested director or, if the votes of the disinterested directors are insufficient to constitute an act of the board as defined in section 708 (Action by the bd), by unanimous vote of the disinterested directors; [need to make full disclosure of all material facts with regards to COI to bd AND get disinterested director vote]OR (2) If the material facts as to such directors interest in such K or transaction and as to any such common directorship, officership or financial interest are disclosed in good faith or known to the shareholders entitled to vote thereon, and such K or transaction is approved by the vote of such shareholders [Need to make full disclosure AND get shareholder vote. Statute does NOT state whether shareholder has to be disinterested or NOT. However, NY cts have read into statute, a requirement for disinterestedness]. (b) If a K or other transaction b/w a corp and one or more of its directors, or b/w a corp and any other corp, firm, assn or other entity in which one or more of its directors are directors or officers, or have a substantial financial interest, is not approved in accordance with paragraph (a), the corp may avoid the K or transaction unless the party or parties thereto shall establish affirmatively that the K or transaction was fair and reasonable as to the corp at the time it was approved by the bd, a committee or the shareholders [deals with fairness of challenged transaction. If a COI is defined as in (a) in preamble but dont have full disclosure or ratification under (a)(1) or (a)(2), then look at the fairness of the challenged transaction. Burden of proof lies with D directors to prove fairness of challenged transaction]. (c) Common or interested directors may be counted in determining the presence of a quorum at a meeting of the bd or of a committee which approves such K or transaction. (d) The certificate of incorporation may contain additional restrictions on Ks or transactions b/w a corp and its directors and may provide that Ks or transactions in violation of such restrictions shall be void or voidable by the corp. (e) Unless o/w provided in the certificate of incorporation of the by-laws, the bd shall have authority to fix the compensation of directors for services in any capacity. 1. Bayer v. Beran (NY case) is example where section 713(b) was at issue. Here, ct held that duty of loyalty was NOT breached by bd b/c decision was in good faith & challenged transaction was fair. Facts showed FAIRNESS. a) Steps to take in COI analysis: 1. If presence of COI, ct will undertake scrutiny at bds conduct with regards to challenged transaction. Ct will NOT defer to decision of bd for challenged transaction. Bus judgment rule will NOT apply. b) Note: NY law NOW requires majority of directors to be independent or outsiders. ii. DE Section 144: Interested directors; quorum (a) No K or transaction b/w a corp and 1 or more of its directors or officers, or b/w a corp and any other corp, partnership, association, or other org in which 1 or more of its directors or officers, are directors or officers, or have a financial interest, shall be void or voidable solely for this reason, or solely b/c the director or officer is present at or participates in the meeting of the bd or committee which authorizes the K or transaction, or solely b/c any such directors or officers votes are counted for such purpose, if [defines COI]: (1) The material facts as to the directors or officers relationship or interest as to the K or transaction are disclosed or are known to the bd of directors or the committee, and the bd or committee in good faith authorizes the K or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum [just because u have COI, that COI is not in violation of duty of loyalty if material facts are disclosed or known to disinterested directors; director ratification]; OR (2) The material facts as to the directors or officers relationship or interest and as to the K or transaction are disclosed or are known to the shareholders entitled to vote thereon, and the K or transaction is specifically approved in good faith by vote of the shareholders [just because u have COI, that COI is not in violation of duty of loyalty if material facts are disclosed or known to disinterested 20

shareholders. Statute does not state disinterested, but DE cts have read the requirement in. Shareholder ratification]; OR (3) The K or transaction is fair as to the corp as of the time it is authorized, approved or ratified, by the bd of directors, a committee or the shareholders [Burden is placed on co to demonstrate transaction was fair]. (b) Common or interested directors may be counted in determining the presence of a quorum at a meeting of the bd of directors or of a committee which authorizes the K or transaction 1. Benihana of Tokyo v. Benihana (DE case) a) At issue here is Section 144(a)(1), bd knew of material facts of COI (common directorship & his interest in purchase of preferred stock), BUT still upheld transaction. Ct held that there was COI b/c there was common directorship b/c this individual served on bd of 2 companies that were doing business with each other. b) Note: Ct scrutinized whole bd b/c bd approved of transaction. 2. Corporate Opportunities (Subset of duty of loyalty): Duty of loyalty of directors & officers to corp prevents them from taking opportunities for themselves that should belong to corp. a. Ex: Director may NOT use corporate prop or assets to develop her own bus or for other personal uses. b. Defenses to charge of usurping corporate opportunity i. Individual capacity: Ds may claim that opportunity was presented to them in their individual capacities, and not as fiduciaries of corp. ii. Corporation unable to take advantage of opportunity: Law is now that an officer or director may take advantage of corporate opportunity if it is disclosed to corp first and corp is unable to take advantage of it. c. Rule: Directors or officers are allowed to take any opportunity as long as opportunity is NOT corporate opportunity. i. Rule: If opportunity is corporate, then need to make formal offer. L would tell C that C needs to offer corporate opportunity formally & ask bd to formally reject offer. ii. Rule: If corp, by independent directors or shareholders, turns down an opportunity, then fiduciaries may take advantage of opportunity. iii. Remedies: If fiduciary has usurped a corporate opportunity, then corp has following remedies: 1. Damages: When opportunity has been resold, profits made by fiduciary may be recovered by corp 2. Constructive trust: Corp may force fiduciary to convey prop to corp at fiduciarys cost. d. 4 elements to determine whether opportunity is corporate opportunity: i. Is the co financially able to take opportunity for itself? Does the company have enough funds to take advantage of the corporate opportunity? ii. Whether the corporate opportunity is within the business of the corporation. iii. Whether corporate opportunity is interest or expectancy. 1.Cts define it in lay terms. Do they expect opportunity or do they have an interest? 2. Some cts apply narrower def: whether an interest is anything in which the corp has a contractual right. Expectancy is simply whether this opportunity is expected to receive in the ordinary course of bus? iv. Whether the corporate opportunity creates a conflict b/w director or officers interest and the interest of corp. e. Broz v. Cellular Information Systems, Inc. (DE case): Ex of case where corp was financially unable to act on corporate opportunity and D did NOT usurp corporate opportunity. 21

If co had been financially capable, then first factor would not be satisfy first factor b/c D would have had personal interest in corporate opportunity over bd interest. f. In re eBay Inc. Shareholders Litigation (DE case): ex of case where Ds did usurp corporate opportunity. See application of 4 elements. B/c of usurping corporate opportunity, this proves Ds are conflicting b/c personal enrichment of executives over interest of corp. This decision is NOT protected by bus judgment rule & corp will scrutinize transaction b/c there is COI. g. Competition with corp: Another area of COI arises when a director or officer enters into competition with corp. i. Use of corporate assets, prop, trade secrets, etc: Clearly, a fiduciary may not use corporate assets, prop, materials, trade secrets, etc to form a competing bus ii. Formation of a competing bus: However, a fiduciary without using corporate assets may leave corp and form a competing bus. In some instances, conduct of fiduciary while still with corp and preparing to leave to form new bus is questioned. 3. Dominant shareholders: Looking at duty of loyalty owed by controlling/dominant shareholders to minority shareholders. Asking whether controlling shareholder breached duty of loyalty. Looking at self dealing=type of COI (see this with parent-subsidiary relationship) a. Shareholders, in some cases, have responsibilities to other shareholders. b. Analysis to apply for whether controlling/dominant shareholder breached duty of loyalty (goal: hold majority shareholder accountable for conduct) (from Sinclair Oil Corp. v. Levien (DE case) derivative suit; controlling shareholder case): i. Whether there was self-dealing on part of the controlling/dominant shareholder. Ask whether the controlling shareholder has received something to the detriment or expense of the minority shareholder. 1.Burden of proof to prove self-dealing is on Ps (minority shareholder). ii. If there is self-dealing, then burden of proof shifts from Ps to Ds (controlling shareholder) to show fairness of challenged transaction. 1. Need to ask whether challenged transaction is fair; this is called intrinsic fairness test. 2.Apply intrinsic fairness test in terms of controlling shareholder. iii. Application of bus judgment rule: Once it is determined that dominant shareholder engaged in self-dealing, then bus judgment rules does NOT apply b/c self-dealing is type of COI. Instead of deferring to what bd did, there will be judiciary scrutiny. 1. Business judgment rule: rule of judicial deference where cts defer to decision of directors. 2.Bd is NOT monitoring in independent capacity b/c controlled by dominant shareholder. When there is self-dealing, this means that bd is no longer monitoring in independent capacity & bd does NOT deserve protection of bus judgment rule. 3. If NO self-dealing, then look at conduct of bd & look at bds duty of loyalty, due care, good faith, and if this is ok, then use bus judgment rule. c. Note: Directors have higher duty of loyalty than shareholders have. d. Sinclair Oil Corp. v. Levien (DE case): Controlling shareholder case (derivative suit) i. Applied the controlling shareholder breach of loyalty analysis to hold that there was self dealing with respect to breach of K b/w Sinven (subsidiary co) & Sinclair (parent co; controlling shareholder). B/c there was self-dealing, burden shifted to Ds to prove that challenged transaction (K) was fair. Impossible to argue the breach of K is fair. e. Duty of loyalty of controlling shareholder with respect to liquidation: controlling shareholder needs to provide information to minority shareholder in order to make informed decision what to do with shares upon liquideation. 22

i.